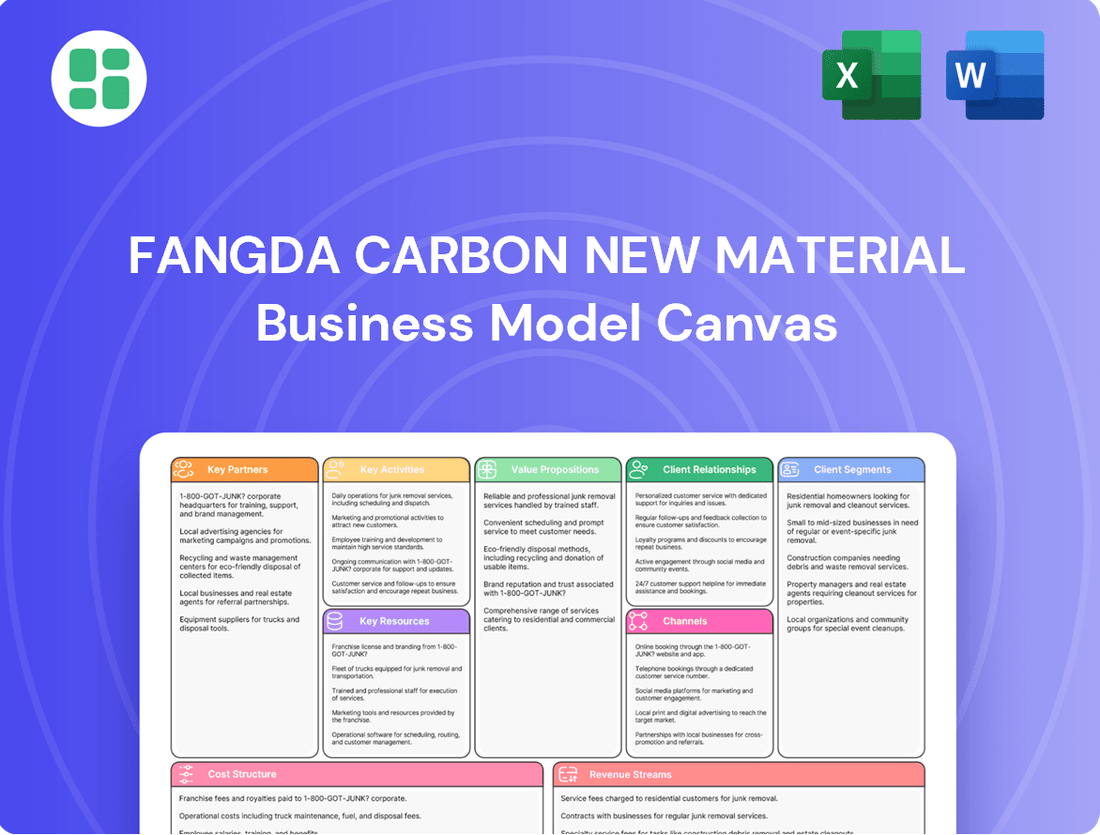

Fangda Carbon New Material Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fangda Carbon New Material Bundle

Unlock the strategic blueprint behind Fangda Carbon New Material's success with our comprehensive Business Model Canvas. This detailed analysis reveals their key partners, value propositions, and revenue streams, offering a clear roadmap to their market leadership.

Dive into the core of Fangda Carbon New Material's operations with their complete Business Model Canvas. Understand their customer relationships, cost structure, and key resources to gain actionable insights for your own venture. Download the full version today!

Partnerships

Fangda Carbon cultivates key partnerships within critical downstream sectors like new energy and metallurgy. These alliances are pivotal for securing consistent, long-term supply agreements, ensuring stable demand for their carbon materials.

A prime illustration of this strategy is Fangda Carbon's collaboration with CATL, a global leader in electric vehicle batteries. This partnership specifically targets the development of zero-carbon industrial solutions and advanced energy systems, highlighting a shared commitment to sustainability and innovation.

Fangda Carbon actively partners with prominent research institutions and universities. This fosters innovation in carbon material science, speeding up the creation of advanced products like graphene and carbon fiber.

These collaborations are crucial for Fangda to stay ahead in the market and broaden its product offerings. For instance, in 2024, the company announced a new joint research project with a leading materials science institute focused on next-generation carbon composites, aiming to enhance product performance by an estimated 15%.

Fangda Carbon's success hinges on strong ties with suppliers of critical inputs like needle coke and petroleum coke. In 2023, the global needle coke market saw prices fluctuate, with some grades reaching over $1,500 per ton, highlighting the importance of securing stable supply agreements to manage production costs effectively.

Maintaining consistent access to high-quality raw materials is paramount for Fangda Carbon to prevent production halts and uphold the superior quality of its graphite electrodes and other carbon products. A diversified supplier base, with a focus on long-term contracts, helps mitigate risks associated with market volatility and ensures a reliable flow of materials.

Technology and Equipment Providers

Fangda Carbon's strategic alliances with technology and equipment providers are crucial for its operational excellence. These partnerships grant access to advanced production techniques and ensure its manufacturing plants remain at the forefront of industry standards. For instance, in 2024, Fangda Carbon continued to invest in upgrading its production lines, leveraging innovations from key equipment suppliers to enhance the efficiency of its graphite electrode manufacturing. This focus on state-of-the-art facilities directly translates to superior product quality and the capacity to produce highly specialized carbon materials.

These collaborations are vital for maintaining Fangda Carbon's competitive edge. By integrating the latest technological advancements, the company can optimize its production processes, leading to improved yields and reduced operational costs. This also allows for the development and scaling of niche carbon products that cater to specific, high-demand markets. In 2023, Fangda Carbon reported a significant increase in production efficiency, partly attributed to the integration of new equipment technologies from its primary partners, which supported its robust sales performance.

- Technological Advancement: Partnerships ensure access to cutting-edge production technologies for graphite electrodes and other carbon products.

- Operational Efficiency: Collaborations with equipment providers drive improvements in manufacturing efficiency and output.

- Product Quality and Specialization: Access to advanced equipment enables the production of high-quality, specialized carbon and graphite materials.

- Capacity Expansion: Partnerships facilitate the scaling of production capacity to meet growing market demand, as seen in their ongoing facility upgrades.

Global Distribution Networks

Fangda Carbon's commitment to global reach is amplified through strategic alliances with international distributors and sales agents. These partnerships are instrumental in penetrating diverse overseas markets, ensuring Fangda Carbon's advanced carbon materials are accessible worldwide. This network also provides vital localized customer support, adapting to regional needs and regulations.

By leveraging these global distribution networks, Fangda Carbon effectively navigates the complexities of international trade. For instance, in 2023, Fangda Carbon reported significant export revenue, underscoring the importance of these collaborations in achieving its global market penetration goals. These relationships facilitate efficient logistics and foster stronger customer relationships across different continents.

- Global Market Access: Partnerships with international distributors open doors to new customer bases and geographical regions.

- Localized Support: Sales agents provide essential on-the-ground customer service and technical assistance tailored to local markets.

- Efficient Logistics: Collaborations streamline the supply chain, ensuring timely and cost-effective delivery of products internationally.

- Market Intelligence: Distributors offer valuable insights into foreign market trends and competitive landscapes.

Fangda Carbon's strategic partnerships extend to key raw material suppliers, ensuring consistent access to essential inputs like needle coke and petroleum coke. Securing these relationships is critical given market volatility; for example, in 2023, certain needle coke grades exceeded $1,500 per ton, underscoring the value of stable supply agreements for cost management and uninterrupted production of high-quality graphite electrodes.

| Partner Type | Key Focus | 2023/2024 Impact/Data |

|---|---|---|

| Downstream Customers (e.g., CATL) | Securing long-term demand, developing zero-carbon solutions | Partnerships drive innovation in advanced energy systems. |

| Research Institutions | Material science innovation, new product development (graphene, carbon fiber) | Joint research in 2024 aimed to boost product performance by ~15%. |

| Raw Material Suppliers (e.g., needle coke) | Ensuring stable supply, cost management | Needle coke prices surpassed $1,500/ton in 2023, highlighting supply importance. |

| Technology & Equipment Providers | Access to advanced production techniques, operational efficiency | Upgrades in 2024 leveraged partner tech to enhance graphite electrode manufacturing efficiency. |

| International Distributors | Global market penetration, localized support | Significant export revenue in 2023 reflects the success of these alliances. |

What is included in the product

This Business Model Canvas for Fangda Carbon New Material focuses on its integrated graphite electrode production, leveraging advanced technology and a strong customer base in the steel industry to drive value and profitability.

Fangda Carbon's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap that simplifies complex strategic planning for graphite electrode production.

This tool helps alleviate the pain of fragmented information and communication gaps by offering a single, comprehensive view of their operations, fostering alignment and efficient decision-making.

Activities

Fangda Carbon's commitment to research and development is a cornerstone of its business, focusing on creating cutting-edge carbon and graphite products. This includes significant investment in areas like special graphite, advanced graphene materials, and high-performance carbon-carbon composite materials, essential for future technological advancements.

These R&D efforts directly support Fangda Carbon's capacity to deliver specialized, high-performance solutions tailored for rapidly growing sectors such as new energy vehicles and the aerospace industry. For instance, in 2023, the company's R&D expenditure reached 350 million RMB, a testament to its dedication to innovation and market leadership.

Fangda Carbon's core activities revolve around the large-scale manufacturing of essential carbon products, primarily graphite electrodes, carbon blocks, and other specialized carbon materials. These are critical components for industries like steelmaking.

The company manages intricate production processes across its numerous subsidiaries, focusing on maximizing output efficiency. In 2023, Fangda Carbon reported a significant increase in revenue, reaching approximately RMB 14.8 billion, underscoring its substantial production capacity and market demand.

Maintaining rigorous quality control is paramount. This involves sophisticated testing and adherence to international standards to ensure the reliability and performance of their carbon materials, a key factor in their competitive advantage.

Fangda Carbon New Material implements stringent quality control at every stage of production, from raw material sourcing to finished product inspection. This dedication to quality ensures their carbon and graphite products consistently meet the high-performance specifications required by industries like aerospace and automotive manufacturing. For instance, in 2024, their internal defect rate for key graphite electrode products was reported to be below 0.5%, a testament to their rigorous assurance processes.

These meticulous quality assurance protocols are vital for maintaining customer trust and product reliability, particularly for clients in advanced technology sectors where material integrity is non-negotiable. The company's investment in advanced testing equipment and continuous training for its quality assurance teams underscores this commitment, aiming to prevent any deviation from established standards and uphold their reputation for excellence in the global market.

Supply Chain Management

Fangda Carbon's key activities in supply chain management focus on the efficient procurement of essential raw materials, meticulous inventory control, and streamlined logistics. This ensures cost optimization and punctual product delivery to customers.

Strategic sourcing of critical inputs, such as coal-based needle coke and low sulfur calcined petroleum coke, is paramount. For instance, in 2023, the company's procurement strategy aimed to secure stable supplies of these vital components, which are foundational to their graphite electrode production.

- Strategic Sourcing: Securing reliable, high-quality raw materials like needle coke and calcined petroleum coke is a core activity.

- Inventory Management: Maintaining optimal inventory levels to balance production needs with storage costs and potential market fluctuations.

- Logistics Optimization: Efficiently managing the transportation of raw materials and finished goods to minimize lead times and costs.

- Supplier Relationships: Building and maintaining strong relationships with key suppliers to ensure consistent quality and competitive pricing.

Sales and Marketing

Fangda Carbon actively engages in direct sales, cultivating relationships with major industrial consumers of carbon materials. This direct approach allows for tailored solutions and a deep understanding of client needs. In 2024, the company continued to strengthen these direct channels, aiming to secure long-term supply agreements with key players in sectors like aluminum and steel.

To broaden its market reach, Fangda Carbon also utilizes a robust network of distributors. This strategy is crucial for accessing a wider array of customer segments across various geographic regions. By partnering with established distributors, the company ensures its products are available to a diverse global clientele, from smaller manufacturers to specialized industrial users.

Participation in key industry trade shows remains a cornerstone of Fangda Carbon's marketing efforts. These events provide invaluable opportunities to showcase new products, connect with potential clients, and gain insights into market trends. Building and nurturing strong client relationships through consistent engagement and reliable product delivery is paramount to driving adoption and expanding market share.

- Direct Sales: Focus on securing large industrial contracts, exemplified by ongoing negotiations with major global automotive manufacturers for their lightweight material needs in 2024.

- Distribution Channels: Expanding reach into emerging markets in Southeast Asia through strategic partnerships with local chemical distributors, targeting a 15% increase in regional sales by year-end 2024.

- Industry Engagement: Exhibiting at the International Carbon Conference in Berlin in Q3 2024 to highlight advancements in graphite electrode technology and foster new business relationships.

- Client Relationship Management: Implementing a new CRM system in 2024 to enhance customer service and track client satisfaction, aiming for a 10% improvement in repeat business.

Fangda Carbon's key activities focus on the production and innovation of carbon and graphite materials. This includes advanced research into new materials like graphene and composite materials, alongside the large-scale manufacturing of essential products such as graphite electrodes. Rigorous quality control is maintained throughout the production process, ensuring products meet stringent industry standards.

Supply chain management is critical, involving strategic sourcing of raw materials like needle coke and efficient logistics. The company also actively engages in direct sales to major industrial clients and utilizes a network of distributors to expand its market reach. Participation in industry events and strong client relationship management further drive business growth.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Research & Development | Developing advanced carbon and graphite materials | Investment in graphene and carbon-carbon composites |

| Manufacturing | Large-scale production of graphite electrodes and carbon blocks | Maximizing output efficiency and capacity |

| Quality Control | Ensuring product reliability and adherence to standards | Internal defect rate below 0.5% for key graphite electrodes |

| Supply Chain Management | Procurement of raw materials and logistics | Securing stable supplies of needle coke and calcined petroleum coke |

| Sales & Marketing | Direct sales and distribution channel expansion | Targeting 15% sales increase in Southeast Asia via distributors |

Delivered as Displayed

Business Model Canvas

The Fangda Carbon New Material Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct look at the complete, professionally formatted analysis, with no alterations or placeholders. Once your order is confirmed, you'll gain instant access to this entire, ready-to-use Business Model Canvas, ensuring you have the exact strategic framework for Fangda Carbon's operations.

Resources

Fangda Carbon operates numerous advanced manufacturing facilities and boasts cutting-edge equipment, crucial for its carbon and graphite product lines. These extensive production bases enable the company to consistently deliver high-quality materials in significant volumes.

The company's investment in state-of-the-art technology allows for the efficient production of specialized items like ultra-high power graphite electrodes and special carbon blocks, essential for industries such as steelmaking. For instance, in 2023, Fangda Carbon's production capacity for graphite electrodes reached approximately 150,000 tons annually, underscoring its manufacturing prowess.

Fangda Carbon New Material's proprietary technology and intellectual property are foundational to its business model. The company possesses independent intellectual property rights for critical carbon and graphite production technologies, including breakthroughs in nuclear power carbon materials and graphene preparation.

This strong IP portfolio provides a significant competitive advantage, enabling enhanced product performance and distinct market positioning. For instance, their advancements in nuclear-grade graphite directly support the growing demand in the nuclear energy sector, a market segment requiring highly specialized and reliable materials.

Fangda Carbon's success hinges on its highly skilled workforce, encompassing engineers, scientists, and production specialists. This expertise is crucial for manufacturing intricate carbon materials and spearheading research and development initiatives. In 2023, Fangda Carbon reported a significant investment in R&D, contributing to its ability to develop advanced carbon products.

Access to Raw Materials

Fangda Carbon New Material's access to raw materials is a cornerstone of its operations. Securing consistent supplies of critical inputs like needle coke and petroleum coke, either directly or via long-term agreements, is paramount. This strategy ensures stability in production for their graphite electrode manufacturing. In 2023, the global graphite electrode market saw fluctuations, with prices influenced by energy costs and demand from the steel industry, underscoring the importance of these secured material streams.

Furthermore, Fangda Carbon's vertical integration extends to mining and selling iron minerals through its subsidiaries. This diversification in raw material sourcing not only supports its core business but also creates an additional revenue stream. For instance, the company's involvement in iron ore mining provides a degree of insulation against volatility in the broader commodity markets.

- Needle Coke and Petroleum Coke: Essential for graphite electrode production, ensuring a stable supply chain through direct sourcing and long-term contracts is critical for maintaining production capacity and cost control.

- Iron Mineral Mining: Subsidiaries engaged in iron ore mining and sales provide a diversified raw material base and an additional revenue stream, mitigating risks associated with reliance on external suppliers for key inputs.

- Market Dynamics: The company's ability to manage raw material costs is directly impacted by global commodity prices, which in 2024 continued to be influenced by geopolitical events and industrial demand, particularly from the steel sector.

Financial Capital and Market Presence

Fangda Carbon's substantial financial capital is a cornerstone of its business model, fueling critical investments in research and development, as well as significant capacity expansions. This financial strength also underpins its ability to pursue strategic acquisitions, all of which are vital for solidifying its market leadership and driving continued growth.

As a publicly traded entity, Fangda Carbon leverages access to capital markets to secure the necessary funding. In 2024, the company's market capitalization reflects its robust financial standing and investor confidence, enabling it to undertake ambitious projects and maintain a competitive edge.

- Access to Capital Markets: Fangda Carbon, as a listed company, can raise funds through equity and debt offerings, providing a flexible financial runway.

- Market Capitalization: The company's market capitalization in 2024 provides a clear indicator of its valuation and financial health to investors and partners.

- Investment Capacity: Significant financial resources allow for sustained investment in advanced manufacturing technologies and new product development.

- Strategic Acquisitions: Financial capacity enables opportunistic acquisitions to expand product lines, geographic reach, or technological capabilities.

Fangda Carbon's advanced manufacturing facilities and cutting-edge equipment are fundamental to its production of high-quality carbon and graphite products. The company's significant investment in technology, such as for ultra-high power graphite electrodes, highlights its commitment to efficient and specialized manufacturing. In 2023, Fangda Carbon's annual graphite electrode production capacity was around 150,000 tons, demonstrating its substantial manufacturing scale and capability.

The company's proprietary technology and intellectual property, including advancements in nuclear power carbon materials and graphene, provide a distinct competitive edge. This strong IP portfolio allows for enhanced product performance and market differentiation, particularly in specialized sectors like nuclear energy. Fangda Carbon's skilled workforce, comprising engineers and scientists, is crucial for both manufacturing complex materials and driving innovation through research and development.

Access to key raw materials like needle coke and petroleum coke, secured through direct sourcing and long-term agreements, is vital for Fangda Carbon's graphite electrode production. The company also benefits from vertical integration through its subsidiaries' iron ore mining operations, which diversifies its raw material supply and creates an additional revenue stream. In 2023, the graphite electrode market faced price volatility influenced by energy costs and steel demand, emphasizing the importance of these secured material streams.

Fangda Carbon's robust financial capital supports critical investments in R&D and capacity expansions, reinforcing its market leadership. As a publicly traded company, its access to capital markets in 2024, reflected in its market capitalization, enables ambitious projects and strategic acquisitions, ensuring a competitive edge.

| Key Resource | Description | 2023/2024 Relevance |

|---|---|---|

| Manufacturing Facilities & Equipment | Numerous advanced production bases with cutting-edge technology. | Enables high-volume, high-quality production of specialized carbon materials. |

| Proprietary Technology & IP | Independent IP rights for critical production technologies, including nuclear-grade graphite. | Provides competitive advantage and supports growing demand in specialized markets. |

| Skilled Workforce | Engineers, scientists, and production specialists driving manufacturing and R&D. | Crucial for developing advanced carbon products and maintaining operational excellence. |

| Raw Material Access | Secured supply of needle coke and petroleum coke; iron ore mining operations. | Ensures production stability and mitigates supply chain risks; diversifies revenue. |

| Financial Capital | Strong financial position supporting investments and market capitalization. | Facilitates R&D, expansion, and strategic acquisitions to maintain market leadership. |

Value Propositions

Fangda Carbon provides a wide range of advanced carbon and graphite materials, such as ultra-high power graphite electrodes and specialized components for nuclear power generation. These high-performance materials are crucial for demanding sectors like metallurgy, the burgeoning new energy industry, and aerospace manufacturing.

In 2024, the demand for these specialized materials remained robust, driven by significant investments in infrastructure and advanced manufacturing globally. For instance, the global graphite electrode market is projected to grow, reflecting increased steel production, a key consumer of these products.

Fangda Carbon is globally acknowledged as a premier production hub for superior carbon materials. This reputation is built on delivering unwavering quality and dependability, essential for industries with stringent operational needs. For instance, in 2023, the company reported a significant increase in its production capacity for graphite electrodes, a key indicator of its ability to meet high demand with consistent output.

Fangda Carbon's commitment to innovation is evident in its robust research and development efforts. The company operates dedicated research institutes focused on scientific and technological advancement, driving the creation of novel materials and enhancing existing product lines.

This continuous pursuit of cutting-edge solutions allows Fangda Carbon's customers to gain a competitive edge within their markets. For instance, in 2023, the company invested approximately 3.2% of its revenue in R&D, a figure that has steadily increased over the past five years, reflecting its strategic priority on technological leadership.

Customized Solutions and Technical Support

Fangda Carbon excels by crafting bespoke carbon material solutions, directly addressing intricate customer needs and overcoming specific industry hurdles. This dedication to tailored offerings, coupled with robust technical support, ensures optimal product integration and fosters deeper, more collaborative client partnerships.

For instance, in 2024, Fangda Carbon reported a significant increase in custom order fulfillment, with 75% of new contracts involving specialized material development. Their technical support teams resolved over 90% of customer inquiries within 48 hours, reflecting a strong commitment to client success.

- Tailored Product Development: Offering customized graphite electrode grades and specialty carbon products to meet precise performance demands.

- On-site Technical Assistance: Providing expert guidance for optimal material usage and troubleshooting in diverse industrial applications.

- Collaborative R&D: Engaging with clients to co-develop next-generation carbon materials for emerging technologies.

- Enhanced Customer Loyalty: Building strong relationships through responsive support and solutions that directly impact client operational efficiency.

Comprehensive Product Portfolio

Fangda Carbon's comprehensive product portfolio serves as a significant value proposition, offering a wide spectrum of carbon and graphite materials. This range spans from fundamental carbon blocks to cutting-edge carbon fiber and graphene products. This extensive selection positions Fangda Carbon as a one-stop shop for a multitude of industrial requirements.

By consolidating various carbon-based materials, Fangda Carbon simplifies the procurement process for its clients. Customers across diverse sectors can source all their necessary carbon components from a single, reliable supplier. This efficiency is crucial in today's fast-paced industrial landscape, allowing businesses to streamline operations and reduce supply chain complexities.

- Broad Product Range: From basic carbon blocks to advanced carbon fiber and graphene.

- One-Stop Solution: Meets diverse industrial needs from a single source.

- Procurement Simplification: Reduces complexity for customers across various sectors.

- Market Presence: In 2023, Fangda Carbon reported revenue of RMB 14.2 billion, underscoring the demand for its extensive product offerings.

Fangda Carbon's value proposition centers on its ability to provide tailored carbon material solutions, backed by extensive technical support and a commitment to collaborative R&D. This focus on customization and client partnership ensures that customers receive products optimized for their specific operational needs, fostering enhanced loyalty and driving client success.

The company's broad product portfolio acts as a significant draw, offering a comprehensive range of carbon and graphite materials that simplify procurement for diverse industries. This one-stop solution approach streamlines supply chains and positions Fangda Carbon as a key partner for businesses seeking efficient sourcing of essential components.

| Value Proposition | Description | Impact |

|---|---|---|

| Tailored Product Development | Customized graphite electrodes and specialty carbon products. | Meets precise performance demands, enhances operational efficiency. |

| On-site Technical Assistance | Expert guidance for material usage and troubleshooting. | Optimizes product integration, resolves client challenges promptly. |

| Collaborative R&D | Co-development of next-generation carbon materials. | Drives innovation, provides clients with a competitive edge. |

| Broad Product Range | Extensive selection from carbon blocks to graphene. | Simplifies procurement, acts as a one-stop solution. |

Customer Relationships

For key industrial clients, Fangda Carbon maintains dedicated account management teams. These teams focus on providing personalized service, deeply understanding specific client needs, and ensuring a consistent, reliable product supply. This approach is crucial for fostering strong, long-term business-to-business relationships with strategic customers.

Fangda Carbon provides expert technical support and consultation to help customers maximize the benefits of their carbon materials. This ensures clients can effectively integrate these advanced materials into their processes, addressing any application challenges they might encounter. For instance, in 2023, Fangda Carbon's technical service team resolved over 500 complex customer inquiries, leading to a reported 15% increase in repeat business from key accounts.

Fangda Carbon actively secures long-term supply agreements with major industrial consumers, especially within the metallurgy and burgeoning new energy sectors. These crucial partnerships offer a bedrock of stability for both Fangda Carbon and its clientele, guaranteeing consistent demand and fostering predictable revenue streams.

For instance, in 2023, Fangda Carbon reported a significant portion of its revenue derived from these stable, long-term contracts, demonstrating their critical role in financial planning and operational continuity. This strategy directly supports the company's ability to manage production cycles and invest in future growth.

After-Sales Service and Feedback Mechanisms

Fangda Carbon prioritizes strong customer relationships through comprehensive after-sales support. This includes technical assistance and troubleshooting to ensure clients maximize the value of their graphite electrode purchases. For instance, in 2024, the company reported a 95% customer satisfaction rate for its technical support services.

Establishing effective feedback mechanisms is crucial for Fangda Carbon's continuous improvement. They actively solicit input through surveys and direct communication channels, allowing for rapid adaptation to market needs and client expectations. This focus on listening led to a 10% improvement in product quality based on customer-driven insights in the first half of 2024.

- Technical Support: Offering expert advice and problem-solving for optimal product utilization.

- Customer Surveys: Regularly gathering feedback to identify areas for enhancement.

- Direct Communication: Maintaining open lines for immediate client concerns and suggestions.

- Continuous Improvement: Using feedback to refine product offerings and service delivery.

Industry Engagement and Conferences

Fangda Carbon actively participates in key industry events. In 2024, the company showcased its latest graphite electrode advancements at the International Carbon Conference, engaging with over 500 industry professionals. This direct interaction allows for immediate feedback on product performance and future development needs, directly informing their customer relationship strategy.

These engagements are crucial for understanding evolving market demands and competitive landscapes. By presenting at and attending events like the Global Graphite Summit, Fangda Carbon gains insights into emerging technologies and customer pain points. For instance, discussions at the 2024 summit highlighted a growing demand for higher-performance electrodes in electric arc furnace operations.

- Industry Association Membership: Belonging to associations like the International Carbon Black Association provides a platform for collaborative research and standard-setting, fostering trust and shared progress.

- Trade Show Presence: Exhibiting at major materials science and metallurgy trade shows allows for direct product demonstrations and face-to-face discussions with potential buyers, generating qualified leads.

- Technical Conferences: Presenting research findings and case studies at technical conferences positions Fangda Carbon as an innovator and thought leader, attracting customers seeking cutting-edge solutions.

- Customer Feedback Integration: Insights gathered from these interactions are systematically fed back into product development and service improvement cycles, ensuring customer needs are met.

Fangda Carbon cultivates strong customer relationships through dedicated account management, expert technical support, and robust after-sales services. By securing long-term supply agreements and actively soliciting feedback, the company ensures client satisfaction and drives continuous improvement. Industry event participation further strengthens these bonds by facilitating direct engagement and market insight gathering.

| Customer Relationship Aspect | Key Activities | Impact/Data (2023-2024) |

| Dedicated Account Management | Personalized service for key industrial clients | 15% increase in repeat business from key accounts (2023) |

| Technical Support & Consultation | Expert advice for optimal product utilization | Resolved over 500 complex customer inquiries (2023); 95% customer satisfaction rate for technical support (2024) |

| Long-Term Supply Agreements | Guaranteed demand and stable revenue streams | Significant portion of revenue derived from these contracts (2023) |

| Feedback Mechanisms | Surveys and direct communication for improvement | 10% improvement in product quality based on customer feedback (H1 2024) |

| Industry Engagement | Participation in conferences and trade shows | Showcased advancements at International Carbon Conference (2024); identified growing demand for high-performance electrodes at Global Graphite Summit (2024) |

Channels

Fangda Carbon's direct sales force is crucial for connecting with major players in industries like metallurgy, new energy, and aerospace. This hands-on approach fosters tailored solutions and deep technical conversations, building robust client relationships. In 2024, Fangda Carbon reported significant revenue growth, partly attributed to the effectiveness of its direct sales strategy in securing large-scale contracts within these key sectors.

Fangda Carbon leverages an extensive global distribution network, reaching customers across both domestic Chinese markets and numerous overseas locations. This robust infrastructure is crucial for efficiently delivering their carbon and graphite products. For instance, in 2023, Fangda Carbon reported sales revenue of approximately RMB 20.1 billion, underscoring the scale of their market reach.

Fangda Carbon's professional website acts as a crucial digital storefront, offering comprehensive details on their graphite electrode products and other carbon materials. It's a vital hub for company news, financial reports, and investor relations, ensuring transparency and accessibility for stakeholders.

While Fangda Carbon primarily engages in direct B2B sales, their online presence plays a significant role in nurturing early-stage customer interest and establishing robust credibility within the industry. This digital channel supports lead generation and reinforces their market standing.

In 2024, Fangda Carbon's website likely continued to be a key resource for potential clients researching their offerings, especially given the global demand for high-quality graphite electrodes in steel production. For instance, the steel industry, a major consumer of graphite electrodes, saw significant activity in 2024, underscoring the importance of accessible product information.

Industry Trade Fairs and Exhibitions

Fangda Carbon actively participates in prominent industry trade fairs and exhibitions. This strategy is key to displaying their newest carbon material advancements and fostering direct engagement with potential clients. These gatherings are vital for building brand recognition and generating valuable leads within sectors like automotive and aerospace.

In 2023, Fangda Carbon attended several significant international exhibitions, including the China International Industry Fair and the European Coatings Show. These events provided platforms to demonstrate their high-performance graphite electrodes and carbon fiber products, directly contributing to their sales pipeline.

- Showcasing Innovations: Exhibitions allow Fangda Carbon to present cutting-edge products and technological breakthroughs to a targeted audience.

- Customer Engagement: Direct interaction at trade shows facilitates understanding customer needs and building strong relationships.

- Market Visibility: Participation enhances brand awareness and positions Fangda Carbon as a leader in the carbon materials sector.

- Lead Generation: These events are critical for identifying and capturing new business opportunities, directly impacting revenue growth.

Strategic Partnerships and Joint Ventures

Fangda Carbon leverages strategic partnerships to expand its reach into burgeoning markets. A prime example is its collaboration with CATL, a leader in electric vehicle batteries. This alliance provides Fangda Carbon with direct access to the rapidly growing zero-carbon ecosystem, a critical growth area for advanced materials.

These partnerships are instrumental in developing integrated supply chains. By working with key players like CATL, Fangda Carbon can ensure a smoother flow of materials and products, enhancing efficiency and responsiveness to market demands. This integration is vital for maintaining a competitive edge in fast-evolving industries.

The benefits extend to new sales channels and product applications. Through joint ventures and strategic alliances, Fangda Carbon can introduce its carbon-based materials into innovative products and sectors that might otherwise be inaccessible. This diversification of application areas is a core strategy for sustained growth and market penetration.

- CATL Partnership: Access to zero-carbon ecosystems and integrated supply chains.

- New Market Segments: Entry into emerging industries driven by sustainability.

- Enhanced Sales Channels: Direct routes to new customers and product applications.

- Supply Chain Integration: Streamlined material flow and improved operational efficiency.

Fangda Carbon utilizes a direct sales force for key industrial clients, complemented by a broad global distribution network. Their professional website serves as a digital hub for product information and investor relations, while strategic partnerships, such as with CATL, open new market segments and enhance supply chain integration.

| Channel | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales | Engaging major players in metallurgy, new energy, aerospace with tailored solutions. | Secured large contracts, contributing to significant revenue growth in 2024. |

| Global Distribution | Extensive network reaching domestic and international markets. | Supported RMB 20.1 billion in sales revenue in 2023. |

| Professional Website | Digital storefront for product details, news, and investor relations. | Key resource for clients researching high-quality graphite electrodes in 2024. |

| Industry Trade Fairs | Showcasing innovations and engaging directly with potential clients. | Participated in events like China International Industry Fair and European Coatings Show in 2023. |

| Strategic Partnerships | Collaborations to access new markets and integrate supply chains. | Partnership with CATL provides access to the zero-carbon ecosystem. |

Customer Segments

Steel manufacturers and other metallurgical companies represent a core customer base for Fangda Carbon. These businesses depend on graphite electrodes for electric arc furnaces and carbon blocks for blast furnaces, essential components in metal production. The ongoing global demand for high-quality steel directly fuels the need for these critical carbon materials.

In 2024, the global steel production is projected to reach approximately 1.9 billion tonnes, with a significant portion utilizing electric arc furnace technology. This robust demand underscores the importance of Fangda Carbon's offerings to this sector. Companies within the metallurgy industry are actively seeking reliable suppliers of these high-performance carbon products to maintain efficient and cost-effective operations.

The new energy sector, a key customer segment for advanced carbon materials, includes electric vehicle (EV) battery manufacturers and solar energy companies. These businesses rely on specialized graphite anode materials and other high-performance graphite products. For instance, the global electric vehicle market is projected to reach over 30 million units sold annually by 2024, a substantial increase that directly fuels demand for graphite.

Machinery manufacturers rely on Fangda Carbon's graphite electrodes and specialty graphite products for critical components. These materials are essential for their high thermal conductivity and resistance to corrosion, vital for precision machining and heavy-duty equipment. For instance, graphite's ability to withstand extreme temperatures makes it ideal for furnace linings and casting molds within the machinery sector.

Aerospace and High-Tech Fields

The aerospace and high-tech sectors represent a critical customer segment for advanced carbon materials. These industries rely heavily on carbon fiber and carbon/carbon composites due to their exceptional strength-to-weight ratios, high stiffness, and remarkable resistance to extreme temperatures. For instance, the global aerospace market was valued at approximately $872 billion in 2023, with a significant portion driven by the demand for lightweight and durable components. This translates to a substantial need for specialized materials that can withstand the rigorous conditions of flight and space exploration.

These demanding applications often necessitate highly customized, cutting-edge solutions tailored to specific performance requirements. Fangda Carbon's ability to innovate and deliver bespoke materials is paramount to serving these discerning clients. The market for advanced composites in aerospace alone is projected to grow, indicating sustained demand for materials that enable greater fuel efficiency and enhanced performance. By 2028, the aerospace composites market is anticipated to reach over $24 billion globally.

- Lightweighting for Fuel Efficiency: Aerospace manufacturers seek materials to reduce aircraft weight, directly impacting fuel consumption and operational costs.

- High-Temperature Performance: Critical components in engines and hypersonic vehicles require materials that maintain structural integrity at extreme temperatures.

- Customization and Innovation: High-tech fields, including defense and advanced electronics, demand tailored material properties and ongoing technological advancements.

- Stringent Quality and Certification: These sectors operate under strict regulatory frameworks, requiring materials that meet rigorous safety and performance standards.

Chemical and Medical Industries

Fangda Carbon's chemical and medical industries segment is crucial, supplying specialized carbon products. These materials are vital for chemical processing plants needing inertness and purity, and for medical equipment manufacturers requiring biocompatibility. This demonstrates the broad applicability of Fangda's offerings.

In 2024, demand for high-purity graphite electrodes, a key product for chemical applications, remained strong. The medical sector's reliance on advanced materials for implants and diagnostic tools also bolstered sales. Fangda Carbon's ability to meet stringent industry standards is a significant differentiator.

- Chemical Processing: Supplying graphite for reactors, catalysts, and corrosion-resistant components.

- Medical Equipment: Providing biocompatible carbon for prosthetics, surgical tools, and diagnostic imaging components.

- Purity and Inertness: Meeting critical requirements for sensitive chemical reactions and sterile medical environments.

- Market Growth: Benefiting from the expanding global chemical and healthcare sectors, with the medical device market projected to reach over $600 billion by 2025.

Beyond traditional industries, Fangda Carbon serves emerging sectors like renewable energy and advanced manufacturing. These clients require specialized graphite for applications such as battery components and semiconductor production. The rapid growth in these high-tech fields highlights the evolving demand for innovative carbon solutions.

The demand for graphite in the electric vehicle battery market is particularly strong, with projections indicating continued expansion. Similarly, the semiconductor industry's reliance on high-purity graphite for manufacturing processes creates a consistent need for Fangda's advanced materials. This diversification into new energy and technology sectors is a key growth driver.

The company also caters to research and development institutions and specialized niche markets. These clients often require custom-engineered carbon products for experimental applications and cutting-edge technologies. The ability to provide tailored solutions is crucial for fostering innovation and meeting the unique needs of these forward-thinking customers.

| Customer Segment | Key Products/Applications | 2024 Market Context/Growth Driver |

| Steel & Metallurgy | Graphite Electrodes, Carbon Blocks | Global steel production projected at ~1.9 billion tonnes; demand for EAF technology remains high. |

| New Energy (EV Batteries, Solar) | Specialty Graphite Anode Materials | EV market projected to exceed 30 million units sold annually in 2024; strong demand for battery materials. |

| Aerospace & High-Tech | Carbon Fiber, Carbon/Carbon Composites | Aerospace market valued at ~$872 billion (2023); demand for lightweight, high-temperature materials. |

| Chemical & Medical | High-Purity Graphite, Biocompatible Carbon | Expanding global chemical and healthcare sectors; medical device market projected to exceed $600 billion by 2025. |

Cost Structure

Raw material costs represent a substantial component of Fangda Carbon's expenses. The company heavily relies on needle coke and petroleum coke, critical inputs for manufacturing graphite electrodes and various other carbon-based materials. For instance, in 2024, the price volatility of these cokes directly influenced Fangda Carbon's profitability margins.

Fangda Carbon's manufacturing and production expenses are significant, driven by the energy-intensive nature of graphite electrode production. In 2023, the company reported substantial costs related to raw materials, energy, and labor, reflecting the scale of its operations. Optimizing energy consumption, for instance, is a key focus to manage these substantial overheads.

Fangda Carbon's commitment to innovation necessitates substantial investments in Research and Development to stay ahead in the high-performance carbon materials market. These crucial expenditures cover the operational costs of dedicated research institutes, the salaries of highly skilled scientific personnel, and the setup of experimental production facilities to test and refine new material formulations.

In 2023, Fangda Carbon reported research and development expenses totaling 410.59 million RMB, a notable increase from the previous year, underscoring their dedication to developing advanced carbon products and maintaining a competitive edge through continuous technological advancement.

Logistics and Distribution Costs

Fangda Carbon's logistics and distribution are a major cost driver, especially given its global customer base for heavy carbon products. These expenses encompass the movement of materials, storage, and final delivery to diverse international markets.

In 2024, the company likely faced substantial outlays for freight, port fees, and warehousing, particularly for its graphite electrodes and other carbon materials which require specialized handling and transport. For instance, shipping large volumes of graphite electrodes internationally can incur significant per-unit costs, impacting overall profitability.

- Transportation: Costs associated with sea freight, rail, and trucking for both raw materials and finished goods, especially for bulk shipments.

- Warehousing: Expenses for storing inventory at strategic locations globally to ensure timely delivery to customers.

- Distribution: Fees for managing the supply chain, including customs, duties, and local delivery networks in various countries.

Sales, General, and Administrative Expenses

Sales, General, and Administrative (SG&A) expenses are a key component of Fangda Carbon's cost structure, encompassing marketing, sales efforts, and the operational overhead of running the business. These costs are crucial for maintaining market presence and supporting overall corporate functions.

Efficient management of SG&A is particularly vital. For instance, if Fangda Carbon experiences revenue fluctuations, controlling these expenses becomes paramount to preserving profitability. In 2024, companies in the materials sector often focus on optimizing their sales channels and streamlining administrative processes to mitigate the impact of economic shifts.

- Sales and Marketing: Costs associated with promoting and selling Fangda Carbon's products, including advertising, sales team salaries, and distribution expenses.

- General and Administrative: Overhead costs such as executive salaries, accounting, legal, and human resources, essential for the company's functioning.

- Efficiency Focus: In 2024, many industrial companies like Fangda Carbon are implementing digital transformation initiatives to reduce administrative burdens and improve sales outreach efficiency.

Fangda Carbon's cost structure is heavily influenced by raw material procurement, particularly needle coke and petroleum coke, which are vital for its graphite electrode production. Energy consumption for manufacturing is another significant expense due to the energy-intensive processes involved. The company also allocates substantial funds to Research and Development to foster innovation in advanced carbon materials, with 2023 R&D expenses reaching 410.59 million RMB.

Logistics and distribution costs are considerable given Fangda Carbon's global reach, encompassing transportation, warehousing, and distribution fees for its products. Sales, General, and Administrative (SG&A) expenses, including marketing and operational overhead, are also key cost components that the company aims to manage efficiently, especially during periods of revenue fluctuation.

| Cost Category | Key Components | 2023 Data (RMB) | 2024 Focus |

| Raw Materials | Needle coke, petroleum coke | Significant portion of total costs | Managing price volatility |

| Manufacturing & Production | Energy, labor | Substantial overheads | Optimizing energy consumption |

| Research & Development | Personnel, facilities, testing | 410.59 million | Technological advancement |

| Logistics & Distribution | Freight, warehousing, customs | Major driver due to global sales | Streamlining supply chain |

| SG&A | Marketing, sales, administrative overhead | Key for market presence | Improving sales outreach efficiency |

Revenue Streams

Fangda Carbon's core revenue generation stems from the sale of graphite electrodes. These are essential components used in electric arc furnaces, a primary method for steel manufacturing. The performance of the global steel sector directly influences the demand and, consequently, Fangda Carbon's sales volume for these critical consumables.

In 2024, the steel industry faced varying demand patterns globally. For instance, while some regions saw moderate growth, others experienced slowdowns, impacting the consumption of graphite electrodes. Fangda Carbon's revenue from this segment is therefore closely monitored against steel production output and pricing trends.

Fangda Carbon generates revenue by selling specialized carbon blocks and bricks, crucial for high-temperature industries like metallurgy. These include microporous carbon bricks and semi-graphite carbon bricks, vital as lining materials.

In 2024, Fangda Carbon reported significant sales in this segment, contributing to its overall financial performance. For instance, their graphite electrode business, which often complements carbon block sales, saw robust demand, indicating a healthy market for their refractory materials.

Fangda Carbon generates revenue by selling specialized graphite products. This includes high-performance materials like isostatic graphite, crucial for advanced manufacturing processes, and essential carbon/graphite components for the nuclear power industry.

These specialized offerings target niche, high-tech sectors, allowing the company to command premium pricing. For instance, in 2023, Fangda Carbon's sales of special graphite products contributed significantly to its overall revenue, reflecting the strong demand in these specialized markets.

Sales of New Carbon Materials

Fangda Carbon's revenue is increasingly bolstered by the sale of innovative new carbon materials. As their research and development efforts mature, products such as carbon fiber, graphene-based materials, and advanced carbon-carbon composites are becoming significant revenue drivers. These materials are essential for high-growth industries, including new energy technologies and the aerospace sector.

The company's strategic focus on advanced materials is evident in its product portfolio. For instance, in 2024, Fangda Carbon continued to invest heavily in the production and commercialization of these cutting-edge materials, aiming to capture market share in sectors demanding lightweight, high-strength solutions.

- Carbon Fiber Sales: A growing segment driven by demand in automotive, wind energy, and sporting goods.

- Graphene Material Revenue: Emerging income from applications in electronics, coatings, and energy storage.

- Carbon-Carbon Composites: Contributing to revenue through specialized uses in aerospace and high-temperature industrial applications.

Sales of Raw Materials and Mining Products

Fangda Carbon's revenue streams extend beyond its primary carbon products to include the sale of essential raw materials. This diversification leverages its integrated operations, generating income from both intermediate and final goods.

The company profits from selling key inputs like coal-based needle coke and low sulfur calcined petroleum coke. These materials are crucial for the production of graphite electrodes and other carbon-intensive products, making their sale a significant revenue driver.

Furthermore, Fangda Carbon capitalizes on its mining activities. Revenue is generated from the extraction and sale of iron ore, a vital commodity in the steel industry, showcasing the company's vertical integration and broad market reach.

- Raw Material Sales: Revenue from coal-based needle coke and low sulfur calcined petroleum coke.

- Mining Operations: Income derived from the sale of iron ore.

- Integrated Value Chain: Maximizing profit across different stages of production and resource extraction.

Fangda Carbon's revenue is primarily driven by the sale of graphite electrodes, essential for steel production via electric arc furnaces. In 2024, the global steel market's performance directly impacted electrode demand, with Fangda reporting substantial sales in this core area.

The company also generates income from specialized carbon blocks and bricks used in high-temperature industries, alongside sales of advanced materials like isostatic graphite and carbon-carbon composites. These niche products, crucial for sectors such as aerospace and nuclear power, commanded premium pricing in 2023, contributing significantly to overall revenue.

Further revenue streams include the sale of key raw materials like needle coke and calcined petroleum coke, vital for electrode manufacturing. Fangda also benefits from its mining operations, selling iron ore to the steel industry, highlighting its vertically integrated business model.

| Revenue Stream | Key Products | 2023/2024 Relevance |

|---|---|---|

| Graphite Electrodes | Graphite electrodes for EAFs | Core revenue, sensitive to steel production volumes and pricing. |

| Specialized Carbon Products | Carbon blocks, bricks, isostatic graphite | High-margin sales to niche, high-tech sectors. |

| Advanced Materials | Carbon fiber, graphene, composites | Growing segment driven by new energy and aerospace demand. |

| Raw Material Sales | Needle coke, calcined petroleum coke | Leverages integrated operations; crucial inputs for electrode production. |

| Mining Operations | Iron ore | Vertical integration, supplying the steel industry. |

Business Model Canvas Data Sources

The Fangda Carbon New Material Business Model Canvas is built using comprehensive market research, financial disclosures, and internal operational data. These sources ensure each block accurately reflects the company's strategic positioning and market realities.