Flight Centre SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Flight Centre Bundle

Flight Centre's strengths lie in its established brand and global network, but understanding its vulnerabilities and the competitive landscape is crucial for strategic planning. Our comprehensive SWOT analysis delves into these critical areas, providing actionable insights to navigate the dynamic travel industry.

Want to truly grasp Flight Centre's competitive edge and potential pitfalls? Purchase the complete SWOT analysis to access a professionally written, fully editable report designed to empower your strategic decisions, whether you're an investor, analyst, or business leader.

Strengths

Flight Centre Travel Group's extensive global network, comprising over 2,000 retail stores and a significant online presence, is a core strength. This reach, evident in its operations across 11 countries, allows it to serve a broad customer base. For the fiscal year 2023, Flight Centre reported a significant increase in total transaction value (TTV) to AUD 24.3 billion, demonstrating the effectiveness of its expansive network.

Flight Centre's corporate travel segment, encompassing brands like FCM Travel and Corporate Traveller, has been a standout performer. This division achieved record profits and total transaction value (TTV) in the fiscal year 2024 and has continued its upward trajectory into the first half of fiscal year 2025.

The corporate travel business is now substantially larger than its pre-pandemic scale, consistently winning new contracts. This sustained growth underscores its resilience and critical role within the broader Flight Centre group, effectively balancing out fluctuations in other business areas.

Flight Centre demonstrated a robust financial rebound in FY24, achieving an underlying profit before tax of AU$320 million, a significant 131% increase. Total Transaction Value (TTV) hit a record AU$23.74 billion, exceeding pre-pandemic figures.

The company has actively fortified its financial position by reducing its debt levels and maintaining substantial holdings in cash and investments. This healthy balance sheet offers crucial stability and supports future strategic growth opportunities and effective capital deployment.

Significant Investment in Technology and AI

Flight Centre's commitment to technological advancement is a significant strength, particularly its substantial investment in digital transformation and artificial intelligence (AI). This focus is designed to boost operational efficiency and elevate the customer experience across its brands.

Key initiatives underscore this commitment. The company is actively deploying platforms such as Corporate Traveller's Melon and the FCM Platform, which are crucial for modernizing their service delivery. Furthermore, strengthening distribution technology through partnerships like TPConnects is a strategic move to enhance booking capabilities and reach.

The establishment of an 'AI Center of Excellence' signals a forward-thinking approach, aiming to harness AI for competitive advantage. These technological upgrades are projected to yield tangible benefits.

- Digital Transformation: Flight Centre is investing heavily in digital platforms to streamline operations and improve customer interactions, aiming for a more integrated and efficient travel booking process.

- AI Integration: The company is establishing an 'AI Center of Excellence' to leverage artificial intelligence for enhanced productivity, personalized customer service, and data-driven decision-making.

- Platform Enhancements: Adoption of platforms like Corporate Traveller's Melon and the FCM Platform, alongside strengthening distribution technology with TPConnects, aims to modernize and optimize the company's technological infrastructure.

- Efficiency Gains: These technological advancements are expected to lead to significant improvements in operational productivity and the delivery of more tailored and responsive services to clients.

Diversified Product and Service Offerings

Flight Centre's strength lies in its extensive portfolio, encompassing leisure and corporate travel solutions. This includes everything from flights and hotels to tours, cruises, and car rentals, serving both individual travelers and businesses. This broad service range ensures multiple income sources and appeals to a wide customer base.

The company's strategic expansion into lucrative sectors, such as the cruise market through acquisitions, further bolsters its revenue streams. For instance, Flight Centre Travel Group reported a significant uplift in its leisure travel segment, with its leisure brands experiencing strong demand in the fiscal year 2024, contributing positively to overall performance.

- Comprehensive Leisure and Corporate Travel: Offers flights, accommodation, tours, cruises, and car rentals.

- Multiple Revenue Streams: Diversification across various travel services mitigates single-product reliance.

- Strategic Acquisitions: Expansion into high-growth areas like cruising enhances market reach and revenue.

- Caters to Varied Needs: Serves both individual travelers and corporate clients with tailored solutions.

Flight Centre's diversified travel offerings, spanning both leisure and corporate segments, represent a key strength, enabling it to cater to a wide array of customer needs and generate multiple revenue streams. The company's strategic acquisitions, such as its expansion into the cruise market, further enhance its market penetration and revenue potential. In fiscal year 2024, the leisure travel segment experienced robust demand, contributing significantly to the group's overall positive performance.

What is included in the product

Analyzes Flight Centre’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to address competitive pressures and internal inefficiencies.

Weaknesses

Flight Centre's reliance on discretionary consumer spending makes it particularly vulnerable to economic downturns. When living costs rise, consumers often cut back on non-essential purchases like travel, directly impacting Flight Centre's revenue. This sensitivity was highlighted when the company recently revised its FY25 profit guidance downwards, citing volatile trading conditions and uneven global demand.

Flight Centre faces formidable competition from online travel agencies (OTAs) such as Booking.com and Expedia. These digital-native platforms leverage convenience and often lower overheads to attract customers, putting pressure on Flight Centre's pricing and market share. The travel industry saw a significant shift towards online bookings, with global online travel sales projected to reach over $1.1 trillion by 2024.

While Flight Centre has invested in its digital presence, the enduring strength of OTAs in offering seamless, user-friendly booking experiences presents a continuous challenge. Consumers increasingly prioritize the ease of comparing options and booking directly online, a preference that can marginalize traditional retail models if not adequately addressed.

The long-term viability of physical travel agency stores is also a concern. As digital adoption accelerates, particularly among younger demographics, the perceived necessity of in-person consultations for travel planning is diminishing. This trend puts Flight Centre's extensive retail network at a disadvantage against purely online competitors.

Flight Centre's recent performance, while showing growth in total transaction value (TTV), is being impacted by a shift towards lower-margin budget offerings, especially within its leisure segment. This means more sales are happening, but the profit from each sale is smaller, which can hurt overall profitability even as sales volume increases.

For example, in the first half of fiscal year 2024, Flight Centre reported a 13% increase in TTV to AUD 10.7 billion, but the focus on budget travel means the profit generated from this growth is less substantial than it could be. The company is actively working to balance this by encouraging customers to choose higher-value products and services.

Operational Challenges and Dependence on Third-Party Suppliers

Flight Centre grapples with operational hurdles, notably in maintaining consistent communication and transparency with customers regarding service delivery and pricing. This can foster frustration and impact customer loyalty. For instance, in FY23, while revenue increased, managing the complexities of a global travel rebound presented ongoing service delivery challenges.

A significant weakness stems from its substantial reliance on third-party suppliers, including airlines and hotels. This dependence creates inherent operational risks, as disruptions or changes by these partners can directly affect Flight Centre's ability to control the end-to-end customer journey and potentially lead to unexpected cost fluctuations. The company is actively working to streamline internal processes and reduce its dependence on external systems to mitigate these risks.

- Communication Gaps: Issues with transparency in customer service and pricing can lead to dissatisfaction.

- Supplier Dependency: Reliance on airlines and hotels limits control over the customer experience and introduces risk.

- Operational Streamlining: Ongoing efforts are focused on improving internal efficiency and reducing reliance on external platforms.

Impact of Geopolitical Events and Policy Changes

Geopolitical instability and shifts in international trade and immigration policies, exemplified by recent U.S. policy adjustments, create volatile trading environments and can hinder overall transaction value growth. These external forces, largely outside Flight Centre's direct influence, introduce substantial unpredictability into its operational and financial projections.

Flight Centre has already factored these challenges into its outlook, revising its FY25 guidance to reflect the impact of these geopolitical and policy-driven uncertainties.

- Geopolitical Risks: Events like regional conflicts or trade wars can directly reduce travel demand and disrupt global operations.

- Policy Changes: Stricter visa regulations or changes in international travel advisories can significantly impact booking volumes and customer confidence.

- FY25 Guidance Adjustment: The company's revised financial forecast for fiscal year 2025 acknowledges the material effect of these external headwinds on expected revenue and profitability.

Flight Centre's reliance on budget travel offerings, while increasing transaction volume, is impacting profitability per sale. For instance, in H1 FY24, total transaction value grew by 13% to AUD 10.7 billion, but the margin contribution from this growth was less robust. This necessitates a strategic focus on upselling higher-value products and services to improve overall financial performance.

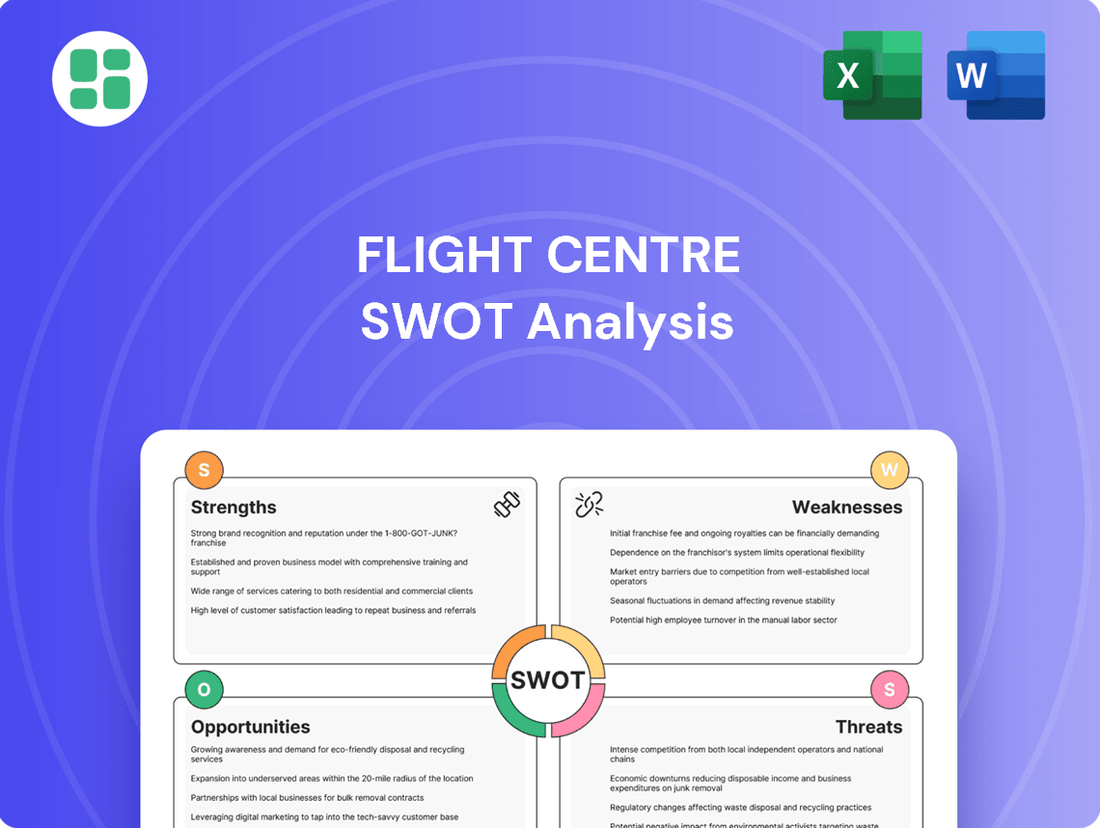

Preview Before You Purchase

Flight Centre SWOT Analysis

The preview you see is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Flight Centre's strategic position.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You'll gain access to the complete, detailed breakdown of Flight Centre's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The business travel sector is experiencing a robust recovery, with projections indicating continued growth through fiscal year 2025. Many organizations are planning to elevate their travel volumes and associated expenditures, signaling a positive outlook for the industry.

Flight Centre's established corporate brands, FCM Travel and Corporate Traveller, are strategically positioned to leverage this resurgence. These brands are actively pursuing new client acquisitions and expanding their presence in crucial geographic markets, aiming to capture a larger share of this expanding segment.

The corporate division of Flight Centre has already demonstrated impressive performance, achieving record total transaction value (TTV). This success is further bolstered by a targeted strategy focusing on specialized industry sectors, indicating a focused approach to maximizing growth opportunities within the business travel landscape.

Flight Centre's substantial investments in artificial intelligence and digital platforms, notably its AI Center of Excellence and tools like the Melon platform for Corporate Traveller and the FCM Platform, represent a significant opportunity. These initiatives are designed to streamline operations by automating routine tasks, freeing up human agents to handle more intricate customer needs.

This strategic adoption of technology is projected to drive considerable productivity gains and elevate the overall customer experience. By enabling staff to concentrate on value-added services, Flight Centre can foster a more efficient and responsive business model, potentially creating a distinct competitive edge in the travel industry.

Flight Centre is strategically targeting high-demand leisure sectors, notably cruising, by acquiring companies like Cruise Club UK and revitalizing specialized brands. This focus allows them to capture growing market segments and broaden their leisure travel portfolio.

The company is also increasing its physical presence for leisure brands, including Flight Centre retail locations and premium offerings such as Travel Associates. This expansion aims to capitalize on increased consumer spending in the leisure travel market, which saw global tourism revenue reach an estimated $1.3 trillion in 2023, with luxury and niche segments showing particularly strong recovery.

Optimizing Operations for Increased Profitability

Flight Centre is actively pursuing operational optimization to boost profitability, targeting a 2% profit margin. Initiatives like 'Productive Operations' and the establishment of a Global Business Services (GBS) area are central to this strategy. These programs focus on streamlining processes, standardizing workflows across the organization, and leveraging advanced data analytics for more informed decision-making.

The company's commitment to efficiency is designed to reduce operational costs and enhance overall financial performance. By refining systems and improving data utilization, Flight Centre aims to unlock greater value from its existing operations, driving a more profitable business model.

- Operational Efficiency Drive: Implementing 'Productive Operations' to streamline workflows and reduce redundancies.

- Global Business Services (GBS): Establishing a centralized GBS function to standardize and optimize back-office processes.

- Cost Reduction Focus: Aiming to lower operational expenses through process improvements and technology adoption.

- Profit Margin Target: Working towards achieving a 2% profit margin by maximizing revenue and controlling costs.

Personalization and Enhanced Customer Experience

Flight Centre can capitalize on the growing desire for unique travel by combining its human touch with smart technology. This allows for deeply personalized recommendations and experiences that online-only players struggle to match. For instance, by the end of 2024, the travel industry saw continued growth in demand for bespoke itineraries, with personalized booking platforms reporting higher conversion rates.

Leveraging AI to understand customer feedback and preferences presents a significant opportunity. This data-driven approach helps Flight Centre create tailored journeys, address specific needs, and build stronger customer loyalty. Reports from early 2025 indicate that travel companies utilizing AI for personalization saw a 15% increase in repeat bookings compared to those without.

The company's ability to offer customized travel can be a key differentiator. By focusing on individual needs and preferences, Flight Centre can stand out in a crowded market. Surveys conducted in late 2024 revealed that over 60% of travelers are willing to pay a premium for personalized travel advice and planning.

Key opportunities include:

- Developing AI-powered recommendation engines to suggest hyper-personalized travel options.

- Expanding human-led consultation services that integrate AI-driven insights for tailored advice.

- Creating loyalty programs that reward customers based on their personalized travel preferences and history.

Flight Centre is well-positioned to benefit from the ongoing recovery in business and leisure travel. The company's strategic focus on specialized sectors and its investments in technology are driving significant growth. For instance, its corporate division achieved record total transaction value (TTV) in the first half of fiscal year 2024, demonstrating the effectiveness of its targeted approach.

The company's expansion into high-demand leisure areas like cruising, through acquisitions such as Cruise Club UK, and the revitalization of brands like Travel Associates, taps into growing consumer spending. Global tourism revenue is projected to surpass pre-pandemic levels by 2025, with niche segments showing particular strength.

Flight Centre's commitment to operational efficiency, including its 'Productive Operations' initiative and the establishment of a Global Business Services (GBS) area, aims to boost profitability. By streamlining processes and leveraging data analytics, the company is targeting a 2% profit margin, a key financial objective for fiscal year 2025.

The strategic adoption of AI and digital platforms, such as the FCM Platform and Melon, is a significant opportunity. These technologies are expected to enhance productivity and customer experience by automating tasks and allowing human agents to focus on complex needs. Early 2025 data shows travel companies using AI for personalization experienced a 15% increase in repeat bookings.

Threats

The travel sector is constantly being reshaped by online travel agencies (OTAs) and direct booking sites, often triggering price wars that squeeze profit margins. This digital onslaught directly challenges Flight Centre's established multi-channel approach, especially its physical stores, which risk becoming less relevant as consumers increasingly favor online transactions.

Global economic uncertainty, marked by persistent inflation and elevated interest rates, presents a significant threat to Flight Centre. These conditions directly impact consumers' ability and willingness to spend on non-essential items like travel, a key driver for the company's leisure segment.

The ongoing cost of living pressures mean travelers may opt for cheaper, lower-margin travel alternatives or postpone trips entirely. This trend could lead to a reduction in Flight Centre's total transaction value and put pressure on the profitability of its core leisure offerings, especially as consumers become more price-sensitive.

Geopolitical instability, including ongoing conflicts and shifting international relations, poses a significant threat to Flight Centre. Evolving government policies, such as new visa requirements or increased airport taxes, can directly impact travel demand and operational costs. For instance, the ongoing geopolitical tensions in Eastern Europe and the Middle East in late 2023 and early 2024 have led to rerouted flights and increased fuel surcharges, impacting airline profitability and, by extension, travel agency margins.

Fluctuations in Airline Capacity and Airfares

Fluctuations in airline capacity and airfares present a significant threat to Flight Centre. While increased capacity can lower prices and boost travel, unpredictable shifts can hinder Flight Centre's ability to negotiate favorable rates, directly impacting their profit margins. This reliance on airline inventory and dynamic pricing means the company is highly susceptible to volatility within the aviation sector.

For instance, during 2024, the International Air Transport Association (IATA) reported that while passenger demand remained robust, airline capacity deployment was often a delicate balancing act. Unexpected capacity reductions by major carriers, perhaps due to fuel price spikes or operational issues, could lead to higher wholesale airfares for Flight Centre. Conversely, an oversupply of seats could depress margins if not managed effectively.

- Capacity Volatility: Sudden changes in the number of available airline seats can disrupt booking strategies and pricing.

- Airfare Instability: Unpredictable swings in ticket prices directly affect Flight Centre's revenue and profitability.

- Margin Squeeze: The company's ability to secure competitive rates is challenged by fluctuating airline pricing strategies.

Execution Risks of Strategic Initiatives and Technology Adoption

Flight Centre's strategic push, particularly its 'Productive Operations' program aimed at productivity gains and the adoption of new AI technologies, faces significant execution risks. Successfully rolling out these changes requires seamless integration and buy-in from the workforce. For instance, if staff struggle to adapt to new booking platforms or if AI tools encounter unexpected glitches, the anticipated efficiency improvements could be significantly delayed.

These adoption hurdles and technical setbacks directly threaten the realization of targeted benefits. For example, a slower-than-expected uptake of new digital tools could mean that projected cost savings from streamlining operations don't materialize as planned. This could impact the company's ability to achieve its financial targets for the 2024-2025 fiscal year.

- Staff Adoption Challenges: A key threat is resistance or difficulty among employees in adopting new digital workflows and AI-powered systems, potentially slowing down the realization of productivity gains.

- Technical Glitches: Unforeseen technical issues during the integration of new technologies could lead to operational disruptions and delays in expected efficiency improvements.

- Delayed ROI: Failure to fully achieve the targeted productivity and efficiency gains from these strategic initiatives could negatively impact Flight Centre's competitive edge and overall financial performance in the near term.

The increasing dominance of online travel agencies (OTAs) and direct booking platforms poses a significant threat by intensifying price competition, potentially eroding Flight Centre's profit margins. This digital shift challenges the relevance of its physical store network as consumer preferences increasingly lean towards online transactions.

Global economic headwinds, including persistent inflation and high interest rates, directly dampen consumer spending on discretionary travel, impacting Flight Centre's leisure segment. Furthermore, ongoing geopolitical instability and evolving government policies can disrupt travel patterns and increase operational costs, as seen with rerouted flights and rising fuel surcharges affecting the travel industry in late 2023 and early 2024.

Flight Centre's ambitious adoption of new technologies like AI faces execution risks, where staff resistance or technical glitches could delay anticipated efficiency gains, impacting its 2024-2025 financial targets. Capacity volatility and airfare instability within the aviation sector also present ongoing challenges, as demonstrated by IATA's reports on the delicate balance of airline capacity deployment throughout 2024, which can directly influence wholesale airfares and agency margins.

| Threat Category | Specific Threat | Impact on Flight Centre | Example/Data Point |

| Competition | Dominance of OTAs & Direct Booking | Margin erosion, reduced relevance of physical stores | Online travel bookings continue to grow, with platforms like Booking.com and Expedia holding significant market share. |

| Economic Factors | Inflation & High Interest Rates | Reduced consumer discretionary spending on travel | Inflation rates in key markets remained elevated through 2024, impacting household disposable income. |

| Geopolitical Factors | Regional Conflicts & Policy Changes | Disrupted travel routes, increased operational costs | Geopolitical tensions in Eastern Europe and the Middle East led to rerouted flights and higher fuel surcharges in late 2023/early 2024. |

| Operational Risks | Technology Adoption & Integration | Delayed efficiency gains, potential impact on financial targets | Successful implementation of AI and new booking platforms is crucial for achieving projected cost savings for FY25. |

| Industry Dynamics | Airline Capacity & Airfare Volatility | Difficulty in negotiating favorable rates, margin pressure | IATA reported robust passenger demand in 2024, but capacity deployment remained a key factor influencing airfare stability. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, including Flight Centre's official financial reports, comprehensive market research on the travel industry, and insights from industry experts and analysts.