First Commonwealth Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

First Commonwealth Bank Bundle

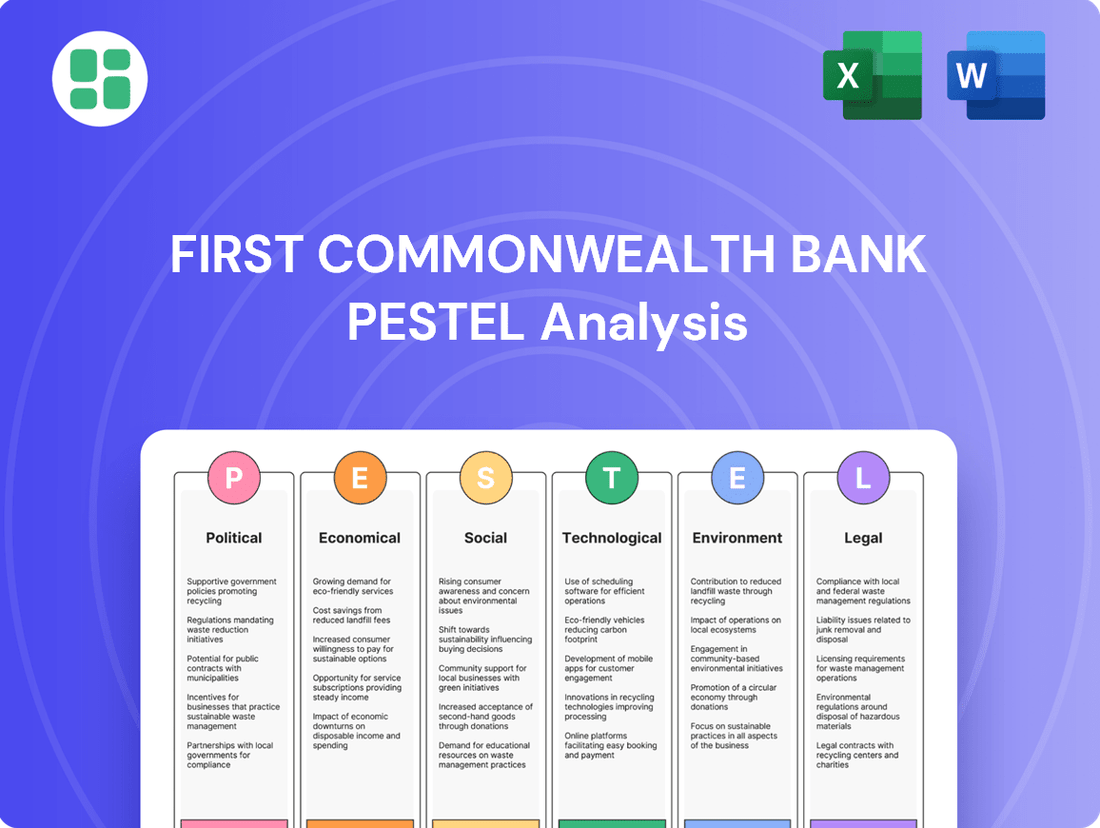

Navigate the complex external landscape impacting First Commonwealth Bank with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the banking sector. Gain a strategic advantage by leveraging these expert insights to inform your decisions and strengthen your market position. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The banking sector is navigating a shifting regulatory environment, with a new administration potentially ushering in deregulatory measures. This could impact areas like bank mergers, climate risk disclosures, and the use of artificial intelligence in financial services. For instance, while the Dodd-Frank Act has been a cornerstone of post-2008 financial regulation, discussions around its potential modification continue.

Federal banking regulators like the OCC and FDIC have recently updated their bank merger guidelines, bringing them more in line with general merger rules across industries. This recalibration aims to simplify and clarify the approval process for financial institutions looking to combine. For instance, in 2023, the FDIC reported approving 15 bank mergers, a slight decrease from 2022, indicating a more scrutinized but still active M&A environment.

A potential shift in administration could lead to further deregulation of bank mergers, which might open up more strategic acquisition avenues for First Commonwealth Bank. Historically, periods of regulatory easing have often coincided with increased M&A activity within the banking sector, as seen in the surge of deals following deregulation in the early 2000s.

The Community Reinvestment Act (CRA) has seen regulatory adjustments impacting financial institutions like First Commonwealth Bank. For 2025, asset-size thresholds have been updated to define 'small bank' and 'intermediate small bank' categories, reflecting inflationary pressures.

Significant political maneuvering is underway, with ongoing litigation challenging the 2023 CRA final rule and an announced intent to rescind it. This could lead to a reversion to earlier CRA standards, creating uncertainty for compliance strategies.

Further complicating matters, the applicability date for key provisions of the 2023 CRA rule, including facility-based assessment areas and public file requirements, has been pushed back to January 1, 2026, offering a temporary reprieve but prolonging the period of regulatory flux.

'Fair Banking' Initiatives and Reputational Risk

President Biden's recent executive order on 'Fair Banking' aims to curb debanking practices and remove 'reputational risk' as a supervisory tool for federal regulators. This directive could impact First Commonwealth Bank's client relationship management, potentially easing requirements to deny services based on subjective risks. The initiative underscores a political commitment to broadening access to financial services, aligning with broader goals of economic inclusion.

This policy shift may encourage financial institutions like First Commonwealth Bank to re-evaluate their risk assessment frameworks, moving away from vague 'reputational risk' factors. For instance, in 2024, the banking sector experienced increased scrutiny over discriminatory practices. The executive order could lead to more transparent and data-driven criteria for customer onboarding and service provision, fostering a more equitable financial landscape.

- Reduced Emphasis on 'Reputational Risk': The executive order signals a move away from using non-quantifiable reputational factors in regulatory supervision.

- Promoting Equitable Access: The initiative aims to ensure that individuals and businesses, regardless of their background or industry, have fair access to banking services.

- Potential for Policy Adjustments: First Commonwealth Bank may need to adapt its internal policies to align with the new federal guidelines, potentially impacting its risk management strategies.

Consumer Financial Protection Bureau (CFPB) Rules

The Consumer Financial Protection Bureau (CFPB) is significantly shaping the financial landscape. New rules mandate that financial institutions like First Commonwealth Bank must securely provide consumer financial data to individuals and approved third parties. This move aims to enhance consumer control over their financial information.

Further impacting banks, the CFPB's adjustments to the Expedited Funds Availability Act (Regulation CC) are set to take effect on July 1, 2025. These changes will alter the thresholds for when funds must be available the next day and for cash withdrawals, requiring banks to adapt their operational procedures.

Compliance with these evolving CFPB regulations necessitates careful review and potential upgrades to existing bank systems and operational workflows. Ensuring seamless data access for consumers and adherence to updated fund availability timelines are critical for maintaining regulatory standing and customer trust.

- Data Accessibility: CFPB rules require secure sharing of consumer financial data with individuals and authorized third parties.

- Funds Availability: Regulation CC updates, effective July 1, 2025, will modify next-day availability and cash withdrawal thresholds.

- Systemic Impact: Banks must update systems and processes to comply with these new data and funds availability requirements.

Political factors significantly influence banking operations. Recent regulatory shifts, such as updated merger guidelines by the OCC and FDIC in 2023, aim to streamline approvals, though 2023 saw a slight decrease in approved mergers compared to 2022. The Community Reinvestment Act (CRA) is also undergoing adjustments, with new asset-size thresholds for 2025 and ongoing legal challenges to the 2023 rule, creating a dynamic compliance landscape.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting First Commonwealth Bank, offering a comprehensive view of its external operating landscape.

A clear, actionable summary of First Commonwealth Bank's PESTLE analysis, enabling swift identification of external threats and opportunities to inform strategic decision-making and mitigate potential risks.

Economic factors

The Federal Reserve's decision to maintain the federal funds rate at 4.5% through March and July 2025, after earlier cuts in late 2024, signals a period of stable monetary policy. This stability is crucial for financial institutions like First Commonwealth Bank.

With market expectations pointing to an additional 0.50 percentage point in rate cuts during 2025, the cost of borrowing is likely to decrease further. This environment directly influences First Commonwealth Bank's net interest margin, as the spread between lending income and deposit expenses adjusts.

Lower interest rates generally stimulate loan demand, potentially boosting First Commonwealth Bank's lending volumes. However, it also means that deposit costs may need to be re-evaluated to remain competitive in a lower-yield landscape.

Inflation remains a key concern, with projections indicating it will stay above the Federal Reserve's 2% target through mid-2025. This persistent inflation, coupled with a revised 2025 GDP growth forecast of 1.7%, suggests a potentially challenging economic environment.

The Federal Reserve's upward revision of core inflation projections to 2.8% for 2025, partly due to U.S. tariffs, directly impacts purchasing power and business costs. These macroeconomic shifts will likely temper consumer spending and business investment in Pennsylvania and Ohio.

Consequently, First Commonwealth Bank can anticipate a more cautious lending environment, with potentially softer demand for loans as both consumers and businesses navigate higher prices and slower economic expansion.

First Commonwealth Bank experienced robust loan growth, with total loans increasing by an annualized 8.1% in Q2 2025. This signifies strong demand for credit and the bank's ability to expand its lending portfolio.

However, this growth was accompanied by a concerning trend in asset quality. Nonperforming loans (NPLs) climbed to 1.04% of total loans by the end of June 2025, a notable jump from 0.65% in the previous quarter.

This rise in NPLs underscores the importance of vigilant asset quality management. The bank must carefully monitor its loan book and adjust loan loss provisions accordingly to mitigate potential impacts on its financial health.

Efficiency and Profitability Metrics

First Commonwealth Bank's efficiency ratio demonstrated a positive trend, improving to 54.1% in the second quarter of 2025. This enhancement signals successful cost-optimization strategies implemented by the bank.

However, the return on average assets experienced a minor dip, settling at 1.11% during the same period. Maintaining and enhancing these crucial profitability indicators remains paramount for the bank's sustained financial stability and for delivering value to its shareholders.

- Efficiency Ratio: 54.1% (Q2 2025)

- Return on Average Assets: 1.11% (Q2 2025)

- Focus: Operational cost optimization

- Goal: Long-term financial health and shareholder value

Capital Adequacy and Regulatory Compliance

First Commonwealth Bank demonstrates robust financial health through its capital adequacy, consistently surpassing regulatory benchmarks. As of the first quarter of 2024, the bank reported a Common Equity Tier I ratio of 12.5%, exceeding the fully phased-in Basel III requirement of 7%. This strong capital position, along with a Tier I Capital Ratio of 14.2% and a Leverage Ratio of 9.8%, equips the bank to absorb potential losses and pursue expansion opportunities, underscoring its resilience in varying economic conditions.

These strong capital ratios are critical for regulatory compliance and also serve as a key indicator of the bank's stability and capacity for future growth. By maintaining capital levels well above minimum requirements, First Commonwealth Bank not only adheres to stringent U.S. banking regulations but also builds stakeholder confidence, enabling it to navigate economic uncertainties and invest in strategic initiatives.

- Common Equity Tier I Ratio: 12.5% (Q1 2024)

- Tier I Capital Ratio: 14.2% (Q1 2024)

- Leverage Ratio: 9.8% (Q1 2024)

- Total Capital Ratio: 15.8% (Q1 2024)

The economic landscape for First Commonwealth Bank in 2024-2025 is characterized by a stable federal funds rate, with projections for further cuts in 2025. While this could boost lending, persistent inflation above the 2% target and a revised GDP growth forecast of 1.7% present challenges, potentially tempering consumer spending and business investment.

Despite robust loan growth of 8.1% annualized in Q2 2025, asset quality is a concern, with nonperforming loans rising to 1.04% by June 2025. The bank's efficiency ratio improved to 54.1% in Q2 2025, but return on average assets saw a slight dip to 1.11%.

First Commonwealth Bank maintains strong capital adequacy, with its Common Equity Tier I ratio at 12.5% in Q1 2024, well above regulatory requirements, indicating resilience and capacity for growth.

| Metric | Q2 2025 | Q1 2024 | Trend/Implication |

|---|---|---|---|

| Loan Growth (Annualized) | 8.1% | N/A | Strong demand for credit |

| Nonperforming Loans (NPLs) | 1.04% | 0.65% (prior quarter) | Asset quality concern, requires monitoring |

| Efficiency Ratio | 54.1% | N/A | Improved cost-optimization |

| Return on Average Assets (ROAA) | 1.11% | N/A | Slight dip, focus on profitability |

| Common Equity Tier I Ratio | N/A | 12.5% | Strong capital position, regulatory compliance |

Same Document Delivered

First Commonwealth Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of First Commonwealth Bank delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations and strategic planning. Understand the complete picture of the external forces shaping the bank's future.

Sociological factors

Consumers increasingly demand intuitive, personalized digital banking, with mobile apps now the main way people interact with their banks. For instance, a 2024 report indicated that 70% of banking transactions for millennials occurred via mobile devices, highlighting a significant shift from traditional branch visits. First Commonwealth Bank needs to ensure its digital offerings are not only functional but also provide a cohesive experience that bridges online and in-person services.

Adapting to these evolving consumer preferences is paramount for First Commonwealth Bank to retain its customer base and stay competitive. By offering seamless integration between digital platforms and physical branches, the bank can cater to a wider range of customer needs and preferences, ultimately boosting satisfaction and loyalty in the dynamic financial landscape of 2024-2025.

The banking landscape is rapidly evolving, with a significant shift towards digital channels. In 2024, it's estimated that over 60% of banking customers prefer digital interactions for routine transactions. This trend necessitates that First Commonwealth Bank invest heavily in its online and mobile platforms to meet customer expectations.

Despite the digital surge, physical branches remain relevant for certain customer segments and complex financial needs. Data from early 2025 indicates that nearly 40% of consumers still value in-person banking for advice and support. Therefore, First Commonwealth Bank must strategically manage its branch network, optimizing locations and services to complement its digital offerings.

Balancing digital adoption with the physical branch network is crucial for First Commonwealth Bank's success in Pennsylvania and Ohio. While digital banking providers are gaining traction, with over 45% of Americans utilizing them in some capacity by mid-2025, a thoughtfully integrated approach ensures the bank can serve a broader customer base, from tech-savvy individuals to those who prefer traditional banking methods.

The increasing reliance on digital banking platforms is fueling a significant demand for enhanced financial literacy. As more individuals manage their finances independently, there's a clear need for accessible educational resources. For instance, a 2024 survey indicated that 65% of young adults feel they need more guidance on managing their investments, highlighting this trend.

First Commonwealth Bank can capitalize on this by offering comprehensive financial education tools. Providing workshops, online modules, and personalized guidance can significantly boost customer loyalty and open avenues for cross-selling valuable financial products. This proactive approach empowers customers to make informed decisions, fostering greater confidence in their financial journey.

Generational Shifts in Banking Preferences

Generational shifts are significantly reshaping banking. Younger demographics, including Millennials and Gen Z, increasingly favor digital self-service options and are more inclined to switch banks if their needs aren't met. For instance, a 2024 survey indicated that over 60% of Gen Z consumers prefer managing their finances entirely through mobile apps.

Gen Z, in particular, is turning to social media platforms for financial guidance, with TikTok and Instagram becoming popular sources for advice. This trend necessitates that financial institutions like First Commonwealth Bank adapt their outreach and service models. By 2025, it's projected that digital-native banking solutions will be paramount for attracting and retaining these younger customer segments.

- Digital Adoption: Millennials and Gen Z prioritize mobile banking and online self-service, driving demand for seamless digital experiences.

- Social Media Influence: Gen Z increasingly seeks financial advice from social media influencers, impacting brand perception and customer acquisition.

- Customer Retention: Banks must innovate their digital offerings and communication strategies to cater to the evolving preferences of younger, tech-savvy consumers.

Building and Maintaining Customer Trust

In today's fast-paced digital world, where competition among banks is fierce, maintaining customer trust and loyalty is absolutely crucial for First Commonwealth Bank. To achieve this, the bank can effectively use artificial intelligence to create more personalized banking experiences for its customers. This focus on individual needs can significantly strengthen relationships.

Furthermore, robust cybersecurity measures are non-negotiable. With nearly one in five consumers expected to switch financial institutions in 2025, demonstrating a strong commitment to data security is vital for retaining clients. This proactive approach to safeguarding information directly impacts customer confidence.

- Personalized Experiences: Leveraging AI to tailor services and communications to individual customer needs.

- Cybersecurity Investment: Implementing advanced security protocols to protect sensitive customer data.

- Customer Retention: Addressing the 20% likelihood of customers switching banks in 2025 by fostering loyalty.

Sociological factors significantly influence banking preferences, with a clear generational divide emerging. Younger demographics, particularly Gen Z and Millennials, increasingly expect digital-first interactions, with mobile banking being their preferred channel. By mid-2025, it's estimated that over 60% of these age groups will conduct most of their banking via apps.

This digital shift is coupled with a growing demand for financial literacy. As more individuals manage their finances independently, there's a heightened need for accessible educational resources. A 2024 survey revealed that 65% of young adults feel they require more guidance on investment management, presenting an opportunity for banks to provide valuable content.

Customer trust and loyalty are paramount, especially with nearly 20% of consumers likely to switch financial institutions in 2025. Banks must prioritize personalized experiences, often powered by AI, and robust cybersecurity measures to retain clients. This focus on individual needs and data security directly impacts customer confidence and retention rates.

| Factor | Trend | Impact on First Commonwealth Bank | Data Point (2024-2025) |

|---|---|---|---|

| Digital Preference | Increasing reliance on mobile and online banking | Need for enhanced digital platforms and seamless user experience | 70% of millennial banking transactions via mobile (2024) |

| Financial Literacy Demand | Growing need for accessible financial education | Opportunity to offer educational tools and personalized guidance | 65% of young adults need more investment guidance (2024) |

| Customer Trust & Loyalty | Heightened importance due to potential for switching | Focus on personalized experiences and strong cybersecurity | ~20% of consumers may switch institutions (2025) |

Technological factors

Artificial intelligence and automation are revolutionizing banking, from customer service to fraud detection. In 2024, the global AI in banking market was valued at approximately $10.5 billion, projected to reach over $30 billion by 2030, highlighting significant investment and adoption.

Generative AI, in particular, is proving instrumental in analyzing complex, unstructured data, thereby refining credit risk assessments. First Commonwealth Bank can harness these advancements to optimize operations, cut expenses, and introduce more advanced financial solutions for its clients.

The banking sector is in the midst of a profound digital transformation, with mobile-first strategies and online service delivery becoming paramount. This shift requires First Commonwealth Bank to fundamentally re-evaluate its service models and customer engagement approaches. For instance, in 2024, mobile banking adoption continued its upward trend, with a significant percentage of customer transactions occurring via mobile apps, underscoring the need for a robust digital presence.

The financial services industry, including institutions like First Commonwealth Bank, is a constant target for sophisticated cyber threats such as ransomware and AI-powered fraud. In 2024, the average cost of a data breach in the financial sector reached $5.90 million, a significant increase that underscores the escalating risks.

To counter these escalating cybersecurity threats, First Commonwealth Bank must prioritize ongoing investment in advanced security protocols and digital identity verification systems. Regulatory bodies are increasingly focused on data protection, with new compliance mandates often requiring enhanced security measures.

Growth of Embedded Finance and Banking-as-a-Service (BaaS)

Embedded finance, the integration of financial services into non-financial platforms, is a significant technological trend. This allows companies like First Commonwealth Bank to offer financial products directly within their customer journeys, enhancing convenience and accessibility. For instance, a retail platform might offer point-of-sale financing directly at checkout, powered by a banking partner.

Banking-as-a-Service (BaaS) further fuels this by enabling banks to provide their infrastructure and regulated services to third parties via APIs. This model allows First Commonwealth Bank to partner with fintechs and other businesses to create innovative, co-branded digital products without needing to build everything from scratch. This approach is projected to see substantial growth, with some estimates suggesting the global embedded finance market could reach trillions of dollars in transaction value by the early 2030s.

- Embedded Finance Market Growth: Projections indicate a significant expansion, with some analyses suggesting the global embedded finance market could reach over $7 trillion in transaction value by 2030.

- BaaS Enabling Innovation: BaaS platforms allow banks to offer their services through APIs, fostering partnerships with fintechs and enabling new digital product development.

- Customer Engagement: By meeting customers at their point of need within non-financial applications, embedded finance and BaaS models enhance customer engagement and loyalty for institutions like First Commonwealth Bank.

- API Economy: The increasing reliance on APIs in the financial sector underpins the growth of BaaS, allowing for seamless integration of financial functionalities into diverse platforms.

Data Analytics for Personalization

The effective use of advanced data analytics and AI is crucial for First Commonwealth Bank to deliver highly personalized financial services and anticipate customer needs. By leveraging these technologies, the bank can offer tailored savings plans, customized investment recommendations, and proactive financial solutions, thereby boosting customer engagement and gaining a competitive advantage in a crowded marketplace.

For instance, in 2024, financial institutions are increasingly investing in AI-driven personalization. A report by Juniper Research projected that the global spending on AI in banking would reach $20 billion by 2025, with a significant portion allocated to enhancing customer experience through data analytics.

- Personalized Product Offerings: Data analytics enables the creation of unique product bundles based on individual spending habits and financial goals.

- Predictive Customer Service: AI can forecast potential customer issues, allowing for proactive outreach and problem resolution.

- Enhanced Customer Loyalty: Tailored experiences fostered by data insights lead to higher satisfaction and retention rates.

Technological advancements, particularly in AI and automation, are reshaping banking operations, from customer interactions to risk management. The global AI in banking market is experiencing robust growth, with projections indicating a significant expansion from approximately $10.5 billion in 2024 to over $30 billion by 2030. This trend underscores the increasing reliance on intelligent systems for efficiency and innovation.

The digital transformation in banking necessitates a mobile-first approach, with online service delivery becoming paramount. In 2024, mobile banking adoption continued to rise, with a substantial portion of customer transactions occurring through mobile applications, highlighting the imperative for First Commonwealth Bank to maintain a strong digital infrastructure.

Cybersecurity remains a critical concern, as financial institutions face sophisticated threats. The average cost of a data breach in the financial sector reached $5.90 million in 2024, emphasizing the need for continuous investment in advanced security measures and digital identity verification to protect sensitive customer data and maintain trust.

Embedded finance and Banking-as-a-Service (BaaS) are key technological drivers, allowing for seamless integration of financial services into non-financial platforms. The global embedded finance market is anticipated to reach trillions of dollars in transaction value by the early 2030s, offering new avenues for customer engagement and product delivery.

Legal factors

Proposed revisions to the US Basel III capital rules, released in July 2023, are set to alter the regulatory capital framework for major banking institutions. These changes, when fully implemented, are designed to enhance the resilience of the banking sector.

First Commonwealth Bank's capital levels are currently robust, already surpassing the anticipated fully phased-in Basel III requirements. This strong financial standing provides a buffer against potential future regulatory shifts.

The dynamic nature of these evolving capital rules highlights the critical need for banks like First Commonwealth to maintain diligent and proactive capital management strategies to ensure continued compliance and financial strength.

The Consumer Financial Protection Bureau (CFPB) finalized a rule in October 2024 concerning personal financial data rights, requiring financial institutions like First Commonwealth Bank to securely provide consumer data when requested. This move significantly enhances consumer control over their financial information.

Furthermore, the Expedited Funds Availability Act necessitates periodic updates to Regulation CC thresholds, with the next adjustments set to take effect on July 1, 2025. These changes will impact how quickly funds deposited into accounts become available to customers.

Adherence to these evolving legal frameworks is crucial for First Commonwealth Bank to ensure robust consumer access to their data and maintain strong data protection standards, fostering trust and compliance in the financial sector.

In 2025, expect updated regulations to bolster financial institutions' Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) programs, a direct result of the Anti-Money Laundering Act of 2020. These changes will revise existing Bank Secrecy Act (BSA) program mandates, introducing a new focus on AML/CFT Priorities.

First Commonwealth Bank will need to adjust its compliance structures to meet these new requirements. For instance, the Financial Crimes Enforcement Network (FinCEN) has been actively working on implementing these reforms, with significant guidance expected throughout 2024 and into 2025, impacting how financial institutions manage risk and report suspicious activities.

FDIC Signage and Advertising Rule Changes

The compliance date for a significant portion of the modernized FDIC signage and advertising rule, specifically Part 328, subpart A, has been extended to May 1, 2025. This extension provides banks like First Commonwealth Bank additional time to implement necessary changes. This means that by this date, all digital platforms, including websites, mobile applications, and ATMs, must prominently display the correct FDIC signage. Failure to comply could result in regulatory scrutiny and potential penalties, underscoring the importance of timely adaptation.

These updated regulations aim to enhance transparency regarding deposit insurance for consumers. Banks are now required to ensure their FDIC signage is clear and conspicuous across all customer-facing digital channels. For instance, a bank’s website homepage and its mobile banking app login screen will likely need to feature the FDIC logo and a statement confirming deposit insurance coverage. This focus on digital presence reflects the evolving ways consumers interact with their financial institutions.

Adhering to these rule changes is crucial for maintaining consumer trust and regulatory compliance. The FDIC's goal is to ensure customers are fully informed about the protection of their deposits. First Commonwealth Bank, like other financial institutions, must integrate these updated signage requirements into their ongoing compliance efforts. The extended deadline offers a window for thorough review and implementation, ensuring all digital touchpoints meet the new standards by May 2025.

Automated Valuation Models (AVMs) Regulations

The upcoming regulations on Automated Valuation Models (AVMs), taking effect October 1, 2025, will require First Commonwealth Bank to solidify its internal policies. These new rules emphasize robust quality control for AVMs, ensuring they operate with high confidence, resist data tampering, and avoid conflicts of interest. Such oversight is crucial for maintaining fair and accurate mortgage lending and appraisal practices.

This regulatory shift directly affects how First Commonwealth Bank utilizes AVMs in its operations. Key areas of impact include:

- Enhanced Data Integrity: Banks must implement measures to prevent manipulation of the data feeding into AVMs, a critical step in maintaining valuation accuracy.

- Conflict of Interest Mitigation: Policies will need to be in place to ensure AVM outputs are objective and free from undue influence, promoting unbiased valuations.

- Non-Discriminatory Practices: AVMs must be designed and deployed to avoid discriminatory outcomes, aligning with broader fair lending principles.

- Quality Control Standards: The final rule mandates a high level of quality control, requiring banks to demonstrate the reliability and accuracy of their AVMs.

First Commonwealth Bank must navigate evolving capital requirements, with proposed Basel III revisions impacting major institutions. The bank's current capital levels exceed anticipated fully phased-in requirements, offering a strategic advantage.

Consumer data rights are expanding, with a CFPB rule finalized in October 2024, requiring secure data provision. Additionally, the Expedited Funds Availability Act mandates updated Regulation CC thresholds by July 1, 2025, affecting fund availability timelines.

Anticipate stricter Anti-Money Laundering (AML) and Countering the Financing of Terrorism (CFT) programs in 2025, driven by the Anti-Money Laundering Act of 2020. This includes revised Bank Secrecy Act mandates and a focus on AML/CFT Priorities, necessitating adjustments to compliance structures.

The FDIC signage and advertising rule, specifically Part 328, subpart A, requires updated compliance by May 1, 2025, impacting all digital platforms to ensure clear FDIC signage. Furthermore, new regulations for Automated Valuation Models (AVMs) take effect October 1, 2025, mandating enhanced quality control, data integrity, and conflict of interest mitigation.

Environmental factors

Environmental, Social, and Governance (ESG) principles are no longer a fringe concept in finance; they are becoming central to how financial institutions operate. While personal adoption is still developing, with only 28% of Americans prioritizing ESG in their own financial choices, a significant 41% expect financial institutions to embrace these standards. This growing societal demand means banks like First Commonwealth must increasingly embed sustainability into their business models and customer-facing products.

Federal banking regulators, including the Federal Reserve Board, FDIC, and OCC, are actively guiding financial institutions like First Commonwealth Bank to bolster their climate risk management. These agencies have issued principles for larger banks, emphasizing the need for robust frameworks to address climate-related financial risks. For instance, the Federal Reserve's 2023 pilot climate scenario analysis involved six of the largest U.S. banking organizations, providing valuable insights into their resilience.

The market for green, social, and sustainability-linked bonds has seen remarkable growth, with global issuance reaching an estimated $1.7 trillion in 2024, a significant jump from previous years. This expansion is fueled by a dual demand: companies seeking to finance their environmental and social initiatives, and investors prioritizing ESG (Environmental, Social, and Governance) factors in their portfolios. For First Commonwealth Bank, this presents a clear avenue to enhance its product offerings.

This growing investor appetite for sustainable finance presents a strategic opportunity for First Commonwealth Bank to develop and promote a wider array of green, social, and sustainability-linked financial products and services. By catering to the increasing number of environmentally and socially conscious clients and businesses, the bank can tap into a burgeoning market segment and reinforce its commitment to responsible financial practices.

Scrutiny on Greenwashing Practices

Financial institutions like First Commonwealth Bank are under increasing pressure to prove their environmental commitments are genuine, not just marketing. This scrutiny on greenwashing, or making misleading claims about sustainability, means banks need to be very clear about what they're doing to be environmentally friendly and have proof to back it up. For instance, a report by PwC in late 2023 indicated that over 70% of investors consider ESG factors when making investment decisions, highlighting the demand for authentic sustainable practices.

To maintain trust and credibility, First Commonwealth Bank must ensure its sustainability initiatives are transparent and supported by verifiable actions. This involves more than just stating goals; it requires demonstrating tangible progress and measurable impact. The bank's approach to ESG reporting and product development will be critical in this regard.

- Increased Investor Demand: A 2024 survey by Morningstar found that ESG-focused funds attracted a net inflow of $12 billion in the first quarter, demonstrating a clear market preference for sustainable investments.

- Regulatory Focus: Global regulators, including those in the US and Europe, are intensifying their focus on ESG disclosures, with new rules expected to come into effect throughout 2024 and 2025, requiring greater accountability.

- Reputational Risk: Instances of greenwashing can lead to significant reputational damage and loss of customer trust, as seen in cases where companies faced backlash for exaggerated environmental claims.

Impact of Climate Alliances and Political Pressure

Several U.S. banks, including some headquartered in regions where First Commonwealth Bank operates, have recently exited climate-focused alliances like the Net-Zero Banking Alliance. This move, often attributed to political pressures and ongoing regulatory probes, signals a challenging environment for financial institutions making public environmental commitments. For First Commonwealth Bank, this trend underscores the need for a strategic approach to sustainability, carefully weighing its environmental goals against evolving political landscapes and potential industry shifts.

The withdrawal of prominent banks from these alliances, such as the Net-Zero Banking Alliance, indicates a growing sensitivity to political scrutiny and potential backlash. This can create a ripple effect, influencing industry norms and potentially impacting the perceived value or risk associated with environmental, social, and governance (ESG) initiatives. First Commonwealth Bank must consider how these broader industry movements might affect its own stakeholder perceptions and operational strategies.

Navigating these complex dynamics requires First Commonwealth Bank to balance its commitment to sustainability with the realities of the current political climate. This involves understanding the specific pressures faced by the banking sector and developing a clear communication strategy regarding its environmental objectives. The bank’s ability to adapt and respond to these external forces will be crucial for maintaining trust and achieving its long-term strategic goals.

The financial sector's engagement with climate alliances is under increased scrutiny. For instance, in 2023, several U.S. banks faced inquiries from state attorneys general regarding their participation in groups like the Net-Zero Banking Alliance, with concerns raised about potential antitrust issues or misrepresentation of climate commitments. This highlights the direct impact of political pressure on corporate environmental strategies.

Environmental factors are increasingly shaping the financial landscape, with a strong push towards sustainability. Investor demand for ESG-focused funds saw a significant $12 billion inflow in Q1 2024, signaling a clear market preference. Regulatory bodies are also tightening their grip, with new ESG disclosure rules expected in 2024 and 2025, demanding greater accountability from institutions like First Commonwealth Bank.

The market for green bonds is booming, with global issuance projected to hit $1.7 trillion in 2024, driven by both corporate and investor interest in sustainable finance. This trend offers First Commonwealth Bank a prime opportunity to expand its product offerings and cater to a growing segment of environmentally conscious clients. However, the bank must also navigate increasing scrutiny over greenwashing, with over 70% of investors in a late 2023 PwC report considering ESG factors in their decisions, demanding verifiable actions.

The political climate presents a complex challenge, as some U.S. banks have exited climate alliances like the Net-Zero Banking Alliance due to political pressure and regulatory probes. This trend, exemplified by state attorney general inquiries in 2023 concerning antitrust issues or misrepresentation of climate commitments, underscores the need for First Commonwealth Bank to strategically balance its environmental goals with evolving political landscapes and stakeholder perceptions.

| Factor | Trend | Impact on First Commonwealth Bank | Data Point |

|---|---|---|---|

| Investor Demand for ESG | Increasing | Opportunity to develop sustainable products | $12 billion net inflow to ESG funds in Q1 2024 |

| Green Bond Market Growth | Rapid Expansion | Potential for financing green initiatives | $1.7 trillion global issuance projected for 2024 |

| Regulatory Scrutiny on ESG | Intensifying | Need for transparent and verifiable ESG reporting | New disclosure rules expected 2024-2025 |

| Political Pressure on Climate Commitments | Significant | Risk of reputational damage, need for strategic adaptation | Banks exiting Net-Zero Banking Alliance |

| Greenwashing Concerns | High | Requirement for authentic and demonstrable sustainability | 70%+ investors consider ESG factors (PwC, late 2023) |

PESTLE Analysis Data Sources

Our PESTLE analysis for First Commonwealth Bank is constructed using a blend of official government publications, reputable financial news outlets, and industry-specific market research reports. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the bank.