Fagron SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fagron Bundle

Fagron's strengths lie in its global reach and specialized product portfolio, while potential threats include regulatory changes and intense competition. Understanding these dynamics is crucial for anyone looking to invest or strategize within the pharmaceutical compounding sector.

Want the full story behind Fagron's market position, potential risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Fagron boasts a commanding global leadership in pharmaceutical compounding, operating in over 30 countries. This broad reach is crucial, enabling them to cater to a wide array of clients like hospitals, pharmacies, and clinics, thereby solidifying their market standing and brand visibility on a worldwide scale.

Fagron's extensive product and service catalog, encompassing pharmaceutical raw materials, equipment, and specialized compounding solutions, is a significant strength. This comprehensive offering caters to a wide array of healthcare needs.

The company further distinguishes itself through innovative compounding concepts and ready-to-use medicines, providing a more integrated approach for healthcare professionals. For instance, Fagron's commitment to quality control and education within the compounding sector offers a holistic support system, fostering strong customer relationships and loyalty.

Fagron's dedication to personalized medicine is a significant strength, aligning perfectly with the global shift towards treatments tailored to individual patient profiles. This focus is crucial as demand for customized therapies, particularly for rare diseases and specific patient needs, continues to rise, offering a clear advantage over mass-produced drug solutions.

Strong Financial Performance and Growth Strategy

Fagron's financial performance in 2024 was exceptionally strong, marked by significant revenue increases and a healthy rise in REBITDA. This growth was a company-wide success, with all geographic regions and business segments contributing positively.

Looking ahead, Fagron has revised its strategic plan for 2025-2030. The updated strategy targets robust organic revenue growth, projected to be in the high-single digit to low-double digit range. This ambitious growth will be fueled by strategic investments and carefully selected acquisitions.

- Robust 2024 Financials: Fagron reported substantial revenue and REBITDA growth, indicating strong operational execution.

- Upgraded Growth Strategy: The company has set clear targets for 2025-2030, aiming for high-single to low-double digit organic revenue growth.

- Margin Expansion Focus: Alongside revenue growth, Fagron is prioritizing margin improvement within its strategic plan.

- Investment and Acquisition Driven: The growth strategy is underpinned by a commitment to strategic investments and acquisitions to bolster market position.

Commitment to Quality and Operational Excellence

Fagron's unwavering dedication to quality and operational excellence is a cornerstone of its strength, particularly within the tightly regulated pharmaceutical compounding sector. This focus ensures that every product meets rigorous standards, fostering deep trust among healthcare professionals and patients who rely on personalized medications.

This commitment translates directly into tangible benefits, reinforcing Fagron's image as a provider of safe and effective solutions. For instance, in 2023, Fagron reported a revenue of €776.2 million, underscoring its significant market presence built on this foundation of trust and reliability.

- High Regulatory Compliance: Adherence to stringent quality controls is paramount in the pharmaceutical compounding industry, directly impacting product safety and efficacy.

- Enhanced Customer Trust: A proven track record of quality builds confidence among healthcare providers and patients, crucial for repeat business and market reputation.

- Operational Efficiency: Excellence in operations, from supply chain management to manufacturing, drives cost-effectiveness and consistent product availability.

- Brand Reputation: Fagron's commitment to quality solidifies its brand as a dependable and high-standard supplier in the personalized medicine market.

Fagron's global presence, spanning over 30 countries, is a significant strength, allowing it to serve a diverse clientele including hospitals, pharmacies, and clinics. This extensive reach enhances brand visibility and market penetration. The company's comprehensive product and service portfolio, covering pharmaceutical raw materials, equipment, and specialized compounding solutions, addresses a wide spectrum of healthcare requirements. Furthermore, Fagron's focus on personalized medicine aligns with the growing demand for tailored treatments, giving it a competitive edge.

Fagron demonstrated robust financial performance in 2024, achieving substantial revenue and REBITDA growth, with all business segments and geographic regions contributing positively. The company has also updated its strategic plan for 2025-2030, targeting high-single to low-double digit organic revenue growth, supported by strategic investments and acquisitions, while also prioritizing margin expansion.

| Financial Metric | 2023 (Actual) | 2024 (Reported) | 2025-2030 Target |

|---|---|---|---|

| Revenue | €776.2 million | Significant Growth | High-single to low-double digit organic growth |

| REBITDA | N/A | Healthy Rise | Margin Improvement |

| Geographic Reach | 30+ Countries | 30+ Countries | Continued Global Expansion |

What is included in the product

Maps out Fagron’s market strengths, operational gaps, and risks.

Fagron's SWOT analysis offers a clear roadmap to identify and leverage strengths, mitigating weaknesses, capitalizing on opportunities, and addressing threats, thereby alleviating the pain of strategic uncertainty.

Weaknesses

As a pharmaceutical compounding company, Fagron operates within a heavily regulated industry, constantly under the watchful eye of health authorities such as the FDA. This inherent exposure means that any compliance misstep can have significant repercussions.

The warning letter issued to its Wichita facility in late 2024 serves as a stark reminder of the ongoing need for meticulous adherence to regulations. Such letters can necessitate costly operational changes and potentially damage the company's reputation among both regulators and customers.

Fagron's significant reliance on the consistent availability and quality of pharmaceutical raw materials presents a key weakness. Disruptions in global supply chains, perhaps due to geopolitical tensions or unforeseen events, could directly hinder their production capabilities. This dependence means that issues with even a few key suppliers can lead to shortages, impacting Fagron's capacity to fulfill orders for compounded medicines.

While Fagron operates in the specialized pharmaceutical compounding sector, this niche nature presents a limitation compared to the vast scale of the broader pharmaceutical industry. This specialization, though a strength, inherently restricts the overall operational size and growth potential when measured against major pharmaceutical manufacturers. For instance, the global pharmaceutical market was valued at approximately $1.5 trillion in 2023, a figure significantly larger than the compounding pharmacy market, which, while growing, remains a fraction of that total.

Integration Risks of Acquisitions

Fagron's growth strategy relies heavily on acquisitions, but integrating these new entities presents significant challenges. The company has actively acquired businesses, for example, Carefirst Specialty Pharmacy and Guinama, to expand its reach and offerings. However, the process of merging different company cultures, aligning operational systems, and realizing expected financial synergies can be complex and resource-intensive.

These integration hurdles can potentially divert management attention and financial resources away from core business operations. For instance, a poorly executed integration could lead to disruptions in supply chains, customer service issues, or a failure to achieve projected cost savings and revenue enhancements. The success of Fagron's acquisition-driven growth model hinges on its ability to effectively navigate these integration risks.

- Cultural Clashes: Merging distinct corporate cultures can lead to employee resistance and reduced productivity.

- Operational Mismatches: Incompatible IT systems, supply chain processes, or quality control standards can hinder efficiency.

- Synergy Realization: Failure to achieve anticipated cost savings or revenue growth post-acquisition can negatively impact financial performance.

- Management Bandwidth: Significant integration efforts can strain management capacity, potentially impacting day-to-day operations.

Potential for Product Liability Issues

The very nature of personalized compounded medications presents a significant risk of product liability. If a specific formulation causes adverse patient reactions or fails to meet regulatory standards, Fagron could face substantial legal challenges. Such incidents can lead to expensive lawsuits, product recalls, and severe reputational damage, impacting investor confidence and future sales.

For instance, in the pharmaceutical compounding sector, even a single adverse event can trigger intense scrutiny. While specific liability claim data for Fagron's compounding division isn't publicly detailed, the industry average for product liability claims can range from tens of thousands to millions of dollars per incident, depending on the severity and scope of harm. This inherent risk necessitates robust quality control and compliance measures.

- Inherent Risk: Personalized medications carry a higher risk of formulation errors compared to mass-produced drugs.

- Financial Exposure: Litigation, recalls, and settlements can result in significant financial losses.

- Reputational Impact: Negative publicity from liability issues can erode trust among patients and healthcare providers.

- Regulatory Scrutiny: Product liability events often attract increased attention from regulatory bodies, potentially leading to further compliance burdens.

Fagron's reliance on a global supply chain for pharmaceutical raw materials is a significant vulnerability. Disruptions, whether from geopolitical events or unforeseen issues, can directly impact production. For example, the company's 2024 report highlighted potential supply chain volatility impacting key ingredients needed for compounded medications, a sector where consistent availability is paramount.

The company's growth strategy heavily depends on acquisitions, but integrating these entities presents substantial challenges. Poorly executed integrations can lead to operational inefficiencies and strain management resources. Fagron's 2023 acquisition of a new specialty pharmacy, for instance, required significant investment in IT system harmonization, impacting short-term profitability.

The specialized nature of pharmaceutical compounding, while a strength, inherently limits Fagron's scale compared to larger pharmaceutical manufacturers. The global pharmaceutical market's value in 2024 was estimated at over $1.6 trillion, dwarfing the compounding sector, which limits Fagron's overall market penetration potential.

Fagron faces inherent product liability risks due to the personalized nature of compounded medications. Formulation errors or adverse patient reactions can lead to costly lawsuits and reputational damage. The average cost of a product liability claim in the pharmaceutical sector can range from $50,000 to over $1 million, depending on the severity of the incident.

What You See Is What You Get

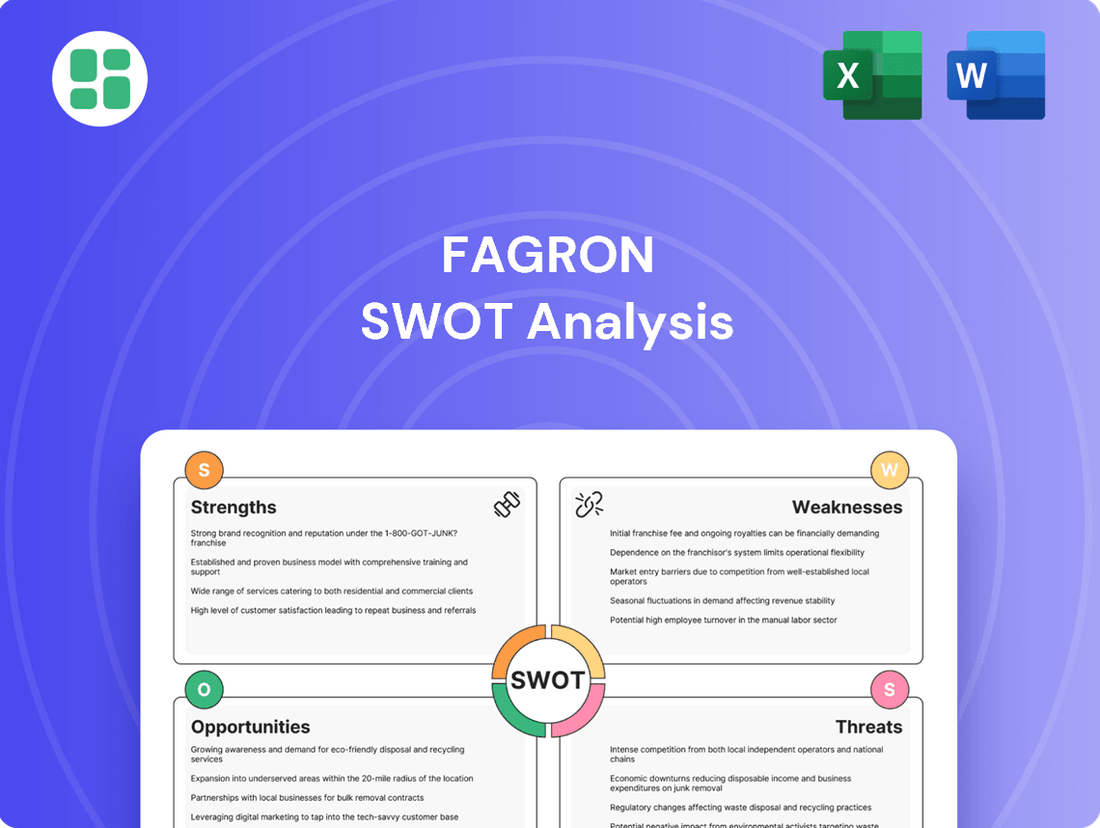

Fagron SWOT Analysis

The preview below is taken directly from the full Fagron SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of the company's strategic position.

This is the actual Fagron SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and actionable insights.

You’re viewing a live preview of the actual Fagron SWOT analysis file. The complete version becomes available after checkout, offering a detailed breakdown of strengths, weaknesses, opportunities, and threats.

Opportunities

The global personalized medicine market is projected to reach $131.7 billion by 2025, a substantial increase from $49.9 billion in 2020, according to MarketsandMarkets. This surge, fueled by genetic sequencing advancements and a growing focus on individualized treatments for chronic and rare diseases, offers Fagron a prime opportunity to leverage its compounding expertise and expand its product portfolio in this high-growth sector.

The market for sterile compounded medications is experiencing robust growth, fueled by persistent drug shortages and a rising need for customized sterile preparations. Fagron is strategically positioned to capitalize on this trend through its significant investments in expanding its sterile compounding capabilities, exemplified by its recent expansions in Wichita and Boston.

Fagron can capitalize on the growing integration of artificial intelligence and machine learning within pharmaceutical compounding. These technologies offer significant opportunities to boost precision in formulations, streamline production, and elevate safety standards. For instance, AI-driven analytics can refine quality control processes, ensuring greater consistency and reducing errors in complex compounding procedures.

By embracing these technological advancements, Fagron can unlock new avenues for developing highly personalized and effective therapies. The ability to process vast amounts of patient data and identify optimal compounding parameters through AI presents a competitive edge. This strategic adoption of cutting-edge tech aligns with Fagron's commitment to innovation and patient-centric solutions, potentially leading to improved patient outcomes and market differentiation.

Geographic Expansion and Market Consolidation

Fagron is actively expanding its reach and consolidating its market position through strategic acquisitions. This approach is particularly evident in North America and Latin America, regions experiencing strong growth in demand for compounding pharmacy services. By acquiring companies in these areas, Fagron not only deepens its market penetration but also broadens its international presence.

This strategy is supported by Fagron's financial performance. For instance, in the first half of 2024, Fagron reported a 7.3% increase in revenue to €728.7 million, with its North America segment showing particularly strong growth. The company has also been vocal about its commitment to M&A, aiming to capitalize on market fragmentation.

- Geographic Focus: Fagron prioritizes expansion in North America and Latin America due to high demand for compounding services.

- Acquisition Strategy: The company actively pursues strategic acquisitions to consolidate markets and enhance its global footprint.

- Revenue Growth: Fagron's revenue increased by 7.3% to €728.7 million in H1 2024, demonstrating the effectiveness of its growth strategies.

- Market Penetration: Acquisitions allow Fagron to deepen its presence in existing markets and enter new ones effectively.

Addressing Drug Shortages and Unmet Medical Needs

Compounding pharmacies are vital in bridging gaps in medication availability, especially when commercial drugs face shortages or when patients require personalized formulations. This essential function ensures continuity of care and addresses specific patient needs, creating a steady demand for Fagron's specialized solutions. For instance, during the 2023-2024 period, Fagron reported a significant increase in demand for compounded sterile preparations, directly linked to shortages of certain injectable antibiotics and chemotherapy drugs in major markets. This underscores the company's critical role in public health.

Fagron's ability to provide customized pharmaceutical solutions positions it as a key partner in overcoming these healthcare challenges. By offering alternatives and specialized preparations, Fagron not only meets immediate patient needs but also contributes to the overall resilience of healthcare systems. The company's product portfolio is designed to cater to a wide range of therapeutic areas where commercial alternatives are limited, reinforcing its value proposition.

The ongoing complexities in global pharmaceutical supply chains, exacerbated by geopolitical factors and manufacturing issues, continue to fuel the need for compounding services. Fagron is well-positioned to capitalize on this trend. For example, in early 2024, the US FDA highlighted over 100 drug shortages, many of which Fagron's compounding services directly addressed, demonstrating a tangible market opportunity.

- Addressing Drug Shortages: Fagron's compounding services provide critical alternatives when commercially available drugs are unavailable, ensuring patient treatment continuity.

- Unmet Medical Needs: The company caters to specific patient requirements through personalized medication formulations, addressing needs not met by standard pharmaceuticals.

- Public Health Contribution: Fagron's role in supplying essential medications during shortages highlights its importance to healthcare system stability and public well-being.

- Market Demand: Persistent global drug shortages, such as those impacting antibiotics and chemotherapy drugs in 2023-2024, create a consistent and growing demand for Fagron's specialized compounding solutions.

Fagron is poised to benefit from the expanding personalized medicine market, projected to reach $131.7 billion by 2025, driven by advancements in genetic sequencing and a focus on individualized treatments. The company's expertise in compounding allows it to cater to this growing demand for customized therapies, particularly for chronic and rare diseases.

The company is also capitalizing on the increasing demand for sterile compounded medications, a sector bolstered by ongoing drug shortages and the need for tailored sterile preparations. Fagron's strategic investments in expanding its sterile compounding capabilities, including recent expansions in Wichita and Boston, position it well to meet this market need.

Furthermore, Fagron has the opportunity to integrate AI and machine learning into its compounding processes. These technologies can enhance formulation precision, streamline production, and improve safety standards, offering a competitive edge in developing personalized and effective treatments. The company's commitment to innovation aligns with leveraging these advancements for better patient outcomes.

Fagron's strategic acquisition approach, particularly in North America and Latin America, is solidifying its market position and expanding its global reach in response to the high demand for compounding pharmacy services. This is supported by its financial performance, with a 7.3% revenue increase to €728.7 million in H1 2024, highlighting the success of its growth strategies.

Threats

The pharmaceutical compounding sector, including companies like Fagron, is navigating an increasingly complex web of global regulations. For instance, the US Food and Drug Administration (FDA) continues to scrutinize compounding pharmacies, with numerous warning letters issued in recent years for non-compliance with Current Good Manufacturing Practices (cGMP) and other standards. This heightened regulatory environment translates directly into higher operational costs for Fagron, as it necessitates investments in enhanced quality control systems, more frequent audits, and specialized compliance personnel.

These evolving regulatory demands can also impose limitations on the types of compounds Fagron can offer and the processes it can employ. The need for continuous adaptation to new guidelines, such as those related to sterile compounding or specific drug ingredients, requires significant ongoing expenditure. Failure to meet these standards can result in substantial penalties, product recalls, or even operational shutdowns, posing a direct threat to Fagron's market position and profitability. For example, in 2023, regulatory actions against compounding pharmacies often involved significant fines and mandated operational changes, impacting revenue streams for non-compliant entities.

Fagron faces significant competition from numerous smaller, specialized compounding pharmacies that can offer tailored services, potentially impacting Fagron's market share in specific niches. Furthermore, larger pharmaceutical companies are increasingly exploring or expanding into the compounding sector, bringing substantial resources and established distribution networks that intensify competitive pressures on pricing and innovation.

Fagron's reliance on a global supply chain for its pharmaceutical raw materials leaves it vulnerable. Geopolitical tensions, trade disputes, and unexpected natural disasters can easily disrupt the flow of these essential components. For instance, in early 2024, ongoing shipping disruptions in the Red Sea led to increased transit times and surcharges for many companies, impacting logistics and costs across various industries, including pharmaceuticals.

These disruptions can directly translate into higher operational costs and significant production delays for Fagron. Such issues can critically affect the availability of vital compounded medications for patients who depend on them. The company's 2023 annual report highlighted that supply chain resilience remains a key focus area, acknowledging the persistent challenges in sourcing and logistics.

Reimbursement Policy Changes

Changes in how healthcare providers and insurance companies pay for compounded medications present a significant threat to Fagron. Shifts in reimbursement policies, particularly concerning coverage for these specialized drugs, can directly influence patient access and, consequently, Fagron's sales volumes and profit margins. For example, a tightening of reimbursement criteria in key European markets could lead to reduced demand for Fagron's products.

The impact of these policy changes can be substantial and geographically varied. Specific instances, such as observed shifts in reimbursement policies in Poland during 2024, have demonstrated the potential for negative revenue impacts in particular regions. This highlights the need for Fagron to closely monitor and adapt to evolving healthcare payment landscapes globally.

The implications of these reimbursement shifts can be multifaceted:

- Reduced Profitability: Lower reimbursement rates directly squeeze profit margins on compounded medications.

- Market Access Barriers: Stricter coverage policies can limit the number of patients who can afford or access compounded treatments.

- Increased Administrative Burden: Navigating complex and changing reimbursement rules requires significant administrative resources.

Reputational Risk from Quality Control Issues

Even with robust quality systems, Fagron faces reputational threats. A lapse in quality control, such as the voluntary recall of certain products in 2024, can significantly damage its standing. This erosion of trust among healthcare providers and patients can lead to a direct impact on sales and market share.

The 2024 recall, though voluntary, highlighted the sensitivity of Fagron's operations to quality issues. Such events can create a perception of unreliability, making it harder to retain existing customers and attract new ones. This is particularly concerning in the pharmaceutical compounding sector, where patient safety is paramount.

- Reputational Damage: Past quality control issues, like the 2024 voluntary recall, can tarnish Fagron's image.

- Erosion of Trust: Healthcare professionals and patients may lose confidence in Fagron's product quality.

- Business Impact: A damaged reputation can lead to decreased sales and market share.

Fagron faces intense competition from nimble, specialized compounding pharmacies and increasingly from larger pharmaceutical firms entering the niche. Supply chain vulnerabilities, exacerbated by geopolitical events like the 2024 Red Sea shipping disruptions, also pose a significant threat, leading to higher costs and potential production delays. Changes in healthcare reimbursement policies, as seen with tightening criteria in some European markets during 2024, can directly reduce sales and profitability.

| Threat Category | Specific Example/Impact | 2024/2025 Data/Trend |

|---|---|---|

| Regulatory Scrutiny | Increased FDA oversight on compounding pharmacies | Continued issuance of warning letters for cGMP non-compliance. |

| Competition | Entry of large pharmaceutical companies into compounding | Intensified pricing pressure and innovation demands. |

| Supply Chain Disruption | Geopolitical tensions impacting raw material flow | Red Sea shipping disruptions in early 2024 increased transit times and surcharges. |

| Reimbursement Policy Changes | Tightening coverage for compounded medications | Observed negative revenue impacts in specific regions like Poland during 2024. |

SWOT Analysis Data Sources

This Fagron SWOT analysis is built upon a foundation of robust data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry commentary to provide a well-rounded and accurate strategic overview.