Fagron Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Fagron Bundle

Fagron navigates a complex landscape shaped by intense rivalry, powerful suppliers, and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder in the pharmaceutical compounding sector.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Fagron’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for essential pharmaceutical raw materials directly influences Fagron's bargaining power. When a limited number of suppliers provide highly specialized active pharmaceutical ingredients (APIs) or excipients critical for personalized medicine, these suppliers gain considerable leverage. For instance, in 2024, the global pharmaceutical excipients market, a key area for Fagron, was valued at approximately $10.5 billion, with significant consolidation observed among key players, potentially increasing their pricing power.

The costs associated with switching suppliers for pharmaceutical raw materials, particularly for specialized compounding, can significantly bolster supplier bargaining power. Fagron, like many in the industry, faces hurdles such as the need for extensive re-validation of new material sources and obtaining necessary regulatory approvals, which can be time-consuming and expensive. These complexities mean that finding and onboarding a new supplier isn't a simple task, potentially leading to production disruptions if not managed meticulously.

The availability of substitute inputs significantly impacts Fagron's bargaining power with its suppliers. If Fagron can readily find alternative raw materials or develop different compounding formulations that yield similar therapeutic results, the power of existing suppliers diminishes. This flexibility allows Fagron to negotiate better terms or switch suppliers if necessary, thereby reducing its reliance on any single source.

For instance, in 2024, the pharmaceutical compounding market saw continued innovation in excipients and active pharmaceutical ingredients (APIs). Companies like Fagron, which invest in research and development for novel formulations, can leverage this by demonstrating that they can achieve comparable patient outcomes even if a specific raw material becomes scarce or prohibitively expensive. This capacity for substitution is a key factor in moderating supplier pricing power.

Threat of Forward Integration by Suppliers

Suppliers of crucial raw materials might consider integrating forward into pharmaceutical compounding. If they did, they could directly compete with Fagron, significantly boosting their own bargaining power. However, the highly specialized nature of compounding and the stringent regulatory requirements typically act as a deterrent, making this threat less potent.

Fagron’s strategic approach involves vertical integration across the entire compounding value chain. This integration helps to buffer against potential risks, including the threat of suppliers moving into their market. By controlling more stages of production and distribution, Fagron can maintain a stronger competitive position.

- Limited Supplier Forward Integration: The specialized knowledge and regulatory compliance needed for pharmaceutical compounding make it a difficult market for raw material suppliers to enter.

- Fagron's Mitigation Strategy: Fagron's vertical integration, controlling key aspects of the compounding process, reduces the impact of potential supplier competition.

- Industry Landscape: In 2024, the pharmaceutical compounding sector continued to be characterized by high barriers to entry, further limiting the feasibility of supplier forward integration.

Importance of Fagron to Suppliers

Fagron's substantial global presence and operational scale position it as a highly significant customer for many of its raw material suppliers. This importance can diminish the suppliers' leverage, as their reliance on Fagron's business may be considerable. For instance, in 2024, Fagron's procurement activities likely involved substantial volumes of specialized pharmaceutical ingredients and compounding supplies, making it a key revenue driver for numerous niche chemical manufacturers and distributors.

The company's extensive network of facilities across Europe, North America, and Asia means it sources materials from a diverse range of providers. This broad supplier base, coupled with Fagron's consistent demand, can create a situation where individual suppliers are more dependent on Fagron than Fagron is on any single supplier. This dynamic inherently shifts bargaining power towards Fagron.

- Fagron's Global Reach: Operating in over 30 countries, Fagron's demand is spread across numerous geographical markets, increasing its importance to a wide array of suppliers.

- Volume Purchasing Power: The sheer volume of raw materials and finished goods Fagron procures annually allows it to negotiate more favorable terms.

- Supplier Dependence: For many specialized ingredient providers, Fagron may represent a significant percentage of their total sales, thereby reducing their ability to dictate terms.

- Strategic Sourcing: Fagron's ability to switch suppliers or develop alternative sourcing strategies further bolsters its position in negotiations.

The bargaining power of suppliers for Fagron is influenced by the concentration of providers for critical pharmaceutical raw materials. When few suppliers offer specialized active pharmaceutical ingredients (APIs) or excipients vital for personalized medicine, their leverage increases. For instance, the global pharmaceutical excipients market, a key segment for Fagron, was valued at approximately $10.5 billion in 2024, exhibiting notable consolidation among major players, which could enhance their pricing power.

The costs associated with switching suppliers for essential pharmaceutical raw materials, particularly for complex compounding, significantly empower these suppliers. Fagron faces substantial expenses related to re-validating new material sources and securing regulatory approvals, which can lead to production delays if not managed carefully. These intricate processes mean that onboarding a new supplier is a considerable undertaking.

Fagron's ability to source substitute inputs directly impacts its negotiation strength with suppliers. If Fagron can readily find alternative raw materials or develop different compounding formulations that achieve similar therapeutic outcomes, the influence of current suppliers diminishes. This flexibility enables Fagron to negotiate better terms or switch providers, reducing its dependence on any single source.

In 2024, the pharmaceutical compounding market continued to see advancements in excipients and APIs. Fagron's investment in research for novel formulations allows it to achieve comparable patient results even if specific raw materials become scarce or excessively expensive, thereby moderating supplier pricing power.

| Factor | Impact on Fagron | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power | Global excipients market ~$10.5 billion, with observed consolidation |

| Switching Costs | High switching costs empower suppliers | Re-validation and regulatory approval processes are time-consuming and costly |

| Availability of Substitutes | Availability of substitutes reduces supplier power | Innovation in formulations allows for alternative sourcing |

| Supplier Forward Integration | Low threat due to high barriers to entry | Specialized knowledge and regulations deter supplier entry into compounding |

| Fagron's Customer Importance | Fagron's scale reduces supplier power | Fagron's global presence makes it a significant customer for many suppliers |

What is included in the product

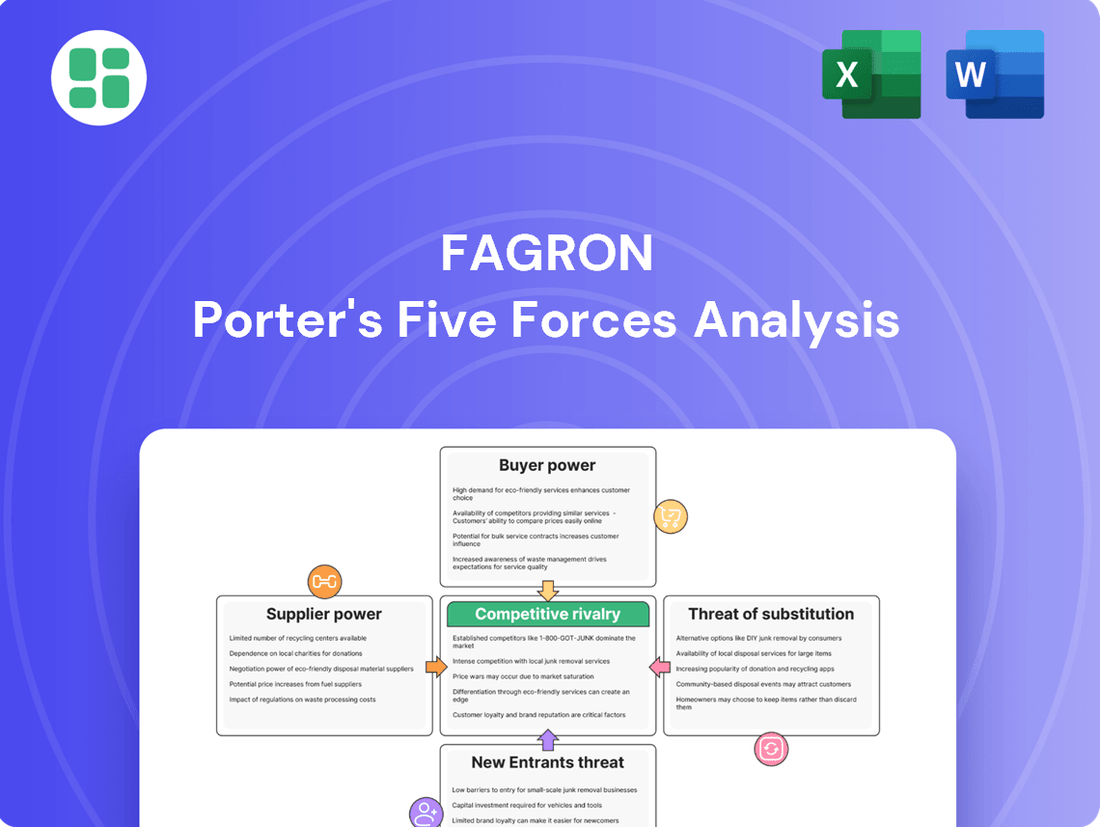

Fagron's Porter's Five Forces Analysis examines the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the pharmaceutical compounding industry.

Easily assess competitive intensity and identify strategic opportunities by visualizing the interplay of all five forces.

Quickly adapt to market shifts by adjusting input variables to understand their impact on profitability and competitive positioning.

Customers Bargaining Power

Fagron's customer base is diverse, including pharmacies, hospitals, clinics, prescribers, and patients, with wholesalers and industry playing a smaller role. This broad reach is a key factor in managing customer bargaining power.

However, if a few major clients, like large hospital groups or pharmacy chains, account for a substantial portion of Fagron's revenue, their ability to negotiate better terms would be amplified. For instance, if the top 10 customers represented over 20% of sales in 2023, this concentration would be a significant factor.

Fagron's strategy to cultivate a wide array of customers across different regions and segments is crucial. This diversification dilutes the impact of any single customer's demands, thereby strengthening Fagron's negotiating position.

Switching costs for customers in the specialized compounded medication sector are often substantial. This is due to the intricate nature of patient-specific formulations, the need to adhere to established treatment protocols, and strict regulatory compliance. These factors create a significant barrier for customers looking to change providers.

Fagron's strategic emphasis on personalized medicine and rigorous quality control fosters strong customer loyalty. The consistency and reliability of their products are critical for patients and healthcare providers, making the established relationship a key factor that diminishes customer bargaining power.

The bargaining power of customers is significantly influenced by the availability of substitute products and services. For Fagron, this means customers can often turn to mass-produced pharmaceuticals or other compounding pharmacies if Fagron's offerings are not competitive on price or availability. This is particularly true for less specialized compounded medications where alternatives are more readily accessible, thereby strengthening the customer's position.

However, Fagron's strategic focus on highly personalized and niche medications creates a scenario where direct substitutes are scarce. In 2024, Fagron continued to emphasize its role in providing tailored pharmaceutical solutions, differentiating itself from generic drug manufacturers and standard compounding services. This specialization limits the substitutability for patients requiring unique formulations, thereby moderating customer bargaining power in these specific market segments.

Price Sensitivity of Customers

Customer price sensitivity for Fagron's products is influenced by several key factors. Reimbursement policies, especially for specialized or compounded medications, can significantly alter how much a patient or payer is willing to spend. For instance, if a particular formulation is fully covered by insurance, the perceived cost to the end-user is lower, reducing price sensitivity.

The criticality of a medication also plays a crucial role. For life-saving or essential treatments where few alternatives exist, customers are naturally less inclined to shop around based on price. Fagron's strength often lies in developing personalized medicines or solutions for unmet patient needs, situations where the therapeutic benefit outweighs minor price differences.

Competitive offerings are another major determinant. If there are readily available, lower-cost alternatives that fulfill a similar medical need, customers will likely exhibit higher price sensitivity. Fagron's ability to differentiate through unique formulations, quality, or specialized services helps mitigate this. In 2024, Fagron continued to focus on niche markets where its specialized offerings provided a distinct advantage, potentially insulating it from extreme price pressures in those segments.

- Reimbursement Landscape: Changes in healthcare coverage and reimbursement rates directly impact how much patients and providers can afford, influencing price sensitivity.

- Therapeutic Necessity: For critical or life-sustaining medications, the urgency and lack of alternatives often lead to lower price sensitivity.

- Competitive Alternatives: The availability and pricing of comparable products in the market are key drivers of how price-conscious customers will be.

- Fagron's Value Proposition: Fagron's focus on specialized formulations and unmet needs can reduce price sensitivity by offering unique solutions.

Customer Information and Transparency

Customers increasingly have access to pricing and quality information, which generally boosts their power. For example, in 2024, online platforms and consumer review sites continued to make it easier for individuals and businesses to compare offerings across various industries. However, the pharmaceutical compounding sector, Fagron's core business, presents unique challenges to full transparency due to its technical complexity and stringent regulatory environment. This complexity can create a knowledge gap, giving Fagron a degree of leverage.

Fagron's strategic focus on educating its customers within the compounding space suggests an effort to bridge this gap and establish itself as a reliable source of expertise. By providing comprehensive information and training, Fagron aims to build trust and foster stronger relationships, potentially mitigating some of the direct price-based bargaining pressure.

- Information Access: General market trends in 2024 showed a continued rise in customer access to comparative pricing and quality data across most sectors.

- Industry Specifics: The technical and regulatory demands of pharmaceutical compounding inherently limit the ease of complete transparency compared to simpler consumer goods.

- Fagron's Strategy: Fagron's investment in customer education positions it as a knowledge provider, aiming to enhance customer understanding and loyalty rather than solely competing on price.

Fagron's diverse customer base, ranging from individual pharmacies to large hospital networks, generally moderates their individual bargaining power. However, the concentration of sales among a few key clients could significantly amplify their leverage, a factor Fagron mitigates through broad customer diversification. The specialized nature of compounded medications and Fagron's focus on unique patient needs create high switching costs and reduce the availability of direct substitutes, thereby limiting customer power.

Customer price sensitivity is further influenced by reimbursement policies and the therapeutic necessity of medications; critical treatments with few alternatives naturally command less price negotiation. While increased information access generally empowers customers, the complexity of pharmaceutical compounding, coupled with Fagron's educational initiatives, creates a knowledge asymmetry that can temper direct price-based bargaining.

| Factor | Impact on Customer Bargaining Power | Fagron's Mitigation Strategy |

|---|---|---|

| Customer Concentration | High if a few clients dominate sales | Diversifying customer base across regions and segments |

| Switching Costs | High due to specialized formulations and regulations | Focus on personalized medicine and rigorous quality control |

| Availability of Substitutes | Low for highly specialized, niche medications | Emphasis on tailored pharmaceutical solutions for unmet needs |

| Price Sensitivity | Influenced by reimbursement, therapeutic necessity, and competition | Differentiating through unique formulations and specialized services |

| Information Access | Generally high, but limited by industry complexity | Customer education and building expertise to foster trust |

Full Version Awaits

Fagron Porter's Five Forces Analysis

This preview showcases the complete Fagron Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the pharmaceutical compounding sector. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately upon purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

The pharmaceutical compounding market is booming, fueled by a strong demand for personalized treatments, ongoing drug shortages, and the rise of specialized healthcare. This rapid expansion is a magnet for new entrants, naturally heightening competitive pressures. However, for established companies like Fagron, this growth also translates into significant opportunities to solidify their market position.

The global personalized medicine market, a key driver for pharmaceutical compounding, is anticipated to reach an impressive value by 2034, underscoring the exceptionally favorable growth environment. For instance, some projections suggest the market could surpass $100 billion by 2030, demonstrating a clear upward trajectory.

Fagron operates in a market characterized by a large number of local competitors, each serving specific geographic regions. While Fagron holds the global lead in pharmaceutical compounding, its primary rivals are often smaller, specialized companies within individual countries. This creates a fragmented competitive environment where direct global competitors of Fagron's size and scope are scarce.

The sheer volume of these local players, though individually smaller, collectively presents a significant competitive force. For instance, in 2024, the pharmaceutical compounding market saw continued growth, with many regional businesses adapting to evolving regulatory landscapes and patient needs, directly challenging Fagron's market share in various territories.

Fagron's strategic focus on expanding its sterile compounding capabilities and solidifying its global leadership aims to counter this fragmented competition. By offering a broader range of specialized services and maintaining a strong international presence, Fagron seeks to differentiate itself from the numerous localized alternatives.

Fagron stands out by offering a broad spectrum of pharmaceutical raw materials, equipment, and specialized services, all geared towards personalized medication. This comprehensive approach, coupled with a commitment to high-quality standards, carves out a distinct position in a market that highly values tailored solutions and reliability.

The company’s vertically integrated structure is a significant differentiator, allowing for greater control over its supply chain and quality assurance processes. This integration, along with Fagron's focus on innovation through R&D and unique genetic testing services, strengthens its competitive advantage by meeting the evolving needs for customized pharmaceutical preparations.

Exit Barriers for Competitors

High exit barriers significantly influence competitive rivalry by trapping less profitable players within the market. In the pharmaceutical compounding sector, specialized assets like sterile manufacturing facilities, stringent regulatory compliance, and the substantial costs associated with obtaining and maintaining licenses act as significant deterrents to exiting. These factors can lock companies into operations even when profitability is low, thereby prolonging and intensifying competition.

Fagron's strategic approach, including its recent acquisitions, aims to consolidate market share and potentially increase the competitive pressure on remaining players. For instance, Fagron's acquisition of a compounding pharmacy chain in 2023 for approximately €50 million aimed to bolster its presence in key European markets. This consolidation can lead to a more concentrated market where larger entities, like Fagron, leverage economies of scale, further pressuring smaller, less efficient competitors who face high exit barriers.

- Specialized Assets: The need for sterile compounding facilities, which can cost millions to build and maintain, makes it difficult for companies to simply shut down.

- Regulatory Compliance: Meeting Good Manufacturing Practices (GMP) and other pharmaceutical regulations involves ongoing investment and specialized knowledge, increasing the cost of ceasing operations.

- Customer Relationships: Long-standing relationships with healthcare providers and patients in compounding pharmacy are hard to sever, creating a sticky customer base that is difficult to abandon.

- Fagron's Consolidation Strategy: Fagron's ongoing acquisition activities demonstrate an intent to gain market share, which can squeeze out smaller competitors struggling with these exit barriers.

Strategic Acquisitions and Market Consolidation

Fagron's proactive approach to strategic acquisitions underscores a trend of market consolidation. By integrating companies, Fagron not only bolsters its presence in key segments like Essentials, Brands, and Compounding Services but also contributes to a shrinking competitive landscape. This inorganic growth path, while potentially reducing the sheer number of rivals, can simultaneously create more substantial, well-resourced competitors.

For instance, Fagron's acquisition of a specialty compounding pharmacy in North America in early 2024 aimed to expand its service offerings and geographic reach. Such moves are indicative of an industry where larger players are consolidating power, potentially increasing the intensity of rivalry among the remaining, more dominant entities.

- Strategic Acquisitions: Fagron has actively acquired companies to enhance its market position and global reach, especially in its Essentials, Brands, and Compounding Services divisions.

- Market Consolidation: This inorganic growth strategy indicates ongoing consolidation within the pharmaceutical compounding sector.

- Reduced Competition, Increased Rivalry: While consolidation can decrease the number of direct competitors, it may also lead to the emergence of larger, more formidable rivals, intensifying competition among the remaining players.

Competitive rivalry in the pharmaceutical compounding market is intense, driven by a large number of smaller, localized players challenging Fagron's global leadership. While direct, large-scale global competitors are few, the sheer volume of regional businesses actively adapting to market demands and regulations means Fagron faces constant pressure across various territories.

Fagron's strategy of expanding sterile compounding capabilities and pursuing strategic acquisitions, such as its 2023 acquisition of a compounding pharmacy chain for approximately €50 million, aims to consolidate market share and create larger, more formidable competitors. This consolidation, while reducing the number of rivals, intensifies rivalry among the remaining dominant entities.

High exit barriers, including specialized assets like sterile manufacturing facilities and stringent regulatory compliance, trap less profitable companies, prolonging competition. Fagron's ongoing acquisition activities, like its early 2024 North American specialty compounding pharmacy acquisition, exemplify this consolidation trend, leading to a more concentrated market where larger players leverage economies of scale.

| Factor | Description | Impact on Rivalry |

|---|---|---|

| Number of Competitors | Many small, specialized local companies alongside Fagron's global presence. | Fragmented market leads to localized competitive battles. |

| Market Growth | Strong demand for personalized medicine, projected to exceed $100 billion by 2030. | Attracts new entrants and fuels competition for market share. |

| Fagron's Consolidation | Acquisitions of companies like a European compounding chain (2023, ~€50M) and a North American specialty pharmacy (early 2024). | Reduces the number of smaller players, but creates larger, more intense rivals. |

| Exit Barriers | High costs of specialized assets, regulatory compliance, and customer relationships. | Keeps less profitable firms in the market, sustaining rivalry. |

SSubstitutes Threaten

Mass-produced, standardized medications represent the primary substitute for Fagron's compounded offerings. While these drugs are generally more affordable and accessible, they often fall short for patients needing specific dosages, unique formulations like liquids instead of pills, or allergen-free preparations. Fagron's business model thrives by filling these critical gaps where commercial options are either non-existent or inadequate for individual patient requirements.

For specific health concerns, non-drug approaches like physical therapy, lifestyle changes, or even certain herbal remedies can act as substitutes for pharmaceutical products. For instance, in 2024, the global wellness market, which includes many of these alternative modalities, was projected to reach over $5.6 trillion, indicating significant consumer interest.

However, the effectiveness of these substitutes is often limited when precise dosages, specific active pharmaceutical ingredients, or complex delivery mechanisms are required. Conditions demanding highly controlled interventions, such as certain types of cancer treatment or complex chronic disease management, find fewer viable non-pharmacological substitutes.

The growing trend towards personalized medicine further diminishes the threat of substitutes. As of early 2025, advancements in genomics and targeted therapies are increasingly allowing for treatments tailored to individual patient needs, a level of specificity that broad alternative therapies often cannot match.

The availability of over-the-counter (OTC) products and dietary supplements presents a significant threat to compounding pharmacies like Fagron. For less severe health concerns or general wellness, consumers can easily access readily available alternatives without a prescription. This is particularly true for products targeting lifestyle improvements and preventative health, where the market is saturated with OTC options.

This accessibility directly impacts compounding pharmacies by siphoning off demand for personalized formulations that could be replicated with mass-produced supplements. For instance, if a patient seeks a vitamin D supplement, they might opt for a widely available OTC product rather than a custom-compounded one, especially if the perceived difference in efficacy is minimal for their needs. This trend was evident in 2024, with the global dietary supplements market projected to reach over $230 billion, showcasing the sheer volume of consumer spending on these accessible alternatives.

However, Fagron is strategically positioning itself to counter this threat through Fagron Genomics. By offering genetic testing, Fagron aims to guide personalized therapy, moving beyond the one-size-fits-all approach of many OTC products. This allows them to offer demonstrably superior, data-driven solutions for individuals seeking truly tailored health outcomes, thereby differentiating themselves from the broad and often generic OTC market.

New Drug Delivery Systems

Innovations in drug delivery systems present a significant threat to traditional compounding pharmacies. For instance, advancements in personalized medicine, driven by AI in drug discovery, are leading to more targeted therapies. Companies are investing heavily in these areas; in 2024, global spending on pharmaceutical R&D was projected to exceed $240 billion, with a substantial portion allocated to novel drug delivery and precision medicine technologies.

These new systems can offer greater convenience and efficacy, potentially reducing the demand for custom-compounded medications. For example, the development of oral peptide delivery systems aims to make biologic drugs, previously requiring injections, more accessible. This could directly impact compounding pharmacies that specialize in preparing injectable formulations.

However, the threat of full substitution is not immediate for all patient needs. While mass-produced, personalized drugs are gaining traction, highly individualized patient requirements, particularly in areas like specialized pediatric or oncology formulations, still heavily rely on the flexibility of compounding. The market for compounding pharmacies, while facing these evolving threats, remains substantial, with the global compounding pharmacy market valued at approximately $11.5 billion in 2023, indicating continued demand for their services.

- Technological Advancements: Innovations like AI-driven drug discovery and gene editing are creating more personalized and targeted pharmaceutical solutions.

- Market Investment: Significant global R&D investment, exceeding $240 billion in 2024 for pharmaceuticals, fuels the development of these new drug delivery systems.

- Impact on Compounding: Novel delivery methods, such as oral peptide delivery, could reduce the need for traditional injectable compounding services.

- Continued Demand: Despite these threats, the global compounding pharmacy market, valued at around $11.5 billion in 2023, demonstrates ongoing reliance on customized pharmaceutical preparations for specific patient needs.

Regulatory Changes Impacting Compounding Scope

Changes in pharmaceutical compounding regulations, such as the FDA's proposed Demonstrable Difficulties for Compounding Lists (DDC lists), could significantly restrict the types of drugs available for compounding. These regulations, aimed at improving safety and quality, might limit the range of services compounding pharmacies can offer.

This restriction effectively elevates the threat of substitutes. Patients may be compelled to seek out FDA-approved, mass-produced alternatives if their compounded medications become unavailable or more difficult to obtain. For instance, if a specific active pharmaceutical ingredient (API) is moved to a DDC list, compounding pharmacies would need to prove a lack of commercial availability to continue compounding it, a process that can be complex and time-consuming.

The potential impact is substantial, as it could shift market share back to traditional pharmaceutical manufacturers. In 2024, the compounding pharmacy sector, while specialized, operates within a framework where regulatory shifts can rapidly alter competitive landscapes. The FDA's ongoing review of compounding practices, including the development of these DDC lists, represents a direct challenge to the existing business models of many compounding pharmacies.

- Regulatory Scrutiny: Increased FDA oversight on compounding practices poses a significant threat.

- Shift to Alternatives: Restrictions can drive patients toward mass-produced, FDA-approved drugs.

- Market Dynamics: Changes in compounding scope can alter competitive advantages and market share.

- Impact on Innovation: Stricter regulations might slow the development of niche compounded therapies.

Mass-produced medications are the primary substitutes for Fagron's custom formulations, often being more affordable and accessible. However, they lack the specificity required for patients needing unique dosages or allergen-free preparations. Fagron excels by addressing these critical gaps where commercial options are insufficient.

Entrants Threaten

The pharmaceutical compounding sector, particularly for sterile products, faces substantial regulatory and licensing challenges. Strict adherence to Good Manufacturing Practices (cGMP), FDA registrations, and individual state licensing requirements are mandatory. For instance, in 2024, the FDA continued to emphasize cGMP compliance, with compounding pharmacies needing to demonstrate robust quality systems to operate legally.

These intricate and frequently updated regulations create significant barriers for new entrants. Establishing the necessary infrastructure and expertise to meet these standards requires considerable capital investment and specialized knowledge. Many new businesses find the cost and complexity of achieving and maintaining compliance prohibitive, effectively limiting the threat of new competition.

Establishing a pharmaceutical compounding facility, especially for sterile products and large-scale output, demands significant upfront capital. This includes specialized equipment, sterile environments, robust quality control labs, and cutting-edge technology. Fagron's own investments in sterile capacity and automation underscore this high capital requirement, acting as a barrier to new players.

New companies entering the pharmaceutical compounding ingredients market would struggle to secure consistent access to specialized, pharmaceutical-grade raw materials. Fagron, for instance, leverages decades of established relationships with certified global suppliers, ensuring quality and reliability that new entrants would find difficult to replicate quickly.

Brand Reputation and Customer Trust

In the pharmaceutical sector, brand reputation and customer trust are paramount, acting as significant barriers to entry. Fagron, with over three decades of experience, has cultivated a strong reputation for quality and safety, fostering deep relationships with healthcare professionals. Newcomers face the daunting task of replicating this established trust and market acceptance, a process that demands substantial time and investment. For instance, in 2024, the pharmaceutical industry continued to see stringent regulatory hurdles and a high cost of clinical trials, further elevating the barriers for new players aiming to establish credibility.

Building a recognizable and trusted brand in pharmaceuticals is not a quick endeavor. It requires consistent delivery of high-quality products and adherence to rigorous safety standards. Fagron’s long-standing presence means they have a deep understanding of market needs and regulatory landscapes.

- Brand Loyalty: Established brands benefit from customer loyalty, making it harder for new entrants to capture market share.

- Regulatory Hurdles: The pharmaceutical industry is heavily regulated, requiring new entrants to navigate complex approval processes.

- Investment in Trust: Fagron’s 30+ years of operation represent a significant investment in building trust with pharmacies, hospitals, and prescribers.

- Market Inertia: Healthcare providers often prefer to stick with trusted suppliers, creating inertia that new entrants must overcome.

Intellectual Property and Proprietary Formulations

Intellectual property and proprietary formulations present a significant barrier to new entrants in the pharmaceutical compounding sector. While many compounding ingredients are readily available, Fagron distinguishes itself through its investment in research and development, leading to specialized formulations and innovative compounding concepts. For instance, Fagron's development of Fagron Genomics showcases a proprietary offering that is not easily replicated by newcomers, thereby strengthening its competitive position.

The threat of new entrants is somewhat mitigated by the complexity and cost associated with developing and protecting intellectual property in this specialized field. Fagron's ongoing commitment to R&D, evidenced by its robust pipeline of unique solutions, creates a higher hurdle for potential competitors. This focus on innovation means that new players would need substantial resources not only to enter the market but also to match Fagron's established intellectual capital and specialized service portfolio.

Consider these points regarding intellectual property as a barrier:

- Proprietary Formulations: Fagron's development of unique and specialized compounding formulations acts as a significant barrier, requiring substantial R&D investment from new entrants to match.

- Intellectual Capital: Investments in areas like Fagron Genomics represent intellectual capital that is difficult and time-consuming for competitors to replicate.

- R&D Focus: Fagron's consistent emphasis on research and development creates a moving target for new companies, making it challenging to compete on innovation alone.

- Value Proposition Differentiation: The combination of proprietary formulations and specialized services allows Fagron to offer a distinct value proposition that new entrants struggle to match without similar IP investments.

The threat of new entrants in the pharmaceutical compounding sector is significantly limited by high capital requirements for sterile facilities and specialized equipment. Fagron’s substantial investments in advanced manufacturing capabilities and automation in 2024 highlight the extensive financial commitment needed, deterring smaller or less capitalized competitors.

Stringent regulatory compliance, including cGMP adherence and FDA registration, presents a formidable barrier. Navigating these complex, evolving rules demands considerable expertise and ongoing investment, making it difficult for new companies to establish a legal and compliant operational framework.

Established brand reputation and deep customer trust, built over decades, are critical deterrents. Fagron's long-standing relationships with healthcare professionals and consistent quality delivery in 2024 mean new entrants face a lengthy and costly process to achieve comparable market acceptance and loyalty.

Proprietary formulations and ongoing investment in R&D create a competitive edge that new entrants struggle to overcome. Fagron’s focus on specialized solutions, like those in its genomics division, requires significant intellectual capital and innovation resources for new players to replicate.

Porter's Five Forces Analysis Data Sources

Our Fagron Porter's Five Forces analysis is built upon a robust foundation of data, incorporating annual financial reports, industry-specific market research from sources like IBISWorld, and regulatory filings to capture the nuances of competitive dynamics.