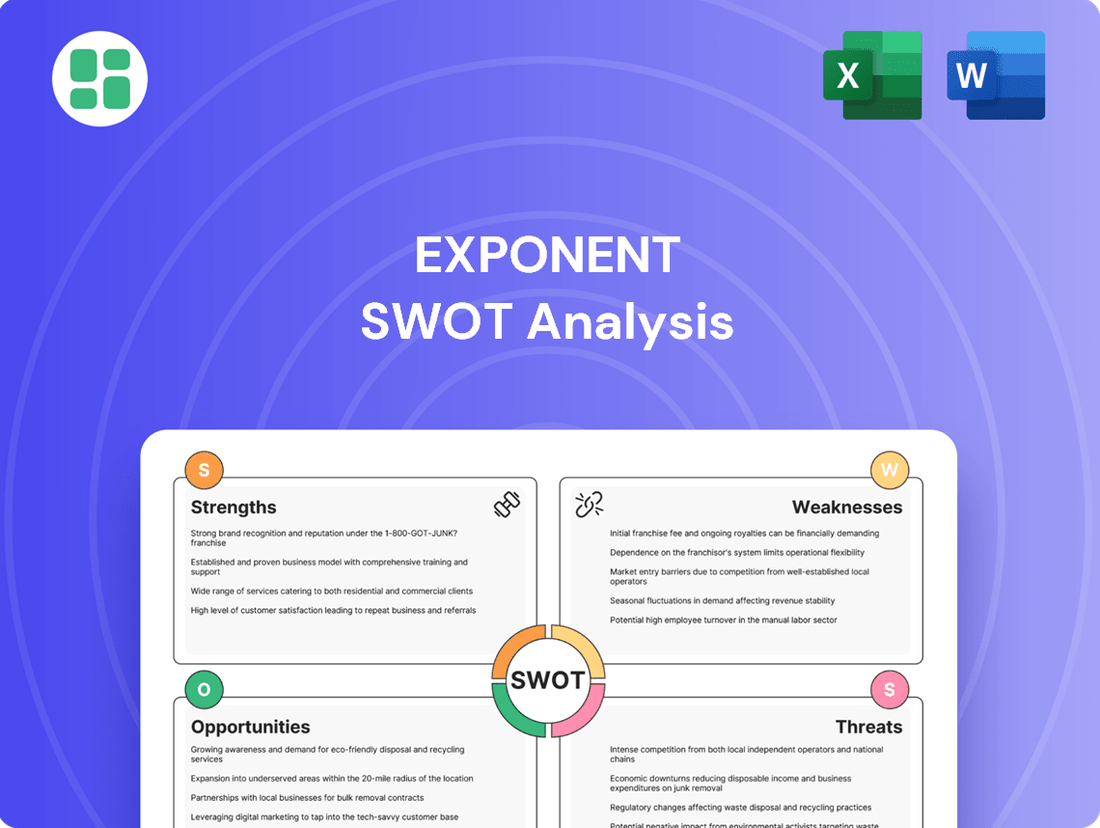

Exponent SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exponent Bundle

Uncover the core strengths, potential weaknesses, market opportunities, and critical threats facing Exponent with our comprehensive SWOT analysis. This isn't just a summary; it's your roadmap to understanding their competitive edge and navigating future challenges.

Ready to dive deeper and gain actionable intelligence? Purchase the full SWOT analysis to access detailed breakdowns, expert commentary, and an editable format perfect for strategic planning and informed decision-making.

Strengths

Exponent's deep technical expertise is a cornerstone of its strength, boasting over 90 technical disciplines and a workforce of more than 900 consulting staff, with over 650 holding doctoral degrees. This extensive knowledge base enables them to address highly complex, safety-critical challenges across a wide array of industries, offering tailored solutions that many competitors struggle to match.

Their multidisciplinary approach allows for the seamless integration of knowledge from various fields, creating comprehensive problem-solving capabilities. This unique synergy, evidenced by their ability to attract and retain top-tier talent in specialized areas, provides a significant competitive edge in tackling intricate issues.

Exponent's reputation, built over five decades, is a cornerstone of its strength, especially in demanding fields like failure analysis and product development. This deep-seated trust is vital for clients in litigation and safety-critical industries who require unwavering accuracy and credibility.

The company's expertise in providing rigorous, objective technical analyses translates into significant brand recognition. This strong standing allows Exponent to command premium pricing for its specialized services, reflecting the high value placed on its proven track record.

Exponent's strength lies in its broad service offerings, encompassing both proactive consulting like product development and reactive services such as failure analysis. This wide range allows them to cater to diverse client needs across multiple sectors.

The company's presence in industries from consumer products to energy and transportation provides significant resilience. This diversification is crucial, as it cushions against downturns in any single market, ensuring more stable revenue streams. For instance, in 2023, Exponent reported revenue of $725.6 million, demonstrating its ability to maintain financial health through varied economic conditions.

Solid Financial Health and Shareholder Returns

Exponent showcases robust financial health, evident in its fiscal year 2024 performance. The company achieved a 4.1% revenue increase, reaching $558.5 million, supported by a solid EBITDA margin of 28.4%. This financial strength translates into tangible shareholder value.

Further underscoring its stability, Exponent held $258.9 million in cash and cash equivalents as of January 2025. This strong liquidity position allows for continued investment and shareholder distributions. The company’s commitment to its investors is clear through its consistent dividend growth, now in its 12th consecutive year of increases.

- Revenue Growth: 4.1% increase in fiscal year 2024 to $558.5 million.

- Profitability: 28.4% EBITDA margin reported.

- Liquidity: $258.9 million in cash and cash equivalents as of January 2025.

- Shareholder Returns: 12th consecutive year of quarterly dividend increases.

Strategic Focus on Emerging High-Growth Areas

Exponent is sharpening its focus on high-growth sectors, aligning its expertise with emerging technological and market trends. This includes significant investment in areas like artificial intelligence validation, battery technology development, and digital health solutions. For instance, the company's work in battery technology is crucial as the electric vehicle market continues its rapid expansion, with global EV sales projected to reach over 15 million units in 2024.

Their strategic expansion into the energy transition, encompassing renewable energy disputes and wildfire risk modeling, is particularly timely. With the global renewable energy sector attracting substantial investment, expected to surpass $2 trillion annually by 2025, Exponent's specialized services are well-positioned to address the complex challenges and opportunities within this dynamic field.

- AI Validation: Addressing the growing need for reliable AI systems across industries.

- Battery Technology: Supporting innovation in energy storage solutions vital for EVs and grid stability.

- Digital Health: Providing expertise in the rapidly evolving healthcare technology landscape.

- Energy Transition: Offering critical support for renewable energy projects and climate-related risk assessment.

Exponent's deep technical expertise, spanning over 90 disciplines with a significant number of staff holding doctoral degrees, allows them to tackle highly complex, safety-critical issues across diverse industries. Their multidisciplinary approach fosters integrated problem-solving, attracting top talent and providing a distinct competitive advantage.

The company's long-standing reputation, built over five decades, is a key strength, particularly in fields like failure analysis where trust and credibility are paramount for clients in litigation and safety-critical sectors. This established brand recognition enables Exponent to command premium pricing for its accurate and objective technical analyses.

Exponent's broad service portfolio, covering both proactive product development and reactive failure analysis, caters to a wide range of client needs across various sectors, ensuring resilience. This diversification, as shown by their $725.6 million revenue in 2023, helps stabilize earnings even during economic fluctuations.

Financially, Exponent demonstrated robust health in fiscal year 2024 with a 4.1% revenue increase to $558.5 million and a strong 28.4% EBITDA margin. As of January 2025, their liquidity stood at $258.9 million in cash and cash equivalents, supporting ongoing investments and consistent dividend growth, now in its 12th consecutive year.

| Metric | Value | Period |

|---|---|---|

| Revenue | $558.5 million | Fiscal Year 2024 |

| Revenue Growth | 4.1% | Fiscal Year 2024 |

| EBITDA Margin | 28.4% | Fiscal Year 2024 |

| Cash and Equivalents | $258.9 million | January 2025 |

| Dividend Growth | 12 consecutive years | Ongoing |

What is included in the product

Analyzes Exponent’s competitive position through key internal and external factors.

Offers a clear, structured approach to identify and address critical business challenges.

Weaknesses

Exponent's commitment to employing highly specialized, doctoral-level experts and delivering bespoke consulting services inherently results in a substantial cost structure. This focus on top-tier talent and customized solutions, while a key differentiator, means their operational expenses are likely higher than many competitors.

This elevated cost base translates into premium pricing for their services. While this strategy aligns with their high-value proposition, it can present a barrier for clients with more constrained budgets or those seeking more commoditized, cost-effective solutions, potentially limiting market penetration in certain segments.

The premium pricing is also reflected in Exponent's valuation multiples. For instance, as of early 2024, many consulting firms in similar specialized niches trade at P/E ratios significantly above the broader market average, indicating investor confidence in their premium positioning but also highlighting the sensitivity to economic downturns that might impact client willingness to pay for such services.

Exponent's reliance on its approximately 900 highly specialized consultants, who form the backbone of its technical expertise, presents a significant weakness. Attracting and retaining this caliber of talent is inherently challenging and expensive, especially in today's competitive landscape for skilled professionals.

The company's reported headcount deficit at the beginning of fiscal year 2025 directly impacts its capacity for growth and its ability to fully satisfy client demand. This talent gap can limit project intake and potentially hinder the firm's expansion plans.

A significant portion of Exponent's income stems from project-based work, such as assisting in legal cases and investigating failures. This type of business can be unpredictable, with demand fluctuating based on economic conditions and the frequency of disputes.

While Exponent benefits from a diversified business model, a downturn in key sectors or a reduction in the need for dispute resolution services could impact its financial stability. This was subtly indicated by flat revenue figures in the first half of 2025, even though the company surpassed its own forecasts for those periods.

Limited Market Share in the Broader Consulting Industry

Exponent's position within the vast consulting industry is notably smaller than some of its larger competitors. As of the first quarter of 2025, its market share was approximately 3.85%, a figure that highlights its dominance in specialized, high-complexity niches rather than a broad market presence. This limited footprint means Exponent may not benefit from the same economies of scale as firms with a more extensive reach across diverse consulting sectors.

While Exponent excels in areas requiring deep technical expertise, its overall market share in the broader consulting landscape remains constrained. Compared to giants like Booz Allen Hamilton, which commands a significantly larger portion of the overall market, Exponent's reach is more concentrated. This can impact its ability to leverage scale and might present challenges in competing for a wider array of projects outside its core competencies.

The company's focused strategy, while effective in its chosen fields, results in a smaller overall market share compared to more diversified consulting firms. This can be seen as a weakness when considering the broader competitive environment.

Operational Margin Pressures and Flat Segment Performance

Exponent has experienced notable operational margin pressures. For instance, EBITDA saw a decline in both the first and second quarters of 2025, and operating margins also trended downwards year-on-year in Q2 2025.

The environmental and health segment, while a smaller contributor to overall revenue, has also faced challenges. This segment demonstrated flat or declining performance throughout 2024 and into the first half of 2025.

These headwinds are attributed to sector-specific issues and a general softening of demand in certain areas within this segment.

- EBITDA Decline: Observed in Q1 and Q2 2025.

- Operating Margin Erosion: Year-on-year decrease noted in Q2 2025.

- Environmental & Health Segment Stagnation: Flat or decreasing performance in 2024 and H1 2025.

- Contributing Factors: Sector-specific headwinds and softer demand.

Exponent's high cost structure, driven by its reliance on specialized, doctoral-level experts, leads to premium pricing. This can limit its appeal to budget-conscious clients and segments seeking more commoditized services. The company's approximately 900 highly skilled consultants are expensive to attract and retain, and a reported headcount deficit at the start of fiscal year 2025 directly impedes growth and client demand fulfillment.

The project-based nature of much of Exponent's work introduces unpredictability, with demand sensitive to economic cycles and dispute frequency. While diversified, a downturn in key sectors or reduced demand for dispute resolution could impact financial stability, as hinted by flat revenue in the first half of 2025. Furthermore, Exponent's market share, around 3.85% as of Q1 2025, is small compared to larger, more diversified competitors, limiting economies of scale.

Operational margins have faced pressure, with EBITDA declining in Q1 and Q2 2025, and operating margins decreasing year-on-year in Q2 2025. The environmental and health segment also showed stagnation or decline throughout 2024 and the first half of 2025 due to sector-specific issues and softening demand.

| Weakness Category | Specific Issue | Impact/Data Point |

|---|---|---|

| Cost Structure & Pricing | Premium pricing due to specialized talent | Barrier for budget-conscious clients |

| Talent Acquisition & Retention | High cost of specialized experts | Headcount deficit at FY2025 start impacting growth |

| Revenue Predictability | Reliance on project-based work | Demand fluctuates with economic conditions and disputes |

| Market Position | Limited overall market share (approx. 3.85% in Q1 2025) | Restricts economies of scale compared to larger firms |

| Profitability Pressures | EBITDA decline (Q1 & Q2 2025) | Operating margins down year-on-year in Q2 2025 |

| Segment Performance | Environmental & Health segment stagnation | Flat or declining performance in 2024-H1 2025 |

Preview the Actual Deliverable

Exponent SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Exponent SWOT Analysis, ensuring you know exactly what you're getting. Once purchased, the full, comprehensive report will be yours to download.

Opportunities

The accelerating integration of artificial intelligence in critical sectors like autonomous vehicles and healthcare presents a substantial growth avenue for Exponent. As AI systems become more sophisticated, the demand for unbiased, expert assessment of their safety, dependability, and ethical considerations is escalating. Exponent's established Phoenix testing facility is strategically equipped to address this burgeoning need for AI validation.

The global shift towards clean energy, a multi-trillion dollar endeavor, offers significant avenues for growth. Exponent is well-positioned to capitalize on this by leveraging its expertise in renewable energy disputes and environmental consulting, particularly in areas like PFAS contamination management.

Challenges within existing energy infrastructure, such as wildfire risks and the need for grid modernization, also create substantial opportunities. Exponent's proactive utility services directly address these critical infrastructure needs, aligning with the ongoing energy transition.

The growing emphasis on Environmental, Social, and Governance (ESG) standards presents a significant opportunity for Exponent. As regulatory bodies worldwide intensify scrutiny, companies are actively seeking specialized assistance to meet these evolving compliance demands. Exponent's established proficiency in health, environmental science, and navigating complex regulatory landscapes allows them to offer critical support, helping clients avert penalties and foster sustainable practices.

Leveraging Digital Health and Wearable Technologies

The rapid growth of digital health and wearable devices presents a significant opportunity for Exponent to broaden its analytical capabilities. The market for wearable technology is projected to reach $150 billion by 2026, indicating a substantial demand for specialized consulting services in this domain.

Exponent can capitalize on this trend by developing expertise in areas such as AI-powered diagnostics for medical devices and the analysis of data generated by wearables. This expansion would allow the firm to offer unique insights into human health and product safety, aligning with the evolving needs of the healthcare and technology sectors.

- AI-driven diagnostics: Offering specialized services for the validation and safety assessment of AI algorithms used in medical devices.

- Wearable data analysis: Providing insights into user health patterns, device performance, and potential safety concerns derived from wearable technology.

- Market growth: Tapping into a rapidly expanding market, with the global digital health market expected to exceed $600 billion by 2026.

Strategic Acquisitions and Geographic Expansion

Exponent's robust financial health, evidenced by its strong cash reserves and prudent financial stewardship, positions it well for strategic acquisitions. This financial flexibility allows the company to actively seek out and integrate businesses that can bolster its technical expertise, broaden its service portfolio, or extend its reach into new geographical territories. Such moves are crucial for market penetration and consolidation.

The company can leverage its financial strength to pursue targeted acquisitions that align with its growth objectives. For instance, acquiring a firm with complementary technology could accelerate Exponent's innovation pipeline. Similarly, expanding into emerging markets through acquisition offers a faster route to market entry than organic growth, thereby diversifying revenue streams and reducing reliance on existing markets.

- Acquisition Potential: Exponent's strong balance sheet provides capital for strategic M&A.

- Market Entry: Acquisitions can unlock access to new customer segments and geographies.

- Service Diversification: Integrating acquired capabilities can enhance Exponent's overall service offering.

- Competitive Positioning: Expansion through acquisition can strengthen Exponent's market share and competitive advantage.

Exponent is poised to benefit from the increasing demand for AI safety and reliability testing, particularly in sectors like autonomous vehicles and healthcare, where its Phoenix facility can provide crucial validation services. The firm is also strategically positioned to capitalize on the global transition to clean energy, offering expertise in renewable energy disputes and environmental consulting, including PFAS contamination management. Furthermore, Exponent's proactive utility services address critical infrastructure needs like wildfire risk mitigation and grid modernization, aligning with the energy transition's demands.

The growing emphasis on ESG standards presents a significant opportunity for Exponent, as companies seek specialized assistance to meet evolving compliance demands. Exponent's proficiency in health, environmental science, and regulatory navigation allows it to offer critical support, helping clients avoid penalties and promote sustainable practices. The digital health and wearable device markets, projected to reach $150 billion by 2026, offer avenues for Exponent to expand its analytical capabilities, providing insights into human health and product safety.

Exponent's strong financial health, characterized by robust cash reserves and prudent management, enables strategic acquisitions to enhance technical expertise, broaden service portfolios, and expand geographical reach. This financial flexibility allows for targeted acquisitions that can accelerate innovation, such as integrating complementary technologies, or facilitate faster market entry into emerging economies, thereby diversifying revenue and reducing market reliance.

| Opportunity Area | Market Projection/Growth Factor | Exponent's Strategic Advantage |

|---|---|---|

| AI Safety & Reliability | Increasing demand in autonomous vehicles, healthcare | Phoenix testing facility, expert assessment capabilities |

| Clean Energy Transition | Multi-trillion dollar global endeavor | Expertise in renewable energy disputes, environmental consulting (PFAS) |

| Infrastructure Modernization | Addressing wildfire risks, grid upgrades | Proactive utility services |

| ESG Compliance | Intensifying regulatory scrutiny worldwide | Proficiency in health, environmental science, regulatory navigation |

| Digital Health & Wearables | Wearable tech market projected to reach $150B by 2026 | Expanding analytical capabilities, AI-powered diagnostics, wearable data analysis |

| Strategic Acquisitions | Strong cash reserves, financial flexibility | Capital for M&A, market entry, service diversification |

Threats

Exponent faces significant threats from large, diversified consulting firms like FTI Consulting and Booz Allen Hamilton. These established players possess broader service offerings and extensive client networks, allowing them to potentially encroach on Exponent's specialized market segments.

The competitive landscape is characterized by aggressive pricing strategies from these diversified firms. This could lead to margin pressure for Exponent, as clients may opt for bundled services or lower costs from larger competitors, even if Exponent offers superior niche expertise.

These competitors can also expand their own capabilities into Exponent's core areas. For instance, FTI Consulting's 2023 revenue reached $3.2 billion, demonstrating its substantial resources to invest in new service lines or acquire specialized talent, directly challenging Exponent's market position.

Economic downturns pose a significant threat to Exponent. A slowdown or recession typically means companies cut back on spending, especially for consulting services that aren't absolutely essential. This could translate to fewer projects for Exponent.

While Exponent's focus on litigation support offers some stability, extended economic challenges can still squeeze client budgets. This might result in a decrease in the number of engagements or increased pressure to lower service fees, directly impacting Exponent's revenue and profit margins. For instance, during the 2008 financial crisis, consulting spending saw a noticeable dip across many sectors.

Exponent, as a knowledge-based consultancy, faces significant challenges in attracting and keeping its highly specialized scientific and engineering talent. The market for these experts is intensely competitive. For instance, in 2024, the demand for cybersecurity and AI specialists saw a notable surge, driving up compensation expectations across the tech and consulting sectors.

Failure to secure and hold onto top performers can directly impact Exponent's operational efficiency and client service delivery. This could manifest as higher recruitment and training expenses, reduced billable hours due to staff shortages, and an inability to scale effectively to meet client project needs, ultimately hindering the firm's growth trajectory.

Technological Disruption and Rapid Industry Changes

The relentless pace of technological advancement presents a significant threat to Exponent. If the company doesn't consistently integrate cutting-edge technologies into its service offerings, its specialized expertise could lose its competitive edge. For instance, the rise of AI-powered analytics platforms, which saw substantial investment and development throughout 2024, could potentially automate aspects of the data analysis Exponent provides, reducing the perceived value of human-led insights.

Furthermore, the possibility of new tools or platforms emerging that directly compete with or even replace Exponent's core analytical capabilities is a constant concern. The market for advanced data analytics tools is projected to grow significantly, with some reports indicating a compound annual growth rate exceeding 15% through 2025. This rapid evolution means that what is considered specialized knowledge today could be commoditized tomorrow, necessitating continuous adaptation and innovation to maintain differentiation.

- Risk of Obsolescence: Failure to adapt to new technologies like advanced AI and machine learning could render Exponent's current expertise less valuable.

- Automation Threat: Emerging platforms automating data analysis could reduce demand for Exponent's specialized human-driven services.

- Increased Competition: The rapid growth in the data analytics tool market means new, potentially disruptive competitors could emerge.

- Need for Continuous Investment: Staying ahead requires ongoing and substantial investment in research and development to integrate emerging technologies.

Regulatory Shifts or Reduced Litigation Activity

Regulatory shifts pose a significant threat to Exponent, particularly concerning their reactive services. A decrease in product liability claims or reduced regulatory oversight in sectors like automotive or consumer products could directly impact demand for failure analysis and expert witness testimony, which are core revenue drivers. For instance, if new legislation simplifies compliance or reduces the grounds for litigation, Exponent's specialized consulting services might see a downturn.

The company's reliance on a robust legal and regulatory environment means that any easing of these pressures could be detrimental. A hypothetical scenario where, for example, a major industry sees a 15% reduction in product recalls due to improved manufacturing standards or a shift in consumer behavior could directly translate to fewer opportunities for Exponent's dispute resolution services. This would necessitate a strategic pivot to proactively grow other service areas.

- Reduced Litigation: A decline in product liability lawsuits, potentially driven by legislative changes or improved industry safety, could diminish demand for Exponent's expert witness and failure analysis services.

- Regulatory Easing: Less stringent regulations or a decrease in enforcement actions within key industries Exponent serves could lower the need for their compliance-related consulting.

- Shifting Legal Frameworks: Changes in how legal accountability is assigned or the types of evidence admissible in court could impact the perceived value of Exponent's core offerings.

- Economic Downturn Impact: During economic slowdowns, companies may cut back on discretionary spending, including consulting services related to litigation and compliance, even if regulatory activity remains high.

Exponent faces intense competition from larger, diversified consulting firms like FTI Consulting and Booz Allen Hamilton, which leverage broader service portfolios and extensive client networks to challenge Exponent's market share. These competitors, such as FTI Consulting with its $3.2 billion in 2023 revenue, possess significant resources to expand into Exponent's specialized areas, often employing aggressive pricing strategies that can pressure Exponent's margins.

Economic downturns represent a substantial threat, as businesses tend to reduce spending on consulting services during recessions, potentially leading to fewer engagements for Exponent. While litigation support offers some resilience, prolonged economic challenges can still force clients to cut budgets or negotiate lower fees, impacting Exponent's revenue and profitability, similar to the observed dips in consulting spending during the 2008 financial crisis.

The firm's reliance on highly specialized talent makes it vulnerable to intense competition for experts, especially in fields like AI and cybersecurity, where demand surged in 2024, driving up compensation. Failure to attract and retain top performers can impair operational efficiency, increase recruitment costs, and limit the ability to scale, thereby hindering growth.

Technological advancements pose a risk of obsolescence if Exponent does not continuously integrate cutting-edge tools, such as AI-powered analytics platforms, which saw significant investment in 2024. The rapid growth in the data analytics tool market, projected to exceed 15% CAGR through 2025, could commoditize specialized knowledge and necessitate ongoing R&D investment to maintain differentiation.

Regulatory shifts can impact Exponent's core services, particularly if there's a decrease in product liability claims or reduced oversight in key industries. A hypothetical 15% reduction in product recalls due to improved manufacturing standards could directly reduce demand for dispute resolution services, requiring strategic adaptation.

| Threat Category | Specific Threat | Impact on Exponent | Example/Data Point |

|---|---|---|---|

| Competition | Diversified Consulting Firms | Market share erosion, margin pressure | FTI Consulting revenue $3.2 billion (2023) |

| Economic Conditions | Recessions/Downturns | Reduced project volume, fee pressure | Consulting spending dips during 2008 crisis |

| Talent Acquisition & Retention | Competition for Specialized Experts | Operational inefficiency, increased costs | Surge in demand for AI/cybersecurity specialists (2024) |

| Technological Advancement | Obsolescence of Expertise | Loss of competitive edge, need for R&D | Data analytics market growth >15% CAGR (through 2025) |

| Regulatory Environment | Easing of Regulations/Litigation | Reduced demand for core services | Potential impact from fewer product recalls |

SWOT Analysis Data Sources

This analysis leverages comprehensive data from internal financial reports, extensive market research, and direct customer feedback to provide a well-rounded perspective.