Exponent Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exponent Bundle

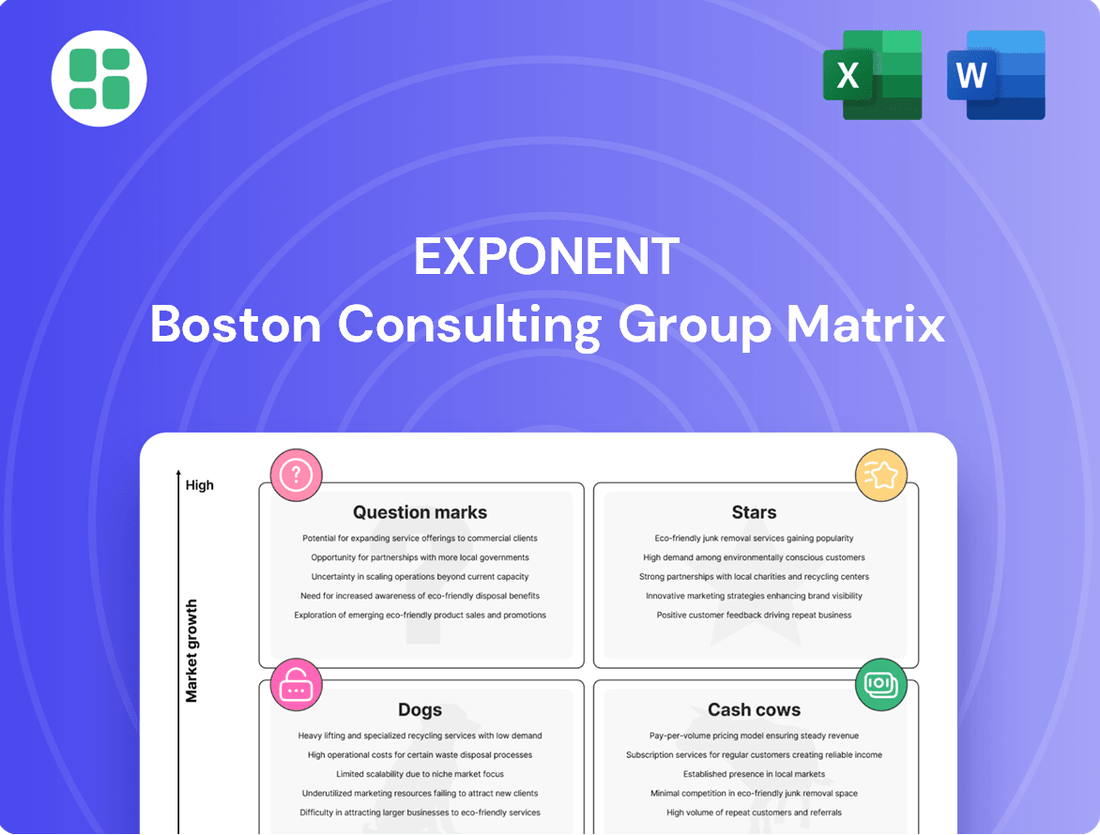

Curious about how this company's portfolio stacks up? The Exponent BCG Matrix offers a powerful snapshot, categorizing products into Stars, Cash Cows, Dogs, and Question Marks to illuminate strategic opportunities. Unlock the full potential of this analysis by purchasing the complete report, which provides deeper insights and actionable recommendations for optimizing your product strategy and investment decisions.

Stars

Exponent is strategically positioning its AI Validation & Safety Consulting within the high-growth AI sector, a move amplified by the increasing integration of AI in critical industries. For instance, the demand for AI validation in medical devices alone is projected to grow significantly, with the global AI in healthcare market expected to reach over $188 billion by 2030, according to some estimates, highlighting the substantial market opportunity.

The firm's Phoenix testing facility is a tangible asset, underscoring Exponent's commitment to becoming a leader in AI validation services. This facility is crucial for testing and certifying AI systems, particularly in sectors like autonomous vehicles where rigorous safety validation is paramount. The automotive industry's investment in AI, with billions poured into autonomous driving technology, directly fuels the need for specialized consulting like Exponent's.

This focus on AI validation and safety consulting aligns perfectly with the escalating need for expert oversight as AI systems become more sophisticated and embedded in safety-critical applications. The complexity of AI algorithms, especially in areas like diagnostic imaging in healthcare or predictive maintenance in energy, necessitates specialized validation to ensure reliability and prevent potential failures, creating a robust demand for Exponent's services.

Exponent's Energy Transition & Infrastructure Resilience Consulting is positioned in a high-growth market, with global investments in clean energy projected to reach $2.3 trillion. The firm's expertise spans evaluating wind and solar infrastructure disputes and advising on large-scale energy storage systems, directly addressing critical needs in this evolving sector.

The company is actively involved in early-stage initiatives concerning distributed energy systems and battery storage. This strategic focus is driven by increasing global power demand and the growing challenges posed by extreme weather events, highlighting a commitment to leading in a vital area of future energy infrastructure.

Exponent is making significant strides in the digital health and wearables sector, a market poised for substantial growth. Their work includes enhancing AI usability and rigorously evaluating medical devices, reflecting a keen understanding of this evolving landscape. This strategic focus taps into the increasing reliance on data-driven diagnostics and the rapid pace of technological innovation.

The firm's engagement in testing sensors and validating AI algorithms for medical devices underscores their commitment to high-growth segments. In 2024, the global digital health market was valued at over $200 billion and is projected to grow significantly, with wearables being a key driver. Exponent's multidisciplinary expertise positions them well to capitalize on these trends, offering a distinct competitive edge.

Advanced Transportation Technologies (Autonomous Vehicles & Electrification)

The automotive sector's rapid pivot to electric vehicles (EVs) and autonomous driving systems positions Exponent as a key player in a burgeoning market. Their expertise in failure analysis and safety is crucial for navigating the complexities of these advanced technologies.

Exponent's involvement spans critical areas such as battery safety, ensuring the reliability of EV power sources, and the rigorous testing of advanced driver-assistance systems (ADAS) and fully autonomous vehicle components. For instance, their work includes validating sensors essential for self-driving capabilities, demonstrating a tangible commitment to safety in this evolving landscape.

- Market Growth: The global EV market is projected to reach over $800 billion by 2027, with autonomous vehicle technology expected to follow a similar upward trajectory.

- Exponent's Role: Exponent actively contributes to ensuring the safety and reliability of these systems through in-depth failure analysis and testing.

- Key Technologies: Focus areas include battery management systems, ADAS calibration, and the validation of sensor suites for autonomous operation.

- Regulatory Landscape: Exponent's expertise is vital in helping manufacturers meet stringent safety and performance regulations in the automotive industry.

Complex Product Development & Regulatory Compliance for Emerging Tech

Exponent's expertise in developing complex, emerging technologies, such as advanced consumer electronics and critical medical devices, is a significant growth driver. The firm’s ability to manage intricate product lifecycles, from initial concept through to post-market support, addresses a crucial market need. This focus on preventing failures and ensuring stringent regulatory compliance in rapidly evolving sectors positions Exponent favorably.

The demand for specialized engineering and consulting services in areas like AI-driven diagnostics and next-generation semiconductors is soaring. For instance, the global market for medical devices alone was projected to reach over $600 billion in 2024, highlighting the substantial opportunities in technically demanding fields. Exponent's role in guiding clients through the labyrinth of FDA approvals or CE marking for innovative products is invaluable.

- Navigating Regulatory Hurdles: Exponent assists clients in meeting complex regulatory requirements, such as those from the FDA for medical devices or the FCC for consumer electronics, minimizing time-to-market and reducing compliance risks.

- Failure Prevention and Risk Mitigation: The firm's deep engineering knowledge helps identify and mitigate potential product failures early in the development cycle, saving significant costs associated with recalls and redesigns.

- Lifecycle Support: Exponent provides end-to-end support, from rapid prototyping and design for manufacturability to addressing field issues and managing product recalls, ensuring product integrity and customer satisfaction.

- Expertise in Emerging Technologies: The company leverages its specialized knowledge in areas like advanced materials, embedded systems, and cybersecurity to support the development of cutting-edge products that define future markets.

Stars represent business units with high market share in a high-growth industry. These are typically market leaders, generating substantial revenue and cash flow. Their strong position allows them to reinvest in growth and maintain their competitive advantage.

Exponent's AI Validation & Safety Consulting and its Energy Transition & Infrastructure Resilience Consulting are prime examples of potential Stars. The AI sector's rapid expansion, coupled with significant investments in clean energy, positions these areas for sustained high growth.

The firm's capabilities in digital health, wearables, and the automotive sector, particularly EVs and autonomous driving, also show strong Star potential. These markets are experiencing robust growth, and Exponent's specialized expertise in failure analysis and safety validation is highly sought after.

Exponent's focus on emerging technologies and complex product lifecycles, especially in medical devices and advanced consumer electronics, further solidifies its Star positioning. The critical need for regulatory compliance and failure prevention in these fields creates a fertile ground for growth.

| Business Unit | Market Growth | Market Share | Cash Flow | Strategic Outlook |

|---|---|---|---|---|

| AI Validation & Safety Consulting | High | Strong | Positive | Invest for Growth |

| Energy Transition & Infrastructure Resilience | High | Growing | Neutral to Positive | Invest for Growth |

| Digital Health & Wearables | High | Emerging | Neutral | Invest for Growth |

| Automotive (EVs & Autonomous) | High | Emerging | Neutral | Invest for Growth |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

The Exponent BCG Matrix offers a clear, visual roadmap for resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Exponent's traditional litigation support and expert witness services are a clear cash cow. These services, which include providing expert testimony in major disputes across sectors like construction, medical devices, and energy, generate a steady and substantial income for the company.

With a global team of over 950 consultants, this segment consistently delivers reliable cash flow. Its sticky and recurring nature means it remains a strong performer even when the economy isn't doing so well.

Exponent's forensic engineering and accident reconstruction services are a prime example of a Cash Cow in the BCG matrix. With over 55 years of experience, this mature service boasts a significant market share, reflecting its established reputation and deep expertise.

The consistent demand from insurance companies and legal firms for independent, science-based investigations ensures a steady and reliable stream of revenue. This ongoing need for their specialized skills translates directly into predictable cash flow for Exponent.

In 2023, Exponent reported that its Engineering and Failure Analysis segment, which heavily features forensic engineering, generated approximately $347 million in revenue, underscoring its substantial contribution to the company's overall financial health.

Exponent's established environmental assessment and remediation services represent a classic Cash Cow within the Exponent BCG Matrix. Despite flat revenue performance in 2024, this segment continues to contribute a substantial portion of the company's overall income, underscoring its dominant market share in a mature industry.

These services, encompassing critical areas like environmental site assessments, soil and groundwater remediation, and navigating complex regulatory compliance for long-standing industrial clients, are essential and consistently in demand. This consistent demand translates into a reliable and predictable stream of cash flow for Exponent, even though the sector itself offers limited avenues for significant expansion.

Construction Defect Analysis & Dispute Resolution

Exponent's Construction Consulting Practice is a mature and reliable revenue generator within its portfolio, essentially acting as a cash cow. This segment offers specialized expertise in project advisory, risk analysis, and crucially, the resolution of construction defects. The consistent demand across infrastructure, utilities, and data center sectors ensures a steady stream of work, as complex disputes frequently require expert third-party analysis.

The firm's deep bench of experienced professionals and a strong track record in this area solidify its position. In 2024, the construction industry continued to face challenges with project complexity and supply chain issues, leading to an increased need for dispute resolution services. Exponent's ability to provide authoritative analysis and facilitate settlements in these high-stakes situations directly translates into predictable and substantial earnings.

- Stable Demand: Infrastructure and utility projects, often multi-year endeavors, inherently generate ongoing needs for expert consultation and dispute resolution, providing a consistent revenue base.

- High Value Services: Construction defect analysis and dispute resolution are specialized, high-value services commanding significant fees due to the technical expertise and legal implications involved.

- Industry Trends: Increased project complexity and the lingering effects of supply chain disruptions in 2024 have amplified the occurrence of construction disputes, further bolstering demand for Exponent's services.

- Reputational Capital: Exponent's established reputation for accuracy and impartiality in construction defect analysis allows it to secure premium pricing and retain a strong client base.

Standard Product Safety & Recall Consulting

Exponent's standard product safety and recall consulting is a cornerstone of their business, reflecting deep expertise in failure analysis. This mature service line consistently generates revenue by assisting clients across various industries with critical product lifecycle management, from initial design to managing post-market challenges.

Their offerings are vital for companies navigating complex regulatory landscapes and consumer protection demands. For instance, in 2023, the U.S. Consumer Product Safety Commission (CPSC) reported over 300 recalls affecting millions of products, highlighting the ongoing need for specialized consulting.

- Core Competency: Failure analysis and root cause determination for product defects.

- Client Base: Broad appeal across manufacturing, automotive, consumer goods, and medical devices.

- Revenue Driver: Steady demand for proactive safety assessments and reactive recall management.

- Market Position: Established leader leveraging decades of experience in complex investigations.

Exponent's litigation support and expert witness services are a prime example of a Cash Cow. These services, which involve providing expert testimony in significant disputes across sectors like construction, medical devices, and energy, consistently generate substantial income.

With a global team of over 950 consultants, this segment reliably delivers steady cash flow, remaining a strong performer even during economic downturns due to its sticky and recurring nature.

Exponent's forensic engineering and accident reconstruction services are a classic Cash Cow, boasting a significant market share due to over 55 years of established reputation and deep expertise.

The consistent demand from insurance companies and legal firms for independent, science-based investigations ensures a predictable stream of revenue, translating directly into reliable cash flow for Exponent.

| Service Segment | BCG Classification | Key Characteristics | 2023 Revenue (Approx.) |

|---|---|---|---|

| Litigation Support & Expert Witness | Cash Cow | Steady income, global consultant base, sticky revenue | Not explicitly broken out, but a core contributor |

| Forensic Engineering & Accident Reconstruction | Cash Cow | Mature service, high market share, consistent demand | Part of Engineering & Failure Analysis ($347 million) |

| Environmental Assessment & Remediation | Cash Cow | Mature industry, dominant market share, consistent demand | Flat revenue in 2024, but substantial income contributor |

| Construction Consulting Practice | Cash Cow | Project advisory, dispute resolution, high value services | Not explicitly broken out, but strong earnings |

| Product Safety & Recall Consulting | Cash Cow | Failure analysis, regulatory compliance, steady demand | Not explicitly broken out, but a core revenue driver |

Preview = Final Product

Exponent BCG Matrix

The BCG Matrix analysis you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive report is meticulously crafted to provide actionable insights into your product portfolio's strategic positioning, enabling informed decision-making for optimal resource allocation and growth initiatives.

Dogs

Exponent, a firm known for tackling intricate, high-stakes challenges, would likely steer clear of undifferentiated general engineering consulting. This segment is often characterized by intense price competition and lower profit margins, making it a poor fit for a premium service provider. Such engagements offer little in the way of unique value proposition or strategic differentiation.

Services focused on optimizing legacy industrial processes in declining sectors, such as traditional manufacturing or fossil fuel extraction, would likely be classified as Dogs in the Exponent BCG Matrix. These areas typically exhibit low market growth and, for Exponent, would represent a low market share if they haven't actively cultivated specialized expertise in these shrinking industries.

For instance, consider the automotive manufacturing sector in regions heavily reliant on internal combustion engine production. While the global automotive market is growing, the specific segment of traditional engine manufacturing faces significant decline due to the shift towards electric vehicles. If Exponent's services are primarily geared towards optimizing these older processes, their market share within this specific niche would likely be low, and the overall sector's growth prospects are dim.

Consulting services for very niche, obsolete regulatory compliance areas represent a low-growth, low-market-share segment. These might involve regulations that are no longer actively enforced or have been superseded by more modern frameworks, such as certain historical environmental reporting requirements or outdated safety standards for legacy equipment. The market for such specialized expertise is shrinking, with fewer new clients seeking these services.

Exponent would likely minimize investment in these areas. The limited demand and the absence of complex challenges mean these services offer few opportunities for high-value engagement or significant revenue generation. For instance, a firm specializing in compliance for a 1980s manufacturing process would find it difficult to secure substantial contracts compared to advising on current GDPR or AI regulatory landscapes.

Basic, Non-Complex Accident Investigations

Exponent's core competency in accident investigation, while a significant strength, can also highlight areas that fall into the 'Dog' quadrant of the BCG matrix. These are engagements that are straightforward, demanding little in the way of specialized scientific or engineering expertise.

Such basic investigations are often handled effectively by smaller, less specialized firms, meaning they don't fully utilize Exponent's premium capabilities. This misallocation of high-level talent to low-complexity tasks results in suboptimal returns on investment for the firm.

For instance, a simple vehicle accident reconstruction that doesn't involve complex physics or material science would fit this description. These cases, while numerous, do not generate the high margins associated with Exponent's more intricate work, potentially impacting overall profitability if not managed strategically.

- Low Complexity Engagements: Basic accident investigations that require minimal scientific depth.

- Suboptimal Resource Allocation: Cases that do not leverage Exponent's specialized, premium expertise.

- Reduced Profitability: Lower potential returns compared to more complex, high-value projects.

Commoditized Data Analysis without Expert Scientific Interpretation

Commoditized data analysis, lacking expert scientific interpretation, would fall into the 'low growth, low market share' quadrant of the Exponent BCG Matrix, often referred to as a 'Dog'. This segment of the market is characterized by services that are easily replicable and automated, offering little differentiation. For instance, basic data aggregation or standard reporting tools, which don't leverage specialized scientific knowledge, face intense price competition. In 2024, the market for generic data analytics tools saw significant growth, but margins for services without a unique value proposition remained thin.

Such commoditized offerings would struggle to capture significant market share because competitors can easily enter and replicate the service. Without the proprietary scientific insights that Exponent might otherwise provide, these services become interchangeable. This leads to a scenario where firms cannot command premium pricing, impacting profitability and hindering expansion. For example, a report from late 2024 indicated that companies offering only standard data visualization without deeper analytical interpretation saw an average revenue growth of only 3% compared to 15% for those with specialized insights.

- Low Differentiation: Services lack unique scientific or engineering interpretation, making them easily substitutable.

- Intense Price Competition: Without proprietary value, pricing becomes the primary competitive factor, squeezing margins.

- Limited Growth Potential: The market for generic, easily automated analysis is mature and offers little room for significant expansion.

- Low Market Share: Competitors can readily enter and replicate offerings, preventing any single player from dominating.

Dogs in the Exponent BCG Matrix represent business areas with low market growth and low market share. For a firm like Exponent, these would be services that are easily replicated, lack specialized expertise, and face intense price competition. These engagements typically offer limited opportunities for high-value contributions or significant revenue generation, making them poor strategic fits.

For instance, basic compliance consulting for outdated regulations or simple data analysis without proprietary insights would likely fall into this category. In 2024, while the broader consulting market saw growth, segments focused on commoditized services experienced stagnant revenue and shrinking margins. Firms in these 'dog' areas often struggle to differentiate themselves, leading to a focus on price rather than value.

Exponent would strategically minimize investment in these 'dog' segments to reallocate resources to more promising areas like Stars or Question Marks. The limited demand and lack of complex challenges mean these services offer few avenues for innovation or premium pricing, impacting overall profitability if not managed carefully.

Consider the market for basic IT support for legacy systems. In 2024, this segment represented a small fraction of the overall IT services market, with growth rates below 2%. Companies offering these services often had low market share due to the ease of entry for smaller competitors and the declining relevance of the technology.

| Business Area Example | Market Growth | Market Share (Exponent) | Strategic Implication |

|---|---|---|---|

| Basic IT Support for Legacy Systems | Low (<2% in 2024) | Low | Divest or minimize investment |

| Commoditized Data Reporting | Low (3% revenue growth for basic services in 2024) | Low | Divest or minimize investment |

| Obsolete Regulatory Compliance | Very Low (Shrinking market) | Low | Divest or minimize investment |

Question Marks

Quantum computing presents a significant, albeit distant, opportunity for Exponent. While its potential to revolutionize risk modeling and complex problem-solving is immense, the technology is still in its nascent stages, with widespread commercial application likely years away. In 2024, the quantum computing market is still developing, with significant investment required to build the necessary infrastructure and talent.

Exponent's current market share in quantum computing is likely negligible, reflecting the early-stage nature of the market. Establishing expertise and a client base in this field demands substantial upfront capital for research, development, and specialized personnel. This positions quantum computing as a high-growth potential area, but one with considerable barriers to entry and a lengthy incubation period.

The burgeoning commercial space sector, projected to reach $1.5 trillion by 2040 according to Morgan Stanley, presents a significant growth avenue for safety and reliability consulting. Exponent's extensive engineering and scientific capabilities are well-suited to address the complex challenges in this domain, from launch vehicle integrity to satellite system resilience.

While Exponent possesses the foundational expertise, its current market penetration in this nascent consulting niche is likely modest. Capturing a substantial share will necessitate strategic investments in specialized talent, advanced testing facilities, and targeted business development efforts to establish a strong foothold.

Navigating the intricate regulatory pathways for advanced gene editing and synthetic biology is crucial for innovation. These fields are rapidly evolving, presenting both opportunities and challenges for companies like Exponent. Developing expertise in assessing safety and compliance within these complex frameworks is key to capturing future market share.

The global synthetic biology market was valued at approximately $10.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 25% through 2030. This rapid expansion underscores the high-growth potential, even with current regulatory hurdles that may limit immediate market penetration but promise substantial future rewards for those adept at compliance.

Metaverse/AR/VR Human Factors & Emerging Risk Consulting

The burgeoning metaverse and AR/VR sectors present a unique intersection of human factors and novel risks, creating a significant consulting opportunity. Exponent could leverage its expertise to guide businesses through these uncharted territories, focusing on user safety, ethical design, and psychological impacts within immersive digital spaces. This represents a high-potential, albeit nascent, market segment where early investment in specialized knowledge could yield substantial returns.

The global metaverse market is projected to reach hundreds of billions of dollars in the coming years, with AR/VR technologies forming its backbone. For instance, the AR/VR market alone was estimated to be worth over $20 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) exceeding 25% through 2030. This rapid expansion necessitates a proactive approach to understanding and mitigating risks associated with prolonged immersion, data privacy, and potential psychological effects on users.

- User Experience & Safety: Consulting on the design of intuitive interfaces and robust safety protocols to prevent motion sickness, eye strain, and disorientation in AR/VR environments.

- Ethical Considerations: Advising on the ethical implications of avatar representation, digital identity, and the potential for addiction or social isolation within virtual worlds.

- Data Security & Privacy: Developing strategies to safeguard sensitive user data collected within immersive platforms, addressing concerns around biometric information and behavioral tracking.

- Emerging Threats: Identifying and mitigating new forms of cyber threats and harassment specific to metaverse and AR/VR interactions, ensuring secure and trustworthy digital spaces.

Sustainable Aviation Fuel (SAF) Production & Supply Chain Risk Analysis

The sustainable aviation fuel (SAF) market is experiencing robust expansion, driven by ambitious global climate targets and increasing airline commitments. Projections indicate the market could reach $11.9 billion by 2028, a substantial leap from its 2023 valuation. Exponent’s deep environmental and engineering capabilities are well-suited to navigate the complexities of SAF production, from feedstock sourcing and conversion processes to the development of necessary infrastructure and resilient supply chains.

Analyzing SAF production and supply chain risks is crucial for market participants. Potential challenges include feedstock availability and price volatility, technological scaling hurdles, and the need for significant capital investment in new production facilities and blending infrastructure. Regulatory frameworks and policy support also play a vital role in de-risking investments and ensuring market stability.

- Feedstock Availability & Price Volatility: Reliance on agricultural byproducts or waste streams can lead to supply fluctuations and price unpredictability, impacting SAF production costs.

- Technological Maturity & Scalability: While SAF technologies are advancing, scaling up production to meet demand presents engineering and operational challenges.

- Infrastructure Development: Building out the necessary infrastructure for SAF production, blending, and distribution requires substantial investment and coordination.

- Regulatory & Policy Uncertainty: Evolving government mandates and incentives for SAF adoption can create market uncertainty for producers and offtakers.

Question Marks represent emerging technologies or markets where Exponent could establish a strong presence, but currently has limited or no market share. These are areas with high growth potential but also significant uncertainty and barriers to entry, requiring substantial investment and strategic focus. Exponent’s ability to identify and navigate these nascent opportunities will be key to its future growth.

In the Exponent BCG Matrix, Question Marks are characterized by low market share in high-growth industries. They consume significant resources for development and market penetration. Successful navigation of these areas can transform them into Stars, but failure can lead to them becoming Dogs if the market growth slows or Exponent's share remains low.

The key challenge for Question Marks is to determine which ones to invest in to foster growth and which ones to divest from if they fail to gain traction. This requires careful market analysis and a willingness to take calculated risks. The goal is to convert these uncertain ventures into future revenue streams.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, encompassing sales figures, competitor analysis, and industry growth rates to provide a clear strategic overview.