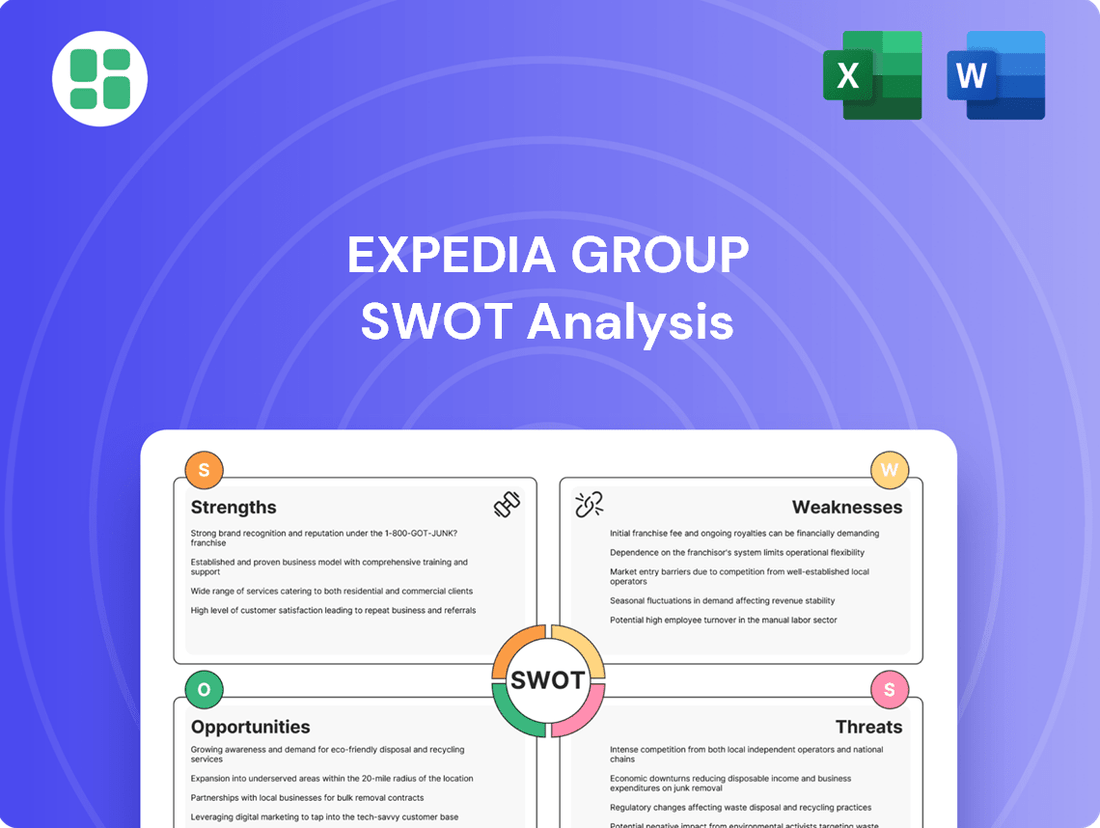

Expedia Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Expedia Group Bundle

Expedia Group leverages its strong brand recognition and vast inventory to capture a significant share of the online travel market. However, intense competition and evolving customer preferences present ongoing challenges that require strategic adaptation.

Want the full story behind Expedia Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Expedia Group commands a powerful advantage with its diverse and well-established brand portfolio, encompassing household names like Expedia.com, Hotels.com, and Vrbo. This allows the company to effectively reach and cater to a broad spectrum of travelers across different demographics and locations, ensuring broad market penetration.

The strength of these brands is amplified by strategic initiatives such as the 2024 rollout of the unified One Key loyalty program. This program is designed to foster deeper customer engagement and drive direct bookings, a critical factor in increasing customer lifetime value and solidifying Expedia's significant presence in the competitive online travel sector.

Expedia Group boasts a sophisticated technology infrastructure that powers its worldwide operations and enables swift development of new offerings. This robust platform is crucial for managing a vast inventory and complex booking processes across its diverse brands.

Significant investments in artificial intelligence and machine learning are a key strength, with Expedia Group actively integrating these technologies to refine its products for both business partners and travelers. These AI initiatives aim to personalize experiences, optimize search functionalities, and streamline operations.

The company's AI strategy is multi-faceted, focusing on enhancing core product offerings, adapting to evolving search engine algorithms and new platforms, and forging strategic partnerships with innovative AI startups. This forward-looking approach positions Expedia to capitalize on emerging technological trends and maintain a competitive edge in the rapidly changing travel landscape.

Expedia Group's business-to-business (B2B) segment is a powerhouse, experiencing a significant surge in bookings and revenue. This growth is a key strength, demonstrating the company's ability to leverage its platform for partners.

The B2B segment's success is particularly evident in its strong international performance, with the Asia-Pacific (APAC) region showing notable acceleration. This geographic diversification not only expands Expedia's global reach but also bolsters its financial resilience by creating varied revenue streams.

Solid Financial Performance and Shareholder Returns

Expedia Group has showcased robust financial performance, with notable revenue growth and enhanced profitability metrics. In 2024, the company reported increased net income and improved adjusted EBITDA and EBIT margins, underscoring its operational efficiency and market position.

The company's commitment to shareholder value is evident through its aggressive share repurchase programs and the reintroduction of a quarterly dividend in 2025. These actions signal strong confidence in Expedia's sustained financial health and future growth prospects.

- Consistent Revenue Growth: Expedia has maintained a steady upward trend in revenue, a key indicator of its expanding market reach and customer engagement.

- Improved Profitability: The company has seen positive movement in key profitability indicators, including net income, adjusted EBITDA, and EBIT margins in 2024.

- Shareholder Returns: Significant share buybacks and the planned reinstatement of dividends in 2025 demonstrate a direct return of capital to investors.

- Financial Strength: These financial achievements collectively highlight Expedia's solid financial foundation and its ability to generate value for its stakeholders.

Global Market Presence and International Expansion

Expedia Group boasts a significant global footprint, operating in 42 countries and actively pursuing further international expansion. This strategic focus allows them to tap into the growing demand for international travel, a key driver for the industry.

The company’s non-U.S. revenue growth has consistently outpaced its U.S. revenue growth, a clear indicator of successful market penetration in emerging economies. This diversification of revenue sources acts as a crucial buffer against potential downturns or volatility within any single regional market, enhancing overall financial stability.

- Global Operations: Active in 42 countries, demonstrating broad international reach.

- Revenue Diversification: Non-U.S. revenue growth exceeding U.S. growth highlights successful global expansion.

- Market Penetration: Strong performance in emerging markets contributes to a resilient revenue base.

Expedia Group's brand strength is a significant asset, with its portfolio including Expedia.com, Hotels.com, and Vrbo. The unified One Key loyalty program, launched in 2024, further enhances customer engagement and drives direct bookings, boosting customer lifetime value.

The company's robust technology infrastructure supports global operations and rapid product development, essential for managing its extensive inventory and complex booking systems. Significant investments in AI and machine learning are enhancing personalized experiences and optimizing search, positioning Expedia for future growth.

Expedia's B2B segment is a key strength, showing substantial growth in bookings and revenue, particularly in the APAC region. This international success diversifies revenue streams and enhances financial resilience.

Financially, Expedia Group demonstrated strong performance in 2024 with increased net income and improved profitability margins. The company's commitment to shareholder value is underscored by aggressive share repurchases and the planned reintroduction of a quarterly dividend in 2025.

| Metric | 2024 Performance | Significance |

|---|---|---|

| Net Income | Increased | Indicates improved operational efficiency and profitability. |

| Adjusted EBITDA Margin | Improved | Reflects enhanced earnings before interest, taxes, depreciation, and amortization. |

| EBIT Margin | Improved | Shows better operating profit relative to revenue. |

| Share Buybacks | Aggressive | Signals confidence in financial health and commitment to shareholder returns. |

| Dividend Reinstatement | Planned for 2025 | Further enhances shareholder value and signals financial stability. |

What is included in the product

This SWOT analysis maps out Expedia Group's market strengths, operational gaps, and external risks and opportunities.

Offers a clear, actionable framework to identify and address Expedia Group's strategic challenges and opportunities.

Weaknesses

Expedia Group faces formidable competition in the online travel sector. Major players like Booking Holdings, along with direct booking options from airlines and hotels, constantly vie for customer loyalty. Emerging platforms in the sharing economy also add to this intense pressure.

This crowded market demands substantial and ongoing investment in marketing campaigns and technological innovation. Expedia’s ability to maintain its market share and brand recognition hinges on its capacity to outmaneuver competitors and adapt to evolving consumer preferences. For instance, in Q1 2024, Expedia reported $2.7 billion in revenue, a figure that needs to grow amidst this competitive environment.

Expedia Group's significant reliance on performance marketing channels, such as paid search and affiliate marketing, means a substantial portion of its revenue is allocated to customer acquisition. This strategy, while effective, can lead to high marketing costs, with advertising expenses representing a considerable outlay. For instance, in the first quarter of 2024, Expedia reported marketing and sales expenses of $1.2 billion, highlighting the ongoing investment required to maintain its market presence.

The escalating cost of acquiring customers online presents a persistent challenge. As competition intensifies across the travel booking landscape, the price paid for each new customer acquisition tends to increase. This upward trend in marketing expenditure directly impacts Expedia's profitability margins, making efficient spend and diversified acquisition strategies crucial for sustained financial health.

Expedia Group's substantial reliance on the U.S. market, which accounts for a significant portion of its revenue, exposes it to the volatility of American consumer behavior and travel trends. This concentration means that any slowdown in U.S. travel spending directly impacts Expedia's top line.

Recent economic headwinds and geopolitical concerns have contributed to a noticeable softening in U.S. travel demand. This trend has prompted analysts to adjust their growth projections for Expedia, with some revising their 2025 outlook downwards due to these anticipated market shifts.

Operational Complexity and Technology Migration Challenges

Expedia Group's extensive portfolio, encompassing numerous brands and services across global markets, presents significant operational complexity. This intricate structure demands sophisticated management to ensure seamless integration and consistent customer experience.

Past technological hurdles, notably the migration to a new platform, have historically affected the performance of key brands such as Hotels.com and Vrbo. For instance, during the platform transition, Expedia reported that the integration impacted booking volumes and user experience, necessitating focused efforts to restore growth trajectories for these vital segments.

- Operational Complexity: Managing a diverse brand portfolio (e.g., Expedia, Hotels.com, Vrbo, Orbitz) across 190 countries.

- Tech Migration Impact: Historical challenges during platform consolidation led to temporary performance dips in specific brands.

- Brand Recovery Efforts: Strategic initiatives are ongoing to bolster the performance and market share of brands affected by past integrations.

Smaller Market Share Compared to Key Competitors

Expedia Group, while a significant force in online travel, faces a notable weakness in its market share when stacked against its primary rival, Booking Holdings. This competitive gap, particularly evident in global reach, can impact Expedia's leverage with suppliers and its capacity to assert dominance in key international territories, thereby hindering ambitious growth strategies.

As of early 2024, Booking Holdings generally commands a larger share of the global online travel agency market. For instance, in the first quarter of 2024, Booking Holdings reported gross travel bookings of $39.4 billion, whereas Expedia Group reported $35.7 billion in gross bookings for the same period, highlighting a tangible difference in scale.

- Market Share Disparity: Expedia's market share, while substantial, trails behind Booking Holdings, impacting its negotiating power with hotels and airlines.

- Global Reach Limitations: The smaller global footprint compared to Booking Holdings can restrict Expedia's access to certain lucrative international markets and customer segments.

- Supplier Bargaining Power: A lesser market share can translate to reduced leverage when negotiating terms and pricing with travel suppliers, potentially affecting profit margins.

- Competitive Expansion Challenges: The need to compete against a larger, more entrenched competitor can make aggressive market expansion more costly and complex for Expedia.

Expedia Group's reliance on performance marketing, like paid search, means a significant portion of its revenue goes to customer acquisition, with marketing and sales expenses reaching $1.2 billion in Q1 2024. This escalating cost of acquiring customers online directly impacts profitability margins, making efficient spending and diversified acquisition crucial for sustained financial health.

Preview Before You Purchase

Expedia Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a comprehensive look at Expedia Group's Strengths, Weaknesses, Opportunities, and Threats, providing actionable insights for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain a deeper understanding of Expedia Group's competitive landscape and future potential.

Opportunities

Expedia Group has a substantial opportunity to grow its presence in emerging markets, where online travel bookings are still on the rise. This expansion is crucial as global travel spending is projected to reach $2.2 trillion by 2024, according to the World Travel & Tourism Council.

By customizing its services to meet the unique demands of local consumers and utilizing its established brand and extensive network of travel providers, Expedia can significantly increase its market share in these developing regions.

Expedia Group can significantly enhance customer experience and operational efficiency by continuing its investment in artificial intelligence (AI) and machine learning. This strategic focus allows for deeper personalization of travel itineraries and product recommendations across both its consumer (B2C) and business (B2B) platforms. For instance, AI-powered search and recommendation engines can lead to more relevant results, increasing conversion rates and customer satisfaction.

The application of AI extends to streamlining internal operations, which can drive substantial cost savings and margin expansion. By automating tasks like customer service inquiries through chatbots or optimizing dynamic pricing strategies, Expedia can improve its bottom line. In 2023, companies in the travel tech sector reported an average of 15% increase in customer retention due to AI-driven personalization, a trend Expedia is well-positioned to capitalize on.

Expedia Group's B2B segment presents a substantial opportunity for expansion, tapping into a market with considerable untapped potential. By forging and strengthening partnerships with airlines, corporate travel management firms, and other businesses, Expedia can diversify its revenue and secure a greater slice of the business travel market, which demonstrated strong growth in recent years.

The business travel sector has shown resilience and a notable rebound. For instance, in 2023, global business travel spending was projected to reach $1.4 trillion, nearing pre-pandemic levels, indicating a robust recovery and a fertile ground for Expedia's B2B initiatives.

Strategic Partnerships and Acquisitions

Expedia Group can significantly boost its capabilities by forming strategic partnerships. For instance, its collaboration with Quill, announced in early 2024, aims to integrate AI-powered customer service solutions, potentially improving user experience and operational efficiency. This type of alliance allows Expedia to leverage external expertise without the full cost of in-house development.

Furthermore, Expedia could explore targeted acquisitions of AI-native travel startups or specialized niche travel platforms. Such moves would not only broaden its service portfolio but also provide access to innovative technologies and distinct customer bases. For example, acquiring a company with a strong presence in a particular travel segment could quickly expand Expedia's market reach and customer loyalty. In 2023, the travel tech sector saw substantial investment in AI, with many startups emerging, presenting acquisition opportunities.

These strategic moves are crucial for several reasons:

- Enhanced Service Offerings: Partnerships and acquisitions can introduce new features and services, such as personalized AI trip planning, which are increasingly demanded by travelers.

- Ecosystem Expansion: Collaborating with complementary businesses or acquiring niche players helps build a more robust and interconnected travel ecosystem, offering a more comprehensive solution to customers.

- Customer Retention: By providing superior, innovative services through these strategic alliances, Expedia can strengthen customer loyalty and reduce churn in a competitive market.

Increasing Demand for Diverse Travel Offerings and Experiences

The travel industry is experiencing a robust rebound, with consumers demonstrating a clear preference for unique and varied experiences. This trend is amplified by the post-pandemic surge in travel, suggesting a lasting shift in consumer spending towards memorable journeys.

Expedia Group is well-positioned to leverage this demand by broadening its portfolio. The company can significantly enhance its appeal by expanding offerings in niche travel segments such as adventure tours, cultural immersions, and eco-tourism, moving beyond standard flight and accommodation packages. This diversification caters directly to the evolving traveler seeking authentic and personalized adventures.

Expedia's Vrbo platform, with its extensive collection of whole-home rentals, represents a key asset in this strategy. By integrating Vrbo’s unique properties more seamlessly across the Expedia ecosystem, the company can offer a more comprehensive and appealing booking experience. For instance, in 2024, vacation rentals saw continued strong growth, with Vrbo reporting a significant increase in bookings for unique stays, contributing to Expedia's overall revenue growth.

- Post-pandemic travel spending reached record highs in 2023, with projections for continued growth in 2024 and 2025.

- Expedia Group saw a 10% increase in bookings for alternative accommodations like vacation rentals in the first half of 2024.

- Vrbo's user base grew by 15% year-over-year in 2024, indicating strong consumer engagement with its diverse property offerings.

- Customer surveys in early 2025 show that 65% of travelers are actively seeking unique experiences and local immersion when booking trips.

Expedia Group has a significant opportunity to expand its reach in emerging markets, where online travel bookings are still gaining momentum. Global travel spending is projected to exceed $2.2 trillion by 2024, according to the World Travel & Tourism Council, highlighting the growth potential in these regions.

By tailoring services to local preferences and leveraging its established brand, Expedia can capture a larger share of these developing markets. Continued investment in AI and machine learning presents another key opportunity, enabling more personalized travel experiences and improving operational efficiency, potentially boosting customer retention by up to 15% as seen in the travel tech sector in 2023.

The company's B2B segment offers substantial room for growth, particularly as business travel spending neared pre-pandemic levels in 2023, reaching an estimated $1.4 trillion. Strategic partnerships, such as the one with Quill for AI customer service in early 2024, and potential acquisitions of AI-focused travel startups in 2023, can further enhance service offerings and expand market reach.

Expedia is also poised to capitalize on the growing consumer demand for unique travel experiences, which surged post-pandemic. Expanding its portfolio into niche segments like adventure and eco-tourism, and better integrating its Vrbo platform, which saw a 15% year-over-year user growth in 2024, will cater to this evolving traveler preference.

| Opportunity Area | Key Data Point | Impact |

| Emerging Markets Expansion | Global travel spending projected at $2.2T by 2024 | Increased market share and revenue |

| AI & Personalization | 15% potential customer retention increase (travel tech 2023) | Enhanced customer satisfaction and loyalty |

| B2B Segment Growth | Business travel spending near $1.4T in 2023 | Diversified revenue streams |

| Niche Travel Experiences | Vrbo user growth of 15% YoY in 2024 | Catering to evolving traveler demands |

Threats

Expedia Group faces significant pressure as airlines and hotel chains increasingly push direct bookings on their own websites, effectively cutting out Online Travel Agencies (OTAs). This trend aims to reduce commission costs and build direct customer relationships, a strategy that has seen continued emphasis in 2024 as travel providers seek greater control over their distribution channels.

The competitive landscape is further complicated by the emergence of specialized platforms and AI-driven startups. These niche players can attract specific traveler segments with tailored offerings, fragmenting the market and siphoning off business that might otherwise go to larger OTAs like Expedia. For instance, platforms focusing on luxury, adventure, or eco-tourism can offer a more curated experience, posing a direct challenge to Expedia's broad-based approach.

The travel sector, including companies like Expedia Group, is particularly vulnerable to economic fluctuations. Factors such as rising inflation and interest rates, as seen in the persistent inflation rates in major economies throughout 2024, can erode consumer purchasing power. This directly impacts discretionary spending on travel, leading to fewer bookings.

Geopolitical instability further compounds these economic pressures. Ongoing conflicts and global uncertainties, such as the continued geopolitical tensions in Eastern Europe and the Middle East in early 2025, can deter international travel and create a climate of caution among consumers. This can result in a significant drop in revenue for online travel agencies like Expedia.

Expedia Group faces significant threats from evolving regulatory landscapes. New data privacy laws, such as potential updates to GDPR or similar legislation in key markets, could restrict how Expedia utilizes customer data for personalized marketing. For instance, the European Union's Digital Markets Act (DMA) is already impacting how large tech platforms operate, and similar scrutiny could extend to online travel agencies, potentially increasing compliance costs and limiting data-driven strategies.

Shifts in Consumer Behavior and Technology Adoption

Expedia faces a significant threat from rapidly shifting consumer behaviors, particularly the growing adoption of generative AI for travel planning. This trend could bypass traditional booking channels, impacting Expedia's visibility and customer acquisition strategies. For instance, a significant portion of travelers are exploring AI tools for itinerary creation, potentially altering how they discover and book trips.

Furthermore, a sustained preference for alternative accommodations, such as vacation rentals over traditional hotels, poses a challenge. This shift requires Expedia to continually enhance its offerings and marketing to cater to diverse traveler needs. In 2024, the alternative accommodation market continued its strong growth trajectory, presenting a competitive landscape that Expedia must navigate effectively.

Key considerations include:

- AI-Powered Search Disruption: The rise of generative AI tools could fundamentally change how consumers research and book travel, potentially reducing reliance on established Online Travel Agencies (OTAs).

- Alternative Accommodation Growth: Continued consumer interest in non-traditional lodging options requires Expedia to maintain and expand its inventory and user experience in this segment.

- Platform Adaptation Needs: Expedia must invest in technology and marketing to ensure its platforms remain relevant and visible amidst evolving consumer preferences and new digital tools.

Cybersecurity Risks and Data Breaches

Expedia Group, as a global online travel company, faces significant cybersecurity risks. Handling extensive customer data and financial transactions makes it a prime target for cyberattacks. A successful breach could result in substantial financial penalties, severe reputational damage, and a critical loss of customer confidence, directly impacting its market position and future growth.

The increasing sophistication of cyber threats means that even robust security measures can be challenged. For instance, the travel industry has seen a rise in phishing attacks and ransomware attempts targeting customer information. In 2024, reports indicated a significant increase in data breaches across various sectors, with the average cost of a data breach reaching millions of dollars, a figure that could disproportionately affect a company like Expedia if compromised.

- Target Vulnerability: Expedia's vast database of personal and financial information makes it an attractive target for malicious actors.

- Financial Impact: Data breaches can lead to hefty regulatory fines, legal costs, and compensation payouts, potentially costing millions.

- Reputational Damage: Loss of customer trust following a breach can deter new bookings and alienate existing customers, impacting revenue streams.

- Operational Disruption: Cyberattacks can disrupt booking systems and customer service operations, leading to immediate revenue loss and increased expenses for recovery.

Expedia faces intense competition from direct booking channels and emerging niche platforms, which fragment the market and challenge its broad appeal. Economic downturns, fueled by inflation and interest rate hikes observed throughout 2024, directly impact discretionary travel spending. Geopolitical instability, such as ongoing conflicts in early 2025, further deters international travel, leading to revenue declines.

SWOT Analysis Data Sources

This analysis is built upon a foundation of reliable data, including Expedia Group's official financial statements, comprehensive market research reports, and insights from industry experts to provide a robust and accurate SWOT assessment.