Expedia Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Expedia Group Bundle

Expedia Group navigates a complex landscape shaped by intense rivalry, powerful suppliers in the travel industry, and significant buyer bargaining power. The threat of new entrants is moderate, while the substitutes for online travel agencies are ever-present. Understanding these dynamics is crucial for strategic success.

The complete report reveals the real forces shaping Expedia Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Expedia Group's reliance on a concentrated number of major hotel chains and airlines, along with Global Distribution Systems (GDS) like Amadeus and Sabre, significantly influences supplier bargaining power. These large suppliers, controlling substantial inventory and critical routes, can leverage their market position to negotiate favorable terms with Expedia.

The uniqueness of inventory offered by certain hotel brands or airline routes can further amplify supplier leverage. When travelers specifically seek out particular accommodations or flight paths, Expedia's ability to fulfill these demands is directly tied to the willingness of these unique suppliers to partner on Expedia's terms.

The bargaining power of suppliers, particularly hotels and airlines, is influenced by switching costs. If it's easy and cheap for these providers to move their inventory to other online travel agencies (OTAs) or focus on direct bookings, their leverage over Expedia Group grows. For instance, a hotel might find it straightforward to list on Booking.com or its own website, thereby reducing reliance on Expedia.

Expedia actively works to mitigate these switching costs through its B2B offerings. By providing technology solutions, marketing support, and access to a broad customer base, Expedia aims to make it more complex and less appealing for partners to leave. This strategy is crucial for retaining suppliers and maintaining Expedia's competitive position in the market.

Suppliers, particularly hotel chains and airlines, possess the capability to integrate forward, meaning they can bypass online travel agencies (OTAs) like Expedia and connect directly with consumers. This is evident in the growing trend of direct bookings, which accounted for 42% of all online travel reservations in 2024, underscoring a significant shift away from intermediaries.

Major hotel groups have reported substantial increases in direct bookings through their own websites and mobile applications, often incentivized by loyalty programs. This direct channel reduces their dependency on OTAs, thereby amplifying their bargaining power and potentially diminishing Expedia's commission revenue.

Importance of Expedia to Supplier Revenue

Expedia's platform is a critical revenue driver for many suppliers, particularly smaller independent hotels and niche travel providers. For these businesses, Expedia often represents a significant portion, sometimes exceeding 50%, of their total bookings, especially during off-peak seasons. This reliance grants Expedia considerable bargaining power, as suppliers may struggle to attract comparable levels of direct bookings without the online travel agency's (OTA) extensive reach and marketing capabilities.

Expedia's value proposition lies in its ability to generate incremental demand and optimize capacity utilization for its partners. In 2024, Expedia Group reported facilitating billions of dollars in gross bookings, underscoring its role in driving sales for hotels, airlines, and other travel service providers. This volume of business means suppliers are often willing to accept Expedia's commission rates and terms to ensure consistent occupancy and revenue streams.

- Supplier Dependence: Many smaller hotels and independent travel operators rely on Expedia for a substantial percentage of their bookings, often making up over half of their total revenue.

- Incremental Demand: Expedia's marketing reach and customer base generate bookings that suppliers might not otherwise secure through their own channels.

- Capacity Utilization: The platform helps suppliers fill rooms and seats, especially during less popular periods, thereby improving overall operational efficiency.

- Negotiating Leverage: The significant revenue generated through Expedia gives the OTA leverage in negotiating commission rates and other contractual terms with suppliers.

Availability of Substitute Suppliers

The availability of substitute suppliers significantly impacts Expedia Group's bargaining power. In many travel segments, Expedia benefits from a vast and fragmented supplier base. For instance, the online travel agency (OTA) market features numerous independent hotels, budget airlines, and diverse tour operators, many of whom are eager to list on Expedia's platform to reach a wider audience. This abundance of choice limits the leverage any single supplier or small group of suppliers can exert.

Consider the hotel sector: as of early 2024, there are millions of hotels globally, with a substantial portion being independent or part of smaller chains. This high degree of fragmentation means that if one hotel or a small group of hotels attempts to dictate unfavorable terms, Expedia can readily shift its focus to other available inventory. This dynamic is particularly pronounced in segments like vacation rentals and boutique tours, where the barrier to entry for new suppliers is relatively low, further diluting the power of existing ones.

- Fragmented Supplier Base: Expedia sources inventory from millions of hotels, airlines, and activity providers globally, reducing reliance on any single entity.

- Low Switching Costs for Expedia: If a supplier's terms become unfavorable, Expedia can easily delist them and promote alternatives, given the vast number of available options.

- Impact of Independent Suppliers: The large number of independent hotels and smaller operators, who often have less bargaining power themselves, contributes to Expedia's ability to negotiate favorable terms.

- Digitalization of Travel: The ongoing digitalization of the travel industry has made it easier for new suppliers to enter the market and for platforms like Expedia to onboard them, continuously increasing the pool of alternatives.

The bargaining power of suppliers to Expedia Group is moderate, influenced by the concentration of key partners and the availability of alternatives. While major hotel chains and airlines hold significant leverage due to their substantial inventory and unique offerings, Expedia's vast network and marketing capabilities often provide a counter-balance.

Expedia's ability to generate significant revenue for many suppliers, especially smaller ones, limits the suppliers' ability to dictate terms. For instance, in 2024, Expedia Group facilitated billions in gross bookings, highlighting its role as a crucial sales channel.

The fragmentation of the travel market, with millions of hotels and diverse travel providers, means Expedia can readily switch to alternative suppliers if terms become unfavorable. This abundance of choice is a key factor in moderating supplier power.

However, the trend of direct bookings, which reached 42% of online travel reservations in 2024, indicates a growing ability for suppliers, particularly large hotel groups, to bypass intermediaries like Expedia, thereby increasing their bargaining power.

| Factor | Impact on Supplier Bargaining Power | Expedia's Mitigation Strategy |

| Supplier Concentration | High for major chains/airlines | Diversification of supplier base |

| Uniqueness of Inventory | High for specific brands/routes | Platform integration and loyalty programs |

| Switching Costs (for Suppliers) | Low for alternative OTAs/direct | B2B technology solutions |

| Supplier Dependence on Expedia | Low for large chains, High for independents | Value proposition of incremental demand |

| Availability of Substitutes | Low for Expedia, High for Suppliers | Leveraging fragmented market |

What is included in the product

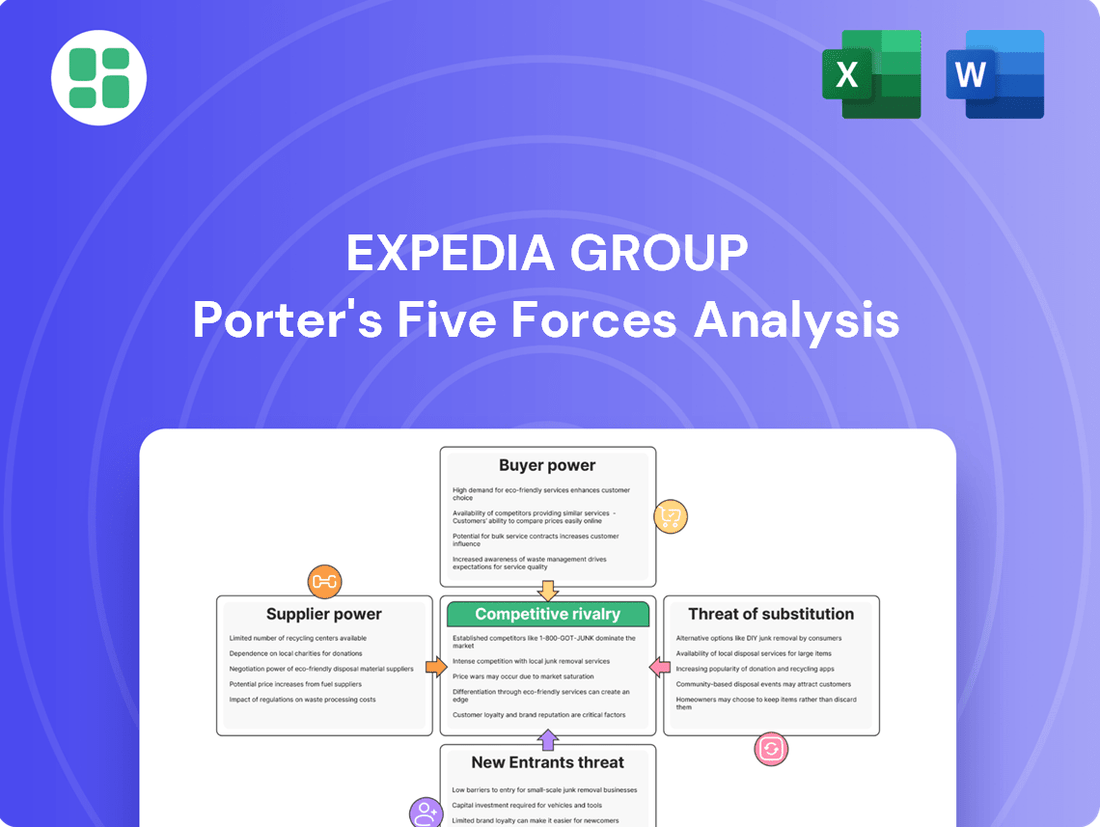

This analysis unpacks the competitive forces shaping the online travel industry for Expedia Group, examining supplier power, buyer bargaining, new entrant threats, substitute services, and the intensity of rivalry.

Instantly identify and mitigate competitive threats by visualizing the Expedia Group's market position against rivals, suppliers, buyers, new entrants, and substitutes.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Expedia Group, amplified by the internet's ability to facilitate easy price comparisons. Travelers can effortlessly check prices across numerous platforms, often within minutes. This ease of comparison means that if Expedia's pricing isn't competitive, customers can quickly find alternatives, thereby increasing their bargaining power.

The widespread availability of information online has dramatically lowered switching costs for consumers looking for travel deals. It's estimated that around 87% of travelers can switch between different online travel agencies or booking sites with minimal effort and time investment. This high degree of transparency and low friction in switching directly empowers customers by giving them more leverage in price negotiations.

Customers can easily switch between online travel agencies (OTAs) like Expedia, Booking.com, or even directly to airline and hotel websites. This is because there are virtually no costs or penalties associated with changing platforms. For instance, a traveler looking for a flight can compare prices across multiple sites in minutes, making it simple to abandon Expedia if a better deal is found elsewhere.

Expedia Group's customer base is primarily fragmented, consisting of millions of individual travelers worldwide. However, this fragmentation doesn't negate customer power. The sheer volume of individual bookings, when aggregated, gives travelers significant leverage, especially through their collective reliance on online reviews and ratings, which directly impact supplier visibility and sales on Expedia's platform.

While individual travelers are numerous, their purchasing decisions are heavily influenced by price comparison and the perceived value offered by different travel providers. This collective bargaining power is amplified by the ease with which consumers can switch between online travel agencies (OTAs) or book directly with airlines and hotels. Expedia's substantial customer acquisition costs, estimated to be in the billions annually, underscore the immense value of retaining each customer and the pressure to offer competitive pricing and attractive deals.

Threat of Backward Integration by Customers

Customers possess considerable bargaining power when they can bypass online travel agencies (OTAs) like Expedia Group and arrange their own travel. This threat of backward integration arises when customers opt to book directly with hotels, airlines, or through traditional travel agents, thereby reducing their reliance on intermediaries.

The increasing prevalence of direct booking platforms and the growing comfort of consumers with managing their own travel arrangements signify a tangible shift. For instance, many major hotel chains and airlines have invested heavily in their direct booking channels, offering loyalty program benefits and exclusive deals to encourage customers to book directly. This trend directly increases customer power by providing viable alternatives to OTAs.

- Direct Booking Growth: Many hotel brands and airline carriers actively promote direct booking through their own websites and apps, often incentivizing customers with loyalty points or discounts not available through OTAs.

- Consumer Empowerment: Advances in technology and the widespread availability of information empower consumers to research and book travel components independently, reducing the perceived value of OTA services for some segments.

- Market Share Shifts: While OTAs still hold significant market share, the growth of direct channels indicates a portion of travel bookings are moving away from intermediaries, a trend observed across the industry.

Product Differentiation and Loyalty Programs

Expedia's ability to differentiate its offerings significantly impacts customer bargaining power. By providing unique travel bundles, exclusive deals through its platform, and a seamless user experience, Expedia aims to cultivate customer loyalty. For instance, their ongoing investment in unifying technology and enhancing customer experience is designed to make their services more sticky. This focus is crucial as customers increasingly seek personalized travel planning and booking experiences.

Loyalty programs are a key lever for Expedia in mitigating customer power. Programs like Expedia Rewards allow customers to earn points on bookings, which can be redeemed for discounts or perks. This incentivizes repeat business and builds a loyal customer base less likely to switch to competitors for minor price differences. As of early 2024, the travel industry continues to see strong demand for personalized digital experiences, making loyalty initiatives more critical than ever for retaining customers.

- Product Differentiation: Expedia offers a wide range of travel products, including flights, hotels, car rentals, and activities, often bundled together for convenience and potential savings.

- Loyalty Programs: The Expedia Rewards program provides members with points for bookings, offering tiered benefits and exclusive member prices, fostering repeat business.

- Customer Experience: Investments in technology aim to improve the user interface, search functionality, and booking process, creating a more attractive and less commoditized offering.

- Market Trends: The general preference for online booking and personalized travel recommendations remains a strong trend, influencing how customers evaluate and choose travel providers.

Customers wield significant bargaining power due to the ease of price comparison across numerous online travel agencies (OTAs) and direct booking channels. This transparency, coupled with low switching costs, empowers travelers to seek the best deals. Expedia's substantial customer acquisition costs, estimated in the billions annually, highlight the pressure to maintain competitive pricing and attractive offers to retain this price-sensitive customer base.

| Factor | Impact on Expedia | Supporting Data/Trend |

|---|---|---|

| Price Transparency | High | Customers readily compare prices across multiple platforms, diminishing price inelasticity. |

| Switching Costs | Low | Around 87% of travelers can switch between OTAs with minimal effort, increasing customer leverage. |

| Direct Booking Threat | Moderate | Major hotel and airline chains actively promote direct booking, offering loyalty benefits that divert some customers from OTAs. |

| Customer Loyalty | Moderate | Loyalty programs like Expedia Rewards aim to mitigate power by incentivizing repeat business, though their effectiveness varies with price sensitivity. |

Preview Before You Purchase

Expedia Group Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Expedia Group's competitive landscape through Porter's Five Forces, analyzing the intense rivalry among online travel agencies, the significant threat of new entrants due to low switching costs and digital accessibility, and the considerable bargaining power of suppliers like airlines and hotels. Furthermore, it examines the moderate threat of substitutes, such as direct booking or alternative travel planning methods, and the substantial buyer power exerted by consumers through price comparison and review platforms.

Rivalry Among Competitors

Expedia Group faces intense competition from a vast array of online travel agencies (OTAs) and metasearch engines. Major rivals include Booking Holdings, which operates brands like Booking.com and Priceline, and Trip.com Group, a dominant force in Asia. The market is further crowded by numerous smaller OTAs and direct booking channels offered by airlines and hotels.

The online travel industry is experiencing robust growth, with projections indicating a continued upward trajectory. For instance, the global online travel market was valued at approximately $765 billion in 2023 and is expected to reach over $1.5 trillion by 2030, demonstrating a compound annual growth rate of nearly 10%.

While this expansion offers ample opportunity, it also fuels intense competition. Expedia Group, like its peers, faces pressure to capture and retain market share within this expanding landscape. The high growth rate, though beneficial for overall demand, does not inherently reduce the rivalry for customer acquisition and loyalty among major online travel agencies.

Expedia Group actively differentiates its offerings through a robust portfolio of brands like Expedia, Hotels.com, and Vrbo, catering to diverse travel needs. This multi-brand strategy, coupled with investments in its technology platform, aims to provide unique customer experiences and capture a wider market share, mitigating direct price wars.

While competitors often offer similar booking functionalities, Expedia's commitment to innovation, particularly in AI-driven personalized recommendations and seamless user interfaces, provides a competitive edge. For instance, in 2024, the company continued to emphasize AI integration to enhance trip planning and booking, aiming to reduce reliance on price alone as a differentiator.

Exit Barriers

Exit barriers in the online travel agency (OTA) market are considerable, making it difficult for companies to leave. Major players like Expedia Group have invested heavily in proprietary technology platforms and global distribution networks. These sunk costs and specialized assets mean that exiting the market can result in significant financial losses.

The substantial investments in technology, marketing, and brand building create high exit barriers. For instance, companies must maintain constant innovation in user experience and data analytics to remain competitive. In 2023, the global online travel market was valued at over $800 billion, underscoring the scale of investment required to even operate, let alone exit gracefully.

- High Capital Investment: Significant upfront costs for technology development, platform maintenance, and customer acquisition deter easy exits.

- Brand Loyalty and Reputation: Established brands have built trust and recognition over years, making it hard for new entrants and difficult for existing players to divest without impacting brand value.

- Specialized Workforce and Knowledge: The industry relies on specialized skills in areas like digital marketing, data science, and travel logistics, which are not easily transferable to other sectors.

- Contractual Obligations: Long-term contracts with suppliers, airlines, and hotels can further complicate and penalize early withdrawal from the market.

Marketing and Advertising Intensity

The online travel agency (OTA) sector, where Expedia Group operates, is characterized by extremely high marketing and advertising expenditures. Major players like Expedia, Booking Holdings, and others consistently invest billions of dollars annually. This intense spending is crucial for customer acquisition and retention, especially in capturing those early searchers looking for travel options.

This fierce competition for visibility and customer engagement directly fuels the intense rivalry among OTAs. For instance, in 2023, Expedia Group reported sales and marketing expenses of approximately $3.4 billion. This significant outlay highlights the continuous need to outspend competitors to maintain and grow market share.

- High Marketing Spend: OTAs like Expedia Group allocate billions to sales and marketing, demonstrating the competitive pressure to attract and keep customers.

- Customer Acquisition Costs: Significant investment is required to capture top-of-funnel interest and secure bookings in a crowded digital landscape.

- Market Share Battle: The substantial marketing budgets reflect a direct fight for market share and a strong presence in consumers' travel planning journeys.

- Industry Norm: Billions spent annually on advertising is a defining characteristic of the OTA industry, underscoring the intense rivalry.

Expedia Group faces intense rivalry from established giants like Booking Holdings and emerging players, particularly in the rapidly growing Asian market with Trip.com Group. The online travel sector's expansion, projected to exceed $1.5 trillion by 2030, intensifies this competition, forcing Expedia to invest heavily in brand differentiation and AI-driven personalization, as seen in its continued focus on AI in 2024 to enhance user experience beyond mere price competition.

| Competitor | Key Brands | Market Focus |

|---|---|---|

| Booking Holdings | Booking.com, Priceline | Global, strong in Europe and North America |

| Trip.com Group | Trip.com, Ctrip, Skyscanner | Dominant in Asia, expanding globally |

| Expedia Group | Expedia, Hotels.com, Vrbo | Global, diverse brand portfolio |

SSubstitutes Threaten

Travelers are increasingly opting to book directly with suppliers like airlines and hotels through their own websites and apps. This trend bypasses the need for online travel agencies (OTAs) like Expedia. By 2024, these direct booking channels secured 42% of all online travel reservations.

Major hospitality players, such as Marriott, are actively encouraging direct bookings, further solidifying this as a significant substitute threat. This shift means suppliers can control the customer relationship and potentially offer better deals directly, eroding Expedia's intermediary role.

Traditional brick-and-mortar travel agencies still pose a threat of substitution for Expedia Group, particularly for travelers seeking complex itineraries, group bookings, or personalized human interaction. While online platforms have captured the majority of the market, these traditional agencies cater to a niche segment that values face-to-face service and expert advice. This segment, though smaller, represents a persistent alternative for specific travel needs.

Metasearch engines like Google Travel, Kayak, and Skyscanner pose a significant threat to Expedia Group. These platforms aggregate pricing information from numerous Online Travel Agencies (OTAs) and direct suppliers, allowing consumers to easily compare options without directly engaging with Expedia's booking interface. This price transparency and the direct pathways to other booking sites intensify competition, potentially diverting customers who might otherwise book through Expedia.

Alternative Accommodation Models

The threat of substitutes is amplified by alternative accommodation models, most notably vacation rental platforms like Airbnb. These platforms offer travelers unique lodging experiences, such as private homes, apartments, and shared spaces, which can appeal to a different segment of the market than traditional hotels. While Expedia Group's Vrbo brand directly competes in this space, the overall growth of unique stays presents a significant alternative that can divert travelers from standard online travel agency (OTA) bookings.

These alternatives are gaining traction, offering diverse options that cater to specific traveler needs, from budget-conscious backpackers to families seeking more space and amenities. The perceived value proposition of vacation rentals, often including kitchens and living areas, can be more attractive than a hotel room for longer stays or group travel. This differentiation challenges the conventional hotel booking model that OTAs like Expedia have historically dominated.

- Market Share: In 2024, the global vacation rental market was valued at over $100 billion, demonstrating its substantial size and impact.

- Growth Trajectory: Projections indicate continued strong growth for the short-term rental sector, with an expected compound annual growth rate (CAGR) of around 10% through 2030.

- Traveler Preferences: Surveys in late 2023 and early 2024 revealed that a significant percentage of travelers, particularly millennials and Gen Z, expressed a preference for unique accommodations over traditional hotels.

Non-digital Travel Planning and Word-of-Mouth

While online booking dominates, non-digital travel planning, like relying on personal recommendations or guidebooks, remains a substitute, especially for spontaneous short trips or niche local experiences. These methods bypass the need for extensive online pre-booking, offering a different, albeit less comprehensive, approach to travel arrangement.

The threat from non-digital substitutes is relatively low for Expedia Group, as complex international travel and business trips heavily favor online platforms. However, for leisure travelers seeking simple, local getaways, word-of-mouth and physical resources can still influence decisions. For instance, a significant portion of travelers still consult friends and family for vacation ideas, a trend that persists even with the ubiquity of online reviews.

- Personal Recommendations: Many travelers still value trusted advice from friends and family over online reviews for certain trip types.

- Guidebooks: Physical guidebooks, though declining, continue to serve a segment of travelers who prefer tangible resources for planning.

- Spontaneous Travel: Unplanned trips that involve minimal pre-booking and more on-the-ground decision-making represent a direct substitute for online travel agencies.

- Local Experiences: Planning for highly localized or off-the-beaten-path experiences might still lean on local knowledge or less digitized resources.

The threat of substitutes for Expedia Group is substantial and multifaceted, stemming from direct bookings, metasearch engines, and alternative accommodation models. By 2024, direct booking channels captured 42% of online travel reservations, with major hotel chains actively promoting this. Metasearch engines like Google Travel and Skyscanner offer price transparency, diverting users who might otherwise book via Expedia.

Alternative lodging, particularly vacation rentals via platforms like Airbnb, presents a growing substitute. The global vacation rental market exceeded $100 billion in 2024, with projections showing a 10% CAGR through 2030. Traveler preferences, especially among younger demographics, increasingly favor unique accommodations over traditional hotels, as indicated by surveys from late 2023 and early 2024.

| Substitute Type | 2024 Market Share/Value | Key Driver | Impact on Expedia |

| Direct Bookings (Hotels/Airlines) | 42% of online reservations | Supplier control, loyalty programs | Reduced OTA commissions |

| Metasearch Engines | Significant user traffic | Price comparison, ease of use | Customer diversion |

| Vacation Rentals (e.g., Airbnb) | >$100 billion market value | Unique experiences, value for groups/families | Market share erosion, changing traveler habits |

Entrants Threaten

Entering the online travel agency (OTA) space demands immense capital. Developing sophisticated booking engines, user-friendly interfaces, and secure payment systems requires millions. Expedia Group, for instance, invests heavily in its technology infrastructure to maintain a competitive edge.

Beyond technology, new entrants face substantial marketing costs. Established players like Expedia Group and Booking Holdings have built strong brand recognition through aggressive advertising campaigns, often spending billions annually. This makes it incredibly difficult for newcomers to gain visibility and attract customers.

Furthermore, building a comprehensive global network of suppliers – airlines, hotels, car rental companies – necessitates significant upfront investment and ongoing relationship management. Expedia Group's extensive supplier partnerships, cultivated over years, represent a considerable barrier to entry.

Building brand loyalty and trust is a significant hurdle for new entrants in the online travel agency (OTA) market. Established players like Expedia Group benefit from years of brand building and a vast existing customer base, making it challenging for newcomers to gain traction.

Customer acquisition costs are notably high, with Expedia reportedly spending around $47 per user. This substantial investment in attracting and retaining customers means new entrants require considerable financial resources to effectively compete and establish a loyal following in this crowded landscape.

Newcomers face a significant hurdle in securing access to established distribution channels and supplier networks. Expedia Group, for instance, has cultivated deep, long-standing relationships with a vast array of travel providers, including major airlines, hotel chains, and car rental companies, often integrated through global distribution systems (GDSs) and direct contracts.

Building such an extensive and reliable inventory network from scratch is exceptionally challenging and capital-intensive for any new online travel agency (OTA). These entrenched relationships provide Expedia with a competitive advantage, making it difficult for new entrants to offer a comparable breadth and depth of travel options to consumers.

Regulatory Hurdles and Data Privacy

New entrants face substantial regulatory hurdles, particularly concerning data privacy. Laws like the General Data Protection Regulation (GDPR) and similar frameworks worldwide impose strict requirements on how customer data is collected, stored, and used, necessitating significant investment in compliance infrastructure and legal counsel. For instance, the fines for GDPR violations can reach up to 4% of annual global turnover or €20 million, whichever is higher, presenting a considerable financial risk for any new player.

Consumer protection regulations also add complexity, demanding transparency in pricing, clear terms of service, and robust dispute resolution mechanisms. Expedia Group, as a major online travel agency (OTA), must adhere to these evolving standards, which can limit certain business practices and increase operational costs. New entrants would need to build systems and processes from the ground up to meet these consumer-centric mandates.

Furthermore, potential anti-competitive practices are under scrutiny by regulatory bodies. New entrants must be mindful of how their market entry strategies might be perceived, as established players like Expedia Group often have significant market share. Navigating these regulatory landscapes requires specialized legal expertise and substantial financial resources, acting as a significant barrier to entry.

- Data Privacy Compliance Costs: New entrants may need to invest millions in legal and technical infrastructure to comply with regulations like GDPR, which came into full effect in 2018 and has since been a benchmark for global privacy standards.

- Consumer Protection Mandates: Regulations ensuring fair practices and transparent pricing can add operational overhead. For example, the EU's Unfair Commercial Practices Directive requires clear communication regarding pricing and services.

- Anti-Trust Scrutiny: The online travel market, dominated by large players, faces ongoing review for monopolistic tendencies, making it harder for new entrants to operate without attracting regulatory attention.

Technology and Innovation Requirements

New entrants into the online travel agency (OTA) space face substantial technology hurdles. Competing effectively demands significant investment in advanced technologies like AI for personalized recommendations and mobile app optimization to provide seamless booking experiences. For instance, in 2024, companies like Expedia Group continued to heavily invest in AI and machine learning to enhance user experience and operational efficiency, with a reported increase in R&D spending dedicated to these areas. This necessitates considerable upfront capital for research and development, as well as attracting highly skilled tech talent, creating a high barrier to entry.

The need for cutting-edge technology translates directly into high initial investment for new players. To offer a product that can even begin to rival established giants, new entrants must allocate substantial resources to develop and integrate sophisticated platforms. This includes everything from robust data analytics capabilities to secure payment gateways and intuitive user interfaces. For example, a new OTA would likely need to spend millions on software development, cloud infrastructure, and cybersecurity measures to meet industry standards in 2024.

- AI-Driven Personalization: New entrants must develop AI algorithms to offer tailored travel suggestions, a significant R&D undertaking.

- Mobile App Optimization: Investment in user-friendly, high-performing mobile applications is crucial, requiring ongoing development and testing.

- Seamless Booking Experience: Integrating complex booking systems, payment processing, and customer support demands advanced technological infrastructure.

- Talent Acquisition: Securing skilled AI engineers, data scientists, and software developers is a major cost and competitive challenge.

The threat of new entrants for Expedia Group is relatively low. The online travel agency (OTA) market is characterized by high capital requirements for technology development and marketing. Established players like Expedia benefit from significant brand recognition and extensive supplier networks, making it difficult for newcomers to gain traction.

Customer acquisition costs are substantial, with Expedia reportedly spending around $47 per user, presenting a significant financial barrier. Furthermore, regulatory compliance, particularly concerning data privacy and consumer protection, adds complexity and cost for any new entrant. The need for advanced technologies like AI for personalization also demands considerable investment.

| Barrier | Description | Impact on New Entrants |

| Capital Requirements | Developing sophisticated booking engines and marketing campaigns requires millions. | High |

| Brand Recognition & Loyalty | Expedia has years of brand building and a large customer base. | High |

| Supplier Networks | Cultivated, long-standing relationships with airlines, hotels, etc. | High |

| Customer Acquisition Cost | Expedia spends approximately $47 per user. | High |

| Technology Investment | Need for AI, mobile optimization, and secure platforms. | High |

| Regulatory Compliance | Data privacy (e.g., GDPR fines up to 4% of global turnover) and consumer protection. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Expedia Group is built upon a foundation of robust data, including annual reports, investor presentations, and financial filings from Expedia Group and its key competitors. We also incorporate insights from reputable industry research reports and market intelligence platforms to capture the competitive landscape.