EXFO SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EXFO Bundle

EXFO's market leadership in network testing and assurance is a significant strength, but understanding the nuances of their competitive landscape and potential threats is crucial for strategic planning.

Want the full story behind EXFO's opportunities for innovation and potential weaknesses in emerging markets? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic decisions.

Strengths

EXFO holds a commanding position as a global frontrunner in fiber optic testing, a sector vital to the ongoing worldwide deployment of fiber optic infrastructure. This leadership is a direct result of their consistent dedication to product innovation, exemplified by offerings such as their FTB Lite 700 series of OTDRs and their advanced 1.6T validation system, which keeps them at the cutting edge of this crucial technology.

EXFO's extensive suite of testing, monitoring, and analytics solutions is a significant strength. Their portfolio covers everything from physical field testing gear to sophisticated software for ensuring service quality and operational insights. This breadth allows them to serve a wide range of customer requirements throughout the entire network lifecycle, from initial setup to ongoing performance tuning.

EXFO boasts a remarkably diverse and high-profile clientele, a significant strength that underpins its market position. Over 95% of the world's leading Communications Service Providers (CSPs) rely on EXFO's solutions, demonstrating broad industry adoption.

This extensive client base, which also includes major equipment manufacturers and web-scale companies, mitigates risk by preventing over-reliance on any single sector. Such diversification contributes to a more stable and predictable revenue flow for the company.

Innovation in Next-Generation Technologies

EXFO's commitment to innovation is a significant strength, particularly in next-generation technologies. The company consistently invests in research and development to meet evolving industry demands. For instance, their introduction of advanced AI testing solutions at OFC 2024 and the development of a 1.6T validation system highlight this focus.

This dedication to cutting-edge technology, especially in high-speed networking (400/800G, 1.6T) and AI-driven analytics, positions EXFO to capitalize on future network infrastructure growth. Their forward-looking approach ensures they remain relevant in a rapidly advancing technological landscape.

- R&D Investment: EXFO's ongoing investment in R&D fuels its ability to develop and launch advanced testing solutions.

- AI Integration: The company is actively developing and showcasing AI-powered testing capabilities, a key differentiator.

- High-Speed Network Focus: EXFO is addressing the critical need for validation in next-generation high-speed networks, such as 1.6T.

- Industry Recognition: Showcasing solutions at events like OFC 2024 demonstrates industry leadership and technological advancement.

Strategic Focus on Automation and AI in Network Management

EXFO's strategic focus on automation and AI in network management is a significant strength. The company is actively developing and deploying solutions that leverage these technologies, such as their semantic 'digital twin' solution. This innovative approach was notably adopted by Vodafone Germany to achieve zero-touch automation, demonstrating real-world applicability and customer value.

This strategic direction directly addresses a critical industry trend: the move towards intelligent, self-optimizing networks. By providing tools that enhance efficiency and reduce operational costs for their clients, EXFO positions itself as a key enabler of next-generation network operations. For instance, the increasing complexity of 5G and beyond necessitates automated management, a space where EXFO is making substantial investments.

- AI-driven Network Automation: EXFO's development of AI and automation solutions directly addresses the industry's need for more efficient network operations.

- Zero-Touch Automation: The successful adoption of their semantic 'digital twin' by Vodafone Germany for zero-touch automation highlights the practical impact of EXFO's strategy.

- Industry Alignment: This focus aligns EXFO with the broader industry shift towards intelligent, self-optimizing networks, enhancing customer efficiency and cost reduction.

EXFO's leadership in fiber optic testing is a core strength, built on continuous innovation. Their FTB Lite 700 series and advanced 1.6T validation systems keep them at the forefront of essential network technology, ensuring they meet the evolving demands of global fiber deployments.

What is included in the product

Delivers a strategic overview of EXFO’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Streamlines strategic assessment by clearly identifying EXFO's competitive advantages and areas for improvement, enabling targeted action plans.

Weaknesses

EXFO's revenue streams are closely tied to the capital expenditure (CapEx) cycles of telecommunications companies. When operators invest heavily in network upgrades, such as 5G rollouts, EXFO's test and measurement solutions see increased demand. For instance, during the peak of 5G deployment in 2023, many operators ramped up their spending, benefiting companies like EXFO.

However, this reliance creates a vulnerability. A slowdown in telecom CapEx, perhaps due to economic uncertainty or a shift in strategic priorities by major clients, can directly impact EXFO's sales. If operators decide to postpone or reduce their network investments, demand for EXFO's products and services will likely decline, as seen in past periods of economic contraction where telecom CapEx softened.

The communications test and measurement sector is a tough arena, dominated by a few big names like Keysight Technologies, Viavi Solutions, and Anritsu. EXFO, while a significant player, sits in fourth place among forty competitors. This intense concentration means EXFO constantly battles for market share, which can lead to considerable pricing pressure and impact profitability.

EXFO faces a significant challenge in maintaining its technological leadership, necessitating substantial and ongoing investment in research and development. This commitment is crucial for staying ahead in dynamic fields such as 5G and 6G deployment, advanced fiber optics, and the integration of artificial intelligence into network testing and assurance. For instance, the telecommunications industry's R&D spending is projected to continue its upward trajectory, with global spending on R&D in the ICT sector expected to reach over $300 billion in 2024, highlighting the competitive landscape EXFO operates within.

This continuous high R&D expenditure, while vital for innovation, can place considerable strain on EXFO's profitability and necessitate careful resource allocation. The pressure to develop next-generation solutions means that a significant portion of the company's budget must be dedicated to future technologies, potentially impacting short-term financial performance. In 2023, EXFO reported R&D expenses of approximately $100 million, a testament to the significant financial commitment required to remain competitive in this fast-paced sector.

Challenges in Global Market Penetration and Scale

While EXFO serves major telecommunications companies, its global market share remains modest when stacked against broader technology conglomerates. For instance, in the network testing and analytics market, EXFO's competitive landscape includes giants like Keysight Technologies and Viavi Solutions, which often leverage more extensive product portfolios and established global distribution networks.

Penetrating and scaling effectively in emerging markets, particularly in the fast-paced Asia-Pacific region, presents a significant hurdle. This requires substantial strategic investment in local infrastructure, sales channels, and tailored product offerings to meet diverse regional demands. EXFO's fiscal year 2024 results showed continued growth, but the company must accelerate its expansion to capture a larger share of these vital growth markets.

- Limited Scale: EXFO's global market share in network testing and analytics is smaller compared to diversified competitors.

- Regional Expansion Needs: Significant strategic investment and effort are required to increase market penetration in regions like Asia-Pacific.

- Competitive Landscape: EXFO competes with larger players like Keysight Technologies and Viavi Solutions, which possess broader product lines and established global reach.

Potential Impact of Being a Private Company

Since EXFO was taken private in 2021, there's a noticeable reduction in public financial reporting. This can create a transparency gap for those outside the company, including potential future investors who rely on detailed disclosures. This shift means less readily available data for market analysis.

While operating privately allows EXFO to focus on long-term strategic goals without the quarterly pressures of public markets, it can also present challenges. Access to a broader range of capital sources, often more readily available to publicly traded companies, might be more constrained. For instance, in 2023, public companies in the tech sector often leveraged public offerings or convertible debt, options that may be less accessible to private entities.

The lack of continuous public financial data makes it harder for external analysts to track EXFO's performance against industry benchmarks. This can impact valuation models and the ability to identify emerging trends or risks in real-time.

Key implications include:

- Reduced Transparency: Less public financial data hinders external stakeholder analysis.

- Limited Capital Access: Potential reliance on fewer, potentially more restrictive, capital sources compared to public markets.

- Valuation Challenges: Difficulty in performing continuous, data-driven valuations for external parties.

- Information Asymmetry: A gap in readily available performance metrics for competitive analysis.

EXFO's competitive position is challenged by larger, more diversified players like Keysight Technologies and Viavi Solutions, who often possess broader product portfolios and more extensive global distribution networks. This makes it difficult for EXFO to gain significant market share. Furthermore, the need for substantial investment to expand into crucial growth markets, particularly in the Asia-Pacific region, presents an ongoing hurdle. For example, while EXFO reported continued growth in its fiscal year 2024 results, accelerating expansion in these dynamic areas is vital to capture a larger slice of the market.

Preview Before You Purchase

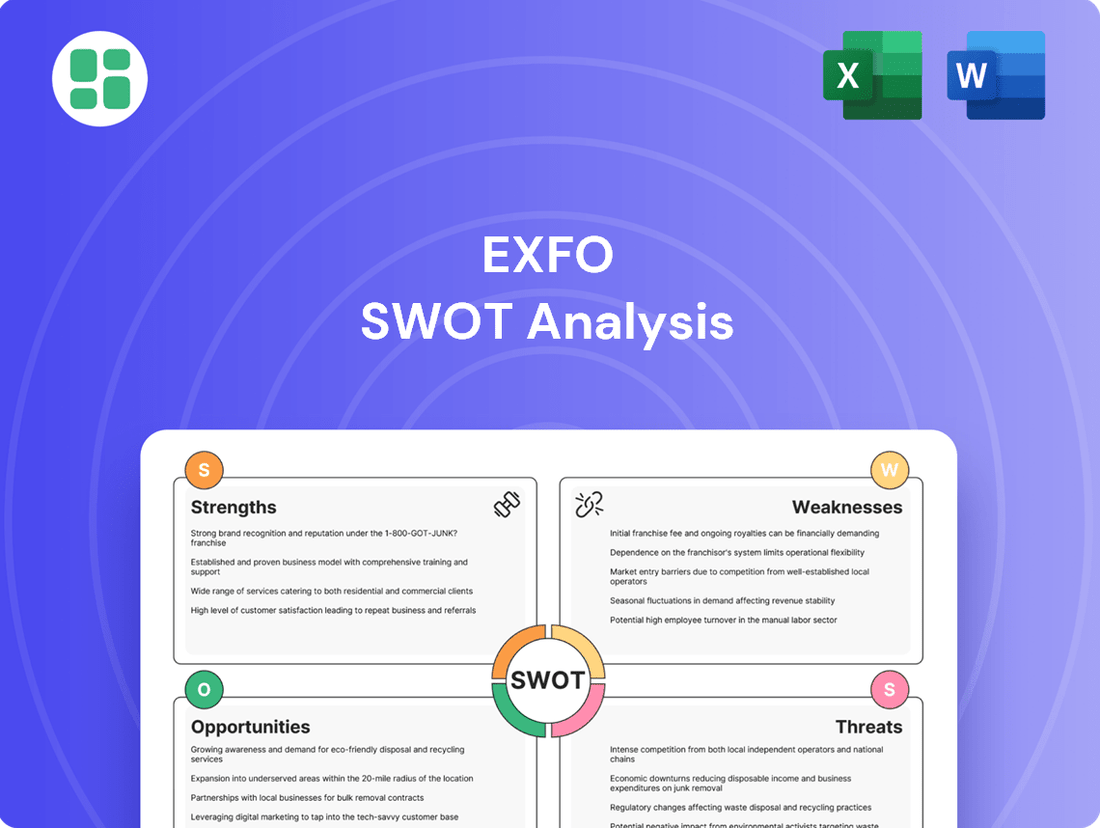

EXFO SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual EXFO SWOT analysis, ensuring you know exactly what you're purchasing.

The content below is pulled directly from the final EXFO SWOT analysis. Unlock the full report when you purchase, gaining comprehensive insights into EXFO's strategic positioning.

Opportunities

The accelerating global deployment of 5G networks, with continued expansion and upgrades expected throughout 2024 and into 2025, represents a substantial opportunity for EXFO. As operators invest heavily in these advanced infrastructures, the demand for sophisticated testing and validation solutions to ensure network performance and reliability will only grow.

Furthermore, the groundwork being laid for future 6G networks, even in these early stages, signals a long-term growth trajectory. EXFO’s expertise in advanced network testing is crucial for validating the complex technologies and stringent performance requirements of these next-generation communication systems, positioning them to capitalize on this evolution.

The ongoing expansion of Fiber-to-the-Home (FTTH) and Fiber-to-the-Business (FTTB) networks is a significant tailwind for EXFO. This trend, coupled with the insatiable demand for faster data speeds, is fueling robust growth in the fiber optic test equipment sector. EXFO's established market presence positions it to effectively leverage this increasing demand for reliable and advanced testing solutions.

The growing integration of AI, machine learning, and automation within network operations presents a significant opportunity for EXFO. These technologies are revolutionizing how networks are managed and tested, paving the way for EXFO's sophisticated analytics and automated solutions to gain traction.

Cloud-based testing platforms are also expanding the market for EXFO by enabling more efficient remote monitoring and operational improvements. This shift allows for greater flexibility and scalability in testing processes, aligning with the evolving demands of the telecommunications industry.

Expansion into Data Center and Web-Scale Segments

The rapid growth of data centers and web-scale operations presents a significant opportunity for EXFO. These entities require sophisticated testing and monitoring to guarantee optimal performance and minimal latency in their complex networks. EXFO's current offerings can be strategically enhanced to capture a larger share of this expanding market.

The demand for high-speed, reliable connectivity within data centers is surging. For instance, global data center traffic is projected to more than double between 2021 and 2026, reaching an estimated 200 zettabytes annually, according to Statista. This trend directly fuels the need for EXFO's specialized solutions.

- Growing Data Center Footprint: The number of hyperscale data centers is increasing globally, driving demand for advanced network testing.

- Web-Scale Network Complexity: The intricate and high-volume nature of web-scale networks necessitates specialized monitoring tools.

- Low-Latency Requirements: Critical applications within these environments demand ultra-low latency, which EXFO's solutions can help ensure.

- Market Growth Potential: The global network testing market, particularly segments serving data centers, is expected to see robust growth in the coming years.

Strategic Acquisitions to Expand Portfolio and Market Reach

EXFO's proven track record of successful acquisitions presents a significant opportunity to bolster its offerings and market presence. For instance, its acquisition of Yenista Optics in 2023 for approximately $30 million significantly expanded its photonics portfolio, particularly in tunable lasers and optical amplifiers, crucial for 5G and future network advancements. This inorganic growth strategy allows EXFO to quickly integrate cutting-edge technologies and capture market share in specialized segments, directly addressing evolving customer needs and competitive dynamics.

Leveraging this acquisition expertise, EXFO can strategically target companies that complement its existing strengths in network testing, assurance, and analytics. Potential acquisition targets could include firms specializing in AI-driven network optimization, cybersecurity solutions for telecom infrastructure, or advanced optical component manufacturing. Such moves would not only broaden EXFO's product suite but also enhance its competitive edge by offering more comprehensive end-to-end solutions in a rapidly evolving telecommunications landscape.

- Acquisition of Yenista Optics: Enhanced photonics capabilities, contributing to EXFO's advanced optical solutions.

- Market Expansion: Gaining access to new geographical markets and customer segments through acquired entities.

- Technology Integration: Rapidly incorporating new technologies, such as AI-driven analytics, to stay ahead of industry trends.

- Portfolio Diversification: Broadening the product and service offerings to meet a wider range of customer requirements in the telecom sector.

The ongoing global rollout and upgrades of 5G networks, expected to continue strongly through 2024 and into 2025, present a significant opportunity for EXFO. As telecom operators invest in advanced infrastructure, the need for sophisticated testing to ensure performance and reliability will rise. Furthermore, the groundwork for 6G networks, even in its nascent stages, indicates a long-term growth avenue where EXFO's expertise in complex network validation will be crucial.

The expansion of Fiber-to-the-Home (FTTH) and Fiber-to-the-Business (FTTB) networks, driven by the demand for faster speeds, is a key growth driver for EXFO in the fiber optic test equipment market. Additionally, the increasing integration of AI, machine learning, and automation in network operations creates a demand for EXFO's advanced analytics and automated testing solutions.

The growth of data centers and web-scale operations, requiring sophisticated testing for optimal performance and low latency, offers another avenue for EXFO. For instance, global data center traffic is projected to reach an estimated 200 zettabytes annually by 2026. EXFO’s strategic acquisitions, such as Yenista Optics in 2023, have expanded its photonics capabilities, positioning it to capitalize on these evolving market needs.

Threats

The telecommunications sector is in constant flux, with new technologies emerging at an unprecedented pace. This rapid evolution poses a significant threat to EXFO, as its existing test and measurement solutions could quickly become outdated. For instance, the ongoing shift towards 5G Advanced and the early stages of 6G development necessitate continuous innovation in how network performance is validated.

Competitors are not standing still; they are actively developing and deploying disruptive innovations that could fundamentally alter the market landscape. If EXFO cannot keep pace with these advancements, its market share and competitive edge are at risk. Consider the rise of AI-driven network testing tools, which promise greater efficiency and predictive capabilities, potentially marginalizing traditional approaches if EXFO doesn't integrate similar technologies.

The communications test and measurement sector is intensely competitive, with a constant threat of price wars. Larger, established companies and agile new entrants alike can exert significant downward pressure on pricing, directly impacting EXFO's profitability. This dynamic could lead to margin erosion, particularly if EXFO cannot differentiate its offerings effectively or maintain premium pricing. For instance, in the first quarter of fiscal year 2024, EXFO reported a gross margin of 37.5%, a figure that could come under pressure if pricing becomes more aggressive across the industry.

A substantial global economic downturn presents a significant threat, potentially leading network operators and equipment manufacturers to scale back their capital expenditures and operational investments. This contraction in spending directly affects the demand for EXFO's testing, assurance, and analytics solutions. For instance, during periods of economic uncertainty, telecom companies often delay network upgrades or new technology rollouts, impacting EXFO's revenue streams.

Complexity and Challenges of 5G/6G Deployment

The rollout of 5G and the upcoming 6G present substantial hurdles for EXFO. These include the immense capital expenditure required for network upgrades, navigating intricate spectrum allocation policies globally, and the sheer complexity of integrating new technologies with legacy systems. For instance, the global 5G infrastructure market alone was projected to reach over $300 billion by 2025, highlighting the scale of investment needed.

These deployment complexities can directly impact EXFO's business. Any delays or unforeseen integration issues in the 5G/6G rollout by telecom operators could consequently slow down the demand for the very testing and assurance solutions EXFO provides. This creates a direct dependency on the pace and success of these large-scale infrastructure projects.

- High Capital Expenditure: Telecom operators face billions in investment for 5G/6G infrastructure, potentially impacting their budget allocation for testing solutions.

- Spectrum Regulation: Inconsistent and evolving spectrum policies across regions can create uncertainty and delays in network deployment.

- Integration Complexity: Merging new 5G/6G technologies with existing 4G and older networks is technically challenging and time-consuming.

- Delayed Adoption: Difficulties in these deployments could lead to a slower adoption rate of advanced testing tools, affecting EXFO's revenue streams.

Cybersecurity Risks and Data Privacy Concerns

As networks grow more intricate and interconnected, EXFO faces escalating cybersecurity risks. With its solutions increasingly focused on network data analytics and monitoring, the potential for data breaches and privacy violations becomes a significant threat. Maintaining customer trust and avoiding substantial liabilities hinges on EXFO's ability to implement and uphold stringent security measures and ensure compliance with evolving data protection regulations.

The increasing sophistication of cyberattacks presents a constant challenge for companies like EXFO. For instance, the global average cost of a data breach reached $4.45 million in 2024, according to IBM's Cost of a Data Breach Report. This highlights the financial and reputational damage that can result from security failures. EXFO must therefore invest heavily in advanced cybersecurity protocols to protect its own infrastructure and, critically, the sensitive network data it manages on behalf of its clients.

- Escalating Cyber Threats: EXFO's reliance on network data analytics exposes it to sophisticated cyberattacks targeting sensitive information.

- Data Privacy Compliance: Adhering to global data privacy laws, such as GDPR and CCPA, is paramount to avoid significant fines and legal repercussions.

- Customer Trust: A single data breach could severely erode customer confidence, impacting future sales and partnerships.

- Operational Disruption: Cybersecurity incidents can lead to service interruptions, directly affecting EXFO's ability to deliver its solutions and generate revenue.

EXFO faces intense competition from established players and emerging innovators, potentially leading to price wars that could erode profit margins. For example, the gross margin for EXFO in Q1 FY24 was 37.5%, a figure vulnerable to aggressive pricing strategies. Furthermore, the rapid evolution of telecommunications technologies, including the ongoing development of 5G Advanced and early 6G, necessitates continuous investment in R&D to prevent its solutions from becoming obsolete.

Economic downturns pose a significant threat by reducing capital expenditure from network operators, directly impacting demand for EXFO's services. The complex and costly rollout of 5G and future 6G networks, coupled with regulatory hurdles and integration challenges, can also delay adoption of new testing tools. Finally, EXFO's increasing reliance on network data analytics exposes it to escalating cybersecurity risks, with the global average cost of a data breach reaching $4.45 million in 2024, threatening customer trust and operational continuity.

SWOT Analysis Data Sources

This EXFO SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence, and expert industry commentary to ensure accurate and actionable insights.