EXFO Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EXFO Bundle

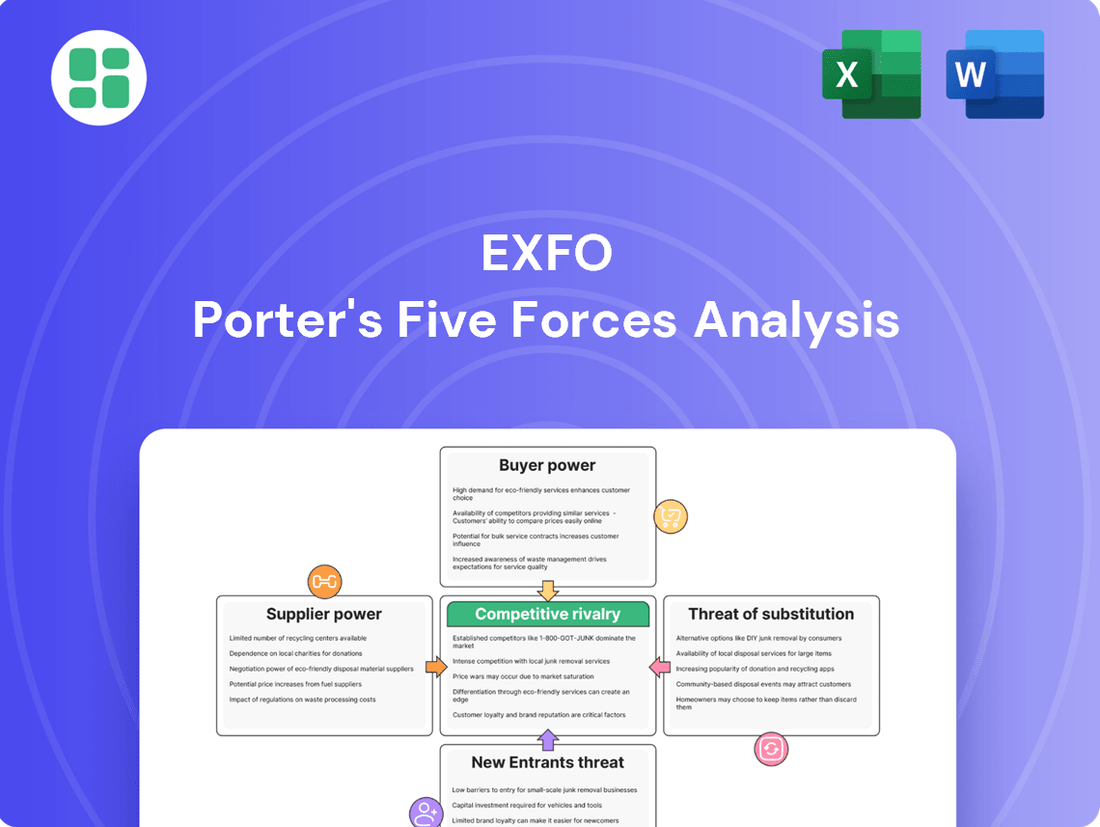

EXFO's competitive landscape is shaped by the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry. Understanding these forces is crucial for navigating the dynamic telecommunications testing and measurement market.

The complete report reveals the real forces shaping EXFO’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

EXFO's reliance on suppliers for highly specialized optical and electronic components, essential for its advanced test and measurement equipment, directly impacts its bargaining power. The proprietary nature of some of these critical parts means suppliers can wield considerable influence, especially when alternative sources are scarce.

This dependence can translate into higher input costs for EXFO, potentially squeezing profit margins. For instance, in the semiconductor industry, a key supplier of advanced optical chips might dictate terms, particularly if they possess unique intellectual property or significant manufacturing capacity that is difficult for competitors to replicate quickly. This situation was evident in 2023 and early 2024, where shortages in certain specialized electronic components affected various technology sectors, including test and measurement, leading to price increases and longer lead times.

The telecommunications test and measurement sector, where EXFO operates, heavily relies on highly skilled engineers and R&D talent. This demand is amplified by the swift advancements in technologies such as 5G and fiber optics, making specialized expertise crucial for innovation and product development.

Suppliers of this critical talent, including universities and specialized recruitment firms, can wield significant bargaining power. This is largely due to the inherent scarcity of professionals possessing the niche skills required in this rapidly evolving industry. For instance, the global demand for telecommunications engineers saw a significant uptick in 2024, with some regions experiencing shortages of up to 20% for highly specialized roles.

To counter this supplier leverage, EXFO must prioritize robust internal talent development programs and offer competitive compensation packages. Investing in training and retaining top-tier R&D professionals is paramount to ensuring EXFO maintains its technological edge and operational efficiency in a competitive landscape.

As EXFO increasingly relies on software, AI, and cloud-native solutions, its dependence on third-party software and analytics platform providers grows. These suppliers, especially those offering essential or proprietary technologies, can wield significant influence over pricing and contract terms. For instance, a critical operating system provider or a specialized AI analytics platform could dictate favorable terms if their solution is deeply embedded and difficult to replace.

Limited Number of Niche Suppliers

In highly specialized segments of the test and measurement market, EXFO may face suppliers with significant bargaining power due to a limited number of qualified providers for critical sub-systems or intellectual property. This concentration of supply means these few suppliers can exert considerable influence over EXFO. For instance, in 2024, the semiconductor industry, a key supplier for advanced testing equipment components, saw lead times for certain specialized chips extend by up to 30% compared to 2023, impacting availability and pricing for equipment manufacturers.

This limited supplier base can translate into higher costs and less favorable terms for EXFO. Strategic measures like establishing long-term contracts and fostering deep partnerships with these niche suppliers are crucial for mitigating this risk. Such alliances can ensure supply continuity and potentially secure more stable pricing, even amidst market volatility. For example, EXFO's 2023 annual report highlighted a strategic partnership with a leading photonics component supplier, which helped maintain a steady supply of essential modules despite broader industry shortages.

The bargaining power of these niche suppliers is amplified by the proprietary nature of their technology or the high barriers to entry for new competitors. This scarcity of alternatives means EXFO has fewer options when sourcing these critical inputs. Consequently, the financial implications can be substantial, affecting EXFO's cost of goods sold and overall profitability. In 2024, companies specializing in advanced optical test modules, a core area for EXFO, reported average profit margins of 25%, reflecting the premium placed on their specialized expertise and limited production capacity.

- Limited Supplier Pool: Certain critical components for EXFO's advanced test and measurement solutions are sourced from a small number of highly specialized providers.

- Supplier Influence: This concentration grants these niche suppliers substantial leverage in price negotiations and contract terms.

- Risk Mitigation: Long-term contracts and strategic alliances are key strategies EXFO employs to manage supplier power and ensure supply chain stability.

- Market Dynamics: In 2024, extended lead times for specialized semiconductor components and the high profit margins of niche technology providers underscore the significant bargaining power these suppliers can wield.

Proprietary Technology and Patents

Suppliers possessing exclusive patents or proprietary technologies crucial for EXFO's product development can significantly influence terms and pricing. EXFO's innovation and competitive standing often hinge on its access to or licensing of these core technologies. This dependency allows suppliers to potentially charge premium prices or enforce stringent licensing terms.

For instance, in the telecommunications testing sector, specialized component manufacturers or software developers holding key patents for advanced optical testing or network monitoring solutions can wield considerable power. If EXFO relies on a unique chipset or a patented algorithm for its high-performance test equipment, that supplier's leverage increases substantially. This can translate to higher input costs for EXFO, impacting its profit margins and pricing strategies for its end products.

- Supplier Leverage: Suppliers with patented, essential technologies can dictate terms and pricing to EXFO.

- Innovation Dependency: EXFO's ability to innovate is tied to its access to these foundational technologies.

- Cost Implications: Reliance on patented components can lead to higher manufacturing costs for EXFO.

EXFO faces significant supplier bargaining power due to its reliance on specialized components and talent. Suppliers of proprietary optical and electronic parts, particularly those with unique intellectual property and limited competition, can command higher prices and dictate terms, impacting EXFO's costs. For example, in 2024, shortages in specialized semiconductor components led to price increases and extended lead times across the tech industry, affecting equipment manufacturers like EXFO.

The scarcity of highly skilled engineers in telecommunications, driven by rapid technological advancements like 5G, further empowers talent suppliers. This demand can result in higher labor costs, as seen in 2024 with regional shortages of specialized telecom engineers reaching up to 20%. EXFO's strategic partnerships and internal talent development are crucial to mitigate this leverage.

Furthermore, EXFO's increasing dependence on third-party software, AI, and cloud-native solutions means providers of these essential or proprietary technologies can exert considerable influence. Suppliers holding key patents for advanced optical testing or network monitoring solutions can also charge premium prices, directly affecting EXFO's manufacturing costs and profit margins. In 2024, specialized optical test module providers reported average profit margins of 25%, highlighting the premium on their niche expertise.

| Factor | Impact on EXFO | Example (2023-2024 Data) |

|---|---|---|

| Specialized Component Suppliers | Higher input costs, potential supply chain disruptions | Extended lead times (up to 30%) for specialized semiconductor chips; 25% profit margins for niche optical test module providers. |

| Talent Suppliers (Specialized Engineers) | Increased labor costs, competition for skilled personnel | Up to 20% shortage of specialized telecom engineers in certain regions. |

| Proprietary Technology/Software Suppliers | Premium pricing, stringent licensing terms, innovation dependency | Key patents for advanced optical testing solutions can lead to higher manufacturing costs for EXFO. |

What is included in the product

This analysis unpacks the competitive forces impacting EXFO, detailing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the telecommunications testing and service assurance market.

Effortlessly identify and quantify competitive threats with pre-built templates for each force, eliminating the guesswork in strategic planning.

Customers Bargaining Power

EXFO's customer base is heavily concentrated among major players like Communications Service Providers (CSPs), equipment manufacturers, and web-scale companies. It's reported that over 95% of the top CSPs utilize EXFO's offerings, highlighting the significant market penetration within this segment.

These large-scale customers typically procure products and services in substantial volumes. This purchasing power grants them considerable leverage in negotiations, enabling them to influence pricing, request tailored functionalities, and secure more favorable service contract terms.

The strategic importance and sheer size of these clients mean they wield significant influence as buyers within the industry. Their ability to dictate terms can impact EXFO's profitability and product development roadmap.

While EXFO's customer base includes large telecommunications operators and equipment manufacturers, their bargaining power is somewhat constrained by high switching costs. The deep integration of EXFO's advanced test, monitoring, and analytics solutions into the intricate architectures of these networks means that changing providers is a complex and costly undertaking. For instance, a significant network operator might face millions in expenses for new hardware, software compatibility, and retraining staff if they were to switch from EXFO, effectively dampening their immediate ability to demand lower prices or better terms.

The criticality of network performance significantly dampens customer bargaining power for EXFO. Because network reliability and speed are paramount for telecommunications companies, they are less likely to switch providers solely based on price. In 2024, network downtime can cost operators millions, making proven solutions like EXFO's essential for maintaining service quality and customer satisfaction.

Potential for In-House Solutions

Large network operators and web-scale companies, such as Amazon or Google, possess significant financial and technical resources. These entities can potentially develop their own testing and monitoring solutions, particularly for more common or less specialized requirements. This capability acts as a powerful bargaining lever.

The ability of major customers to create in-house alternatives directly pressures EXFO's pricing power. It necessitates a constant drive for innovation and the development of highly specialized, value-added features to maintain a competitive edge and justify premium pricing. For instance, if a major telecom operator can replicate 70% of a specific testing functionality internally, they will be less willing to pay for the full suite from an external vendor.

- In-house development capability: Large customers can leverage their substantial R&D budgets and engineering talent for self-sufficiency in testing solutions.

- Threat of vertical integration: This potential for customers to bring testing functions in-house poses a credible threat to EXFO's market share and pricing flexibility.

- Impact on pricing: EXFO must offer compelling value and differentiation to prevent customers from opting for internal solutions, especially for standard testing needs.

- Driver for innovation: The customer's ability to develop alternatives incentivizes EXFO to continuously enhance its product portfolio with advanced capabilities and unique selling propositions.

Price Sensitivity and Market Alternatives

Even with substantial switching costs, major clients of EXFO demonstrate significant price sensitivity. This is primarily driven by the presence of numerous well-established competitors in the market, such as Keysight Technologies, VIAVI Solutions, and Spirent Communications. These alternatives provide customers with leverage.

Customers can effectively use competitive bidding processes and the availability of alternative solutions to pressure EXFO on pricing. This is particularly true for products that are more standardized or have become commoditized within the industry, where differentiation is less pronounced.

- Price Sensitivity: Large customers remain sensitive to price, despite high switching costs.

- Market Alternatives: Competitors like Keysight, VIAVI, and Spirent offer viable options.

- Customer Leverage: Customers can use competitive bids to influence EXFO's pricing.

- Commoditization Impact: Standardized product aspects are more susceptible to price pressure.

EXFO's customer concentration among major Communications Service Providers (CSPs) and web-scale companies grants these clients significant bargaining power. Over 95% of top CSPs use EXFO, meaning these large buyers can influence pricing and demand tailored solutions due to their substantial order volumes.

Despite high switching costs due to deep integration, customers can leverage the competitive landscape. With players like Keysight, VIAVI, and Spirent offering alternatives, customers can use competitive bidding to pressure EXFO, especially for more standardized products. This price sensitivity means EXFO must continuously innovate to justify its value.

The potential for large customers to develop in-house testing solutions also acts as a powerful bargaining lever. This threat compels EXFO to differentiate its offerings with advanced capabilities and unique selling propositions to maintain pricing power and market share.

| Customer Segment | Bargaining Power Factors | Impact on EXFO |

|---|---|---|

| Major CSPs | High volume purchases, price sensitivity, competitive alternatives | Price pressure, demand for tailored solutions |

| Web-Scale Companies | Financial resources for in-house development, technical expertise | Threat of vertical integration, pressure on pricing for standard functions |

| Equipment Manufacturers | Integration into broader product offerings, volume commitments | Negotiating leverage on bundled solutions and pricing |

Full Version Awaits

EXFO Porter's Five Forces Analysis

This preview showcases the complete EXFO Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within EXFO's industry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into the forces shaping EXFO's strategic environment. You're looking at the actual document, which includes a thorough breakdown of buyer power, supplier power, threat of new entrants, threat of substitutes, and industry rivalry, all ready for immediate application.

Rivalry Among Competitors

EXFO operates in a communications test and measurement market dominated by formidable global players. Companies like Keysight Technologies, VIAVI Solutions, Spirent Communications, Fortive Corp, and Anritsu are significant forces, boasting substantial research and development budgets and comprehensive product offerings.

These established competitors have cultivated extensive global distribution and support networks, enabling them to reach a broad customer base effectively. Their deep market penetration and brand recognition create a high barrier to entry for newer or smaller companies looking to gain market share.

For instance, Keysight Technologies reported revenues of $5.46 billion for the fiscal year ending September 2023, demonstrating its significant scale and market presence. Similarly, VIAVI Solutions, a key competitor, generated $1.33 billion in revenue for its fiscal year ending June 2023, highlighting the substantial resources available to major players in this sector.

The telecommunications industry is experiencing significant expansion, with the 5G testing market expected to grow at a compound annual growth rate of 10.2% between 2024 and 2025. Similarly, the broader communication test and measurement market is projected for 10% growth during the same timeframe. This robust growth is largely attributed to the ongoing rollout of 5G networks and the expansion of fiber optic infrastructure, creating a fertile ground for increased competition among established and emerging players.

This dynamic market environment, characterized by high industry growth, naturally intensifies competitive rivalry. As companies see substantial opportunities arising from 5G deployments and the increasing complexity of network infrastructure, existing players are motivated to expand their market share. Simultaneously, new entrants are attracted to the sector, leading to a more crowded competitive landscape where companies actively compete for new contracts and technological leadership.

Competitive rivalry in this sector is fueled by a relentless pursuit of innovation and distinct product offerings. Companies are heavily investing in cutting-edge technologies such as AI/ML integration for smarter testing, cloud-native solutions for flexibility, and advancements for emerging standards like 6G and Wi-Fi 7.

EXFO, a prominent player in fiber optic test solutions, exemplifies this trend by prioritizing R&D to deliver enhanced performance and unique features. For instance, EXFO's continued investment in its optical portfolio, a key area for differentiation, aims to provide integrated solutions that meet the evolving demands of network operators and service providers.

Significant Fixed Costs and Scale Economies

Developing and producing advanced test and measurement gear demands significant upfront investment in research and development, specialized manufacturing plants, and patents. This reality means companies must achieve economies of scale to be competitive.

This drive for scale intensifies rivalry, as firms vie for major client agreements and strive to keep production lines running at high capacity. For instance, EXFO's significant investments in R&D for 5G testing solutions, which can run into tens of millions of dollars annually, underscore these high fixed costs.

- High R&D Investment: Companies like EXFO pour substantial resources into developing cutting-edge technology, creating a barrier for smaller players.

- Economies of Scale: Larger production volumes allow companies to spread fixed costs over more units, enabling more aggressive pricing.

- Customer Contract Competition: The need for large, consistent orders fuels intense competition for major contracts with telecom operators and equipment manufacturers.

- Pricing Pressure: Firms with greater scale can often offer lower prices, putting pressure on less scaled competitors.

Mergers, Acquisitions, and Strategic Alliances

The competitive landscape for EXFO is being reshaped by significant merger and acquisition (M&A) activity. A prime example is Emerson's acquisition of NI for $10 billion, a deal completed in 2023. This consolidation trend points towards the emergence of larger, more comprehensive 'one-stop-shop' solution providers, directly impacting industry rivalry.

These strategic moves intensify competition by bolstering the market standing of the newly formed entities. For EXFO, this means facing more powerful and integrated rivals, potentially leading to greater market concentration and a more challenging environment for smaller players seeking to gain or maintain market share.

- Emerson's $10 billion acquisition of NI in 2023

- Trend towards consolidation creating 'one-stop-shop' providers

- Strengthened market positions of combined entities

- Increased market concentration and more formidable competitors for EXFO

Competitive rivalry within EXFO's market is intense, driven by a few large, global players with significant R&D budgets and established distribution networks. Companies like Keysight Technologies, with fiscal year 2023 revenues of $5.46 billion, and VIAVI Solutions, reporting $1.33 billion in fiscal year 2023, demonstrate the substantial scale of these competitors.

The market is characterized by high growth, with the 5G testing sector expected to grow at a 10.2% CAGR from 2024-2025, and the broader communications test and measurement market projected for 10% growth in the same period. This expansion attracts new entrants and spurs existing players to innovate and capture market share, leading to fierce competition for contracts and technological leadership.

Mergers and acquisitions, such as Emerson's $10 billion acquisition of NI in 2023, are further consolidating the market, creating larger, more comprehensive competitors and increasing overall market concentration.

| Competitor | Fiscal Year End | Revenue (USD Billions) |

| Keysight Technologies | September 2023 | 5.46 |

| VIAVI Solutions | June 2023 | 1.33 |

SSubstitutes Threaten

Major network operators, including large telecommunication companies and web-scale entities, are EXFO's primary customers. These giants often have substantial internal research and development (R&D) departments. This capability allows them to develop certain network testing or monitoring tools themselves, directly competing with EXFO's offerings.

While EXFO provides specialized and integrated solutions, these powerful customers might choose to build their own tailored tools. This is particularly true for less complex or proprietary network elements where they see an advantage in self-development, thereby reducing their dependence on external vendors like EXFO.

For basic network health monitoring and general IT infrastructure oversight, customers might consider generic IT monitoring software or open-source network performance tools as substitutes.

These alternatives, while lacking the specialized depth and precision of EXFO's telecommunications-focused solutions, can offer a lower-cost option for fundamental requirements.

For instance, in 2024, the IT monitoring market saw significant growth, with many businesses adopting cloud-based solutions that offer broad functionality at competitive price points, potentially diverting some demand from specialized telecom equipment providers.

The increasing adoption of cloud computing and cloud-native network architectures presents a significant threat of substitutes for traditional monitoring and assurance platforms. These cloud environments often embed monitoring and assurance capabilities directly within their ecosystems, reducing the need for external solutions.

Cloud-based communication services and network automation platforms are emerging as partial substitutes. For instance, many hyperscalers offer integrated monitoring tools as part of their cloud service packages. By the end of 2024, it's projected that over 90% of enterprises will be using hybrid or multi-cloud environments, increasing their reliance on these embedded cloud capabilities.

Alternative Network Technologies and Architectures

The threat of substitutes for EXFO's testing solutions is significantly influenced by evolving network technologies. The full adoption of Software-Defined Networking (SDN) and Network Functions Virtualization (NFV) promises more agile and programmable networks, potentially reducing reliance on traditional, hardware-centric testing methods. For instance, by 2024, the global NFV market was projected to reach over $60 billion, indicating a substantial shift towards virtualized infrastructure.

Further advancements, such as the anticipated rollout of 6G, could introduce networks with enhanced self-optimization and self-diagnosis capabilities. If these future networks can autonomously identify and resolve issues, the demand for external test and measurement equipment could diminish. This shift could reduce the perceived need for EXFO's specialized diagnostic tools if the underlying network infrastructure becomes inherently more resilient and capable of internal troubleshooting.

- Emerging Network Paradigms: SDN and NFV enable greater network programmability and flexibility, potentially reducing the need for some traditional testing equipment.

- Self-Healing Networks: Future technologies like 6G aim for increased network autonomy, which could lead to built-in diagnostic capabilities that substitute external testing.

- Market Trends: The growing adoption of virtualized network functions, with the NFV market exceeding $60 billion by 2024, highlights a move towards architectures that may integrate testing differently.

- Impact on EXFO: A significant shift towards self-optimizing networks could decrease the demand for EXFO's core external test and measurement solutions.

Emergence of Predictive Analytics and AI-driven Automation

The increasing sophistication of predictive analytics and AI-driven automation presents a significant threat of substitution for traditional network testing solutions. As artificial intelligence and machine learning become more ingrained in network operations, these advanced systems can proactively pinpoint and resolve network issues before they become critical. This capability could diminish the reliance on manual testing procedures and specialized diagnostic equipment that companies like EXFO traditionally offer.

This trend is particularly relevant as the market for AI in network management is rapidly expanding. For instance, Gartner projected that by 2025, AI-driven network automation would be implemented in over 50% of enterprise networks, a substantial increase from previous years. This integration means that AI can potentially perform many of the diagnostic and troubleshooting functions currently handled by EXFO's hardware and software, thereby acting as a direct substitute.

- AI-powered network monitoring platforms can predict failures with high accuracy, reducing the need for reactive testing.

- Automated root cause analysis by AI can replace manual troubleshooting processes.

- The growing adoption of AI in telecommunications infrastructure signifies a shift away from reliance on standalone diagnostic tools.

The threat of substitutes for EXFO is amplified by the rise of integrated, in-network monitoring capabilities. As network operators increasingly adopt cloud-native architectures and leverage hyperscaler offerings, they gain access to embedded monitoring tools. This trend is underscored by the projected over 90% adoption of hybrid or multi-cloud environments by enterprises by the end of 2024, leading to a reduced need for external, specialized solutions.

Furthermore, advancements in AI and machine learning are enabling self-healing and self-optimizing networks. These intelligent systems can proactively identify and resolve issues, diminishing reliance on traditional, external test and measurement equipment. With AI-driven network automation projected for implementation in over 50% of enterprise networks by 2025, the demand for EXFO's core diagnostic offerings faces direct substitution.

| Substitute Category | Key Characteristics | Impact on EXFO | Examples |

| In-house Development | Custom solutions for specific network needs | Reduced reliance on external vendors | Large operators building proprietary testing tools |

| Generic IT Monitoring | Basic network health and performance tracking | Lower cost alternative for fundamental needs | Open-source network performance tools |

| Cloud-Native Monitoring | Embedded capabilities within cloud ecosystems | Decreased demand for external platforms | Hyperscaler integrated monitoring services |

| AI/ML Automation | Proactive issue prediction and resolution | Diminished need for manual testing | AI-powered network management platforms |

Entrants Threaten

Entering the communications test and measurement sector, especially for cutting-edge technologies like 5G and fiber optics, demands significant upfront capital. This includes substantial investment in research and development to keep pace with rapid technological advancements, as well as the establishment of specialized manufacturing facilities and extensive global distribution networks. For instance, companies need to invest heavily in photonics, signal processing, and software development to create advanced test solutions.

The telecommunications testing industry, where EXFO operates, presents a significant barrier to new entrants due to the profound need for specialized technical expertise. Success in this field hinges on deep understanding of optical physics, complex telecommunications protocols, advanced software development, and intricate network architecture. For instance, developing cutting-edge optical test equipment requires mastery of photonics and signal processing, areas with steep learning curves.

Acquiring or developing the necessary intellectual property (IP) and attracting a highly skilled workforce represent substantial hurdles for newcomers. Companies like EXFO have invested decades in building their patent portfolios and cultivating top-tier engineering talent. In 2024, the demand for engineers with expertise in 5G and future 6G technologies, crucial for network testing, remains exceptionally high, making talent acquisition a competitive and costly endeavor for any aspiring competitor.

EXFO's dominance is underscored by its claim that over 95% of top Communication Service Providers (CSPs) globally utilize its solutions. This widespread adoption points to deeply entrenched customer relationships and robust brand loyalty, making it challenging for newcomers to gain a foothold.

New entrants face a significant hurdle in displacing established providers who are not only integrated into critical operational workflows but are also trusted partners for essential functions. This high switching cost, coupled with proven reliability, creates a formidable barrier to entry.

Regulatory and Standardization Hurdles

The telecommunications sector, where EXFO operates, is a minefield of regulations and intricate international standards, particularly for emerging technologies like 5G and advanced fiber optics. For any newcomer, successfully navigating this complex web of compliance is a major barrier.

New entrants must invest heavily in understanding and adhering to these stringent requirements. Failure to comply can result in significant penalties or outright market exclusion. For instance, obtaining necessary certifications for network equipment can be a lengthy and costly process, often taking months and requiring substantial financial outlay.

Furthermore, ensuring seamless interoperability with existing network infrastructure is critical. This means new products must work flawlessly with the vast array of equipment already deployed by established players. This technical challenge adds another layer of complexity and expense for potential competitors looking to enter the market.

- Regulatory Complexity: Navigating diverse national and international telecom regulations is a significant hurdle.

- Standardization Demands: Adherence to evolving technical standards (e.g., 3GPP for 5G) is non-negotiable for market access.

- Interoperability Challenges: New entrants must ensure their solutions integrate seamlessly with existing, often proprietary, network architectures.

- Cost of Compliance: Meeting regulatory and standardization requirements can add substantial costs, estimated to be millions of dollars for comprehensive certification processes in major markets.

Economies of Scale and Cost Advantages of Incumbents

Established players in the telecommunications testing and measurement industry, such as EXFO, often leverage significant economies of scale. This advantage translates to lower per-unit costs in manufacturing, bulk purchasing power for components, and more efficient distribution networks. For example, EXFO's extensive global presence and established supply chains in 2024 allow for optimized procurement, a feat difficult for a newcomer to replicate quickly.

These cost efficiencies, built over years of operation, create substantial barriers for potential new entrants. A new company would face the daunting task of matching EXFO's established cost structure, making it challenging to compete on price and achieve profitability in the early stages of market entry. In 2023, EXFO reported revenues of approximately $1.1 billion, underscoring the scale of operations that new entrants would need to overcome.

- Economies of Scale: Incumbents benefit from lower per-unit costs in production and R&D.

- Cost Advantages: Established players can absorb market fluctuations and offer competitive pricing.

- Barriers to Entry: New entrants struggle to match the cost efficiencies of companies like EXFO.

- Profitability Challenges: New firms face difficulties achieving profitability due to higher initial costs.

The threat of new entrants into the communications test and measurement sector is significantly mitigated by the substantial capital requirements for research and development, manufacturing, and global distribution. Furthermore, the need for deep technical expertise in areas like photonics and complex network protocols creates a steep learning curve for newcomers.

Intellectual property, a skilled workforce, and strong customer relationships, exemplified by EXFO's claim that over 95% of top Communication Service Providers use its solutions, present formidable barriers. High switching costs and the need for seamless interoperability with existing infrastructure also deter new players.

Navigating complex regulations and standards, such as those for 5G, adds another layer of difficulty and cost. Established players also benefit from significant economies of scale, with EXFO's 2023 revenue of approximately $1.1 billion highlighting the operational scale new entrants must overcome to compete on cost and achieve profitability.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High investment in R&D, manufacturing, and distribution. | Makes market entry prohibitively expensive. | Significant investment in photonics and signal processing is essential. |

| Technical Expertise | Need for deep knowledge in optical physics, protocols, and software. | Steep learning curve and difficulty in acquiring talent. | Mastery of photonics is required for advanced optical test equipment. |

| Intellectual Property & Talent | Established patent portfolios and highly skilled workforce. | Challenging to replicate decades of development and talent acquisition. | High demand for 5G/6G engineers in 2024 makes talent acquisition costly. |

| Customer Relationships & Brand Loyalty | Entrenched customer base and trust in established providers. | Difficult to displace incumbents and gain market share. | Over 95% of top CSPs globally use EXFO solutions. |

| Switching Costs | Integration into operational workflows and proven reliability. | Customers are reluctant to switch due to disruption and risk. | New entrants must prove reliability to overcome established trust. |

| Regulatory & Standardization Compliance | Navigating complex telecom regulations and evolving technical standards. | Adds significant cost and time to market entry. | Certification processes can take months and cost millions. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to match cost efficiencies and pricing. | EXFO's 2023 revenue of ~$1.1 billion indicates significant scale advantages. |

Porter's Five Forces Analysis Data Sources

Our EXFO Porter's Five Forces analysis leverages comprehensive data from EXFO's annual reports, investor presentations, and relevant industry analyst reports to assess competitive intensity and strategic positioning.