Exela Technologies Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exela Technologies Bundle

Exela Technologies faces moderate bargaining power from its buyers, who can often switch providers, and significant rivalry from established competitors in the business process automation space. The threat of substitutes is also a key consideration, as alternative solutions can disrupt Exela's market share.

The complete report reveals the real forces shaping Exela Technologies’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Exela Technologies' reliance on technology providers, software vendors, and infrastructure services means supplier concentration is a key factor. When a few suppliers control essential components or specialized software, their ability to dictate terms and pricing to Exela significantly increases.

For instance, if a critical cloud service provider or a unique software module is only available from a handful of companies, Exela has less leverage. This concentration can lead to higher input costs or limited choices, impacting Exela's operational efficiency and profitability. In 2024, the IT services sector continued to see consolidation, potentially amplifying this effect for companies like Exela.

The bargaining power of suppliers for Exela Technologies is significantly impacted by switching costs. If it's costly and complex for Exela to move from one key technology or service provider to another, existing suppliers gain leverage. This can involve substantial expenses for system re-integration or extensive staff retraining, making it difficult for Exela to seek better terms or alternative providers.

The availability of substitute inputs significantly curtails a supplier's bargaining power. If Exela Technologies can easily source comparable technologies or services from alternative vendors, its leverage in negotiations with any single supplier increases. For instance, if Exela relies on a specific software for document processing, but multiple vendors offer similar functionalities, the original supplier has less ability to dictate terms or pricing. This is a crucial factor in managing input costs and ensuring operational flexibility.

Uniqueness of Supplier Offerings

Suppliers offering highly specialized or proprietary technology, such as advanced AI algorithms or niche industry-specific software, hold significant bargaining power. Exela Technologies' ability to develop these capabilities in-house or secure reliable alternatives directly influences its negotiation leverage.

For instance, if a critical component for Exela's digital transformation solutions is sourced from a single provider with unique intellectual property, that supplier can command higher prices. However, if Exela invests in developing its own proprietary software or diversifies its supplier base for key technologies, it can reduce its dependence and strengthen its position.

- Supplier Specialization: The degree to which suppliers offer unique or highly differentiated products or services.

- Exela's Mitigation Strategies: In-house development of critical technologies and diversification of the supplier pool.

- Impact on Exela: Reduced dependence on single suppliers leads to better pricing and terms.

Impact of Input on Exela's Output

The bargaining power of suppliers for Exela Technologies is significantly influenced by how critical their inputs are to Exela's core service delivery. If a specific input is indispensable for Exela's digital business process automation solutions, the supplier of that input gains considerable leverage.

For instance, specialized software components or unique data processing technologies that Exela relies on heavily would empower those suppliers. This leverage can translate into higher input costs or less favorable contract terms for Exela. In 2023, Exela reported significant investments in technology infrastructure, highlighting the importance of reliable and cost-effective sourcing for these critical inputs.

- Criticality of Inputs: Suppliers of essential software, hardware, or specialized data processing services hold more power.

- Availability of Substitutes: If few alternatives exist for a crucial input, supplier power increases.

- Supplier Concentration: A market with few dominant suppliers for a key input amplifies their bargaining strength.

- Switching Costs: High costs for Exela to switch to a different supplier for a vital component bolster the current supplier's position.

Exela Technologies faces significant supplier bargaining power when specialized inputs are critical and difficult to substitute, as seen in the IT services sector. In 2024, the increasing demand for advanced cloud solutions and AI capabilities meant that providers of these niche technologies could command higher prices, impacting Exela's cost structure.

High switching costs further embolden suppliers; if Exela invests heavily in integrating a particular vendor's system, the vendor's leverage increases due to the expense and complexity of changing providers. This situation was exacerbated in early 2024 as many companies prioritized digital transformation, leading to greater reliance on a few key technology partners.

The concentration of suppliers for essential components, such as specialized software modules or unique data processing tools, directly translates to increased supplier power. When Exela relies on a limited number of vendors for these critical inputs, those suppliers can dictate terms, potentially increasing Exela's operational expenses.

| Factor | Impact on Exela | 2024 Trend/Data |

| Supplier Concentration | Increased leverage for few dominant providers | Continued consolidation in IT services |

| Switching Costs | Reduced Exela flexibility, higher supplier power | Growing complexity of integrated systems |

| Criticality of Inputs | Empowers suppliers of essential technologies | High demand for specialized AI and cloud services |

| Availability of Substitutes | Limited substitutes amplify supplier leverage | Niche technologies often have few direct alternatives |

What is included in the product

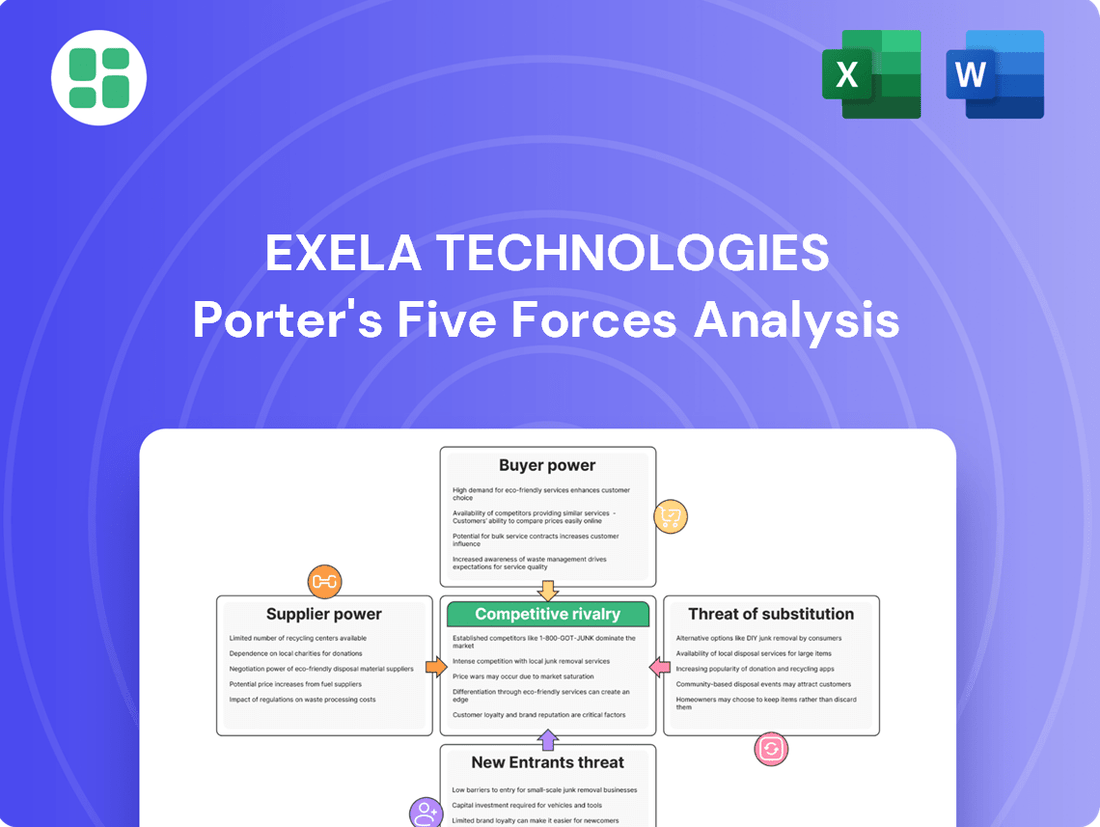

This analysis reveals the competitive pressures impacting Exela Technologies, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its industry.

Exela's Porter's Five Forces analysis provides a streamlined, visual representation of competitive pressures, simplifying complex market dynamics for immediate strategic insight.

Customers Bargaining Power

Exela Technologies serves a broad range of industries, including banking, healthcare, legal, and government sectors. A significant portion of its client base, over 60% of the Fortune® 100 companies, are large enterprises.

These large enterprise customers wield considerable bargaining power. Their substantial business volume allows them to negotiate for more favorable pricing and demand highly customized solutions tailored to their specific operational needs.

For Exela Technologies' customers, the decision to switch providers for transaction processing or enterprise information management is often a complex one due to substantial switching costs. These costs can encompass data migration, which involves transferring vast amounts of sensitive information, as well as the intricate process of re-integrating Exela's systems with the customer's existing IT infrastructure. Furthermore, employees typically require retraining on new platforms and workflows, adding another layer of expense and disruption.

These significant barriers to switching directly impact the bargaining power of Exela's customers. When it is costly and time-consuming to move to a competitor, customers are less likely to demand lower prices or more favorable terms, as the effort and expense involved in changing providers outweigh the potential benefits. This dynamic generally strengthens Exela's position, allowing them to maintain pricing and service levels more effectively.

Customers considering Exela Technologies often have a range of alternatives, significantly influencing their bargaining power. These options include building their own internal solutions, partnering with other Business Process Outsourcing (BPO) firms, or implementing readily available automation software. For instance, the rise of cloud-based, low-code/no-code platforms in 2024 has made it easier and more cost-effective for businesses to develop custom solutions in-house, reducing reliance on external providers like Exela.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Exela Technologies, particularly in markets where outsourcing is driven by cost reduction. Clients in these sectors closely scrutinize pricing, making Exela's competitive cost structure a key differentiator.

However, Exela's value proposition extends beyond mere price. By showcasing substantial cost savings and demonstrable efficiency improvements, the company can sway customer decisions, highlighting the long-term financial benefits that outweigh initial price considerations.

- Price Sensitivity in Outsourcing: Industries focused on outsourcing for cost savings often exhibit high customer price sensitivity.

- Exela's Cost Advantage: Exela Technologies leverages its operational efficiencies to offer competitive pricing, a critical factor for price-sensitive clients.

- Beyond Price: Value Proposition: The company emphasizes its ability to deliver significant cost savings and efficiency gains, influencing customer choices beyond just the initial price point.

Information Asymmetry

Information asymmetry significantly impacts customer bargaining power. When customers possess comprehensive knowledge regarding pricing, service quality, and alternatives available from competitors, their ability to negotiate favorable terms with Exela Technologies is amplified. This transparency allows them to readily identify and exploit any discrepancies in value offered.

Exela's strategy to mitigate this involves enhancing its own transparency and clearly articulating its unique value proposition. By providing customers with detailed information about its offerings and demonstrating superior service or cost-effectiveness, Exela can reduce the information gap.

- Information Asymmetry: Customers with full knowledge of pricing, service, and competitor offerings gain leverage.

- Exela's Response: Focus on transparency and a compelling value proposition to counter this.

- Impact: Reduced asymmetry empowers customers to demand better terms.

- Strategic Goal: Build trust and demonstrate clear advantages to retain customer loyalty.

Exela Technologies' large enterprise clients, representing over 60% of Fortune 100 companies, possess significant bargaining power. Their substantial business volume allows them to negotiate favorable pricing and demand highly customized solutions. While switching costs, including data migration and retraining, are high, the increasing availability of cloud-based, low-code/no-code platforms in 2024 offers customers viable alternatives to build solutions in-house, thus moderating their leverage.

| Factor | Impact on Exela's Customers | Mitigation by Exela |

|---|---|---|

| Customer Size & Volume | High bargaining power due to large contracts. | Leverage scale efficiencies to offer competitive pricing. |

| Switching Costs | High, due to data migration, integration, and retraining. | High switching costs generally reduce customer ability to demand concessions. |

| Availability of Alternatives | Growing due to cloud, low-code/no-code platforms (2024). | Focus on demonstrating superior value proposition beyond price. |

| Information Asymmetry | Customers with more information gain negotiation leverage. | Enhance transparency and clearly articulate unique value. |

Full Version Awaits

Exela Technologies Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Exela Technologies' competitive landscape through Porter's Five Forces, analyzing the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry within the business process automation industry.

Rivalry Among Competitors

Exela Technologies operates in a business process automation (BPA), enterprise information management (EIM), and business process outsourcing (BPO) landscape that is intensely competitive. The sheer volume of players, with over 1173 active competitors noted, underscores the fragmented nature of this market.

These competitors span a wide spectrum, from global technology titans such as Oracle and SAP, who offer comprehensive suites of enterprise solutions, to numerous niche BPO firms focusing on specific industries or services. This diversity means Exela must contend with both broad-based offerings and highly specialized capabilities.

The Business Process Outsourcing (BPO) and digital process automation sectors are booming. The global BPO market is anticipated to hit approximately USD 840.60 billion by 2034, showcasing substantial expansion. Similarly, the digital process automation market is forecast to reach $28.02 billion by 2029.

This robust industry growth, while generally a positive sign that can temper intense rivalry by expanding the pie, also acts as a magnet for new entrants. As these markets demonstrate significant upward trajectories, they naturally attract a greater number of competitors seeking to capitalize on the expanding opportunities, potentially intensifying competition over time.

Exela Technologies strives to stand out through its proprietary technology, advanced workflow automation, and tailored solutions for specific industries. This differentiation is crucial in a market where competitors can quickly mimic successful service models, thereby heightening competitive rivalry.

The intensity of this rivalry is directly linked to how easily competitors can match Exela's unique selling propositions. If rivals, such as HCLTech or Wipro, can readily develop similar automation tools or industry-specific platforms, the pressure on Exela to innovate and maintain its competitive edge increases significantly.

Exit Barriers

Exela Technologies likely faces significant exit barriers, which can trap even underperforming companies within the competitive landscape. These barriers, such as specialized IT infrastructure and long-term service agreements with clients, make it costly and difficult for firms to simply cease operations or divest assets. This situation can exacerbate competitive rivalry, as companies may continue to compete on price to cover fixed costs, even if it erodes profitability for everyone involved.

For instance, the nature of Exela's business, heavily reliant on integrated technology platforms and customer relationships, suggests substantial investments in specialized assets. Divesting these assets without significant loss would be challenging. Furthermore, the company's focus on providing business process automation and digital transformation solutions often involves multi-year contracts, creating a commitment that extends beyond immediate profitability concerns.

- Specialized Assets: Exela's reliance on proprietary software, data centers, and integrated technology platforms represents a significant investment that is difficult to redeploy or sell at full value.

- Long-Term Contracts: Many of Exela's service agreements are multi-year commitments, obligating the company to continue providing services even if the specific segment becomes less profitable.

- Employee Severance and Transition Costs: Winding down operations or exiting specific business lines can incur substantial costs related to employee severance, retraining, and the management of customer transitions.

- Brand Reputation and Customer Relationships: A sudden exit could damage Exela's reputation and negatively impact its ability to maintain relationships with remaining clients, further complicating any divestiture strategy.

Strategic Alliances and Acquisitions

Exela Technologies actively pursues strategic alliances to bolster its competitive position. A notable example is the partnership with Michael Page, announced in January 2025, aimed at broadening Exela's service portfolio and extending its market penetration. These collaborations are crucial for adapting to evolving industry demands and accessing new customer segments.

The business process automation industry is experiencing significant consolidation. Companies like Exela are strategically acquiring smaller players or forming alliances to gain scale, technology, and market share. This ongoing M&A activity intensifies competitive rivalry by creating larger, more capable entities that can challenge established players. For instance, in 2024, the Business Process Outsourcing (BPO) market saw continued M&A activity, with deal volumes remaining robust, indicating a trend towards industry consolidation.

- Michael Page Partnership (January 2025): Expanded service offerings and market reach.

- Industry Consolidation: Ongoing mergers and acquisitions reshape the competitive landscape.

- Impact on Rivalry: Larger, consolidated entities increase competitive pressure.

The competitive rivalry within Exela Technologies' market is fierce due to a large number of players offering similar services. This is compounded by the fact that competitors can readily replicate successful service models, forcing Exela to continuously innovate. The market's growth, while beneficial, also attracts new entrants, further intensifying competition.

High exit barriers, such as specialized assets and long-term contracts, mean that even struggling companies remain in the market, potentially leading to price wars. Exela's strategic alliances, like the one with Michael Page in January 2025, and participation in industry consolidation through acquisitions, are key strategies to navigate this intense rivalry.

| Competitor Type | Examples | Market Share Impact |

| Global Tech Titans | Oracle, SAP | Offer broad enterprise solutions, challenging Exela's comprehensive offerings. |

| Niche BPO Firms | Various specialized providers | Focus on specific industries, offering tailored solutions that compete with Exela's specialized services. |

| Consolidated Entities | Acquired or merged competitors | Increased scale and capability, intensifying overall market pressure. |

SSubstitutes Threaten

Even with the drive towards digitization, some businesses still lean on older, manual methods for handling documents and financial operations. This reliance on traditional processes can act as a substitute, especially if the perceived cost and difficulty of adopting new, automated systems seem too high.

For instance, in 2024, many small to medium-sized businesses (SMBs) might still be processing invoices manually, viewing the investment in new software as a barrier. This inertia means that solutions like Exela's automation offerings face competition not just from direct digital rivals, but also from the status quo of manual workarounds.

Large enterprises increasingly possess the resources and technical expertise to develop their own in-house automation solutions, bypassing external providers like Exela Technologies. This trend is amplified by the growing accessibility and sophistication of low-code and no-code platforms, which significantly lower the barrier to entry for internal development, potentially impacting Exela's market share in automation services.

Customers increasingly consider readily available, off-the-shelf software solutions as viable substitutes for comprehensive Business Process Outsourcing (BPO) or Business Process Automation (BPA) services. These generic tools, while often less integrated, can effectively address specific functional needs, thereby acting as substitutes for portions of Exela Technologies' broader service portfolio.

For instance, businesses might adopt specialized project management software or customer relationship management (CRM) platforms instead of fully outsourcing these functions. This trend is amplified by the growing accessibility and affordability of cloud-based software, making it easier for companies to manage certain processes internally.

Alternative Outsourcing Models

The threat of substitutes for Exela Technologies' integrated outsourcing solutions is significant, as businesses can opt for alternative models. Instead of a single, comprehensive provider like Exela, companies might choose to outsource distinct business processes to multiple specialized vendors. This fragmented approach offers flexibility and allows businesses to cherry-pick best-in-class services for each function. Furthermore, hybrid models, combining in-house capabilities with outsourced services from various providers, present another substitute. These alternatives can fragment the market and reduce reliance on any single large-scale outsourcing partner.

These alternative outsourcing models can impact Exela's market share and pricing power. For instance, a company might use one vendor for customer service, another for IT support, and a third for back-office processing. This fragmentation allows for greater customization and potentially lower costs for specific functions, directly competing with Exela's all-in-one offerings. In 2023, the global business process outsourcing (BPO) market was valued at approximately $270 billion, with a significant portion driven by specialized service providers, highlighting the competitive landscape.

- Fragmented Outsourcing: Businesses can engage multiple specialized vendors for different functions, bypassing the need for a single, integrated provider.

- Hybrid Models: Combining in-house expertise with outsourced services from various sources offers a flexible alternative to comprehensive outsourcing packages.

- Cost and Specialization Benefits: These substitute models can offer cost efficiencies and access to niche expertise that a single provider might not match.

- Market Impact: The availability of these alternatives pressures integrated providers like Exela to maintain competitive pricing and service quality.

Emerging Technologies and AI Tools

The rise of AI-driven automation and intelligent process automation tools poses a significant threat of substitutes for Exela Technologies. Companies can now leverage these advanced technologies from various providers to achieve similar efficiency gains and cost reductions without needing to outsource their entire business processes. This trend is accelerating, with the global AI market projected to reach over $1.8 trillion by 2030, indicating a substantial shift towards in-house AI adoption.

These emerging technologies offer flexible and often more cost-effective solutions compared to traditional outsourcing models. For instance, machine learning algorithms can automate tasks previously handled by BPO providers, directly impacting demand for Exela's services. The increasing accessibility and sophistication of these tools mean that clients can build or acquire capabilities that directly compete with Exela's core offerings.

- AI Market Growth: The global AI market is expected to exceed $1.8 trillion by 2030, highlighting the increasing adoption of AI solutions.

- Automation Adoption: Businesses are increasingly investing in automation to streamline operations, potentially reducing reliance on outsourced services.

- In-house Capabilities: The availability of advanced AI tools allows companies to develop their own automation solutions, creating a direct substitute for BPO providers like Exela.

The threat of substitutes for Exela Technologies is multifaceted, ranging from manual processes to sophisticated AI. Businesses can opt for specialized software, fragmented outsourcing, or even in-house development, each acting as a substitute for Exela's integrated solutions.

For instance, the global market for Robotic Process Automation (RPA) alone was valued at approximately $3.7 billion in 2023, indicating a strong trend towards adopting automation tools that can replace outsourced functions.

These alternatives often provide greater flexibility and cost efficiencies for specific tasks, directly challenging Exela's comprehensive offerings.

The increasing accessibility of advanced technologies like AI further intensifies this threat, enabling companies to build their own automation capabilities.

| Substitute Category | Examples | 2023 Market Data/Trend |

| Manual Processes | In-house invoice processing, paper-based workflows | Still prevalent in SMBs, inertia to adopt new tech |

| Off-the-Shelf Software | CRM, Project Management tools | Cloud-based solutions make internal management easier |

| Fragmented Outsourcing | Multiple specialized vendors for different functions | Global BPO market ~$270 billion, driven by specialists |

| AI-Driven Automation | RPA, Intelligent Process Automation | RPA market ~$3.7 billion in 2023; AI market projected >$1.8 trillion by 2030 |

Entrants Threaten

Entering the digital business process automation and enterprise information management sectors, where Exela Technologies operates, demands substantial upfront capital. This includes significant investment in developing and maintaining sophisticated technology platforms, robust IT infrastructure, and attracting specialized talent. For instance, companies in this space often spend millions on cloud computing, data security, and AI development.

Exela Technologies' threat of new entrants is significantly mitigated by its proprietary technology and decades of accumulated expertise. Developing comparable advanced technology and gaining the deep industry knowledge required to manage mission-critical processes effectively poses a substantial barrier for potential newcomers. For instance, Exela's specialized solutions in areas like healthcare revenue cycle management or financial document processing require intricate understanding and robust, often patented, technological infrastructure that is difficult and costly to replicate.

Established players like Exela Technologies leverage significant economies of scale, enabling them to process vast transaction volumes at a lower per-unit cost. This cost advantage makes it difficult for new entrants to compete effectively from the outset.

Furthermore, Exela benefits from economies of scope by offering a diverse range of services across multiple industries, creating bundled solutions and cross-selling opportunities. This broad service offering presents a barrier to entry for newcomers who may initially focus on a narrower market segment.

Customer Loyalty and Switching Costs

Exela Technologies' strong customer base, serving over 4,000 clients worldwide, including a substantial number of Fortune 100 companies, indicates a significant level of customer loyalty. This extensive reach creates a formidable barrier for potential new entrants aiming to capture market share.

The high switching costs associated with Exela's integrated solutions make it challenging and expensive for customers to transition to a competitor. This inertia further solidifies Exela's position and discourages new companies from entering the market.

- Customer Retention: Exela's large global customer base suggests high retention rates.

- Switching Barriers: The complexity and cost of migrating Exela's services deter new entrants.

- Market Stability: High switching costs contribute to a more stable market, reducing the threat of new competitors.

- Competitive Advantage: Exela's established relationships and ingrained services create a durable competitive advantage.

Regulatory and Compliance Hurdles

Exela Technologies operates in sectors like banking and healthcare, which are heavily regulated. This means new companies wanting to enter must meet strict compliance rules and robust data security measures. For instance, HIPAA regulations in healthcare demand significant investment in secure data handling, a cost that can deter smaller, less capitalized entrants.

Navigating these complex and ever-evolving regulatory landscapes presents a substantial barrier. Potential competitors must invest heavily in legal expertise, compliance infrastructure, and ongoing monitoring to ensure adherence. This significantly raises the cost and complexity of market entry, thereby reducing the threat of new entrants for established players like Exela.

- High Compliance Costs: Industries like finance and healthcare necessitate adherence to regulations such as GDPR, CCPA, and HIPAA, imposing significant operational and technological expenses on all participants.

- Data Security Demands: Stringent data protection requirements, including encryption and access controls, require substantial upfront and ongoing investment, creating a high barrier for newcomers.

- Industry-Specific Certifications: Obtaining necessary certifications and approvals within regulated sectors can be a lengthy and costly process, limiting the speed at which new competitors can enter the market.

The threat of new entrants for Exela Technologies is generally considered low to moderate. Significant capital investment is required for technology development and infrastructure, with companies often spending millions on cloud computing and AI. Exela's proprietary technology and deep industry expertise, built over decades, also present a formidable barrier, as replicating these advanced solutions is both costly and time-consuming.

Furthermore, Exela benefits from economies of scale and scope, offering diverse services that create bundled solutions and cross-selling opportunities, making it difficult for niche entrants to compete. High customer retention, evidenced by its over 4,000 clients including Fortune 100 companies, and substantial switching costs for its integrated solutions, further solidify its market position and deter new competition.

The highly regulated nature of Exela's operating sectors, such as banking and healthcare, imposes significant compliance costs and data security demands. For instance, meeting HIPAA regulations requires substantial investment, creating a high barrier for less capitalized entrants and contributing to market stability.

| Barrier Type | Description | Impact on New Entrants | Example for Exela |

|---|---|---|---|

| Capital Requirements | High upfront investment in technology, infrastructure, and talent. | Deters smaller, less-funded competitors. | Millions spent on cloud, AI, and data security platforms. |

| Proprietary Technology & Expertise | Developed advanced solutions and deep industry knowledge. | Difficult and costly for newcomers to replicate. | Specialized healthcare revenue cycle management solutions. |

| Economies of Scale & Scope | Lower per-unit costs due to high transaction volumes and diverse service offerings. | Makes it hard for new entrants to compete on price. | Bundled solutions across multiple industries. |

| Customer Loyalty & Switching Costs | Established client base and integrated solutions that are expensive to migrate. | Creates customer inertia and discourages switching. | Over 4,000 clients, including Fortune 100 companies, with ingrained services. |

| Regulatory Compliance | Strict rules in banking and healthcare requiring adherence to data security and privacy. | Increases costs and complexity for market entry. | HIPAA compliance in healthcare; GDPR in financial services. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Exela Technologies leverages a comprehensive data strategy, incorporating insights from their annual reports, investor presentations, and SEC filings. We supplement this with data from reputable industry research firms and market intelligence platforms to provide a robust assessment of the competitive landscape.