Exela Technologies Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Exela Technologies Bundle

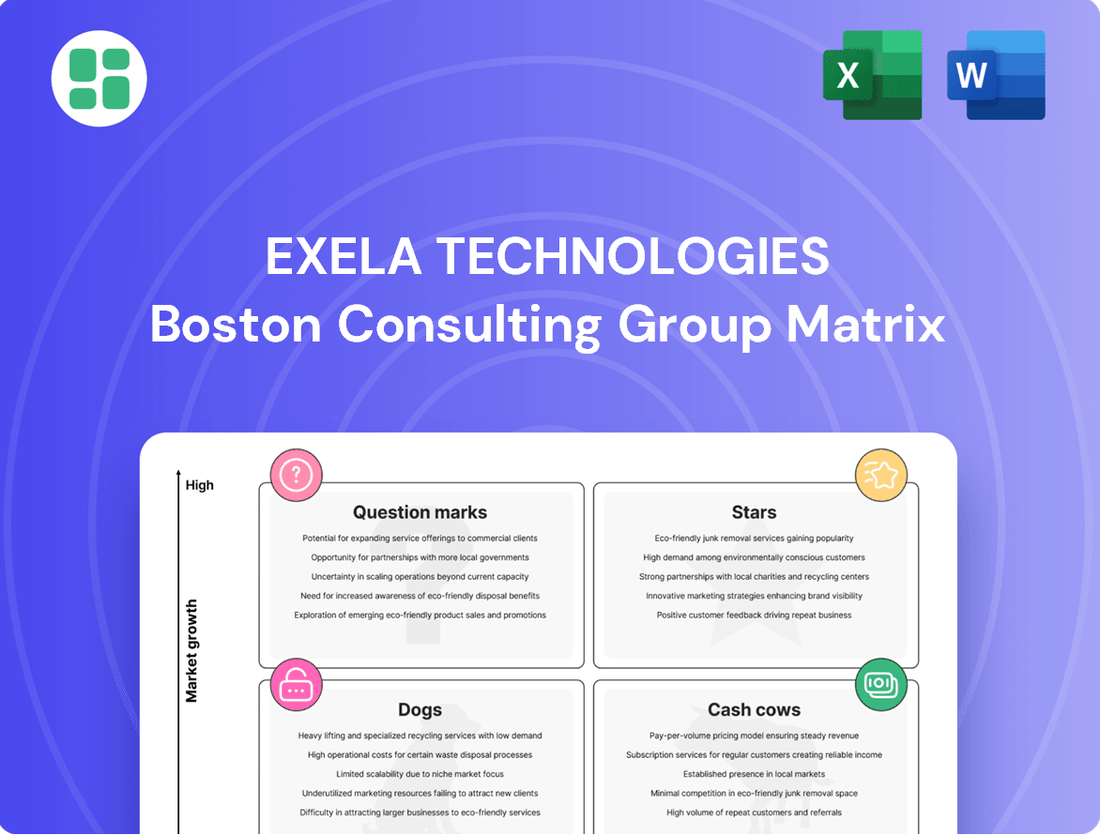

Curious about Exela Technologies' market position? This preview offers a glimpse into their strategic landscape, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Ready to unlock the full picture and make informed decisions? Purchase the complete BCG Matrix for a detailed breakdown and actionable insights.

Stars

Exela Technologies' intelligent content and document processing capabilities are a significant strength, as highlighted by its 'Strong Performer' designation in the Q4 2024 Forrester Wave for Task-Centric Automation Software. This recognition underscores Exela's advanced solutions in a rapidly expanding market, crucial for businesses undergoing digital transformation.

Exela Technologies is actively investing in AI-enabled automation to bolster its Business Process Automation (BPA) offerings. This strategic move targets a rapidly expanding market, with the company aiming to significantly boost client productivity and operational efficiency through these advanced solutions.

A key development in this area is the November 2024 launch of Reaktr.ai, an AI-powered SecAi Service. This initiative underscores Exela's commitment to leveraging cutting-edge artificial intelligence to provide innovative solutions to its customer base.

Exela Technologies' Digital Now solutions are cloud-hosted platforms aimed at speeding up digital transformation for businesses across different sectors. This strategic focus places Exela within the burgeoning digital transformation market, which is experiencing significant growth.

While precise market share figures for Digital Now aren't publicly detailed, the overall digital transformation market was projected to reach $1.5 trillion in 2024, highlighting the immense opportunity Exela is targeting. The company's investment in these solutions signals an ambition to become a key player in this expanding landscape.

Cloud-based Document Management Solutions

Cloud-based document management solutions are a significant growth area for Exela Technologies. The global market for these systems is expected to expand considerably, with projections indicating a compound annual growth rate of 16.6% between 2025 and 2032. Exela's focus on digitalizing and managing documents through its cloud offerings positions it well to capitalize on this robust market expansion.

This segment likely represents a Star or a strong Question Mark within Exela's portfolio, given the high growth potential of the cloud document management sector.

- Market Growth: The cloud-based document management system market is anticipated to grow at a 16.6% CAGR from 2025 to 2032.

- Exela's Offering: Exela provides cloud-based solutions for document digitalization and management.

- Strategic Alignment: Exela's services align with the strong upward trend in demand for cloud document management.

Strategic Finance and Accounting Outsourcing (FAO) Expansion

Exela Technologies is strategically expanding its Finance and Accounting Outsourcing (FAO) services, a move that positions it for growth within the Business Process Outsourcing (BPO) market. This expansion is a key component of Exela's overall strategy, aiming to capture a larger share of a rapidly evolving industry.

In January 2025, Exela announced a significant partnership with Michael Page, a global leader in specialist recruitment. This collaboration is designed to bolster Exela's FAO business unit by tapping into Michael Page's extensive talent network. The partnership underscores Exela's commitment to enhancing its service delivery capabilities and broadening its market reach in the FAO sector.

- Strategic Partnership: Exela's collaboration with Michael Page in January 2025 aims to accelerate the growth of its Finance and Accounting Outsourcing (FAO) division.

- Market Expansion: This move signals Exela's ambition to increase its market share and influence within the competitive BPO landscape.

- Talent Acquisition: Leveraging Michael Page’s recruitment expertise will be crucial for sourcing specialized talent needed to support Exela's expanding FAO operations.

- Industry Growth: The FAO segment is a growing area within BPO, and Exela's strategic focus here aligns with broader market trends favoring outsourced financial services.

Exela's cloud-based document management solutions are positioned as Stars due to the sector's robust growth. The market for these systems is projected to expand at a 16.6% CAGR from 2025 to 2032, indicating substantial future demand. Exela's focus on digitalizing and managing documents via its cloud offerings directly taps into this high-potential market.

The company's investment in AI-enabled automation, particularly with the November 2024 launch of Reaktr.ai's SecAi Service, also points to Star potential. This move targets the expanding Business Process Automation (BPA) market, aiming to enhance client productivity through advanced AI solutions.

Exela's Digital Now solutions, designed for rapid digital transformation, align with the massive digital transformation market, estimated to reach $1.5 trillion in 2024. This broad market appeal and Exela's strategic focus suggest a strong future growth trajectory.

| Business Unit/Offering | Market Growth Potential | Exela's Strategic Focus | BCG Matrix Classification |

|---|---|---|---|

| Cloud Document Management | High (16.6% CAGR 2025-2032) | Digitalization and cloud-based management | Star |

| AI-Enabled Automation (Reaktr.ai) | High (Expanding BPA market) | AI-powered SecAi Service launch | Star |

| Digital Now Solutions | Very High ($1.5 trillion market in 2024) | Accelerating digital transformation | Star |

What is included in the product

Exela's BCG Matrix analysis categorizes its business units to guide investment decisions.

It highlights which units to invest in, hold, or divest based on market share and growth.

The Exela Technologies BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of complex strategic analysis.

Cash Cows

The Core Information and Transaction Processing Solutions (ITPS) segment stands as Exela Technologies' primary revenue engine, consistently generating the highest income among its various business units. For instance, in the first quarter of 2024, ITPS contributed a significant portion of Exela's overall revenue, underscoring its dominant position.

While the ITPS segment has experienced some year-over-year revenue fluctuations, its robust revenue base and the potential for growth through large-scale projects highlight a deeply entrenched customer foundation. This established client base ensures a steady and reliable cash flow, characteristic of a mature market segment.

Exela Technologies' traditional document management services represent a classic Cash Cow. With a deep-rooted history and a significant global presence, the company excels in both physical mailroom operations and the crucial process of document digitalization. This established market, while experiencing slower growth, is a bedrock for Exela.

The sheer breadth of Exela's client base, which notably includes numerous Fortune 100 companies, underscores its substantial market share in these essential services. This strong position translates into a consistent and stable revenue stream, a hallmark of a successful Cash Cow.

Exela Technologies' legacy financial transaction processing services, a cornerstone of its offerings to the banking and financial services sector, likely command a significant market share. These established solutions benefit from the sector's stability and stringent regulatory environment, fostering long-term customer loyalty.

Characterized by enduring contracts, these services are a predictable source of consistent cash flow for Exela. Given their mature market position and established client base, the need for substantial promotional investment is typically low, allowing for efficient revenue generation.

As of the first quarter of 2024, Exela reported that its Financial Information Processing segment, which encompasses these legacy services, generated $110.2 million in revenue. This segment continues to be a vital contributor to the company's overall financial health.

North American Onsite Services Business

Exela Technologies' North American onsite services business is poised to become a significant cash cow following the planned spin-off of its BPA business. This segment typically operates embedded within client locations, generating consistent, recurring revenue from a well-established and loyal customer base. Such a profile aligns perfectly with the characteristics of a low-growth, high-market-share offering, a hallmark of cash cows in a BCG matrix.

In 2023, Exela Technologies reported that its Services segment, which includes onsite services, generated approximately $817.6 million in revenue. This segment is expected to maintain its stable performance, contributing significantly to Exela's overall financial health post-spin-off.

- Stable Revenue Streams: The onsite services model, often involving long-term contracts and embedded operations, ensures predictable and recurring income.

- Loyal Customer Base: Exela's established presence within client facilities fosters strong relationships and customer retention, minimizing churn.

- High Market Share in Niche: While the overall market might be low-growth, Exela holds a strong position within its specialized onsite service areas.

- Cash Generation: The business is expected to generate substantial cash flow, which can be reinvested in other areas of the company or returned to shareholders.

Established Public Sector Information Management

Exela Technologies' established public sector information management solutions function as a Cash Cow within its BCG Matrix. The company provides government entities with crucial information management and process automation tools. These public sector contracts are generally characterized by their stability and long-term nature, indicating Exela has secured a substantial market share in this particular segment.

This strong market position translates into consistent and dependable cash generation, even though the growth prospects for this segment are relatively modest. For instance, Exela's Public Sector segment reported revenue of $127.7 million in Q1 2024, demonstrating its ongoing contribution to the company's financial stability.

- Stable Revenue: Public sector contracts provide a predictable revenue stream.

- High Market Share: Exela holds a significant position in government information management.

- Low Growth, High Cash: Generates consistent cash flow with limited expansion opportunities.

- Q1 2024 Performance: Public Sector segment revenue reached $127.7 million.

Exela Technologies' ITPS segment, particularly its document management and financial transaction processing services, acts as a strong Cash Cow. These areas benefit from a large, established client base, including Fortune 100 companies, and long-term contracts, ensuring steady revenue. The company's Q1 2024 performance saw its Financial Information Processing segment generate $110.2 million, highlighting its consistent cash generation capability.

| Segment | Q1 2024 Revenue | BCG Classification | Key Characteristics |

| ITPS (Document Management & Financial Processing) | $110.2 million (Financial Information Processing) | Cash Cow | High market share, stable revenue, low growth, established client base |

| North American Onsite Services | $817.6 million (Services Segment 2023) | Potential Cash Cow | Recurring revenue, loyal customers, embedded operations, stable performance |

| Public Sector Information Management | $127.7 million (Public Sector Segment Q1 2024) | Cash Cow | Stable, long-term contracts, significant market share, consistent cash flow |

What You’re Viewing Is Included

Exela Technologies BCG Matrix

The Exela Technologies BCG Matrix preview you see is the definitive version you will receive upon purchase, offering a complete and unwatermarked analysis ready for immediate strategic application. This document is not a sample but the actual, fully formatted BCG Matrix report, meticulously prepared to provide actionable insights into Exela's product portfolio. Once purchased, this comprehensive report will be instantly downloadable, allowing you to seamlessly integrate its findings into your business planning and decision-making processes without any further modifications required.

Dogs

Exela Technologies' Healthcare Solutions (HS) segment is currently positioned as a Dog in the BCG Matrix. This is evidenced by its performance in the first three quarters of 2024. The segment saw a 1.1% decline in revenue during Q2 2024 and a more pronounced 5.3% drop in Q3 2024.

This downward trend is particularly concerning given that the overall healthcare IT market has been experiencing robust growth. The fact that Exela's HS segment is shrinking while its industry expands suggests a low market share and negative growth trajectory.

As a Dog, this segment likely requires significant investment to maintain its current position, yet offers limited potential for future growth or profitability. It may be consuming valuable resources without generating adequate returns, a classic characteristic of a Dog in the BCG framework.

Exela Technologies' Legal and Loss Prevention Services (LLPS) segment presents a challenging picture within its BCG Matrix. The segment experienced a 6.3% growth in Q2 2024, a positive sign, but this was followed by a 2.4% decline in Q3 2024.

Furthermore, reported margin drops within LLPS indicate underlying profitability issues. This inconsistent and often negative growth trajectory, coupled with an assumed smaller market share against dedicated legal technology providers, firmly places LLPS in the 'Dog' category, signaling a need for a thorough strategic review.

Within Exela Technologies' ITPS segment, which is its largest, a notable 15.2% year-over-year decline was observed in Q2 2024, even after accounting for the sale of its scanner business. This contraction points to specific sub-segments or older product lines struggling significantly.

These underperforming areas likely occupy small market shares within their respective niches, which are themselves experiencing low or negative growth. Such segments can become cash traps, consuming resources without generating substantial returns.

Divested High-Speed Scanner Business

Exela Technologies divested its high-speed scanner business in June 2023. This strategic move, while impacting overall revenue, was aimed at improving the company's gross margins. The sale of this segment, which had been a consistent revenue contributor, strongly suggests it was classified as a 'Dog' within the BCG Matrix framework. This implies the business line was consuming resources without generating sufficient returns or aligning with Exela's core strategic objectives.

The divestiture of the high-speed scanner business is a clear indicator of Exela's efforts to streamline its operations and focus on more profitable ventures. By shedding this unit, the company aimed to enhance its financial health and reallocate capital to areas with higher growth potential. This action aligns with the typical strategy for managing 'Dog' products, which often require significant investment for minimal return.

- Divestiture Date: June 2023

- Impact on Revenue: Decline

- Impact on Gross Margins: Improvement

- BCG Matrix Classification: Dog

Legacy On-Premise Software Solutions

Legacy on-premise software solutions for Exela Technologies likely fall into the Dogs category of the BCG Matrix. As the market increasingly favors cloud-based alternatives, these older systems, if not modernized, represent a declining market share with limited growth potential.

These solutions can be resource-intensive to maintain, often requiring significant IT support and incurring higher operational costs compared to more agile cloud offerings. This can divert capital and attention from more promising growth areas within Exela's portfolio.

For instance, while specific figures for Exela's legacy on-premise segment aren't publicly detailed in a way that directly maps to BCG categories, the broader trend in enterprise software in 2024 shows continued migration to SaaS models. Companies are actively divesting or phasing out on-premise solutions to reduce costs and improve scalability.

- Low Market Growth: The overall market for traditional on-premise software is experiencing slower growth as cloud adoption accelerates.

- Low Market Share: Exela's legacy offerings likely hold a diminishing share of the market as newer, more flexible cloud solutions gain traction.

- High Maintenance Costs: Older on-premise systems often come with substantial upkeep expenses, impacting profitability.

- Resource Drain: Continued investment in legacy systems can divert essential resources from innovation and growth initiatives.

Exela Technologies' Healthcare Solutions (HS) segment is a prime example of a Dog in the BCG Matrix, evidenced by its revenue decline of 1.1% in Q2 2024 and a steeper 5.3% drop in Q3 2024. This underperformance occurs despite a growing healthcare IT market, suggesting both low market share and a negative growth trajectory for the segment. As a Dog, HS likely demands significant investment for minimal returns, consuming resources without contributing substantially to Exela's overall profitability.

| Segment | BCG Category | Q2 2024 Revenue Change | Q3 2024 Revenue Change | Key Characteristic |

|---|---|---|---|---|

| Healthcare Solutions (HS) | Dog | -1.1% | -5.3% | Shrinking revenue in a growing market. |

| Legal and Loss Prevention Services (LLPS) | Dog | +6.3% | -2.4% | Inconsistent growth and reported margin drops. |

| Information Technology & Professional Services (ITPS) | Dog | -15.2% (YoY) | N/A | Significant contraction, indicating struggling sub-segments. |

| High-Speed Scanner Business | Dog (Divested) | N/A | N/A | Divested in June 2023 to improve margins. |

| Legacy On-Premise Software | Dog | N/A | N/A | Declining market share and high maintenance costs. |

Question Marks

Exela Technologies' new AI-powered SecAi service, Reaktr.ai, launched in November 2024, positions itself within the burgeoning AI and cybersecurity sectors. This makes it a classic Question Mark in the BCG matrix, characterized by high market growth potential but currently a low market share for Exela.

The AI cybersecurity market is projected for substantial growth, with some estimates suggesting it could reach over $300 billion by 2027. For Reaktr.ai to move from a Question Mark to a Star, Exela will need to invest heavily in research and development, marketing, and sales to capture a significant portion of this expanding market.

The January 2025 partnership with Michael Page for expanding Exela's Finance and Accounting Outsourcing (FAO) Center of Excellence positions the company in a dynamic and expanding market. This strategic move is designed to capture a larger share of the FAO sector by introducing innovative service delivery methods.

However, the success of these new models remains to be seen, placing Exela's FAO offerings in the 'Question Mark' category of the BCG Matrix. This classification signifies a need for substantial investment to foster growth and determine market viability.

Exela Technologies strategically invested in late 2023 in cybersecurity, data modernization, and Infrastructure-as-a-Service (IaaS). These investments are designed to position the company for significant growth throughout 2024 and beyond.

While these sectors represent high-growth opportunities, Exela's current market share and established presence within them are likely nascent. This means substantial capital and dedicated effort will be required to transform these initiatives from question marks into market-leading Stars in the BCG matrix.

Specific Industry-Focused Digital Transformation Initiatives

Exela Technologies is actively driving digital transformation across key sectors such as education, energy, and retail. These initiatives are designed to modernize operations and enhance customer experiences within these industries.

While the overall digital transformation market presents significant growth opportunities, Exela's current market share within specific, niche sub-segments of these industries or its success in acquiring new clients in these targeted areas might be limited. This suggests that these particular digital transformation efforts could be categorized as question marks in a BCG Matrix, requiring careful consideration and focused investment to build market presence.

- Education: Exela's focus on digital solutions for educational institutions aims to streamline administrative tasks and improve learning management systems.

- Energy: In the energy sector, initiatives target digitalizing operations for efficiency and data management, particularly in areas like utility billing and customer engagement.

- Retail: Exela is developing digital transformation solutions for retailers to enhance supply chain visibility, customer loyalty programs, and e-commerce integration.

Cloud-Enabled Platforms with Developing Adoption

Exela's cloud-enabled platforms, featuring adaptable automation modules, are engineered for swift implementation. These offerings target the expanding cloud services sector. However, with nascent adoption rates and a currently modest market share, they are positioned as question marks. Significant ongoing investment is necessary to drive broader market penetration and establish a stronger competitive foothold.

The global cloud computing market is projected to reach approximately $1.3 trillion by 2025, indicating substantial growth potential. Despite this, Exela's specific cloud-enabled platform adoption may still be in its early stages. For instance, in 2024, while cloud spending continued to climb, many enterprises are still in the process of migrating legacy systems, impacting the immediate uptake of newer, specialized cloud solutions.

- Market Potential: The cloud services market is experiencing robust growth, offering a fertile ground for Exela's platforms.

- Adoption Hurdles: Developing adoption rates and a limited current market share necessitate strategic investment to overcome inertia.

- Investment Focus: Continued R&D and targeted sales efforts are crucial to accelerate uptake and build market presence.

- Strategic Positioning: These platforms represent future growth opportunities but require nurturing to transition from question marks to stronger market positions.

Exela Technologies' initiatives in emerging areas like AI-powered cybersecurity (Reaktr.ai) and digital transformation for specific sectors (education, energy, retail) are currently classified as Question Marks. These represent high-growth potential markets where Exela is still building its market share and proving its competitive edge.

The company's investments in cloud-enabled platforms also fall into this category, facing the challenge of increasing adoption rates in a rapidly expanding cloud services market, projected to reach around $1.3 trillion by 2025. Significant capital and strategic effort are needed to convert these nascent ventures into market leaders.

The success of Exela's Finance and Accounting Outsourcing (FAO) Center of Excellence, established through partnerships like the one with Michael Page in January 2025, also remains to be fully determined, placing it in the Question Mark quadrant. These efforts require focused investment to solidify their market position and drive growth.

| Initiative | Market Growth Potential | Current Market Share | BCG Classification | Strategic Imperative |

|---|---|---|---|---|

| Reaktr.ai (AI Cybersecurity) | High | Low | Question Mark | Invest in R&D, Sales & Marketing |

| Digital Transformation (Education, Energy, Retail) | High | Nascent/Limited | Question Mark | Targeted Investment, Client Acquisition |

| Cloud-Enabled Platforms | Very High (est. $1.3T by 2025) | Modest | Question Mark | Drive Adoption, Enhance Features |

| Finance & Accounting Outsourcing (FAO) | High | Developing | Question Mark | Prove Service Delivery Models |

BCG Matrix Data Sources

Our Exela Technologies BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.