Evolent Health Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evolent Health Bundle

Evolent Health operates in a dynamic healthcare landscape, where understanding the intensity of competitive rivalry and the bargaining power of buyers significantly shapes its strategic decisions. The threat of substitute products also presents a constant challenge, requiring Evolent to innovate and differentiate its offerings.

The complete report reveals the real forces shaping Evolent Health’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Evolent Health's reliance on specialized technology and data providers grants these suppliers significant bargaining power. The company procures essential software, advanced data analytics platforms, and potentially proprietary datasets crucial for its technology-enabled services.

The bargaining power of these suppliers is amplified when their solutions are unique, possess high switching costs for Evolent, or are difficult to replicate. For instance, a provider of a highly specialized healthcare data analytics platform that is deeply integrated into Evolent's operations would wield considerable influence.

The increasing demand for AI and sophisticated analytics in the healthcare sector, a trend observed throughout 2024, further strengthens the position of vendors offering these cutting-edge capabilities. Companies like Evolent must carefully manage these supplier relationships to mitigate potential cost increases or service disruptions.

Evolent Health's reliance on a specialized workforce, including data scientists and AI/ML experts, means that a limited supply of this talent directly impacts their operational efficiency. The intense competition for these professionals in the healthcare sector can significantly amplify their bargaining power.

This scarcity translates into increased recruitment and retention expenses for Evolent, potentially reaching 15-20% higher salaries for in-demand roles in 2024. Such elevated costs can strain Evolent's profitability and create operational bottlenecks if key positions remain unfilled.

The bargaining power of suppliers in cloud infrastructure services for Evolent Health is moderate. While major providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) dominate the market, Evolent can mitigate this power through multi-cloud strategies or by leveraging its scale to negotiate favorable terms. For instance, in 2024, the global cloud computing market was valued at over $600 billion, indicating significant competition among providers, which can benefit large consumers like Evolent.

Cybersecurity Solutions Vendors

Vendors of cybersecurity solutions hold significant bargaining power over Evolent Health. The critical need to protect sensitive patient health information (PHI) makes these services indispensable. As cyber threats continue to escalate, particularly in the healthcare sector, the demand for robust security measures only grows, amplifying vendor leverage. For instance, the healthcare industry experienced a 124% increase in ransomware attacks in 2023, highlighting the urgency and cost of data breaches.

The specialized nature of advanced cybersecurity software and services further concentrates power among a limited number of providers. Evolent Health’s reliance on these specialized solutions means switching vendors can be complex and costly, reinforcing the existing suppliers' positions.

- High demand for specialized cybersecurity services in healthcare.

- Increasing frequency and sophistication of cyberattacks on healthcare organizations.

- Significant costs and complexities associated with switching cybersecurity vendors.

- Strict regulatory compliance requirements (e.g., HIPAA) necessitate advanced security solutions.

Regulatory Compliance and Legal Services

The bargaining power of suppliers in regulatory compliance and legal services is significant for Evolent Health. Healthcare providers must navigate a labyrinth of regulations, and specialized legal and compliance firms are essential. The complexity of HIPAA, Stark Law, and Anti-Kickback Statute compliance, for instance, means that suppliers of these critical services hold considerable sway. Failure to adhere to these rules can result in substantial fines, with penalties for HIPAA violations alone potentially reaching millions of dollars per breach in 2024.

Suppliers in this domain, such as law firms specializing in healthcare or regulatory consulting groups, can leverage their expertise. Their ability to interpret and implement complex legal frameworks directly impacts Evolent Health's operational integrity and financial health. The high stakes involved in non-compliance, including potential exclusion from federal healthcare programs, amplify the suppliers' bargaining position. For example, in 2023, the Department of Justice announced settlements totaling billions of dollars for healthcare fraud and abuse cases, underscoring the financial risks associated with regulatory missteps.

- High Demand for Specialized Expertise: Suppliers possess niche knowledge crucial for navigating complex healthcare laws like the Affordable Care Act (ACA).

- Risk of Non-Compliance Penalties: Significant financial penalties and reputational damage for Evolent Health incentivize reliance on expert legal and compliance suppliers.

- Limited Number of Qualified Suppliers: The specialized nature of healthcare regulatory law means fewer firms can provide adequate services, increasing supplier leverage.

- Criticality of Services: Legal and compliance services are not optional but fundamental to Evolent Health's ability to operate and avoid legal entanglements.

Evolent Health's reliance on specialized technology and data providers grants these suppliers significant bargaining power, especially when their solutions are unique and difficult to replicate. The increasing demand for AI and sophisticated analytics in healthcare throughout 2024 further strengthens the position of vendors offering these cutting-edge capabilities.

Vendors of cybersecurity solutions hold significant bargaining power due to the critical need to protect sensitive patient health information. The escalating cyber threats in healthcare, demonstrated by a 124% increase in ransomware attacks in 2023, amplify vendor leverage, as switching providers is complex and costly.

Suppliers in regulatory compliance and legal services possess considerable sway, given the complexity of healthcare laws and the severe penalties for non-compliance. The high stakes, including potential exclusion from federal programs, empower these specialized firms, with HIPAA violations alone potentially costing millions in 2024.

| Supplier Category | Bargaining Power | Key Factors | Supporting Data/Trends (2023-2024) |

| Technology & Data Providers | High | Uniqueness of solutions, high switching costs, difficulty in replication | Growing demand for AI/analytics in healthcare |

| Cybersecurity Vendors | High | Criticality of PHI protection, complexity of switching, increasing cyber threats | 124% rise in ransomware attacks on healthcare (2023) |

| Regulatory Compliance & Legal Services | High | Complexity of laws (HIPAA, etc.), severe non-compliance penalties, limited qualified suppliers | HIPAA violation penalties up to millions (2024); billions in healthcare fraud settlements (2023) |

What is included in the product

This analysis of Evolent Health's competitive landscape examines the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the risk of substitute solutions.

Evolent Health's Porter's Five Forces Analysis provides a clear, actionable framework to navigate competitive pressures, enabling strategic adjustments to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

Evolent Health's customer base is dominated by large, consolidated health plans and extensive provider systems. These entities wield considerable bargaining power due to their sheer size and the volume of business they represent, enabling them to negotiate highly favorable terms and influence pricing structures. For instance, major health insurers often manage millions of members, giving them substantial leverage in contract discussions with service providers like Evolent.

The bargaining power of customers is significantly influenced by the availability of in-house solutions. Many large health systems and payers possess substantial IT departments and resources. This allows them to develop or integrate their own population health and value-based care technologies. This internal capability creates a strong 'build versus buy' option for these customers.

This internal development capacity directly strengthens their negotiating position with vendors like Evolent. Instead of being solely reliant on external providers, these customers can opt to build capabilities in-house. For instance, in 2024, the healthcare IT spending by large hospital systems continued to grow, with many allocating significant portions to internal innovation and platform development, underscoring this trend.

While customers, particularly large health systems, wield significant bargaining power when initially negotiating contracts with Evolent Health, this power can diminish once Evolent's comprehensive solutions are deeply embedded into their operational workflows. The initial investment and the intricate nature of integrating Evolent's technology and services create a considerable hurdle for clients looking to switch providers, effectively raising switching costs.

This integration complexity, however, often translates into a stronger negotiating position for customers during the initial contract phase. They can leverage the upfront investment and the anticipated operational benefits to secure more favorable terms and pricing, knowing that Evolent's commitment to successful integration is paramount to their own success.

Focus on Measurable Outcomes and ROI

Healthcare customers, especially those in value-based care arrangements, are increasingly prioritizing measurable results and a clear return on investment (ROI). This means they are scrutinizing the actual impact of solutions on clinical outcomes and financial performance.

This intense focus on demonstrable value gives customers significant bargaining power. They can leverage their demand for improved patient health and cost efficiencies to negotiate for performance-based pricing and hold providers like Evolent Health accountable for delivering on promised results. For instance, in 2024, many health systems reported that a significant portion of their reimbursement was tied to quality metrics and patient satisfaction scores, directly influencing their purchasing decisions.

- Focus on Outcomes: Customers demand proof that Evolent's services lead to better patient health and reduced costs.

- ROI Scrutiny: The ability to demonstrate a strong return on investment is critical for securing and retaining contracts.

- Performance-Based Pricing: Customers are more willing to pay for services when a portion of the fee is contingent on achieving specific, agreed-upon outcomes.

- Accountability Demands: Clients expect Evolent to be transparent and accountable for the effectiveness of its solutions in achieving desired healthcare metrics.

Price Sensitivity in a Cost-Conscious Industry

Healthcare organizations are inherently cost-conscious, making them highly sensitive to pricing. This sensitivity translates into aggressive negotiation tactics by customers seeking the most economical solutions.

This dynamic puts significant downward pressure on Evolent Health's service fees and, consequently, its profit margins. For instance, in 2023, the healthcare sector saw an average increase in operating costs of 6.5%, driving providers to seek cost reductions wherever possible, which directly impacts Evolent's pricing power.

- Price Sensitivity: Healthcare providers are under constant pressure to manage expenses, making them acutely aware of service costs.

- Negotiation Leverage: This cost consciousness empowers customers to negotiate aggressively for lower fees.

- Margin Impact: The drive for cost-effectiveness directly squeezes Evolent's pricing and profit potential.

- Market Pressure: Industry-wide cost pressures reinforce customers' demand for value-driven pricing.

Evolent Health's customers, primarily large health plans and provider systems, possess substantial bargaining power due to their significant scale and the volume of business they represent. This leverage allows them to negotiate favorable terms and pricing structures, as they can easily switch to alternative solutions if dissatisfied.

The availability of in-house capabilities further amplifies customer bargaining power. Many large healthcare entities can develop or integrate their own population health technologies, creating a viable 'build versus buy' option that strengthens their negotiating position with vendors like Evolent. In 2024, healthcare IT spending by major hospital systems continued its upward trend, with substantial investments directed towards internal innovation.

Customers are increasingly focused on demonstrable ROI and measurable outcomes, giving them leverage to negotiate performance-based pricing. In 2024, a significant portion of health system reimbursements were tied to quality metrics, directly influencing their purchasing decisions and demanding accountability from service providers.

Healthcare organizations' inherent cost-consciousness leads to aggressive price negotiations, pressuring Evolent Health's service fees and profit margins. The healthcare sector experienced a 6.5% average increase in operating costs in 2023, compelling providers to seek cost reductions, which impacts Evolent's pricing power.

| Customer Type | Bargaining Power Factors | Impact on Evolent | 2024 Data Point |

| Large Health Plans | High volume, consolidation | Favorable pricing, contract terms | Major insurers manage millions of members |

| Provider Systems | In-house IT capabilities, 'build vs. buy' | Negotiating leverage, reduced reliance on vendors | Increased healthcare IT spending on internal innovation |

| Value-Based Care Entities | Focus on ROI, measurable outcomes | Demand for performance-based pricing, accountability | Reimbursements tied to quality metrics and patient satisfaction |

| Cost-Conscious Organizations | Price sensitivity, operating cost pressures | Downward pressure on fees, reduced profit margins | 6.5% average increase in healthcare operating costs (2023) |

Preview the Actual Deliverable

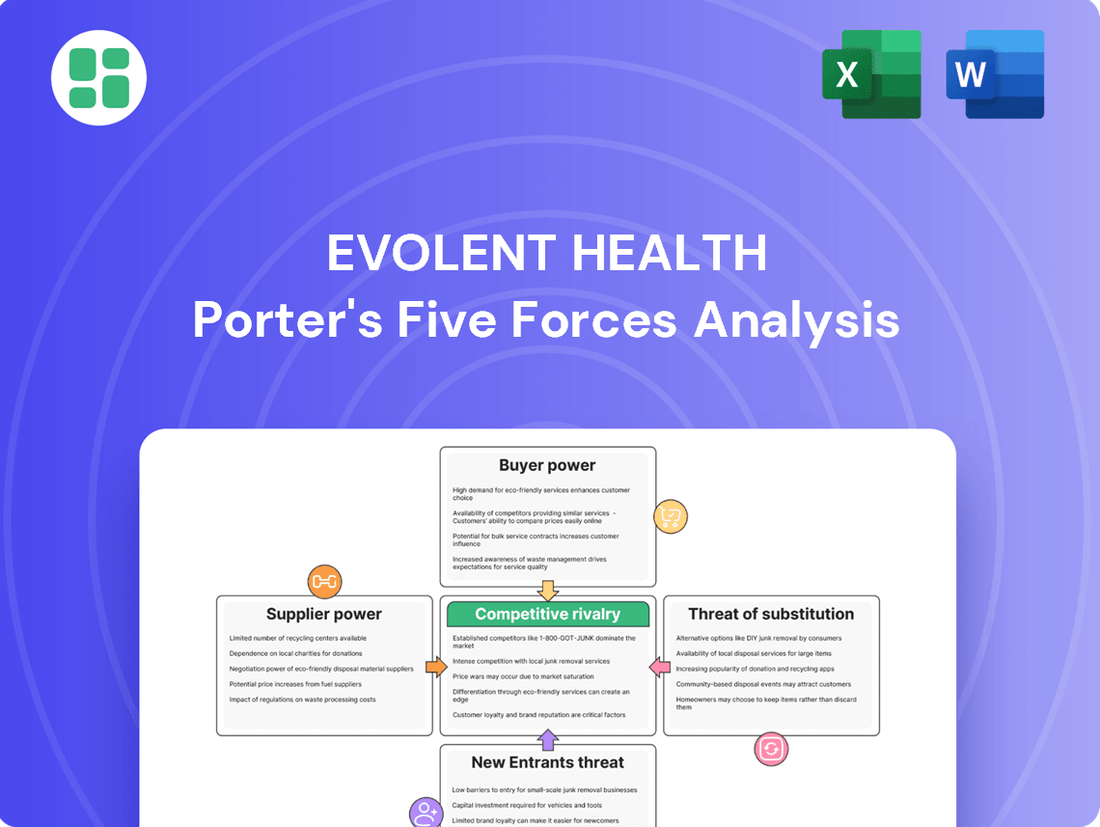

Evolent Health Porter's Five Forces Analysis

This preview provides a comprehensive Evolent Health Porter's Five Forces analysis, detailing the competitive landscape and strategic implications for the company. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy, offering actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the threat of substitute products.

Rivalry Among Competitors

The market for technology-enabled healthcare services, particularly in areas like population health management and value-based care, is notably fragmented. This means there are many companies, both large and small, operating within this space, all competing for clients.

This high degree of fragmentation fuels intense rivalry. Companies are constantly innovating and introducing new services to gain an edge. For instance, in 2024, the healthcare IT market, which encompasses these services, was projected to reach over $400 billion globally, indicating a vast and competitive arena.

Evolent Health operates in a highly competitive arena, contending with a broad spectrum of rivals. These include major healthcare IT providers with extensive resources, niche players offering specialized solutions, established healthcare consulting firms, and even large health systems developing their own in-house capabilities. This diversity means Evolent must constantly adapt its strategies to counter different competitive approaches.

Securing contracts with major health plans and provider systems is a drawn-out process, demanding substantial time and resources from Evolent Health and its rivals. These long sales cycles mean competitors are locked in for extended periods, making each win crucial.

The immense value of these contracts fuels intense competition. Companies like Evolent Health often face aggressive pricing strategies and feature-by-feature comparisons as rivals vie for market share. For instance, in 2024, the average sales cycle for enterprise healthcare IT solutions can extend beyond 18 months, with contract values often in the tens of millions of dollars.

Product and Service Differentiation Challenges

Evolent Health faces a competitive landscape where differentiating its integrated technology and specialty care management services proves challenging, as many rivals offer comparable solutions for population health and value-based care. This similarity can drive commoditization, pushing companies like Evolent to continually innovate, such as their investment in AI-driven solutions, to secure a distinct market position.

The intense competition means that basic services can become interchangeable, forcing a constant pursuit of specialization to stand out. For instance, Evolent's strategic focus on AI in 2024 aims to carve out a unique value proposition in a crowded market.

- Evolent's AI initiatives aim to differentiate its population health management offerings.

- Many competitors provide similar value-based care optimization tools.

- The market risks commoditization of core services.

- Continuous innovation is crucial for maintaining a competitive edge.

Impact of Regulatory Changes and Market Trends

Changes in healthcare policy, such as the ongoing evolution of Medicare Advantage regulations, directly impact how companies like Evolent Health operate and compete. These shifts often accelerate the move towards value-based care models, rewarding outcomes over volume. For instance, the Centers for Medicare & Medicaid Services (CMS) continues to refine its quality incentive programs, pushing providers and payers towards performance metrics.

Technological advancements, particularly in areas like artificial intelligence, are also reshaping the competitive landscape. Evolent's AI-powered Auth Intelligence is a prime example, offering solutions that streamline administrative processes and improve member engagement. This focus on innovation allows companies to differentiate themselves and capture market share by addressing emerging industry needs effectively.

The ability to adapt to these dynamic forces is crucial for maintaining a competitive edge. Companies that can swiftly integrate new regulatory requirements and leverage emerging technologies, like Evolent's approach to leveraging AI for prior authorization, are better positioned to thrive. This continuous adaptation fuels ongoing rivalry as firms strive to offer superior, compliant, and technologically advanced solutions to the healthcare market.

- Regulatory Agility: Evolent Health's ability to navigate and adapt to evolving healthcare policies, such as changes in reimbursement models, is a key competitive factor.

- Value-Based Care Adoption: The accelerating shift towards value-based care incentivizes companies to develop solutions that improve patient outcomes and reduce costs, intensifying rivalry among those offering such capabilities.

- Technological Differentiation: Investments in technologies like AI, as seen with Evolent's Auth Intelligence, provide a significant advantage by enhancing efficiency and offering innovative solutions to complex healthcare challenges.

Competitive rivalry within Evolent Health's market is intense due to a fragmented industry populated by numerous players, from large IT firms to specialized niche providers. This high level of competition forces companies to constantly innovate and differentiate their offerings, particularly in areas like population health management and value-based care. The long sales cycles and substantial contract values, often exceeding tens of millions of dollars and spanning over 18 months in 2024, further amplify the stakes, making each client acquisition critical.

| Rivalry Factor | Description | Impact on Evolent Health |

|---|---|---|

| Market Fragmentation | Numerous companies, large and small, compete in healthcare IT and services. | Requires continuous differentiation and strategic positioning. |

| Product Similarity | Many rivals offer comparable solutions for population health and value-based care. | Drives commoditization, necessitating innovation to create unique value propositions. |

| Long Sales Cycles | Securing contracts with health plans and providers takes significant time and resources. | Each contract win is crucial; intense competition during the sales process. |

| Pricing Pressure | Aggressive pricing strategies are common as companies vie for market share. | Evolent must balance competitive pricing with profitability and service quality. |

SSubstitutes Threaten

Health plans and large provider systems frequently maintain robust internal IT departments and possess deep clinical knowledge. This allows them to create their own custom platforms for population health management and value-based care, effectively acting as a substitute for Evolent's offerings. For instance, a 2024 industry report indicated that 65% of major health insurers are increasing their investment in in-house technology development, aiming to reduce reliance on third-party vendors.

Traditional consulting firms can offer strategic guidance for population health management and administrative streamlining, presenting a viable alternative for healthcare organizations. While they might not possess Evolent's specific technology platform, these established players can deliver comparable strategic direction and process improvements. For instance, in 2024, the healthcare consulting market was estimated to be worth billions, with many firms focusing on operational efficiency and value-based care strategies that overlap with Evolent's core offerings.

Customers might opt for specialized, individual software solutions instead of a unified platform, a trend that intensified in 2024 as many organizations sought to optimize specific functions. For instance, a health system might acquire a best-in-class analytics tool from one vendor and a separate patient engagement platform from another. This fragmented approach can directly substitute for the all-encompassing, integrated solutions Evolent Health provides, potentially leading to lower demand for their comprehensive offerings.

Manual Processes and Legacy Systems

Manual processes and legacy systems can act as substitutes for more advanced solutions in healthcare. Despite ongoing digital transformation efforts, some organizations might stick with older, less efficient methods due to concerns about the cost, complexity, or disruption of implementing new technologies. This inertia means that these existing, albeit inferior, systems can substitute for more streamlined and effective digital alternatives.

For instance, a significant portion of healthcare still relies on paper-based records or outdated Electronic Health Record (EHR) systems that lack interoperability. In 2024, it’s estimated that a substantial percentage of healthcare data remains siloed, hindering efficient data exchange and process automation. This reliance on manual or semi-manual workflows, often perpetuated by the perceived high cost of upgrades, presents a viable, though less optimal, alternative to fully integrated digital platforms.

- Inertia in Technology Adoption: Healthcare organizations may delay or avoid adopting new technologies due to perceived high implementation costs and operational disruption.

- Legacy System Reliance: Outdated EHRs and manual record-keeping continue to function as substitutes for modern, integrated health information systems.

- Cost as a Barrier: The significant financial investment required for digital transformation can make sticking with existing, less efficient systems a seemingly more attractive option in the short term.

- Data Silos: In 2024, a considerable amount of healthcare data remains fragmented, underscoring the continued presence of manual workarounds and the slow adoption of truly interoperable systems.

Alternative Value-Based Care Models

The healthcare landscape is dynamic, with continuous innovation in value-based care models. If alternative frameworks emerge that are less dependent on Evolent's proprietary technology or service delivery, they could pose a significant threat. For instance, simpler, less technologically demanding approaches to value-based care might gain broader adoption, offering a more accessible substitute.

Consider the rise of direct-to-employer primary care models, which bypass many of the complex administrative layers Evolent addresses. These models, often focused on direct patient engagement and preventative care, represent a potential substitute for Evolent's integrated solutions. In 2024, the growth of these direct primary care providers has been notable, with some reporting double-digit year-over-year membership increases.

The threat of substitutes is amplified if these alternative models demonstrate superior cost-effectiveness or patient outcomes without requiring substantial technological investment. This could pressure Evolent to continually innovate and demonstrate the unique value proposition of its platform. The market is actively seeking efficiency, and any model that can deliver comparable or better results with less overhead inherently becomes a more attractive alternative.

Key substitute threats include:

- Direct-to-employer primary care models: Offering simpler, often tech-light, patient engagement.

- Bundled payment arrangements: Focusing on specific episodes of care, potentially reducing reliance on broad platform solutions.

- AI-driven patient navigation tools: Providing automated support and guidance, substituting some of Evolent's care coordination functions.

- Provider-led accountable care organizations (ACOs): Leveraging existing provider infrastructure to manage value-based contracts.

The threat of substitutes for Evolent Health's offerings is significant, stemming from both in-house capabilities and alternative market solutions. Health plans and large provider systems often possess the resources and expertise to develop their own population health management platforms, a trend supported by a 2024 industry report showing 65% of major health insurers increasing their IT investment. Additionally, traditional consulting firms provide strategic guidance that can overlap with Evolent's core services, operating within a healthcare consulting market valued in the billions in 2024.

Organizations may also opt for specialized, best-in-class software solutions from various vendors rather than a single integrated platform, a fragmented approach that gained traction in 2024. Even manual processes and legacy systems can act as substitutes, particularly given the continued presence of data silos in healthcare, estimated in 2024, which hinders the adoption of fully interoperable systems.

Emerging value-based care models that are less reliant on complex technology also pose a threat. For instance, direct-to-employer primary care models, which saw notable growth in 2024 with some providers reporting double-digit membership increases, offer a simpler, often tech-light alternative to Evolent's integrated solutions.

These substitutes are compelling if they demonstrate greater cost-effectiveness or improved patient outcomes with less technological overhead, pressuring Evolent to continuously highlight its unique value proposition.

| Substitute Type | Description | 2024 Market Trend/Data Point |

|---|---|---|

| In-house IT Development | Health plans and providers building their own platforms. | 65% of major health insurers increased IT investment in 2024. |

| Traditional Consulting Firms | Offering strategic guidance and process improvements. | Healthcare consulting market valued in the billions in 2024. |

| Specialized Software Solutions | Using multiple best-in-class tools instead of an integrated platform. | Increased adoption of fragmented approaches observed in 2024. |

| Direct-to-Employer Primary Care | Simpler, often tech-light patient engagement models. | Notable growth in 2024, with some reporting double-digit membership increases. |

Entrants Threaten

The health technology and services industry demands a significant upfront financial commitment. For instance, developing sophisticated platforms, building robust IT infrastructure, and launching comprehensive sales and marketing campaigns can easily run into tens or even hundreds of millions of dollars. This high capital requirement acts as a formidable barrier, making it difficult for new companies to enter and effectively challenge established entities like Evolent Health.

The healthcare sector presents a formidable threat of new entrants due to its intricate web of regulations. For instance, compliance with the Health Insurance Portability and Accountability Act (HIPAA) for data privacy and security demands substantial investment and expertise, acting as a significant barrier. New players must navigate these complex rules, which can be costly and time-consuming, especially for those unfamiliar with the industry's specific demands.

Success in partnering with health plans and providers requires deep domain expertise in clinical workflows, payer operations, and intricate reimbursement models. New entrants often lack this foundational knowledge, making it challenging to offer credible solutions.

Building trust and long-term relationships with risk-averse healthcare organizations is paramount. This process is inherently slow, and new players struggle to establish the necessary credibility quickly, especially when dealing with sensitive patient data and financial stakes.

Established Competitor Relationships and Market Share

Evolent Health benefits from deeply entrenched relationships with its existing client base, which are difficult for new entrants to penetrate. These established connections, often built over years, create a significant barrier. For instance, in 2024, many health systems have long-standing contracts with established population health management providers like Evolent, making switching costly and complex.

Newcomers face the daunting task of not only matching but exceeding the value proposition of incumbents. This often means offering substantially lower prices or truly innovative services to lure customers away. The market share held by companies like Evolent in 2024 represents a substantial hurdle, as new entrants must capture a meaningful portion of this existing business to gain traction.

- Established Client Relationships: Incumbents like Evolent Health have cultivated strong, long-term partnerships with key players in the healthcare ecosystem.

- Significant Market Share: Evolent holds a considerable portion of the market, making it challenging for new entrants to gain immediate access.

- Customer Acquisition Costs: New entrants must invest heavily in marketing and sales to overcome existing loyalty and acquire customers.

- Differentiation Imperative: To succeed, new companies must offer demonstrably superior or more cost-effective solutions than Evolent.

Talent Acquisition and Retention Challenges

The healthcare industry, particularly for companies like Evolent Health that rely on sophisticated technology, faces intense competition for specialized talent. Developing and delivering advanced technology-enabled healthcare services demands a workforce proficient in areas like data science, healthcare informatics, clinical expertise, and software engineering. This specialized skill set is in high demand across various sectors, making talent acquisition a significant challenge.

Attracting and retaining these highly skilled professionals is not only competitive but also incredibly costly. For instance, in 2024, the average salary for a data scientist in the US ranged from $120,000 to $170,000 annually, with experienced professionals commanding even higher figures. This escalating cost of human capital presents a substantial barrier for new entrants aiming to establish a strong foothold in this market.

- High Demand for Specialized Skills: Evolent Health requires data scientists, healthcare informaticists, clinicians, and software engineers, all of whom are in short supply.

- Competitive Talent Market: Companies across tech, finance, and healthcare vie for the same pool of specialized talent.

- Significant Recruitment and Retention Costs: In 2024, the average compensation for a senior data scientist exceeded $170,000, impacting new entrants' ability to compete.

- Impact on New Entrants: The substantial investment needed for talent acquisition and retention makes it difficult for new companies to match the capabilities of established players.

The threat of new entrants for Evolent Health is relatively low, primarily due to the substantial capital investment required to enter the health technology and services market. Developing sophisticated platforms and robust IT infrastructure can easily cost tens to hundreds of millions of dollars, creating a significant financial hurdle for newcomers. Furthermore, navigating the complex regulatory landscape, including HIPAA compliance, demands considerable expertise and financial resources, further deterring potential entrants.

Established client relationships and significant market share held by incumbents like Evolent Health also act as strong deterrents. New companies must overcome existing customer loyalty and invest heavily in sales and marketing to gain traction. In 2024, many health systems have long-standing contracts with established providers, making switching costly and complex, thus reinforcing the low threat of new entrants.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront costs for technology, infrastructure, sales, and marketing. | Significant financial barrier, requiring substantial funding. |

| Regulatory Compliance | Navigating complex healthcare regulations like HIPAA. | Costly and time-consuming, demanding specialized knowledge. |

| Established Relationships | Deeply entrenched partnerships with health plans and providers. | Difficult for new entrants to penetrate the existing client base. |

| Talent Acquisition | Competition for specialized skills in data science, informatics, and clinical expertise. | High recruitment and retention costs, impacting operational capabilities. |

Porter's Five Forces Analysis Data Sources

Our Evolent Health Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Evolent's annual reports and SEC filings, alongside industry-specific market research from firms like KLAS Research and Definitive Healthcare. We also incorporate insights from healthcare policy updates and economic indicators relevant to the managed care and healthcare technology sectors.