Evolent Health Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Evolent Health Bundle

Curious about Evolent Health's product portfolio? This glimpse into their BCG Matrix reveals how their offerings are performing in terms of market share and growth. Are they Stars poised for future dominance, or Cash Cows generating steady revenue?

To truly understand Evolent Health's strategic positioning and unlock actionable insights, you need the full picture. Purchase the complete BCG Matrix report for a detailed quadrant breakdown, expert analysis, and a clear roadmap for optimizing their product investments.

Stars

Evolent Health stands out as a leader in managing care for individuals with complex health needs, especially in costly areas like oncology and cardiology. The increasing need for efficient management of these conditions places Evolent's solutions in a rapidly expanding market. For instance, in 2024, the specialty care management market was valued at approximately $60 billion globally, with projections indicating continued robust growth.

Evolent Health is making significant strides in AI-enabled clinical workflow automation, particularly with its acquisition and integration of platforms like Machinify Auth. This strategic move is designed to elevate the quality, speed, and uniformity of reviews for complex specialty conditions.

The company anticipates this AI technology will drastically cut down on manual tasks and boost overall efficiency, creating a strong competitive edge in the fast-paced healthcare tech sector. Evolent’s commitment is further solidified by their planned investment of roughly $35 million in capitalized software development during 2025, highlighting their dedication to this cutting-edge area.

Evolent Health's Value-Based Care Transformation Services are a cornerstone of their strategy, directly addressing the industry's pivot towards outcomes over volume. The global population health management market, a key indicator for this segment, is expected to surge to $625.86 billion by 2034, highlighting the immense growth potential. Evolent's established track record and deep relationships within this evolving landscape solidify their position as a leader.

Expansion within Existing Partner Base

Evolent Health is strategically focused on deepening its relationships within its existing client base. Despite serving approximately 41.4 million unique members, the company's market penetration within these partnerships remains relatively low. This presents a significant opportunity for expansion by cross-selling a broader suite of services and upselling existing contracts.

This approach capitalizes on the trust and infrastructure already established with current partners, allowing for high-potential organic growth. By increasing the depth of services provided to each client, Evolent can drive substantial revenue increases without the need for extensive new client acquisition.

- Low Market Penetration: Evolent Health serves around 41.4 million members but has considerable room to grow within its existing client relationships.

- Cross-Selling Opportunities: Significant potential exists to offer additional services to current partners, enhancing value and revenue.

- Upselling Existing Contracts: Expanding the scope of services within current agreements is a key growth driver.

- Leveraging Established Relationships: This strategy utilizes existing trust and operational frameworks for efficient expansion.

New Revenue Agreements and Market Expansions

Evolent Health is actively broadening its reach through new revenue agreements and strategic market expansions. This growth is fueled by strong market acceptance and a healthy pipeline of future business opportunities.

- New Agreements: In the first quarter of 2025, Evolent secured five new agreements, extending their service offerings into surgical management and oncology.

- Client Acquisition: A significant new health plan client was onboarded in New England, adding approximately 1.9 million product members for 2025.

- Market Penetration: These expansions into new geographies and lines of business demonstrate Evolent's commitment to capturing growth in dynamic healthcare markets.

- Growth Pipeline: The consistent acquisition of new business underscores Evolent's solidifying position within expanding market segments.

Evolent Health's focus on deepening existing client relationships positions them as a potential Star in the BCG Matrix. By leveraging established trust and infrastructure, they can effectively cross-sell and upsell their comprehensive suite of services. This strategy capitalizes on relatively low market penetration within their 41.4 million member base, offering a clear path for significant organic revenue growth.

What is included in the product

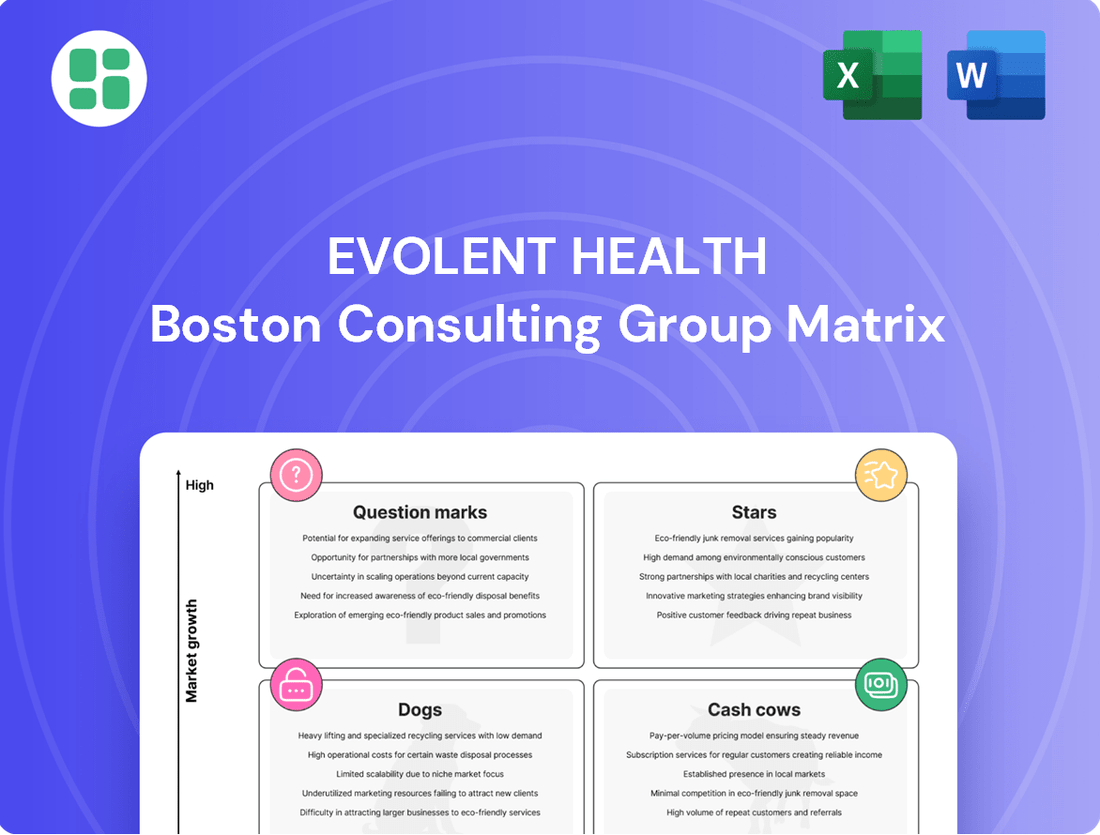

The Evolent Health BCG Matrix analyzes its business units based on market growth and share.

It guides strategic decisions on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

The Evolent Health BCG Matrix provides a clear, one-page overview of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Evolent's Performance Suite contracts, especially those successfully renegotiated, are solidifying their position as predictable cash generators. These agreements, forming a substantial part of Evolent's revenue, are designed to boost profitability and smooth out financial fluctuations, creating a reliable cash inflow for strategic initiatives. The company anticipates notable year-over-year gains from these renegotiated deals in 2025.

Evolent Health's Core Administrative Services are positioned as Cash Cows within the BCG Matrix. These services cater to health plans in a mature market, characterized by stable demand and established operational efficiencies. In 2024, Evolent continued to leverage these services, which are designed to streamline administrative processes for their partners, generating consistent and predictable revenue streams.

Evolent Health's long-term payer and provider partnerships are a prime example of a Cash Cow in the BCG Matrix. The company proudly maintains a 100% contract retention rate with its key clients, who collectively contribute over 90% of its 2024 revenue. This remarkable stability underscores the deep integration and value Evolent provides.

These enduring relationships with major payers and providers indicate a strong market position within a well-established segment. This translates into a reliable and predictable stream of cash flow, a hallmark of Cash Cow businesses. The efficiency gained from these stable partnerships also significantly lowers customer acquisition costs, further bolstering profitability.

Proprietary Technology Platform (Identifi/CarePro)

Evolent Health's proprietary technology platforms, Identifi and CarePro, represent significant assets within their business model. These platforms are the bedrock for delivering a range of health management services.

While substantial investment has been made in their development, the platforms now function as stable infrastructure. This stability means that ongoing revenue generation from client usage doesn't necessitate disproportionate new capital for basic maintenance or core functionality.

This characteristic positions Identifi and CarePro as cash cows. They contribute to a steady cash flow because they leverage existing, developed technology to serve multiple clients, requiring less incremental investment to maintain their revenue-generating capacity.

- Identifi and CarePro serve as the stable technological backbone for Evolent Health's service delivery.

- Revenue is generated through client utilization of these established platforms, minimizing the need for substantial new investment in basic functionality.

- This efficient revenue generation from existing assets classifies them as cash cows within the BCG Matrix.

Mature Fee-Based Technology & Services Suite

Evolent Health's mature fee-based technology and services suite represents a significant cash cow. These established offerings, such as their population health management tools and claims processing solutions, generate predictable revenue streams. For instance, in 2023, Evolent reported that its technology and administrative services segment contributed a substantial portion of its overall revenue, demonstrating the stability of these fee-based models.

These components have achieved a strong market position, benefiting from economies of scale and established client relationships. This competitive advantage translates into consistent profit margins, requiring minimal incremental investment to maintain their market share. The reliable cash flow generated by these mature services allows Evolent to fund growth initiatives in other areas of its business.

- Stable Revenue: Fee-based services provide predictable income, insulated from medical cost fluctuations.

- Competitive Advantage: High client adoption and established market presence ensure consistent performance.

- Low Investment Needs: Mature offerings require less promotional spending, boosting profitability.

- Cash Flow Generation: These services are key generators of reliable cash for Evolent.

Evolent Health’s established payer and provider partnerships are firmly positioned as Cash Cows. The company reported a 100% contract retention rate with its key clients in 2024, who accounted for over 90% of its revenue. This stability highlights Evolent's deep integration and the consistent value delivered.

These long-standing relationships in a mature market segment generate a highly predictable cash flow, a defining characteristic of Cash Cows. The efficiency derived from these stable partnerships also helps reduce customer acquisition costs, further enhancing profitability.

Evolent's Core Administrative Services are also considered Cash Cows. These services, designed to streamline operations for health plans, operate in a mature market with stable demand and efficient operations. In 2024, Evolent continued to leverage these services for consistent revenue generation.

The company's proprietary technology platforms, Identifi and CarePro, function as stable infrastructure, generating revenue from client usage without requiring significant new capital for basic maintenance. This efficient revenue generation from existing assets classifies them as cash cows.

What You See Is What You Get

Evolent Health BCG Matrix

The Evolent Health BCG Matrix preview you are viewing is the identical, fully formatted report you will receive immediately after purchase. This comprehensive document, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and actionable analysis. You can trust that the insights and structure presented here are exactly what you'll be able to utilize for your business planning and competitive strategy. Once purchased, this Evolent Health BCG Matrix is yours to edit, present, or integrate into your ongoing strategic initiatives.

Dogs

Evolent Health's legacy Performance Suite contracts are facing challenges with declining membership. Some of these older agreements have seen a drop in enrolled members or less favorable per-member-per-month (PMPM) fees. This decline stems from factors like clients leaving or contract changes.

These segments, if not actively renegotiated or revitalized, risk becoming cash traps for Evolent Health. They could tie up valuable resources without delivering sufficient returns or contributing to overall growth. For instance, if a significant portion of their membership base, which represented a substantial revenue stream in prior years, continues to shrink, it directly impacts Evolent's ability to reinvest in growth areas.

Certain risk-bearing arrangements within Evolent Health's portfolio, particularly those concerning oncology services prior to recent contract adjustments, presented significant challenges. These arrangements experienced elevated costs, directly impacting the company's profitability and cash flow. For instance, in 2023, Evolent reported that its oncology segment experienced higher-than-anticipated medical cost trends, contributing to a negative impact on adjusted EBITDA from its value-based care business.

If these legacy or renegotiated contracts continue to underperform, consistently requiring cash infusions without a clear trajectory towards profitability, they would be classified as 'dogs' in a BCG matrix framework. Such arrangements would represent a drain on resources, hindering the company's ability to invest in more promising growth areas. The ongoing mitigation efforts are crucial to prevent these specific arrangements from becoming persistent cash drains.

Within Evolent Health's BCG Matrix, the Dogs category would encompass any products, services, or smaller business units deemed non-core, divested, or those failing to gain significant market traction. These assets typically represent areas where Evolent might consider divestiture to reallocate resources toward more high-growth opportunities.

While Evolent Health has not publicly detailed specific divestments fitting this 'dog' classification, the strategic pruning of portfolios is a common practice for companies aiming to optimize resource allocation. For instance, in 2023, many healthcare technology companies evaluated their service lines, with some divesting non-essential or underperforming segments to sharpen their strategic focus.

Outdated Administrative or Clinical Workflow Tools

Outdated administrative or clinical workflow tools represent a significant challenge for Evolent Health, potentially classifying them as dogs in the BCG matrix. These systems, lacking integration with modern technological advancements like AI-driven automation, hinder efficiency and competitiveness. For instance, a 2023 survey revealed that healthcare organizations still relying on manual processes for patient intake experienced a 20% longer processing time compared to those utilizing automated systems.

These legacy tools often demand disproportionate resources for maintenance, yielding diminishing returns. Their inability to leverage current capabilities means they are less effective in an increasingly digital healthcare landscape. This situation necessitates a strategic review for potential replacement or phased retirement to optimize operational performance.

- Low Market Share: Outdated tools struggle to compete with modern, feature-rich alternatives, leading to a declining user base or limited adoption within Evolent Health or its client organizations.

- Low Growth Rate: The market for advanced workflow solutions is rapidly expanding, making these older systems stagnant in terms of market penetration and relevance.

- High Maintenance Costs: Continued support and upkeep of legacy systems often outweigh the value they deliver, consuming resources that could be invested in growth areas.

- Limited Scalability: These tools may not be able to adapt to increasing data volumes or evolving regulatory requirements, creating bottlenecks and operational inefficiencies.

Segments Heavily Impacted by Medicaid Redeterminations Without Offset

Certain segments within Evolent Health's operations could be considered 'dogs' in a BCG matrix if they are significantly affected by Medicaid redeterminations without adequate offsetting growth. This means that the ongoing process of states re-evaluating Medicaid eligibility, which began in 2023 and continued through 2024, has led to a substantial loss of members for Evolent's clients in these specific areas. For instance, if a particular state or client group experienced a sharp drop in insured individuals due to these redeterminations, and Evolent's revenue is directly tied to membership numbers, this segment would face declining revenue and limited growth prospects.

The impact of these redeterminations can be severe, particularly for revenue streams heavily reliant on government-sponsored programs. As of late 2023 and into 2024, millions of individuals were found to be no longer eligible for Medicaid. If Evolent's business model in certain segments is closely aligned with these vulnerable populations, the loss of even a moderate percentage of members can translate into significant revenue shortfalls. Without successful strategies to either retain these members, attract new ones through different channels, or diversify into less affected markets, these segments would exhibit characteristics of low growth and potential market share erosion.

- Medicaid Redetermination Impact: States resumed eligibility reviews in 2023, leading to significant member churn.

- Revenue Sensitivity: Segments tied to government-sponsored programs are particularly vulnerable to membership declines.

- Mitigation Challenges: Failure to offset membership losses through new client acquisition or diversification can result in 'dog' status.

- Growth and Market Share: Declining membership directly impacts growth potential and can erode market share for affected segments.

Within Evolent Health's portfolio, 'dogs' represent underperforming segments with low market share and growth potential, often requiring significant resource investment without commensurate returns. These could include legacy administrative tools or specific value-based care arrangements that have faced cost pressures or membership declines. For instance, outdated workflow systems lacking AI integration can lead to inefficiencies, as seen in a 2023 survey where manual processes increased patient intake time by 20% compared to automated systems.

Segments heavily impacted by Medicaid redeterminations, which resumed in 2023 and continued through 2024, also risk falling into the 'dog' category. If Evolent's revenue is closely tied to these government-sponsored programs and membership declines due to eligibility reviews, these areas would exhibit low growth and potential market share erosion. As of late 2023, millions lost Medicaid eligibility, directly impacting revenue streams reliant on these populations.

These 'dog' segments are characterized by high maintenance costs, limited scalability, and a struggle to compete with modern alternatives. Evolent may consider divesting these non-core or underperforming assets to reallocate capital towards more promising growth opportunities, a strategy common among healthcare technology firms optimizing their service lines.

For example, while Evolent's specific divestitures are not detailed, the company's 2023 financial reports highlighted ongoing efforts to manage costs and improve performance in its value-based care segments, particularly those impacted by elevated medical cost trends in areas like oncology.

Question Marks

Evolent Health's recent acquisition of Machinify Auth and its continued investment in AI-driven automation, like Auth Intelligence, place it squarely within the rapidly expanding healthcare technology sector. This market is experiencing significant growth, signaling strong potential for these new platforms.

Despite the promising market, these AI and automation platforms are still in their nascent stages of integration within Evolent's operations. They represent new ventures that necessitate considerable financial commitment to scale effectively and capture a leading market position.

While these acquisitions show clear potential, their current market share is relatively low. Substantial capital is required to nurture these assets, transforming them from question marks into Evolent's future 'stars' within the BCG matrix.

When Evolent Health ventures into new geographic markets or entirely new business lines, these are considered its Question Marks in the BCG Matrix. These areas hold significant promise for rapid growth, largely because there's a substantial demand for value-based healthcare solutions throughout the United States that remains largely unmet.

However, in these emerging regions or sectors, Evolent's current market share is naturally quite small. This necessitates substantial upfront investment in areas like sales, marketing, and building out necessary operational capabilities to successfully establish a presence and gain traction. For instance, in 2024, Evolent continued its strategic expansion into new states, aiming to capture market share in regions with growing adoption of value-based payment models, a key driver for their Question Mark initiatives.

Evolent Health is likely investigating or trialing new specialty care solutions that extend beyond its core areas of oncology, cardiology, and musculoskeletal conditions. These nascent markets hold significant growth potential, but Evolent's current market penetration and demonstrated expertise in these new fields may be nascent. This necessitates substantial investment and a concentrated strategic effort to establish a competitive foothold.

For instance, the behavioral health market is experiencing rapid expansion, with the U.S. market size projected to reach $110 billion by 2024 according to some industry reports. Evolent's potential expansion into this area would require building new capabilities and partnerships, similar to how they developed their oncology offerings, which saw significant growth in recent years.

Advanced Digital Patient Engagement Solutions

Advanced digital patient engagement solutions, like those integrating tools from Careology, represent a significant growth opportunity for Evolent Health. These platforms are designed to enhance the member experience and ensure better adherence to care plans, a critical factor in driving value-based care outcomes.

While these digital engagement tools are vital for Evolent's long-term strategy, they are likely in their nascent stages of deployment. The market for such advanced digital health solutions is rapidly expanding, with projections indicating substantial growth in the coming years.

- Market Growth: The digital health market, encompassing patient engagement solutions, was valued at over $300 billion globally in 2023 and is expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030.

- Investment Needs: Significant investment is required for the development, integration, and widespread adoption of these sophisticated digital tools, impacting their current market share and profitability.

- Strategic Importance: These solutions are crucial for differentiating Evolent in the competitive healthcare landscape by offering superior member experience and improved clinical pathway adherence.

- Early Stage: Despite their strategic importance, the widespread market penetration and revenue generation from these advanced digital engagement solutions are still developing, placing them in a position that requires ongoing investment and strategic focus.

Targeted Solutions for Unique Payer/Provider Niches

Evolent Health might create very specific solutions for particular payer or provider groups with unique needs and strong growth prospects. These specialized offerings could initially have a smaller market presence because they are so focused.

Capturing and growing within these niche markets will necessitate targeted investment. For example, a solution designed for a specific type of rural health clinic, facing unique reimbursement challenges, would fall into this category. By 2024, the healthcare IT market saw significant growth in specialized solutions, with some niche segments experiencing double-digit annual growth rates.

- Niche Market Focus: Developing highly specialized solutions for distinct payer/provider segments with high growth potential.

- Initial Low Market Share: These specialized offerings may start with a limited market share due to their focused nature.

- Targeted Investment: Requires focused investment to capture and expand within these unique client segments.

- Example: Solutions tailored for specific provider types like Federally Qualified Health Centers (FQHCs) or particular payer models such as Accountable Care Organizations (ACOs) with unique operational and financial demands.

Evolent Health's ventures into new markets or specialized healthcare solutions are classified as Question Marks in the BCG matrix. These represent areas with high growth potential but currently low market share, demanding significant investment to mature.

For example, Evolent's expansion into new states in 2024, targeting regions with increasing value-based care adoption, exemplifies a Question Mark. Similarly, exploring new specialty care areas like behavioral health, a market projected to reach $110 billion by 2024, requires substantial capital for capability building and market penetration.

These initiatives, including advanced digital patient engagement tools and niche solutions for specific provider groups, are strategically important for Evolent's future growth. However, their early stage necessitates focused investment to transform them into profitable market leaders.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Evolent Health's internal financial statements, market share reports, and competitor performance analyses to accurately position business units.