Eventbrite Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eventbrite Bundle

Eventbrite navigates a dynamic landscape shaped by buyer power, supplier leverage, and the threat of new entrants. Understanding these forces is crucial for grasping their competitive position.

The complete report reveals the real forces shaping Eventbrite’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eventbrite's reliance on cloud infrastructure means the bargaining power of providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud is a significant factor. These providers offer essential services, and the cost and complexity of migrating data and applications can be substantial, giving them considerable leverage. For instance, in 2024, the cloud computing market continued to be dominated by these few major players, with AWS holding an estimated 31% market share, followed by Azure at 24% and Google Cloud at 11%.

The critical nature of these services, coupled with high switching costs, places Eventbrite in a position where they must carefully manage their relationships with these suppliers. Failure to negotiate favorable terms could lead to increased operational expenses. Eventbrite's strategy to counter this power likely involves exploring multi-cloud strategies or leveraging its scale to negotiate volume-based discounts, aiming to secure more competitive pricing and ensure platform stability.

Payment processing services are vital for Eventbrite, as they enable the core function of ticket sales. While numerous payment gateways exist, their pricing structures and operational stability significantly impact Eventbrite's bottom line. These suppliers, though numerous, possess leverage because their service is non-negotiable for Eventbrite's operations.

Eventbrite's bargaining power with payment processors stems from its substantial transaction volume, which allows for negotiation of favorable rates. For instance, in 2024, Eventbrite processed millions of tickets globally, translating to billions of dollars in transaction value. This scale provides a strong basis for negotiating lower per-transaction fees and improved service level agreements, thereby mitigating supplier power.

Software and technology vendors hold a moderate bargaining power over Eventbrite. Eventbrite relies on various third-party software, APIs, and development tools to build and maintain its platform. While some specialized or proprietary software might give vendors more leverage, the availability of numerous generic and substitutable tools generally limits their individual power.

Marketing and Advertising Channels

Eventbrite leverages a diverse array of digital marketing and advertising channels to boost event visibility and user engagement. The wide availability of platforms within the digital advertising landscape generally dilutes the bargaining power of individual marketing suppliers. This fragmentation allows Eventbrite to strategically select from numerous promotional avenues, mitigating reliance on any single provider.

For instance, in 2024, the global digital advertising market was projected to reach over $600 billion, showcasing the vast number of channels available. Eventbrite can utilize social media advertising, search engine marketing, email campaigns, and affiliate marketing. This broad spectrum of options limits the ability of any one advertising platform or agency to exert significant price control or demand unfavorable terms.

- Diverse Digital Channels: Eventbrite utilizes platforms like Google Ads, Meta Ads, TikTok Ads, and various programmatic advertising networks.

- Fragmented Supplier Base: The digital advertising ecosystem comprises numerous agencies and platforms, preventing any single supplier from dominating.

- Negotiating Leverage: Eventbrite's ability to spread its advertising spend across multiple channels provides leverage in negotiating rates and terms.

- Cost Efficiency: By diversifying, Eventbrite can optimize its marketing spend by identifying the most cost-effective channels for specific campaigns.

Skilled Labor and Talent

Eventbrite, as a technology-driven platform, relies heavily on securing and keeping top-tier talent, especially in crucial areas like software engineering, product development, and data analytics. The availability and demand for these specialized skills directly impact the company's ability to innovate and scale.

In today's dynamic job market, particularly within the tech sector, skilled professionals often possess considerable bargaining power. This can translate into higher salary expectations, more attractive benefits packages, and demands for flexible work arrangements, all of which can elevate Eventbrite's recruitment and retention costs.

- Talent Dependency: Eventbrite's technological advancements and platform improvements are directly tied to the expertise of its engineering and data science teams.

- Competitive Landscape: The tech industry is characterized by intense competition for skilled labor, with companies frequently offering competitive compensation and perks to attract top candidates.

- Impact on Costs: High demand for specialized skills can drive up salary benchmarks, increasing Eventbrite's operational expenses related to human capital.

- Retention Challenges: Retaining key talent is crucial; otherwise, the cost of replacing experienced employees can be substantial, affecting project continuity and institutional knowledge.

Eventbrite's reliance on cloud infrastructure providers like AWS, Azure, and Google Cloud grants these suppliers significant bargaining power. The high cost and complexity of migrating data and applications mean Eventbrite is somewhat locked into these relationships. In 2024, these three providers continued to dominate the cloud market, with AWS holding approximately 31% share, Azure 24%, and Google Cloud 11%, underscoring their leverage.

Payment processing services are essential for Eventbrite's core ticket sales function. While many payment gateways exist, their pricing and operational stability give them leverage, as their service is critical and non-negotiable for Eventbrite's operations. Eventbrite's substantial transaction volume, processing billions of dollars in ticket sales globally in 2024, allows for negotiation of favorable rates and terms, helping to mitigate this supplier power.

The bargaining power of software and technology vendors is generally moderate for Eventbrite. While some specialized tools may offer vendors leverage, the availability of numerous generic and substitutable options limits their individual power. Similarly, the digital advertising landscape is fragmented, with many platforms and agencies, allowing Eventbrite to diversify its marketing spend and negotiate effectively across channels.

What is included in the product

This analysis unpacks the competitive forces shaping Eventbrite's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly grasp competitive dynamics with a visual breakdown of industry power, enabling swift strategic adjustments.

Customers Bargaining Power

Event organizers, particularly smaller ones, experience low costs when considering a move from Eventbrite to an alternative ticketing service. This low barrier to switching allows them to readily explore platforms that might offer more attractive features, reduced fees, or enhanced customer service, thereby boosting their leverage.

For instance, many new ticketing platforms in 2024 are actively competing by offering introductory discounts or waiving initial setup fees, making the financial aspect of switching even less of a concern for organizers. This competitive landscape directly translates to increased bargaining power for customers, as they can easily demand better terms from Eventbrite.

Eventbrite faces significant customer bargaining power due to the sheer number of alternative event ticketing and management solutions available. Organizers can easily switch to platforms like Ticketmaster, Universe, or even leverage direct sales through their own websites or social media channels, diminishing Eventbrite's leverage.

In 2024, the event technology market continued to be highly competitive, with numerous platforms offering similar functionalities. This abundance of choice means that event organizers, Eventbrite's primary customers, can readily compare pricing, features, and user experience across multiple providers, putting pressure on Eventbrite to remain competitive.

Event organizers, especially those planning smaller or non-profit events, often scrutinize ticketing fees. This price sensitivity means they actively look for platforms with cost-effective pricing, sometimes even free options for specific event categories. This search intensifies their bargaining power.

Fragmented Customer Base

Eventbrite's customer base is incredibly diverse, with a significant portion comprised of individual event creators and small to medium-sized businesses. This fragmentation is a key factor in understanding customer bargaining power.

While Eventbrite caters to a massive number of organizers, the sheer volume of independent creators and smaller entities means that, individually, they possess limited leverage to negotiate terms or pricing. This widespread distribution of customers prevents any single entity from exerting substantial individual influence.

However, it's important to note that very large, high-volume clients might represent an exception to this general rule. These significant partners could potentially command more favorable terms due to the substantial revenue they generate for Eventbrite, illustrating a nuanced aspect of customer power within the platform.

- Fragmented Customer Base: Eventbrite serves millions of event organizers globally, with a substantial majority being individual creators and small businesses.

- Limited Individual Bargaining Power: The dispersed nature of these smaller organizers means no single customer typically holds significant power to dictate Eventbrite's pricing or service terms.

- Potential Power for Large Clients: Exceptionally high-volume organizers or those with substantial event attendance might possess greater individual bargaining leverage.

- Overall Weakened Customer Bargaining: The overall fragmentation of the customer base generally results in lower collective bargaining power for Eventbrite's customers.

Demand for Comprehensive Features

Event organizers are increasingly looking for platforms that offer more than just basic ticketing. They want comprehensive solutions that handle marketing, attendee communication, and post-event analytics. This drive for integrated functionality means Eventbrite must continually enhance its feature set to meet these evolving needs.

The collective desire for advanced tools gives customers significant leverage. For instance, in 2024, surveys indicated that over 60% of event organizers prioritize integrated marketing and CRM capabilities when selecting an event management platform. This demand directly influences Eventbrite's product development roadmap, pushing for innovation in areas like AI-driven attendee engagement and sophisticated data reporting.

- Demand for Integrated Solutions: Event organizers seek platforms combining ticketing, marketing, analytics, and attendee management.

- Impact on Innovation: Customer expectations for advanced features compel Eventbrite to invest in continuous platform improvement.

- Market Trends (2024): Over 60% of organizers prioritize integrated marketing and CRM features, highlighting customer power.

Eventbrite's customers, primarily event organizers, possess moderate bargaining power. This is driven by the ease of switching to competitors and the availability of numerous alternative platforms offering similar functionalities. In 2024, the competitive landscape saw many new entrants offering aggressive pricing strategies, further empowering organizers to seek better terms.

| Factor | Description | Impact on Eventbrite | 2024 Data Point |

|---|---|---|---|

| Switching Costs | Low costs for organizers to move to alternative platforms. | Increases customer leverage. | Many new platforms in 2024 offered introductory discounts. |

| Availability of Alternatives | Numerous ticketing and event management solutions exist. | Reduces Eventbrite's pricing power. | Market continues to offer similar functionalities across providers. |

| Price Sensitivity | Organizers, especially smaller ones, are cost-conscious. | Pressures Eventbrite on fees and pricing. | Over 60% of organizers prioritize cost-effectiveness. |

Preview the Actual Deliverable

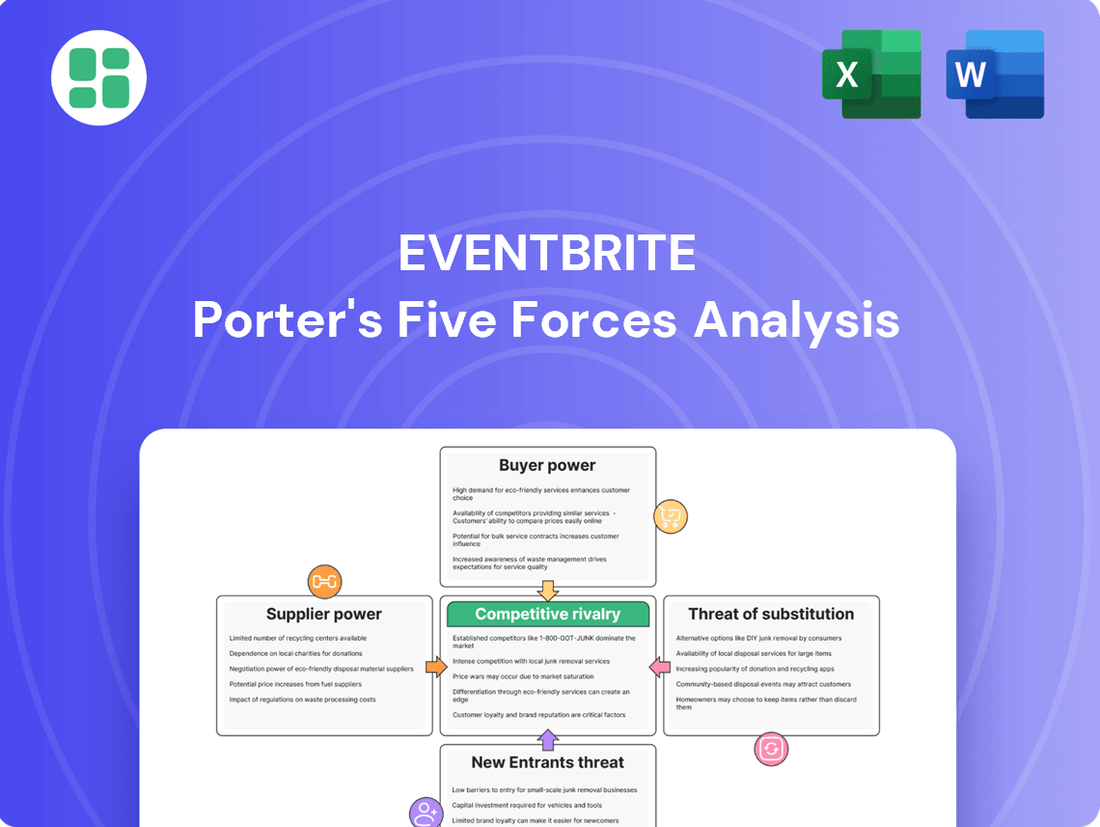

Eventbrite Porter's Five Forces Analysis

The document you see here is your complete Eventbrite Porter's Five Forces Analysis, precisely as it will be delivered to you immediately after purchase.

You're previewing the final, professionally formatted analysis, meaning you'll receive this exact file, ready for immediate use, without any alterations or placeholders.

This is the actual deliverable; what you see is what you get, ensuring you have the comprehensive Eventbrite Porter's Five Forces Analysis without any surprises upon completion of your purchase.

Rivalry Among Competitors

The online ticketing and event management arena is incredibly crowded, with numerous companies vying for attention. Think of giants like Ticketmaster, but also many smaller, specialized platforms and regional players. This sheer volume of competitors means Eventbrite faces constant pressure to stand out and attract users.

In 2023, the global event management software market was valued at approximately $1.2 billion, with projections indicating significant growth. This expanding market, while promising, also attracts more entrants, intensifying the rivalry Eventbrite navigates.

Competitors in the event ticketing space often resort to aggressive pricing and flexible fee structures to win over event organizers, particularly those managing large-scale or recurring events. This intense price competition directly impacts profitability, forcing companies like Eventbrite to continuously refine their pricing models to stay competitive.

For instance, in 2024, the market saw several smaller ticketing platforms emerge, offering significantly lower per-ticket fees, sometimes as low as 0.5% plus a small fixed fee, compared to Eventbrite's tiered structure which can range from 1.75% to 4.99% plus a fixed fee per ticket, especially for smaller events. This puts pressure on Eventbrite to offer comparable value or specialized features to justify its pricing, especially for organizers with substantial ticket volumes.

The event technology landscape is defined by relentless innovation, compelling competitors like Ticketmaster and Cvent to consistently roll out novel features. These advancements span enhanced event promotion tools, interactive attendee engagement platforms, and sophisticated data analytics capabilities. For instance, in 2024, many platforms introduced AI-powered recommendation engines for attendees and advanced social media integration for promoters.

This intense drive for new functionalities necessitates significant investment in research and development for companies like Eventbrite. To remain competitive and ensure its platform stays relevant in a fast-evolving market, Eventbrite must allocate substantial resources to innovation, mirroring the industry trend where R&D spending is a key differentiator.

Brand Loyalty and Network Effects

While Eventbrite benefits from brand recognition, loyalty among event organizers isn't deeply entrenched. Switching costs are relatively low, meaning organizers can move to alternative platforms if they find better value or features. This fluidity means Eventbrite must continually innovate and provide superior service to retain its user base.

The platform thrives on network effects: more events attract more attendees, which in turn encourages more organizers to list their events. This creates a virtuous cycle, but it's also a battleground. In 2024, Eventbrite continued to invest in features that enhance this ecosystem, aiming to solidify its position by making the platform more valuable as its user base grows.

- Brand Recognition: Eventbrite is a well-known name in event ticketing, fostering a degree of trust among users.

- Low Switching Costs: Organizers can easily migrate to competing platforms, making loyalty a challenge to maintain.

- Network Effects: The platform's value increases with more events and attendees, a key driver of growth and competition.

- 2024 Focus: Continued investment in platform features to strengthen the network effect and user retention.

Global and Local Market Dynamics

Competitive rivalry for Eventbrite is intense and multifaceted, varying significantly between global and local markets. While international platforms like Ticketmaster and StubHub hold considerable sway, Eventbrite also contends with numerous localized ticketing and event management solutions. This dynamic requires constant strategic adaptation to diverse consumer preferences, regulatory frameworks, and established local competitor strengths in different regions.

For instance, in 2024, the event ticketing market continued to see robust growth, with global revenues projected to reach over $60 billion. Eventbrite's challenge lies in carving out market share against both these giants and agile local players who often possess deeper community ties and understanding of specific market nuances. This often necessitates tailored approaches to pricing, marketing, and feature sets for each geographic segment.

- Global Reach vs. Local Dominance: Eventbrite competes with global ticketing giants like Ticketmaster, which reported over $2.2 billion in revenue in 2023, as well as numerous smaller, region-specific platforms.

- Market Fragmentation: The rise of niche event categories and the increasing demand for hyper-local experiences mean that Eventbrite faces competition not just from direct ticketing rivals but also from specialized event discovery and management tools.

- Adaptation Imperative: Success in diverse markets, such as navigating the unique regulatory landscape in Germany or the strong local event culture in Brazil, demands that Eventbrite customize its offerings, impacting operational costs and strategic focus.

The competitive landscape for Eventbrite is fiercely contested, marked by both global behemoths and agile local players. In 2024, the global event ticketing market continued its expansion, with estimates suggesting it would surpass $65 billion, presenting both opportunity and intense rivalry. Eventbrite must differentiate itself not only from giants like Ticketmaster, which generated over $2.3 billion in revenue in 2023, but also from numerous specialized platforms catering to niche markets or specific geographic regions.

Aggressive pricing strategies are a common tactic, with some competitors in 2024 offering per-ticket fees as low as 0.5% plus a fixed amount, putting pressure on Eventbrite's tiered pricing which can range from 1.75% to 4.99% plus a fixed fee. This necessitates constant innovation and value proposition refinement to retain event organizers, especially as switching costs remain low.

The market is characterized by a continuous drive for enhanced features, with competitors like Cvent investing heavily in AI-powered attendee recommendations and advanced social media integrations in 2024. Eventbrite's ability to maintain its market position hinges on its ongoing investment in research and development to keep its platform competitive and relevant.

| Competitor Type | Key Characteristics | 2023/2024 Data Points |

| Global Ticketing Giants | Extensive reach, brand recognition, broad feature sets. | Ticketmaster revenue: >$2.3 billion (2023). |

| Niche/Specialized Platforms | Focus on specific event types (e.g., music festivals, conferences), often with lower fees. | Emergence of platforms with <1% per-ticket fees (2024). |

| Local/Regional Players | Deep community ties, understanding of local market nuances, tailored offerings. | Market fragmentation driven by hyper-local event demand. |

SSubstitutes Threaten

Event organizers can bypass platforms like Eventbrite by managing ticket sales and registrations directly through their own websites. This often involves utilizing readily available e-commerce plugins or even simpler manual processes. While these self-managed options may not offer the same breadth of features or scalability as dedicated event platforms, they represent a significant threat, especially for smaller, more intimate gatherings or informal events where advanced functionality is less critical.

Social media platforms like Facebook Events and Instagram, along with direct communication tools such as email and messaging apps, present a significant threat of substitutes for Eventbrite. These channels often provide free or very low-cost alternatives for event promotion and managing RSVPs, directly competing with Eventbrite's core discovery and registration functionalities.

The widespread adoption of these platforms means a vast audience is already engaged, making them an attractive and convenient option for many event organizers. For instance, as of early 2024, Facebook reported over 3 billion monthly active users, many of whom utilize its event features, highlighting the sheer scale of this substitute offering.

Traditional ticketing methods, such as physical box offices and cash-at-the-door sales, continue to serve as viable substitutes for online platforms like Eventbrite. These conventional approaches are particularly relevant for local community events, smaller venues, and private gatherings where digital engagement might be less prevalent or preferred. In 2024, a significant portion of smaller, community-focused events still rely on these direct sales channels, bypassing online ticketing altogether.

General E-commerce Platforms

General e-commerce platforms, like Amazon or eBay, can be repurposed by event organizers to sell tickets. While these platforms lack the specialized features of Eventbrite, they provide a functional alternative for the basic transaction of selling tickets. This is particularly true for businesses that already have an e-commerce presence and are looking for a supplementary sales channel.

The threat of substitutes from general e-commerce platforms is moderate. These platforms offer a wide reach and established customer bases, which can be attractive to organizers. However, they often lack the integrated event management tools, such as attendee tracking, communication features, and on-site check-in capabilities, that Eventbrite provides. For instance, in 2023, global e-commerce sales reached an estimated $6.3 trillion, demonstrating the sheer scale of these alternative marketplaces.

- Broad Reach: General e-commerce platforms offer access to a vast, existing customer base, potentially increasing ticket sales volume.

- Cost-Effectiveness: For simple ticket sales without complex event management needs, using a general platform might be cheaper than specialized event ticketing services.

- Limited Functionality: These platforms are not built for events, meaning organizers miss out on crucial features like attendee communication, analytics, and branding specific to events.

- Competitive Landscape: Event organizers using these platforms face competition not just from other events but from a wide array of unrelated products sold on the same marketplace.

In-house Proprietary Systems

Large organizations, venues, or frequent event hosts might opt to build their own proprietary ticketing and event management systems. This approach represents a significant investment, but it offers a highly customized and controlled alternative to using third-party platforms like Eventbrite. For instance, a major sports league or a large university could develop software that integrates seamlessly with their existing ticketing infrastructure, membership databases, and internal reporting tools, thereby reducing their dependence on external providers.

The development of in-house systems can be driven by a need for unique features not offered by off-the-shelf solutions, or by concerns over data security and platform control. While the initial cost of building such a system can be substantial, it can lead to long-term cost savings and greater operational efficiency for organizations with high-volume event needs. For example, a venue that hosts thousands of events annually might find that the ongoing fees for a third-party platform outweigh the capital expenditure of an in-house solution over several years.

- Customization: In-house systems allow for unparalleled tailoring to specific organizational workflows and branding.

- Control: Full ownership of the technology provides greater control over data, security, and feature development.

- Cost Efficiency (Long-term): For high-volume users, developing proprietary software can be more cost-effective than recurring platform fees.

- Integration: Seamless integration with existing enterprise resource planning (ERP) or customer relationship management (CRM) systems is often a key driver.

The threat of substitutes for Eventbrite is substantial, stemming from various alternatives that allow event organizers to manage ticketing and registrations outside of dedicated platforms. These substitutes range from direct website sales and social media tools to traditional methods and even custom-built systems.

Social media platforms like Facebook Events, with billions of active users as of early 2024, offer a free and convenient way to promote events and manage RSVPs, directly competing with Eventbrite's core offerings. Similarly, traditional methods like physical box offices remain relevant for local events, with many smaller, community-focused gatherings still relying on these direct sales channels in 2024.

The availability of general e-commerce platforms and the option for organizations to develop proprietary systems further diversify the substitute landscape. While these alternatives may lack Eventbrite's specialized event management features, their accessibility and potential cost-effectiveness, especially for simpler events or large-scale custom needs, pose a significant competitive challenge.

| Substitute Type | Key Characteristics | Eventbrite's Competitive Advantage | 2024 Relevance |

|---|---|---|---|

| Social Media Platforms (e.g., Facebook Events) | Free/low-cost promotion, large user base, easy RSVP management | Specialized event discovery, analytics, branding, payment processing | High usage for organic event promotion |

| Direct Website Sales | Full control, custom branding, direct customer relationship | Integrated ticketing, attendee management, marketing tools | Common for established brands and recurring events |

| Traditional Ticketing (Box Office) | Familiarity, accessibility for non-digital users | Scalability, advanced reporting, digital marketing integration | Persistent for local and niche events |

| In-house Systems | Complete customization, data control, long-term cost savings | Ease of use, broad feature set, immediate scalability | Feasible for large enterprises with high event volume |

Entrants Threaten

While a full-scale global platform demands significant investment, the barrier to entry for basic online ticketing or event management services is surprisingly low. Entrepreneurs can launch niche platforms or tools with relatively modest capital, targeting specific event types or local markets.

This accessibility means that even smaller, specialized competitors can emerge, offering focused solutions that might appeal to segments of the market Eventbrite serves. For instance, a platform specializing solely in music festivals or corporate conferences could be developed with considerably less upfront funding than Eventbrite’s comprehensive offering.

Established players like Eventbrite thrive on powerful network effects. A large organizer base draws more attendees, and conversely, a substantial attendee pool attracts more events, creating a self-reinforcing cycle. For instance, in 2024, Eventbrite's platform likely facilitated millions of events, showcasing this inherent advantage.

Newcomers struggle to replicate this scale. Building a critical mass of both organizers and attendees from scratch requires immense marketing investment and time, posing a significant barrier to entry. Without this established network, new entrants find it challenging to compete effectively on reach and user engagement.

The threat of new entrants into the online ticketing space is significantly tempered by the intricate web of regulatory and compliance hurdles. New players must grapple with a diverse array of laws governing financial transactions, robust data privacy standards like GDPR and CCPA, and consumer protection mandates that vary by region. For instance, in 2024, companies operating in the EU faced ongoing scrutiny regarding data handling practices, with potential fines for non-compliance reaching up to 4% of annual global revenue.

Establishing the necessary legal and compliance infrastructure represents a substantial upfront investment, creating a formidable barrier for potential newcomers. This includes developing secure payment gateways, implementing stringent data protection protocols, and ensuring adherence to a multitude of consumer rights legislation. The sheer cost and complexity of building this foundation can deter many aspiring entrants, effectively protecting established platforms like Eventbrite.

Brand Recognition and Trust

Eventbrite's established brand recognition and trust present a significant barrier for new entrants. Years of operation have cultivated a reputation for reliability and user-friendliness, making it a go-to platform for event organizers and attendees alike. Newcomers face the daunting task of building comparable brand equity, which typically demands substantial investment in marketing and a considerable timeframe to gain traction.

For instance, Eventbrite reported a strong presence in 2023, serving millions of events and a vast user base. This widespread adoption means new platforms must not only offer comparable functionality but also convince both sides of the marketplace to switch, a challenge amplified by the inherent trust consumers place in familiar brands.

- Brand Loyalty: Eventbrite benefits from existing user loyalty, making it harder for new entrants to attract and retain customers.

- Marketing Investment: New entrants need to allocate significant marketing budgets to build awareness and compete with Eventbrite's established brand presence.

- Reputation Building: Establishing a reputation for reliability and ease of use, akin to Eventbrite's, is a lengthy and resource-intensive process.

- Network Effects: Eventbrite's large user base creates network effects, where more users attract more users, further solidifying its market position.

Access to Event Inventory and Data

Incumbents like Eventbrite hold a significant advantage due to their extensive databases of past events, established organizer relationships, and amassed attendee data. This wealth of historical information provides invaluable insights into market trends and consumer behavior, creating a substantial barrier for newcomers.

New entrants face the daunting task of building their event listings and cultivating a user base from the ground up. They lack the pre-existing event inventory and the deep understanding of attendee preferences that Eventbrite and similar established platforms already possess, presenting a considerable competitive hurdle.

- Established Data Advantage: Eventbrite's years of operation have resulted in a comprehensive database of millions of past events and associated attendee information, offering a rich resource for analytics and targeted marketing that new entrants cannot easily replicate.

- Network Effects: The value of Eventbrite's platform increases with each new event listed and attendee registered, a network effect that is difficult for new entrants to overcome without a significant initial user base.

- Organizer Loyalty: Organizers who have successfully used Eventbrite for past events are less likely to switch to a new platform, especially if they benefit from established workflows and existing attendee lists.

While the initial cost to launch a basic ticketing service is low, the threat of new entrants is significantly mitigated by substantial barriers. Eventbrite's established brand recognition and the immense marketing investment required to build comparable trust and reach are major deterrents. Newcomers must also overcome the powerful network effects that Eventbrite leverages, where a large organizer and attendee base attracts even more users, creating a self-reinforcing cycle that is incredibly difficult to replicate from scratch.

Furthermore, the complex regulatory landscape, particularly concerning data privacy and financial transactions, demands significant upfront investment in legal and compliance infrastructure. For instance, in 2024, compliance with evolving data protection laws like GDPR and CCPA presented ongoing challenges and potential financial risks for businesses operating in the digital space. Eventbrite's existing infrastructure and experience in navigating these regulations provide a distinct advantage, making it costly and time-consuming for new entrants to establish a secure and compliant operation.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Brand Recognition & Trust | Eventbrite's established reputation for reliability and ease of use. | Requires substantial marketing investment and time to build comparable brand equity. |

| Network Effects | Large base of organizers and attendees attracts more users. | Difficult for new entrants to achieve critical mass without significant initial user acquisition. |

| Regulatory Compliance | Adherence to data privacy (e.g., GDPR, CCPA) and financial transaction laws. | Demands significant upfront investment in legal and infrastructure development. |

| Data & Relationships | Existing databases of past events and organizer relationships. | New entrants lack historical insights and established partnerships, hindering market understanding and reach. |

Porter's Five Forces Analysis Data Sources

Our Eventbrite Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Eventbrite's SEC filings, investor relations reports, and industry-specific market research from firms like Statista and IBISWorld. This blend of primary and secondary data allows for a comprehensive evaluation of competitive forces within the event ticketing and management industry.