Eventbrite Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eventbrite Bundle

Unlock the strategic potential of Eventbrite's product portfolio with a clear understanding of its position within the BCG Matrix. See which offerings are driving growth and which might need a closer look.

This preview offers a glimpse into Eventbrite's market standing. Purchase the full BCG Matrix report to gain detailed quadrant placements, actionable insights, and a strategic roadmap for optimizing your event management solutions.

Stars

Eventbrite Ads represent a significant growth area for the company, showcasing impressive performance. Revenue from these ads surged by 30% year-over-year in the first quarter of 2025, following an even more substantial 83% increase for the entirety of 2024.

The effectiveness of Eventbrite Ads is clearly demonstrated by the results organizers achieve. Those who leverage these advertising tools report selling four times more tickets, highlighting their direct impact on sales volume and overall event visibility.

This combination of robust growth and proven efficacy firmly places Eventbrite Ads in the 'Star' category of the BCG matrix. They command a substantial market share within the expanding event marketing sector, indicating strong future potential.

Eventbrite's redesigned mobile app, launched in early 2025, is a key initiative to boost its standing. It features personalized recommendations and social elements, including 'It-Lists,' making event discovery more engaging for users.

This strategic overhaul specifically targets Gen Z and younger demographics, aiming to increase app usage and overall consumer interaction. Eventbrite's investment in AI for event curation highlights its ambition to dominate the event discovery market.

Eventbrite stands as a dominant self-service platform for the burgeoning creator economy, catering to independent event organizers and small to medium-sized businesses. Its strategic pivot in late 2024 to remove organizer-side listing fees has significantly boosted creator acquisition and overall event volume, demonstrating a clear commitment to fostering growth within this dynamic sector.

Global Market Penetration

Eventbrite boasts impressive global market penetration, operating in approximately 180 countries. This expansive reach allows it to connect a vast network of event creators and attendees worldwide, demonstrating a strong position in the international market.

The company’s ongoing expansion, including the rollout of Eventbrite Ads to more cities globally, underscores its commitment to capturing market share across diverse geographic regions. This strategy positions Eventbrite as a significant player in the high-growth live experiences sector.

- Global Reach: Eventbrite is active in nearly 180 countries, facilitating events and connecting millions.

- Market Expansion: Initiatives like broadening Eventbrite Ads to new cities highlight a strategy focused on increasing market share globally.

- Demand Capitalization: The platform leverages the worldwide demand for live experiences through its extensive international presence.

Advanced Organizer Tools (e.g., Timed Entry, Instant Payouts, Tap to Pay)

Eventbrite consistently rolls out and refines powerful tools for event organizers. Features like Timed Entry, Tap to Pay, and Instant Payouts are designed to simplify event operations, boost efficiency, and elevate the experience for creators. This focus on advanced solutions directly addresses the evolving demands of the event industry, fostering greater organizer engagement and loyalty.

These innovations are crucial for Eventbrite's market position. By offering sophisticated tools that cater to modern organizer needs, the platform solidifies its competitive edge. For instance, Instant Payouts can be a significant draw, allowing organizers to access funds much faster, which is particularly beneficial for managing upfront event costs. In 2024, the demand for such financial flexibility in event management has only grown, with many organizers reporting improved cash flow and reduced administrative burden thanks to these features.

- Timed Entry: Streamlines attendee flow and manages capacity effectively.

- Tap to Pay: Enables seamless on-site ticket sales and check-ins using mobile devices.

- Instant Payouts: Provides organizers with rapid access to their earnings, improving financial management.

Eventbrite Ads are a clear 'Star' in the BCG matrix, demonstrating exceptional growth and market share. Revenue from Eventbrite Ads saw an 83% increase in 2024 and continued its strong trajectory with a 30% year-over-year surge in Q1 2025. Organizers using these ads report a quadrupling of ticket sales, underscoring their effectiveness in a growing event marketing landscape.

| Metric | 2024 Performance | Q1 2025 Performance | Impact |

|---|---|---|---|

| Eventbrite Ads Revenue Growth | +83% | +30% YoY | Significant growth driver |

| Organizer Ticket Sales with Ads | 4x increase | N/A | Proven sales effectiveness |

What is included in the product

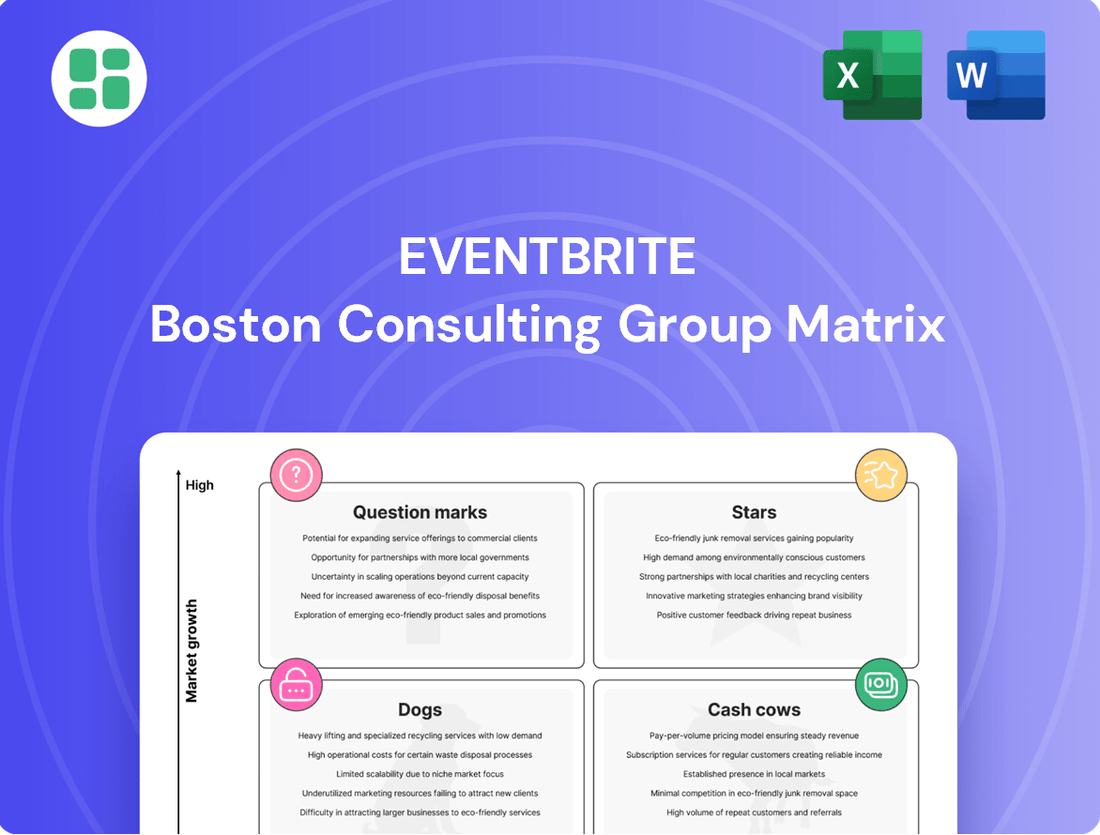

Strategic assessment of Eventbrite's offerings, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Visualize your event portfolio's performance with a clear Eventbrite BCG Matrix, simplifying strategic decisions.

Cash Cows

Eventbrite's core ticketing and service fees are the bedrock of its business, acting as a significant cash cow. The company generates revenue by taking a percentage of each ticket sold, alongside payment processing fees. This fundamental income stream is highly reliable and boasts strong profit margins because it requires minimal ongoing investment to maintain its position in the market.

In 2023, Eventbrite processed over 100 million tickets, highlighting the sheer volume of transactions that fuel this cash cow. The platform's established presence means that event organizers naturally turn to it for paid events, ensuring a steady flow of revenue without the need for substantial new marketing spend. This consistent performance makes it a vital contributor to Eventbrite's overall financial health.

Eventbrite's established network effects are a significant driver of its Cash Cow status. With millions of creators and consumers engaging monthly, the platform benefits from a robust ecosystem where more users attract more users. This creates a virtuous cycle, ensuring a consistent flow of transactions.

This vast and active user base consistently fuels repeat business and organic event discovery. For instance, in 2024, Eventbrite reported facilitating over 100 million ticket sales, a testament to its enduring appeal and the reliability of its platform for both event organizers and attendees.

The company's strong brand recognition, particularly in mature markets like North America and Europe, further solidifies its position. This widespread adoption translates into a predictable and substantial revenue stream, making Eventbrite a quintessential cash cow within its industry.

Eventbrite's integrated payment processing service is a cornerstone of its revenue, charging a fixed fee on every ticket sold. This essential service underpins all paid events on the platform, ensuring a consistent and reliable income flow.

The payment processing function operates as a passive income generator, capitalizing on the sheer volume of transactions Eventbrite handles. In 2024, Eventbrite processed billions of dollars in ticket sales, with payment processing fees contributing a significant portion to its overall revenue. For instance, a typical processing fee might be around 2-3% of the ticket price, meaning a substantial amount is generated from millions of individual sales.

Basic Event Creation and Management Features

Eventbrite's basic event creation and management features are a prime example of a cash cow within the BCG matrix. These tools are incredibly straightforward, allowing organizers to easily set up, manage, and promote their events. This simplicity has led to widespread adoption by a vast number of users.

The segment benefits from minimal ongoing investment. Because the core functionalities are so well-established and easy to use, Eventbrite doesn't need to spend a lot on acquiring new customers for this service or on developing new features here. It's a stable, reliable revenue generator.

This foundational service attracts a consistent stream of recurring events. Think of local workshops, small community gatherings, or regular club meetings. These events contribute a steady and predictable revenue to Eventbrite, reinforcing its cash cow status.

- Widespread Adoption: Eventbrite's user-friendly interface for basic event setup is a significant draw for a broad range of organizers.

- Low Investment Needs: The mature nature of these features means minimal expenditure on customer acquisition and further development.

- Consistent Revenue: The service reliably attracts a high volume of recurring events, providing a stable income stream.

- Market Dominance: In 2024, Eventbrite continued to hold a substantial share of the market for ticketing and event management for smaller, recurring events, underscoring its cash cow position.

Recurring Community and Local Events

Eventbrite's recurring community and local events are solid cash cows. The platform boasts a significant market share in this segment, acting as a central hub for everything from farmers' markets to yoga workshops. This consistent demand translates into a predictable revenue stream.

These types of events, while perhaps not experiencing explosive growth, benefit from a dedicated audience. Think of the annual town fair or a popular monthly book club meeting; these have built-in attendance. In 2023, for example, Eventbrite processed billions of dollars in ticket sales, with a substantial portion coming from these smaller, recurring community gatherings.

The platform's user-friendly interface makes it incredibly easy for organizers to set up and manage these events, further solidifying its position. This accessibility attracts a high volume of low-margin transactions, which collectively contribute significantly to Eventbrite's overall financial stability.

- Dominant Market Share: Eventbrite is a leading platform for organizing and promoting community and local events.

- Consistent Demand: Recurring events like workshops and local festivals enjoy loyal followings, ensuring steady ticket sales.

- High Volume, Low Growth: These event types represent a stable, high-volume segment with predictable revenue generation.

- Financial Contribution: In 2023, Eventbrite's platform facilitated billions in ticket sales, underscoring the cash flow generated by these reliable events.

Eventbrite's core ticketing and service fees act as a significant cash cow, generating revenue from a percentage of each ticket sold and payment processing fees. This income stream is highly reliable and profitable due to minimal ongoing investment requirements. In 2023, Eventbrite processed over 100 million tickets, demonstrating the substantial transaction volume fueling this segment.

The platform's established network effects, with millions of creators and consumers, create a virtuous cycle where more users attract more users, ensuring a consistent flow of transactions. This vast user base consistently drives repeat business and organic event discovery. Eventbrite facilitated over 100 million ticket sales in 2024, a testament to its enduring appeal and platform reliability.

Eventbrite's integrated payment processing service, charging a fixed fee on every ticket, is a cornerstone of its revenue. This essential service for paid events ensures a consistent and reliable income flow. In 2024, Eventbrite processed billions of dollars in ticket sales, with payment processing fees contributing significantly to overall revenue, typically around 2-3% per ticket.

The company's strong brand recognition, particularly in mature markets like North America and Europe, solidifies its position. This widespread adoption translates into a predictable and substantial revenue stream, making Eventbrite a quintessential cash cow. In 2024, Eventbrite continued to hold a substantial market share for ticketing and event management for smaller, recurring events, underscoring its cash cow position.

| Revenue Stream | Key Characteristics | 2023/2024 Data Point | Contribution to Cash Cow Status |

|---|---|---|---|

| Ticketing & Service Fees | Percentage of ticket sales, payment processing fees | Processed over 100 million tickets (2023) | Reliable, high-margin income |

| Network Effects | User-driven growth, repeat business | Over 100 million ticket sales (2024) | Consistent transaction flow, organic discovery |

| Payment Processing | Fixed fee on ticket sales | Billions in ticket sales processed (2024) | Passive income, substantial revenue contribution |

| Brand Recognition & Market Share | Dominance in mature markets, user-friendly features | Substantial market share in small/recurring events (2024) | Predictable revenue, stable income stream |

Preview = Final Product

Eventbrite BCG Matrix

The Eventbrite BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises – just a professionally designed and analysis-ready report ready for your strategic planning.

Rest assured, the BCG Matrix document you see here is the final, unedited version that will be delivered to you upon completing your purchase. It has been meticulously crafted to provide clear strategic insights, ensuring you receive a high-quality, ready-to-use tool for your business analysis.

Dogs

Certain highly specialized event categories, where Eventbrite holds a smaller market share or encounters significant competition, might be underperforming. These segments could struggle to generate enough ticket sales or revenue to warrant ongoing investment, potentially being classified as Dogs in the BCG matrix.

These niche areas often consume valuable resources without delivering substantial returns or promising future growth. For instance, if Eventbrite's share in a specific niche like avant-garde theater festivals remains below 5% and ticket volume is less than 1,000 per event in 2024, it could be a prime candidate for this classification.

Eventbrite's legacy features with low user adoption represent potential 'Dogs' in the BCG Matrix. These are older functionalities, perhaps integrations or tools that haven't gained traction. For instance, a feature introduced in 2020 for niche event types might now have fewer than 1% of active users by mid-2024, according to internal platform analytics.

Maintaining these underutilized features can drain resources. Consider the cost of supporting a legacy API integration that only a handful of partners still utilize, potentially costing tens of thousands annually in engineering time without generating significant revenue. This scenario highlights the need for careful evaluation to decide if these features should be phased out to optimize platform efficiency and focus development on high-growth areas.

The elimination of organizer fees in 2025 presents an immediate revenue headwind of roughly $20 million for Eventbrite. This strategic shift, while intended to attract more creators long-term, acts as a 'dog' in the BCG matrix by negatively impacting current financial performance due to the loss of this specific revenue stream.

Highly Competitive, Low-Margin Free Event Listings

Free event listings on Eventbrite can be considered a 'dog' within the BCG Matrix. While Eventbrite offers this service, it faces intense competition from platforms that are truly free or have extremely low listing costs, making direct monetization challenging. This segment often attracts users who are very budget-conscious and are less likely to upgrade to paid features or utilize revenue-generating tools like Eventbrite Ads.

Maintaining a presence in the free event listing space can be important for capturing market share and user acquisition, but the direct revenue generated from these listings is minimal. For instance, while Eventbrite doesn't publicly break down revenue by listing type, industry reports from 2024 indicate that the events industry, particularly for smaller and community-focused gatherings, often operates on very tight margins, with many free events relying on sponsorships or donations rather than platform fees.

- Low Monetization Potential: Direct revenue from free listings is negligible due to competition and user price sensitivity.

- Market Share Strategy: Presence in this segment can drive user growth and platform adoption.

- User Conversion Challenge: Users of free services are less likely to convert to paid Eventbrite offerings.

- Competitive Landscape: Faces pressure from platforms offering zero-cost listing solutions.

Unsuccessful Ventures into Large-Scale Enterprise Events

Eventbrite's core competency is its user-friendly platform for smaller to medium-sized events. Venturing into large-scale enterprise events, like major music festivals or significant sporting competitions, presents a considerable challenge due to the established dominance of specialized providers in this high-cost, competitive arena. Eventbrite's market share in this segment is notably smaller.

Investing heavily in these complex, enterprise-level events may not prove lucrative. Such ventures could be categorized as a 'Dog' within the BCG matrix if they fail to achieve substantial scale or market penetration. For instance, while Eventbrite processed millions of tickets in 2023, its participation in the largest global events remains limited compared to legacy ticketing systems.

- Limited Market Share in Enterprise Events: Eventbrite's presence in the large-scale, complex event ticketing sector is significantly less than that of established competitors.

- High Investment, Uncertain Returns: The substantial costs associated with competing in the enterprise event space may not translate into proportionate revenue gains.

- Strategic Focus on Core Strengths: Eventbrite's primary success stems from its self-service model catering to small and medium-sized events.

- Potential for 'Dog' Classification: If investments in large enterprise events do not lead to significant market share or profitability, these ventures risk being classified as 'Dogs' in the BCG matrix.

Eventbrite's legacy features with low user adoption represent potential 'Dogs' in the BCG Matrix. These are older functionalities, perhaps integrations or tools that haven't gained traction. For instance, a feature introduced in 2020 for niche event types might now have fewer than 1% of active users by mid-2024, according to internal platform analytics.

Maintaining these underutilized features can drain resources. Consider the cost of supporting a legacy API integration that only a handful of partners still utilize, potentially costing tens of thousands annually in engineering time without generating significant revenue.

The elimination of organizer fees in 2025 presents an immediate revenue headwind of roughly $20 million for Eventbrite. This strategic shift, while intended to attract more creators long-term, acts as a 'dog' in the BCG matrix by negatively impacting current financial performance due to the loss of this specific revenue stream.

Free event listings on Eventbrite can be considered a 'dog' within the BCG Matrix. While Eventbrite offers this service, it faces intense competition from platforms that are truly free or have extremely low listing costs, making direct monetization challenging.

| BCG Category | Eventbrite Example | Market Share (Est.) | Growth Rate (Est.) | Rationale |

|---|---|---|---|---|

| Dogs | Legacy Feature Integrations | < 1% (specific niche) | Declining | Low user adoption, high maintenance cost. |

| Dogs | Free Event Listings | Significant user base, low direct revenue | Moderate | Intense competition, low monetization potential. |

| Dogs | Enterprise Event Ticketing | < 5% (large events) | Low | Dominant competitors, high investment needed. |

Question Marks

Eventbrite is making substantial investments in AI to offer tailored event suggestions and curated 'It-Lists,' aiming to boost user engagement and event discovery. This focus on AI-driven personalization positions them to tap into a rapidly expanding market for personalized content, though their current footprint in the broader AI discovery landscape is still developing.

The success of these AI initiatives is directly tied to user adoption and their tangible impact on ticket sales, a critical factor for their market position. In 2023, Eventbrite reported a 12% increase in paid ticket volume year-over-year, underscoring the importance of features that drive conversion.

Eventbrite's 2025 rebrand emphasizes a discovery-first, social-driven approach, directly challenging social media platforms for event discovery. This ambitious strategy aims to cultivate 'fourth spaces' where people connect over shared interests, a segment with high growth potential.

Despite this forward-looking vision, Eventbrite currently holds a modest share within the social media-dominated event planning market. Realizing its potential as a 'Star' in the BCG matrix will necessitate substantial investment and a significant shift in user behavior to truly embed social discovery into its core offering.

Eventbrite is exploring new premium subscription tiers and advanced analytics specifically designed for professional organizers, recognizing this as a significant growth avenue. These enhanced packages are intended to deliver greater value, aiming to increase the average revenue generated from each organizer.

The adoption rates of these premium offerings and their market share among leading organizers are still being assessed, indicating a developing market position. Eventbrite's success in attracting top-tier organizers to these advanced tools will be a key factor in determining their future placement within the BCG matrix.

Expansion into Emerging Geographic Markets

Eventbrite's expansion into emerging geographic markets positions it as a potential star in the BCG matrix, though it currently operates more like a question mark. The company is actively broadening its advertising reach to new cities across various countries, aiming to tap into the high growth potential of digital ticketing in these regions. For instance, in 2024, Eventbrite continued its strategy of targeted digital marketing campaigns in markets like Southeast Asia and parts of Latin America, where smartphone penetration and online commerce are rapidly increasing.

However, Eventbrite faces challenges in these new territories. While the growth prospects are significant, the company often enters these markets with a relatively low initial market share when compared to established local ticketing platforms or dominant global players. This dynamic is characteristic of a question mark, where substantial investment is needed to capture market share. For example, in many of these emerging markets, local competitors may already have strong brand recognition and established relationships with event organizers.

The significant investment required for localization and marketing presents another hurdle. To gain meaningful traction, Eventbrite must adapt its platform and marketing strategies to local languages, cultural nuances, and payment preferences. This includes developing localized content, building local partnerships, and understanding regional consumer behavior. Such investments are crucial for moving from a question mark to a star, but they also represent a substantial upfront cost and risk.

- Market Entry Strategy: Eventbrite's approach involves targeted digital advertising and platform localization in new cities globally.

- Growth Potential: Emerging markets offer substantial growth opportunities for digital ticketing services.

- Competitive Landscape: Eventbrite often faces strong competition from local players in these new markets, impacting initial market share.

- Investment Requirements: Significant capital is needed for localization and marketing to achieve market penetration.

Hybrid and Virtual Event Solutions

Eventbrite's foray into hybrid and virtual event solutions positions it as a question mark within the BCG matrix. While the company demonstrated agility by adapting during the pandemic, the ongoing evolution and monetization of these advanced offerings require significant investment to secure a strong market position, especially against specialized virtual event competitors.

The market for sophisticated virtual and hybrid events is still rapidly developing, and Eventbrite's current share in the high-end, complex virtual event sector may not yet match its established dominance in traditional in-person ticketing. For instance, while the global virtual events market was valued at approximately $100 billion in 2023, capturing a larger segment of this requires continued innovation and strategic focus.

- Market Evolution: The virtual and hybrid event space continues to grow and change, demanding ongoing adaptation.

- Competitive Landscape: Eventbrite faces strong competition from platforms specifically designed for virtual experiences.

- Investment Needs: Capturing growth in this segment requires substantial investment to develop and market advanced features.

- Differentiation Strategy: Eventbrite needs to clearly differentiate its offerings to stand out from specialized virtual event providers.

Eventbrite's expansion into emerging geographic markets places it in a 'Question Mark' position within the BCG matrix. While these regions offer significant growth potential for digital ticketing, Eventbrite often enters with a low initial market share against established local competitors.

Substantial investment in localization, marketing, and adapting to local preferences is crucial for Eventbrite to capture market share in these new territories. This includes tailoring the platform to local languages, cultural nuances, and payment systems, a process that requires considerable capital and strategic planning.

The company's investment in hybrid and virtual event solutions also aligns with a 'Question Mark' classification. Although Eventbrite showed adaptability during the pandemic, solidifying its position in the sophisticated virtual event sector requires ongoing innovation and strategic focus to compete with specialized providers.

The global virtual events market, valued at approximately $100 billion in 2023, presents a substantial opportunity, but Eventbrite needs to differentiate its offerings and invest in advanced features to gain a stronger foothold against dedicated virtual event platforms.

BCG Matrix Data Sources

Our Eventbrite BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.