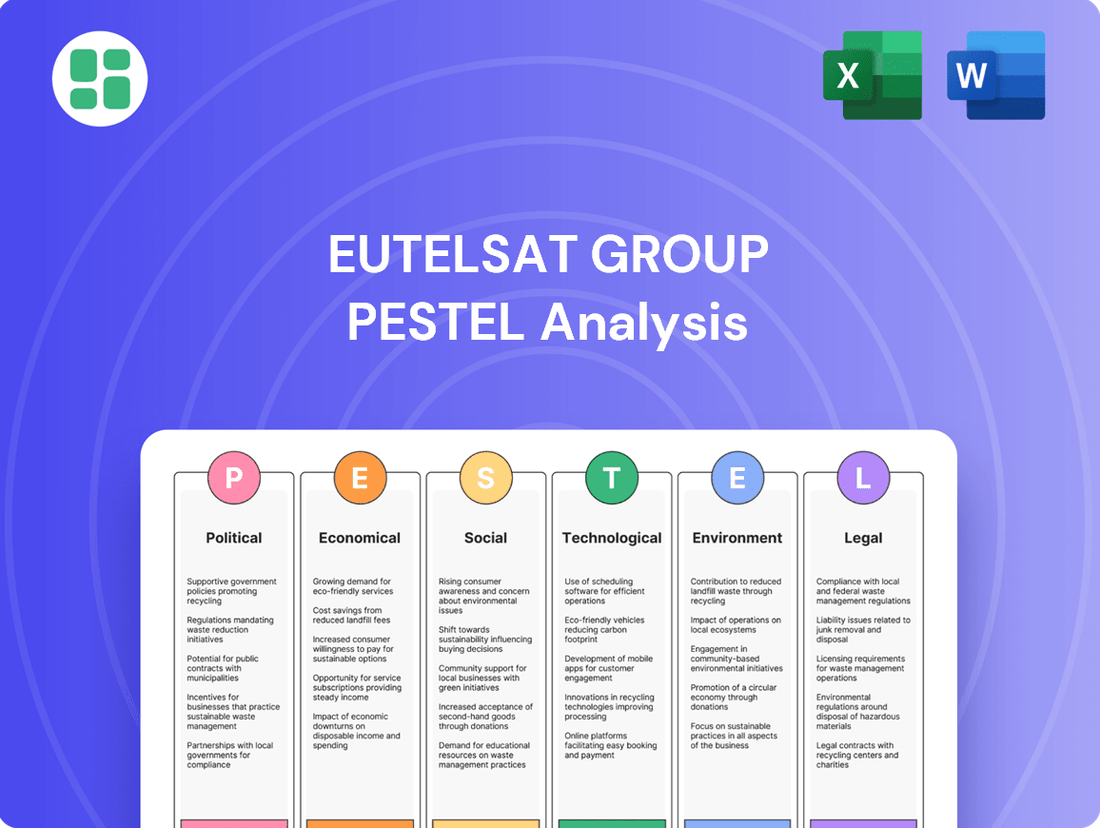

Eutelsat Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eutelsat Group Bundle

Navigating the complex satellite communications landscape requires a deep understanding of external forces. Our PESTLE analysis of Eutelsat Group meticulously unpacks the political, economic, social, technological, legal, and environmental factors shaping its trajectory. Discover how evolving regulations, global economic shifts, and rapid technological advancements present both challenges and opportunities for Eutelsat.

Gain a critical edge by understanding the full spectrum of influences on Eutelsat Group. This comprehensive PESTLE analysis is your key to unlocking actionable intelligence for strategic planning and competitive advantage. Don't miss out on the insights that can redefine your market approach—download the complete report now.

Political factors

Eutelsat Group's strategic positioning is significantly bolstered by government backing and key partnerships, particularly from its major shareholders, the French State and the UK government. This governmental support is instrumental in enabling Eutelsat to undertake ambitious, large-scale ventures.

A prime example is Eutelsat's central role in the European Union's IRIS² program, a critical initiative to establish a sovereign European Low Earth Orbit (LEO) constellation. This collaboration underscores how government alignment provides financial stability and strategic direction for Eutelsat’s expansion into new satellite technologies and services.

Eutelsat Group operates within a complex web of global regulations, requiring constant navigation of diverse legal frameworks for its satellite services and recent integrations like OneWeb. Securing necessary clearances across multiple jurisdictions is paramount for its operations.

Regulatory bodies, such as the UK's Ofcom, significantly influence Eutelsat's business by managing crucial spectrum allocations and fostering competitive market conditions. These decisions directly impact Eutelsat's capacity to launch and operate its satellite constellations worldwide.

Geopolitical stability is a significant factor for Eutelsat. Nations increasingly prioritize sovereign space capabilities, aiming to reduce reliance on non-European satellite systems. This trend directly influences Eutelsat's strategic decisions and partnership opportunities.

Eutelsat's involvement in the IRIS² program exemplifies Europe's commitment to developing independent space infrastructure. This initiative aims to enhance secure connectivity and autonomous space operations for the European Union.

However, geopolitical tensions can pose risks. For instance, sanctions imposed on countries like Russia can impact revenue streams from those specific regions, as seen in past financial reporting.

International Space Policy and Cooperation

Eutelsat Group navigates a complex web of international space policies, increasingly emphasizing collaboration to tackle issues like orbital debris. The company's involvement in initiatives such as the European Space Agency's (ESA) Space Safety Programme and its participation in the Net Zero Space campaign underscore a proactive stance in promoting sustainable space operations. These efforts are crucial as global discussions around space traffic management and responsible satellite deployment intensify, directly influencing Eutelsat's ability to operate and expand its services.

International agreements on spectrum allocation and orbital slot coordination are fundamental to Eutelsat's business model, impacting its satellite network planning and service delivery. For instance, the International Telecommunication Union (ITU) plays a vital role in managing global radio-frequency spectrum, ensuring fair access and preventing interference for satellite operators. Eutelsat's adherence to these regulations and its engagement in ongoing dialogues are essential for maintaining its competitive edge and ensuring the reliability of its connectivity solutions across its global footprint.

- Space Debris Mitigation: Eutelsat is committed to reducing space debris, aligning with international efforts to ensure the long-term sustainability of the space environment.

- Spectrum Coordination: The company actively participates in ITU-led processes for frequency coordination, vital for preventing interference and securing orbital resources for its satellite fleet.

- Space Traffic Management: Eutelsat contributes to discussions and initiatives aimed at establishing effective space traffic management systems, crucial for safe and efficient satellite operations.

Government and Defense Contracts

Eutelsat's engagement with government and defense sectors represents a substantial revenue stream. The company provides vital communication infrastructure, including its Low Earth Orbit (LEO) network, to support diplomatic efforts and critical operations globally. This reliance on government contracts means that changes in public spending or national security priorities can directly impact Eutelsat's contract stability.

In 2023, Eutelsat reported that its government and defense segment contributed a significant portion of its revenue, with a notable increase in demand for LEO-enabled solutions from non-US governmental bodies. For instance, the company secured several multi-year agreements in late 2023 and early 2024 to provide secure satellite communications for international defense initiatives.

- Government Contracts: Eutelsat's revenue is significantly tied to contracts with government and defense entities, providing essential communication services.

- LEO Network Deployment: The company's LEO network is crucial for supporting diplomatic missions and various essential operations worldwide.

- Non-US Government Growth: There's an observed increase in demand for LEO-enabled solutions from governments outside the United States.

- Risk of Spending Shifts: Eutelsat's business is susceptible to fluctuations in governmental priorities and potential spending cuts, which could affect contract renewals.

Governmental support and strategic alignment with national interests are crucial for Eutelsat. The company's role in the EU's IRIS² program highlights how government backing enables large-scale ventures and provides financial stability. This focus on sovereign capabilities is driven by a global trend to reduce reliance on non-European satellite systems, influencing Eutelsat's partnerships and strategic decisions.

What is included in the product

The Eutelsat Group PESTLE analysis dissects the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic positioning.

This comprehensive evaluation provides actionable insights for navigating the complex global landscape and identifying strategic advantages.

A PESTLE analysis for Eutelsat Group serves as a pain point reliever by offering a structured framework to anticipate and navigate complex external factors, thereby reducing uncertainty and enabling proactive strategic adjustments.

Economic factors

Eutelsat Group is navigating a major market transition, moving away from its legacy Video business. This segment's revenue has seen a continued downturn, reflecting broader industry trends.

In contrast, the Connectivity segment is experiencing substantial growth, largely fueled by the integration of OneWeb's Low Earth Orbit (LEO) satellite technology. This is a key driver for the company's future.

This strategic pivot requires significant capital allocation towards advanced technologies and adapting business models to capture opportunities in burgeoning markets like mobile and fixed broadband connectivity.

Eutelsat's ambitious expansion plans, including its Low Earth Orbit (LEO) constellation and next-generation satellites, demand significant capital expenditure. For fiscal year 2023-2024, Eutelsat adjusted its capex forecast downwards to €550 million, but substantial investments are still earmarked for future projects like the IRIS² program.

To fund these endeavors and bolster its financial health, Eutelsat is executing a capital increase targeting €300 million. This move is designed to reduce the company's leverage and provide crucial financial flexibility for its strategic growth initiatives.

The satellite internet market is experiencing fierce competition, notably with the expansion of mega-constellations like SpaceX's Starlink. This intense rivalry pressures established players like Eutelsat to innovate and adapt rapidly.

Eutelsat's strategy, post-merger with OneWeb, focuses on leveraging its combined geostationary (GEO) and low-Earth orbit (LEO) capabilities. This multi-orbit approach targets high-value sectors such as enterprise, aviation, maritime, and government, aiming to offer differentiated services.

The competitive environment necessitates aggressive pricing strategies and a commitment to ongoing technological advancements. For instance, Eutelsat's investment in LEO capabilities alongside its GEO fleet underscores the need to remain competitive against new entrants and evolving customer demands in 2024 and beyond.

Revenue Performance and Profitability

Eutelsat Group's revenue performance for fiscal year 2024-25 shows resilience, with operating vertical revenues remaining stable. This stability is largely thanks to robust growth in connectivity services, which effectively counterbalances the ongoing decline in its traditional video broadcasting segment.

Despite revenue stability, the adjusted EBITDA margin is projected to experience a slight dip. This is primarily attributed to increased operating expenses stemming from the integration of OneWeb and persistent market pressures that are impacting profitability. Eutelsat is targeting a medium-term improvement in its EBITDA margin, aiming for growth in the mid-to-high-single-digit range.

- Stable Operating Vertical Revenues: Fiscal year 2024-25 results indicate steady revenue streams, bolstered by strong connectivity growth.

- Video Decline Offset: Gains in connectivity services are successfully mitigating the downturn observed in the video services sector.

- EBITDA Margin Pressure: Expectation of a slight decrease in adjusted EBITDA margin due to OneWeb consolidation costs and market headwinds.

- Medium-Term Outlook: Company strategy focuses on achieving mid-to-high-single-digit EBITDA margin improvements over the next few years.

Global Economic Trends and Currency Fluctuations

Broader global economic conditions, including inflation and interest rates, significantly influence Eutelsat's financial health. For instance, the Eurozone experienced an inflation rate of 2.4% in April 2024, a slight decrease from previous months, impacting operational costs and potentially customer spending power. Eutelsat's diverse international operations expose it to currency volatility; while some favorable exchange rate movements were observed in early 2024, ongoing fluctuations remain a key consideration.

Economic downturns can dampen demand for satellite services, especially those tied to discretionary spending. As of mid-2024, global growth forecasts suggest moderate expansion, but risks of recession in certain regions persist, which could impact Eutelsat's revenue streams, particularly from sectors sensitive to economic cycles.

- Inflationary pressures: Persistent inflation in key operating regions can increase Eutelsat's operational expenses.

- Interest rate sensitivity: Rising interest rates can affect the cost of capital and investment decisions for Eutelsat and its clients.

- Currency exchange rate impact: Fluctuations in currencies like the Euro against other major currencies can alter reported revenues and profits.

- Economic slowdown risks: A global or regional economic downturn could reduce demand for satellite bandwidth and services.

Global economic conditions directly impact Eutelsat's financial performance. Inflation, such as the 2.4% rate in the Eurozone in April 2024, increases operational costs. Fluctuating exchange rates also present a challenge, as seen with early 2024 currency movements. Potential economic slowdowns in various regions could reduce demand for satellite services, particularly from economically sensitive sectors.

| Economic Factor | Impact on Eutelsat | Relevant Data (as of mid-2024) |

|---|---|---|

| Inflation | Increased operational expenses | Eurozone inflation: 2.4% (April 2024) |

| Exchange Rates | Currency volatility affects reported revenue and profit | Mixed favorable movements observed in early 2024 |

| Economic Growth/Downturn | Demand for services can decrease in slowdowns | Moderate global growth forecasts with regional recession risks |

Full Version Awaits

Eutelsat Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Eutelsat Group. This detailed report covers the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Eutelsat's operations and strategic positioning. You can trust that the insights and structure you see now are precisely what you'll be working with.

Sociological factors

Eutelsat Group is actively bridging the digital divide, a critical sociological challenge. In regions like Sub-Saharan Africa, where internet access is limited, Eutelsat's Konnect Wi-Fi hotspots are a game-changer. This initiative aims to connect millions, aligning with global efforts like the Partner2Connect Digital Coalition to ensure digital inclusion.

Societies are increasingly dependent on constant, fast internet access, impacting everything from home entertainment to critical business operations and government services. This pervasive need isn't limited to stationary locations; it's a growing expectation for users on the move, whether on ships, planes, or in rural areas.

The global demand for internet connectivity continues to surge, with projections indicating significant growth in connected devices and data consumption. For instance, the number of connected IoT devices alone was estimated to reach over 29 billion by 2023, highlighting the expanding digital footprint that requires robust network infrastructure.

Eutelsat Group's strategic investment in a multi-orbit satellite network, integrating both geostationary (GEO) and low-earth orbit (LEO) satellites, directly addresses this escalating societal requirement for ubiquitous and reliable internet. This approach allows Eutelsat to offer high-capacity, low-latency services, catering to diverse user needs and geographical demands, including those in underserved regions.

The societal embrace of remote work and distance learning, amplified by events in 2020 and continuing through 2024, has created a significant demand for reliable internet access. Eutelsat's satellite services are directly addressing this by connecting underserved populations, enabling individuals to participate in the digital economy and access educational opportunities, a trend expected to see continued growth.

As of early 2024, the global remote workforce continues to expand, with many organizations adopting hybrid models. Similarly, online learning platforms have become integral to education systems worldwide. Eutelsat's role in bridging the digital divide through satellite internet directly supports these evolving societal norms, unlocking potential in regions previously limited by terrestrial infrastructure.

Societal Adoption of IoT and Smart Technologies

The widespread adoption of Internet of Things (IoT) devices is a significant societal trend directly impacting Eutelsat Group. Industries like utilities, manufacturing, and healthcare are increasingly deploying IoT solutions, creating a substantial demand for reliable connectivity, especially in areas lacking terrestrial infrastructure. Eutelsat's satellite services are crucial for enabling data collection and communication from these remote and off-grid locations, supporting the operational efficiency of these vital sectors.

The integration of satellite technology into everyday societal and industrial operations is becoming more pronounced. For instance, smart agriculture initiatives are leveraging IoT sensors for soil monitoring and crop management, often in rural settings where satellite backhaul is essential. Similarly, the expansion of smart grids in underserved regions relies on satellite communication for real-time data transmission from distributed energy resources.

The growth in the IoT market underscores this shift. Projections indicate the global IoT market will reach approximately $1.5 trillion by 2025, with a significant portion of this growth driven by industrial IoT (IIoT) applications. This expansion directly translates into increased opportunities for satellite operators like Eutelsat to provide connectivity solutions for a burgeoning ecosystem of connected devices.

Key aspects of societal adoption influencing Eutelsat include:

- Increased demand for remote connectivity: IoT deployments in agriculture, mining, and disaster management, often in areas without terrestrial networks, rely heavily on satellite links.

- Growth of smart cities and infrastructure: While often urban, smart city initiatives also extend to managing remote infrastructure such as transportation networks and environmental monitoring stations.

- Healthcare accessibility: Telemedicine and remote patient monitoring solutions are expanding into rural and underserved communities, requiring robust satellite connectivity for data transfer.

- Industrial automation: Manufacturing facilities and supply chain logistics are increasingly using IoT for process optimization and asset tracking, with satellite connectivity supporting operations in geographically dispersed locations.

Public Safety and Emergency Services

Satellite communication is indispensable for public safety and emergency response, offering a lifeline when traditional networks are compromised. Eutelsat's role in disaster relief and crisis management is crucial, ensuring vital links for government and first responders. For instance, during the 2023 Turkey-Syria earthquake, satellite terminals provided essential communication for rescue teams in areas where ground infrastructure was destroyed.

Societies increasingly expect uninterrupted communication, especially during emergencies, highlighting the critical need for resilient satellite infrastructure. This expectation drives demand for Eutelsat's services, reinforcing their importance in national security and public welfare. The global market for satellite services supporting public safety is projected to grow significantly, with estimates suggesting it could reach billions of dollars by 2028, driven by increasing frequency and severity of natural disasters and geopolitical instability.

- Resilience: Satellite networks offer a robust alternative to terrestrial systems, which are vulnerable to damage during natural disasters.

- Mission Criticality: Eutelsat's capacity supports government agencies and emergency services for secure and reliable communication.

- Societal Demand: Public reliance on connectivity during crises necessitates dependable satellite solutions.

- Market Growth: The public safety satellite communications market is expanding, reflecting the growing recognition of its importance.

Societal reliance on constant, high-speed internet is a defining characteristic of the 2024-2025 landscape, driving demand for Eutelsat's services across diverse applications. This includes bridging the digital divide, as seen with initiatives like Eutelsat's Konnect Wi-Fi hotspots connecting underserved populations, and supporting the burgeoning remote work and education sectors. The increasing integration of IoT devices across industries further amplifies the need for ubiquitous connectivity, particularly in remote or off-grid locations.

Technological factors

The integration of Eutelsat with OneWeb marks a significant technological leap, creating the first fully integrated GEO-LEO satellite operator globally. This strategic combination leverages the distinct advantages of both geostationary (GEO) and Low Earth Orbit (LEO) satellite constellations.

This multi-orbit capability allows Eutelsat to provide a diversified service portfolio. GEO satellites are ideal for broadcasting and wide-area coverage, while LEO offers high-speed, low-latency internet, creating a compelling and differentiated market offering.

By mid-2024, Eutelsat's LEO constellation was already demonstrating its potential, with early service deployments targeting enterprise and government clients seeking robust connectivity solutions. This integrated approach positions Eutelsat to capitalize on the growing demand for seamless, high-performance satellite communications across various sectors.

LEO satellite technology is seeing rapid advancements, with new generations poised to deliver significantly faster speeds, lower latency, and more cost-effective manufacturing and launch processes. Eutelsat is actively participating in this evolution through its investment in the next-generation OneWeb constellation and its involvement in the IRIS² program, both designed to push the boundaries of LEO capabilities.

These technological leaps are fundamental to Eutelsat's strategy for expanding into emerging applications and new markets. For instance, the increasing data throughput and reduced latency offered by advanced LEO systems are critical for enabling widespread adoption of services like high-speed broadband in underserved regions and supporting the growing demand for real-time data transmission in various industries.

The expansion of Eutelsat Group's services hinges not only on its satellite fleet but also on the robust development of its ground segment. This includes the crucial installation of gateways and the widespread deployment of user terminals, both essential for delivering connectivity. Delays in these ground-based elements, as seen with OneWeb's service rollout which experienced some acceleration challenges, underscore their critical role in timely service delivery and market penetration.

Innovations in user terminal technology, particularly electronically steered antennas (ESAs), are paramount for enabling seamless multi-orbit operations. These advanced antennas are vital for sectors requiring constant connectivity, such as aviation, where they facilitate uninterrupted service as aircraft transition between different satellite coverage zones.

Cybersecurity and Network Resilience

As satellite networks become increasingly vital for global communications and data services, cybersecurity and network resilience are paramount technological concerns for Eutelsat Group. The growing integration of these networks into critical infrastructure, from defense to financial services, amplifies the risk of sophisticated cyberattacks. Eutelsat must maintain substantial investments in advanced security protocols and threat detection systems to safeguard its extensive satellite fleet and ground infrastructure, as well as the sensitive data of its diverse clientele.

Protecting against these evolving threats is not just a matter of data integrity but also of ensuring uninterrupted service delivery, which is crucial for maintaining customer trust and market position. The company's commitment to robust cybersecurity directly impacts its ability to operate reliably in an increasingly interconnected digital landscape.

Furthermore, ensuring multi-orbit network resiliency is a key technological imperative. This approach involves leveraging assets across different orbital paths to provide redundancy and maintain service continuity even if one part of the network experiences an outage or is targeted by an attack. For instance, Eutelsat's strategy often involves a mix of geostationary (GEO) and medium Earth orbit (MEO) satellites, offering diverse connectivity options and enhancing overall dependability. This multi-orbit capability is essential for meeting the stringent uptime requirements of many of Eutelsat's enterprise and government customers.

Key technological considerations for Eutelsat include:

- Advanced Encryption: Implementing state-of-the-art encryption for data in transit and at rest across all network segments.

- Threat Intelligence: Continuously monitoring and integrating global threat intelligence to proactively identify and mitigate emerging cyber risks.

- Network Segmentation: Architecting the network with clear segmentation to limit the blast radius of any potential security breach.

- Resilience Testing: Regularly conducting rigorous testing of failover mechanisms and disaster recovery plans to ensure rapid response to disruptions.

Innovation in Satellite Applications and Services

Eutelsat Group is actively innovating in satellite applications, developing advanced connectivity solutions for diverse sectors. Their focus spans fixed and mobile applications, notably enhancing maritime, in-flight, and land-based networks. This strategic development is crucial for maintaining a competitive edge in the evolving satellite communications landscape.

The integration of both Geostationary (GEO) and Low Earth Orbit (LEO) satellite assets is a key technological driver for Eutelsat. This hybrid approach enables seamless, high-performance connectivity, unlocking access to previously underserved markets and customer segments. Eutelsat's Q4 2023/2024 financial update indicated continued growth in their connectivity services segment, reflecting the market demand for such integrated solutions.

Beyond traditional connectivity, Eutelsat is exploring novel applications. These include providing IoT connectivity for remote, off-grid areas, a market with significant growth potential as industries seek to expand their data collection capabilities. Furthermore, the company is advancing new technologies for high-quality video distribution, ensuring it remains at the forefront of media delivery services.

- Maritime Connectivity: Eutelsat's solutions aim to provide reliable, high-speed internet for vessels, enhancing operational efficiency and crew welfare.

- In-flight Connectivity: The company is expanding its offerings for airlines, delivering a seamless passenger Wi-Fi experience.

- IoT in Off-Grid Areas: Development of specialized services to connect devices in remote locations for various industrial and environmental monitoring purposes.

- Advanced Video Distribution: Investing in technologies that support higher resolution and more efficient video streaming over satellite networks.

Eutelsat's technological strategy centers on its integrated GEO-LEO multi-orbit capability, positioning it as a leader in satellite communications. This dual-orbit approach allows for diverse service offerings, from broadcasting via GEO to low-latency internet from LEO. The company's Q4 2023/2024 performance highlighted growth in connectivity services, driven by these advanced solutions.

The rapid evolution of LEO technology, promising faster speeds and lower latency, is a key focus, with Eutelsat investing in next-generation constellations and programs like IRIS². This technological advancement is crucial for expanding into new markets, such as providing high-speed broadband to underserved regions and supporting real-time data demands across industries.

Innovations in user terminals, particularly electronically steered antennas, are vital for seamless multi-orbit operations, especially for sectors like aviation requiring uninterrupted connectivity. Cybersecurity and network resilience are paramount, necessitating ongoing investment in advanced security protocols and threat detection to protect infrastructure and client data.

Eutelsat is actively developing advanced satellite applications, including maritime and in-flight connectivity, alongside IoT solutions for off-grid areas and enhanced video distribution. These efforts underscore the company's commitment to innovation and maintaining a competitive edge in the dynamic satellite communications sector.

Legal factors

Eutelsat Group navigates a complex web of international and national space laws, including the French Space Operations Act and the UK Outer Space Act. These regulations are critical, dictating everything from satellite launch permissions to orbital management and eventual decommissioning, ensuring responsible operations and mitigating legal risks.

Eutelsat's business relies heavily on securing and protecting its allocated radio frequency spectrum, a critical resource for satellite communications. Regulatory bodies, such as the UK's Ofcom, manage spectrum allocation, and Eutelsat actively engages in policy advocacy to ensure its satellite services are shielded from interference, particularly from the expanding terrestrial mobile sector. This protection is essential for maintaining service quality and enabling future innovations.

The global nature of satellite operations necessitates international cooperation, with organizations like the International Telecommunication Union (ITU) playing a key role in harmonizing spectrum usage across borders. For instance, the ITU's World Radiocommunication Conferences (WRC) are crucial for agreeing on spectrum allocations that impact Eutelsat's ability to operate its fleet and deploy new technologies, like those supporting 5G and future satellite broadband services. Eutelsat's participation in these forums helps secure favorable conditions for its continued growth and service provision.

The Eutelsat-OneWeb merger, a significant global transaction, necessitated thorough review and approval from numerous competition authorities worldwide. For instance, the European Commission granted unconditional clearance in July 2023, recognizing that the combination would not substantially lessen competition in the relevant markets. This highlights the intricate and often lengthy process of obtaining regulatory consent for large-scale corporate actions involving international entities.

Licensing and Operational Standards

Eutelsat Group must secure and maintain a complex web of licenses to operate its satellite fleet and ground infrastructure across numerous jurisdictions. These licenses are not static; they often impose stringent technical and operational requirements. For instance, adherence to collision avoidance protocols for orbital debris management is paramount, as is compliance with data sharing mandates that ensure regulatory oversight and spectrum efficiency. Failure to meet these evolving standards can jeopardize Eutelsat's ability to provide services, impacting revenue streams and market access.

In 2024, regulatory bodies worldwide continue to refine satellite licensing frameworks, with a growing emphasis on sustainability and space traffic management. Eutelsat's commitment to these evolving standards is critical for its long-term operational viability. The company actively engages with international organizations like the International Telecommunication Union (ITU) to shape these regulations, ensuring that its operational models align with global best practices. This proactive approach is essential for maintaining its license to operate and for fostering continued innovation in the satellite communications sector.

Key legal and operational considerations for Eutelsat include:

- Satellite Operation Licenses: Obtaining and renewing licenses for each satellite in orbit, covering frequency allocation and orbital slot utilization.

- Ground Station Approvals: Securing permits for the construction and operation of ground segment facilities in various countries.

- Regulatory Compliance: Adhering to national and international regulations concerning data protection, cybersecurity, and interference mitigation.

- Orbital Debris Mitigation: Implementing and reporting on measures to prevent satellite collisions and manage space debris, as mandated by licensing agreements.

Data Privacy and Security Regulations

Eutelsat, as a global provider of connectivity, navigates a complex web of data privacy and security regulations that are constantly evolving. Compliance with these laws is paramount to safeguarding customer data and maintaining operational integrity. For instance, the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018, sets stringent standards for data handling and breach notification, impacting how Eutelsat manages user information across its services.

The increasing reliance on data connectivity services means Eutelsat must remain vigilant about new and updated legislation in various operating regions. Failure to comply can result in significant legal penalties and reputational damage. As of early 2025, discussions around data sovereignty and cross-border data flows continue to shape regulatory landscapes, requiring Eutelsat to adapt its data management strategies proactively.

- Global Compliance Burden: Eutelsat must adhere to diverse data protection frameworks like GDPR, CCPA, and others, each with unique requirements for consent, data minimization, and security.

- Evolving Regulatory Landscape: Ongoing legislative changes, particularly concerning cybersecurity and data localization, necessitate continuous monitoring and adaptation of Eutelsat's data handling practices.

- Customer Trust and Security: Robust data security measures and transparent privacy policies are crucial for maintaining customer confidence, especially as connectivity services expand into sensitive sectors.

Eutelsat Group's operations are deeply intertwined with international and national legal frameworks governing space activities, including licensing, spectrum allocation, and debris mitigation. The company must secure and maintain numerous operational licenses, with compliance requirements evolving to emphasize space traffic management and sustainability, as seen in ongoing discussions with bodies like the ITU in 2024 and early 2025.

Data privacy and security regulations, such as GDPR, continue to shape Eutelsat's data handling practices, requiring vigilance against evolving laws concerning data sovereignty and cross-border flows. As of early 2025, adapting to these changes is critical for maintaining customer trust and avoiding significant legal penalties.

| Legal Area | Key Regulations/Bodies | Eutelsat's Focus |

|---|---|---|

| Space Operations | French Space Operations Act, UK Outer Space Act, ITU | Licensing, orbital management, debris mitigation |

| Spectrum Management | Ofcom (UK), ITU WRC | Spectrum protection, interference mitigation |

| Data Privacy & Security | GDPR, CCPA | Customer data protection, compliance with evolving laws |

Environmental factors

Eutelsat Group has long prioritized space debris mitigation, implementing a dedicated plan since 2005 and boasting a high success rate in deorbiting its satellites. This proactive approach is crucial as the number of active satellites grew significantly, with over 10,000 satellites in orbit by early 2024, a stark increase from just a few thousand a decade prior.

As a founding member of the Net Zero Space initiative, Eutelsat demonstrates a commitment to environmental responsibility in orbit. Their LEO constellation has earned a Platinum rating in the Space Sustainability Rating, underscoring their dedication to reducing orbital debris and ensuring the long-term viability of space operations for all.

Eutelsat Group is actively pursuing aggressive climate goals, as evidenced by its near-term carbon reduction targets, which were validated by the Science Based Targets initiative (SBTi) in January 2025. This commitment underscores a strategic focus on environmental responsibility within the telecommunications sector.

Specifically, Eutelsat aims for a substantial 50% absolute reduction in energy-related greenhouse gas emissions across Scopes 1 and 2 by the year 2030. This ambitious target reflects a direct effort to minimize the company's operational environmental impact.

Furthermore, the company is targeting a 52% reduction in its satellite carbon intensity, measured per Mbit/s, for Scope 3 emissions by the same 2030 deadline. This initiative directly addresses the environmental footprint associated with data transmission services, aligning with global sustainability efforts.

These targets are not arbitrary; they are designed to align with the Paris Agreement's critical 1.5°C warming limit, demonstrating Eutelsat's dedication to contributing to global climate change mitigation strategies through tangible, science-backed objectives.

Eutelsat Group prioritizes responsible satellite end-of-life management, ensuring safe de-orbiting to prevent space debris. This commitment is reinforced by strict internal policies and compliance with national regulations like the French Space Operations Act, which governs satellite disposal procedures.

The French Space Operations Act, for instance, mandates that operators like Eutelsat must deplete remaining energy reserves and deactivate satellite systems at the end of their operational life. This proactive approach minimizes the risk of uncontrolled re-entry and contributes to the long-term sustainability of the space environment.

Environmental Impact Assessment of Operations

Eutelsat Group actively assesses the environmental impact of its space operations. This includes evaluating potential hazards like space debris generation and the broader effects on Earth's environment. Their proactive strategy focuses on reducing ecological footprints across the entire satellite lifecycle, from creation to launch and ongoing service.

Minimizing negative environmental impacts is a key consideration for Eutelsat. They implement measures to manage space debris, a growing concern in Earth's orbit. For instance, in 2023, Eutelsat continued its commitment to responsible satellite end-of-life management, with a significant portion of its fleet designed for deorbiting at the end of their operational lives, aiming to prevent the accumulation of defunct satellites.

- Space Debris Mitigation: Eutelsat designs satellites with end-of-life deorbiting capabilities, a critical factor given the estimated 1 million pieces of space debris larger than 1 cm orbiting Earth as of early 2024.

- Resource Efficiency: The company aims to improve resource efficiency in manufacturing and operations, considering the energy and material inputs required for satellite production and launch.

- Climate Impact: Eutelsat evaluates the carbon footprint associated with its operations, including launch activities, which are a significant contributor to greenhouse gas emissions in the space sector.

Contribution to Environmental Monitoring

While specific Eutelsat Group contributions to environmental monitoring aren't detailed in general industry overviews, satellite operators like Eutelsat are pivotal. Their extensive coverage and advanced technology can indirectly bolster global environmental research and climate change initiatives. For instance, the European Space Agency (ESA), which Eutelsat partners with, utilizes satellite data for crucial environmental monitoring, including tracking deforestation and ice melt, with significant data collection ongoing in 2024.

Eutelsat's broad satellite network can facilitate the transmission of vast amounts of environmental data collected by ground-based sensors and other Earth observation systems. This capability is vital for real-time climate tracking and disaster response. The satellite industry, in general, plays a key role in providing the infrastructure for these critical environmental data flows, a trend expected to intensify through 2025 as climate change impacts become more pronounced.

The satellite sector's contribution to environmental monitoring often aligns with broader corporate sustainability goals. Companies like Eutelsat, by enabling the collection and dissemination of environmental data, indirectly support efforts to understand and mitigate climate change. This indirect contribution is a significant environmental factor for the industry, reflecting a growing awareness and integration of environmental stewardship within satellite operations.

Eutelsat Group actively addresses environmental concerns, particularly space debris, with a robust mitigation plan in place since 2005. By early 2024, over 10,000 satellites were in orbit, highlighting the critical need for responsible space management.

The company is committed to climate action, with near-term carbon reduction targets validated by the Science Based Targets initiative (SBTi) in January 2025. Eutelsat aims for a 50% absolute reduction in Scopes 1 and 2 emissions by 2030, aligning with the Paris Agreement's 1.5°C goal.

Eutelsat also targets a 52% reduction in satellite carbon intensity for Scope 3 emissions by 2030, demonstrating a focus on the environmental impact of data transmission. Their LEO constellation holds a Platinum rating in the Space Sustainability Rating, underscoring their dedication to a cleaner orbit.

| Environmental Factor | Eutelsat's Approach/Commitment | Relevant Data/Context (as of early 2024/2025) |

|---|---|---|

| Space Debris Mitigation | Dedicated plan since 2005; satellites designed for deorbiting. | Over 10,000 active satellites in orbit; ~1 million debris pieces >1cm. |

| Climate Goals | SBTi-validated near-term targets; Net Zero Space founding member. | 50% absolute reduction in Scopes 1 & 2 emissions by 2030; 52% reduction in Scope 3 satellite carbon intensity by 2030. |

| Operational Impact | Focus on resource efficiency; assessment of environmental impact. | Platinum rating for LEO constellation in Space Sustainability Rating. |

PESTLE Analysis Data Sources

Our Eutelsat Group PESTLE Analysis is grounded in data from reputable sources including the European Space Agency, national regulatory bodies, and leading market intelligence firms. We also incorporate insights from global economic reports and technological trend analyses to ensure comprehensive coverage.