Eutelsat Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eutelsat Group Bundle

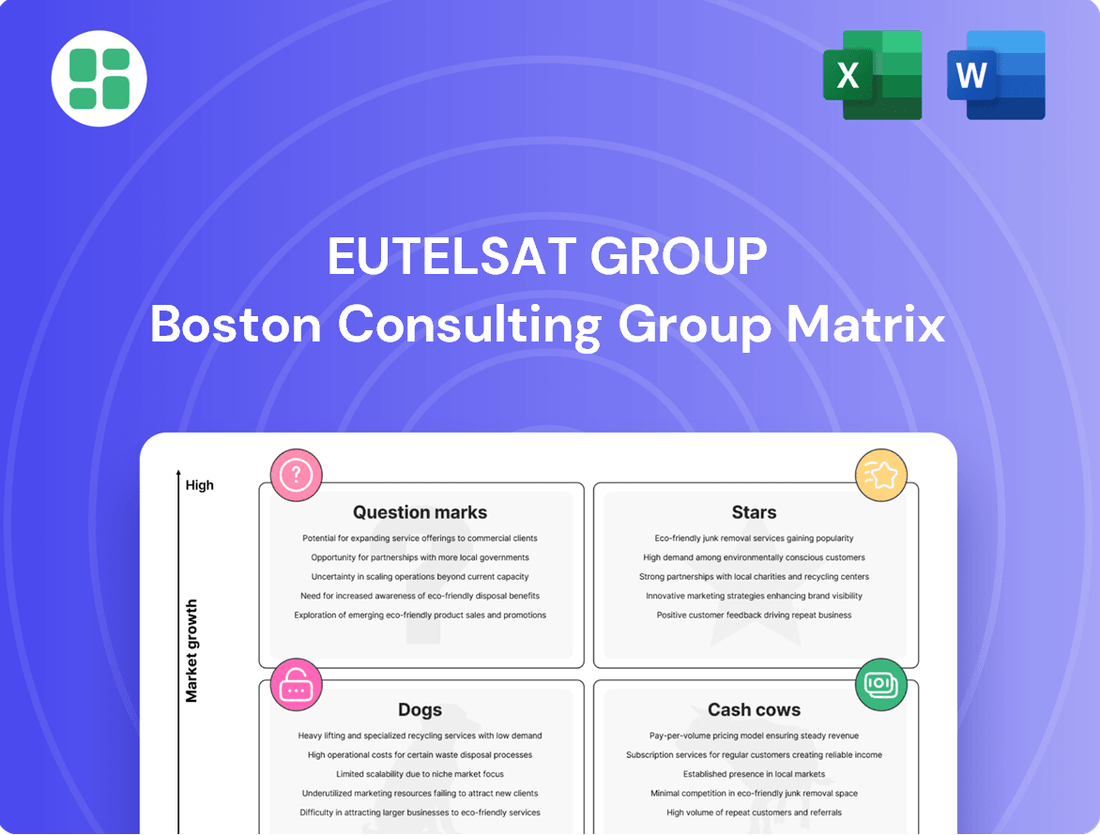

Curious about Eutelsat Group's strategic positioning? Our BCG Matrix preview reveals the foundational insights into their product portfolio's market share and growth potential. Understand which segments are driving growth and which require careful consideration.

Dive deeper into Eutelsat Group's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

LEO-enabled Fixed Connectivity is a star performer for Eutelsat, driven by the OneWeb acquisition. This segment is experiencing robust double-digit revenue growth, fueled by increasing demand for high-speed, low-latency internet. Key contracts, such as the one with NEOM, and expanding cellular backhaul services in Africa, underscore its strong market position in a rapidly evolving sector.

Eutelsat's engagement with government agencies, particularly leveraging its Low Earth Orbit (LEO) capabilities, is a significant growth driver. These services are crucial for secure, resilient, and high-bandwidth communication needs within the public sector.

The increasing demand for advanced government communications is evident in Eutelsat's recent successes. For instance, Eutelsat secured a key contract in 2024 to provide satellite connectivity for a major European defense initiative, highlighting the growing reliance on satellite technology for national security and operational efficiency.

Eutelsat's participation in strategic projects like IRIS² further solidifies its position in this expanding market. This European initiative aims to create a secure connectivity system, and Eutelsat's involvement underscores its commitment to providing cutting-edge solutions for government entities seeking enhanced communication infrastructure.

The multi-orbit mobility solutions market, encompassing in-flight and maritime connectivity, is experiencing robust growth. Eutelsat's strategic positioning with both Geostationary (GEO) and Low Earth Orbit (LEO) satellites is a key differentiator, enabling it to provide superior, uninterrupted connectivity for these demanding environments.

This dual-orbit capability allows Eutelsat to capture substantial market share in this expanding sector. A prime example of this synergy is the integration of OneWeb's LEO technology with Inmarsat Maritime's NexusWave solution, demonstrating a commitment to delivering advanced, high-performance connectivity.

Next-Generation LEO Constellation Expansion

Eutelsat Group is strategically expanding its Low Earth Orbit (LEO) constellation, a move positioning it as a strong contender in the next-generation satellite market. This investment is crucial for solidifying its leadership in a rapidly evolving sector. The company has committed to procuring 100 new satellites, with deliveries expected by the end of 2026. This proactive approach ensures Eutelsat can capitalize on future growth opportunities in the LEO space.

This significant investment in LEO technology reflects Eutelsat's ambition to maintain and enhance its competitive edge. By expanding its constellation, Eutelsat is preparing for increased demand and technological advancements in broadband connectivity. This forward-thinking strategy is essential for navigating the competitive landscape and securing a dominant market share in the coming years.

- LEO Constellation Expansion: Eutelsat is investing in 100 new satellites for its LEO constellation.

- Delivery Timeline: These satellites are slated for delivery by the end of 2026.

- Market Position: This expansion aims to secure and grow Eutelsat's leadership in the LEO market.

- Strategic Importance: The investment is vital for staying ahead in a high-growth technological frontier.

Integrated GEO-LEO Enterprise Solutions

Eutelsat's Integrated GEO-LEO Enterprise Solutions are a key differentiator, especially for large enterprises with complex connectivity demands. This multi-orbit strategy offers unparalleled flexibility, combining the broad coverage of Geostationary (GEO) satellites with the low latency of Low Earth Orbit (LEO) constellations.

By offering this blended approach, Eutelsat is well-positioned to capture a significant share of the expanding enterprise market. For instance, in fiscal year 2023-2024, Eutelsat reported a strong performance in its commercial services segment, driven by demand for advanced connectivity solutions.

- Differentiated Offering: The combination of GEO and LEO services provides a unique value proposition not easily replicated by single-orbit providers.

- Market Position: This strategy strengthens Eutelsat's standing in the enterprise sector, catering to diverse needs from broadcast to broadband.

- Flexibility for Enterprises: Businesses can leverage the strengths of both orbits for applications requiring high bandwidth, low latency, or extensive geographic coverage.

- Revenue Growth: The demand for such integrated solutions is a significant driver for Eutelsat's revenue, particularly within its commercial satellite services.

LEO-enabled Fixed Connectivity is a definite star for Eutelsat, showing impressive double-digit revenue growth. This surge is driven by the increasing need for fast, reliable internet, especially with contracts like the one for NEOM and expanded services in Africa. Eutelsat's government business, particularly its LEO capabilities, is also a major growth engine, providing secure and high-bandwidth communications for public sector needs.

Eutelsat's multi-orbit mobility solutions are also shining stars, combining GEO and LEO satellites to offer seamless connectivity for sectors like aviation and maritime. This dual-orbit approach, exemplified by the integration of OneWeb's LEO with Inmarsat Maritime's NexusWave, allows Eutelsat to effectively capture market share in this expanding area. The company's strategic expansion of its LEO constellation, with 100 new satellites due by late 2026, is a critical move to maintain its leadership in this high-growth technology space.

| Segment | BCG Category | Key Drivers | 2024 Data/Outlook |

| LEO-enabled Fixed Connectivity | Star | Demand for high-speed internet, NEOM contract, African cellular backhaul | Double-digit revenue growth |

| Government Services (LEO) | Star | Need for secure, resilient communication, European defense contracts, IRIS² initiative | Significant growth driver |

| Multi-Orbit Mobility Solutions | Star | In-flight and maritime connectivity demand, dual-orbit strategy (GEO+LEO) | Robust growth, market share capture |

What is included in the product

The Eutelsat Group BCG Matrix categorizes its business units into Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Eutelsat Group BCG Matrix offers a clear, one-page overview, relieving the pain of scattered business unit data.

Cash Cows

Eutelsat's traditional Direct-to-Home (DTH) video broadcasting, while facing a declining video market overall, continues to be a robust cash cow. This segment benefits from a substantial and loyal customer base in mature markets, secured by long-term agreements. These contracts ensure a steady and predictable stream of revenue, even as the industry evolves.

Established Fixed Satellite Services (GEO) are Eutelsat Group's cash cows, generating consistent revenue from long-term contracts for fixed data and telecom backhaul. This mature segment leverages Eutelsat's extensive GEO satellite fleet, ensuring predictable cash flows in a stable, low-growth market.

Eutelsat enjoys a dominant market share in this segment, a position solidified by its robust infrastructure and deep-rooted customer relationships. For instance, in the fiscal year ending June 30, 2023, Eutelsat reported that its GEO fleet continued to be a significant revenue contributor, underpinning the group's financial stability.

Eutelsat Group's legacy government communications contracts represent significant cash cows. These long-standing agreements with various government bodies leverage Eutelsat's robust Geostationary (GEO) satellite fleet to provide essential, reliable communication services.

These contracts generate a consistent and predictable revenue stream, underscoring Eutelsat's dominant position in this mature market segment. The stable nature of these revenue streams means they require very little additional investment to maintain, allowing them to generate substantial free cash flow for the group.

European Broadcast Distribution

European Broadcast Distribution represents a significant Cash Cow for Eutelsat Group. The company boasts a deep-rooted history and a vast network dedicated to television broadcast distribution throughout Europe.

This segment operates within a mature market, characterized by stable, high-margin revenue streams. Eutelsat's established market position and extensive reach are key drivers of this consistent profitability, even though the market itself experiences slower growth.

For the fiscal year ending June 30, 2023, Eutelsat's Broadcast segment generated €1,233 million in revenue. This demonstrates the segment's ongoing financial strength and its role as a reliable contributor to the group's overall performance.

- Established Infrastructure: Eutelsat possesses a robust and extensive infrastructure for delivering television broadcasts across the European continent.

- Mature Market Dynamics: While not experiencing rapid expansion, the European broadcast market offers stable and predictable revenue.

- High-Margin Revenue: The segment consistently generates high profit margins, a testament to Eutelsat's strong market share and operational efficiencies.

- Financial Contribution: In FY23, the Broadcast segment contributed €1,233 million to Eutelsat's total revenue, highlighting its importance as a cash generator.

High-Capacity Trunking for ISPs in Well-Served Regions

Eutelsat's provision of high-capacity trunking to Internet Service Providers (ISPs) in well-served regions represents a significant cash cow. This segment benefits from the ongoing demand for robust data transfer, especially in areas where satellite connectivity remains a vital component of the internet backbone. In 2024, Eutelsat continued to leverage its extensive fleet of geostationary (GEO) satellites to offer these bulk data services, ensuring a consistent revenue stream.

This strategic offering capitalizes on Eutelsat's established infrastructure, transforming high-capacity GEO satellites into reliable cash generators. The predictable nature of these contracts with ISPs contributes to the stability of Eutelsat's financial performance.

- Stable Revenue Generation: Eutelsat's trunking services for ISPs in developed markets provide a consistent and predictable income source.

- Leveraging Existing Assets: The business model effectively utilizes Eutelsat's high-capacity GEO satellites, minimizing the need for new capital expenditure in this segment.

- Crucial Backbone Infrastructure: Satellite trunking remains essential for many ISPs in well-served regions, ensuring sustained demand for Eutelsat's capacity.

- Contribution to Financial Stability: This segment acts as a reliable cash cow, underpinning Eutelsat's overall financial health and operational capacity.

Eutelsat's established Fixed Satellite Services (GEO) are key cash cows, generating predictable revenue from long-term contracts for fixed data and telecom backhaul. This mature segment, utilizing Eutelsat's extensive GEO fleet, ensures stable cash flows in a low-growth market, contributing significantly to financial stability.

Legacy government communications contracts also represent substantial cash cows, leveraging Eutelsat's robust GEO satellite fleet for essential, reliable services. These long-standing agreements provide a consistent revenue stream with minimal investment needs, generating substantial free cash flow.

European Broadcast Distribution remains a significant cash cow, benefiting from Eutelsat's deep history and extensive network for television distribution. This mature market offers stable, high-margin revenue, driven by Eutelsat's strong market position and reach.

Eutelsat's high-capacity trunking services for ISPs in well-served regions are also cash cows, capitalizing on ongoing demand for robust data transfer. In 2024, these services continued to provide a consistent revenue stream by leveraging the company's GEO satellite fleet.

| Segment | Revenue (FY23) | Key Characteristics |

|---|---|---|

| Broadcast | €1,233 million | Mature market, high margins, stable revenue |

| Fixed Satellite Services (GEO) | Significant contributor | Long-term contracts, predictable cash flow |

| Government Communications | Consistent revenue | Legacy contracts, minimal investment |

| ISP Trunking | Ongoing demand | Leverages existing GEO assets, stable income |

Preview = Final Product

Eutelsat Group BCG Matrix

The Eutelsat Group BCG Matrix preview you're examining is the identical, fully rendered report you will receive upon purchase. This means you're seeing the exact strategic analysis, complete with all data points and classifications, that will be yours to download and utilize immediately. Rest assured, there are no hidden pages or missing sections; what you see is precisely the comprehensive document ready for your strategic planning.

Dogs

Eutelsat Group's older geostationary satellites, often referred to as outmoded GEO capacity, represent assets that are becoming less efficient or are nearing the end of their operational life. These satellites may serve niche markets that are experiencing a decline in demand.

These older assets can be a drain on resources, requiring continued maintenance while generating minimal revenue. For instance, Eutelsat has recognized significant goodwill impairments related to certain satellite assets, highlighting their status as cash traps. In 2023, Eutelsat reported an impairment charge of €150 million related to its satellite fleet, underscoring the financial impact of these older assets.

Highly commoditized fixed data services represent a challenge for Eutelsat Group, often falling into the 'Dogs' quadrant of the BCG Matrix. These are basic connectivity offerings in saturated markets where differentiation is difficult, leading to low margins and minimal returns. For instance, in 2024, the satellite broadband market, while growing, faces intense competition from terrestrial providers, impacting the profitability of these foundational services.

Legacy Consumer Broadband (GEO-based) within Eutelsat Group's portfolio is a prime example of a potential 'Dog' in the BCG matrix. These services are grappling with substantial market challenges, primarily from the rapid expansion of terrestrial fiber networks and the emergence of low-Earth orbit (LEO) satellite constellations offering lower latency and competitive speeds.

The demand for traditional geostationary consumer broadband is notably declining, leading to a decrease in profitability. This segment is characterized by high operational costs coupled with diminishing revenue streams, placing it under significant pressure. Eutelsat’s GEO broadband revenue saw a decline in recent reporting periods, reflecting these market shifts.

Given these persistent headwinds, Eutelsat Group may consider strategic options for this segment, including divestiture or a substantial overhaul of its service offerings and cost structure to remain viable. The intense competition and evolving consumer expectations necessitate a critical evaluation of its future role within the group's broader strategy.

Underutilized Capacity in Over-Served Markets

Eutelsat Group, like many players in the satellite industry, faces challenges with underutilized capacity in markets where supply outstrips demand. This situation means that valuable assets are not generating optimal returns, tying up capital that could be deployed elsewhere. For instance, in some established broadband markets, multiple satellite operators compete, leading to lower revenue per transponder and consequently, reduced profitability.

This underutilization directly impacts financial performance. When capacity isn't fully utilized, the cost of ownership, including launch, insurance, and ground segment, is spread over fewer revenue-generating services. This scenario can lead to a decline in key financial metrics, such as return on invested capital.

The strategic implications are significant. Assets with low utilization rates struggle to gain market share and contribute minimally to cash flow. This can hinder a company's ability to invest in next-generation technologies or expand into more promising growth areas.

- Low Utilization Rates: In over-served markets, satellite capacity utilization can fall below 50%, significantly impacting revenue generation.

- Capital Tie-up: Billions invested in satellite construction and launch are not effectively monetized, reducing the return on equity.

- Competitive Pressure: Intense competition in established regions leads to price erosion, further diminishing the value of underutilized capacity.

- Strategic Reallocation: Companies like Eutelsat are exploring options to re-task or divest underutilized assets to focus on high-growth segments like government services or emerging markets.

Non-Strategic Assets slated for Divestiture

Eutelsat Group's portfolio likely includes older, less profitable satellite assets that no longer align with its forward-looking multi-orbit strategy. These might be assets with declining revenues or those requiring significant capital expenditure without commensurate growth potential. For instance, Eutelsat’s Q4 FY23 results showed a slight decline in video revenues, a segment that might house some of these non-strategic assets.

The divestiture of these assets is a strategic move to streamline operations and focus resources on higher-growth areas, such as broadband and mobility services. This aligns with the broader industry trend of consolidation and specialization. Eutelsat’s acquisition of OneWeb, for example, signals a clear pivot towards integrated, multi-orbit solutions.

- Low Profitability: Assets with declining margins or those operating below optimal capacity are candidates for divestiture.

- Limited Growth Prospects: Satellites serving mature markets with little room for expansion may be considered non-core.

- Lack of Strategic Fit: Older technologies or orbital positions that don't complement the integrated multi-orbit vision are subject to review.

- Capital Allocation: Divesting underperforming assets frees up capital for investment in next-generation technologies and services.

Eutelsat Group's legacy GEO broadband services are categorized as 'Dogs' in the BCG Matrix due to intense competition from terrestrial networks and LEO constellations. These services face declining demand and profitability, characterized by high operational costs against shrinking revenues.

The market for traditional GEO consumer broadband is contracting, putting significant pressure on these offerings. Eutelsat’s GEO broadband revenue has seen a downturn, reflecting these challenging market dynamics.

Given these pressures, Eutelsat may consider divesting or significantly restructuring these legacy assets. The group's strategic focus is shifting towards high-growth areas like integrated multi-orbit solutions, exemplified by the OneWeb acquisition.

These 'Dog' assets, like legacy consumer broadband, represent a drain on resources with limited growth potential. Their low profitability and lack of strategic fit with the group's future direction necessitate careful management or divestment to optimize capital allocation.

| BCG Category | Eutelsat Segment | Market Growth | Relative Market Share | Strategic Implication |

|---|---|---|---|---|

| Dogs | Legacy GEO Consumer Broadband | Low / Declining | Low | Divestiture or Restructure |

| Dogs | Commoditized Fixed Data Services | Low | Low | Focus on Efficiency / Niche Markets |

Question Marks

Direct-to-Device (D2D) satellite connectivity, allowing standard smartphones to connect directly to satellites, represents a burgeoning market with significant future promise. Eutelsat Group is actively engaged in this space, currently navigating the early phases of testing and development for its D2D services.

This sector demands considerable financial outlay for research, infrastructure, and spectrum licensing, with Eutelsat's investment in this area reflecting its high-risk, high-reward profile. As of early 2024, the market is still nascent, with Eutelsat yet to capture a substantial commercial foothold, positioning D2D as a potential question mark within its broader strategic portfolio.

Eutelsat's investment in IRIS² positions it as a key player in Europe's ambitious sovereign broadband constellation, a venture with considerable long-term growth prospects. This strategic commitment, however, demands significant upfront capital investment, making it a classic question mark in the BCG matrix.

While the constellation is slated for service entry in 2030, its ultimate market penetration and profitability remain uncertain, reflecting the high risk and potential reward characteristic of this category. Eutelsat's 2023 financial report highlighted ongoing research and development expenditures, with specific figures for IRIS² development not yet broken out separately but contributing to the overall R&D budget.

Eutelsat's involvement in advanced 5G Non-Terrestrial Network (NTN) integration positions it in a high-growth area, with trials demonstrating significant potential for new applications. While the market is still developing, with low current penetration, these early efforts are crucial for securing future market share in this evolving technological landscape.

The company's commitment to these trials, including collaborations for direct-to-device 5G NTN services, underscores the substantial investment required to unlock the commercialization of these advanced satellite-based communications. This strategic focus on 5G NTN aligns with the broader industry trend towards ubiquitous connectivity.

New Market Entry (Specific Developing Regions)

Eutelsat's new market entry into specific developing regions represents a strategic push into high-growth geographies where its current footprint is minimal. These ventures are characterized by substantial initial capital outlays for infrastructure development, regulatory approvals, and market penetration efforts. The objective is to capture emerging demand and establish a strong competitive position, though initial market share is naturally uncertain.

These initiatives align with Eutelsat's broader strategy to diversify its revenue streams and tap into rapidly expanding telecommunications and broadcasting markets. For instance, in regions like Sub-Saharan Africa, satellite broadband demand is projected to grow significantly. By 2024, it's estimated that over 500 million people in Sub-Saharan Africa will still lack reliable internet access, presenting a substantial opportunity for satellite-based solutions.

- High Growth Potential: Targeting developing regions with increasing demand for connectivity and media services.

- Significant Investment Required: Upfront costs for infrastructure, licensing, and market development are considerable.

- Uncertain Initial Market Share: New entrants face challenges in building brand recognition and customer loyalty.

- Strategic Diversification: Aims to reduce reliance on mature markets and capture future growth opportunities.

Cloud-Native Satellite Ground Segment Solutions

Eutelsat Group's investment in cloud-native satellite ground segment solutions positions them squarely in a high-growth, high-investment area. This focus on scalable, flexible, and cloud-integrated technologies signifies a commitment to modernizing satellite operations. The company is actively developing and deploying these advanced ground segment capabilities, aiming to capture future market opportunities.

This segment is characterized by significant R&D expenditure due to evolving industry standards and the need for substantial market adoption. Eutelsat's strategic allocation of resources here reflects a belief in the transformative potential of cloud-native approaches for satellite communications, even with the inherent risks and long development cycles. For instance, the global satellite ground segment market is projected to reach approximately $20 billion by 2028, with cloud integration being a key driver.

- High R&D Investment: Significant capital is being channeled into research and development for cloud-native ground segment technologies.

- Evolving Standards: The company navigates a landscape of developing industry standards, requiring adaptability and forward-thinking design.

- Market Adoption Dependency: Success hinges on widespread market acceptance and integration of these new operational paradigms.

- Growth Potential: This area represents a substantial opportunity for future market share gains in a rapidly advancing sector.

Eutelsat's ventures into Direct-to-Device (D2D) satellite connectivity and advanced 5G Non-Terrestrial Networks (NTN) are classic question marks. These areas demand substantial investment for development and market penetration, with uncertain initial returns. While offering high growth potential, their success hinges on technological evolution and market adoption, making them strategic bets with significant risk.

BCG Matrix Data Sources

Our Eutelsat Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.