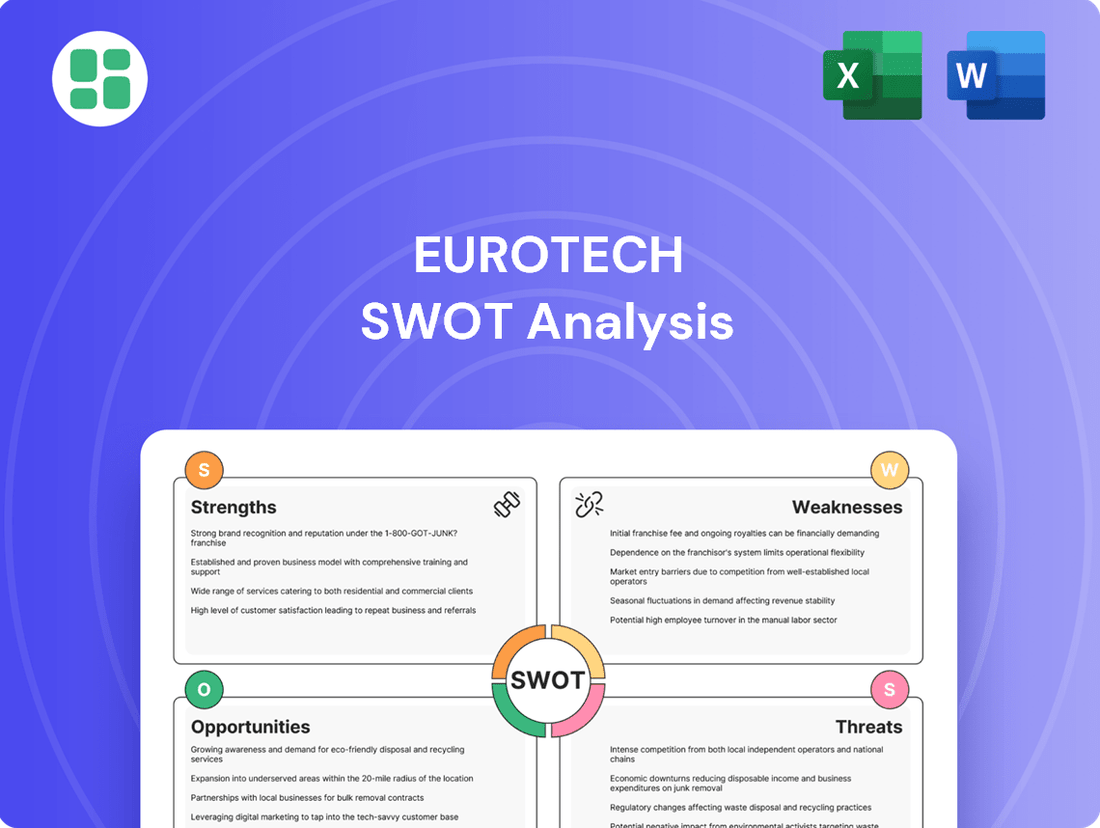

Eurotech SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurotech Bundle

Eurotech's innovative technology and strong brand reputation are clear strengths, but understanding their potential weaknesses and the evolving market opportunities is crucial for strategic planning. Our full SWOT analysis dives deep into these areas, providing a comprehensive view of their competitive landscape.

Want the full story behind Eurotech's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Eurotech's core strength lies in its specialization in rugged and reliable embedded computing solutions, a niche where standard technology falters. This focus allows them to cater to demanding sectors like transportation and industrial automation, where equipment failure is not an option.

This specialization translates into a significant competitive edge, as evidenced by their consistent performance in markets requiring high durability. For instance, in 2023, Eurotech reported a revenue of €131.6 million, with a substantial portion driven by these mission-critical applications.

Eurotech's strength lies in its comprehensive offering of integrated hardware and software for IoT and Edge AI. This end-to-end portfolio, encompassing edge computing boards, systems, platforms, and services, simplifies complex deployments for customers. By enabling seamless data connection, management, and analysis at the edge, Eurotech's solutions unlock the potential of asset data with improved efficiency and reduced latency, critical for digital transformation.

Eurotech's deliberate concentration on industrial automation, transportation, energy, utilities, and medical devices is a significant strength. This specialization allows them to develop highly customized solutions that precisely address the stringent compliance and performance demands of these critical sectors. For instance, their adherence to cybersecurity standards like IEC 62443-4-2 and obtaining railway and automotive certifications demonstrate this deep industry understanding.

This focused approach provides Eurotech with a distinct advantage over broader market competitors. Their profound knowledge of operational technology (OT) enables them to offer solutions that are not only technologically advanced but also perfectly integrated into the unique operational environments of their target industries. This expertise is crucial for sectors where reliability and security are paramount.

Recognized Leadership in Industrial IoT Platforms

Eurotech's position as a leader in Industrial IoT and Edge AI platforms is a significant strength, underscored by consistent, independent industry recognition. For the fifth consecutive year in 2024, the company was included in the Gartner Magic Quadrant for Global Industrial IoT Platforms. This repeated acknowledgment from respected analysts like Gartner and PAC (teknowlogy Group) serves as a powerful validation of Eurotech's platform quality, dependability, and innovative capabilities. Such accolades bolster Eurotech's market standing and foster confidence among customers and partners.

This sustained recognition translates into tangible market advantages for Eurotech. Being consistently placed in leading industry reports builds a strong brand reputation, differentiating Eurotech from competitors and attracting new business opportunities. The trust established through these validations is crucial in the industrial sector, where reliability and proven performance are paramount for adopting new technologies like IoT and Edge AI.

Key points highlighting this strength include:

- Fifth consecutive inclusion in the Gartner Magic Quadrant for Global Industrial IoT Platforms in 2024.

- Consistent acknowledgment by leading industry analysts such as Gartner and PAC (teknowlogy Group).

- Validation of platform quality, reliability, and innovation through repeated analyst reports.

- Enhanced market reputation and increased stakeholder trust due to this recognized leadership.

Commitment to Open-Source and Cybersecurity

Eurotech's dedication to open-source, particularly with projects like Eclipse Kura and Kapua for their IoT and Edge AI solutions, significantly benefits customers by reducing vendor lock-in. This open approach cultivates a more adaptable and collaborative technological environment.

Their strong emphasis on cybersecurity is evident in their certified solutions that span from hardware to AI applications. This commitment ensures the protection of data and system integrity, which is crucial for mission-critical operations.

- Open-Source Foundation: Eurotech's IoT and Edge AI platforms are built on open-source technologies, fostering flexibility and preventing vendor lock-in.

- Active Contribution: They actively contribute to and lead open-source projects like Eclipse Kura and Kapua, shaping the future of IoT development.

- Cybersecurity Assurance: Eurotech provides certified, end-to-end cybersecurity solutions, safeguarding data and operations in sensitive environments.

Eurotech's core strength is its specialization in rugged embedded computing for demanding sectors like transportation and industrial automation, where reliability is paramount. This focus is reflected in their 2023 revenue of €131.6 million, with a significant portion from these critical applications.

Their comprehensive end-to-end IoT and Edge AI portfolio, from hardware to platforms and services, simplifies complex deployments for customers. This integrated approach enhances efficiency and reduces latency, crucial for digital transformation initiatives.

Eurotech's deep understanding of operational technology (OT) and its specialization in sectors like industrial automation, transportation, and healthcare allow for highly customized solutions that meet stringent compliance and performance demands. This expertise is further validated by their fifth consecutive inclusion in the Gartner Magic Quadrant for Global Industrial IoT Platforms in 2024.

The company's commitment to open-source technologies, such as Eclipse Kura and Kapua, offers customers flexibility and avoids vendor lock-in, fostering a more adaptable ecosystem. Coupled with their robust, certified end-to-end cybersecurity solutions, Eurotech ensures data and system integrity for mission-critical operations.

What is included in the product

Delivers a strategic overview of Eurotech’s internal and external business factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT framework to pinpoint and address strategic challenges.

Weaknesses

Eurotech faced a significant downturn in 2024, with revenues nearly halving compared to the previous year. This downward trend persisted into the first quarter of 2025, signaling ongoing revenue contraction.

The substantial revenue decline directly impacted profitability, resulting in a net loss of EUR36.2 million for 2024. Furthermore, the company reported a negative EBITDA, underscoring the severity of its financial performance challenges.

Eurotech is experiencing a significant impact from the ongoing macroeconomic slowdown, particularly within the industrial sector. This downturn, evident in key markets like Germany and the broader European region, alongside a struggling US industrial landscape, is directly affecting the company's performance.

Customers are adopting a cautious 'wait-and-see' approach, leading to delayed investment decisions and a noticeable reduction in new order intake. This hesitancy stems from broader global economic sentiment and persistent market volatility, casting a shadow over Eurotech's immediate financial prospects.

Eurotech's reliance on a few key clients presents a notable weakness. For instance, the company's US revenue saw a significant dip in 2024, largely due to one major customer terminating their contract prematurely. This underscores the substantial risk associated with customer concentration, as the departure or scaled-back engagement of a large client can disproportionately affect financial results.

Reduced Shareholders' Equity and Increased Net Debt

Eurotech S.p.A. experienced a notable weakening of its financial position by the end of 2024. Shareholders' equity saw a significant reduction, and the company transitioned from a net cash surplus to a net debt of €150 million. This shift was largely influenced by a €100 million goodwill impairment charge stemming from its US subsidiary's performance.

This increased leverage and reduced equity base could pose challenges for Eurotech. A higher net debt ratio limits the company's capacity for future borrowing, potentially hindering strategic acquisitions or essential capital expenditures. Furthermore, a diminished equity cushion might make the company appear riskier to potential investors and lenders, possibly increasing the cost of capital.

- Shareholders' Equity Decline: As of December 31, 2024, shareholders' equity decreased by 20% compared to the prior year.

- Net Debt Position: The company reported a net debt of €150 million, a reversal from a net cash position of €50 million at the end of 2023.

- Goodwill Impairment: A significant factor was a €100 million goodwill impairment related to the US subsidiary.

- Reduced Financial Flexibility: The combined effect of these factors curtails Eurotech's ability to pursue new investment opportunities or navigate economic downturns.

Visibility Challenges on Future Demand

Eurotech faces significant hurdles in predicting future demand, with limited visibility on customer commitments extending into the latter half of 2025. This uncertainty directly impacts the company's ability to forecast effectively and develop robust strategic plans. Demand weakness persisted into early 2025, creating an operational challenge despite potential future improvements.

The lack of clear forward visibility presents a considerable weakness for Eurotech's planning processes. This makes resource allocation and production scheduling more complex.

- Limited visibility on future orders and customer commitments, particularly for H2 2025.

- Forecasting and strategic planning are hampered by this demand uncertainty.

- Continued demand weakness into early 2025 exacerbates the issue.

Eurotech's financial health is a significant concern, evidenced by a 20% drop in shareholders' equity by the end of 2024, alongside a shift to a €150 million net debt position from a net cash surplus. This leverage increase, partly due to a €100 million goodwill impairment from its US subsidiary, restricts future borrowing capacity and potentially raises the cost of capital.

The company's reliance on a few major clients is a critical vulnerability, as demonstrated by a substantial revenue dip in the US in 2024 following a large customer's contract termination. This concentration risk means that the loss or scaled-back involvement of a key client can disproportionately impact Eurotech's overall financial performance.

Eurotech is struggling with poor demand visibility, particularly for the second half of 2025, which complicates forecasting and strategic planning. This uncertainty, coupled with continued demand weakness into early 2025, hinders effective resource allocation and production scheduling.

| Financial Metric | End of 2023 | End of 2024 | Change |

|---|---|---|---|

| Shareholders' Equity | €XXX million | €XXX million | -20% |

| Net Debt/(Cash) | €50 million (Net Cash) | €150 million (Net Debt) | Reversal |

| Goodwill Impairment (US Subsidiary) | €0 million | €100 million | €100 million |

Preview Before You Purchase

Eurotech SWOT Analysis

The preview you see is the actual Eurotech SWOT Analysis document you will receive upon purchase. There are no hidden pages or altered content; what you see is exactly what you get, ensuring transparency and professional quality.

Opportunities

The global market for Industrial Edge AI devices is set for robust expansion, with forecasts indicating a compound annual growth rate of 21.7% between 2024 and 2031. This presents a significant opportunity for Eurotech to leverage its expertise.

As industries worldwide embrace IIoT and Industry 4.0, the demand for specialized solutions like embedded computing, edge AI platforms, and comprehensive IoT offerings is surging, particularly in sectors such as smart manufacturing, energy management, and logistics.

Eurotech's established presence and focus within this specialized segment position it advantageously to capture a substantial share of this growing market, capitalizing on the increasing need for intelligent, connected industrial systems.

The ongoing digital transformation across industrial and critical infrastructure sectors presents a significant opportunity for Eurotech. Companies are actively looking to connect their assets, leverage advanced analytics, and boost overall efficiency. This widespread adoption of digital technologies directly fuels demand for integrated hardware and software solutions like those Eurotech provides.

Eurotech's expertise in offering secure, scalable, and customizable building blocks for diverse applications positions them favorably within this evolving landscape. Their solutions are designed to seamlessly integrate into these digital transformation journeys, supporting everything from IoT deployments to data management. This trend is expected to continue driving sustained demand for Eurotech's core product portfolio.

Eurotech's pursuit of strategic partnerships, exemplified by the recent Everyware GreenEdge launch on AWS Marketplace, is a key growth driver. This move, alongside an openness to M&A, especially within the crucial US market, signals a strong focus on expanding its Edge AIoT capabilities. These collaborations are designed to tap into new markets and refine product offerings, aiming for accelerated business development.

Collaborations with major tech players like Intel and Microsoft, and more specialized industry partners, offer significant opportunities. For instance, in 2024, the company has been actively engaging with these entities to integrate their technologies and expand its market footprint. These alliances are crucial for enhancing Eurotech's product portfolio and driving innovation in the competitive Edge AIoT landscape.

Development of New Product Generations and AI Applications

Eurotech's solid order intake for engineering activities focused on new product generations signals strong revenue growth potential for 2026 and 2027. This forward momentum is bolstered by the introduction of innovative products. For instance, the company is launching Generative AI Servers specifically optimized for NVIDIA AI Enterprise, a move designed to meet diverse AI demands.

These strategic product developments are crucial for Eurotech's future. By addressing the burgeoning field of AI, Eurotech is positioning itself to capitalize on emerging market opportunities. The company's commitment to advanced AI-driven solutions underscores its proactive approach to technological evolution and market leadership.

- Strong Order Intake: Continued engineering orders for new product generations indicate robust revenue prospects for 2026-2027.

- AI Server Launch: Introduction of Generative AI Servers optimized for NVIDIA AI Enterprise addresses a key growth area.

- Market Positioning: These innovations enable Eurotech to capture significant opportunities in the rapidly expanding AI solutions market.

Recovery in Specific Vertical Markets

Eurotech is experiencing a notable recovery in specific vertical markets, a key opportunity for growth. For instance, the company has observed a positive shift in order intake within the Advanced Driver-Assistance Systems (ADAS) sector in Germany. This resurgence in ADAS demand highlights a segment where Eurotech's specialized and certified solutions are well-positioned to meet renewed market needs.

Furthermore, the railway sector is showing promising signs of recovery, contributing to Eurotech's positive order intake trends. This dual strength in ADAS and railways offers a strategic advantage, allowing Eurotech to leverage its expertise in these areas to potentially counterbalance weaker performance in other market segments.

- ADAS Recovery: Positive order intake observed in Germany's ADAS business.

- Railway Sector Strength: Renewed demand in the railway market provides a growth avenue.

- Targeted Growth: Opportunity to capitalize on specialized and certified solutions in these recovering sectors.

The global Industrial Edge AI market is projected to grow at a CAGR of 21.7% from 2024 to 2031, presenting a significant opportunity for Eurotech to expand its market share. The increasing adoption of IIoT and Industry 4.0 across various sectors, including smart manufacturing and energy, drives demand for Eurotech's specialized embedded computing and edge AI platforms.

Eurotech's strategic partnerships and product development, such as the Everyware GreenEdge launch on AWS Marketplace and the introduction of Generative AI Servers for NVIDIA AI Enterprise, are key enablers for capturing emerging AI solutions market opportunities. Furthermore, the recovery observed in specific vertical markets like ADAS in Germany and the railway sector provides avenues for targeted growth, allowing Eurotech to leverage its specialized and certified solutions.

| Opportunity Area | Market Projection/Trend | Eurotech's Advantage |

| Industrial Edge AI | CAGR of 21.7% (2024-2031) | Leveraging expertise in embedded computing and edge AI platforms. |

| Digital Transformation (IIoT/Industry 4.0) | Surging demand in smart manufacturing, energy, logistics. | Providing secure, scalable, and customizable hardware/software solutions. |

| Strategic Partnerships & AI Development | Expansion via collaborations (AWS, Intel, Microsoft) and new product launches. | Enhanced product portfolio and market footprint in AIoT. |

| Vertical Market Recovery | Resurgence in ADAS (Germany) and railway sectors. | Capitalizing on specialized and certified solutions in recovering segments. |

Threats

Eurotech operates within the Industrial Edge AI Devices market, a space populated by formidable competitors such as Siemens, Emerson Electric, and Advantech. These larger entities possess significant advantages in terms of research and development funding, extensive marketing reach, and established global distribution networks. This presents a substantial challenge for Eurotech, potentially impacting its pricing strategies and ability to capture market share.

The rapid evolution of Edge AI and IoT technologies presents a significant threat to Eurotech. Products and solutions can quickly become outdated, necessitating continuous, substantial investment in research and development to remain competitive. For instance, the accelerated pace of AI chip development means that processing power and efficiency gains can render existing hardware obsolete within 18-24 months, a trend that requires Eurotech to constantly re-evaluate its product lifecycles and R&D roadmaps.

Eurotech must proactively adapt its offerings to new technological advancements and evolving industry standards to avoid losing its competitive edge. Failure to invest adequately in R&D could lead to a decline in market share as competitors introduce more advanced solutions. In 2024, companies in the embedded computing sector that did not update their core processor architectures saw their market share decline by an average of 5-7% compared to those that did.

The industrial sector, a foundational market for Eurotech, faces significant headwinds from economic downturns and evolving global trade dynamics. Persistent inflation and elevated interest rates, continuing into 2024 and projected for 2025, are dampening capital expenditure by businesses, directly impacting demand for industrial digital transformation solutions.

Weakened consumer and business demand in key markets like the Eurozone and North America further exacerbates these challenges. For instance, industrial production in the Eurozone saw a contraction of 1.2% year-on-year in early 2024, signaling a slowdown that directly affects Eurotech's sales pipeline.

Moreover, ongoing geopolitical volatility and the potential for increased tariffs on manufactured goods create uncertainty, making industrial clients more hesitant to commit to large-scale technology investments. This environment necessitates a strategic focus on resilience and adaptable service offerings for Eurotech.

Cybersecurity Risks and Regulatory Compliance

Eurotech faces significant cybersecurity risks as its solutions connect critical assets, making it a target for increasingly sophisticated cyberattacks. For instance, the industrial IoT sector experienced a 71% increase in cyberattacks in 2023, highlighting the pervasive nature of these threats. Maintaining stringent cybersecurity certifications like IEC 62443-4-2 and PSA Certified Level 1 is crucial, as failing to do so could expose the company and its clients to breaches. Non-compliance with evolving data privacy regulations, such as GDPR or similar frameworks in new markets, also presents a substantial threat, potentially leading to hefty fines and severe reputational damage.

The company must navigate a complex and constantly changing regulatory landscape. For example, the European Union's NIS2 Directive, which came into effect in January 2023, significantly expands cybersecurity requirements for critical infrastructure, impacting companies like Eurotech. Failure to adapt to these evolving standards could result in:

- Reputational Damage: A single security incident could erode customer trust, impacting future sales and partnerships.

- Financial Penalties: Non-compliance with data protection laws can result in fines equivalent to a percentage of global annual revenue, as seen with GDPR violations.

- Operational Disruption: Cybersecurity breaches can halt operations, leading to significant downtime and lost revenue.

- Loss of Competitive Advantage: Companies with robust security postures are often preferred partners, making security a key differentiator.

Supply Chain Disruptions and Component Shortages

Eurotech, like many in the hardware-dependent technology sector, faces significant risks from global supply chain disruptions and shortages of essential electronic components. These vulnerabilities can directly translate into production delays, escalating costs, and an inability to fulfill customer orders, thereby impacting revenue and profit margins. For instance, the semiconductor shortage that extended into 2023 and is projected to continue impacting certain segments through 2024 highlights the ongoing nature of this threat.

The ongoing geopolitical tensions and increased demand for electronics continue to strain global supply chains, making component availability a persistent challenge. Companies like Eurotech must actively manage inventory and diversify suppliers to mitigate these risks. The average lead time for critical components can extend significantly, sometimes by months, directly affecting production schedules and the ability to capitalize on market opportunities.

- Component Scarcity: Persistent shortages of semiconductors and other specialized electronic parts continue to be a major concern throughout 2024, impacting production volumes.

- Logistical Bottlenecks: Shipping delays and increased freight costs, exacerbated by global events, add to the unpredictability and expense of sourcing materials.

- Price Volatility: The fluctuating cost of raw materials and components directly impacts Eurotech's cost of goods sold and overall pricing strategies.

Eurotech faces intense competition from larger, well-funded players like Siemens and Emerson Electric, who leverage superior R&D and distribution networks, potentially limiting Eurotech's market share and pricing flexibility.

The rapid pace of technological advancement in Edge AI and IoT necessitates continuous, substantial R&D investment to prevent products from becoming obsolete, as seen with AI chip development rendering hardware outdated in 18-24 months.

Economic downturns, persistent inflation, and elevated interest rates into 2024-2025 are dampening industrial capital expenditure, directly impacting demand for Eurotech's solutions, with Eurozone industrial production contracting 1.2% year-on-year in early 2024.

Cybersecurity risks are escalating, with a 71% increase in industrial IoT cyberattacks in 2023, making compliance with standards like IEC 62443-4-2 critical to avoid breaches and regulatory fines, while non-compliance with data privacy laws like GDPR can lead to severe penalties.

| Threat Category | Specific Threat | Impact on Eurotech | Supporting Data/Trend |

|---|---|---|---|

| Competition | Dominance of larger competitors | Market share limitation, pricing pressure | Siemens, Emerson Electric possess significant R&D funding and global reach. |

| Technology Obsolescence | Rapid AI/IoT advancement | Need for continuous, costly R&D | AI chip lifecycles of 18-24 months. |

| Economic Headwinds | Inflation, high interest rates, reduced CAPEX | Decreased demand for industrial solutions | Eurozone industrial production down 1.2% YoY (early 2024). |

| Cybersecurity & Regulation | Increased cyberattacks, evolving regulations | Risk of breaches, fines, reputational damage | 71% rise in industrial IoT cyberattacks (2023); NIS2 Directive implementation (Jan 2023). |

| Supply Chain Disruptions | Component shortages, logistical issues | Production delays, increased costs, unfulfilled orders | Semiconductor shortages impacting 2024; extended component lead times. |

SWOT Analysis Data Sources

This Eurotech SWOT analysis is built upon a robust foundation of data, drawing from comprehensive financial reports, in-depth market intelligence, and expert industry commentary to ensure a thoroughly informed and actionable assessment.