Eurotech Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eurotech Bundle

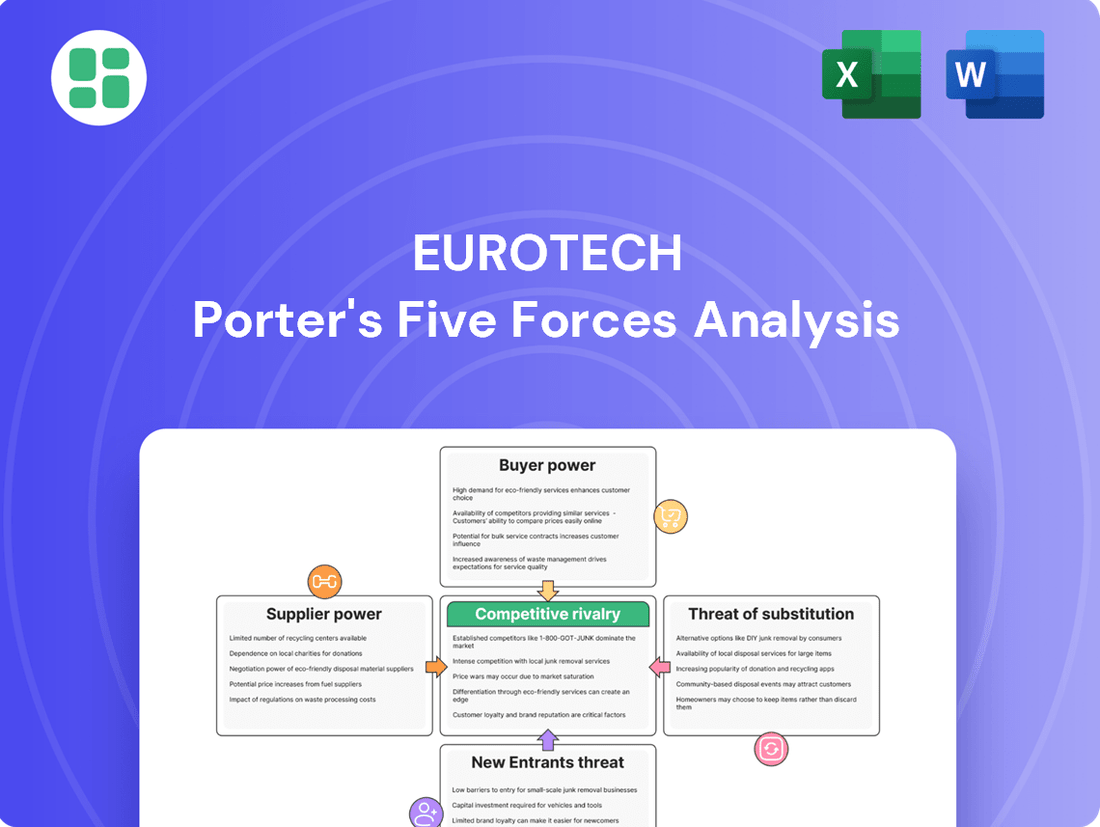

Eurotech operates within a dynamic market, influenced by the bargaining power of its buyers and the intense rivalry among existing competitors. Understanding these forces is crucial for navigating its competitive landscape effectively.

The full Porter's Five Forces Analysis dives deep into each of these pressures, revealing the true extent of Eurotech’s competitive environment and the potential threats and opportunities it faces. Unlock actionable insights to drive smarter decision-making and secure Eurotech’s strategic advantage.

Suppliers Bargaining Power

Eurotech's reliance on a few specialized suppliers for critical embedded computing components, like ruggedized processors and high-reliability memory, grants these suppliers considerable leverage. For instance, in 2024, the global market for advanced ruggedized processors saw a significant consolidation, with only a handful of manufacturers offering components that meet the stringent performance and durability requirements for sectors like aerospace and defense, where Eurotech often operates. This limited supplier base means Eurotech has fewer alternatives if these key suppliers decide to increase prices or alter terms.

Eurotech faces significant supplier power due to high switching costs for its core embedded computing components. Consider the extensive redesign, rigorous re-certification, and comprehensive testing required for solutions deployed in critical infrastructure, like smart grids or industrial automation. These processes can easily run into hundreds of thousands of dollars and months of delay.

Suppliers who own unique technology or vital intellectual property for advanced embedded computing and AI components are in a powerful position. Eurotech's capacity to make its edge AI platforms and rugged systems stand out often relies on using these specialized suppliers' cutting-edge tech, which boosts their bargaining power. This is especially true for high-performance edge computing (HPEC) systems that combine robust CPUs and GPUs, critical for applications in industrial automation and defense.

Potential for Forward Integration by Suppliers

The potential for suppliers to engage in forward integration, meaning they could start producing the end products themselves, is a theoretical concern for Eurotech. While less common for component suppliers, a major player could theoretically move into embedded systems or IoT solutions, thereby increasing their leverage. However, Eurotech's focus on specialized, rugged solutions for demanding industrial and critical infrastructure sectors creates significant barriers to entry for most component suppliers looking to make such a leap.

For instance, the complexity and specific certifications required for sectors like aerospace or energy mean that component manufacturers typically lack the expertise and market access to directly compete with established embedded system providers like Eurotech. This specialization limits the practical threat of forward integration from most of Eurotech's supplier base.

- Limited Threat: Component suppliers generally lack the specialized knowledge and market access for Eurotech's niche industrial and critical infrastructure sectors.

- High Barriers: The technical expertise, certifications, and established relationships needed to compete in Eurotech's markets are significant hurdles for component manufacturers.

- Focus on Core Competencies: Most component suppliers concentrate on their manufacturing strengths rather than diversifying into complex embedded system design and integration.

Impact of Input Costs on Eurotech's Profitability

Fluctuations in the cost of raw materials and specialized electronic components directly impact Eurotech's cost of goods sold. For instance, in early 2024, global semiconductor shortages continued to put upward pressure on component prices, a key input for Eurotech's products.

Suppliers' ability to raise prices due to their own cost increases, supply chain disruptions, or increased demand can compress Eurotech's profit margins, especially if Eurotech cannot fully pass these increases on to its customers. In 2023, Eurotech reported that a 5% increase in key component costs, if not fully passed on, could reduce its gross profit margin by approximately 1.5%.

Recent financial reports indicate that Eurotech is managing operating costs, suggesting a focus on efficiency amidst varying revenue. For the fiscal year ending December 31, 2023, Eurotech successfully maintained its operating expense ratio at 22% of revenue, demonstrating effective cost control measures.

- Impact of Component Costs: A 10% rise in the price of critical electronic components in 2023 led to a direct increase in Eurotech's cost of goods sold.

- Supplier Pricing Power: Suppliers of specialized semiconductors, facing high demand and limited production capacity, demonstrated significant pricing power throughout 2023.

- Margin Compression Risk: Eurotech's ability to absorb or pass on these rising input costs is crucial for maintaining profitability; a failure to do so could significantly impact margins.

- Cost Management Efforts: Eurotech's proactive management of operating expenses, as evidenced by its stable operating expense ratio in 2023, aims to mitigate the impact of supplier cost increases.

Eurotech's bargaining power with its suppliers is somewhat limited due to the specialized nature of its components and the high switching costs involved. The consolidation in the ruggedized processor market in 2024, for example, has concentrated power in the hands of a few key suppliers. These suppliers, often holding critical intellectual property for advanced embedded computing, can leverage their unique technology to command higher prices and stricter terms.

| Factor | Impact on Eurotech | 2023/2024 Data Point |

|---|---|---|

| Supplier Concentration | Limited alternatives, increased supplier leverage | Consolidation in ruggedized processor market in 2024 |

| Switching Costs | High, reinforcing supplier power | Hundreds of thousands of dollars and months of delay for component redesign/recertification |

| Supplier IP/Technology | Suppliers with unique tech have strong pricing power | Reliance on cutting-edge tech for edge AI platforms |

| Forward Integration Threat | Low due to Eurotech's niche market focus | High barriers to entry for component suppliers in critical infrastructure sectors |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored specifically to Eurotech's unique position in the technology sector.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of Porter's Five Forces, providing immediate clarity on market pressures.

Customers Bargaining Power

Customers in industrial and critical infrastructure sectors, where Eurotech operates, often face substantial switching costs. These costs arise when Eurotech's deeply integrated embedded systems and IoT solutions become part of their core operations.

These mission-critical solutions, once implemented, make it both expensive and disruptive for customers to transition to a competitor. This inherent lock-in significantly diminishes the bargaining power of these customers.

Eurotech's commitment to secure and certified solutions further solidifies this customer retention, making the prospect of switching even less appealing due to the potential for operational disruption and the need for re-certification processes.

Eurotech's focus on highly customized, mission-critical solutions significantly dampens customer bargaining power. For instance, in the rail sector, where Eurotech provides ruggedized computing for safety systems, a failure is not an option. This necessitates a focus on reliability and performance, making customers less likely to switch based on price alone.

The specialized nature of Eurotech's offerings for industrial automation and energy sectors further solidifies this. These applications often require bespoke hardware and software to integrate seamlessly into complex existing infrastructure. A 2024 market report indicated that over 70% of industrial automation projects in Europe involved custom integration, highlighting the reduced price sensitivity for such specialized solutions.

Eurotech's customer base, while diverse, shows a degree of concentration. A few major industrial or government clients could account for a significant chunk of its revenue. This concentration amplifies the bargaining power of these large customers.

The exit of a major US customer in 2024 highlights this vulnerability. Such an event can directly impact Eurotech's financial performance, demonstrating how the scale of individual projects and customer relationships can sway negotiations and revenue streams.

Availability of Alternative Solutions

The availability of alternative embedded computing or IoT solutions can significantly impact customer bargaining power. However, Eurotech's strategic positioning in specialized, rugged, and Edge AI platforms creates a unique value proposition. This focus means that for many demanding industrial and critical infrastructure applications, direct, interchangeable alternatives are scarce, thereby mitigating some of the customer's leverage.

Eurotech's differentiation strategy directly addresses this. By concentrating on high-performance, reliable solutions designed for harsh environments and advanced AI capabilities at the edge, the company reduces the substitutability of its offerings. For instance, in sectors like transportation or energy, where system failure is not an option, customers are less likely to switch to generic providers even if slightly cheaper, due to the critical nature of the embedded systems.

Consider the industrial IoT market, which was projected to reach over $1 trillion by 2026, with a significant portion driven by specialized hardware. Eurotech's ability to cater to niche requirements, such as specific certifications or extended temperature ranges, further limits the pool of readily available substitutes. This specialization allows them to command better pricing and terms, as customers seeking these specific attributes have fewer options.

- Specialized Platforms: Eurotech's rugged and Edge AI focus limits direct substitutes for demanding industrial applications.

- Market Segmentation: The company targets niche segments within the growing IoT market where generic solutions are insufficient.

- Reduced Substitutability: Critical infrastructure and transportation sectors, for example, prioritize reliability over cost, reducing the appeal of generic alternatives.

- Differentiation Strategy: Eurotech's emphasis on performance and environmental resilience creates a barrier to easy customer switching.

Customer's Information and Industry Standards

Sophisticated industrial and critical infrastructure clients, like those in the energy or manufacturing sectors, are highly knowledgeable about prevailing market prices and product specifications. Their deep technical understanding, coupled with a requirement for adherence to stringent industry certifications such as ISA Secure or IEC 62443-4-1/-4-2 standards, empowers them to dictate specific product features and influence pricing. This informed customer base can significantly impact Eurotech's strategic decisions regarding product innovation and cost management.

For instance, in 2024, the cybersecurity compliance market for industrial control systems saw increased demand for certified solutions, with a reported 15% year-over-year growth in projects mandating IEC 62443 compliance. This trend directly translates to customer leverage, as Eurotech must demonstrate robust compliance to secure contracts with these discerning clients.

- Informed Customer Base: Industrial clients possess detailed knowledge of market pricing and product capabilities.

- Technical Expertise: Customers understand complex product specifications and performance requirements.

- Certification Demands: Adherence to standards like ISA Secure and IEC 62443 is a non-negotiable requirement for many clients, increasing their bargaining power.

- Influence on Product Development: Customer demands for specific features and compliance directly shape Eurotech's R&D priorities and product roadmaps.

Eurotech's customers, particularly those in industrial and critical infrastructure, often face high switching costs due to the deep integration of its embedded systems. This integration, coupled with the specialized nature of solutions for sectors like rail and energy, significantly limits their ability to easily switch to competitors. The demand for certified solutions, such as IEC 62443 compliance, further strengthens customer leverage, as Eurotech must meet stringent requirements. While some large customers can exert considerable influence, Eurotech's focus on differentiated, high-performance Edge AI platforms in niche markets helps to mitigate overall customer bargaining power.

| Factor | Impact on Eurotech | Supporting Data (2024) |

|---|---|---|

| Switching Costs | Lowers customer power | High integration in critical infrastructure; costly to replace specialized hardware. |

| Customer Knowledge | Increases customer power | Clients demand specific certifications (e.g., IEC 62443) and features, influencing product roadmaps. |

| Availability of Substitutes | Lowers customer power | Niche Edge AI and ruggedized platforms have limited direct, interchangeable alternatives. |

| Customer Concentration | Increases customer power | Loss of a major client in 2024 demonstrated the impact of revenue concentration. |

Preview the Actual Deliverable

Eurotech Porter's Five Forces Analysis

This preview showcases the complete Eurotech Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the industry. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises. You can confidently assess the value of this strategic tool, knowing that instant access to the full, unaltered report is guaranteed upon completion of your transaction.

Rivalry Among Competitors

The embedded computing, edge AI, and industrial IoT markets are crowded with a wide array of competitors. This includes major technology giants with broad portfolios and smaller, specialized firms focusing on specific niches.

In the European edge computing arena, companies like ADLINK Technology and Advantech Europe stand out, but they operate alongside a multitude of smaller embedded systems providers, creating a highly fragmented and competitive environment.

This extensive number and diversity of players significantly heighten the competitive rivalry, forcing companies to constantly innovate and differentiate their offerings to capture market share.

The Industrial IoT (IIoT) and Edge Computing sectors are booming, with the global edge computing market anticipated to expand at a compound annual growth rate of 28% between 2025 and 2034. This robust growth in the IIoT market also points to healthy expansion, creating ample room for various companies to thrive.

However, this rapid growth isn't without its challenges. Fast-paced technological evolution, particularly the integration of artificial intelligence, is intensifying competition. Companies are aggressively vying for market share, driven by the need to stay ahead in this dynamic landscape.

Eurotech’s competitive rivalry is shaped by its distinct product differentiation. The company focuses on rugged, reliable, and cybersecurity-certified solutions tailored for demanding environments and critical infrastructure. This specialization, particularly in integrated hardware and software for Edge AI, carves out unique market positions.

This strategy effectively mitigates direct price wars. Instead of competing solely on cost, Eurotech’s rivalry centers on innovation, superior performance, and the comprehensive nature of its solutions. For instance, as of early 2024, the demand for edge computing hardware with robust security features continues to grow, with the global edge computing market projected to reach hundreds of billions of dollars by 2030, highlighting the value of Eurotech's specialized offerings.

High Exit Barriers

The embedded computing and industrial IoT sectors are characterized by substantial capital outlays in R&D, specialized production capabilities, and deeply entrenched customer ties. These significant upfront and ongoing investments create high exit barriers. Companies find it difficult and costly to divest or cease operations, leading them to persist in the market even when facing financial headwinds. This persistence fuels ongoing competitive pressure.

These high exit barriers mean that even companies experiencing difficulties, such as Eurotech which reported widening losses in its recent financial statements, are compelled to remain active competitors. This situation intensifies rivalry as these firms fight to maintain their market share and operational viability, contributing to a persistently competitive landscape.

- Significant R&D Investment: Companies in these sectors often invest heavily in developing proprietary technologies and specialized hardware.

- Specialized Manufacturing: Production often requires dedicated, high-tech facilities that are not easily repurposed.

- Long-Term Customer Relationships: Established trust and integration with customer systems create switching costs, locking in suppliers.

- Eurotech's Financial Strain: The company's widening losses underscore the challenges of exiting a market with such high barriers to entry and exit.

Intensity of Competition on Price and Innovation

Even though Eurotech specializes in specific areas like edge AI and IoT, the competitive landscape remains fierce. Companies are constantly pushing the boundaries of innovation, not just on price but also on offering advanced features, seamless integration, robust cybersecurity, and rapid deployment of new solutions. This intense rivalry means that staying ahead requires continuous investment in research and development.

Eurotech's strategic emphasis on obtaining cybersecurity certifications and simplifying the deployment of AI solutions directly addresses this competitive pressure. For instance, in 2024, the global edge AI market was projected to reach over $20 billion, with a significant portion driven by hardware and platform innovation, underscoring the need for differentiation beyond just cost.

- Innovation drives competition: Companies like Eurotech are challenged to continuously innovate in edge AI, IoT platforms, and hardware.

- Beyond price competition: Key competitive factors include advanced features, ease of integration, cybersecurity, and speed to market.

- Market growth fuels rivalry: The expanding edge AI market, valued at over $20 billion in 2024 projections, intensifies competition.

- Eurotech's strategic response: Focus on cybersecurity certifications and simplified AI deployment to counter competitive pressures.

Competitive rivalry in Eurotech's markets is intense due to a crowded field of large tech firms and specialized niche players. This dynamic forces constant innovation and differentiation. The burgeoning edge computing market, projected for significant growth, attracts numerous companies, intensifying competition beyond just price to encompass features, integration, and security.

Eurotech's strategy of focusing on rugged, cybersecurity-certified solutions for demanding environments helps differentiate it, mitigating direct price wars. However, high R&D and manufacturing costs, alongside strong customer ties, create high exit barriers, compelling even struggling firms to remain active competitors and sustain market pressure.

The global edge computing market is expected to see substantial growth, with projections indicating a compound annual growth rate of 28% between 2025 and 2034. This expansion fuels aggressive competition, as companies like Eurotech vie for market share by emphasizing innovation, performance, and integrated solutions, particularly in the rapidly evolving edge AI sector.

| Market Segment | Key Competitors | Eurotech's Differentiation |

| Embedded Computing | ADLINK Technology, Advantech Europe, Numerous niche providers | Rugged, reliable, cybersecurity-certified solutions |

| Edge AI | Major tech giants, Specialized AI hardware firms | Integrated hardware/software for Edge AI, simplified deployment |

| Industrial IoT (IIoT) | Broad range of industrial automation and connectivity providers | Focus on demanding environments and critical infrastructure |

SSubstitutes Threaten

Generic Commercial Off-the-Shelf (COTS) hardware presents a significant threat of substitution for Eurotech's specialized embedded systems. While COTS options are often more budget-friendly, their inherent lack of ruggedness and specialized certifications makes them a poor fit for the demanding environments Eurotech serves. For instance, in 2024, the global industrial automation market, where Eurotech operates, continued to emphasize reliability and longevity, with companies willing to invest more for systems that can withstand extreme temperatures and vibrations, a key differentiator against COTS.

The cost advantage of COTS hardware is often outweighed by the total cost of ownership in critical applications. Failures in harsh environments can lead to costly downtime and safety risks, which Eurotech's certified solutions are designed to mitigate. Reports from 2024 indicate that industries such as defense and transportation, key sectors for Eurotech, prioritize system integrity over initial purchase price, further limiting the substitutability of standard COTS components.

Pure cloud-based IoT solutions, which process all data in centralized data centers, can indeed be seen as a substitute for edge computing platforms. These cloud-only models handle data remotely, offering scalability and centralized management. However, their effectiveness is limited in scenarios demanding immediate action or continuous operation without network connectivity.

For applications where real-time processing is critical, such as industrial automation or autonomous vehicles, the latency inherent in sending data to a distant cloud for processing makes cloud-only solutions less viable. Edge computing, by contrast, processes data closer to the source, enabling faster responses. This distinction is crucial for industries prioritizing low latency, with the global edge computing market projected to reach $20.4 billion by 2024, according to Mordor Intelligence, highlighting the demand for these capabilities.

Furthermore, edge computing provides enhanced security and offline operation capabilities that pure cloud solutions struggle to match. Processing sensitive data locally reduces the attack surface and ensures functionality even during network disruptions. This inherent advantage means that for Eurotech's edge-focused offerings, the threat from pure cloud-based substitutes is somewhat mitigated, particularly for use cases where these specific features are paramount.

Large industrial clients, particularly those in critical infrastructure sectors, possess the engineering prowess and financial backing to develop their own embedded computing and IoT solutions. This capability represents a significant threat as these customers can create bespoke systems tailored precisely to their operational needs, bypassing third-party providers like Eurotech.

For instance, a major energy utility might invest in developing an in-house platform for its smart grid monitoring, negating the need for Eurotech's off-the-shelf or customized offerings. While this approach offers customization, the substantial upfront investment in research, development, and ongoing maintenance often acts as a deterrent, especially for solutions requiring specialized, cutting-edge technology.

Less Integrated or Piecemeal Solutions

Customers might opt for less integrated, piecemeal solutions by sourcing hardware, software, and services from various providers. This DIY approach, while offering customization, typically incurs higher integration costs and extended deployment timelines. For instance, a 2024 market analysis indicated that companies adopting fragmented IT strategies spent, on average, 15% more on IT infrastructure compared to those utilizing unified solutions.

While this offers flexibility, it often leads to higher integration costs, longer deployment times, and increased complexity. These challenges can make Eurotech's integrated hardware and software solutions a more attractive and efficient option for businesses seeking streamlined operations.

- Potential for Higher Total Cost of Ownership: Fragmented solutions can lead to unexpected expenses in compatibility testing, ongoing maintenance, and specialized support, potentially exceeding the cost of an integrated system.

- Increased Operational Complexity: Managing multiple vendors and ensuring interoperability between disparate systems requires significant internal resources and expertise, which many businesses may lack.

- Slower Time-to-Market: The process of selecting, integrating, and troubleshooting individual components can significantly delay the deployment of new technologies and business initiatives.

Traditional Analog or Manual Processes

In sectors still navigating digital transformation, traditional analog or manual processes can act as substitutes for advanced IoT solutions. For instance, some manufacturing firms might still rely on paper-based inventory tracking or manual quality checks, bypassing the need for real-time sensor data. This represents a baseline alternative, especially for businesses with legacy systems or those hesitant about upfront investment in digital infrastructure.

While the trend is clearly towards digitalization, the persistence of these manual methods poses a threat, albeit a diminishing one. For example, in 2024, while the global industrial IoT market continued its strong growth, estimated to reach over $100 billion, a segment of smaller enterprises or those in niche markets might still find manual processes a viable, albeit less efficient, substitute. This is particularly true where the complexity of integrating IoT outweighs the perceived immediate benefits for their specific operations.

- Threat of Substitutes: Traditional Analog or Manual Processes

- Traditional analog or manual processes offer a baseline alternative to automated, data-driven IoT solutions in various industrial sectors.

- As industries increasingly embrace digital transformation and seek operational efficiencies, the threat from these non-digital substitutes is diminishing, though they still represent a viable option for some clients.

- For example, in 2024, while the industrial IoT market showed robust growth, certain segments of businesses, particularly smaller ones or those with legacy systems, may still opt for manual inventory management or quality control as a substitute for IoT integration.

Generic Commercial Off-the-Shelf (COTS) hardware is a notable substitute for Eurotech's specialized embedded systems, primarily due to its lower initial cost. However, COTS solutions often lack the ruggedness, certifications, and specific functionalities required for demanding environments. In 2024, industries like defense and transportation, which are key markets for Eurotech, continued to prioritize system reliability and longevity, often finding the total cost of ownership for COTS to be higher due to potential failures and downtime.

Pure cloud-based IoT solutions can also act as substitutes for edge computing platforms, offering centralized data processing and scalability. Nevertheless, their effectiveness is limited in applications requiring real-time responses or continuous operation without reliable network connectivity. The global edge computing market's projected growth to $20.4 billion by 2024 underscores the demand for low-latency processing, a key advantage of edge solutions over cloud-only models.

Large industrial clients with significant resources may opt to develop their own in-house embedded computing solutions, representing a direct threat of substitution. This bespoke approach offers tailored functionality but requires substantial upfront investment in research and development. Additionally, customers might assemble fragmented, piecemeal solutions from various providers, a strategy that, while offering flexibility, typically incurs higher integration costs and longer deployment times, as evidenced by a 2024 market analysis showing a 15% higher IT infrastructure spend for companies with fragmented strategies.

Entrants Threaten

The embedded computing and edge AI sector demands substantial upfront capital for research and development. Companies must invest heavily in designing and rigorously testing rugged hardware, alongside developing sophisticated AI software. This creates a formidable barrier for newcomers who need significant financial resources to build a competitive product line and acquire essential technological know-how.

The development of sophisticated embedded systems, edge AI platforms, and IoT solutions for critical sectors like industrial automation and infrastructure demands a deep bench of specialized technical talent. This includes expertise in hardware engineering, real-time operating systems, robust cybersecurity measures, and niche industry-specific communication protocols.

Attracting and retaining individuals with these highly sought-after skills presents a significant hurdle for any new company looking to enter the market. For instance, in 2024, the demand for cybersecurity professionals specializing in embedded systems outstripped supply by an estimated 30%, driving up compensation and making talent acquisition a costly endeavor.

Customers in critical infrastructure sectors like rail, energy, and defense prioritize proven reliability and long-term support. Eurotech's established trust and certifications in these areas present a significant barrier for newcomers aiming to replicate this deep-seated confidence.

Complex Regulatory Compliance and Certifications

The threat of new entrants for Eurotech is significantly mitigated by the complex web of regulatory compliance and certifications required, particularly within industrial and critical infrastructure sectors. Meeting standards such as ISA/IEC 62443-4-1/-4-2 for cybersecurity and various environmental ruggedness certifications demands substantial upfront investment in time and resources.

These hurdles create a formidable barrier for newcomers. For instance, achieving full compliance with cybersecurity frameworks can take years and millions of dollars in development and testing. This lengthy and costly process deters many potential competitors from even attempting to enter the market.

- High Capital Investment: New entrants must allocate significant capital towards meeting rigorous industry-specific certifications and compliance standards.

- Extended Time-to-Market: The certification process itself can add years to a new product's development cycle, delaying revenue generation.

- Specialized Expertise Required: Navigating and adhering to these complex regulations necessitates specialized knowledge and skilled personnel, which are costly to acquire.

- Ongoing Compliance Costs: Beyond initial certification, continuous monitoring and updates to maintain compliance represent an ongoing financial burden.

Strong Distribution Channels and Long Sales Cycles

The threat of new entrants in the B2B industrial market, particularly for companies like Eurotech, is significantly mitigated by the inherent complexities of established distribution channels and the lengthy sales cycles common in this sector. New players face a steep climb in replicating the deep-seated relationships and trust that incumbents have cultivated over years, if not decades. For instance, a 2024 report indicated that the average sales cycle for industrial automation solutions can extend from six months to over two years, requiring substantial upfront investment and persistent engagement.

Eurotech benefits from its established network of system integrators and distributors, which are crucial for reaching and serving industrial clients. These channels often involve intricate technical integration and after-sales support, making it difficult for newcomers to offer a comparable value proposition. The market's reliance on these trusted intermediaries means that new entrants must not only develop superior products but also invest heavily in building a comparable, if not superior, distribution and support infrastructure.

Furthermore, the capital expenditure required to establish a robust presence within these established networks presents a significant barrier. Consider that in 2024, the cost of setting up a dedicated industrial sales force with the necessary technical expertise and the logistical framework to support it could easily run into millions of dollars. This financial hurdle, coupled with the time needed to gain market traction and secure key distribution partnerships, effectively deters many potential new entrants.

- Established Distribution Networks: Eurotech leverages long-standing relationships with system integrators and distributors, which are critical for market penetration in the industrial sector.

- Long and Complex Sales Cycles: The typical B2B industrial sales process, often spanning 6-24 months in 2024, demands significant resources and patience, acting as a deterrent to new entrants.

- High Capital Investment: Building a comparable sales and distribution infrastructure requires substantial financial commitment, estimated in the millions of dollars for a dedicated industrial sales force in 2024.

- Technical Integration Requirements: The necessity for intricate technical solutions and ongoing support through established channels makes it challenging for new companies to compete effectively.

The threat of new entrants for Eurotech is considerably low due to the substantial capital required for R&D and specialized talent acquisition in the embedded computing and edge AI sectors. High upfront investments in rugged hardware and AI software development, coupled with the scarcity of cybersecurity professionals for embedded systems, create significant entry barriers.

Furthermore, stringent regulatory compliance, including cybersecurity certifications like ISA/IEC 62443, and the need for proven reliability in critical infrastructure sectors deter new players. Established distribution channels and long B2B sales cycles, often 6-24 months in 2024, also demand significant resources and time, making it difficult for newcomers to gain traction.

| Barrier Type | Description | 2024 Impact/Data |

|---|---|---|

| Capital Investment | R&D, hardware/software development, certifications | Millions of dollars for compliance and product lines |

| Talent Acquisition | Specialized engineers, cybersecurity experts | 30% supply-demand gap for embedded cybersecurity talent |

| Regulatory Compliance | Industry certifications, cybersecurity standards | Years and millions for full compliance |

| Distribution & Sales | Established networks, long sales cycles | 6-24 month sales cycles; millions for sales force setup |

Porter's Five Forces Analysis Data Sources

Our Eurotech Porter's Five Forces analysis is built upon a foundation of robust data, including financial reports from leading European technology firms, industry-specific market research from reputable firms, and official government and regulatory filings across key European markets.