Etteplan SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Etteplan Bundle

Etteplan's robust engineering expertise and commitment to innovation form significant strengths, while its global reach presents a key opportunity for expansion. However, understanding the full scope of its competitive landscape and potential market shifts is crucial for strategic advantage.

Want the full story behind Etteplan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Etteplan's strength lies in its extensive service offering, covering industrial engineering, software development, and technical documentation. This allows them to partner with clients from the very beginning of a product's journey through its entire lifecycle, ensuring continuous support and optimization.

This comprehensive approach means Etteplan can assist with everything from initial concept and design to the complexities of software and embedded systems, and finally to the crucial area of technical documentation. For instance, in 2023, Etteplan reported a net sales of €375.6 million, demonstrating the scale and demand for their integrated services.

Etteplan's strategic emphasis on AI and digitalization is a significant strength, clearly outlined in its 'Transformation with AI' strategy for 2025-2027. This forward-thinking approach aims for AI-driven solutions to represent 35% of revenue by the close of 2027, positioning the company as a leader in industrial digital transformation.

Etteplan's expansive global presence, with around 4,000 professionals spread across three continents and eight countries, provides a robust foundation for international operations and client service. This broad reach allows the company to tap into diverse talent pools and offer localized support.

The strategic acquisition of a minority stake in BJIT in Bangladesh is a key move, significantly bolstering Etteplan's global delivery capabilities. This partnership grants access to cost-efficient expertise, a crucial advantage in the competitive landscape of engineering and technology services.

High Proportion of Stable Managed Services Revenue

Etteplan benefits significantly from a high proportion of stable managed services revenue. In 2023, this segment constituted a substantial 68% of their total revenue, with an ambitious target to reach 75% by 2027. This recurring revenue model cultivates stronger, more enduring customer relationships and offers a predictable income stream, which typically leads to better profit margins than one-off project work.

This reliance on managed services provides Etteplan with a solid foundation, insulating them somewhat from the volatility often associated with project-based engagements. The consistent income allows for more predictable financial planning and investment in long-term growth initiatives.

- Revenue Stability: 68% of Etteplan's revenue in 2023 was derived from managed services, aiming for 75% by 2027.

- Customer Loyalty: The managed services model encourages deeper, long-term customer partnerships.

- Improved Margins: Recurring revenue from managed services generally supports healthier profit margins.

- Predictable Cash Flow: This structure contributes to a more stable and predictable financial outlook.

Resilience in Challenging Market Segments

Etteplan has shown remarkable resilience, particularly in niche market segments that continue to thrive despite broader economic headwinds. For instance, the company's strategic focus on the defense and energy sectors has paid off, with sustained investment activity in these areas throughout 2024. This targeted approach allows Etteplan to navigate challenging market conditions more effectively.

Further bolstering this strength, Etteplan experienced significant growth in the Chinese market during 2024, with reported revenue increases contributing positively to the company's overall performance. This geographical expansion and market penetration highlight the company's adaptability and its ability to identify and capitalize on opportunities even in a fluctuating global economic landscape. These diversified revenue streams are crucial for maintaining stability.

- Defense Sector Investments: Continued strong demand and project pipelines in defense throughout 2024.

- Energy Industry Focus: Sustained client spending on energy infrastructure and technological upgrades.

- Chinese Market Growth: Significant revenue uplift reported from operations in China during 2024.

- Diversified Revenue Streams: Reduced reliance on any single market or industry segment for overall financial health.

Etteplan's broad service portfolio, encompassing industrial engineering, software development, and technical documentation, allows for end-to-end client support across a product's lifecycle. This integrated approach, demonstrated by €375.6 million in net sales for 2023, ensures continuous value delivery.

The company's strategic focus on AI and digitalization, aiming for AI-driven solutions to contribute 35% of revenue by 2027, positions Etteplan as a leader in industrial transformation. Its global workforce of approximately 4,000 professionals across eight countries and three continents provides extensive operational reach and local expertise.

A significant strength is Etteplan's high proportion of stable managed services revenue, which accounted for 68% of total revenue in 2023 and is targeted to reach 75% by 2027. This recurring revenue model fosters strong customer relationships and provides predictable income, supporting healthier profit margins and financial planning.

Etteplan demonstrates resilience through its focus on niche markets like defense and energy, which saw sustained investment activity throughout 2024. Furthermore, significant growth in the Chinese market during 2024 contributed positively to overall performance, showcasing adaptability and diversified revenue streams.

| Metric | 2023 Value | 2027 Target | Key Insight |

|---|---|---|---|

| Net Sales | €375.6 million | N/A | Demonstrates scale of integrated services. |

| Managed Services Revenue % | 68% | 75% | Indicates revenue stability and customer loyalty. |

| AI-Driven Solutions % of Revenue | N/A | 35% | Highlights strategic focus on digitalization. |

| Global Workforce | ~4,000 professionals | N/A | Underpins international operations and talent access. |

What is included in the product

Delivers a strategic overview of Etteplan’s internal strengths and weaknesses, alongside external opportunities and threats.

Offers a clear, actionable framework to pinpoint and address strategic weaknesses.

Weaknesses

Etteplan's reliance on the global machinery and metal industries means its performance is closely tied to the health of these sectors. Economic slowdowns or recessions in these areas can directly translate to reduced demand for Etteplan's engineering services.

Geopolitical instability, including trade disputes and broader international tensions, creates significant uncertainty for customers. This uncertainty often leads to delayed or canceled capital expenditure projects, which in turn dampens Etteplan's order intake and revenue streams.

Etteplan faced a notable downturn in its financial performance during the first quarter of 2025. Profitability took a hit, with Earnings Before Interest, Taxes, and Amortization (EBITA) falling by a substantial 29.4%. This sharp decline suggests difficulties in managing costs and maintaining healthy profit margins.

Furthermore, the company saw a 7.7% decrease in its organic revenue during the same period. This contraction in growth from its core operations signals potential challenges in attracting new business or expanding its existing client base in the current market environment.

Etteplan's profitability has faced headwinds from significant non-recurring expenses. These include costs tied to adapting to market shifts, integration expenses from acquisitions such as Novacon Powertrain, and a notable credit loss recorded in Germany. These one-off charges have directly impacted the company's bottom line, as evidenced by the reported earnings figures for the period.

Inconsistent Performance Across Service Areas

Etteplan's performance showed inconsistency across its various service segments in the first quarter of 2025. While the company pursues a unified strategic direction, the execution and results varied significantly by division.

Specifically, the Technical Communication and Data Solutions segment experienced a notable decrease in its EBITA margin. This occurred even as the company was making strides in market share, partly attributed to the integration of artificial intelligence. Conversely, the Software and Embedded Solutions division faced challenges, particularly with the initiation of new projects during the same period.

- Technical Communication and Data Solutions: EBITA margin declined despite market share gains, influenced by AI adoption.

- Software and Embedded Solutions: Faced headwinds with the commencement of new project pipelines in Q1 2025.

Ongoing Competition for Highly Specialized Talent

Despite a general cooling in some sectors of the labor market, Etteplan continues to face intense competition for highly specialized engineers and technical experts. This is particularly true in areas like advanced automation, cybersecurity, and digital transformation, where demand often outstrips supply. For instance, in early 2024, reports indicated that the average time to fill highly technical roles remained significantly longer than for general positions, often exceeding 60 days in some European tech hubs where Etteplan operates.

This persistent challenge directly impacts Etteplan's capacity to attract and retain the niche talent essential for delivering its core services. The inability to scale its highly skilled workforce efficiently could become a bottleneck for growth, potentially limiting the company's ability to take on larger projects or expand into new, specialized service areas. In 2023, the global shortage of cybersecurity professionals was estimated to affect over 70% of organizations, a trend that directly affects companies like Etteplan that rely on such expertise.

- Talent Scarcity: Continued difficulty in finding and securing experts in critical fields like AI, IoT, and embedded systems.

- Retention Pressure: High demand for specialized skills leads to increased salary expectations and a greater risk of key personnel being recruited by competitors.

- Scalability Concerns: The pace of growth may be constrained by the availability of qualified personnel, impacting project execution and new business development.

- Cost of Acquisition: Increased recruitment costs and potentially higher compensation packages are necessary to attract and retain top talent in these competitive niches.

Etteplan's profitability was impacted by significant non-recurring expenses in early 2025, including integration costs from acquisitions like Novacon Powertrain and a credit loss in Germany, which directly affected its bottom line.

The company's performance showed segment-specific inconsistencies, with the Technical Communication and Data Solutions segment experiencing a decline in its EBITA margin even as it gained market share, partly due to AI adoption.

Intense competition for specialized engineers, particularly in fields like advanced automation and digital transformation, continues to pose a challenge, impacting Etteplan's ability to scale its workforce efficiently and potentially limiting growth.

The Software and Embedded Solutions division faced headwinds related to the initiation of new projects in Q1 2025, indicating potential project pipeline management or execution challenges.

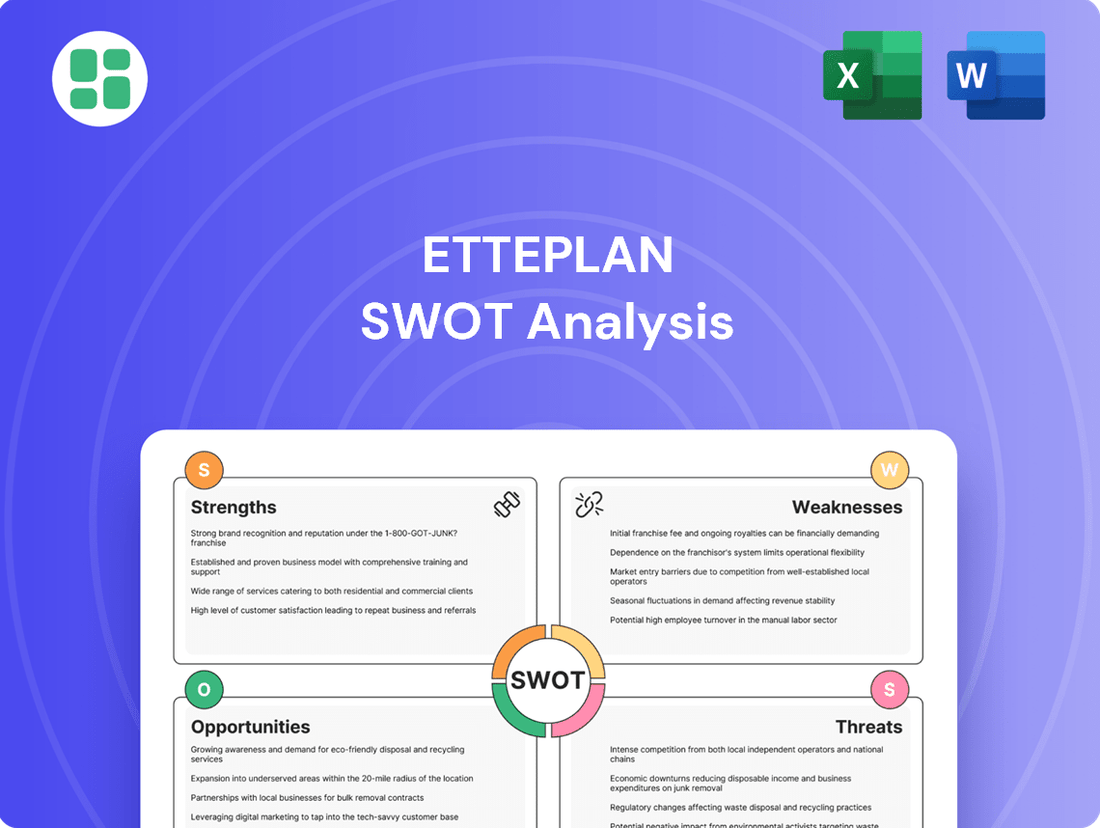

Preview the Actual Deliverable

Etteplan SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Etteplan SWOT analysis, ensuring you know exactly what you're getting before you buy. The complete, detailed report is unlocked immediately after purchase.

Opportunities

The ongoing surge in digitalization and the increasing integration of Artificial Intelligence across various sectors offer a substantial avenue for expansion. Etteplan's commitment to developing AI-powered solutions, with a target of generating 35% of its revenue from these services by 2027, strategically places the company to capitalize on this burgeoning market.

The global push for sustainability and a greener economy is a significant tailwind for companies like Etteplan. This trend translates directly into a growing need for industrial solutions that are not only smarter but also more energy-efficient and environmentally friendly. For instance, the European Union's Green Deal aims to make the bloc climate-neutral by 2050, spurring massive investment in sustainable technologies and practices across industries.

Etteplan is well-positioned to capitalize on this by offering its expertise in optimizing products and processes for sustainability. This includes areas like energy efficiency improvements, circular economy solutions, and the development of greener materials. The company's ability to help clients reduce their environmental footprint while enhancing operational performance makes it an attractive partner in this evolving market.

Etteplan's strategic mergers and acquisitions are a key driver for growth and capability enhancement. Recent moves, such as acquiring Novacon Powertrain in Germany, bolster their engineering expertise, particularly in the automotive sector. This inorganic growth strategy also aims to expand their geographical footprint and improve cost efficiencies.

Further evidence of this strategy is Etteplan's investment in a minority stake in BJIT, a software engineering company based in Bangladesh. This move not only diversifies their service offerings into digital solutions but also taps into new talent pools and potentially lower-cost operational centers, thereby strengthening their overall market position and competence capital.

Targeted Growth in Resilient Industrial Sectors and Geographies

Despite broader economic hesitations, certain industrial sectors are proving remarkably robust, presenting significant opportunities. For instance, the defense industry, driven by evolving geopolitical landscapes, saw global military spending reach an estimated $2.44 trillion in 2024, a 6.8% increase from 2023 according to the Stockholm International Peace Research Institute (SIPRI). Similarly, the energy sector, particularly in areas related to renewable energy and grid modernization, continues to attract substantial investment as nations pursue energy security and decarbonization goals. The International Energy Agency (IEA) projects clean energy investment to reach $2 trillion globally in 2024, up 40% from 2023 levels.

Furthermore, specific geographic markets are exhibiting impressive resilience and growth. China's industrial output, for example, has shown a strong recovery and expansion, with its manufacturing purchasing managers' index (PMI) consistently above the 50-point mark, indicating expansion. Etteplan can strategically leverage these trends by focusing its expertise and resources on these high-potential areas.

- Defense Sector Growth: Global military spending is projected to continue its upward trajectory, creating demand for advanced engineering solutions.

- Energy Transition Investment: Significant capital is being allocated to renewable energy and grid infrastructure, offering opportunities for specialized engineering services.

- Chinese Market Expansion: The robust performance of China's industrial sector provides a fertile ground for securing new projects and partnerships.

- Strategic Focus: By targeting these resilient sectors and geographies, Etteplan can enhance its project pipeline and drive sustainable revenue growth.

Enhancing Value Proposition through Data Management and Analytics

Etteplan can significantly boost its value proposition by creating advanced data management and analytics services, particularly those leveraging Artificial Intelligence (AI). This strategic move positions them to deliver actionable insights, enabling industrial clients to make smarter, data-driven decisions. For instance, by integrating AI into their existing industrial IoT platforms, Etteplan could unlock predictive maintenance capabilities, potentially reducing client downtime by an estimated 15-30% based on industry averages for 2024.

This focus on data services allows Etteplan to deepen its role as a trusted advisor. By transforming raw data into tangible business intelligence, they can help clients optimize operations, improve product design, and even identify new market opportunities. Companies that effectively utilize data analytics in 2024 have seen revenue growth rates up to 5-10% higher than their less data-centric counterparts, highlighting the tangible benefits of such offerings.

- Develop AI-powered predictive maintenance solutions.

- Offer data analytics consulting for operational optimization.

- Integrate advanced analytics into existing product lifecycle management services.

- Provide training and support for clients to maximize data utilization.

Etteplan's expansion into advanced data management and AI-driven analytics presents a significant opportunity to enhance client value. By offering services that transform raw data into actionable insights, the company can help industrial clients optimize operations and improve decision-making. For example, AI-powered predictive maintenance could reduce client downtime by an estimated 15-30% in 2024, a substantial benefit.

The company's strategic acquisitions, like the one of Novacon Powertrain, and investments, such as the stake in BJIT, are broadening its expertise and market reach. This inorganic growth strategy diversifies service offerings, particularly into digital solutions, and taps into new talent pools, strengthening Etteplan's overall market position and competence capital.

The growing global emphasis on sustainability and the green economy directly benefits Etteplan. The demand for energy-efficient and environmentally friendly industrial solutions is increasing, driven by initiatives like the EU's Green Deal. Etteplan can leverage its expertise in optimizing products and processes for sustainability, including energy efficiency and circular economy solutions, to meet this rising demand.

Robust industrial sectors, such as defense and energy, coupled with resilient geographic markets like China, offer considerable growth prospects. Global military spending reached an estimated $2.44 trillion in 2024, while clean energy investment is projected to hit $2 trillion globally in 2024. Etteplan can strategically focus its resources on these high-potential areas to drive revenue growth.

Threats

Persistent global economic and geopolitical uncertainty, including ongoing trade disputes and a sluggish recovery in key industrial markets, poses a significant threat to Etteplan. This volatile environment makes industrial customers more hesitant, leading to postponed or canceled projects, directly dampening demand for Etteplan's engineering and design services. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from previous years, reflecting these persistent headwinds.

The industrial engineering and technology services sector is a crowded arena, featuring a multitude of global giants and specialized firms vying for market share. This high level of competition naturally translates into significant pricing pressures, which can erode profit margins and make winning new business a considerable challenge, particularly during periods of subdued overall market demand.

The swift evolution of technology, particularly in areas like AI and digitalization, presents a significant challenge. Etteplan faces the constant pressure to adapt its services and expertise to avoid becoming outdated in a rapidly changing market.

To counter this, substantial and ongoing investment in research and development is crucial. This ensures Etteplan stays at the forefront of innovation, maintaining its competitive edge and relevance.

Furthermore, continuous employee training and the development of new service offerings are vital. For instance, in 2024, Etteplan continued to emphasize upskilling its workforce in areas like industrial AI and cybersecurity, reflecting the market’s demand for advanced digital solutions.

Potential for Client Concentration and Dependence on Key Industries

Etteplan's reliance on a concentrated client base, particularly within the manufacturing sector, presents a significant threat. A substantial portion of revenue could be tied to a few key accounts, making the company vulnerable to individual client performance or strategic changes. For instance, if a major manufacturing client were to significantly reduce their outsourcing or experience financial difficulties, Etteplan's revenue streams could be severely impacted.

This dependence extends to specific industrial sub-sectors. A downturn or disruption in one of these core industries, such as automotive or machinery, could have a disproportionate effect on Etteplan's overall financial health. The company's 2023 financial reports indicate that the manufacturing sector remains a primary revenue driver, underscoring the importance of diversification to mitigate this risk.

- Client Concentration Risk: A few large clients could account for a significant percentage of Etteplan's revenue.

- Industry Dependence: Over-reliance on specific manufacturing sub-sectors makes Etteplan susceptible to industry-specific downturns.

- Revenue Volatility: Strategic shifts or financial challenges faced by key clients can lead to unpredictable revenue fluctuations.

- Impact of Economic Cycles: The manufacturing industry is often cyclical, meaning Etteplan's performance can be heavily influenced by broader economic trends affecting its core client base.

Cybersecurity Risks and Data Integrity Concerns

As Etteplan's reliance on software, embedded systems, and digital technical documentation grows, so does its vulnerability to cybersecurity threats. A significant data breach or system malfunction could severely harm Etteplan's reputation, result in substantial financial penalties, and undermine the trust of its clients, particularly those in sensitive industrial sectors.

The increasing digitalization of services exposes Etteplan to risks such as intellectual property theft and operational disruptions. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial implications of security failures.

- Increased attack surface: The integration of more digital solutions expands the potential entry points for cyberattacks.

- Reputational damage: Data breaches can lead to a loss of customer confidence and long-term brand erosion.

- Financial penalties: Non-compliance with data protection regulations, such as GDPR, can result in hefty fines.

- Operational disruption: System failures or ransomware attacks can halt critical business operations, impacting service delivery.

The increasing reliance on digital solutions and connected systems exposes Etteplan to significant cybersecurity risks. A data breach could severely damage its reputation and lead to substantial financial penalties, especially given that the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025.

Etteplan's dependence on a concentrated client base, particularly within the manufacturing sector, presents a notable threat. Downturns or strategic shifts within these key industries, such as automotive or machinery, could disproportionately impact the company's revenue streams, as the manufacturing sector remained a primary revenue driver in 2023.

Intensifying competition within the industrial engineering and technology services sector creates considerable pricing pressures. This environment makes securing new contracts challenging and can negatively affect profit margins, especially during periods of slower market demand.

The rapid pace of technological advancement, particularly in AI and digitalization, necessitates continuous adaptation and investment. Etteplan must constantly update its services and expertise to remain competitive and avoid obsolescence in this dynamic market.

SWOT Analysis Data Sources

This Etteplan SWOT analysis is built upon a robust foundation of data, drawing from Etteplan's official financial statements, comprehensive market intelligence reports, and insights from industry experts. These sources ensure a thorough and accurate assessment of the company's strategic position.