Etteplan Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Etteplan Bundle

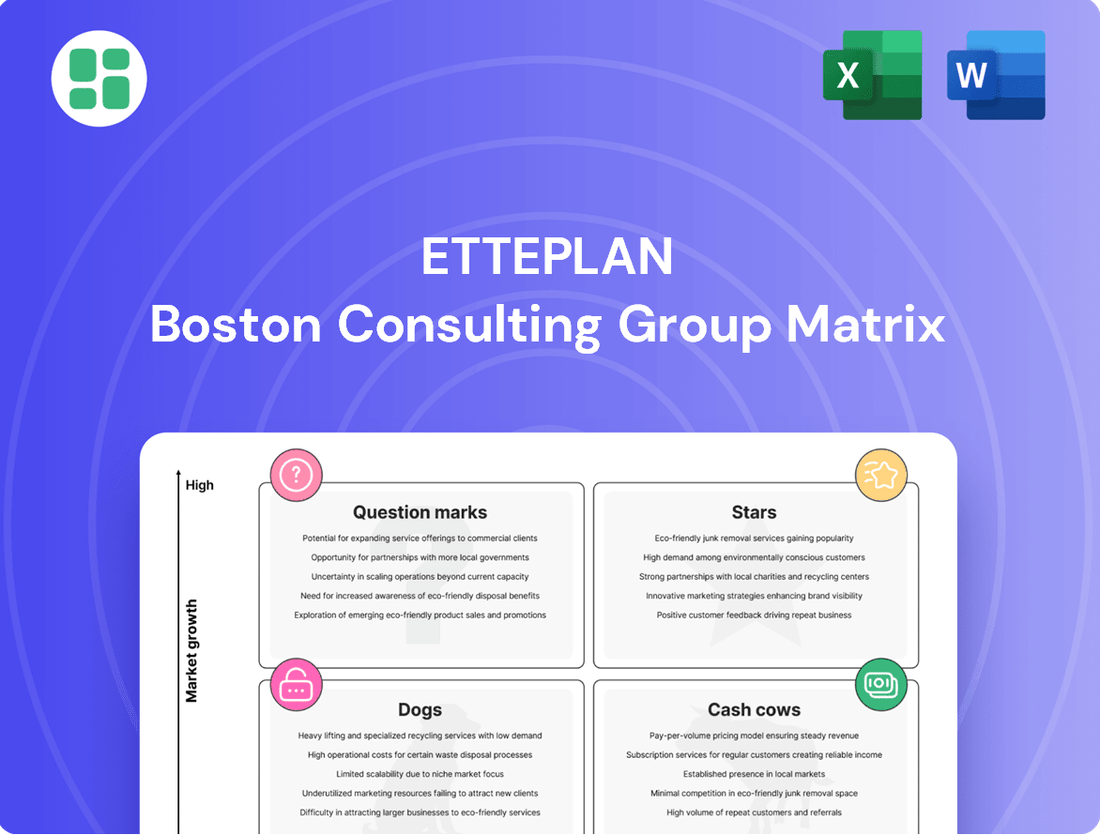

This glimpse into the Etteplan BCG Matrix highlights their strategic product portfolio, showcasing potential Stars and established Cash Cows. To truly unlock the power of this analysis and guide your investment decisions, dive into the full report for a comprehensive breakdown of each quadrant and actionable insights.

Don't stop at the overview; the complete Etteplan BCG Matrix provides the detailed quadrant placements and data-driven recommendations you need to confidently navigate market dynamics and optimize your resource allocation. Purchase the full version for a strategic roadmap to growth.

The full Etteplan BCG Matrix reveals the precise positioning of their offerings in a competitive landscape, offering quadrant-by-quadrant clarity and strategic takeaways. Invest in this comprehensive report to gain a significant shortcut to competitive advantage and informed decision-making.

Stars

Etteplan's strategic emphasis on AI-powered solutions positions them firmly in the 'Stars' quadrant of the BCG matrix. Their ambitious target of deriving 35% of revenue from AI-driven solutions by 2027 highlights a significant investment in a high-growth market where they are actively expanding their presence. This includes developing innovative data services tailored for industrial product and asset companies, aiming to unlock efficient AI utilization.

The company's recent launch of AI-powered HyperSTE for technical documentation is a prime example of their commitment to integrating AI into their core service offerings. This move not only strengthens their market position but also demonstrates a clear strategy to lead in applying artificial intelligence to critical business functions, driving efficiency and innovation for their clients.

Etteplan's strategic focus on specialized software and embedded solutions, especially within the automotive and defense sectors, positions this segment as a star performer. Despite some short-term headwinds, ongoing investments and acquisitions, such as that of AFFRA AB for automotive software and HIL testing, underscore their commitment to these rapidly expanding markets.

The company’s dedication to intelligent devices and industrial internet solutions further solidifies this category’s star status. For instance, in 2023, Etteplan reported a significant increase in demand for its embedded systems expertise, contributing substantially to their overall revenue growth.

Defense industry engineering services represent a strong growth area, with investments remaining robust even during periods of market volatility. For instance, global defense spending was projected to reach $2.2 trillion in 2024, demonstrating sustained demand.

Etteplan's notable performance in this sector suggests they are capitalizing on a high-growth market, likely possessing a solid market share or experiencing rapid expansion. This consistent demand offers a stable and promising avenue for their specialized engineering capabilities.

Energy Sector Engineering and Digitalization

The energy sector, a key strategic area for Etteplan, is experiencing moderate investment levels, driven significantly by the global green transition and the increasing demand for sustainability services.

Etteplan's deep expertise in managing complex distributed energy systems, coupled with their innovative application of AI for smart asset management, positions them favorably for expansion within this dynamic market. This specialization addresses a clear and growing need for advanced engineering and digital solutions across the energy landscape.

- Moderate Investment: The energy sector's investment landscape remains steady, with a clear directional shift towards sustainable and renewable energy projects.

- Green Transition Focus: Etteplan's strategic alignment with sustainability services is crucial, as global energy policy increasingly prioritizes decarbonization and renewable energy integration.

- AI for Asset Management: The application of AI in optimizing distributed energy systems and enhancing asset performance is a significant growth driver, improving efficiency and reliability.

- Growing Demand: The sector's evolution necessitates specialized engineering and digital solutions to manage the complexities of modern energy infrastructure, from grid modernization to renewable energy integration.

Global Delivery Capabilities (Offshoring/Nearshoring)

Etteplan actively strengthens its global delivery network by leveraging offshoring and nearshoring. This strategy is designed to boost cost efficiency and secure new business opportunities.

The company's investment in BJIT, an IT consulting firm in Bangladesh, exemplifies their dedication to expanding this global model. This move is crucial for accessing new markets and improving service delivery.

- Cost Competitiveness: Offshoring and nearshoring enable Etteplan to offer competitive pricing, a key factor in winning projects in the global market.

- Market Expansion: By establishing a presence in new regions, Etteplan can tap into diverse talent pools and customer bases.

- Efficiency Gains: A distributed delivery model allows for optimized resource allocation and faster project turnaround times.

- Strategic Partnerships: Acquisitions like the stake in BJIT are integral to building a robust and scalable global delivery infrastructure.

Stars in Etteplan's portfolio represent high-growth, high-market-share business segments that require significant investment to maintain their leading positions and capitalize on future growth. These are areas where Etteplan is actively investing and sees substantial future potential, often driven by technological advancements and evolving market demands.

Their AI-powered solutions are a prime example, with a target of 35% revenue from AI by 2027, indicating a strong commitment to this rapidly expanding domain. Similarly, specialized software and embedded solutions, particularly in automotive and defense, are identified as star performers due to sustained investment and market demand.

The company's strategic expansion into intelligent devices and industrial internet solutions also falls into the star category, supported by robust demand for embedded systems expertise. The defense industry engineering services are another key star, benefiting from strong global defense spending, projected to reach $2.2 trillion in 2024.

| Business Segment | Growth Rate | Market Share | Investment Level | Rationale |

|---|---|---|---|---|

| AI-Powered Solutions | High | Growing | High | Targeting 35% revenue from AI by 2027; developing innovative data services. |

| Specialized Software & Embedded Solutions (Automotive, Defense) | High | Strong/Expanding | High | Acquisitions like AFFRA AB; strong demand in automotive and defense sectors. |

| Intelligent Devices & Industrial Internet | High | Strong/Expanding | High | Significant increase in demand for embedded systems expertise in 2023. |

| Defense Industry Engineering Services | High | Strong/Expanding | High | Capitalizing on projected $2.2 trillion global defense spending in 2024. |

What is included in the product

Strategic guidance on managing Etteplan's portfolio by classifying business units as Stars, Cash Cows, Question Marks, or Dogs.

The Etteplan BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic uncertainty.

Cash Cows

Etteplan's traditional industrial engineering services, primarily within its Engineering Solutions segment, represent its established Cash Cow. This segment, though operating in a mature market, holds a significant market share and consistently delivers substantial revenue, forming the bedrock of Etteplan's financial stability.

While recent market headwinds, including slower customer investment and non-recurring items, have affected profitability, this segment's resilience is notable. For instance, in 2023, Etteplan reported that its Engineering Solutions segment generated revenues of €228.1 million, underscoring its consistent contribution to the company's top line.

The robust revenue generation from these mature services provides a reliable source of cash flow, enabling Etteplan to fund strategic growth initiatives and investments in emerging areas, thereby maintaining its competitive edge in the long term.

Etteplan's Technical Communication and Data Solutions segment, formerly known for its established technical documentation, operates in a mature European market where Etteplan holds a significant share. This division consistently generates substantial revenue, acting as a reliable income stream for the company.

Despite facing some headwinds in early 2025, the segment's mature nature means it requires less capital expenditure compared to rapidly expanding business areas. This stability allows it to function as a dependable cash cow, contributing steadily to Etteplan's overall financial health.

Etteplan's managed services are a prime example of a Cash Cow within its BCG matrix. The company has been strategically growing this segment, aiming for a significant 75% of its total revenue by the close of 2027. This focus on managed services is crucial as it cultivates deeper, more enduring relationships with clients, ensuring a consistent flow of recurring revenue.

This recurring revenue model acts as a powerful engine for stable cash generation, a hallmark of a Cash Cow. The predictable income stream from managed services is particularly valuable in a mature market, enabling Etteplan to effectively manage and oversee customer projects with greater certainty and control.

Product Development Solutions for Mature Industries

Etteplan's product development solutions for mature industries, particularly its work with established manufacturing and industrial equipment companies, are highly likely to be classified as cash cows within the BCG matrix. This is because these services address consistent, ongoing needs in markets that are already well-developed, generating stable revenue streams without the need for significant new investment or market expansion. For instance, in 2023, Etteplan reported that its services for the industrial equipment sector continued to be a strong revenue driver, reflecting the sustained demand from its long-standing client base.

These offerings benefit from Etteplan's deep-rooted relationships with leading global manufacturers. Such established partnerships ensure a predictable demand for their expertise in areas like lifecycle management, modernization of existing product lines, and efficiency improvements. This stability is crucial for cash cow status, as it allows the company to capitalize on existing market share and operational efficiencies.

- Mature Market Focus: Services for established industries cater to ongoing needs, ensuring consistent demand.

- Stable Revenue: These offerings generate predictable income without requiring extensive new market development.

- Client Stability: Long-standing relationships with global manufacturers underpin the reliability of this business segment.

- Efficiency Gains: Mature industry services often leverage existing infrastructure and expertise for profitable operations.

Legacy Embedded Systems and IoT Solutions

Etteplan's legacy embedded systems and IoT solutions function as dependable cash cows within their business portfolio. While the company actively pursues growth in newer IoT and embedded technologies, these established, mature offerings continue to generate consistent revenue streams. They are particularly valuable because they cater to stable industrial applications where reliability and long-term support are paramount, ensuring a steady cash flow from a loyal customer base.

These mature product lines benefit from a significant installed base of services, meaning existing clients rely on Etteplan for ongoing maintenance, updates, and support for their integrated systems. This recurring revenue model is a hallmark of a cash cow, providing financial stability that can fund investments in more dynamic, high-growth areas of the business. For instance, in 2024, Etteplan reported that its industrial internet and embedded solutions continued to be a significant contributor to its overall revenue, demonstrating the sustained demand for these reliable systems.

- Established Revenue Streams: Mature embedded systems and industrial internet solutions provide predictable income from existing clients.

- Stable Industrial Applications: These offerings are integrated into sectors with consistent demand, minimizing market volatility.

- Strong Installed Base: A large existing customer base ensures ongoing service and support revenue.

- Financial Stability: These cash cows generate consistent profits, funding innovation and growth in other business areas.

Etteplan's Engineering Solutions segment is a clear cash cow, consistently generating substantial revenue despite operating in a mature market. This segment's resilience is evident, with revenues of €228.1 million reported in 2023, forming the bedrock of Etteplan's financial stability and enabling funding for growth initiatives.

The Technical Communication and Data Solutions segment also functions as a cash cow, benefiting from Etteplan's significant market share in a mature European market. Its stable revenue stream requires less capital expenditure, contributing steadily to the company's financial health.

Managed services are a strategic cash cow for Etteplan, with the company aiming for them to represent 75% of total revenue by the close of 2027. This recurring revenue model ensures a consistent cash flow, vital for managing projects with greater certainty.

Mature product development solutions, especially for established manufacturing and industrial equipment companies, are also cash cows. These offerings leverage deep client relationships and address consistent needs, ensuring stable revenue streams and operational efficiencies. In 2023, services for the industrial equipment sector remained a strong revenue driver.

Legacy embedded systems and IoT solutions act as dependable cash cows, generating consistent revenue from stable industrial applications. The significant installed base ensures ongoing service and support revenue, providing financial stability to fund innovation. In 2024, industrial internet and embedded solutions continued to be a significant revenue contributor.

| Segment | BCG Classification | 2023 Revenue (approx.) | Key Characteristics |

|---|---|---|---|

| Engineering Solutions | Cash Cow | €228.1 million | Mature market, significant market share, stable revenue |

| Technical Communication and Data Solutions | Cash Cow | N/A (Mature market) | Established, consistent revenue, low capital expenditure |

| Managed Services | Cash Cow (Strategic Focus) | N/A (Growth target) | Recurring revenue model, client retention, stable cash generation |

| Product Development (Mature Industries) | Cash Cow | N/A (Strong driver) | Deep client relationships, consistent demand, operational efficiencies |

| Embedded Systems & IoT (Legacy) | Cash Cow | N/A (Significant contributor) | Installed base, stable applications, ongoing support revenue |

What You See Is What You Get

Etteplan BCG Matrix

The Etteplan BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means you can assess the quality and content with complete confidence, knowing there are no hidden surprises or missing sections. It's a professionally crafted strategic tool, ready for immediate integration into your business planning processes.

Dogs

Generic, undifferentiated engineering staff augmentation services often fall into the question mark or dog category of the BCG matrix. In a competitive landscape, these services, particularly in less specialized engineering fields, can face low growth and low market share. This makes them vulnerable to price wars and outsourcing to regions with lower labor costs, impacting profitability.

For Etteplan, this segment might represent a challenge, as easily replaceable skill sets offer little competitive advantage. The reported need for adaptation measures and temporary layoffs in 2024, as mentioned in industry analyses, could indicate that certain less differentiated service lines are indeed experiencing reduced demand or struggling to maintain profitability in the face of market shifts.

Outdated technical information formats and methods, such as paper-based manuals or legacy digital systems lacking AI integration, are likely facing declining demand. These approaches struggle to keep pace with the need for real-time data access and efficient knowledge management.

If Etteplan continues to heavily rely on these older methods without significant modernization, these service lines would exhibit low growth potential and a shrinking market share. Clients are increasingly prioritizing digital-first, AI-enhanced solutions for technical documentation and information management.

Etteplan's Q1 2025 report signals a challenging environment in Europe, with heightened uncertainty and a noticeable slowdown in customer investment decisions. This hesitancy, particularly evident in Germany, is causing delays and cancellations of crucial investment projects.

Services that depend significantly on these postponed new investments, especially those lacking a distinct competitive advantage, are likely to be categorized as dogs within the BCG matrix. Their market growth is subdued, and demand is on the decline, mirroring the broader economic caution observed.

Non-Strategic, Low-Margin Acquisitions without Integration Success

Acquisitions that haven't integrated well or operate in low-margin, slow-growth markets can become dogs in Etteplan's portfolio. These businesses might drain resources without offering substantial returns, particularly if they don't fit with the company's strategic focus on AI-driven transformation. For instance, a small, acquired software firm in a niche without clear AI integration potential would likely fall into this category.

These underperforming units can hinder overall company performance by diverting management attention and capital from more promising ventures. In 2023, Etteplan's revenue grew by 13% to €391.7 million, highlighting the importance of focusing resources on growth drivers. Acquisitions that don't contribute to this momentum, especially those with margins below industry averages, pose a risk.

- Resource Drain: Non-integrated or low-margin acquisitions consume capital and management bandwidth.

- Stagnant Market Position: Operates in niches with limited growth potential and low profitability.

- Strategic Misalignment: Fails to contribute to Etteplan's core strategies, such as its 'Transformation with AI' initiative.

- Impact on Growth: Can dilute overall company growth rates and profitability if not addressed.

Specific Geographic Regions with Persistent Weak Demand

Certain European regions, particularly Central Europe, have demonstrated consistently weak demand for Etteplan's services. This weakness is further exacerbated by significant variations in customer-specific demand within these areas, making strategic planning and resource allocation challenging.

If Etteplan maintains operations or a substantial focus in these underperforming regions without a compelling, differentiated offering, these segments would likely be classified as dogs within the BCG matrix. This classification stems from their persistent low growth prospects and the inherent difficulty in capturing or expanding market share.

- Weak Demand in Central Europe: Reports from early 2024 indicated a slowdown in industrial investment across several Central European economies, impacting demand for engineering and design services. For instance, manufacturing output in some of these countries saw marginal year-over-year growth, below the European average.

- Customer-Specific Demand Volatility: Etteplan's experience in 2024 highlighted that even within these weak markets, customer project pipelines were highly unpredictable, with many clients delaying or scaling back commitments. This made it difficult to forecast revenue accurately for these specific regional operations.

- Lack of Differentiating Offering: In areas where Etteplan's service portfolio did not offer a unique advantage or specialization compared to local competitors, the challenge of competing in a low-growth environment intensified, reinforcing the 'dog' status.

Dogs represent business units or services with low market share in low-growth industries. For Etteplan, this could include generic engineering staff augmentation or services tied to outdated technologies. These offerings typically generate low profits and may even require significant investment to maintain, draining resources from more promising areas.

The Q1 2025 report highlighting customer investment hesitations in Europe, particularly Germany, suggests that services reliant on new projects without a strong differentiator are vulnerable to becoming dogs. This economic caution, coupled with regional demand weakness in Central Europe noted in early 2024, reinforces this classification for certain Etteplan operations.

These underperforming segments can hinder overall company growth. For example, if Etteplan's acquired businesses in niche markets without AI integration don't perform, they become dogs. In 2023, Etteplan's revenue growth of 13% to €391.7 million underscores the need to divest or restructure such units to focus on strategic growth drivers.

Managing these dog segments involves either divesting them, finding a niche to revitalize them, or integrating them into stronger business units. Failure to address them can lead to a drag on overall profitability and strategic focus, especially when considering Etteplan's 'Transformation with AI' initiative.

| Service Area Example | Market Growth | Market Share | Profitability | BCG Classification |

| Generic Engineering Staff Augmentation | Low | Low | Low | Dog |

| Technical Documentation (Legacy Formats) | Low | Low | Low | Dog |

| Acquired Niche Software (No AI Integration) | Low | Low | Low | Dog |

| Services in Weak Central European Markets (Undifferentiated) | Low | Low | Low | Dog |

Question Marks

Etteplan's strategic push towards 35% of revenue from AI-driven solutions by 2027 signals a deliberate move into emerging AI applications. These new service areas, such as advanced data management for AI and predictive analytics, are currently in their early stages, requiring substantial investment and offering limited returns as they gain traction.

These nascent AI services, including specialized data engineering for machine learning models and AI-powered cybersecurity, represent Etteplan's "question marks" in the BCG matrix. While their current revenue contribution is small, their high growth potential positions them as future stars, provided they can successfully scale and achieve market acceptance.

Etteplan's new digital twin and simulation services are positioned in a rapidly expanding market, driven by the increasing demand for virtual prototyping and process optimization across various industries. This segment represents a significant growth opportunity, though Etteplan's current market share may still be developing as these advanced capabilities are relatively new or recently enhanced.

The development and scaling of these sophisticated digital twin and simulation services necessitate substantial investment in technology, talent, and infrastructure. This commitment is crucial for Etteplan to effectively penetrate the market and establish a strong foothold among a diverse clientele seeking to leverage these cutting-edge solutions for product lifecycle management and operational efficiency.

The market for specialized cybersecurity and data integrity solutions for Operational Technology (OT) and the Internet of Things (IoT) is experiencing robust growth, driven by the increasing complexity and connectivity of industrial systems. This segment represents a high-growth opportunity, with the global OT cybersecurity market projected to reach $29.3 billion by 2026, growing at a CAGR of 7.5%.

If Etteplan is actively developing or has recently introduced services in this niche area, these offerings would likely be classified as question marks within the Etteplan BCG Matrix. This classification signifies a high market growth potential coupled with a potentially low current market share, necessitating substantial investment to build brand recognition, establish a strong market presence, and effectively differentiate from established and emerging competitors.

Advanced Predictive Maintenance and Smart Asset Management with AI

Leveraging artificial intelligence for predictive maintenance and smart asset management represents a significant growth opportunity, particularly within sectors like energy and utilities where Etteplan holds a strong presence. This focus area is characterized by rapid technological advancement and increasing demand for operational efficiency.

However, achieving a leading market position in this competitive and dynamic field necessitates considerable investment in cutting-edge technology and specialized expertise. Consequently, these advanced AI-driven services are currently classified as question marks within the Etteplan BCG Matrix, pending wider market acceptance and demonstrated profitability.

- Market Growth: The global predictive maintenance market was valued at approximately USD 6.9 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of around 30% from 2024 to 2030, reaching an estimated USD 37.4 billion by 2030.

- Industry Adoption: The energy and utilities sector is a primary adopter, with AI in this domain expected to significantly reduce downtime and operational costs, potentially saving billions annually across the industry.

- Investment Needs: Developing sophisticated AI algorithms and acquiring the necessary data science talent requires substantial upfront and ongoing financial commitment, impacting immediate returns.

- Competitive Landscape: The market includes established players and emerging startups, intensifying the challenge for new entrants or those expanding into advanced AI capabilities to capture significant market share quickly.

Highly Innovative but Unproven Niche Engineering Technologies

Highly innovative but unproven niche engineering technologies represent Etteplan's ventures into the frontier of engineering. These are the experimental concepts, the cutting-edge methodologies that haven't yet solidified their market position or demonstrated consistent profitability. Think of advanced materials science applications or novel AI-driven design processes that are still in their nascent stages.

These areas hold immense promise for future growth, potentially disrupting existing markets or creating entirely new ones. However, their unproven nature means they are inherently high-risk. Etteplan must continue to invest significant resources into research and development to refine these technologies and navigate the challenges of low initial market share.

- High Growth Potential: Successful development could lead to significant market penetration and revenue streams.

- Significant Risk: Failure to achieve market acceptance or technological viability poses a substantial risk.

- Continuous Investment: Ongoing R&D funding is critical to overcome technical hurdles and build market traction.

- Low Initial Market Share: These technologies start with minimal adoption, requiring dedicated market development efforts.

Question marks in Etteplan's BCG matrix represent business areas with high market growth potential but currently low market share. These are typically new or emerging service offerings that require significant investment to develop and scale. Their success hinges on Etteplan's ability to capture market interest and achieve profitability.

These segments, such as advanced AI-driven analytics and specialized cybersecurity for OT/IoT, are crucial for Etteplan's future growth strategy. The company is investing heavily in these areas, recognizing their potential to become future stars if they gain market traction and establish a competitive advantage.

The challenge for these question marks lies in their nascent stage; they demand substantial capital for R&D, talent acquisition, and market penetration efforts. Etteplan's strategic allocation of resources to these high-potential, high-risk ventures underscores its commitment to innovation and long-term market leadership.

| BCG Category | Etteplan's Focus Area | Market Growth Potential | Current Market Share | Investment Need | Strategic Implication |

|---|---|---|---|---|---|

| Question Mark | AI-Driven Solutions (e.g., Predictive Maintenance, Data Management for AI) | High | Low | High | Requires significant investment to grow market share and achieve profitability. Potential future star. |

| Question Mark | Digital Twin & Simulation Services | High | Developing | High | Invest to build capability and capture growing demand in virtual prototyping and process optimization. |

| Question Mark | Specialized OT/IoT Cybersecurity | High | Low | High | Needs investment to establish presence in a rapidly growing industrial cybersecurity market. |

| Question Mark | Niche Engineering Technologies (e.g., Advanced Materials, Novel AI Design) | Very High | Very Low | Very High | High-risk, high-reward ventures requiring substantial R&D to validate and commercialize. |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, encompassing sales figures, customer feedback, and competitive landscape analysis to provide a clear strategic overview.