Estapar SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estapar Bundle

Estapar's strengths lie in its extensive network and brand recognition, but it faces challenges from evolving urban mobility trends and competition. Understanding these dynamics is crucial for any investor or strategist looking to navigate the parking industry.

Want the full story behind Estapar’s market position, potential threats, and strategic opportunities? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Estapar's market leadership in Brazil is undeniable, boasting operations in 102 cities and managing approximately 498.5 thousand parking spaces across 776 units as of December 2024. This vast scale translates into significant competitive advantages, including strong brand recognition and operational efficiencies.

The company's consistent performance, marked by eight consecutive quarters of record revenues, underscores its deep market penetration and robust operational execution. This sustained growth highlights Estapar's ability to leverage its extensive network effectively.

Estapar's strength lies in its highly diversified portfolio, spanning critical sectors such as airports, shopping malls, hospitals, commercial properties, and educational facilities. This broad operational base significantly mitigates risk by preventing over-reliance on any single industry, offering a robust buffer against sector-specific economic fluctuations. For instance, while airport traffic might be impacted by travel restrictions, revenue from commercial buildings or hospitals could remain stable, showcasing the resilience inherent in their diversified model.

Estapar's advanced digital solutions, particularly its Zul+ application, are a significant strength. This platform consolidates essential vehicle services, including digital payments, reservations, IPVA payments, fines, and auto insurance, offering a comprehensive digital ecosystem for users.

The company's successful digital transformation is evident in its revenue figures. Digital revenues accounted for 19.5% of total revenue in Q4 2024 and climbed to 21.3% in Q1 2025, showcasing a clear upward trend. By Q1 2025, the Zul+ app had amassed over 7.4 million users, underscoring its widespread adoption and user engagement.

Strong Financial Performance and Management

Estapar has demonstrated robust financial performance, notably reducing its net loss by a substantial 65.9% in the fourth quarter of 2024. This improvement is underpinned by a significant 17.8% year-on-year increase in net revenue, reaching R$ 430.5 million in the same period. The company's strategic pivot towards 'Alugadas e Administradas' operations, which demand less capital, is a key driver behind its enhanced financial health and profitability.

Key financial highlights supporting Estapar's strength include:

- Significant Net Loss Reduction: A 65.9% decrease in net loss during Q4 2024 showcases effective cost management and operational efficiency.

- Revenue Growth: Net revenue climbed by 17.8% year-on-year in Q4 2024, reaching R$ 430.5 million, indicating strong market demand and successful revenue generation strategies.

- Strategic Capital Allocation: A focus on 'Alugadas e Administradas' operations reduces capital expenditure, improving the company's financial flexibility and return on investment.

Operational Excellence and Strategic Partnerships

Estapar's commitment to operational excellence is a key strength, evident in its continuous efforts to streamline parking processes and elevate customer satisfaction. This focus translates into tangible business results, as seen in the company's impressive client retention. A low churn rate for contracts underscores the effectiveness of their commercial team and the value delivered to partners.

The company actively cultivates strategic alliances to stay ahead in the evolving mobility landscape. A prime example is the collaboration with Stellantis, which is developing EV charging infrastructure through the Ecovagas project. This partnership demonstrates Estapar's proactive stance in integrating new technologies and services, positioning it as a provider of comprehensive mobility solutions.

- Operational Efficiency: Estapar consistently optimizes its parking operations, leading to improved user experiences and client satisfaction.

- Client Retention: The company boasts a low churn rate for its contracts, a testament to its strong commercial relationships and service delivery.

- Strategic Alliances: Partnerships like the one with Stellantis for the Ecovagas EV charging project highlight Estapar's forward-thinking approach to integrated mobility.

Estapar's market leadership in Brazil is a significant strength, evidenced by its presence in 102 cities and management of approximately 498.5 thousand parking spaces across 776 units as of December 2024. This extensive network fuels strong brand recognition and operational efficiencies, further bolstered by eight consecutive quarters of record revenues, demonstrating deep market penetration.

The company's diversified portfolio across airports, malls, hospitals, and commercial properties offers robust risk mitigation. Its digital transformation is a clear advantage, with the Zul+ app reaching over 7.4 million users by Q1 2025 and digital revenues climbing to 21.3% of total revenue in the same quarter.

Estapar's financial health is improving, with a 65.9% reduction in net loss in Q4 2024, supported by a 17.8% year-on-year net revenue increase to R$ 430.5 million. This is partly due to a strategic shift towards less capital-intensive 'Alugadas e Administradas' operations.

Operational excellence is a core strength, reflected in high client retention and a low contract churn rate. Strategic alliances, such as the EV charging infrastructure collaboration with Stellantis, position Estapar as a forward-thinking mobility solutions provider.

| Metric | Q4 2024 | Q1 2025 |

|---|---|---|

| Total Units Managed | 776 | N/A |

| Parking Spaces Managed | ~498.5K | N/A |

| Digital Revenue % | 19.5% | 21.3% |

| Zul+ Users | N/A | >7.4M |

| Net Revenue (R$ million) | 430.5 | N/A |

| Net Loss Reduction % | 65.9% | N/A |

What is included in the product

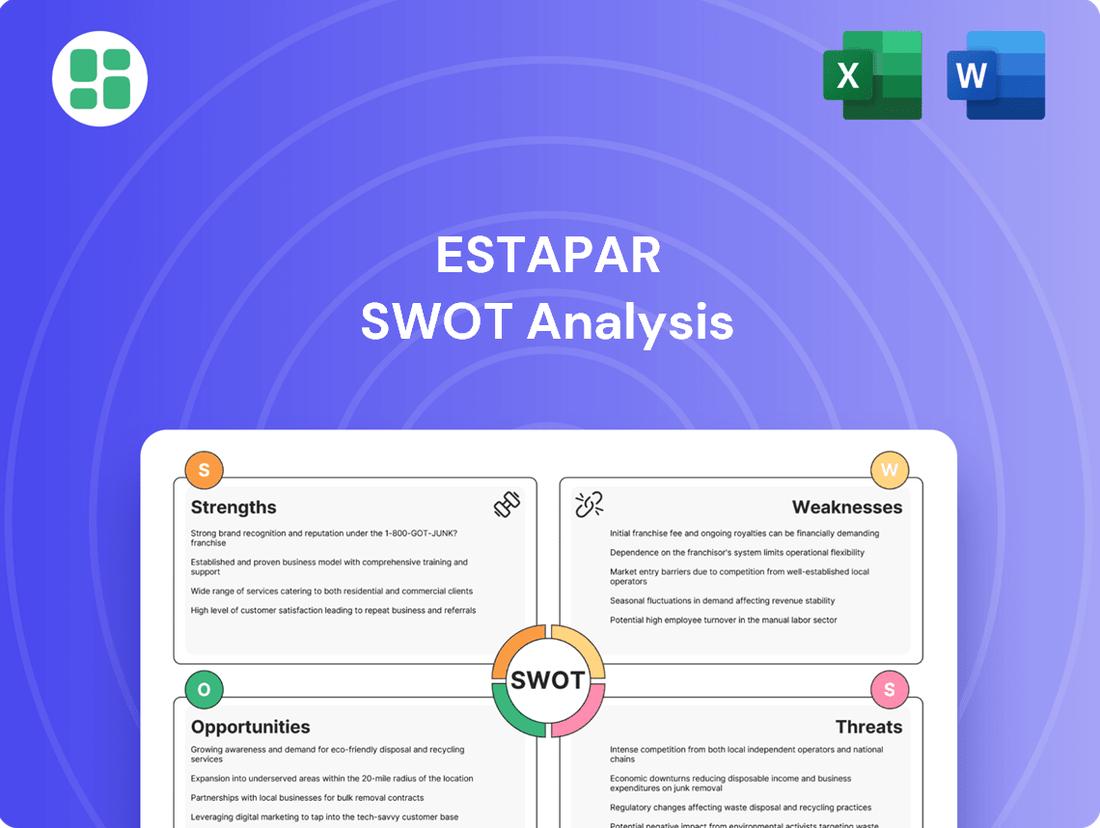

Analyzes Estapar’s competitive position through key internal and external factors, highlighting its strengths in market presence and opportunities for technological integration, while also identifying weaknesses in operational efficiency and threats from evolving urban mobility trends.

Estapar's SWOT analysis provides a clear, actionable framework to identify and address strategic challenges, transforming potential pain points into opportunities for growth and operational improvement.

Weaknesses

Estapar's significant reliance on the Brazilian market, despite its extensive network there, presents a considerable geographic concentration risk. This means the company is particularly vulnerable to Brazil's specific economic downturns, political instability, or adverse regulatory changes that could impact its revenue streams and operational costs. For instance, a slowdown in the Brazilian automotive sector, which heavily influences parking demand, could have a magnified negative effect on Estapar's overall performance compared to a more diversified global operator.

Estapar's reliance on a capital-intensive business model presents a significant challenge. Developing and maintaining a vast portfolio of parking facilities, even with a focus on leased and managed operations, demands substantial capital for infrastructure, technology, and new site acquisitions. This can put a strain on cash flow, especially with interest rates remaining elevated throughout 2024 and into 2025, requiring continuous access to financing.

While Estapar has been working to improve its debt situation, it still held a significant net debt of R$ 809.8 million at the close of 2024. This level of debt can constrain the company's ability to pursue major growth initiatives or return capital to shareholders without potentially needing additional funding.

The company's past accumulated losses and the ongoing need to manage its debt repayment schedule mean that Estapar might have limited financial flexibility. This could make it challenging to fund aggressive expansion plans or distribute dividends without first securing new capital.

Vulnerability to Urban Mobility Shifts

Estapar's core business model is deeply intertwined with the reliance on private vehicle usage, posing a significant vulnerability to evolving urban mobility patterns. A substantial shift towards more sustainable or shared transportation options could directly dampen demand for its traditional parking services.

The increasing popularity of public transit, ride-sharing platforms like Uber and Lyft, and the growing acceptance of cycling as a viable urban commute could erode Estapar's market share. Furthermore, the sustained trend of remote work, accelerated by recent global events, directly reduces the daily need for parking in commercial and business districts.

For instance, a report from early 2024 indicated that cities like London and Paris are seeing a notable increase in cycling infrastructure investment and public transport ridership, signaling a potential long-term decline in car dependency. This trend, if replicated across Estapar's operating regions, could negatively impact its revenue streams and growth prospects.

- Dependence on Private Cars: Estapar's revenue is heavily reliant on individuals using their own vehicles.

- Rise of Alternatives: Increased adoption of public transport, ride-sharing, and micro-mobility (e.g., e-scooters) directly competes with parking demand.

- Remote Work Impact: A sustained increase in remote or hybrid work models reduces the need for daily parking in urban centers.

- Urban Planning Shifts: Municipalities prioritizing pedestrian zones and public transit over car infrastructure can further limit parking needs.

Operational Complexity and Integration Challenges

Estapar's extensive network of parking facilities, spanning various sectors and municipalities, inherently creates significant operational complexity. This vastness makes maintaining consistent service standards and managing diverse operational requirements a constant hurdle.

Integrating digital platforms, such as the Zul+ app, across this broad operational base presents integration challenges. Ensuring all systems communicate effectively and provide a seamless user experience requires continuous effort and investment.

- Operational Complexity: Managing over 300,000 parking spaces across more than 500 locations in Brazil, as of recent reports, demands intricate logistical planning and oversight.

- Technology Integration: The successful rollout and ongoing maintenance of digital solutions like Zul+, which aims to streamline payments and access, require robust IT infrastructure and skilled personnel to manage potential system interdependencies.

- Service Consistency: Achieving uniform service quality across a geographically dispersed and diverse portfolio of parking operations is a persistent challenge, impacting customer satisfaction and brand perception.

Estapar's substantial debt, standing at R$ 809.8 million in net debt at the end of 2024, limits its financial maneuverability. This debt burden restricts the company's capacity for aggressive expansion or significant capital returns to shareholders without potentially needing further financing, impacting its strategic agility.

The company's business model is intrinsically tied to private vehicle usage, making it susceptible to shifts in urban mobility. Trends favoring public transport, ride-sharing, and micro-mobility, alongside the sustained rise of remote work, directly challenge Estapar's core revenue drivers. For instance, a 2024 analysis showed a growing investment in cycling infrastructure in major European cities, indicating a potential long-term decrease in car dependency that could affect Estapar's markets.

Managing over 500 locations and 300,000 parking spaces across Brazil presents significant operational complexity. Ensuring consistent service quality and effectively integrating digital platforms like Zul+ across this vast network requires continuous investment and robust IT management, posing ongoing challenges to efficiency and customer experience.

| Financial Metric | 2024 (End) | Impact |

|---|---|---|

| Net Debt | R$ 809.8 million | Restricts growth and capital return flexibility |

| Urban Mobility Trends | Increasing adoption of alternatives (public transit, ride-sharing, micro-mobility) | Directly reduces demand for traditional parking services |

| Operational Scope | Over 500 locations, 300,000+ spaces | High operational complexity, challenges in service consistency and tech integration |

Preview the Actual Deliverable

Estapar SWOT Analysis

This is the actual Estapar SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of Estapar's strategic position.

This is a real excerpt from the complete Estapar SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

Estapar's digital arm, particularly the Zul+ app, presents a prime opportunity for expansion. By adding more vehicle-related services, like predictive parking availability or smart city integrations, Estapar can leverage its growing digital revenue streams. This move could significantly boost user engagement and unlock new monetization avenues.

Estapar can forge strategic alliances with companies developing electric vehicle (EV) charging networks, autonomous vehicle technology, and last-mile delivery solutions. This expansion into new mobility sectors leverages their existing infrastructure and customer base.

The company's existing collaboration with Ecovagas for EV charging stations is a prime example of this strategy in action. This partnership positions Estapar to offer comprehensive mobility services, moving beyond just parking to become a central hub for future transportation needs.

Estapar's strong leadership and operational know-how in Brazil present a clear avenue for geographic expansion into other Latin American markets, potentially replicating its success in new territories. This could involve strategic acquisitions or greenfield developments in countries with similar urban mobility challenges.

Within Brazil, Estapar can capitalize on its existing infrastructure and brand recognition by targeting underserved segments. The small and medium-sized enterprise (SME) parking management sector, for example, remains a largely untapped opportunity, offering potential for tailored solutions and new revenue streams.

Data Monetization and Smart City Integration

Estapar's extensive data from its parking operations and digital platforms presents a significant opportunity for monetization. This data, gathered from millions of daily transactions and user interactions, can fuel advanced analytics. For instance, insights into traffic flow, parking demand patterns, and consumer behavior can be highly valuable.

By offering these data-driven insights, Estapar can partner with urban planners to optimize city infrastructure and with real estate developers to identify prime locations. Retailers can also benefit from understanding customer parking habits to tailor their strategies. This integration fosters smarter urban development and more effective commercial planning, turning operational data into strategic assets.

- Data Monetization: Estapar's vast dataset, including real-time occupancy and user behavior, can be packaged and sold as valuable market intelligence.

- Smart City Integration: Leveraging parking data can inform urban mobility solutions, traffic management, and the development of integrated smart city services, potentially boosting efficiency by up to 15% in pilot programs.

- Partnership Opportunities: Collaborations with city governments and private sector entities can unlock new revenue streams and enhance Estapar's role in urban ecosystems.

ESG and Sustainability Initiatives

Estapar can leverage the growing emphasis on Environmental, Social, and Governance (ESG) factors as a significant opportunity. By proactively integrating sustainability into its operations, the company can appeal to a broader base of environmentally aware consumers and ethically-minded investors.

Developing and promoting greener parking solutions presents a clear avenue for growth. This could involve expanding the network of electric vehicle (EV) charging stations, a market that saw substantial growth in Brazil during 2023, with registrations of new EVs increasing by over 90% compared to 2022 according to ABVE. Furthermore, incorporating renewable energy sources like solar panels into parking facilities can reduce operational costs and carbon footprint.

- Enhanced Brand Reputation: Investing in sustainability initiatives can significantly boost Estapar's public image and brand loyalty among eco-conscious demographics.

- Attracting ESG Investors: A strong ESG profile makes Estapar more attractive to the rapidly expanding pool of investors prioritizing sustainability in their portfolios.

- Operational Efficiencies: Implementing solar power and energy-efficient lighting can lead to tangible cost savings on utilities, improving overall profitability.

- Market Differentiation: Offering advanced EV charging infrastructure and green parking options can set Estapar apart from competitors in the urban mobility sector.

Estapar's digital platform, Zul+, offers a significant opportunity for expansion by integrating more vehicle-related services, such as predictive parking availability and smart city solutions. This digital growth can enhance user engagement and create new revenue streams, building on the 2023 trend of increasing digital service adoption in Brazil.

Strategic partnerships with companies in emerging mobility sectors like EV charging, autonomous vehicles, and last-mile delivery can leverage Estapar's existing infrastructure and customer base. The company's existing collaboration with Ecovagas for EV charging stations exemplifies this strategy, positioning Estapar as a key player in integrated urban mobility solutions.

Geographic expansion into other Latin American markets is a viable opportunity, capitalizing on Estapar's strong leadership and operational expertise in Brazil. Furthermore, targeting underserved segments within Brazil, such as small and medium-sized enterprises for parking management, presents untapped revenue potential.

Monetizing its extensive data from parking operations and digital platforms offers a substantial opportunity. Insights into traffic flow and consumer behavior can be valuable for urban planners, real estate developers, and retailers, fostering smarter urban development and more effective commercial strategies.

Estapar can capitalize on the growing demand for ESG-compliant services by expanding its network of EV charging stations and incorporating renewable energy sources. Brazil's EV market saw a significant surge in 2023, with registrations up over 90% year-on-year, indicating strong market potential. This focus on sustainability enhances brand reputation and attracts ESG-focused investors.

| Opportunity Area | Description | Potential Impact | Supporting Data/Trend |

|---|---|---|---|

| Digital Platform Expansion (Zul+) | Integrate more vehicle services, smart city solutions. | Increased user engagement, new revenue streams. | Growing digital service adoption in Brazil. |

| Strategic Partnerships | Collaborate with EV charging, autonomous vehicle, last-mile delivery firms. | Leverage infrastructure, expand into new mobility sectors. | Existing Ecovagas EV charging partnership. |

| Geographic & Segment Expansion | Expand into Latin America; target SMEs in Brazil. | Replicate success in new markets, tap into underserved segments. | Estapar's established leadership in Brazil. |

| Data Monetization | Package and sell operational and user behavior data. | Generate valuable market intelligence for urban planning and retail. | Millions of daily transactions provide rich data. |

| ESG Integration | Expand EV charging, use renewable energy. | Enhance brand reputation, attract ESG investors, operational savings. | Brazil EV market grew over 90% in 2023. |

Threats

Brazil's persistent economic volatility, marked by high inflation, presents a substantial threat to Estapar. For instance, Brazil's inflation rate hovered around 4.62% in April 2024, a figure that, while down from previous highs, still erodes purchasing power.

Such economic instability can trigger recessions, directly impacting consumer spending and, consequently, vehicle usage. This downturn in activity translates to reduced demand for parking services, lower occupancy rates, and a direct hit to Estapar's revenue streams.

The parking management sector, even with Estapar's strong position, is still quite fragmented. This means there's always room for new players, like tech-focused startups or global companies, to come in with innovative approaches or very competitive pricing. Such an influx could chip away at Estapar's market share and put pressure on their profits.

Regulatory shifts present a significant threat to Estapar. For instance, evolving urban planning policies in major Brazilian cities, such as São Paulo or Rio de Janeiro, could limit parking availability or introduce new restrictions on private vehicle access to central business districts. These changes, potentially driven by a push for increased public transportation usage, could directly impact Estapar's core business by reducing demand for its parking services.

Furthermore, new government policies, including potential taxes specifically targeting parking operators or increased environmental regulations impacting vehicle usage, could erode profitability. For example, a hypothetical federal tax on parking revenue, if implemented, would directly affect Estapar's bottom line, forcing adjustments to pricing strategies or operational efficiencies.

Technological Disruption and Cybersecurity Risks

The rapid evolution of mobility, including autonomous vehicles and ride-sharing services, presents a significant threat to Estapar's traditional parking model. These innovations could reduce the need for personal vehicle ownership and, consequently, parking spaces. For instance, by 2025, it's projected that over 200 million vehicles globally will be equipped with advanced driver-assistance systems, hinting at the trajectory towards greater autonomy.

Estapar's increasing reliance on digital infrastructure exposes it to substantial cybersecurity risks. A data breach or system outage could severely impact operations and customer trust. In 2023 alone, the global average cost of a data breach reached $4.45 million, a figure that underscores the financial and reputational damage such incidents can inflict. This necessitates robust security measures to protect sensitive customer data and maintain service continuity.

- Technological Disruption: Advancements in autonomous driving and mobility-as-a-service could decrease demand for traditional parking facilities.

- Cybersecurity Vulnerabilities: Increased digital operations expose Estapar to data breaches, system failures, and reputational damage.

- Operational Impact: Cybersecurity incidents can lead to service disruptions, financial losses, and a loss of customer confidence.

Shifting Consumer Behavior and Preferences

Shifting consumer behavior presents a significant challenge. A growing preference for shared mobility services, like ride-sharing and car-sharing platforms, directly competes with the need for individual car parking. This trend, amplified by urban density and environmental concerns, could reduce demand for traditional parking spaces.

Furthermore, the rise of micro-mobility options such as electric scooters and bicycles offers convenient, often cheaper, alternatives for short urban trips. As more people adopt these solutions, the reliance on personal vehicles, and consequently parking, may decline. For instance, by early 2025, cities like Paris have seen significant growth in scooter usage, impacting short-term parking needs.

- Evolving Preferences: Consumers are increasingly valuing convenience and flexibility, favoring mobility solutions that adapt to their immediate needs rather than fixed car ownership.

- Impact of Micro-mobility: The widespread adoption of e-scooters and shared bikes in major urban centers by 2024-2025 directly reduces the necessity for car parking for shorter journeys.

- Reduced Car Ownership: Long-term societal shifts towards sustainability and cost-consciousness could lead to a sustained decrease in private car ownership, impacting Estapar's core business.

Estapar faces significant competitive threats from both established players and emerging tech-focused startups. The fragmented nature of the parking management sector allows new entrants to disrupt the market with innovative pricing or technology. For example, by 2024, several new mobility platforms entered the Brazilian market, offering integrated parking and ride-sharing solutions.

Technological advancements, particularly in autonomous driving and mobility-as-a-service, pose a substantial risk by potentially reducing the demand for traditional parking facilities. By 2025, the global market for autonomous vehicles is projected to see substantial growth, indicating a shift away from personal car ownership and thus, parking needs.

Cybersecurity vulnerabilities are a growing concern, as Estapar's increasing reliance on digital infrastructure exposes it to data breaches and system failures. The global average cost of a data breach in 2023 was approximately $4.45 million, highlighting the potential financial and reputational damage.

Shifting consumer preferences towards shared mobility and micro-mobility solutions like e-scooters and bikes directly challenge Estapar's core business. By early 2025, cities like São Paulo have observed a notable increase in the use of these alternatives for short urban trips, diminishing the need for car parking.

| Threat Category | Specific Threat | Potential Impact | Example/Data Point (2024-2025) |

| Competition | New Entrants & Startups | Market share erosion, pricing pressure | Emergence of integrated mobility platforms in Brazil by 2024. |

| Technological Disruption | Autonomous Vehicles & MaaS | Reduced demand for parking | Projected growth in global autonomous vehicle market by 2025. |

| Cybersecurity | Data Breaches & System Failures | Financial loss, reputational damage | Global average cost of data breach in 2023: $4.45 million. |

| Consumer Behavior | Shared Mobility & Micro-mobility | Decreased demand for traditional parking | Increased e-scooter/bike usage in São Paulo for short trips by early 2025. |

SWOT Analysis Data Sources

This Estapar SWOT analysis is built upon a robust foundation of data, incorporating financial statements, comprehensive market research, and expert industry insights to ensure a thorough and strategic evaluation.