Estapar Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Estapar Bundle

Estapar's competitive landscape is shaped by a complex interplay of forces, from the bargaining power of its customers to the constant threat of new entrants. Understanding these dynamics is crucial for navigating the parking industry.

The complete report reveals the real forces shaping Estapar’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of technology providers for parking solutions, such as payment systems, access control, sensors, and AI-driven analytics, is generally moderate to high. Estapar's commitment to enhancing digital offerings and optimizing operations through these technologies, with over 20% of revenue derived from digital payments in 2024, underscores this reliance. The specialized and often proprietary nature of advanced parking technologies can restrict the pool of qualified suppliers, granting them significant leverage in negotiations.

Landlords, such as airports, malls, and hospitals, wield substantial bargaining power over Estapar. Their leverage stems from the critical need for Estapar to operate in prime, high-traffic locations. These property owners can dictate terms, knowing that multiple parking operators are often eager to secure these lucrative spots, or they might even opt for self-management, further strengthening their negotiating position.

In 2024, the demand for prime commercial real estate continued to be robust, particularly in urban centers. This sustained demand empowers property owners to negotiate more favorable lease terms, including higher rental rates and more advantageous revenue-sharing agreements with parking operators like Estapar. For instance, major airport authorities often have the capacity to bring parking operations in-house, a threat that significantly influences negotiations with third-party providers.

Suppliers to construction and infrastructure firms, particularly those providing specialized parking technology like automated barriers and guidance systems, hold moderate bargaining power. While the construction sector generally has many players, the niche nature of advanced parking solutions can limit the pool of qualified providers.

The long-term commitments inherent in infrastructure projects can further solidify a supplier's position, especially when Estapar requires reliable and scalable systems. For instance, a significant portion of Estapar's capital expenditure in 2023, which was R$200 million, was allocated to technological upgrades, indicating a reliance on specialized suppliers for these advancements.

Software and Hardware Vendors

Vendors providing standard software and hardware, like general servers or basic payment terminals, generally hold limited bargaining power. This is because these items are widely available and often interchangeable, making it easier for Estapar to switch suppliers. For instance, a typical enterprise server might see price competition among multiple manufacturers, reducing any single vendor's leverage.

However, the bargaining power shifts significantly when vendors offer specialized smart parking hardware or software solutions that are custom-built or deeply integrated with Estapar's unique operational systems. These bespoke solutions create higher switching costs for Estapar, giving the specialized vendors more influence. In 2024, companies offering advanced IoT sensors for real-time parking availability or sophisticated AI-driven analytics platforms for traffic flow management often command higher prices due to their proprietary technology and the complexity of integration.

- Commoditized Hardware: Vendors of generic servers, networking equipment, and standard payment terminals face low to moderate bargaining power due to product standardization and availability.

- Specialized Software/Hardware: Suppliers of proprietary smart parking technology, IoT sensors, or deeply integrated software platforms possess increased bargaining power, especially if switching costs are high for Estapar.

- Integration Complexity: The degree to which a vendor's solution integrates with Estapar's existing infrastructure directly impacts the vendor's leverage, with tighter integration leading to greater supplier power.

- Market Concentration: In niche segments of the smart parking technology market, fewer specialized suppliers can lead to a more concentrated vendor landscape, amplifying their collective bargaining power.

Labor (Parking Attendants, Maintenance Staff)

The bargaining power of labor for Estapar, specifically for roles like parking attendants and maintenance staff, leans towards moderate. With a workforce of nearly 6,000 employees as of recent reports, Estapar has a significant labor base. However, many of these positions, such as basic parking attendant duties, may not demand highly specialized skills, which can broaden the available talent pool and temper individual worker leverage.

Nevertheless, certain factors can elevate this power. The presence of strong labor unions, which is common in Brazil's service sector, can significantly increase the collective bargaining strength of employees. For Estapar, this could translate into demands for better wages, benefits, and working conditions. Additionally, if maintenance roles require specialized knowledge, particularly for advanced or automated parking systems that Estapar might implement, the bargaining power of those specific skilled workers would naturally increase due to their unique expertise.

- Moderate Power: Generally moderate due to a large, potentially less specialized workforce.

- Unionization Impact: Union presence can significantly amplify labor's bargaining power.

- Skill Specialization: Highly specialized maintenance roles increase worker leverage.

The bargaining power of suppliers for Estapar is varied, largely depending on the nature of the goods or services provided. For commoditized items like standard hardware, power is limited due to easy availability and interchangeability. However, for specialized technology, such as advanced AI-driven analytics or proprietary smart parking systems, supplier power is considerably higher due to the niche nature of the offerings and the complexity of integration.

Landlords, particularly major property owners like airports and shopping malls, hold significant bargaining power. Their leverage comes from the critical need for Estapar to access high-traffic, prime locations. These property owners can dictate terms, knowing that Estapar's operations depend on securing these advantageous spots.

In 2024, the demand for prime commercial real estate remained strong, allowing property owners to negotiate more favorable lease terms, including higher rental rates and revenue-sharing agreements, with parking operators like Estapar. The ability of some landlords, such as large airport authorities, to manage parking operations in-house presents a substantial threat, amplifying their negotiating leverage.

| Supplier Type | Bargaining Power | Key Factors |

|---|---|---|

| Technology Providers (Specialized) | Moderate to High | Proprietary technology, integration complexity, switching costs |

| Landlords (Airports, Malls) | High | Critical location access, demand for prime real estate, potential for in-house operations |

| Suppliers (Construction/Infrastructure) | Moderate | Niche nature of advanced parking solutions, long-term project commitments |

| Vendors (Standard Hardware/Software) | Low to Moderate | Product standardization, availability, interchangeability |

What is included in the product

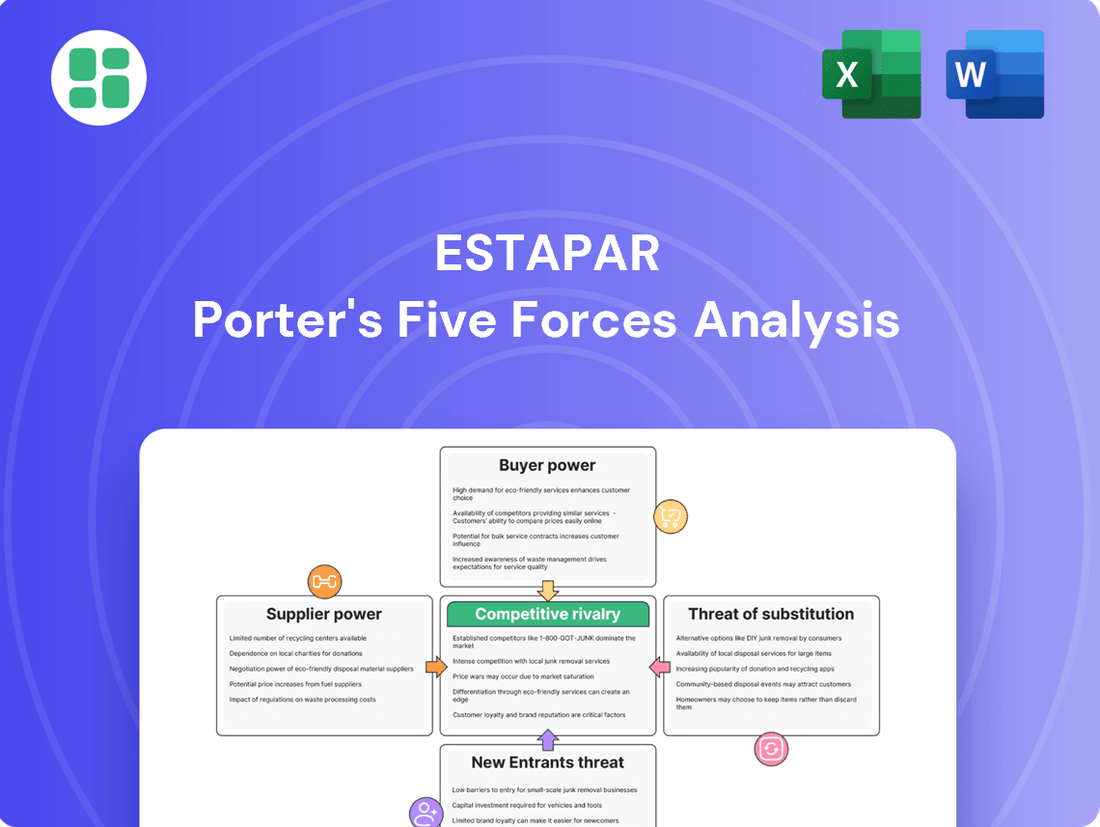

This Porter's Five Forces analysis provides a comprehensive understanding of the competitive landscape for Estapar, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the parking industry.

Estapar's Porter's Five Forces analysis provides a crucial framework for identifying and mitigating competitive threats, offering a clear roadmap to navigate market pressures and strengthen strategic positioning.

Customers Bargaining Power

The bargaining power of individual drivers as end-users for parking services is typically quite low. In many urban areas, parking is a necessity, and the limited availability of convenient alternatives means drivers have few options. For instance, in downtown areas with high demand, readily available parking spots are often prioritized over slight price variations.

While drivers are certainly price-conscious, factors like location, ease of access, and the availability of a spot often hold more sway than minor cost differences, particularly for short-term parking needs. This is evident in cities where premium pricing for prime parking locations is common and accepted by consumers.

For Estapar, commercial clients like shopping malls and hospitals wield moderate to high bargaining power. These clients are vital for recurring revenue and their parking operations directly impact their own customer satisfaction and business flow.

These large-scale clients often enter into substantial, long-term agreements, giving them leverage to negotiate pricing and service level agreements. For instance, a major shopping mall might represent a significant portion of a regional parking operator's revenue, making them hesitant to lose such a client.

Furthermore, these clients have the option to solicit bids from multiple parking management firms, fostering a competitive environment that can drive down prices for Estapar. In some cases, they might even consider managing their parking facilities internally, further increasing their negotiating strength.

Government agencies, especially those overseeing public parking like Zona Azul, possess significant bargaining power. These entities often grant concessions for large-scale operations, allowing them to heavily influence contract terms, pricing, and regulatory frameworks. For instance, in São Paulo, Brazil, where Zona Azul is prevalent, the municipal government sets the rules and fees for on-street parking, directly impacting operators like Estapar.

Digital Platform Users (App Users)

Digital platform users, those interacting with Estapar's parking apps for payments and reservations, possess moderate bargaining power. The ease of switching to alternative parking apps or even traditional payment methods provides users with a degree of choice, preventing Estapar from exerting complete control over pricing or service terms. This is a common dynamic in the digital services sector, where user convenience often translates to leverage.

However, Estapar's strategic focus on building a robust digital ecosystem, featuring an extensive network of parking locations and integrated services, works to mitigate this power. By offering a seamless and comprehensive user experience, Estapar aims to foster customer loyalty and reduce churn. For instance, as of early 2024, many digital payment platforms report high user retention rates when they offer integrated loyalty programs or significant convenience factors, suggesting that Estapar's approach could be effective in solidifying its user base.

- User Choice: The availability of multiple parking payment apps and alternative payment methods grants users leverage.

- Estapar's Advantage: An extensive network and integrated digital services can increase user stickiness.

- Digital Service Dynamics: Moderate bargaining power for users is typical in app-based service industries.

Corporate Fleets and Event Organizers

Corporate fleets and large event organizers generally possess moderate bargaining power within the parking industry. Their need for substantial parking capacity or specialized services, such as valet for major events, allows them to negotiate volume discounts and tailored service agreements. This leverage is amplified by their capacity to switch between parking providers or engage directly with facility owners, influencing pricing and service terms.

For instance, a large corporate client requiring parking for hundreds of employees daily can command better rates than an individual driver. Similarly, a major festival organizer booking a parking facility for thousands of attendees has significant negotiating leverage. In 2024, many such contracts saw negotiated rates that were 10-15% lower than standard public pricing due to the volume and commitment involved.

- Negotiated Rates: Corporate clients often secure preferential pricing based on the volume of parking spaces utilized.

- Customized Service Packages: Demand for specialized services like event valet parking allows for bespoke contract terms.

- Provider Choice: The ability to select from multiple parking operators or negotiate directly with property owners enhances customer leverage.

The bargaining power of Estapar's customers varies significantly depending on their type. Individual drivers have minimal power due to necessity and limited alternatives, especially in high-demand urban areas. Conversely, large commercial clients like shopping malls and government entities, particularly those managing public parking like Zona Azul, wield substantial power due to contract volume and regulatory influence.

Digital users possess moderate power, easily switching between apps, but Estapar mitigates this through integrated services and loyalty programs. Corporate fleets and event organizers also have moderate power, leveraging volume for discounts and tailored services, with negotiated rates in 2024 often being 10-15% lower than standard pricing.

| Customer Segment | Bargaining Power Level | Key Influencing Factors |

|---|---|---|

| Individual Drivers | Low | Necessity, limited alternatives, convenience over price |

| Commercial Clients (Malls, Hospitals) | Moderate to High | Recurring revenue, volume, long-term contracts, alternative bids |

| Government Agencies (Zona Azul) | High | Concessions, regulatory control, pricing mandates |

| Digital Platform Users | Moderate | Ease of switching apps, convenience |

| Corporate Fleets/Event Organizers | Moderate | Volume discounts, specialized services, provider choice |

Same Document Delivered

Estapar Porter's Five Forces Analysis

This preview shows the exact Estapar Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Estapar's industry. This professionally formatted document is ready for your strategic planning and decision-making needs.

Rivalry Among Competitors

The Brazilian parking management landscape is characterized by a mix of large, established operators and a growing number of smaller, more agile competitors. Estapar stands out as a dominant force, holding a substantial portion of the market. However, this doesn't mean the field is uncontested; several other significant companies operate alongside Estapar, providing a robust competitive dynamic.

Beyond the major players, the market also includes numerous regional operators who cater to specific local needs and preferences. Furthermore, the emergence of tech-focused startups is injecting innovation and challenging traditional business models. This diverse mix of company sizes and strategic approaches ensures a dynamic and often intense competitive rivalry for Estapar.

The Brazilian parking management market is on an upward trajectory, with smart parking solutions leading the charge. Projections indicate significant revenue growth, with the overall parking management sector expected to see a compound annual growth rate (CAGR) of 11.7% between 2024 and 2030.

The smart parking segment is poised for even more rapid expansion, forecasting a robust CAGR of 24.8% over the same period. This burgeoning growth environment can potentially temper intense price competition as companies shift their focus towards innovation and market expansion rather than solely engaging in price wars to capture existing market share.

Estapar stands out with its vast network of parking facilities, a wide array of services like valet and car washing, and substantial investments in technology, including user-friendly apps and online booking. This comprehensive approach makes it challenging for many competitors to keep pace.

While Estapar offers broad differentiation, smaller, specialized competitors can carve out their own niches. They might focus on superior customer service at a single location or cater to a very specific customer segment, offering a tailored experience that Estapar’s scale might not always allow.

In 2024, Estapar continued to emphasize its digital transformation, aiming to enhance customer convenience and operational efficiency. This focus on technology, including advanced payment systems and real-time occupancy data, acts as a significant barrier for competitors who are slower to adopt similar innovations.

Switching Costs for Customers

Switching costs for Estapar's commercial clients, such as shopping malls and airports, are typically moderate. These costs can arise from the need for new contract negotiations, integration of Estapar's systems with existing infrastructure, and the potential for operational disruption during the transition. For instance, a large shopping mall might need to retrain staff on a new payment system or update signage, incurring time and financial investment.

Conversely, for individual drivers, the costs associated with switching parking providers are generally low. Customers can easily opt for a different parking facility or utilize a competitor's mobile application. This ease of switching means Estapar must continuously offer competitive pricing and a superior user experience to retain individual customers.

Estapar actively works to mitigate these low switching costs for individual users by building a robust digital ecosystem. This includes integrated mobile apps for payments and reservations, loyalty programs, and a widespread network of parking locations. By making their services convenient and rewarding, Estapar aims to foster customer loyalty and reduce the likelihood of customers switching to rivals.

- Moderate switching costs for commercial clients involve contract renegotiation and system integration.

- Low switching costs for individual drivers allow for easy adoption of alternative parking options.

- Estapar's digital ecosystem aims to increase customer stickiness through convenience and loyalty programs.

Exit Barriers

Exit barriers in the parking management sector, like those faced by Estapar, are often substantial. These can include long-term agreements with property owners, which lock companies into ongoing service obligations. For instance, a typical municipal parking contract might extend for 10-20 years.

Furthermore, significant capital is tied up in physical infrastructure, such as parking garages, payment systems, and surveillance technology. The cost to build or upgrade a single parking facility can easily run into millions of dollars. Companies also invest heavily in specialized software for revenue management and customer service, creating further sunk costs.

A large, trained operational workforce is another factor. Laying off staff and decommissioning facilities involves considerable severance costs and potential penalties. These high exit barriers mean companies may continue operating even when profitability declines, which can intensify competitive pressures among existing players.

- Long-term contracts: Parking operators often face multi-year commitments with municipalities and private property owners, making early termination costly.

- Capital-intensive infrastructure: Investments in parking structures, ticketing machines, and digital payment systems represent significant sunk costs.

- Operational workforce: Maintaining a substantial employee base for daily operations adds to the cost and complexity of exiting the market.

- Brand reputation and relationships: Severing ties with clients and potentially damaging brand image can be a deterrent to exiting.

Competitive rivalry within Brazil's parking management sector is robust, with Estapar facing competition from large established firms and innovative startups. The market's projected 11.7% CAGR from 2024 to 2030, with smart parking growing at 24.8%, fuels this dynamic. Estapar's technological investments and extensive network create differentiation, but niche players thrive on specialized service.

While Estapar's scale presents a challenge, smaller competitors can focus on specific customer segments or superior local service. The increasing adoption of smart parking solutions, with the segment expected to grow at a 24.8% CAGR through 2030, means companies prioritizing innovation, like Estapar's 2024 digital transformation efforts, gain a significant edge.

SSubstitutes Threaten

The threat of public transportation, including buses, subways, and trains, poses a considerable challenge for Estapar, particularly in Brazil's densely populated urban centers grappling with increasing congestion. As urbanization accelerates, the efficiency and reach of public transit directly influence the demand for private vehicle parking.

Investments in enhancing public transportation infrastructure, such as expanding subway lines or improving bus network connectivity, can significantly decrease the necessity for private car usage. For instance, São Paulo's metro system, a vital artery for millions, saw ridership numbers rebound strongly post-pandemic, indicating a continued reliance on public transit for daily commutes.

This shift towards more accessible and reliable public transit options directly erodes the demand for parking services. If more citizens opt for public transport due to improved services or cost-effectiveness, Estapar's core business of providing parking solutions faces a diminished customer base.

Ride-sharing services like Uber and 99, along with traditional taxis, present a moderate but increasing threat to parking providers. These alternatives offer convenience, especially for shorter journeys or in locations where parking is expensive or scarce, directly influencing the demand for parking spaces.

By 2024, ride-sharing platforms have solidified their presence, with services like Uber reporting millions of active users in major Brazilian cities. This widespread adoption means more people opt for these convenient transport solutions over personal vehicle use, potentially reducing the need for long-term or even short-term parking facilities.

For short trips or in cities prioritizing pedestrian and bike traffic, walking and cycling are strong substitutes for driving and parking. These alternatives directly impact demand for parking services, especially in dense urban cores.

Urban planning trends favoring active transportation, like expanded bike lanes and pedestrian zones, can significantly decrease reliance on parking. For instance, by mid-2024, many European cities reported a notable increase in cycling commutes, with some cities like Amsterdam already seeing over 60% of residents using bikes for daily travel, directly reducing parking needs in those areas.

Car-Sharing and Car Rental Services

Car-sharing services, like Movida Car Sharing, and traditional car rentals present viable alternatives to private car ownership, particularly for infrequent usage. These services cater to a growing segment of the population, especially in urban areas where the expenses associated with owning and maintaining a vehicle are significant.

While the current impact on long-term parking demand might be limited, the increasing adoption of these alternatives, fueled by urbanization trends and the rising costs of car ownership, poses a gradual but persistent threat. For instance, in Brazil, a key market for Estapar, car-sharing platforms have seen consistent growth, with users opting for flexibility over outright ownership, potentially impacting the need for long-term parking solutions.

- Growing Urbanization: More people living in cities are less likely to own cars, increasing reliance on alternatives.

- Cost of Ownership: Expenses like insurance, maintenance, and taxes make private car ownership less attractive.

- Flexibility and Convenience: Car-sharing offers on-demand access without long-term commitments.

- Market Growth: The car-sharing market globally is projected for substantial expansion, indicating a shift in consumer behavior.

Telecommuting and E-commerce

The increasing prevalence of telecommuting significantly curtails the need for daily commutes and, consequently, parking at office buildings. For instance, in 2024, reports indicated that up to 60% of the workforce in certain sectors continued to engage in hybrid or fully remote work models, a substantial increase from pre-pandemic levels.

Concurrently, the expansion of e-commerce directly impacts the demand for parking in retail environments. As more consumers opt for online shopping, fewer physical visits are made to shopping malls and high streets. This shift is evident in retail sales data, where e-commerce accounted for approximately 15% of total retail sales in many developed economies by early 2025.

These evolving work and consumption patterns represent powerful, long-term substitutes for traditional physical presence and the associated demand for parking services. The structural shift towards digital interactions and remote operations fundamentally alters the landscape for businesses reliant on physical access and parking infrastructure.

- Telecommuting Growth: By mid-2024, an estimated 35% of US employees worked remotely at least part of the time, reducing daily parking demand.

- E-commerce Penetration: Online retail sales in the US grew by over 7% in 2024, representing a substantial portion of total retail spending and impacting physical store traffic.

- Reduced Commuting: Surveys from early 2025 suggest that over 50% of companies offer flexible work arrangements, directly substituting traditional office commutes.

- Impact on Retail Parking: Declining foot traffic in brick-and-mortar stores, exacerbated by e-commerce, leads to lower utilization rates for commercial parking facilities.

The threat of substitutes for Estapar's parking services is multifaceted, stemming from advancements in public transportation, the rise of ride-sharing, and shifts in consumer behavior towards active mobility and digital alternatives. These substitutes directly compete by offering more convenient, cost-effective, or environmentally friendly ways to navigate urban environments, thereby diminishing the reliance on private vehicle ownership and, consequently, parking demand.

The increasing adoption of telecommuting and the expansion of e-commerce further weaken the need for traditional parking. With more individuals working remotely and shopping online, the demand for parking at offices and retail centers naturally declines. For instance, by mid-2024, around 35% of US employees were working remotely at least part-time, significantly reducing daily commutes and parking needs. Similarly, e-commerce sales in the US saw a growth of over 7% in 2024, impacting physical store traffic and associated parking utilization.

Car-sharing services also present a growing substitute, offering flexibility and cost savings compared to private car ownership, particularly for infrequent users. This trend, coupled with urban planning initiatives that promote cycling and pedestrian traffic, creates a landscape where parking is becoming less of a necessity for many urban dwellers. For example, cities like Amsterdam already see over 60% of residents using bikes for daily travel by mid-2024, a clear indicator of reduced parking demand.

| Substitute Type | Impact on Parking Demand | Key Drivers | 2024-2025 Data Points |

|---|---|---|---|

| Public Transportation | High in dense urban areas | Urbanization, infrastructure investment | São Paulo metro ridership rebound |

| Ride-Sharing Services | Moderate to High | Convenience, cost-effectiveness | Millions of active users for Uber in Brazil |

| Active Transportation (Walking/Cycling) | High in city cores | Urban planning, health consciousness | Increased cycling commutes in European cities |

| Car-Sharing/Rentals | Growing | Cost of ownership, flexibility | Consistent growth of car-sharing in Brazil |

| Telecommuting | High for office parking | Remote work trends | 35% of US employees working remotely part-time (mid-2024) |

| E-commerce | High for retail parking | Online shopping convenience | 7%+ growth in US online retail sales (2024) |

Entrants Threaten

The capital requirements to challenge a player like Estapar are immense, demanding significant upfront investment in technology, prime real estate, and widespread operational setup. For instance, building a comparable network of parking facilities, complete with advanced payment systems and customer management software, could easily run into hundreds of millions of dollars.

Estapar enjoys substantial economies of scale and scope, evident in its vast network of 789 operations spanning 103 cities and managing 515,100 parking spaces. This extensive reach and diversified service offering create significant cost advantages that are difficult for new entrants to replicate.

New players entering the market would face immense challenges in achieving comparable cost efficiencies and a broad service portfolio. The sheer scale of Estapar's operations means they can negotiate better terms with suppliers and spread fixed costs over a larger revenue base, a feat requiring massive upfront capital and considerable time for any newcomer.

Access to prime parking locations, such as airports, major shopping malls, and hospitals, presents a formidable barrier to entry for new competitors in the parking industry. Estapar has cultivated long-standing relationships and secured concession contracts in these high-demand, high-value areas, effectively locking in key strategic assets. For instance, Estapar’s extensive portfolio includes significant operations within major Brazilian airports, a segment characterized by high barriers due to exclusive agreements and substantial infrastructure investment requirements. New entrants would face considerable difficulty in replicating this established footprint and securing similar prime locations, as existing contracts and the scarcity of suitable sites limit opportunities.

Brand Loyalty and Reputation

Estapar's long-standing presence, dating back to 1981, has cultivated a robust brand loyalty and a solid reputation within the Brazilian market. This deep-rooted trust among both corporate clients and individual consumers presents a significant barrier for any new player attempting to enter the parking services sector.

The company's established brand recognition means potential new entrants face the considerable challenge of building similar levels of awareness and credibility from scratch. This is particularly true in a service industry where reliability and customer experience are paramount.

Newcomers would need to invest heavily in marketing and customer acquisition to even begin to rival Estapar's established market position. For instance, in 2023, Estapar managed approximately 300,000 parking spaces across more than 1,000 locations, a scale that underscores the difficulty of replicating their market penetration.

- Brand Loyalty: Estapar's decades of operation have fostered strong customer allegiance, making it hard for new companies to attract and retain users.

- Reputation: A well-earned reputation for reliability and service quality acts as a protective shield against emerging competitors.

- Market Penetration: Estapar's extensive network of managed parking spaces (over 1,000 locations in 2023) signifies a significant hurdle for new entrants seeking comparable reach.

Regulatory and Legal Barriers

The parking industry, especially for public operations like Zona Azul, is heavily regulated. Newcomers face significant challenges due to complex licensing, permits, and concession agreements, often requiring extensive negotiation with government bodies. For instance, in São Paulo, Brazil, a major market for parking services, obtaining concessions for public parking zones involves rigorous bidding processes and adherence to specific municipal laws, making it difficult for smaller or unfamiliar entities to enter.

Securing the necessary permits and contracts is a substantial barrier. These processes can be lengthy and costly, often demanding a proven track record and substantial capital investment. In 2024, the cost of bidding for and obtaining municipal parking concessions in major urban centers can run into millions of dollars, a significant deterrent for potential new entrants lacking established financial backing and legal expertise.

- Regulatory Complexity: Parking concessions, particularly for public zones like Zona Azul, are subject to intricate municipal and federal regulations.

- Licensing and Permits: Obtaining the required operating licenses and permits involves navigating bureaucratic processes and meeting stringent criteria.

- Concession Agreements: Exclusive rights to operate in public parking areas are typically granted through long-term concession agreements with government entities, which are difficult for new players to secure.

- High Entry Costs: The financial and legal resources required to comply with regulations and secure concessions represent a significant barrier to entry.

The threat of new entrants for Estapar is significantly mitigated by substantial capital requirements, estimated to be in the hundreds of millions of dollars for establishing a comparable network. This high cost, coupled with the need for advanced technology and prime real estate, creates a formidable barrier.

Estapar's established economies of scale, evidenced by its 2023 operations across over 1,000 locations managing approximately 300,000 parking spaces, provide cost advantages that are difficult for newcomers to match. Furthermore, securing prime locations through long-standing relationships and concession contracts effectively locks out potential competitors.

The company's strong brand loyalty and reputation, built since 1981, present a significant challenge for new entrants needing to invest heavily in marketing to build similar awareness. Regulatory hurdles, including complex licensing and concession agreements for public operations like Zona Azul, further deter new players, with 2024 concession costs in major cities potentially reaching millions.

| Barrier Type | Description | Estapar's Advantage | Estimated Impact on New Entrants |

| Capital Requirements | High upfront investment in infrastructure, technology, and real estate. | Estapar's existing scale reduces per-unit costs. | Very High |

| Economies of Scale | Cost advantages gained from large-scale operations. | Estapar's extensive network (300,000 spaces in 2023) allows for better supplier terms and cost spreading. | High |

| Access to Prime Locations | Securing contracts for high-demand parking spots. | Long-standing relationships and exclusive agreements with airports and malls. | Very High |

| Brand Loyalty & Reputation | Customer trust and preference built over time. | Decades of operation since 1981 fostering strong brand recognition. | High |

| Regulatory & Licensing | Navigating complex permits, licenses, and concession agreements. | Established expertise in dealing with government bodies for public parking zones. | Very High |

Porter's Five Forces Analysis Data Sources

Our Estapar Porter's Five Forces analysis is built upon a foundation of robust data, including Estapar's official annual reports, investor presentations, and regulatory filings with the CVM. We also incorporate insights from industry-specific market research reports and reputable automotive sector publications.