Equity Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity Bank Bundle

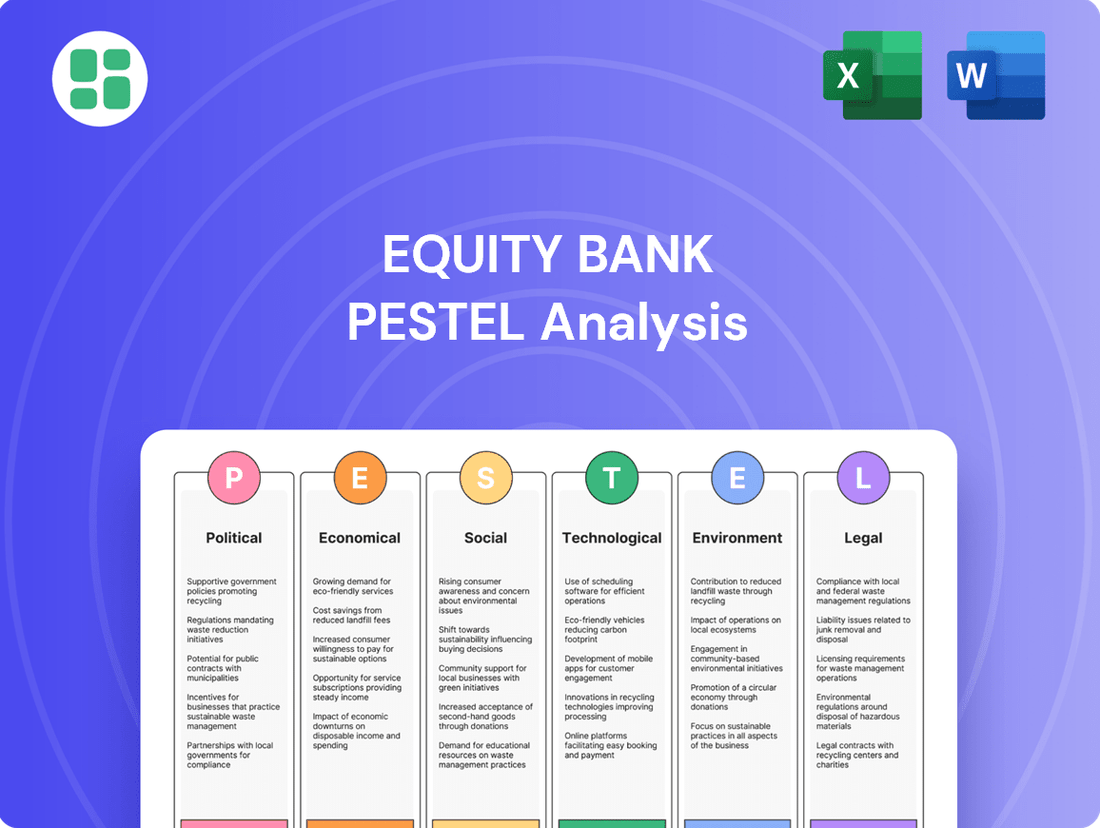

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Equity Bank's strategic landscape. Our comprehensive PESTLE analysis provides actionable intelligence to anticipate market shifts and capitalize on emerging opportunities. Gain a competitive advantage by understanding these external forces. Download the full version now for expert insights.

Political factors

Changes in banking regulations, like capital requirements or consumer protection laws, directly impact Equity Bank's operational costs and product offerings. For instance, the U.S. Federal Reserve's focus on strengthening capital buffers for large banks through initiatives like Basel III endgame proposals in 2024 signals a potentially more stringent operating environment.

The political landscape in 2024 saw active federal bank regulators, and a potential shift towards deregulation in 2025 under a new administration could significantly alter Equity Bank's strategic planning and risk management approaches.

Monetary policy, particularly interest rate decisions by central banks like the Federal Reserve, directly influences Equity Bank's net interest margin. For instance, if the Fed raises its benchmark interest rate, the cost of deposits for Equity Bank will likely increase, while the yield on its loans may also rise, though potentially with a lag. As of early 2024, the Federal Reserve maintained interest rates at a target range of 5.25% to 5.50%, a level that has been in place since July 2023, creating a challenging environment for banks to expand margins.

Broader fiscal policies, such as government spending and taxation, also play a role. Increased government borrowing to fund spending can drive up interest rates across the economy, impacting Equity Bank's funding costs. Conversely, tax policies can affect corporate profitability and consumer spending power, indirectly influencing loan demand and the overall health of the bank's loan portfolio. For 2024, projections indicate continued government deficits, suggesting sustained upward pressure on borrowing costs.

Political stability is a cornerstone for banking sector growth. In Kenya, the period leading up to and following the August 2022 general election, which saw a peaceful transition of power, generally fostered a more predictable environment for financial institutions like Equity Bank. This stability is crucial as it influences investor confidence and the government's ability to implement consistent economic policies, directly impacting loan demand and the overall financial health of the banking industry.

Government Support for Regional Banks

The U.S. regulatory environment for regional banks is anticipated to ease in 2025, potentially fostering growth and expansion opportunities. This shift could translate into more robust loan origination and a quicker pace of mergers and acquisitions, scenarios Equity Bank can strategically capitalize on.

For instance, the Federal Reserve's stress tests, a key regulatory component, might see adjustments impacting capital requirements for regional banks. A less stringent approach could free up capital for lending and investment, directly benefiting institutions like Equity Bank. In 2024, regional banks faced heightened scrutiny following the failures of Silicon Valley Bank and Signature Bank, leading to increased capital buffer demands.

- Anticipated Regulatory Easing: Expected in 2025, creating a more conducive environment for regional banks.

- Impact on Loan Activity: Potential for increased lending as capital requirements may be adjusted.

- Merger and Acquisition Acceleration: Favorable conditions could spur consolidation within the sector.

- Strategic Leverage for Equity Bank: Opportunities to grow through acquisition or expanded lending.

Trade Policies and International Relations

While Equity Bank's core operations are within Kenya, shifts in global trade policies and international relations can still ripple through its domestic market. For instance, changes in trade agreements affecting key Kenyan export sectors, such as agriculture or manufacturing, could impact the financial health and borrowing capacity of businesses that are Equity Bank's commercial clients. This, in turn, influences the bank's loan portfolio performance and overall economic stability within its operating regions.

Furthermore, geopolitical tensions or shifts in international economic alliances can indirectly affect consumer confidence and spending patterns. A more uncertain global economic outlook, stemming from trade disputes or international instability, might lead to reduced consumer borrowing and investment, thereby influencing deposit growth and demand for banking services at Equity Bank. For example, a slowdown in global demand for Kenyan exports due to trade protectionism could dampen domestic economic activity, affecting consumer spending power.

- Impact on Commercial Clients: Trade policies can alter the cost of imports and the competitiveness of exports for Kenyan businesses, directly affecting their revenue and ability to service loans from Equity Bank.

- Consumer Spending and Borrowing: International relations and trade stability influence overall economic sentiment, which can lead to changes in consumer confidence and, consequently, their propensity to borrow or spend.

- Foreign Direct Investment: Favorable international relations can attract foreign direct investment into Kenya, boosting economic activity and creating opportunities for banks like Equity to expand their services.

- Remittance Flows: International relations and the economic health of countries where Kenyans work abroad can affect remittance flows, which are a significant source of income for many households and can influence their banking behavior.

Political stability in Kenya is paramount for Equity Bank's operations, with the 2022 general election's peaceful transition fostering a predictable environment. This stability underpins investor confidence and consistent economic policy implementation, directly influencing loan demand and the banking sector's health.

Anticipated regulatory easing in the U.S. by 2025 could present growth avenues for regional banks, potentially boosting loan origination and mergers, which Equity Bank could leverage. Adjustments to capital requirements following stress tests in 2024, influenced by earlier bank failures, may free up capital for lending.

Global trade policies and international relations indirectly impact Equity Bank by affecting its Kenyan commercial clients' financial health and borrowing capacity, particularly in export-oriented sectors. Shifts in global economic outlook can also influence consumer confidence and borrowing patterns.

What is included in the product

This PESTLE analysis of Equity Bank examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, offering a comprehensive view of its external operating landscape.

It provides actionable insights for strategic decision-making, identifying potential risks and opportunities within the bank's operating environment.

A PESTLE analysis for Equity Bank provides a structured framework to identify and address external factors, acting as a pain point reliever by proactively highlighting potential challenges and opportunities in political, economic, social, technological, environmental, and legal landscapes.

Economic factors

Changes in interest rates, particularly those influenced by central banks like the Federal Reserve, significantly shape Equity Bank's financial performance. These shifts directly affect how much the bank earns on its loans and investments, as well as the cost of attracting customer deposits. For instance, if rates rise, the bank can charge more for new loans, potentially increasing its net interest income.

Analysts anticipate a 'normal-for-longer' interest rate environment, which is generally beneficial for bank profitability. This scenario allows banks like Equity Bank to benefit from loans and securities repricing at higher yields, boosting their earnings potential. This environment supports a more stable and predictable revenue stream for financial institutions.

In 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level not seen in over two decades. This sustained higher rate environment has provided a tailwind for net interest margins for many banks, including those operating in similar economic conditions to Equity Bank.

The U.S. economy's trajectory is a critical determinant for Equity Bank, impacting everything from loan demand to the overall creditworthiness of its clientele. While forecasts for 2025 suggest a soft landing with projected GDP growth around 2.1%, potential headwinds are present.

Moderating consumer spending, with retail sales growth showing signs of slowing in late 2024, and a potential uptick in unemployment, projected to reach around 4.2% by mid-2025, could temper the bank's growth prospects and increase credit risk.

Persistent inflationary pressures continue to erode consumer and business purchasing power, potentially affecting their capacity to manage existing debt obligations. This dynamic also directly influences Equity Bank's operational expenditures, as the cost of goods and services rises.

For instance, the US Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.2% in early 2024, a figure that, while moderating from previous highs, still signals ongoing price pressures. This environment necessitates careful management of lending portfolios and operational efficiencies for financial institutions like Equity Bank.

Furthermore, elevated inflation remains a key consideration for central banks. The Federal Reserve's stance on interest rates, directly influenced by inflation data, introduces significant market uncertainty. Higher interest rates, often a response to inflation, can increase the cost of borrowing for both the bank and its customers, impacting loan demand and credit risk.

Loan Activity and Credit Quality

Equity Bank's financial health is intrinsically linked to its loan activity and the quality of its credit portfolio. Analysts anticipate a rebound in loan growth for regional banks, including those operating in Equity Bank's markets, by 2025, signaling potential for increased interest income. However, persistent concerns around the commercial real estate (CRE) sector and the resilience of consumer credit could introduce headwinds, potentially impacting net charge-offs.

The overall economic environment will directly influence these factors. For instance, a slowdown in economic activity or rising interest rates could strain borrowers' ability to repay loans, leading to higher delinquency rates and, consequently, increased provisions for loan losses. Conversely, a robust economic recovery would likely boost demand for credit and improve borrowers' repayment capacity.

- Loan Growth Projections: Forecasts suggest a modest uptick in loan origination for regional banks in 2025, potentially benefiting Equity Bank's net interest margin.

- Commercial Real Estate Exposure: The CRE market, particularly office spaces, remains a watchpoint, with potential for increased defaults that could affect asset quality.

- Consumer Credit Trends: Elevated inflation and potential job market softening could pressure consumer loan repayment, leading to higher non-performing loans.

- Net Charge-Offs: A combination of CRE stress and consumer credit deterioration could push net charge-offs higher than anticipated, impacting profitability.

Mergers and Acquisitions Activity

Mergers and acquisitions (M&A) activity in the U.S. regional banking sector is expected to pick up pace in 2025. This surge is fueled by a combination of economic pressures and rising compliance expenses, creating a dynamic environment for banks like Equity Bancshares.

This trend presents a dual-edged sword for Equity Bank. On one hand, it opens avenues for strategic growth through carefully selected acquisitions, allowing the bank to expand its market reach and service offerings. On the other hand, it intensifies the competitive landscape as larger or more agile institutions consolidate.

- U.S. Regional Bank M&A Forecast: Projections indicate an acceleration in M&A deals within the U.S. regional banking sector for 2025.

- Driving Factors: Economic headwinds and increasing regulatory compliance costs are key catalysts for this consolidation trend.

- Equity Bank's Strategy: Equity Bancshares actively pursues a balanced approach, focusing on both organic growth initiatives and opportunistic strategic mergers and acquisitions.

Economic factors significantly influence Equity Bank's operational landscape. The prevailing interest rate environment, with the Federal Reserve maintaining rates between 5.25%-5.50% in 2024, directly impacts net interest margins. Projections for 2025 anticipate a soft landing for the U.S. economy, with GDP growth around 2.1%, though moderating consumer spending and a potential rise in unemployment to 4.2% by mid-2025 pose risks.

Inflationary pressures, with the CPI around 3.2% in early 2024, continue to affect purchasing power and operational costs. Loan growth is expected to rebound in 2025 for regional banks, but concerns about commercial real estate and consumer credit could lead to higher net charge-offs. M&A activity is also projected to increase in 2025, driven by economic pressures and compliance costs.

| Economic Indicator | 2024 (Actual/Estimate) | 2025 (Projection) |

|---|---|---|

| Federal Funds Rate | 5.25%-5.50% | Likely to remain elevated, potential for slight reductions |

| US GDP Growth | ~2.5% | ~2.1% |

| US Unemployment Rate | ~3.9% | ~4.2% |

| US CPI Inflation | ~3.2% (early 2024) | Moderating, but still a concern |

| Regional Bank Loan Growth | Modest | Rebound expected |

Preview Before You Purchase

Equity Bank PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Equity Bank PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Equity Bank must adapt to a significant shift in consumer preferences, with a growing number of customers, especially younger demographics, embracing digital banking and fintech solutions. This trend saw digital transactions at Equity Bank rise by 30% in 2024, highlighting the urgency for enhanced digital infrastructure.

Younger consumers, in particular, are increasingly opting for fintech services over traditional banking models, signaling a need for Equity Bank to continuously innovate its digital platforms and service offerings. Failure to do so risks losing market share to more agile competitors.

Equity Bank operates within a dynamic demographic landscape across its key markets in East Africa. For instance, Kenya, a primary market, experienced a population growth rate of approximately 2.1% annually leading up to 2023, with a significant youth bulge. This means a growing segment of the population is entering their prime earning and borrowing years, creating demand for services like personal loans, mortgages, and savings accounts tailored for younger demographics.

The age distribution is also crucial; with a median age often below 20 in many of its operating countries, Equity Bank needs to focus on financial literacy programs and digital banking solutions that resonate with digitally native young adults. Understanding the evolving income levels, particularly the rise of the middle class in urban centers, allows the bank to develop and promote more sophisticated wealth management and investment products, moving beyond basic transactional banking.

Equity Bank's dedication to community development and accessible financial services directly boosts financial literacy and inclusion across its operating regions. For instance, in 2023, Equity Bank Kenya reported reaching over 10 million customers with financial education programs, a significant step in empowering individuals and small businesses.

This commitment translates into stronger customer bonds and broader market penetration by equipping more people with the knowledge to manage their finances effectively. The bank's initiatives, such as digital banking solutions and tailored savings products, are designed to bring previously unbanked populations into the formal financial system, enhancing their economic participation.

Community Engagement and Trust

Equity Bank's deep roots in community engagement are foundational to its success. By actively participating in and supporting local initiatives, the bank cultivates essential trust and loyalty among its customer base. This commitment goes beyond mere transactions, fostering strong relationships that solidify its reputation as a reliable financial partner.

The bank's approach emphasizes personalized, relationship-based service, which is crucial for building confidence, especially in diverse communities. This focus directly translates into stronger customer retention and a positive brand image.

Recent data highlights the impact of this strategy. For instance, Equity Bank's financial inclusion programs, which often involve community outreach, reached over 14 million customers by the end of 2023, demonstrating tangible progress in building trust through accessibility and support.

- Community Investment: Equity Bank's commitment to local development, evident in its support for education and health initiatives, directly bolsters community trust.

- Customer Relationships: The bank prioritizes personalized service, aiming to build long-term relationships rather than just facilitating transactions.

- Brand Loyalty: This focus on community and relationships fosters strong brand loyalty, making Equity Bank a preferred financial institution for many.

- Financial Inclusion: Initiatives aimed at bringing unbanked populations into the formal financial system are key to expanding trust and reach.

Workforce Dynamics and Talent

The availability and retention of skilled talent are paramount for Equity Bank's success, particularly in the rapidly evolving banking and technology landscapes. The competition for experienced professionals, especially those with digital and data analytics expertise, is intense. For instance, in 2024, the average salary for a banking analyst in Kenya saw an increase, reflecting this demand.

Rising compensation expenses present a significant challenge for financial institutions like Equity Bank. Attracting and keeping top performers requires competitive remuneration packages, which can impact profitability. Effective human resource strategies, focusing on employee development and engagement, are therefore critical to managing these costs while maintaining a high-performing workforce.

- Talent Acquisition: Equity Bank must continuously adapt its recruitment strategies to attract specialized skills in areas like cybersecurity and AI.

- Employee Retention: Implementing robust retention programs, including professional development and competitive benefits, is essential to combat talent drain.

- Compensation Benchmarking: Regular analysis of industry compensation trends ensures Equity Bank's salary structures remain competitive.

- Upskilling Initiatives: Investing in training programs to upskill existing employees in new technologies is a cost-effective way to meet evolving demands.

Sociological factors significantly shape Equity Bank's operational landscape, particularly concerning changing consumer behaviors and demographic shifts. The increasing adoption of digital banking, with a 30% rise in digital transactions in 2024, underscores a move towards convenience and tech-savviness, especially among younger populations. This demographic trend, characterized by a youth bulge in key markets like Kenya, presents both opportunities for growth in services like personal loans and a challenge to adapt offerings for a digitally native audience. Equity Bank's focus on financial literacy and community engagement, reaching over 10 million customers with educational programs in 2023, is vital for building trust and fostering financial inclusion among diverse segments.

Technological factors

The increasing embrace of digital banking by consumers, including mobile and online services and digital payments, means Equity Bank must continually upgrade its digital platforms. This commitment ensures customers have easy access to financial solutions.

As of early 2024, mobile money transactions in Kenya, Equity Bank's primary market, continued to show robust growth, with billions of dollars processed monthly, highlighting the critical importance of strong digital infrastructure for customer engagement and service delivery.

Cybersecurity risks are a major technological hurdle for Equity Bank, especially as digital banking adoption accelerates. In 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually, a figure that underscores the immense financial and reputational damage potential. Equity Bank must maintain stringent data protection and transaction integrity to safeguard customer trust and prevent operational disruptions.

Equity Bank, like many regional players, is actively forging partnerships with fintech firms to bolster its competitive edge against larger banks. This strategic move allows them to integrate cutting-edge technologies such as artificial intelligence for personalized customer service and real-time payment systems for faster transactions.

By embracing innovations from fintech collaborators, Equity Bank aims to streamline its operations and elevate the overall customer experience. For instance, the adoption of AI-powered chatbots and advanced data analytics can significantly improve response times and offer more tailored financial solutions. In 2024, the global fintech market was valued at over $2.5 trillion, highlighting the significant impact and reach of these technological advancements.

Artificial Intelligence (AI) Integration

Artificial intelligence (AI) integration is becoming a cornerstone for financial institutions, with a notable surge in industry enthusiasm for technologies like large language models. This rapid advancement presents Equity Bank with significant opportunities to innovate, streamline operations, and bolster risk management. For instance, AI-powered chatbots can handle customer inquiries 24/7, freeing up human agents for more complex tasks. In 2024, the global AI market in financial services was projected to reach over $20 billion, highlighting the significant investment and adoption trends.

AI's impact extends to enhancing operational efficiency through automation. Tasks like data entry, transaction monitoring, and fraud detection can be significantly accelerated and made more accurate with AI algorithms. This not only reduces costs but also minimizes human error. By 2025, it's estimated that AI will automate a substantial portion of routine financial processes, allowing banks to focus resources on strategic growth initiatives.

Furthermore, AI plays a critical role in improving risk management capabilities. Predictive analytics, powered by AI, can identify potential loan defaults or market fluctuations with greater precision. This proactive approach allows Equity Bank to mitigate risks more effectively. The adoption of AI in fraud detection alone has shown a significant reduction in financial losses for many institutions, with some reporting up to a 30% decrease in fraudulent transactions.

- AI-driven personalization of customer experiences: Offering tailored financial advice and product recommendations.

- Enhanced fraud detection and prevention: Utilizing machine learning to identify suspicious activities in real-time.

- Automated compliance and regulatory reporting: Streamlining adherence to financial regulations.

- Improved credit scoring and loan processing: Leveraging AI for more accurate risk assessment.

Payment System Evolution

The global payment landscape is rapidly transforming, with digital methods taking center stage. By the end of 2024, it's projected that over 90% of all transactions worldwide will be digital, a significant jump from just over 70% in 2020. This shift is largely driven by the increasing adoption of digital wallets and the ongoing exploration of Central Bank Digital Currencies (CBDCs) by numerous nations. For Equity Bank, this evolution presents a critical juncture, requiring strategic adaptation of its payment infrastructure to stay competitive and cater to evolving customer expectations.

Equity Bank needs to embrace this digital wave to remain relevant. The bank's ability to integrate new payment technologies and offer seamless digital experiences will be key to its success. This includes enhancing its mobile banking platforms and exploring partnerships that broaden its digital payment acceptance. For instance, the global digital payment market was valued at approximately $8.5 trillion in 2023 and is expected to grow substantially in the coming years, underscoring the immense opportunity.

Key areas for Equity Bank to focus on include:

- Digital Wallet Integration: Enhancing compatibility with popular digital wallets to facilitate easier transactions for customers.

- CBDC Preparedness: Monitoring and preparing for the potential introduction of CBDCs in markets where Equity Bank operates, ensuring compliance and service integration.

- Real-time Payment Systems: Investing in and upgrading to real-time payment processing capabilities to offer instant settlement and improve customer experience.

- Cybersecurity Enhancement: Strengthening security measures across all digital payment channels to protect customer data and maintain trust in an increasingly digital environment.

Technological advancements are reshaping banking, pushing Equity Bank to continuously innovate its digital offerings. The increasing adoption of mobile money and digital payments, with billions processed monthly in Kenya as of early 2024, necessitates robust digital infrastructure. Cybersecurity remains a critical concern, especially with global cybercrime costs projected to exceed $10.5 trillion annually in 2024, demanding stringent data protection measures.

Equity Bank is actively partnering with fintech firms to integrate advanced technologies like AI for personalized services and real-time payments, reflecting the global fintech market's valuation of over $2.5 trillion in 2024. AI integration is key for operational efficiency, risk management, and enhancing customer experiences, with the AI in financial services market projected to surpass $20 billion in 2024.

The global shift towards digital payments, with over 90% of transactions expected to be digital by the end of 2024, requires Equity Bank to adapt its payment infrastructure. Enhancing digital wallet integration and preparing for potential Central Bank Digital Currencies (CBDCs) are crucial steps, as the global digital payment market was valued at approximately $8.5 trillion in 2023.

| Key Technological Trend | Impact on Equity Bank | Data Point (2024/2025) |

| Digital Banking Adoption | Need for continuous platform upgrades and enhanced mobile/online services. | Mobile money transactions in Kenya processing billions monthly. |

| Cybersecurity | Increased risk requiring stringent data protection and transaction integrity. | Global cybercrime costs projected to reach $10.5 trillion annually. |

| Fintech Partnerships & AI Integration | Opportunities for personalized services, real-time payments, and operational efficiency. | Global fintech market valued over $2.5 trillion; AI in financial services market projected over $20 billion. |

| Digital Payments Evolution | Requirement to adapt payment infrastructure for digital wallets and potential CBDCs. | Over 90% of global transactions projected to be digital by end of 2024; Global digital payment market valued at ~$8.5 trillion in 2023. |

Legal factors

Equity Bank navigates a complex web of banking regulations, requiring strict adherence to federal and state laws covering capital requirements, loan provisions, and corporate oversight. For instance, the Basel III framework, which influences capital adequacy ratios, continues to be a cornerstone of global banking stability, with ongoing refinements expected.

The regulatory environment is not static; anticipated changes in 2025 could impact lending practices and operational procedures. Staying ahead of these evolving compliance demands is crucial for maintaining financial health and market trust.

Equity Bank must meticulously adhere to consumer protection laws to safeguard its reputation and avert legal penalties. This involves strict compliance with regulations concerning fair lending, transparent fee disclosures, and robust protection of customer financial data.

In 2024, the banking sector faced increased scrutiny regarding data privacy, with several institutions incurring fines for breaches. Equity Bank's commitment to these regulations, including Kenya's Data Protection Act, is paramount for fostering customer trust and ensuring operational integrity.

Equity Bank, like all financial institutions, operates under stringent Anti-Money Laundering (AML) and sanctions compliance frameworks. This necessitates substantial investment in technology and personnel to monitor transactions and identify illicit activities. For instance, in 2023, global AML spending by financial institutions was projected to exceed $10 billion, highlighting the significant resources dedicated to this area.

Failure to comply with these regulations can result in severe penalties, including hefty fines and reputational damage. Equity Bank's commitment to robust internal controls, transaction monitoring, and timely reporting of suspicious activities is crucial for maintaining its license to operate and safeguarding its stakeholders.

Data Privacy Regulations

Equity Bank must navigate an increasingly complex web of data privacy regulations, such as the Kenya Data Protection Act, 2019, which mandates strict handling of personal information. Failure to comply can result in significant penalties, impacting financial performance and brand reputation. For instance, the Act allows for fines of up to KES 5 million or imprisonment for non-compliance, underscoring the critical need for robust data security protocols.

Maintaining customer trust is paramount, and adherence to these laws is non-negotiable for safeguarding sensitive financial data. This involves implementing advanced encryption, secure storage solutions, and clear consent mechanisms for data processing. In 2023, global data breaches cost an average of USD 4.35 million, a figure Equity Bank aims to avoid through proactive compliance measures.

- Kenya Data Protection Act, 2019 mandates strict data handling.

- Financial Penalties can reach up to KES 5 million for non-compliance.

- Customer Trust hinges on robust data protection.

- Global Breach Costs averaged USD 4.35 million in 2023, highlighting financial risks.

Merger and Acquisition Legal Scrutiny

Equity Bancshares' growth strategy, which often involves mergers and acquisitions, faces considerable legal and regulatory oversight. Antitrust reviews are a significant part of this process, ensuring that such combinations do not unduly stifle competition in the financial sector. For instance, the U.S. Department of Justice and the Federal Trade Commission are key bodies involved in these evaluations. Successfully navigating these legal complexities is paramount for Equity Bank to achieve its expansion goals and integrate new entities effectively into its existing operations.

The legal framework governing bank mergers in 2024 and 2025 continues to emphasize market concentration and consumer protection. Regulators closely examine the potential impact of acquisitions on local banking markets and the availability of services. Equity Bancshares must demonstrate that its proposed transactions will not lead to reduced competition or negatively affect pricing and access for customers.

- Antitrust Compliance: Ensuring proposed mergers meet U.S. Department of Justice and Federal Trade Commission guidelines to prevent monopolistic practices.

- Regulatory Approvals: Securing necessary clearances from banking authorities like the Federal Reserve and state banking departments.

- Integration Legalities: Addressing legal aspects of combining different operational systems, compliance protocols, and customer agreements post-acquisition.

- Shareholder and Stakeholder Rights: Adhering to legal requirements concerning shareholder votes, disclosures, and the rights of all involved parties during the M&A process.

Equity Bank operates under a stringent legal framework, encompassing capital adequacy regulations like Basel III, which dictate minimum capital ratios. Anticipated regulatory shifts in 2025 may further refine these requirements, impacting lending capacity and operational strategies.

Compliance with consumer protection laws, including fair lending and transparent fee structures, is paramount. In 2023, data privacy breaches cost businesses an average of USD 4.35 million globally, underscoring the financial and reputational risks of non-compliance with acts like Kenya's Data Protection Act, 2019.

Anti-Money Laundering (AML) and sanctions compliance demand significant investment in technology and personnel, with global AML spending by financial institutions projected to exceed $10 billion in 2023. Failure to adhere to these frameworks can lead to substantial penalties and operational disruptions.

Mergers and acquisitions are subject to rigorous antitrust reviews by bodies like the U.S. Department of Justice and the Federal Trade Commission, ensuring market competition is preserved. Navigating these legal complexities is vital for Equity Bancshares' growth and integration strategies.

| Legal Factor | Key Regulations/Acts | 2023/2024 Impact/Data | 2025 Outlook | Equity Bank Relevance |

|---|---|---|---|---|

| Capital Adequacy | Basel III Framework | Ongoing implementation and scrutiny of capital ratios. | Potential refinements to capital requirements. | Ensures financial stability and lending capacity. |

| Consumer Protection | Kenya Data Protection Act, 2019 | Global data breach costs averaged USD 4.35 million. | Increased focus on data privacy and security. | Protects customer data and maintains trust. |

| Financial Crime Compliance | AML and Sanctions Regulations | Global AML spending > $10 billion (projected 2023). | Continued investment in compliance technology. | Mitigates risks of illicit financial activities. |

| Mergers & Acquisitions | Antitrust Laws (e.g., DOJ, FTC) | Merger reviews focus on market concentration. | Continued regulatory oversight on M&A activities. | Facilitates strategic growth through acquisitions. |

Environmental factors

The banking sector, including regional players like Equity Bank, is experiencing heightened regulatory scrutiny regarding climate-related financial risks. This evolving landscape necessitates a proactive approach to assessing and managing environmental exposures, potentially shaping future risk management strategies and reporting mandates.

Equity Bank's dedication to Environmental, Social, and Governance (ESG) principles, evident in its sustainability reports, resonates with the increasing demand for corporate accountability from investors and the public. These efforts bolster the bank's reputation, attracting stakeholders who prioritize ethical and sustainable business practices.

Equity Bank is actively enhancing its operational energy efficiency, notably by powering its ATMs with solar energy. This initiative not only cuts down on electricity expenses but also significantly lowers the bank's carbon footprint.

Further plans include a widespread adoption of LED lighting and solar panels across all Equity Bank branches and facilities. This commitment aligns with global sustainability trends and demonstrates a proactive approach to environmental stewardship, potentially leading to substantial cost savings in the 2024-2025 fiscal year.

Natural Disaster Preparedness

Equity Bank's operational resilience is significantly shaped by its exposure to natural disasters. The bank must maintain comprehensive business continuity plans to safeguard its physical infrastructure, customer assets, and loan portfolios from environmental disruptions. This proactive approach is crucial for ensuring uninterrupted service delivery and financial stability.

The bank's preparedness for natural disasters is underscored by several key considerations:

- Geographic Vulnerability: Equity Bank operates in East African regions frequently impacted by events such as droughts, floods, and locust infestations, which can disrupt economic activity and affect loan repayment capabilities. For instance, the 2021-2023 drought significantly impacted agricultural output across several of its key markets.

- Infrastructure Protection: Investments in resilient IT systems and secure physical branches are paramount to minimize downtime and data loss during environmental crises.

- Customer Support: Developing strategies to support customers affected by natural disasters, including flexible loan repayment options and access to emergency funds, is a critical component of disaster preparedness.

- Insurance and Risk Transfer: Exploring insurance policies and other risk transfer mechanisms can help mitigate the financial impact of widespread damage to assets or significant loan defaults resulting from catastrophic events.

Green Finance and Sustainable Products

The financial sector is increasingly prioritizing green finance and sustainable products, reflecting a global shift towards environmentally conscious investing. This growing demand, evidenced by the significant growth in ESG (Environmental, Social, and Governance) investments, presents a clear opportunity for financial institutions like Equity Bank. For instance, global sustainable investment assets reached an estimated $37.8 trillion in early 2024, a substantial increase from previous years, indicating strong market appetite.

Equity Bank can leverage this trend by developing and offering a range of environmentally friendly financial solutions. This could include green bonds, sustainable loans for eco-friendly projects, or investment funds focused on companies with strong environmental performance. Such initiatives align with evolving customer preferences and regulatory landscapes, positioning the bank for future growth and enhanced brand reputation.

The bank's strategic focus on sustainability could also attract a new segment of investors and clients who are specifically looking for financial products that contribute positively to environmental outcomes. By proactively engaging with this burgeoning market, Equity Bank can solidify its position as a responsible and forward-thinking financial institution.

Equity Bank's environmental strategy includes powering ATMs with solar energy and plans for LED lighting and solar panels across its facilities, aiming to reduce its carbon footprint and operational costs, with an eye on potential savings in the 2024-2025 fiscal year.

PESTLE Analysis Data Sources

Our Equity Bank PESTLE Analysis is informed by a comprehensive review of data from financial regulatory bodies, economic forecasting agencies, and industry-specific market research. This ensures our insights into political stability, economic trends, and technological advancements are grounded in factual, up-to-date information.