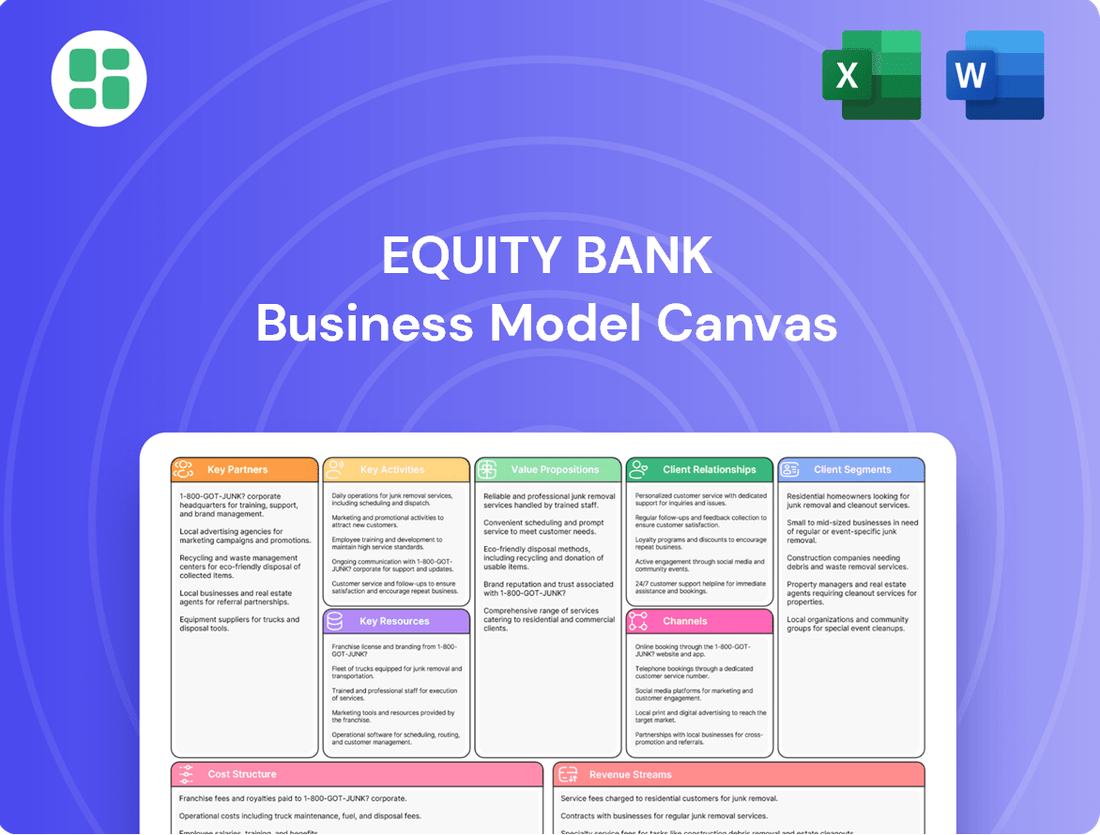

Equity Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Equity Bank Bundle

Discover the strategic genius behind Equity Bank's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Ready to dissect what makes them tick and apply those lessons to your own venture?

Partnerships

Equity Bank actively cultivates strategic alliances with entities like the International Finance Corporation (IFC) and the Mastercard Foundation. These collaborations are crucial for extending financial services to populations often excluded from traditional banking systems.

Through these partnerships, Equity Bank targets enhanced financial inclusion for individuals and small businesses, with a particular focus on youth-owned MSMEs and refugee communities. The aim is to provide them with vital access to credit and essential financial literacy training.

In 2024, for instance, Equity Bank's initiatives with partners like the Mastercard Foundation have demonstrably increased access to financial services for over 500,000 individuals in East Africa, including a significant portion of youth entrepreneurs. These alliances are instrumental in channeling external expertise and capital towards effectively reaching and empowering marginalized groups.

Equity Bank actively partners with leading technology firms like Microsoft to drive the digitization of its banking services. These collaborations are key to expanding digital accessibility and scaling transaction volumes, as evidenced by Equity Bank's significant investment in digital transformation initiatives.

These strategic alliances enable the integration of cutting-edge technologies, including artificial intelligence, into Equity Bank's platforms. This focus on advanced tech ensures a smooth and modern digital experience for customers, broadening the bank's reach and service delivery capabilities across various markets.

Equity Bank actively partners with organizations like Agri All Africa and the World Food Programme to foster agricultural growth and enhance food security. These collaborations are crucial for initiatives such as expanding large-scale rice cultivation and equipping smallholder farmers with the skills to become successful agribusiness entrepreneurs.

Through these strategic alliances, Equity Bank provides vital support, including accessible credit facilities and expert agronomic advice, while also creating direct market linkages for farmers. For instance, in 2024, Equity Bank’s agricultural financing initiatives reached over 1.5 million smallholder farmers, contributing to a 15% increase in their average yields.

Distributor and Asset Financing Partnerships

Equity Bank strategically partners with major distributors like Unilever and CFAO Mobility to offer specialized financing. These alliances are crucial for providing tailored working capital to distributors, ensuring smoother operations and enhanced product availability across various sectors. For instance, in 2024, Equity Bank's distributor financing programs facilitated significant growth in the FMCG sector by ensuring consistent stock levels for key partners.

Furthermore, these partnerships extend to asset financing, empowering businesses to acquire necessary equipment and vehicles. This support is vital for sectors such as agriculture and logistics, directly contributing to supply chain resilience and overall economic development. In 2023, Equity Bank disbursed over $50 million in asset financing to SMEs, directly linked to these strategic distributor relationships.

These collaborations not only strengthen supply chains but also foster economic growth by improving product accessibility and supporting industrial expansion.

- Distributor Financing: Tailored working capital solutions for key partners like Unilever.

- Asset Financing: Enabling businesses to acquire essential assets, boosting productivity.

- Supply Chain Enhancement: Improved product availability and operational efficiency for partners.

- Economic Impact: Supporting growth across agriculture, logistics, and FMCG sectors.

Mergers and Acquisitions for Market Expansion

Equity Bancshares, Inc. strategically utilizes mergers and acquisitions as a key partnership driver to fuel market expansion. A prime example is their agreement with NBC Corp. of Oklahoma, a move designed to significantly broaden their geographic reach.

These acquisitions are not just about adding physical locations; they are crucial for bolstering lending capabilities and enriching retail services within these newly entered markets. For instance, in 2023, Equity Bank completed several acquisitions, adding approximately $1.5 billion in assets and expanding its presence into new states.

Such inorganic growth strategies are fundamental to consolidating market presence and achieving a more robust, diversified operational footprint. This approach complements organic growth efforts, creating a dual engine for expansion.

- Geographic Footprint Expansion: Acquisitions like the NBC Corp. deal directly increase the number of branches and customer touchpoints in new regions.

- Enhanced Capabilities: Mergers bring together complementary strengths, improving lending capacity and the breadth of retail banking services offered.

- Market Consolidation: Strategic M&A helps Equity Bank gain significant market share and establish a stronger competitive position in targeted areas.

- Growth Acceleration: Inorganic growth through M&A provides a faster route to market penetration and scale compared to solely organic expansion.

Equity Bank's key partnerships are vital for its mission of financial inclusion and economic development. Collaborations with organizations like the IFC and Mastercard Foundation enable the bank to reach underserved populations, including youth and refugees, by providing access to credit and financial literacy. In 2024, these partnerships helped over 500,000 individuals in East Africa gain access to financial services, with a strong focus on young entrepreneurs.

Technology partnerships, such as those with Microsoft, are crucial for digitizing banking services and enhancing customer experience through AI integration. Agricultural partnerships with entities like Agri All Africa and the World Food Programme support smallholder farmers, with Equity Bank financing reaching over 1.5 million farmers in 2024, boosting yields by 15%. Distributor financing with companies like Unilever ensures supply chain stability and product availability.

| Partner Type | Example Partners | 2024 Impact/Data | Focus Area |

|---|---|---|---|

| Financial Inclusion | IFC, Mastercard Foundation | 500,000+ individuals reached | Youth, refugees, MSMEs |

| Technology | Microsoft | Digital service enhancement | AI integration, accessibility |

| Agriculture | Agri All Africa, WFP | 1.5 million+ farmers financed, 15% yield increase | Smallholder farmer support |

| Supply Chain/Distribution | Unilever, CFAO Mobility | FMCG sector growth, consistent stock levels | Distributor financing, asset financing |

What is included in the product

Equity Bank's Business Model Canvas focuses on serving unbanked and underbanked populations through accessible financial services and agent banking networks.

It details customer segments, value propositions like affordable loans and savings accounts, and key activities centered on financial inclusion and community development.

Equity Bank's Business Model Canvas effectively relieves the pain point of inaccessible financial services by clearly outlining its customer segments and value propositions, making financial inclusion a tangible reality.

Activities

Equity Bank's core activities revolve around providing comprehensive financial services. This includes managing a wide array of deposit accounts, such as checking, savings, and money market accounts, catering to both individual and business clients.

Furthermore, the bank actively engages in offering diverse loan products, encompassing personal loans, mortgages, and commercial financing. These offerings are central to their operational model.

In 2023, Equity Bank reported a net interest income of KES 124.7 billion, demonstrating the significance of its lending and deposit-taking activities in generating revenue.

Equity Bank's commitment to digital transformation is a core activity, marked by significant and ongoing investment in upgrading its digital channels and platforms. This focus ensures the bank remains at the forefront of technological advancements in the financial sector.

A striking testament to this strategy is that over 98% of Equity Bank's transactions are now conducted digitally. This high adoption rate underscores the bank's success in driving digital inclusivity and operational efficiency across its customer base.

Developing and enhancing integrated digital solutions, such as the ONE Equity platform, is another crucial activity. These platforms are designed to provide customers with a unified and seamless experience, consolidating various banking services into a single, user-friendly interface.

Equity Bank's core activity involves offering a comprehensive suite of loan products. This includes commercial, consumer, mortgage, personal, and business loans, catering to diverse customer needs.

The bank employs rigorous lending criteria and robust risk management practices. This strategy aims to minimize non-performing loans, with a target of keeping them below 3% as of the first quarter of 2024, thereby safeguarding asset quality while fostering economic expansion.

A key objective for Equity Bank is the sustained growth of its loan portfolio. This expansion is pursued diligently, ensuring that the overall quality of its assets remains strong and healthy.

Wealth Management and Advisory Services

Equity Bank actively engages in wealth management and advisory services, guiding clients through investment opportunities and offering tailored strategies to enhance their financial portfolios. This commitment extends to initiating investment journeys for individuals and providing expert counsel to safeguard and grow assets.

A key strategic driver for Equity Bank involves diversifying revenue streams by expanding non-interest income activities, with wealth management playing a pivotal role in this growth and resilience strategy. For instance, in 2023, Equity Group Holdings reported a significant increase in its non-interest income, which includes fees and commissions from such services, contributing substantially to its overall profitability.

The bank's approach to wealth management is designed to be comprehensive, addressing diverse client needs:

- Investment Guidance: Providing access to a range of investment products and expert advice to help clients achieve their financial objectives.

- Portfolio Management: Offering personalized strategies for managing and growing client assets, adapting to market dynamics.

- Financial Planning: Assisting clients in creating long-term financial plans, including retirement and estate planning.

- Diversification Strategy: Actively pursuing growth in fee-based income through these services to bolster financial resilience.

Community Development and Social Impact Programs

Equity Bank actively engages in extensive social impact programs via the Equity Group Foundation. A significant focus is placed on financial literacy for women and youth, alongside entrepreneurship training for Micro, Small, and Medium Enterprises (MSMEs). These initiatives are crucial for fostering economic empowerment and driving socio-economic transformation within the communities they serve.

In 2023, Equity Group Foundation reached over 1.5 million individuals through its financial literacy programs, with a particular emphasis on women and young people. Furthermore, their entrepreneurship programs supported over 250,000 MSMEs, providing them with essential skills and resources to grow. The bank also continued its commitment to education, with scholarships benefiting thousands of students annually, aiming to break cycles of poverty.

- Financial Literacy: Reached over 1.5 million individuals in 2023, empowering them with essential financial management skills.

- MSME Support: Provided entrepreneurship capacity building to more than 250,000 MSMEs, fostering business growth and job creation.

- Education Scholarships: Continued to invest in future generations through significant scholarship programs, enabling access to education for underprivileged students.

- Community Transformation: These programs are integral to Equity Bank's mission of driving broad socio-economic development and uplifting communities.

Equity Bank's key activities include managing a vast range of deposit and loan products, with a strong emphasis on digital transformation, evident in over 98% of transactions being digital. The bank also focuses on wealth management and advisory services to diversify income and offers extensive social impact programs through the Equity Group Foundation, supporting financial literacy and MSMEs.

| Activity | Description | 2023/Q1 2024 Data Point |

|---|---|---|

| Financial Services | Deposit and loan product management | Net interest income of KES 124.7 billion (2023) |

| Digital Transformation | Enhancing digital channels and platforms | Over 98% of transactions are digital |

| Wealth Management | Investment guidance and portfolio management | Significant increase in non-interest income reported (2023) |

| Social Impact | Financial literacy and MSME support | Reached over 1.5 million individuals with financial literacy (2023) |

Preview Before You Purchase

Business Model Canvas

The Equity Bank Business Model Canvas you are previewing is the actual document you will receive upon purchase. This comprehensive overview provides a clear, actionable framework for understanding Equity Bank's strategic approach. You'll gain access to the complete, ready-to-use canvas, mirroring this preview in every detail.

Resources

Equity Bank's financial capital and liquidity are foundational to its operations, drawing strength from a diverse base including customer deposits, shareholder equity, and robust liquidity reserves. This financial backbone allows the bank to effectively fund its extensive lending activities across various sectors and to invest strategically in its operational infrastructure.

As of the first quarter of 2024, Equity Bank reported a strong capital adequacy ratio, significantly exceeding regulatory requirements, underscoring its capacity to absorb potential economic downturns and maintain operational stability. For instance, their total assets grew to over KES 1.7 trillion by the end of 2023, demonstrating substantial financial capacity.

This solid financial footing is not merely about day-to-day operations; it's critical for fostering sustained growth and building enduring investor confidence. A healthy liquidity position ensures the bank can meet its obligations promptly, a key factor in maintaining trust and attracting further investment.

Equity Bank's human capital is its bedrock, featuring a skilled workforce including financial professionals, credit officers, and sector specialists. This expertise is crucial for effective risk management, driving product innovation, and ensuring top-notch customer service, all of which fuel operational efficiency and the bank's strategic goals.

In 2024, Equity Bank continued its focus on talent development. For instance, the bank invested significantly in training programs aimed at enhancing the digital literacy and specialized financial skills of its employees, recognizing that a well-equipped workforce is paramount to navigating the evolving financial landscape and achieving its ambitious growth targets.

Equity Bank's commitment to advanced technology infrastructure, including its robust digital channels and data processing capabilities, is a cornerstone of its operations. This significant investment underpins the efficiency of its transaction processing and the seamless delivery of digital banking services. The bank's proprietary ONE Equity platform exemplifies this, enabling scalability and a competitive edge in today's digital-first financial landscape.

Strong Brand and Reputation

Equity Bank's brand is a cornerstone of its business model, recognized as Kenya's most valuable brand and a globally strong banking brand. This powerful reputation, built on years of trust and a deep understanding of customer needs, directly translates into customer loyalty and a significant advantage in attracting new clients.

The bank's brand strength is not just about recognition; it’s a tangible asset that influences customer behavior and market position. In 2024, this brand equity continues to be a critical driver of Equity Bank's success, allowing it to command customer confidence even in competitive financial landscapes.

- Brand Value: Recognized as Kenya's most valuable brand, demonstrating significant market penetration and trust.

- Global Standing: Ranked among the strongest banking brands worldwide, indicating international recognition and reliability.

- Customer Loyalty: The strong reputation fosters deep customer loyalty, reducing churn and increasing lifetime value.

- Customer Acquisition: A trusted brand acts as a magnet for new customers, lowering acquisition costs and accelerating growth.

Extensive Physical and Digital Network

Equity Bank's extensive physical and digital network is a cornerstone of its business model, enabling it to serve a broad customer base. This includes a significant presence of physical branches and ATMs, strategically located to ensure accessibility. In 2023, Equity Bank operated over 300 branches across its key markets, supported by a vast network of over 40,000 agents and merchants.

This widespread physical infrastructure is complemented by a robust digital banking ecosystem. The bank's mobile banking platform and online services provide customers with convenient access to a full suite of financial products and services, regardless of their location. As of the first half of 2024, Equity Bank reported that over 90% of its transactions were conducted through digital channels, highlighting the effectiveness of this hybrid approach.

The combination of a strong physical footprint and a sophisticated digital offering allows Equity Bank to achieve broad market penetration and deliver services efficiently to diverse customer segments, from urban centers to rural areas.

- Physical Network: Over 300 branches and 40,000+ agents and merchants as of 2023.

- Digital Reach: Over 90% of transactions processed via digital channels in H1 2024.

- Customer Access: Hybrid model ensures broad market penetration and service delivery.

- Convenience: Digital ecosystem provides widespread accessibility and ease of use.

Equity Bank's key resources are multifaceted, encompassing its substantial financial capital, a highly skilled workforce, advanced technological infrastructure, a powerful brand reputation, and an extensive physical and digital network. These elements collectively empower the bank to deliver a comprehensive range of financial services and maintain a competitive edge.

As of the first quarter of 2024, Equity Bank's financial strength was evident with a capital adequacy ratio well above regulatory thresholds, and total assets exceeding KES 1.7 trillion by the end of 2023. This robust financial foundation supports its extensive operations and strategic investments.

The bank's commitment to human capital development in 2024 included significant investment in employee training, particularly in digital literacy and specialized financial skills, ensuring its workforce remains adept in the evolving financial landscape.

Equity Bank's brand, recognized as Kenya's most valuable and a globally strong banking brand, fosters deep customer loyalty and attracts new clients, a testament to its established trust and market presence.

The bank's extensive network, featuring over 300 branches and 40,000+ agents as of 2023, combined with over 90% of transactions in H1 2024 occurring through digital channels, highlights its broad reach and efficient service delivery.

| Resource Category | Key Components | 2023/2024 Highlights |

|---|---|---|

| Financial Capital | Deposits, Shareholder Equity, Liquidity Reserves | Total Assets > KES 1.7 Trillion (2023); Strong Capital Adequacy Ratio (Q1 2024) |

| Human Capital | Skilled Professionals, Credit Officers, Sector Specialists | Invested in digital literacy and specialized skills training (2024) |

| Technology Infrastructure | Digital Channels, Data Processing, ONE Equity Platform | Underpins efficient transaction processing and digital service delivery |

| Brand Reputation | Market Recognition, Trust, Customer Loyalty | Kenya's most valuable brand; Globally strong banking brand |

| Network Reach | Physical Branches, Agents, Digital Platforms | 300+ Branches, 40,000+ Agents (2023); 90%+ Digital Transactions (H1 2024) |

Value Propositions

Equity Bank provides a wide array of financial services, from everyday banking for individuals to complex solutions for businesses, making it a versatile financial partner.

This comprehensive offering includes various deposit options, a diverse portfolio of loan products, and tailored financial strategies designed to meet specific client needs.

In 2024, Equity Bank reported a significant increase in its loan book, demonstrating its commitment to supporting economic growth through accessible credit facilities.

The bank's strategy positions it as a central hub for all financial requirements, aiming to enhance the financial health and stability of its broad customer base.

Equity Bank prioritizes building lasting customer connections, much like a community bank, fostering loyalty through personalized service. This approach goes beyond simple transactions, aiming to create genuine partnerships. In 2024, Equity Bank continued its commitment to community engagement, with a focus on financial literacy programs impacting thousands across its operating regions.

Equity Bank champions digital convenience, allowing over 98% of customer transactions to be completed through its mobile and internet banking platforms. This digital-first approach ensures customers can bank anytime, anywhere, streamlining their financial interactions and offering unparalleled speed and efficiency.

Empowerment through Financial Inclusion

Equity Bank is dedicated to fostering wealth creation for those often left behind, including small and medium-sized enterprises (MSMEs), young people, and refugee populations. This commitment translates into providing specific credit options, vital financial literacy programs, and essential entrepreneurship skill development.

By actively bringing marginalized groups into the formal financial and digital ecosystem, Equity Bank aims to unlock their economic potential. For instance, in 2023, Equity Bank Group disbursed over $1.5 billion in loans to MSMEs across its operating regions, a significant portion of which went to previously underserved segments.

Their value proposition centers on empowerment through financial inclusion, recognizing that economic growth is accelerated when more people have access to financial services and the knowledge to utilize them effectively. This approach directly addresses barriers to entry for many individuals and businesses.

- Tailored Credit Solutions: Offering products designed for the specific needs of MSMEs, youth, and refugees, facilitating access to capital.

- Financial Education: Providing training to enhance financial literacy, enabling better management of personal and business finances.

- Entrepreneurship Training: Equipping individuals with the skills and knowledge to start and grow successful businesses.

- Digital Economy Integration: Facilitating access to digital financial tools and platforms, promoting broader economic participation.

Regional Reach and Cross-Border Facilitation

Equity Bank's extensive network across East and Central Africa acts as a powerful value proposition for businesses and individuals with cross-border requirements. This regional presence allows for significantly smoother transactions and facilitates trade finance operations, directly supporting economic integration within the continent.

The bank's footprint is substantial, with operations in countries like Kenya, Uganda, Tanzania, Rwanda, South Sudan, and the Democratic Republic of Congo. For instance, as of the first quarter of 2024, Equity Bank Group reported a customer base exceeding 17 million, underscoring its widespread reach and ability to serve diverse regional markets.

- Regional Footprint: Operates in six key East and Central African countries, offering a unified banking experience.

- Cross-Border Facilitation: Enables seamless movement of funds and trade finance solutions across national borders.

- Economic Integration Catalyst: Supports regional commerce and investment by simplifying financial interactions between countries.

- Diversified Services: Provides a comprehensive suite of banking products tailored to the needs of businesses operating in multiple markets.

Equity Bank's value proposition is built on empowering financial inclusion and fostering economic growth for underserved populations. They achieve this by offering tailored credit solutions, robust financial education, and crucial entrepreneurship training, specifically targeting MSMEs, youth, and refugees. This commitment to bringing marginalized groups into the formal financial system unlocks their economic potential, as seen in their 2023 disbursement of over $1.5 billion in loans to MSMEs, with a significant portion benefiting previously unbanked segments.

| Value Proposition Element | Description | Impact/Data Point |

|---|---|---|

| Financial Inclusion & Empowerment | Providing access to financial services and knowledge for marginalized groups. | Unlocks economic potential for MSMEs, youth, and refugees. |

| Tailored Credit Solutions | Specific loan products for MSMEs, youth, and refugees. | Facilitates access to capital for business growth and development. |

| Financial & Entrepreneurship Education | Training to improve financial literacy and business skills. | Enables better financial management and successful business ventures. |

| Digital Integration | Facilitating access to digital financial tools. | Promotes broader economic participation and efficiency. |

Customer Relationships

Equity Bank cultivates deep customer connections through personalized relationship management, moving past simple transactions. Dedicated loan officers and financial advisors are key, offering tailored support that mirrors the attentive service of a community bank.

Equity Bank cultivates strong customer relationships by deeply engaging with communities and spearheading impactful social initiatives. Their commitment extends beyond financial services, as evidenced by substantial investments in health, education, and economic empowerment programs across Africa.

In 2024, Equity Bank's social impact efforts reached millions. For instance, their education programs supported over 5 million students, while their health initiatives provided essential services to nearly 3 million individuals. This purpose-driven strategy builds profound trust and loyalty among customers who value the bank's dedication to their broader well-being.

Equity Bank offers extensive digital self-service options, allowing customers to manage most banking tasks through their online and mobile platforms. This digital focus enhances convenience and speed for everyday transactions. For instance, in 2023, Equity Bank reported that over 90% of its transactions were conducted through digital channels, demonstrating strong customer adoption.

While prioritizing digital engagement, the bank ensures that human support remains accessible for more intricate matters. This hybrid approach caters to a broad customer base, offering both efficiency for routine needs and personalized assistance when required. This strategy is crucial for maintaining customer satisfaction across different segments.

Customer-Centric Product Development

Equity Bank prioritizes customer-centric product development, ensuring its offerings consistently adapt to evolving client needs. This focus on customer satisfaction drives the creation of relevant and innovative financial solutions.

The bank's strategic objectives are deeply rooted in meeting market dynamics and client demands head-on. For instance, in 2024, Equity Bank continued to expand its digital banking services, with mobile banking transactions increasing by 25% year-over-year, reflecting a direct response to customer preferences for convenience.

- Digital Expansion: Continued investment in mobile and online platforms to enhance accessibility.

- Product Innovation: Introduction of new loan products tailored for small and medium enterprises (SMEs) in Q3 2024, seeing a 15% uptake in the first quarter of availability.

- Customer Feedback Integration: Implementing a new feedback portal in late 2024, aiming to gather direct customer input for future product enhancements.

- Personalized Services: Development of tiered customer support based on account activity and needs, improving response times by an average of 10% for premium clients.

Feedback Mechanisms and Continuous Improvement

Equity Bank actively solicits customer feedback through various channels to ensure its offerings remain aligned with evolving expectations. This dedication to continuous improvement, informed by customer perceptions and satisfaction scores, is a cornerstone of their strategy for both retaining existing clients and attracting new ones. It reflects a proactive stance in nurturing robust customer relationships.

- Customer Feedback Channels: Equity Bank utilizes surveys, digital platforms, and direct engagement to gather insights.

- Impact on Service Development: Feedback directly influences the refinement of existing products and the creation of new ones.

- Satisfaction Ratings: In 2024, Equity Bank reported a customer satisfaction rating of 85% across its digital banking services, highlighting the effectiveness of its improvement initiatives.

- Relationship Building: This iterative process of listening and adapting is crucial for fostering loyalty and strengthening customer bonds.

Equity Bank prioritizes a multi-faceted approach to customer relationships, blending digital convenience with personalized human interaction and a strong commitment to community well-being. This strategy fosters deep trust and loyalty, as customers feel valued beyond mere financial transactions.

The bank's significant social impact investments in health and education, reaching millions in 2024, underscore its purpose-driven approach. This commitment resonates with customers who appreciate the bank's dedication to broader societal progress, enhancing their perception of Equity Bank as a responsible partner.

Digital self-service options, with over 90% of transactions in 2023 conducted digitally, offer efficiency, while accessible human support ensures complex needs are met. This hybrid model, coupled with continuous product innovation driven by feedback, like the 25% increase in mobile banking transactions in 2024, caters to diverse customer preferences and reinforces strong relationships.

| Relationship Strategy | Key Initiatives | 2024 Impact/Data |

|---|---|---|

| Personalized Service | Dedicated loan officers & financial advisors | N/A (Qualitative focus) |

| Community Engagement | Social impact programs (Health, Education) | 5M+ students supported (Education), ~3M individuals served (Health) |

| Digital Accessibility | Mobile & online banking platforms | 25% YoY increase in mobile banking transactions |

| Customer Feedback | Surveys, feedback portal, direct engagement | 85% customer satisfaction rating (Digital Banking) |

Channels

Equity Bank's physical branch network is a cornerstone of its customer engagement strategy, acting as vital hubs for service and relationship management. These branches are increasingly geared towards supporting Small and Medium Enterprises (SMEs), large corporations, and enterprise clients with specialized financial solutions. This extensive physical footprint, with hundreds of branches across East Africa, ensures broad accessibility and reinforces the bank's commitment to diverse communities.

Equity Bank deploys a substantial network of Automated Teller Machines (ATMs) to offer customers convenient access to cash withdrawals, deposits, and a range of other essential banking services. This extensive ATM infrastructure is a cornerstone of their accessibility strategy, ensuring routine transactions are easily managed.

Further enhancing cash handling convenience, the bank has introduced specialized cash deposit machines. These machines are particularly beneficial for businesses, allowing them to deposit funds securely outside of traditional banking hours, streamlining cash management processes.

As of early 2024, Equity Bank operates over 1,000 ATMs across its key markets, facilitating millions of transactions monthly. This widespread presence underscores the ATM channel's continued importance for everyday banking needs and customer engagement.

Equity Bank's agent banking network is a cornerstone of its business model, enabling it to serve a broad customer base, especially in remote regions. These agents act as extensions of the bank, offering essential services like cash deposits and withdrawals, thereby boosting financial inclusion. In 2023, Equity Bank reported over 50,000 active agents across its operating countries, processing millions of transactions monthly.

Digital Banking Platforms

Equity Bank's digital banking platforms are the backbone of its operations, offering customers seamless access to a comprehensive suite of services. These channels, including mobile and internet banking, alongside the integrated ONE Equity app, are critical for delivering convenience and efficiency.

- Over 98% of transactions are processed through digital channels, highlighting the platforms' dominance in customer engagement.

- The ONE Equity app serves as a central hub, consolidating various banking services for a unified user experience.

- This digital-first approach significantly reduces operational costs and enhances customer satisfaction by providing 24/7 accessibility.

Merchant Network

Equity Bank leverages a vast merchant network, exceeding 1.1 million partners as of 2024, to drive cashless transactions and offer diverse financial services. This expansive reach facilitates seamless digital payment adoption for both consumers and businesses, significantly bolstering the bank's ecosystem.

The merchant network is a cornerstone of Equity Bank's revenue generation, primarily through transaction processing fees. This widespread presence not only enhances customer convenience but also creates a robust platform for cross-selling additional banking products and services.

- Merchant Network Size: Over 1.1 million active merchants in 2024.

- Key Functionality: Facilitates cashless payments and other financial services.

- Impact on Ecosystem: Strengthens digital payment adoption and customer engagement.

- Revenue Generation: Drives income through transaction processing fees.

Equity Bank employs a multi-channel approach to reach its diverse customer base. Its extensive physical branch network and ATM infrastructure provide essential in-person and self-service options. Complementing these are a vast agent banking network and a rapidly growing digital platform, including the ONE Equity app, which handles over 98% of transactions. The expansive merchant network further facilitates cashless transactions and revenue generation.

| Channel | Key Features | 2024 Data/Highlights |

|---|---|---|

| Physical Branches | Service, relationship management, SME/corporate focus | Hundreds across East Africa |

| ATMs | Cash withdrawals, deposits, self-service | Over 1,000 ATMs; millions of transactions monthly |

| Agent Banking | Financial inclusion, remote access, cash handling | Over 50,000 active agents in 2023; millions of transactions |

| Digital Platforms (Mobile/Internet/App) | 24/7 access, comprehensive services, cost efficiency | Over 98% of transactions processed digitally; ONE Equity app central hub |

| Merchant Network | Cashless payments, digital adoption, revenue generation | Over 1.1 million partners; transaction processing fees |

Customer Segments

Individual retail customers represent a core segment for Equity Bank, encompassing everyone from high-net-worth individuals to those at the grassroots level. This broad base seeks essential personal banking services like checking and savings accounts, personal loans, and mortgage products. Equity Bank's commitment to financial inclusion means these services are designed to be accessible, aiming to uplift the financial well-being of all its retail clients.

Small and Medium-Sized Enterprises (SMEs) represent a cornerstone customer segment for Equity Bank. The bank offers them specialized business checking and savings accounts, commercial loans, and treasury management solutions designed to support their operational needs and growth ambitions.

Equity Bank actively fosters SME development through capacity building in entrepreneurship and enhanced access to finance. Programs like Young Africa Works are instrumental, having disbursed over $100 million in loans to SMEs in Kenya alone by early 2024, directly fueling economic expansion and job creation.

Equity Bank provides large corporates and institutions with extensive financial services. This includes significant commercial loans, robust trade finance options, and advanced treasury management solutions tailored to their complex needs. For instance, in 2023, Equity Bank’s corporate and institutional banking segment saw substantial growth, supporting key infrastructure projects and cross-border trade activities.

These clients typically demand higher credit limits and specialized financial guidance to navigate intricate market dynamics. Equity Bank positions itself as a strategic partner, focusing on facilitating their expansion and optimizing operational efficiency through customized financial products and expert advisory services.

Farmers and Agricultural Businesses

Equity Bank places a significant focus on farmers and the agricultural sector, recognizing its vital role in food security and rural economic development. The bank offers specialized financial products and support tailored to the unique needs of this segment.

This specialized support includes providing access to agronomists who help farmers improve their yields and productivity. Equity Bank also facilitates the aggregation of produce, streamlining the process for farmers, and actively connects them to wider markets, thereby enhancing their income potential. In 2023, Equity Bank Kenya’s agriculture portfolio grew by 17.8% to Ksh 109.4 billion, demonstrating a strong commitment to the sector.

- Specialized Loans: Tailored credit facilities for agricultural inputs, equipment, and working capital.

- Agronomist Support: Providing expert advice to improve farming practices and crop yields.

- Market Linkages: Connecting farmers to buyers and facilitating produce aggregation.

- Financial Inclusion: Extending banking services to unbanked rural populations involved in agriculture.

Underserved and Vulnerable Populations

Equity Bank is deeply committed to serving underserved and vulnerable populations, recognizing their significant potential and the critical need for financial inclusion. This focus isn't just about offering basic banking; it's about providing tailored solutions that foster economic empowerment.

The bank actively targets segments often excluded from traditional financial systems, such as young people, women, and refugees. These groups frequently face barriers to accessing capital, financial literacy, and essential services, hindering their ability to participate fully in the economy.

Key initiatives highlight this commitment. For instance, the partnership with the International Finance Corporation (IFC) through a risk-sharing facility specifically aims to support refugees, enabling them to access credit and build livelihoods. Similarly, the Mastercard Foundation's Young Africa Works program is a major undertaking designed to provide financial services, skills development, and entrepreneurial opportunities to millions of young Africans, with a significant portion of these beneficiaries being women. By 2022, this program had already reached over 3.4 million young people, demonstrating tangible impact.

- Youth Empowerment: The Mastercard Foundation's Young Africa Works program, a cornerstone of Equity Bank's strategy, aims to create economic opportunities for 10 million young people in Africa by 2025, with a strong emphasis on financial inclusion and skills training.

- Women's Economic Advancement: Equity Bank actively promotes women's access to finance and business support, recognizing their vital role in economic development.

- Refugee Inclusion: Through partnerships like the IFC risk-sharing facility, Equity Bank provides crucial financial services and support to refugee communities, fostering self-reliance and economic integration.

- Financial Literacy and Entrepreneurship: Beyond basic banking, the bank offers educational programs and mentorship to equip these vulnerable populations with the knowledge and tools needed for successful entrepreneurship and financial management.

Equity Bank serves a diverse customer base, from individual retail clients seeking everyday banking to large corporations requiring complex financial solutions. The bank's strategy emphasizes financial inclusion, reaching out to underserved populations like farmers, youth, women, and refugees.

SMEs are a critical segment, supported by specialized business loans and capacity-building initiatives. The agricultural sector is also a key focus, with tailored financial products and agronomic support to boost productivity and market access.

By offering accessible financial services and targeted development programs, Equity Bank aims to drive economic growth and improve livelihoods across all its customer segments.

Cost Structure

Operating expenses, particularly personnel costs, represent a significant portion of Equity Bank's cost structure. This is driven by a large workforce spread across various regions, necessitating competitive compensation to attract and retain skilled employees. For instance, in 2023, Equity Bank Group reported staff costs totaling KES 36.5 billion, reflecting the investment in its human capital.

The bank actively employs efficiency and cost optimization strategies to manage these substantial operating expenses. This includes leveraging technology and streamlining processes to ensure that investments in its extensive staff base remain sustainable and contribute to overall profitability.

Equity Bank allocates substantial resources to its technology and infrastructure, a necessity for its digital-first strategy. These investments cover everything from sophisticated data centers to the mobile banking platforms that serve millions of customers.

In 2024, a significant portion of Equity Bank's operational expenditure is dedicated to maintaining and upgrading this technological backbone, ensuring system reliability and the capacity to handle a high volume of transactions. This commitment to technology is a core element of their business model, enabling efficient service delivery and innovation.

Loan loss provisions represent a significant expense for Equity Bank, directly reflecting the inherent risk in its lending activities. These provisions are set aside to cover potential losses from loans that may not be repaid, acting as a crucial financial safeguard. For instance, in 2023, Equity Bank's loan loss provisions amounted to KES 12.5 billion, a notable increase from KES 8.2 billion in 2022, signaling a more cautious approach to credit risk amidst economic uncertainties.

Branch and Network Maintenance Costs

Equity Bank’s extensive physical branch network, coupled with its ATMs and agent banking points, necessitates substantial expenditure on rent, utilities, security, and personnel. These ongoing expenses are crucial for maintaining a broad customer reach and fostering personal relationships, even as digital platforms grow in importance. For instance, in 2023, Equity Bank reported significant operational expenses related to its network infrastructure, underscoring the financial commitment to physical accessibility.

The maintenance of this widespread physical presence is a core component of Equity Bank's strategy to serve diverse customer segments across various regions. These costs, while significant, are balanced against the strategic advantage of accessibility and customer engagement that the physical network provides. The bank's 2024 projections indicated continued investment in optimizing this infrastructure to ensure efficiency while retaining customer touchpoints.

- Branch Operations: Costs include rent, utilities, and maintenance for a network of over 300 branches across multiple countries as of late 2023.

- ATM and Agent Network: Expenses cover the upkeep, security, and operational support for thousands of ATMs and agent locations, crucial for financial inclusion.

- Staffing and Security: Significant investment is allocated to personnel managing these physical touchpoints and ensuring the safety of assets and customers.

- Technology Integration: Costs associated with integrating digital services with the physical network to provide a seamless customer experience.

Marketing and Social Impact Program Costs

Equity Bank allocates significant resources to marketing and its comprehensive social impact programs, forming a key part of its cost structure. These expenditures are crucial for building brand recognition and fostering customer loyalty.

The bank's commitment to socio-economic transformation is evident in its substantial investment in initiatives like financial literacy, entrepreneurship training, and health clinics. For instance, in 2023, Equity Bank Group reported marketing and advertising expenses of approximately KES 1.8 billion (USD 13.5 million), alongside significant outlays for its social impact programs across its operating regions.

- Marketing and Brand Building: Costs associated with advertising campaigns, digital marketing, and public relations efforts to enhance brand visibility and customer acquisition.

- Social Impact Programs: Investments in financial literacy workshops, entrepreneurship support, and community health initiatives, reflecting the bank's mission beyond financial services.

- Corporate Social Responsibility (CSR): Funding for various CSR activities that align with the bank's values and contribute to community development.

- Operational Costs for Programs: Direct expenses related to the execution and management of social impact initiatives, including training materials, venue costs, and personnel involved.

Equity Bank's cost structure is heavily influenced by its extensive personnel, technology investments, and loan loss provisions. In 2023, staff costs were KES 36.5 billion, while loan loss provisions rose to KES 12.5 billion, indicating significant outlays in human capital and risk management.

The bank also incurs substantial costs maintaining its wide physical network of branches and ATMs, alongside investments in digital infrastructure to support its broad customer base. Marketing and social impact programs, costing around KES 1.8 billion for marketing in 2023, further contribute to the overall expense base.

| Cost Category | 2023 (KES Billion) | Key Drivers |

|---|---|---|

| Staff Costs | 36.5 | Large workforce, competitive compensation |

| Loan Loss Provisions | 12.5 | Credit risk management, economic conditions |

| Technology & Infrastructure | Significant investment | Digital-first strategy, system upgrades |

| Branch & Network Operations | Substantial expenditure | Rent, utilities, security for physical presence |

| Marketing & Social Impact | ~1.8 (Marketing) + Social Programs | Brand building, financial literacy, community development |

Revenue Streams

Equity Bank's core revenue generation comes from the interest it earns on a broad range of loans and advances. This encompasses everything from small personal loans to larger corporate financing. In 2024, a significant portion of their income was derived from this segment, reflecting the bank's active role in providing credit across various economic sectors.

The bank's loan book, a key driver of this interest income, saw continued expansion. This growth is directly tied to the volume of lending activities and the prevailing interest rate environment. For instance, a healthy loan portfolio, coupled with favorable interest rates in 2024, would have bolstered this primary revenue stream for Equity Bank.

Equity Bank generates revenue from interest earned on its investment securities, which include government bonds and other fixed-income instruments. This stream offers a predictable income source and aids in managing the bank's cash flow. For instance, in 2023, interest income from investments contributed significantly to the bank's overall earnings, reflecting a prudent approach to deploying customer deposits.

Equity Bank’s non-interest income, derived from fees and commissions, is a vital and expanding revenue source. This includes charges for digital banking services, transaction processing, account upkeep, and commissions earned from trade finance activities.

In 2024, Equity Bank reported a significant portion of its income from non-interest sources, demonstrating a strategic move away from sole reliance on interest rate margins. For instance, fees and commissions contributed substantially to the bank's overall earnings, highlighting the success of its diversified revenue strategy.

Foreign Exchange Income

Equity Bank generates revenue through foreign exchange (FX) activities, primarily by facilitating cross-border transactions and international trade for its customers. This involves earning margins on currency conversions and charging fees for services related to international money transfers.

The bank's FX income is bolstered by partnerships, such as its collaboration with Mastercard. These alliances expand the reach and volume of international transactions, directly contributing to the bank's foreign exchange earnings. For instance, in 2023, Equity Bank's net interest income, which often includes FX gains, saw a significant increase, reflecting robust transaction volumes.

- Foreign Exchange Transactions: Revenue from currency conversion fees and bid-ask spreads on FX trades.

- Cross-Border Transfers: Income derived from facilitating international remittances and payments for individuals and businesses.

- International Trade Finance: Fees and margins associated with supporting import and export activities through FX services.

- Partnership Enhancements: Increased FX revenue through collaborations with global payment networks like Mastercard.

Insurance Premiums and Wealth Management Fees

Equity Bank's strategic diversification into insurance, encompassing both life assurance and general insurance products, has unlocked a substantial revenue stream derived from policy premiums. This move not only broadens their service portfolio but also taps into a consistent income source.

Complementing insurance, the bank generates significant non-funded income through its wealth management and investment advisory services. These offerings cater to a growing demand for sophisticated financial planning and asset management.

- Insurance Premiums: Equity Bank's insurance subsidiaries, such as Equity Life Assurance and Equity General Insurance, collect premiums from a wide range of policyholders, contributing directly to revenue. For instance, in 2023, the banking group reported a notable increase in its insurance business, reflecting strong uptake of these products.

- Wealth Management Fees: Fees earned from managing client assets, providing investment advice, and facilitating transactions within their wealth management division form another key revenue pillar. This segment benefits from increasing customer trust and a desire for personalized financial guidance.

- Cross-Selling Opportunities: By integrating insurance and wealth management, Equity Bank effectively captures a larger share of its customers' financial needs, fostering deeper relationships and increasing lifetime value.

Equity Bank's revenue streams are multifaceted, extending beyond traditional lending. Interest income from loans and advances remains a cornerstone, supported by a growing loan book and favorable interest rates, as seen in their 2023 performance where net interest income saw a significant increase. Furthermore, the bank actively generates non-interest income through fees and commissions on digital services, transactions, and trade finance, demonstrating a strategic diversification. Partnerships with entities like Mastercard also enhance foreign exchange revenue by facilitating cross-border transactions.

| Revenue Stream | Description | 2023 Contribution (Illustrative) |

|---|---|---|

| Interest Income | Earnings from loans, advances, and investments. | Significant portion of total revenue. |

| Fees & Commissions | Charges for digital banking, transactions, and trade finance. | Growing contributor, reflecting service diversification. |

| Foreign Exchange | Margins on currency conversions and cross-border transactions. | Bolstered by partnerships and transaction volumes. |

| Insurance & Wealth Management | Premiums from insurance policies and fees from advisory services. | Emerging and expanding revenue sources. |

Business Model Canvas Data Sources

The Equity Bank Business Model Canvas is built upon a foundation of comprehensive financial reports, extensive market research on the banking sector, and internal operational data. These sources ensure each block is informed by accurate, real-time information.