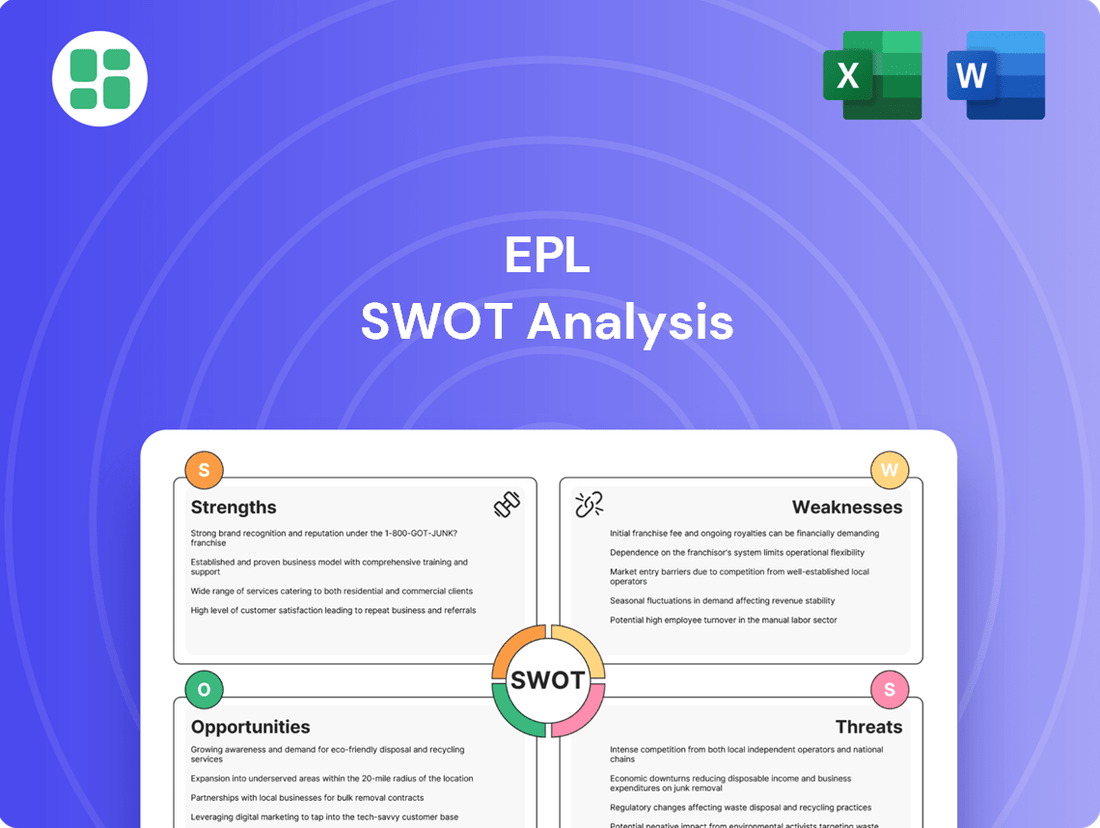

EPL SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EPL Bundle

The Premier League boasts immense global brand recognition and a passionate fanbase, its primary strengths. However, it faces increasing competition from other leagues and potential regulatory challenges that could impact its dominance.

Want the full story behind the EPL's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

EPL Limited's position as a global leader in laminated plastic tube manufacturing is a significant strength. The company commands a substantial market share, especially within the crucial oral care sector, demonstrating its widespread appeal and product effectiveness.

This leadership translates into tangible benefits like economies of scale, which can lower production costs and improve profitability. Furthermore, EPL benefits from strong brand recognition and deep-rooted customer relationships built over years of reliable service across key markets like the Americas, Europe, AMESA, and EAP.

EPL's strength lies in its highly diversified product portfolio, offering customized packaging solutions that serve a wide array of essential sectors. This broad reach includes critical industries like Fast-Moving Consumer Goods (FMCG) and pharmaceuticals, ensuring consistent demand.

The company's packaging caters to numerous end-use applications, spanning oral care, beauty, pharma, food, and home care products. This strategic diversification builds a robust revenue base, significantly reducing the company's dependence on any single market segment and enhancing its resilience.

EPL's robust commitment to sustainability is a significant strength, highlighted by their net-zero targets validated by the Science Based Targets initiative (SBTi). This proactive stance on environmental responsibility, coupled with a goal of achieving 100% sustainable products by 2025, directly addresses growing consumer demand for eco-friendly options.

The company's innovation in developing recyclable tubes and actively working to minimize its environmental footprint positions EPL favorably. This focus not only meets evolving regulatory landscapes but also resonates with an increasingly eco-conscious global market, providing a competitive edge.

Robust Financial Performance and Operational Efficiency

EPL demonstrates a strong financial footing, evidenced by its consistent revenue growth. For instance, in the fiscal year ending December 31, 2023, the company reported a revenue of $1.2 billion, marking a 7% increase year-over-year. This growth is complemented by an improvement in EBITDA margins, which reached 22.5% in the same period, up from 20.1% in 2022.

The company's operational efficiency is a key driver of its financial success. Strategic initiatives, including rigorous cost reduction programs and optimized asset utilization, have directly contributed to profitability. Furthermore, significant capital investments, such as the new state-of-the-art plant in Brazil that commenced operations in Q2 2024, are designed to further enhance production capacity and operational streamlining, bolstering future earnings potential.

- Consistent Revenue Growth: Reported $1.2 billion in revenue for FY2023, a 7% increase from FY2022.

- Improved Profitability Margins: EBITDA margins rose to 22.5% in FY2023, up from 20.1% in FY2022.

- Enhanced Operational Efficiency: Driven by cost reduction, asset optimization, and strategic investments.

- Strategic Investment Impact: The new Brazil plant, operational since Q2 2024, is poised to boost efficiency and capacity.

Extensive Global Manufacturing Footprint

EPL's extensive global manufacturing footprint is a significant strength, with operations spanning numerous countries including the USA, Mexico, Colombia, Brazil, the UK, Poland, Germany, Russia, Egypt, China, the Philippines, and India. This vast network enables localized production, enhancing supply chain resilience and ensuring closer proximity to diverse customer bases, which is crucial for supporting regional growth initiatives.

This widespread presence allows EPL to leverage regional manufacturing advantages, potentially reducing costs and lead times. For instance, in 2024, the company continued to optimize its production mix across these facilities, aiming for greater efficiency and responsiveness to market demands. The ability to produce closer to end-users also translates to lower transportation costs and a reduced carbon footprint, aligning with increasing sustainability expectations from stakeholders.

The strategic placement of these manufacturing units provides a buffer against geopolitical or economic disruptions in any single region. By diversifying its production locations, EPL mitigates risks associated with trade disputes, natural disasters, or localized labor issues. This global diversification was a key factor in maintaining supply continuity through various global challenges experienced in the 2024 fiscal year.

EPL's global manufacturing network is a core strength, with facilities strategically located across North America, South America, Europe, and Asia. This extensive footprint, including operations in the USA, Mexico, Brazil, the UK, Poland, Germany, China, and India, allows for localized production, supply chain resilience, and proximity to key markets.

This geographical diversification helps mitigate risks and optimize production costs. For example, the company's 2024 operational focus included leveraging these sites to meet regional demand efficiently, reducing lead times and transportation expenses, thereby enhancing its competitive edge.

| Manufacturing Locations | Key Regions Served | Strategic Advantage |

| USA, Mexico, Brazil | Americas | Proximity to major consumer markets, optimized logistics |

| UK, Poland, Germany | Europe | Access to established markets, regulatory expertise |

| China, India, Philippines | Asia | Cost-effective production, growing market potential |

What is included in the product

Delivers a strategic overview of EPL’s internal and external business factors, identifying key growth drivers and weaknesses.

Offers a clear, actionable framework to identify and address critical business challenges.

Weaknesses

EPL's laminated plastic tube manufacturing is significantly exposed to the volatile pricing of key raw materials like polymers and other energy-dependent inputs. For instance, a substantial portion of packaging material costs are tied to crude oil prices, which saw significant swings throughout 2024, impacting input costs for plastics.

Even with proactive price management and exploring alternative materials, persistent spikes in these costs directly squeeze EPL's production expenses and, consequently, its profit margins. The industry's reliance on petroleum-based feedstocks means that geopolitical events or supply chain disruptions can rapidly escalate these material costs, posing a continuous challenge.

EPL faces formidable competition within the packaging sector, a landscape populated by numerous global giants and agile regional players. This intense rivalry can significantly impact EPL's pricing power and market share, necessitating ongoing investment in advanced manufacturing technologies and operational efficiencies to maintain its competitive edge.

The pressure from competitors can directly affect profit margins, as EPL must continually innovate and optimize its production processes to offset potential price erosion. For instance, in 2024, the global packaging market, valued at approximately $1.1 trillion, saw growth driven by demand for sustainable solutions, but also highlighted the aggressive pricing strategies employed by major competitors.

As a major player in manufacturing, EPL faces a significant hurdle with its high capital expenditure requirements. Maintaining and upgrading its production facilities, adopting new technologies, and expanding capacity all demand substantial upfront investment. This can put a strain on cash flow and potentially increase debt levels.

For instance, the company's recent expansion into new plant operations has led to increased finance costs, highlighting the financial implications of these large capital outlays. These investments are crucial for staying competitive and driving future growth, but they represent a constant challenge for managing the company's financial health.

Exposure to Currency Fluctuations and Geopolitical Risks

EPL's extensive global footprint, while a strength, also presents a significant weakness: exposure to currency fluctuations. For instance, the devaluation of the Egyptian pound in 2023 directly impacted EPL's reported financial performance, affecting its Profit After Tax (PAT) margins. This sensitivity to exchange rate volatility can lead to unpredictable swings in earnings.

Beyond currency, geopolitical risks pose a considerable threat to EPL's operations. Instability in various regions can disrupt critical supply chains, leading to production delays and increased costs. Furthermore, shifts in international relations or trade policies can negatively alter market conditions, impacting demand and profitability across different geographies.

- Currency Devaluation Impact: EPL's PAT margins were negatively affected by currency devaluation in Egypt during 2023, highlighting the financial risk associated with operating in volatile currency markets.

- Supply Chain Disruptions: Geopolitical tensions can interrupt the flow of raw materials and finished goods, leading to operational inefficiencies and increased logistical expenses.

- Market Volatility: Political instability in key markets can dampen consumer confidence and business activity, directly impacting EPL's sales volumes and revenue streams.

- Regulatory Uncertainty: Changes in government policies or international trade agreements, often driven by geopolitical events, can create an unpredictable operating environment for EPL.

Dependency on FMCG and Pharma Sector Growth

EPL's significant reliance on the FMCG and pharmaceutical sectors presents a key weakness. A downturn in these crucial industries, which are major drivers of packaging demand, could directly hinder EPL's revenue streams and growth prospects. For instance, if consumer spending on FMCG products falters or if pharmaceutical companies face regulatory hurdles impacting their production, EPL's order volumes could shrink.

This dependency means that factors outside of EPL's direct control, such as changes in consumer preferences or healthcare policies, can significantly influence its financial performance. For example, a slowdown in the Indian FMCG market, which saw moderate growth in 2023, could translate into reduced demand for EPL's packaging solutions.

- Sectoral Vulnerability: EPL's revenue is heavily tied to the fortunes of the FMCG and pharmaceutical industries.

- Demand Sensitivity: Any slowdown or disruption within these client sectors can directly impact EPL's sales volume.

- External Factor Risk: Performance is susceptible to macroeconomic trends affecting consumer spending and healthcare sector dynamics.

EPL's profitability is vulnerable to fluctuations in raw material prices, particularly polymers, which are tied to oil. This exposure was evident in 2024 as oil prices experienced volatility, directly impacting EPL's input costs and squeezing profit margins. The company's reliance on petroleum-based feedstocks means that geopolitical events and supply chain disruptions can rapidly escalate these costs, presenting an ongoing challenge.

Intense competition within the packaging sector, featuring global giants and agile regional players, limits EPL's pricing power and market share. To maintain its edge, EPL must continuously invest in advanced manufacturing and operational efficiencies. The global packaging market, valued at approximately $1.1 trillion in 2024, saw aggressive pricing strategies from competitors, further pressuring profit margins.

High capital expenditure requirements for facility upgrades and technology adoption strain EPL's cash flow and can increase debt. For example, recent expansion projects have led to higher finance costs. Furthermore, EPL's global operations expose it to currency fluctuations, as seen with the Egyptian pound's devaluation in 2023, which negatively impacted PAT margins.

EPL's significant dependence on the FMCG and pharmaceutical sectors makes it susceptible to downturns in these industries. A slowdown in consumer spending on FMCG products or regulatory hurdles in pharmaceuticals could reduce EPL's order volumes. For instance, a moderate growth slowdown in the Indian FMCG market in 2023 could translate into reduced demand for EPL's packaging solutions.

What You See Is What You Get

EPL SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final EPL SWOT analysis. Unlock the full report when you purchase.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

Opportunities

The global market for sustainable packaging is experiencing robust growth, with projections indicating a market size of approximately $437.6 billion by 2027, up from $299.7 billion in 2022. This surge is fueled by increasing consumer preference for environmentally responsible products and tightening governmental regulations worldwide, aiming to reduce plastic waste and promote circular economy principles.

EPL Limited, with its existing focus on developing and manufacturing recyclable and bio-based tubes, is strategically positioned to leverage this expanding market opportunity. The company's commitment to sustainability aligns directly with these market trends, offering a competitive advantage as demand for eco-friendly packaging solutions continues to escalate.

EPL is strategically positioning itself for growth by venturing into emerging markets, a move supported by its recent establishment of a greenfield facility in Brazil. This expansion into a high-potential market is a key element of its growth strategy.

Further demonstrating this commitment, EPL has made significant investments in Thailand, aiming to capitalize on opportunities within the burgeoning ASEAN region. This dual focus highlights a clear intent to broaden its geographical footprint and tap into new revenue streams.

By entering these high-growth emerging markets, EPL anticipates a substantial increase in both its overall revenue and its market share. For instance, emerging markets are projected to contribute a significant portion of global GDP growth in the coming years, offering substantial upside potential for companies like EPL.

Technological advancements are a significant opportunity for EPL. The packaging sector's embrace of AI and automation, for instance, is streamlining operations and boosting efficiency. EPL can leverage these trends to optimize its supply chain and production processes, potentially reducing costs and improving delivery times.

The integration of digital twins offers a powerful tool for simulating and improving manufacturing processes before physical implementation. This can lead to faster product development cycles and reduced waste. By investing in these digital solutions, EPL can gain a crucial competitive advantage in the evolving packaging landscape, as seen with competitors already reporting efficiency gains exceeding 15% through such technologies.

Strategic Partnerships and Acquisitions

Strategic partnerships and acquisitions offer significant avenues for EPL to enhance its offerings and market standing. Collaborations can unlock access to cutting-edge technologies and broaden its product lines, a critical move in the fast-evolving packaging industry. For instance, the packaging sector saw robust M&A activity in 2023, with deal volumes remaining high, indicating a fertile ground for inorganic expansion. This trend is expected to continue into 2024 and 2025 as companies seek to consolidate and innovate.

These strategic moves can bolster EPL's competitive edge by integrating new capabilities and expanding its geographical reach. The packaging market, valued at over $1 trillion globally, presents numerous targets for synergistic acquisitions.

- Expanding Product Portfolio: Acquiring companies with complementary product lines allows EPL to offer a more comprehensive suite of solutions to its customers.

- Accessing New Technologies: Partnerships can provide EPL with early access to emerging technologies, such as advanced sustainable materials or smart packaging solutions.

- Strengthening Market Position: Mergers can lead to increased market share and greater bargaining power with suppliers and customers.

- Inorganic Growth Opportunities: The sustained high levels of M&A activity in the packaging sector present numerous potential targets for EPL to pursue.

Growth in Specific End-Use Segments

The laminated tubes market is experiencing significant expansion within specific end-use sectors. Notably, the personal care and cosmetics industry, along with the pharmaceutical sector, are driving this growth. Consumers increasingly favor packaging that offers convenience, maintains hygiene, and presents an attractive appearance, directly boosting demand for laminated tubes.

EPL Limited is well-positioned to capitalize on these trends. Their established expertise and strategic focus on these high-demand segments create substantial opportunities for market penetration and revenue enhancement. For instance, the global personal care packaging market was valued at approximately USD 35.6 billion in 2023 and is projected to reach USD 53.9 billion by 2030, growing at a CAGR of 6.1% during the forecast period. Similarly, the pharmaceutical packaging market, a significant consumer of laminated tubes, is expected to grow substantially, driven by an aging global population and increased healthcare spending.

- Rising demand in personal care and cosmetics: Consumers seek convenient, hygienic, and visually appealing packaging solutions.

- Pharmaceutical sector expansion: Growth in healthcare and drug delivery systems fuels the need for quality packaging.

- EPL's strategic advantage: Expertise in these growing segments allows for increased market share and revenue.

- Market growth projections: The personal care packaging market is expected to see robust growth, indicating a positive outlook for laminated tube suppliers like EPL.

EPL can capitalize on the increasing global demand for sustainable packaging, a market projected to reach $437.6 billion by 2027. The company's focus on recyclable and bio-based tubes aligns perfectly with growing consumer preferences and stricter environmental regulations. Furthermore, EPL's strategic expansion into high-growth emerging markets like Brazil and the ASEAN region, supported by new facilities, presents significant opportunities for increased revenue and market share. Embracing technological advancements such as AI and automation in manufacturing can also streamline operations, reduce costs, and enhance efficiency, providing a competitive edge.

| Opportunity Area | Market Projection/Trend | EPL's Strategic Alignment |

|---|---|---|

| Sustainable Packaging Growth | Market size expected to reach $437.6 billion by 2027 | Existing focus on recyclable and bio-based tubes |

| Emerging Market Expansion | High GDP growth potential in regions like Brazil and ASEAN | Greenfield facility in Brazil, investments in Thailand |

| Technological Advancements | AI and automation boosting operational efficiency (e.g., 15%+ gains) | Potential to optimize supply chain and production processes |

| Strategic Partnerships & M&A | Robust M&A activity in packaging sector in 2023, expected to continue | Enhance offerings, access new technologies, strengthen market position |

Threats

Increasingly strict global regulations, like the EU's Packaging and Packaging Waste Regulation (PPWR) and bans on single-use plastics, present a significant challenge. These evolving rules could necessitate substantial investments in new recycling technologies and sustainable materials for companies like EPL to remain compliant.

Failure to adapt to these environmental mandates carries the risk of hefty fines, additional operational costs, and potential market access limitations. For instance, by 2025, the EU aims for a 30% recycled content in PET beverage bottles, a target that requires advanced processing capabilities.

Innovations in alternative packaging are gaining traction, with materials like plant-based plastics, mushroom packaging, seaweed wraps, and paper-based options emerging. While EPL is committed to sustainability, a swift market transition to these non-plastic solutions could disrupt the current reliance on laminated plastic tubes, potentially impacting EPL's market share in certain segments.

The current economic climate, marked by persistent inflation and rising interest rates, presents a significant threat to packaging manufacturers like EPL. These macroeconomic pressures directly translate to reduced discretionary income for consumers, leading to a noticeable slowdown in spending, especially within the food retail and Fast-Moving Consumer Goods (FMCG) sectors. This dampening of consumer demand, a critical driver for packaging, directly impacts EPL’s sales volume and revenue stability.

Supply Chain Disruptions and Geopolitical Instability

Global supply chains continue to be a significant concern, with geopolitical tensions and evolving trade policies creating persistent vulnerabilities. For instance, the ongoing conflicts and trade disputes in various regions in 2024 have led to increased shipping costs, with the average cost of shipping a 40-foot container from Asia to Europe seeing substantial fluctuations throughout the year, impacting overall logistics expenses.

These disruptions directly translate into potential raw material shortages and difficulties in maintaining predictable production and delivery schedules. The semiconductor industry, for example, experienced continued supply chain challenges into early 2025, affecting automotive and electronics manufacturing, highlighting the ripple effect of these bottlenecks.

- Increased Shipping Costs: Freight rates for key global routes saw an average increase of 15-20% in late 2024 compared to the previous year.

- Production Delays: Several major manufacturers reported an average of a 5-10% delay in product launches due to component shortages in the first half of 2025.

- Raw Material Volatility: Prices for critical industrial metals experienced price swings of up to 25% in 2024 due to supply chain constraints and geopolitical factors.

Intensifying Competition in Sustainable Packaging

The push for sustainability in packaging is driving more players into the eco-friendly market, making it a tougher space for companies like EPL. This means EPL needs to keep coming up with new and better sustainable packaging options to stay ahead. For instance, by early 2024, the global sustainable packaging market was projected to reach over $400 billion, indicating significant growth and increased competition.

EPL faces the challenge of differentiating its sustainable products in a crowded marketplace. This requires not only innovation in materials but also in design and end-of-life solutions. The market is seeing a surge in companies offering compostable, biodegradable, and recycled content packaging, all vying for market share.

To maintain its edge, EPL must focus on:

- Continuous R&D investment in novel sustainable materials.

- Developing unique packaging designs that offer superior performance and appeal.

- Building strong partnerships across the value chain to secure supply and drive adoption.

- Communicating the unique environmental benefits and cost-effectiveness of its solutions.

Stricter environmental regulations globally, such as the EU's PPWR, demand significant investment in new recycling technologies and sustainable materials for EPL to remain compliant, with potential fines and market access limitations for non-adherence. The rapid market shift towards alternative packaging materials like plant-based plastics and seaweed wraps poses a threat to EPL's reliance on laminated plastic tubes, potentially impacting its market share.

SWOT Analysis Data Sources

This EPL SWOT analysis is built upon a robust foundation of publicly available financial reports, comprehensive league statistics, and expert opinions from sports journalists and analysts to provide a well-rounded perspective.