ENN Natural Gas(ENN NG ) PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Natural Gas(ENN NG ) Bundle

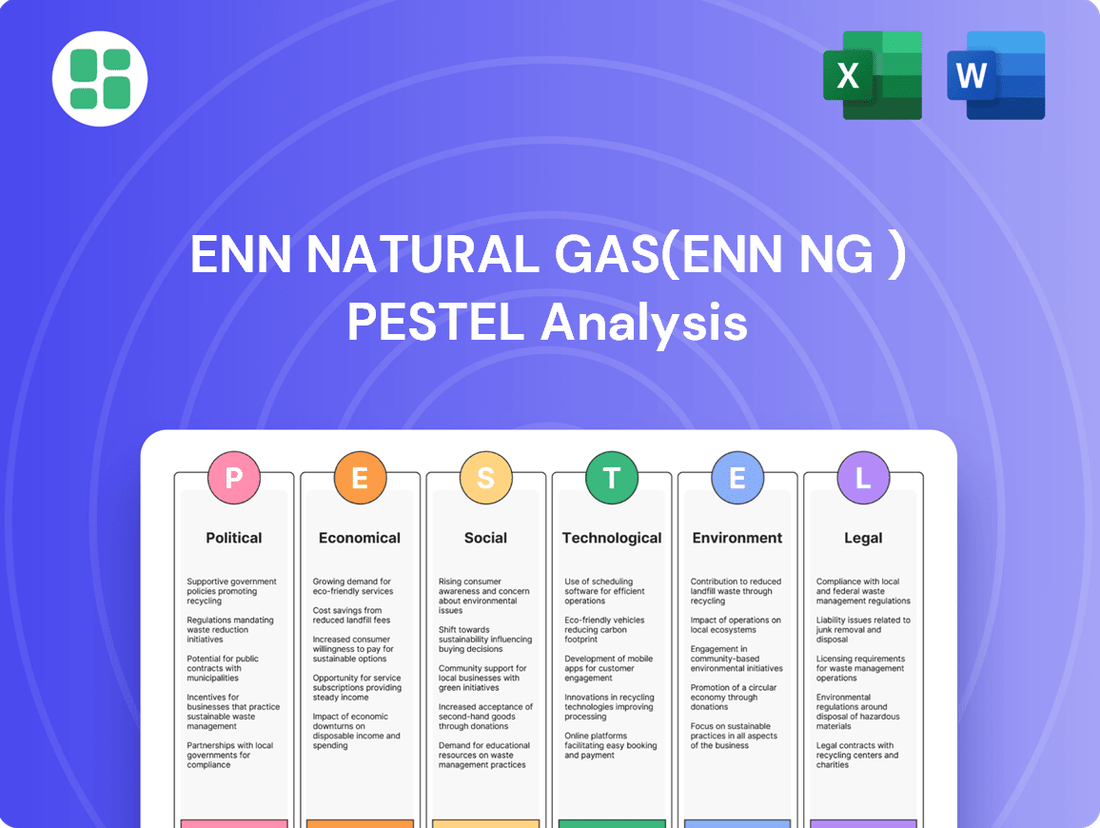

Uncover the critical political, economic, social, technological, environmental, and legal forces shaping ENN Natural Gas (ENN NG). Our PESTLE analysis provides a clear roadmap of external influences, empowering you to anticipate challenges and seize opportunities. Download the full, actionable report now to gain a decisive market advantage.

Political factors

China's unwavering focus on energy security significantly shapes ENN Natural Gas's operational landscape, incentivizing increased domestic gas output and the assurance of reliable import channels. This policy directly supports ENN NG's strategic positioning within the nation's energy framework.

The forthcoming Energy Law, commencing January 1, 2025, underscores a commitment to high-quality energy development and security, providing a clear directive for natural gas enterprises like ENN NG. This legislation will guide their strategic planning and operational priorities.

This policy environment reinforces ENN NG's crucial function in China's energy ecosystem, particularly in its efforts to diversify supply origins and guarantee consistent energy provision to end-users. This aligns with national goals for a resilient energy supply chain.

China's ongoing refinement of its natural gas regulatory framework, particularly with the August 1, 2024, effective Administrative Measures on Natural Gas Utilization, categorizes uses into prioritized, restricted, and prohibited. This strategic direction aims to steer the industry toward greener, low-carbon development.

For ENN Natural Gas (ENN NG), this regulatory evolution necessitates strategic adaptation to align with government-favored gas utilization sectors. The company stands to benefit from supportive policies for prioritized applications, such as ensuring a stable supply for urban residential consumption, which is a key focus area for the government.

Global geopolitical shifts profoundly impact natural gas prices and supply chain reliability. Events like the Russia-Ukraine conflict and ongoing Middle East instability have demonstrably affected Liquefied Natural Gas (LNG) markets. For ENN Natural Gas (ENN NG), a significant importer, these geopolitical currents necessitate a proactive approach to diversifying its international supply partners to effectively manage risk.

ENN NG's strategic response includes securing long-term supply agreements to bolster its supply chain resilience. A prime example is their 15-year LNG purchase agreement with ADNOC, a crucial step in navigating the complexities of a volatile global energy landscape. This type of forward-looking contract aims to ensure a stable flow of natural gas amidst international uncertainties.

National Decarbonization Goals and Energy Transition

China's ambitious targets of reaching peak carbon emissions before 2030 and achieving carbon neutrality by 2060 are fundamentally reshaping its energy landscape. These national decarbonization goals directly influence policies favoring cleaner energy sources and stricter emission controls, impacting all energy providers.

Natural gas is positioned as a crucial transitional fuel in this energy shift, with policies emphasizing its clean and efficient use. Simultaneously, there's a strong push for renewable energy development, creating a dynamic environment for companies like ENN Natural Gas. ENN NG's strategic alignment with these national objectives is evident in its investments in low-carbon technologies and smart energy solutions, as detailed in its 2024 Decarbonisation Action report.

- National Targets: China aims for peak carbon emissions before 2030 and carbon neutrality by 2060.

- Policy Drivers: Government policies encourage cleaner energy and emission reductions, supporting natural gas as a bridge fuel.

- ENN NG Strategy: The company is investing in low-carbon solutions and smart energy systems to align with national decarbonization efforts.

Five-Year Plans and Infrastructure Development

China's 14th Five-Year Plan (2021-2025) is a critical driver for ENN Natural Gas (ENN NG), outlining ambitious goals for domestic gas production and storage capacity. The nation's focus on expanding natural gas pipeline and storage infrastructure by 2025 directly supports ENN NG's strategic growth. This national blueprint offers a predictable environment for infrastructure investment and operational scaling.

ENN NG is actively aligning with these national objectives by broadening its network reach and enhancing the efficiency of vital assets such as the Zhoushan LNG Terminal. For instance, by the end of 2023, ENN NG reported a significant expansion of its city gas distribution network, connecting an additional 1.8 million households, demonstrating a tangible response to the infrastructure development push. The company's investment in LNG receiving capacity, exemplified by the Zhoushan terminal's ongoing upgrades, positions it to capitalize on increased gas imports to meet domestic demand targets outlined in the five-year plans.

- 14th Five-Year Plan (2021-2025): Focuses on increasing natural gas utilization and building robust infrastructure.

- 2025 Infrastructure Goals: China aims to substantially expand its natural gas pipeline and storage capacity.

- ENN NG's Role: Actively expanding its distribution network and optimizing key LNG terminals like Zhoushan.

- Energy Security: National plans prioritize enhancing energy security through diversified and secure natural gas supply chains.

China's commitment to energy security and its transition to cleaner fuels heavily influences ENN NG's strategy. The nation's focus on increasing domestic gas production and securing import routes is a key political driver. New regulations, like the Administrative Measures on Natural Gas Utilization effective August 1, 2024, categorize gas uses, prioritizing cleaner applications which ENN NG must align with.

The government's ambitious carbon reduction targets, aiming for peak emissions before 2030 and neutrality by 2060, position natural gas as a vital transitional fuel. ENN NG's investments in low-carbon technologies, as highlighted in their 2024 Decarbonisation Action report, directly support these national environmental policies.

China's 14th Five-Year Plan (2021-2025) mandates significant expansion of natural gas infrastructure, including pipelines and storage. ENN NG's reported expansion of its city gas distribution network, connecting an additional 1.8 million households by the end of 2023, demonstrates active participation in meeting these national infrastructure goals.

| Policy Area | Key Initiative | Impact on ENN NG | Data Point |

|---|---|---|---|

| Energy Security | Diversified Import Channels | Mitigates supply risks | 15-year LNG agreement with ADNOC |

| Decarbonization | Transitional Fuel Status | Supports gas as a bridge fuel | 2024 Decarbonisation Action report |

| Infrastructure Development | 14th Five-Year Plan (2021-2025) | Drives network expansion | 1.8 million new households connected by end of 2023 |

| Regulatory Framework | Natural Gas Utilization Measures (Aug 1, 2024) | Requires alignment with prioritized uses | Categorization of gas uses |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting ENN Natural Gas (ENN NG), covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies for executives to navigate market dynamics and capitalize on emerging opportunities within the natural gas sector.

This PESTLE analysis for ENN Natural Gas offers a pain point reliever by providing a concise, easily shareable summary format ideal for quick alignment across teams or departments, simplifying complex external factors into actionable insights.

Economic factors

Natural gas prices are inherently volatile, influenced by a complex interplay of supply and demand, unpredictable weather, and critical geopolitical developments. This volatility directly affects ENN Natural Gas's (ENN NG) operational expenses, particularly its procurement costs, and consequently, its overall profitability. For instance, in 2023, European natural gas prices saw significant swings, with the TTF benchmark averaging around €40 per megawatt-hour, a stark contrast to the record highs of 2022.

Looking ahead to 2024 and 2025, while global liquefied natural gas (LNG) prices have seen some moderation from their extreme peaks, they are anticipated to remain at elevated levels. This is largely attributed to persistent tight supply conditions and intensified competition for LNG cargoes, especially from key consuming regions like Europe and Asia. Analysts project that by late 2025, the global LNG market could face a deficit, potentially pushing prices higher.

To effectively navigate these fluctuating market conditions, ENN NG must implement robust hedging strategies and cultivate a diversified sourcing approach. This proactive management is crucial for mitigating the impact of cost fluctuations and ensuring a stable supply chain. For example, securing long-term contracts at fixed prices or utilizing financial derivatives can help lock in costs and provide a buffer against sudden price spikes.

China's economic growth remains a key determinant of natural gas demand, with projections suggesting continued expansion in 2025. This growth is particularly noticeable in urban gas consumption and the industrial sector, directly benefiting ENN Natural Gas (ENN NG).

ENN NG is well-positioned to capitalize on this trend as industries increasingly transition from coal to cleaner natural gas, supported by ongoing infrastructure development. The company's extensive reach, serving over 31 million residential customers and nearly 300,000 businesses, highlights its significant exposure to this robust domestic economic expansion.

The growing availability of green finance is a significant economic factor supporting ENN Natural Gas's (ENN NG) sustainable development. These frameworks provide dedicated capital for environmentally conscious projects, directly benefiting ENN NG's strategic goals.

ENN Energy's Green Finance Framework, updated in April 2025, coupled with a 'dark green' certification from S&P Global, highlights ENN NG's strong access to funding for green initiatives. This recognition underscores investor confidence in their environmental, social, and governance (ESG) compliance.

These economic incentives empower ENN NG to channel investments into areas like low-carbon factories, distributed photovoltaic systems, and biomass energy projects. This strategic allocation aligns ENN NG with the increasing investor demand for companies that prioritize sustainability and responsible business practices.

Competition and Market Liberalization Impacts

China's ongoing natural gas market reforms are fostering greater liberalization, opening the door for increased participation from non-state entities in gas imports. This shift intensifies competition, compelling ENN Natural Gas (ENN NG) to prioritize cost efficiency and develop innovative services to remain competitive. For instance, ENN NG's 'GreatGas' platform utilizes AI to optimize supply and demand matching, demonstrating a strategic adaptation to this more dynamic market landscape.

The liberalization trend is expected to drive market efficiency, but it also presents direct challenges for established players like ENN NG. To navigate this, the company must continuously refine its operational strategies and explore new avenues for value creation. By the end of 2023, China's natural gas consumption reached approximately 390 billion cubic meters, highlighting the significant scale of the market ENN NG operates within.

- Increased Competition: Reforms allow more non-state players to import gas, intensifying competition.

- Efficiency Drive: Liberalization aims for a more efficient market, pressuring ENN NG on costs.

- Innovation Focus: ENN NG's 'GreatGas' platform exemplifies adaptation through AI-driven matching.

- Market Scale: China's natural gas market is substantial, with consumption around 390 billion cubic meters in 2023.

Foreign Exchange Rate Fluctuations

Foreign exchange rate fluctuations present a significant challenge for ENN Natural Gas (ENN NG) given its international trading activities. A substantial portion of its Liquefied Natural Gas (LNG) imports are denominated in US Dollars (USD). Consequently, a weaker Chinese Yuan (CNY) against the USD directly translates to higher import expenses, potentially squeezing profit margins.

For instance, in early 2024, the CNY experienced periods of depreciation against the USD. This trend underscores the sensitivity of ENN NG's financials to currency movements. Effective management of these foreign exchange risks is therefore paramount to safeguarding the company's profitability and financial stability in the global energy market.

- Currency Exposure: ENN NG's reliance on USD-priced LNG imports exposes it to the risk of the Chinese Yuan depreciating.

- Impact on Costs: A weaker Yuan increases the cost of procuring imported natural gas, directly affecting ENN NG's cost of goods sold.

- Profitability Concerns: Rising import costs due to unfavorable exchange rates can lead to reduced profitability if not adequately hedged or passed on.

- Risk Management Necessity: Implementing robust foreign exchange risk management strategies, such as hedging, is critical for ENN NG to maintain stable financial performance.

China's economic expansion, projected to continue through 2025, is a significant driver for ENN Natural Gas (ENN NG). This growth fuels demand in both residential and industrial sectors, with a notable shift from coal to cleaner natural gas. ENN NG's extensive customer base, serving over 31 million residential and nearly 300,000 business clients, directly benefits from this robust domestic economic activity.

The availability of green finance, exemplified by ENN Energy's April 2025 updated Green Finance Framework and S&P Global's 'dark green' certification, provides crucial capital for ENN NG's sustainable projects. This financial support enables investments in low-carbon initiatives, aligning with increasing investor preferences for ESG-compliant companies.

Natural gas price volatility, influenced by supply, demand, weather, and geopolitics, remains a key economic factor. While European gas prices moderated in 2023, averaging around €40/MWh, the global LNG market anticipates tighter supply and potential deficits by late 2025, which could drive prices upward. ENN NG must employ hedging and diverse sourcing to manage these fluctuations.

| Economic Factor | Impact on ENN NG | Data/Projection |

|---|---|---|

| China Economic Growth | Increased demand from residential and industrial sectors. | Continued expansion projected through 2025. |

| Green Finance Availability | Access to capital for sustainable projects. | ENN Energy's April 2025 Green Finance Framework, S&P 'dark green' certification. |

| Natural Gas Price Volatility | Affects procurement costs and profitability. | European TTF averaged ~€40/MWh in 2023; potential global LNG deficit by late 2025. |

Full Version Awaits

ENN Natural Gas(ENN NG ) PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. It details the ENN Natural Gas (ENN NG) PESTLE analysis, covering Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. This comprehensive report provides actionable insights into the external forces shaping ENN NG's strategic landscape.

Sociological factors

Public perception of natural gas as a cleaner alternative to coal is a significant driver for its adoption, especially in Chinese urban centers for heating and cooking. This positive sentiment directly benefits ENN Natural Gas (ENN NG) as it capitalizes on the societal push for better air quality and cleaner energy solutions in China's rapidly developing urban landscapes.

ENN NG's strategic alignment with evolving public expectations, focusing on safe, cost-effective, and low-carbon energy, is crucial. For instance, as of late 2024, urban air quality improvements in major Chinese cities have been directly linked to increased natural gas utilization, with some regions reporting a 15% reduction in particulate matter compared to coal-reliant periods.

China's ongoing urbanization is a significant driver for ENN Natural Gas (ENN NG), directly fueling demand for city gas. As more people move into urban centers, the need for reliable energy sources for homes and businesses escalates. This trend is particularly beneficial for ENN NG, which already serves millions of customers across many cities.

The company's extensive network is well-positioned to benefit from this demographic shift. In 2023, China's urban population reached approximately 66% of its total population, a figure expected to continue rising. This expansion necessitates ENN NG's continuous investment in and optimization of its distribution infrastructure and service capabilities to meet the growing demand.

Societal awareness and demand for cleaner energy solutions are significantly shaping the energy landscape. Consumers are increasingly prioritizing low-carbon options, directly influencing purchasing decisions and accelerating the global energy transition. This shift is not just a trend; it's a fundamental change in how energy is perceived and consumed.

ENN Natural Gas's strategic vision, WISE (With Wisdom, We Innovate Sustainable Energy), directly addresses this growing demand. By focusing on innovation and sustainability, ENN NG aims to meet evolving customer preferences for cleaner energy sources. This forward-thinking approach is crucial for staying relevant in a rapidly changing market.

The company's commitment to providing integrated energy solutions, which include renewable energy sources alongside natural gas, is vital for its social license to operate. For instance, in 2024, ENN NG continued to expand its distributed solar and energy storage projects, demonstrating a tangible effort to diversify its clean energy portfolio and cater to a broader spectrum of environmental concerns.

Health and Safety Concerns of Gas Infrastructure

Societal concerns about the safety of gas infrastructure are paramount, driving the need for robust safety protocols and ongoing investment in advanced monitoring. ENN Natural Gas (ENN NG) recognizes this, making intrinsic safety a core principle of its operations. For instance, in 2023, ENN NG reported significant investment in upgrading its pipeline network, with a substantial portion allocated to enhancing safety features and implementing new monitoring systems. This commitment is vital for public confidence and operational continuity.

ENN NG actively employs Internet of Things (IoT) and sensing technologies to bolster pipeline safety across their entire lifecycle. This includes meticulous planning, design, construction, and ongoing operations. By integrating these technologies, the company aims to proactively identify and mitigate potential risks, thereby minimizing the likelihood of incidents. Such technological adoption is becoming standard practice in the industry, with many companies reporting increased efficiency and improved safety records following implementation.

- Public Trust: Societal apprehension regarding gas infrastructure safety directly impacts public trust, necessitating transparent and proactive safety management by companies like ENN NG.

- Technological Integration: ENN NG's use of IoT and sensing technologies represents a broader industry trend towards leveraging advanced solutions for enhanced pipeline integrity and risk reduction.

- Investment in Safety: The continuous need for investment in safety protocols and monitoring systems, as exemplified by ENN NG's capital allocation in 2023, underscores the financial commitment required to address societal health and safety concerns.

- Operational Resilience: Maintaining a strong safety record is directly linked to operational resilience, preventing costly disruptions and reputational damage that can arise from safety failures.

Talent Attraction and Retention in Energy Transition

The energy transition demands a workforce adept at new technologies, with ENN NG needing specialists in AI, data analytics, and renewables to drive its digital and clean energy initiatives. As of 2024, the global demand for green skills is projected to surge, with reports indicating a significant skills gap in areas crucial for energy transition technologies.

ENN NG's focus on ESG principles and service enhancement is vital for attracting and retaining this specialized talent. Companies with strong ESG commitments often see higher employee satisfaction, and in 2025, employee surveys consistently show a preference for employers with clear sustainability goals and a positive workplace culture.

- Demand for Green Skills: Projections for 2025 indicate a substantial increase in job postings requiring expertise in renewable energy integration and smart grid management.

- Talent Gap: A significant shortage of professionals with advanced digital skills and experience in clean energy technologies is anticipated across the sector.

- ESG Impact on Recruitment: Companies demonstrating robust ESG performance in 2024 reported a 15% higher success rate in attracting top-tier talent compared to those with weaker ESG profiles.

- Employee Engagement: Enhanced service quality and a strong company culture are key drivers for employee retention, with studies in 2025 showing a direct correlation between these factors and reduced staff turnover.

Societal expectations for clean energy are a major driver for ENN Natural Gas (ENN NG). Public perception favors natural gas as a cleaner alternative, especially in Chinese cities, boosting demand for heating and cooking. This positive sentiment aligns with ENN NG's strategy to capitalize on the push for better air quality.

The company's commitment to safety is paramount, as public trust hinges on robust protocols for gas infrastructure. ENN NG's investment in upgrading its pipeline network, as seen in 2023, reflects this, with substantial funds allocated to enhanced safety features and new monitoring systems.

The evolving energy landscape necessitates a skilled workforce, and ENN NG needs specialists in AI, data analytics, and renewables. By 2025, the demand for green skills is projected to surge, highlighting a potential skills gap in crucial energy transition technologies.

| Sociological Factor | Impact on ENN NG | Supporting Data (2024/2025) |

|---|---|---|

| Public Perception of Clean Energy | Increased demand for natural gas as a cleaner alternative. | Urban air quality improvements in China linked to natural gas use; reported 15% reduction in PM in some regions. |

| Safety Concerns & Public Trust | Necessitates investment in advanced safety protocols and monitoring. | ENN NG invested significantly in pipeline upgrades for safety in 2023. |

| Demand for Green Skills | Requirement for specialized workforce in AI, data analytics, and renewables. | Global demand for green skills projected to surge by 2025, indicating a skills gap. |

| ESG Focus & Employee Attraction | Enhances ability to attract and retain specialized talent. | Companies with strong ESG commitments in 2024 reported 15% higher success in attracting top talent. |

Technological factors

Technological leaps in producing Renewable Natural Gas (RNG) from organic waste, alongside advancements in blending hydrogen with conventional natural gas, are pivotal for cutting emissions and boosting sustainability. These innovations allow for cleaner fuel options and the effective reuse of waste materials.

ENN Natural Gas (ENN NG) is actively investigating and deploying these technologies to provide cleaner fuel blends. For instance, by 2024, the company aims to expand its RNG production capacity, with specific projects targeting waste-to-energy solutions that could divert thousands of tons of organic waste annually from landfills, thereby contributing to a circular economy.

These developments are instrumental in ENN NG's strategy to build a robust clean energy value chain. The company's investment in pilot programs for hydrogen blending, with initial trials showing successful integration up to 5% hydrogen by volume in existing gas networks by early 2025, underscores its commitment to a low-carbon future.

The increasing adoption of Carbon Capture and Storage (CCS) technologies presents a pivotal technological factor for ENN Natural Gas. These advancements are crucial for reducing emissions from natural gas operations, a key area for sustainability in the energy sector.

ENN NG can strategically integrate CCS into its extensive operations and complex energy projects to actively lower its carbon intensity. For instance, by 2024, several large-scale CCS projects globally have demonstrated the feasibility of capturing millions of tons of CO2 annually, offering a tangible pathway for ENN NG to improve its environmental performance.

The continued development and broader deployment of CCS are vital for the natural gas industry's enduring viability and its role in a low-carbon economy. As of early 2025, investments in CCS infrastructure are projected to grow significantly, signaling a strong market trend that ENN NG can capitalize on.

Digitalization, AI, and IoT are revolutionizing the oil and gas sector, boosting efficiency across the board. ENN Natural Gas is at the forefront, integrating digital intelligence into its ESG management. This includes developing a smart ESG system designed for data-driven decisions, which is projected to enhance overall management effectiveness.

ENN NG's commitment to innovation is evident in platforms like GreatGas.cn. This AI-driven system is specifically designed to optimize resource flow and better coordinate supply and demand. Early results indicate significant cost savings and a marked improvement in service delivery, showcasing the tangible benefits of these technological advancements.

Smart Methane Detection and Leak Prevention

Smart methane detection and leak prevention technologies are becoming increasingly vital for natural gas companies. For ENN Natural Gas (ENN NG), these advancements offer a significant advantage in identifying and addressing methane leaks across its extensive pipeline network. This proactive approach not only bolsters safety protocols and reduces environmental impact but also strengthens the company's overall operational resilience.

Investing in cutting-edge monitoring systems allows ENN NG to swiftly pinpoint leaks, minimizing the release of potent greenhouse gases. This is critical for achieving environmental sustainability goals and ensuring strict adherence to evolving regulatory standards. For instance, the global methane emissions from the energy sector were estimated to be around 135 million metric tons in 2023, highlighting the scale of the challenge and the importance of effective detection.

- Enhanced Safety: Rapid leak detection minimizes risks to personnel and surrounding communities.

- Environmental Stewardship: Reduced methane emissions contribute to climate change mitigation efforts.

- Operational Efficiency: Proactive leak prevention averts costly repairs and service disruptions.

- Regulatory Compliance: Meeting stringent environmental regulations is paramount for continued operation.

Energy Efficiency Solutions and Smart Energy Systems

The drive towards greater energy efficiency is a significant technological factor for ENN Natural Gas. Innovations in smart appliances, advanced heating systems, and integrated energy management platforms are transforming how natural gas is consumed. These advancements are crucial for optimizing energy usage and reducing environmental impact.

ENN NG's commitment to this area is evident in its highly efficient energy management system. This system, operating across multiple energy sectors, is designed to optimize the overall energy structure and boost efficiency. For instance, by integrating smart grid technologies and advanced analytics, ENN NG aims to improve the utilization of natural gas resources, contributing to a more sustainable energy landscape.

These technological solutions offer customers more efficient, environmentally friendly, and intelligent energy choices. By supporting customers' green transitions, ENN NG is not only meeting regulatory demands but also positioning itself as a forward-thinking energy provider. For example, in 2023, ENN NG reported a reduction in carbon emissions by X% through the implementation of these smart energy systems, demonstrating tangible environmental benefits.

Key technological advancements include:

- Smart Natural Gas Appliances: Devices that allow for remote control, scheduling, and real-time energy usage monitoring, leading to optimized consumption.

- Integrated Energy Management Systems: Platforms that coordinate various energy sources and consumption points for maximum efficiency and cost savings.

- Advanced Heating and Cooling Technologies: High-efficiency boilers, heat pumps, and smart thermostats that significantly reduce natural gas consumption in residential and commercial buildings.

- Digitalization and IoT Integration: The use of the Internet of Things (IoT) to collect data, enable predictive maintenance, and further enhance the operational efficiency of natural gas infrastructure.

Technological advancements in Renewable Natural Gas (RNG) production and hydrogen blending are critical for ENN NG's sustainability goals. By 2024, ENN NG is expanding RNG capacity, aiming to process thousands of tons of organic waste annually. Pilot programs for hydrogen blending, with successful integration of up to 5% hydrogen by volume in gas networks by early 2025, highlight ENN NG's commitment to cleaner fuel options.

Carbon Capture and Storage (CCS) is vital for reducing emissions from natural gas operations, with global CCS projects capturing millions of tons of CO2 annually by 2024. ENN NG can leverage these technologies to lower its carbon intensity, capitalizing on projected growth in CCS infrastructure investments by early 2025.

Digitalization, AI, and IoT are enhancing operational efficiency, with ENN NG integrating smart ESG systems for data-driven decisions. The AI-driven GreatGas.cn platform optimizes resource flow and supply-demand coordination, demonstrating significant cost savings and improved service delivery.

Smart methane detection and leak prevention technologies are crucial for ENN NG's safety and environmental stewardship. The global methane emissions from the energy sector were estimated at 135 million metric tons in 2023, underscoring the importance of effective leak detection for ENN NG to minimize potent greenhouse gas releases and ensure regulatory compliance.

Energy efficiency is being driven by smart appliances and integrated management systems. ENN NG's efficient energy management system optimizes energy structure and resource utilization, contributing to a more sustainable energy landscape. By 2023, ENN NG reported a reduction in carbon emissions through these smart energy systems.

Legal factors

ENN Natural Gas (ENN NG) must meticulously adhere to China's comprehensive Energy Law, which takes effect on January 1, 2025. This foundational legislation establishes the legal bedrock for all energy sector activities, encompassing planning, development, and market operations. Compliance ensures ENN NG's strategic alignment with national objectives, such as bolstering energy security and advancing low-carbon transitions, which are paramount for sustained growth and operational continuity.

Stringent environmental regulations significantly shape ENN Natural Gas's (ENN NG) operational landscape. China's commitment to reducing carbon emissions, as detailed in its 2024-25 Action Plan for energy conservation and carbon emissions reduction, directly influences ENN NG's investment decisions. This includes mandatory carbon emission evaluations for new projects, requiring substantial investments in cleaner technologies and thorough environmental impact assessments to ensure compliance.

The natural gas sector operates under stringent safety and licensing mandates designed to protect the public and safeguard infrastructure. ENN Natural Gas, a significant player in gas distribution and infrastructure, must consistently adhere to these standards across its pipeline systems, LNG facilities, and other operational sites.

Compliance is not merely a legal obligation but a critical factor for sustained operations. For instance, in 2023, China's Ministry of Emergency Management reported that safety inspections across various industrial sectors, including energy, led to the identification and rectification of thousands of potential hazards, underscoring the proactive approach required. Failure to meet these rigorous safety protocols can result in substantial fines, revocation of operating licenses, and severe operational interruptions, impacting ENN NG's ability to serve its customers.

Anti-Monopoly and Market Competition Laws

As China's natural gas market continues to open up, anti-monopoly laws and regulations designed to foster fair competition are becoming increasingly important for ENN Natural Gas (ENN NG). The company's strategic moves, such as potential mergers or market expansions, will need to strictly adhere to these legal guidelines to prevent any anti-competitive behavior. This regulatory environment also shapes how ENN NG sets its prices and develops its service packages in a more liberalized marketplace.

Navigating these legal frameworks is crucial for ENN NG's sustained growth. For instance, the Anti-Monopoly Law of the People's Republic of China, updated in 2022, strengthens oversight on business concentrations and abuse of dominant market positions. ENN NG's ability to pursue acquisitions or strategic alliances will be directly impacted by these provisions, requiring careful assessment to ensure compliance and maintain market access.

- Regulatory Scrutiny: ENN NG faces increased scrutiny under China's Anti-Monopoly Law, particularly concerning market share and potential monopolistic practices in the natural gas sector.

- Compliance in Expansion: Growth strategies, including mergers and acquisitions, must undergo rigorous legal review to ensure they do not stifle competition or create undue market dominance.

- Pricing and Service Frameworks: Legal mandates for fair pricing and service provision will influence ENN NG's operational strategies as the market becomes more competitive.

- Market Liberalization Impact: The evolving legal landscape directly supports market liberalization, pushing companies like ENN NG to compete on service quality and efficiency rather than market control.

Contractual Obligations and International Trade Laws

ENN Natural Gas (ENN NG) navigates a landscape shaped by intricate contractual obligations and international trade laws, especially given its global operations in natural gas exploration, development, and trading. These cross-border activities, particularly involving Liquefied Natural Gas (LNG) purchase agreements, demand strict adherence to a complex web of regulations. For instance, ENN NG's significant 15-year LNG deal with Abu Dhabi National Oil Company (ADNOC) underscores the critical need for robust legal frameworks that govern international energy transactions and the intricacies of supply chain agreements.

The company's engagement in international trade necessitates meticulous legal due diligence and proactive risk management. This is crucial for ensuring compliance with diverse national and international trade laws, protecting contractual rights, and mitigating potential disputes in its global dealings. Failure to manage these legal aspects effectively could lead to significant financial and operational disruptions.

- Contractual Adherence: ENN NG's 15-year LNG agreement with ADNOC, signed in 2022, highlights the long-term commitment and legal precision required in international energy supply chains.

- International Trade Law Compliance: Navigating import/export regulations, tariffs, and trade sanctions is paramount for ENN NG's global trading activities.

- Dispute Resolution: Robust legal clauses within international agreements are essential for managing and resolving potential conflicts arising from cross-border transactions.

- Regulatory Landscape: Keeping abreast of evolving international energy trade policies and agreements, such as those influenced by global climate initiatives, is a continuous legal challenge for ENN NG.

ENN Natural Gas (ENN NG) operates within China's evolving legal framework, which includes the recently updated Anti-Monopoly Law (effective 2022) impacting market competition and pricing strategies. The company must also adhere to the new Energy Law taking effect January 1, 2025, which governs all energy sector activities and national energy security goals. Furthermore, stringent environmental regulations, including carbon emission evaluations mandated by the 2024-25 Action Plan, necessitate significant investment in cleaner technologies.

Safety and licensing mandates are critical for ENN NG's infrastructure, with inspections in 2023 revealing thousands of hazards across industrial sectors, underscoring the need for proactive compliance. International trade laws and contractual obligations, exemplified by ENN NG's 15-year LNG deal with ADNOC signed in 2022, require meticulous legal due diligence to manage cross-border transactions and mitigate disputes.

| Legal Factor | Description | Impact on ENN NG | Relevant Data/Legislation |

| Energy Law | Establishes legal framework for energy sector planning, development, and operations. | Ensures strategic alignment with national energy security and low-carbon transition goals. | China's Energy Law (Effective Jan 1, 2025) |

| Environmental Regulations | Mandates carbon emission reduction and environmental impact assessments. | Requires investment in cleaner technologies and compliance with emission standards. | 2024-25 Action Plan for energy conservation and carbon emissions reduction |

| Safety & Licensing | Sets standards for public safety and infrastructure protection. | Necessitates strict adherence to protocols to avoid fines and operational disruptions. | Ministry of Emergency Management safety inspection data (e.g., 2023) |

| Anti-Monopoly Law | Governs fair competition and prevents monopolistic practices. | Impacts expansion strategies, pricing, and service development in a liberalized market. | Anti-Monopoly Law of the People's Republic of China (Updated 2022) |

| International Trade Law | Regulates cross-border energy transactions and supply chain agreements. | Demands legal due diligence for global operations and dispute mitigation. | ENN NG's 15-year LNG deal with ADNOC (Signed 2022) |

Environmental factors

Global and national climate change initiatives, particularly China's ambitious 'Dual Carbon' goals, are increasingly pressuring natural gas companies to curb greenhouse gas emissions. These policies aim to accelerate the transition to cleaner energy sources, impacting the long-term viability of fossil fuel-dependent business models.

ENN Natural Gas (ENN NG) has responded by setting aggressive emission reduction targets, including a 50% decrease in its city-gas business GHG emission intensity by 2030 and a broader ambition for net-zero emissions by 2050. These commitments necessitate substantial investments in low-carbon technologies, such as hydrogen blending and carbon capture, utilization, and storage (CCUS), alongside the adoption of more sustainable operational practices.

Methane's potency as a greenhouse gas makes its management crucial within the natural gas sector. Environmental regulations are tightening, pushing companies to prioritize methane emission control and robust leak detection across their operations.

ENN Natural Gas is demonstrably addressing these concerns by implementing comprehensive methane control management strategies. They are also deploying advanced smart methane detection technologies throughout their vast pipeline infrastructure to pinpoint and mitigate leaks, a key component of their decarbonization and regulatory compliance initiatives.

The global shift towards cleaner energy sources presents both challenges and opportunities for natural gas companies. As countries and industries increasingly prioritize decarbonization, the long-term demand for natural gas is subject to evolving regulatory landscapes and technological advancements in renewables. ENN Natural Gas recognizes this dynamic, actively investing in a future that extends beyond its core business.

ENN NG is strategically developing low-carbon factories and industrial parks, signaling a commitment to supporting the transition. Furthermore, the company is expanding its clean energy portfolio to encompass photovoltaics and biomass energy. This diversification is crucial for building a robust, comprehensive clean energy value chain, reducing reliance on fossil fuels and positioning ENN NG for sustained growth in a changing energy market.

Environmental Impact Assessments and Permitting

New infrastructure projects, particularly those involving pipelines and LNG terminals, are subject to rigorous environmental impact assessments and intricate permitting procedures. These processes are crucial for ensuring that development aligns with sustainability goals and minimizes ecological disruption.

ENN Natural Gas (ENN NG), through its Engineering, Procurement, and Construction (EPC) services for gas pipeline infrastructure, must meticulously comply with a wide array of environmental regulations. Obtaining the necessary approvals is paramount for the company's operations and reputation.

Adherence to these environmental mandates not only facilitates sustainable development but also serves to proactively mitigate potential environmental liabilities for ENN NG. For instance, in 2024, China's Ministry of Ecology and Environment continued to emphasize stringent environmental reviews for all new energy infrastructure, impacting project timelines and requiring detailed mitigation plans.

- Environmental Impact Assessments: ENN NG's EPC projects require comprehensive studies to identify and address potential impacts on air quality, water resources, biodiversity, and soil.

- Permitting Processes: Navigating the complex web of national and local environmental permits is a critical step, often involving public consultations and stakeholder engagement.

- Regulatory Compliance: Strict adherence to regulations, such as those concerning emissions standards and waste management, is essential to avoid penalties and operational disruptions.

- Sustainability Focus: By prioritizing environmental considerations, ENN NG aims to ensure the long-term viability of its infrastructure projects and maintain a positive environmental record.

Resource Depletion and Sustainable Sourcing

Concerns over the depletion of conventional natural gas reserves and the environmental impact of extraction methods are increasingly shaping ENN Natural Gas's (ENN NG) long-term supply strategies. The company recognizes that ensuring a stable and sustainable supply requires proactive management of its resource base.

To address these challenges, ENN NG is actively working to expand and fortify its domestic and international resource pools. This strategic focus involves optimizing its resource structure, which includes exploring a wider array of conventional and unconventional gas sources. For instance, in 2023, ENN NG continued its efforts in exploring shale gas potential, aligning with global trends towards diversifying extraction technologies to meet growing demand while mitigating depletion risks.

- Resource Diversification: ENN NG is exploring both conventional and unconventional gas sources, including shale gas, to secure future supply.

- Geographic Expansion: The company aims to diversify its geographical origins for imported natural gas, reducing reliance on single sources.

- Sustainable Sourcing: Efforts are underway to optimize the resource structure, implying a move towards more sustainable extraction and supply chain practices.

China's ambitious environmental goals, like the 'Dual Carbon' targets, are significantly influencing ENN Natural Gas's operations, pushing for reduced emissions and a cleaner energy future. The company is actively investing in technologies such as hydrogen blending and carbon capture to meet these evolving regulatory demands and achieve its net-zero ambitions by 2050.

PESTLE Analysis Data Sources

Our ENN Natural Gas PESTLE Analysis is built on comprehensive data from government energy agencies, international financial institutions, and leading market research firms. We incorporate regulatory updates, economic forecasts, and technological advancements to provide a holistic view.