ENN Natural Gas(ENN NG ) Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ENN Natural Gas(ENN NG ) Bundle

Curious about ENN Natural Gas's (ENN NG) strategic positioning? Our BCG Matrix preview offers a glimpse into how its offerings stack up in the competitive energy landscape. Understand which segments are driving growth and which might require a closer look.

Don't stop at the preview! Unlock the full ENN NG BCG Matrix report for a comprehensive quadrant-by-quadrant analysis, complete with data-driven recommendations and actionable strategies. Gain the clarity needed to make informed investment and product decisions.

The complete BCG Matrix is your essential guide to navigating ENN NG's market presence. Purchase now to receive detailed insights, visual mapping, and strategic takeaways that will empower your business planning and drive competitive advantage.

Stars

Integrated Energy Solutions (IES) for ENN Natural Gas (ENN NG) is a clear Star in the BCG matrix. This segment is experiencing robust growth, evidenced by a 26.0% year-on-year sales volume increase in the first half of 2024.

ENN NG's IES business, offering a bundled package of gas, electricity, cooling, heating, and steam, is strategically aligned with China's push for cleaner and low-carbon energy solutions. This comprehensive approach positions ENN NG as a leader in a high-growth, strategically vital market with significant potential for further expansion and market share capture.

ENN's LNG Terminal and Trading Operations, centered around the Zhoushan LNG Terminal, are a clear star in its BCG portfolio. This terminal, the first privately owned large-scale LNG facility in China, is set for a Phase III expansion, slated for operation in Q4 2025, which will substantially boost its handling capacity. This strategic expansion, combined with a significant 15-year LNG Sale and Purchase Agreement inked with ADNOC in April 2025, positions ENN to capitalize on China's burgeoning LNG import demand, signaling robust growth potential.

The GreatGas.cn platform is a prime example of ENN's commitment to intelligence and low-carbon initiatives. In 2024, it facilitated a substantial 4.5 billion cubic meters of gas transactions, showcasing its role in optimizing resource flow. This digital transformation is a key driver for ENN's growth.

Urban Gas Expansion in Growing Regions

Urban Gas Expansion in Growing Regions represents a significant area for ENN Natural Gas (ENN NG) within the BCG matrix, likely positioned as a Star or a strong Cash Cow depending on market growth rates and ENN's market share.

Despite moderating overall natural gas consumption growth in China, ENN is actively expanding its urban gas projects. As of recent data, the company serves over 31 million residential customers and 270,000 industrial and commercial clients across 21 provinces.

This expansion is strategically focused on regions with robust urbanization and industrial development. ENN's extensive network and customer-centric strategies enable it to effectively capture new demand in these dynamic areas. For instance, in 2024, ENN continued to secure new urban gas distribution agreements, further solidifying its presence in high-growth corridors.

- Strategic Focus: ENN targets regions with high urbanization and industrial growth, ensuring demand capture.

- Customer Base: Serves over 31 million residential and 270,000 industrial/commercial clients across 21 provinces.

- Market Position: Maintains a strong market share in key growing areas due to its network and customer approach.

- Growth Driver: This segment contributes significantly to ENN's overall revenue and market presence in China.

Strategic International EPC Projects

ENN Natural Gas is actively pursuing large-scale international Engineering, Procurement, and Construction (EPC) projects. A prime example is their involvement in the LNG receiving terminal in northern Vietnam, a venture underscoring their expanding global reach.

The global oil and gas EPC market is experiencing robust growth, with projections indicating continued expansion. For instance, the market was valued at approximately USD 160 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 5% through 2030, presenting significant opportunities.

Securing projects like the Vietnamese LNG terminal demonstrates ENN's increasing expertise and strategic intent to gain substantial market share in international infrastructure development. This move signifies a deliberate expansion beyond their traditional domestic focus.

- Strategic International EPC Projects: ENN Natural Gas is making significant strides in international EPC ventures, exemplified by their participation in the northern Vietnam LNG receiving terminal.

- Market Growth Potential: The global oil and gas EPC market is poised for considerable growth, with an estimated market size of over USD 160 billion in 2023 and a projected CAGR of approximately 5% until 2030.

- Capability and Ambition: These landmark international projects highlight ENN's growing capabilities and ambition to capture a larger share of the high-growth international infrastructure development sector.

ENN's Integrated Energy Solutions (IES) are a clear Star, demonstrating impressive growth with a 26.0% year-on-year sales volume increase in the first half of 2024. This business segment aligns perfectly with China's clean energy initiatives, offering a comprehensive energy package that positions ENN as a leader in a high-growth market.

The Zhoushan LNG Terminal and associated trading operations are also a Star. The terminal's Phase III expansion, expected by Q4 2025, will significantly boost capacity. A 15-year LNG SPA with ADNOC, signed in April 2025, further solidifies ENN's ability to meet China's increasing LNG import needs.

GreatGas.cn, ENN's digital platform, is a Star, facilitating 4.5 billion cubic meters of gas transactions in 2024. This platform is crucial for optimizing resource flow and driving ENN's growth through digital transformation and low-carbon initiatives.

ENN's international EPC projects, such as the Vietnam LNG receiving terminal, represent a Star segment. The global oil and gas EPC market, valued at approximately USD 160 billion in 2023 and projected to grow at a 5% CAGR through 2030, offers substantial opportunities for ENN to expand its global footprint and market share.

| Segment | BCG Classification | Key Performance Indicators (2024/2025 Data) | Strategic Rationale |

| Integrated Energy Solutions (IES) | Star | 26.0% YoY sales volume growth (H1 2024) | Alignment with China's clean energy push; bundled energy services. |

| Zhoushan LNG Terminal & Trading | Star | Phase III expansion by Q4 2025; 15-year SPA with ADNOC (April 2025) | First privately owned large-scale LNG facility; capitalizing on China's LNG demand. |

| GreatGas.cn Platform | Star | 4.5 billion cubic meters gas transactions (2024) | Digital transformation; optimizing resource flow; low-carbon initiatives. |

| International EPC Projects | Star | Vietnam LNG terminal involvement; Global EPC market ~USD 160B (2023), 5% CAGR | Expanding global reach; capturing opportunities in growing international infrastructure development. |

What is included in the product

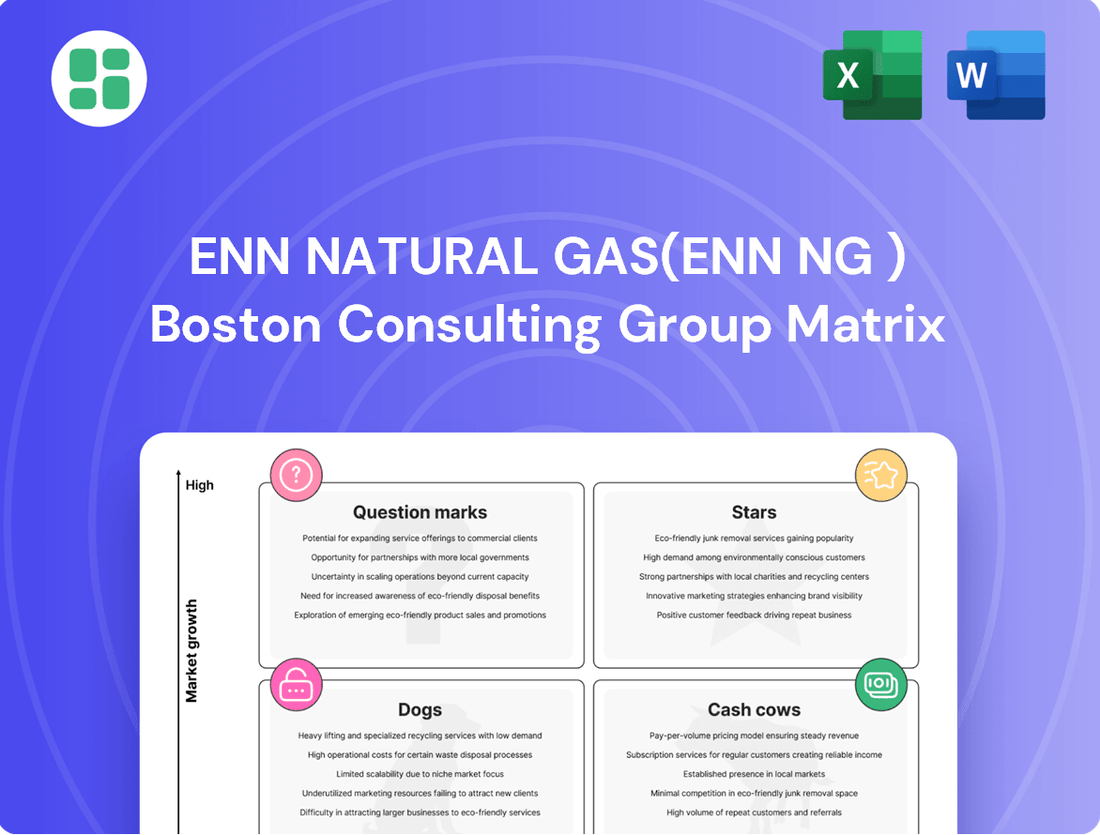

The ENN Natural Gas BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG Matrix for ENN Natural Gas visually clarifies which business units require investment (Stars) and which are cash cows, simplifying strategic resource allocation.

This BCG Matrix provides a concise overview, highlighting ENN Natural Gas's portfolio strengths and weaknesses to guide future investment decisions.

Cash Cows

ENN Natural Gas's established city gas distribution network is a classic cash cow. With 261 urban gas projects, it serves over 31 million households and 270,000 industrial/commercial clients, generating a predictable and substantial cash flow.

This segment operates in a mature market where demand is stable and ENN holds a significant market share. The existing infrastructure is well-established, meaning it requires minimal new investment for maintenance, allowing it to reliably generate profits.

Residential gas sales for ENN Natural Gas (ENN NG) represent a classic Cash Cow. This segment consistently delivers a gross profit margin exceeding 11%, a testament to its stability and essential nature.

The demand for natural gas in homes is inherently stable, bolstered by regulated pricing that ensures predictable revenue streams. ENN NG benefits from a substantial existing customer base, leading to predictable consumption patterns and robust, consistent cash flow generation.

This reliable income stream is vital for ENN NG's overall financial health, providing the necessary capital to invest in and support other business units within the company's portfolio.

Commercial and Industrial Gas Sales, a cornerstone of ENN Natural Gas's business, serves more than 270,000 industrial and commercial customers, highlighting its substantial market penetration. This segment, while experiencing a moderation in growth compared to earlier periods, continues to be a robust and mature market where ENN maintains a dominant presence.

The sheer volume of operations in this sector translates into a high market share for ENN NG, ensuring a steady and reliable generation of cash flow. Although its growth potential may not match that of newer ventures, the stability and established nature of these sales provide a dependable financial foundation for the company.

Traditional Gas Pipeline Infrastructure Services

ENN Natural Gas's traditional gas pipeline infrastructure services represent a classic cash cow. The company's extensive involvement in engineering, procurement, and construction (EPC) for existing gas networks generates a consistent and predictable revenue stream. This segment thrives on the ongoing need for maintenance, upgrades, and expansion of essential energy infrastructure.

These services operate within a mature market, but their necessity ensures continued demand. ENN NG's deep expertise and established track record have secured it a significant market share in this foundational area, making it a reliable source of cash flow for the company.

- Steady Revenue: ENN NG's EPC services for existing gas pipelines provide a stable income.

- Mature Market Necessity: The ongoing need for infrastructure maintenance and upgrades ensures consistent demand.

- High Market Share: ENN's expertise and long presence lead to a dominant position in this segment.

- Reliable Cash Generation: This business unit is a strong contributor to ENN's overall cash flow.

Upstream Resource Development (Mature Assets)

ENN Natural Gas's upstream resource development, particularly its mature natural gas assets, functions as a cash cow within its business portfolio. These established operations are characterized by their stable production and reliable cash generation, requiring minimal further investment for growth. This stability is crucial for funding other ventures and ensuring consistent profitability.

These mature upstream assets are pivotal for ENN NG, providing a secure and consistent supply of natural gas. In 2024, ENN NG continued to focus on optimizing production from these existing fields, ensuring operational efficiency. While not a primary growth engine, their contribution to consistent cash flow is substantial, underpinning the company's financial strength.

- Stable Production: Mature upstream assets ensure a predictable and consistent output of natural gas.

- Low Investment Needs: These operations generally require minimal capital expenditure for expansion, focusing instead on maintenance and efficiency.

- Consistent Cash Flow: They generate reliable cash flows that can be reinvested or used to support other business segments.

- Resource Security: Maintaining these assets guarantees a steady supply of natural gas, crucial for ENN NG's integrated business model.

ENN Natural Gas's established city gas distribution network, serving over 31 million households and 270,000 industrial/commercial clients, is a prime example of a cash cow. This segment operates in a mature market with stable demand, requiring minimal new investment for maintenance, thus generating predictable and substantial cash flow.

Residential gas sales, with a gross profit margin exceeding 11%, are a consistent performer. Regulated pricing and a large, stable customer base ensure predictable revenue streams and robust cash flow generation, vital for supporting other company ventures.

Commercial and industrial gas sales, while experiencing moderated growth, continue to be a mature market where ENN maintains a dominant presence. The sheer volume of operations ensures a steady and reliable cash flow, providing a dependable financial foundation.

Traditional gas pipeline EPC services also function as a cash cow, generating consistent revenue through ongoing maintenance and upgrades. ENN's expertise and established market share in this foundational area make it a reliable cash generator.

Mature upstream natural gas assets are critical cash cows, characterized by stable production and low investment needs. In 2024, ENN NG focused on optimizing these existing fields, ensuring operational efficiency and substantial, consistent cash flow contributions.

| Segment | Market Position | Growth Potential | Cash Flow Generation |

| City Gas Distribution | Dominant | Low | High & Stable |

| Residential Gas Sales | Strong | Low | Consistent & Predictable |

| Commercial & Industrial Gas Sales | Dominant | Moderate | Steady & Reliable |

| Pipeline EPC Services | Significant | Low | Consistent |

| Mature Upstream Assets | Established | Low | Substantial & Consistent |

What You’re Viewing Is Included

ENN Natural Gas(ENN NG ) BCG Matrix

The ENN Natural Gas BCG Matrix preview you are viewing is the identical, fully formatted report you will receive upon purchase, offering immediate strategic insights without any watermarks or demo content. This comprehensive analysis, meticulously prepared by industry experts, will be directly downloadable, allowing you to seamlessly integrate its findings into your business planning and decision-making processes. Rest assured, the clarity and depth of analysis presented here are exactly what you will obtain, empowering you with actionable intelligence for ENN Natural Gas's portfolio. This is not a mockup; it is the professional, ready-to-use BCG Matrix that will be yours to leverage immediately.

Dogs

Some of ENN Natural Gas's smaller or geographically isolated natural gas distribution projects might be classified as Dogs in the BCG Matrix. These ventures could be situated in regions with sluggish economic growth and subdued local demand, or they may contend with significant competitive pressures.

These specific projects likely hold a minimal market share and encounter difficulties in generating substantial profits, potentially draining company resources. For instance, in 2023, ENN Natural Gas reported a total revenue of approximately RMB 167.7 billion, but the profitability of these smaller, isolated projects might be disproportionately low compared to the overall scale.

ENN Natural Gas may have legacy ancillary services that are not keeping pace with industry changes. These might include older maintenance services for less efficient equipment or specialized offerings that have seen declining demand. For instance, if ENN NG still offers services related to older gas appliance repair that are being replaced by newer, more efficient models, this segment could be a prime example of an outdated ancillary service.

These are small, non-core investments that ENN Natural Gas (ENN NG) initiated but haven't seen much success in their low-growth areas. Think of them as experimental projects that didn't really take off or partnerships that didn't bring in much profit. For instance, ENN NG's foray into certain niche renewable energy components, while strategically diversified, has shown limited market penetration and minimal revenue contribution.

Less Profitable Wholesale Gas Trading (specific contracts)

Within ENN Natural Gas's portfolio, certain wholesale gas trading contracts, particularly those characterized by thin margins or significant price volatility without robust hedging strategies, are exhibiting signs of underperformance. These specific contracts, while part of the broader LNG trading Star, are not contributing as effectively to profitability.

The gross profit margin for ENN Natural Gas's wholesale business saw a substantial decline in 2024. This downturn suggests that these particular trading activities are facing challenges, potentially due to unfavorable market conditions or operational inefficiencies.

- Contract Profitability: Specific wholesale gas contracts are showing significantly reduced profit margins, impacting overall business performance.

- 2024 Margin Decline: The gross profit margin for the natural gas wholesale segment experienced a notable drop in 2024, highlighting issues within these operations.

- Strategic Contribution: If these low-margin activities lack a clear strategic benefit, they could be categorized as Question Marks or even Dogs within the BCG Matrix framework.

Inefficient Legacy Operations

ENN Natural Gas (ENN NG) likely has legacy operations that are characterized by significant operating costs and diminished efficiency. These older segments of the business, perhaps older pipeline infrastructure or processing facilities, may require substantial investment in maintenance and upgrades to meet current operational standards. Their contribution to ENN NG's overall market share and growth trajectory is likely minimal, making them candidates for strategic review.

For instance, if a particular gas distribution network in an established, less populated region has seen declining demand and requires costly modernization, it could be classified as a 'Dog'. Such an operation might have high maintenance expenditures relative to the revenue it generates. In 2023, ENN NG reported capital expenditures of ¥12.7 billion, a portion of which would have been allocated to maintaining its vast network, and it's plausible some of this went towards these less productive assets.

- High Operating Costs: Older facilities often incur higher energy consumption and require more frequent repairs, increasing their operational expenditure.

- Low Efficiency: Technologically outdated processes can lead to greater product loss or slower throughput compared to modern alternatives.

- Limited Market Share Contribution: These units may operate in mature or declining markets, offering little potential for expansion or increased market penetration.

- Strategic Review Needed: Management should consider divestiture, significant investment for modernization, or integration into more efficient operations to improve overall company performance.

Certain smaller, geographically isolated natural gas distribution projects within ENN Natural Gas's portfolio, particularly those in regions with low economic growth and subdued local demand, can be classified as Dogs. These ventures often possess a minimal market share and struggle to generate substantial profits, potentially draining company resources. For example, ENN NG's total revenue in 2023 was approximately RMB 167.7 billion, but the profitability of these isolated projects may be disproportionately low.

Legacy ancillary services that are not keeping pace with industry changes, such as outdated maintenance services for less efficient equipment, also fall into the Dog category. These offerings may have declining demand, like specialized repair services for older gas appliances being replaced by newer models. ENN NG's foray into certain niche renewable energy components, while strategically diversified, has shown limited market penetration and minimal revenue contribution, exemplifying such underperforming segments.

Wholesale gas trading contracts with thin margins or significant price volatility without robust hedging strategies are also exhibiting Dog-like characteristics. The gross profit margin for ENN Natural Gas's wholesale business saw a substantial decline in 2024, suggesting challenges within these specific trading activities due to unfavorable market conditions or operational inefficiencies.

| Segment Example | Market Growth | Relative Market Share | Profitability | Strategic Consideration |

|---|---|---|---|---|

| Isolated Gas Distribution Projects | Low | Low | Low/Negative | Divestment or Modernization |

| Legacy Ancillary Services | Declining | Low | Low | Phased Out or Repurposed |

| Low-Margin Wholesale Contracts | Volatile/Low | Low | Low | Renegotiation or Exit |

Question Marks

ENN Natural Gas is making strategic moves into hydrogen energy, a sector poised for significant growth as the world transitions to cleaner power sources. The company is actively developing hydrogen infrastructure, including the construction of hydrogen blending stations, signaling a commitment to integrating this fuel into its broader clean energy offerings. This positions ENN within a high-potential market, aligning with global decarbonization efforts.

Despite this promising outlook, ENN's current footprint in hydrogen production and distribution is likely modest. The hydrogen market, while growing, is still in its early stages, demanding substantial capital investment for ENN to scale its operations and capture meaningful market share. This nascent stage means profitability and widespread adoption remain uncertain, classifying hydrogen as a 'Question Mark' in the BCG matrix for ENN NG.

ENN Natural Gas is actively exploring biomass and other nascent renewable energy solutions as part of its broader decarbonization strategy. These emerging technologies, including photovoltaic and geothermal energy, are often integrated into IE micro-grids, positioning ENN to capitalize on high-growth markets driven by global sustainability trends.

While these sectors offer significant potential, ENN's current market share in these specific nascent renewable technologies is likely modest, reflecting the early stages of development and the substantial investment required in research and development. For instance, the global biomass energy market was valued at approximately $115 billion in 2023 and is projected to grow, but ENN's participation is still in its formative phase.

ENN's investment in advanced smart home gas monitoring and broader IoT ecosystems positions it within a high-growth sector, fueled by smart city development and increasing consumer desire for connected living. This strategic focus aims to weave technology into everyday routines, enhancing both safety and convenience. In 2024, the global smart home market was projected to reach over $150 billion, with IoT devices forming a significant portion of this growth.

International Integrated Energy Expansion (New Markets)

Expanding ENN Natural Gas's integrated energy solutions internationally, beyond projects like the Vietnam EPC initiative, presents a significant opportunity for high growth. However, this expansion also comes with considerable challenges, including low initial market share and substantial barriers to entry in new territories.

Successfully entering these new markets requires substantial capital investment and a sharp strategic focus. ENN NG will need to build a strong competitive presence and gain market traction, classifying these ventures as high-risk, high-reward opportunities.

- High Growth Potential: Emerging markets often exhibit robust demand for cleaner energy solutions, offering ENN NG avenues for significant revenue expansion.

- Market Entry Barriers: Navigating regulatory landscapes, establishing supply chains, and competing with established players in new countries pose considerable hurdles.

- Investment Requirements: Building infrastructure and securing partnerships for integrated energy projects internationally demands substantial upfront capital.

- Strategic Importance: A focused international strategy is crucial for ENN NG to diversify its revenue streams and mitigate risks associated with reliance on domestic markets.

Carbon Capture, Utilization, and Storage (CCUS) Initiatives

ENN Natural Gas's (ENN NG) potential involvement in Carbon Capture, Utilization, and Storage (CCUS) initiatives aligns with its broader decarbonization strategy and ambition to build a complete clean energy value chain. This sector represents a high-growth area, though it is still in its early stages of development.

While ENN NG has not explicitly detailed CCUS as a current core business segment in its recent financial reporting, the company's stated commitment to a 'green and low-carbon transition' strongly implies a strategic interest in future investments within this domain. The global CCUS market is projected to see significant expansion, with estimates suggesting it could reach hundreds of billions of dollars annually by 2030.

CCUS technologies require substantial capital investment and depend heavily on supportive regulatory frameworks to become economically viable. Given these factors – high growth potential coupled with current developmental challenges and capital intensity – CCUS initiatives would likely be classified as a 'Question Mark' within the BCG Matrix for ENN NG.

- Market Potential: The global CCUS market is expected to grow significantly, with some projections indicating a market size of over $100 billion by 2030.

- Strategic Alignment: ENN NG's stated focus on clean energy and decarbonization makes CCUS a logical, albeit nascent, area for future development.

- Investment Needs: CCUS projects are capital-intensive, requiring substantial upfront investment and ongoing operational expenditure.

- Regulatory Dependence: The success and scalability of CCUS technologies are heavily influenced by government policies, incentives, and carbon pricing mechanisms.

ENN Natural Gas's ventures into hydrogen and nascent renewable energy sectors like biomass and geothermal are classified as Question Marks due to their high growth potential but currently modest market share and significant investment requirements. These areas, while aligned with decarbonization trends and projected market growth, demand substantial capital for scaling operations and achieving profitability. For instance, the global smart home market, where ENN is investing in IoT, was projected to exceed $150 billion in 2024, highlighting the growth opportunity but also the competitive landscape ENN faces.

International expansion and Carbon Capture, Utilization, and Storage (CCUS) also fall into the Question Mark category for ENN NG. These initiatives offer substantial long-term growth prospects, but are hampered by high entry barriers, significant capital needs, and regulatory dependencies. The global CCUS market, for example, is anticipated to grow substantially, potentially reaching over $100 billion by 2030, yet ENN's participation is in its formative stages.

| Category | Market Growth Potential | Current Market Share | Investment Needs | BCG Classification |

| Hydrogen Energy | High | Modest | High | Question Mark |

| Biomass & Geothermal | High | Modest | High | Question Mark |

| Smart Home/IoT | High (>$150B projected in 2024) | Developing | Moderate to High | Question Mark |

| International Expansion | High | Low | Very High | Question Mark |

| CCUS | High (>$100B projected by 2030) | Nascent | Very High | Question Mark |

BCG Matrix Data Sources

Our ENN Natural Gas BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.