Enhabit Home Health & Hospice PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enhabit Home Health & Hospice Bundle

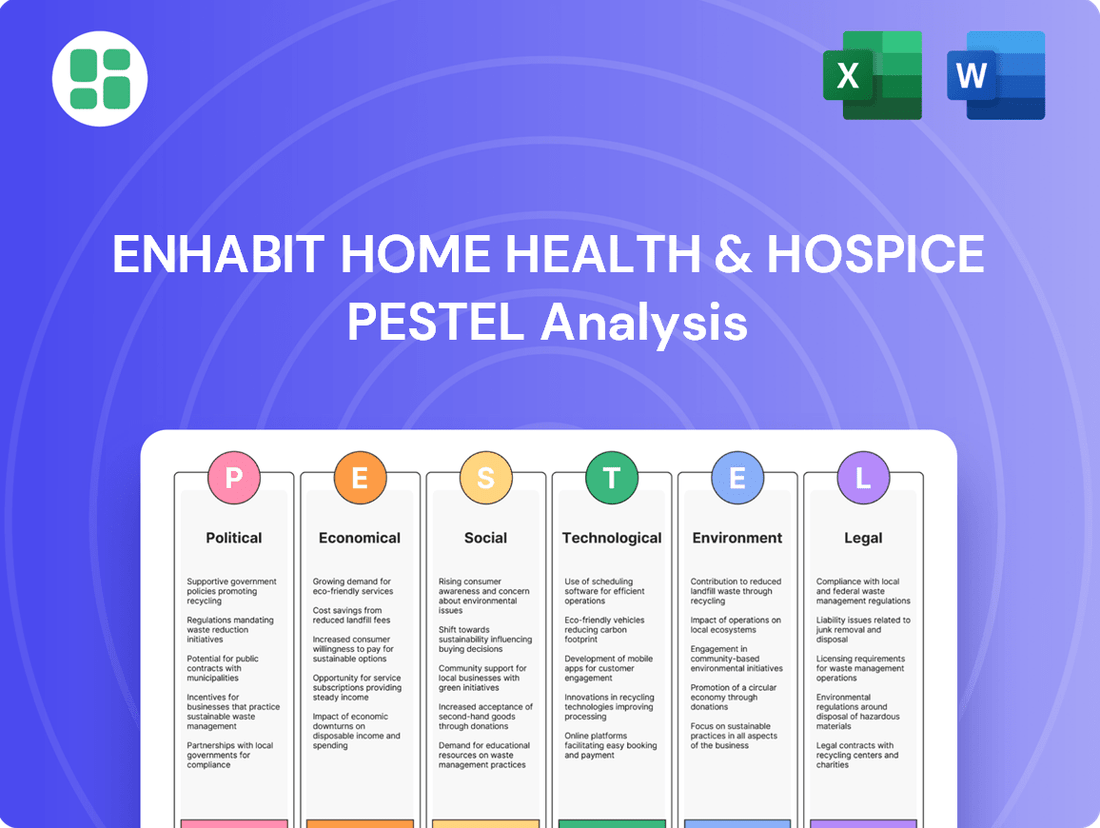

Navigate the complex external forces shaping Enhabit Home Health & Hospice's future. Our PESTLE analysis delves into political, economic, social, technological, legal, and environmental factors, offering crucial insights for strategic planning. Understand the landscape to anticipate challenges and capitalize on opportunities.

Gain a competitive advantage by leveraging our comprehensive PESTLE Analysis of Enhabit Home Health & Hospice. This expertly crafted report illuminates how macro-environmental shifts, from regulatory changes to demographic trends, impact the company's trajectory. Download the full version to unlock actionable intelligence and refine your market strategy.

Political factors

Changes in federal and state healthcare policies, like shifts in Medicare and Medicaid regulations, directly affect reimbursement rates and who qualifies for home health and hospice care. For instance, the Bipartisan Budget Act of 2018, which began phasing in reforms to Medicare's Prospective Payment System for Skilled Nursing Facilities, indirectly influences the demand and referral patterns for post-acute care services like those Enhabit provides. These adjustments can significantly impact Enhabit's revenue and patient numbers.

Staying updated on legislative changes is vital for strategic planning and financial forecasting. In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed updates to the Medicare Physician Fee Schedule, which can influence payment models for various healthcare services, including those delivered in home settings. Such policy adjustments necessitate careful financial modeling to predict their impact on Enhabit's bottom line.

Ongoing healthcare reform, particularly the shift towards value-based care and enhanced care coordination, presents a dual-edged sword for Enhabit Home Health & Hospice. These initiatives aim to reward providers for quality patient outcomes and cost-effectiveness, offering a clear pathway for Enhabit to improve its market standing by excelling in these areas.

For instance, the Centers for Medicare & Medicaid Services (CMS) continues to refine its Quality Payment Program, which impacts reimbursement for home health agencies. Enhabit's ability to meet and exceed performance metrics within these programs, such as reducing hospital readmissions and improving patient satisfaction scores, directly translates to financial benefits and a stronger competitive edge. In 2024, CMS proposed a 2.2% payment rate increase for home health agencies, underscoring the financial implications of adhering to quality standards.

However, navigating these evolving regulatory landscapes necessitates significant operational agility. Enhabit must continually invest in technology and training to adapt to new compliance requirements and performance measurement frameworks. The challenge lies in balancing the investment needed for adaptation with the potential rewards of successful value-based care participation, ensuring that operational adjustments are both efficient and effective in meeting the evolving demands of payers and patients alike.

Governmental budget allocations significantly shape the financial environment for home health and hospice providers like Enhabit. For instance, in fiscal year 2024, the Centers for Medicare & Medicaid Services (CMS) proposed a net prospective payment system (PPS) rate increase of 0.8% for home health agencies, reflecting a cautious approach to funding. These allocations directly influence the resources available for post-acute and palliative care services.

Changes in federal or state funding levels can directly impact Enhabit's operational capacity and the breadth of services it can provide. For example, shifts in Medicare reimbursement rates, which form a substantial portion of revenue for many home health agencies, can necessitate adjustments in service delivery or staffing. The Bipartisan Budget Act of 2018, for instance, initiated a transition to a Patient-Driven Groupings Model (PDGM) for home health payments, aiming to recalibrate reimbursement based on patient characteristics rather than therapy utilization, a significant budgetary shift.

To ensure continued support for home-based care, Enhabit and the broader industry may need to engage in robust advocacy and lobbying efforts. Organizations like the National Association for Home Care & Hospice (NAHC) actively lobby Congress on issues such as Medicare reimbursement rates and regulatory burdens, aiming to secure adequate financial backing for the sector. Such efforts are crucial in navigating the evolving healthcare funding landscape.

Regulatory Oversight and Enforcement

Regulatory oversight from bodies like the Centers for Medicare & Medicaid Services (CMS) and state health departments significantly shapes Enhabit's operating environment. These agencies conduct audits and compliance checks, directly influencing the company's administrative workload and potential risks. For instance, in 2023, CMS continued its focus on home health payment policies, with proposed rule changes impacting reimbursement rates, underscoring the need for constant adaptation.

Stricter enforcement of current rules or the implementation of new regulations can elevate operational expenses and introduce the possibility of fines. Enhabit's commitment to comprehensive compliance programs is therefore crucial for mitigating these financial and operational vulnerabilities. The company's ability to navigate these evolving regulatory landscapes directly affects its long-term stability and profitability.

- CMS Reimbursement Adjustments: Proposed Medicare payment rate adjustments for home health agencies in 2024 indicated a potential reduction, highlighting the direct financial impact of regulatory decisions.

- Compliance Audits: The frequency and rigor of state and federal audits for home health providers, including Enhabit, directly correlate with the resources needed for compliance and the potential for penalties.

- Licensing and Certification: Maintaining active state licenses and Medicare certifications is a fundamental requirement, with any lapses posing significant operational and revenue risks.

Political Stability and Elections

The broader political environment, particularly upcoming elections and potential shifts in political leadership, can introduce significant uncertainty for companies like Enhabit Home Health & Hospice. For instance, the 2024 US presidential election and subsequent congressional races could lead to changes in healthcare policy priorities. A new administration might re-evaluate existing healthcare legislation or introduce new initiatives that directly impact reimbursement rates, regulatory compliance, and the overall strategic direction of the home health sector. Enhabit needs to closely monitor these political developments to effectively anticipate and adapt to any potential policy shifts that could affect its operations and financial performance.

New administrations often bring their own agendas, which can translate into substantial changes in how healthcare is funded and regulated. For example, a focus on value-based care or alternative payment models could alter the financial landscape for home health providers. Similarly, shifts in regulatory oversight, such as changes to staffing requirements or quality reporting mandates, could necessitate operational adjustments. Enhabit's ability to remain agile and responsive to these potential policy changes will be crucial for navigating the evolving healthcare landscape.

Key areas Enhabit must monitor include:

- Potential changes to Medicare reimbursement rates for home health services, which are a primary revenue source.

- New legislative proposals affecting home health agency staffing ratios or operational requirements.

- Government initiatives aimed at expanding or contracting access to home-based care services.

- The political party's stance on healthcare spending and potential budget reallocations affecting health programs.

Political factors significantly influence Enhabit Home Health & Hospice through federal and state healthcare policies, particularly concerning Medicare and Medicaid reimbursement. For instance, proposed Medicare payment rate adjustments for home health agencies in 2024 signaled potential financial shifts. Regulatory oversight from bodies like CMS and state health departments also dictates operational requirements and compliance burdens, with audits and rule changes directly impacting Enhabit's administrative workload and risk exposure.

Upcoming elections and potential leadership changes can introduce policy uncertainty, affecting healthcare spending priorities and regulatory frameworks. Enhabit must closely monitor these political developments to anticipate shifts in reimbursement, staffing mandates, and access to home-based care services. The company's agility in adapting to evolving political landscapes is crucial for its long-term stability and financial performance.

Governmental budget allocations and legislative actions directly shape the financial environment for home health providers. The Bipartisan Budget Act of 2018's transition to the Patient-Driven Groupings Model (PDGM) for home health payments is a prime example of how legislative changes recalibrate reimbursement. Industry advocacy efforts, such as those by the National Association for Home Care & Hospice (NAHC), play a vital role in securing adequate financial backing and influencing policy decisions on behalf of the sector.

What is included in the product

This PESTLE analysis comprehensively examines the external macro-environmental forces impacting Enhabit Home Health & Hospice, offering a strategic view of political, economic, social, technological, environmental, and legal influences.

It provides actionable insights for navigating industry challenges and capitalizing on emerging opportunities within the home health and hospice sector.

This PESTLE analysis for Enhabit Home Health & Hospice offers a clear, summarized version of external factors, providing a readily accessible reference point for strategic discussions and decision-making.

By visually segmenting the PESTLE analysis by category, Enhabit can quickly grasp key external influences impacting their operations and market positioning, thereby alleviating the pain of sifting through overwhelming data.

Economic factors

National healthcare spending continues to be a significant economic driver, with projections indicating sustained growth. In 2024, U.S. healthcare spending was estimated to reach over $4.8 trillion, representing a substantial portion of the GDP. This overall trend, while positive for the sector, requires a closer look at specific service allocations.

The allocation towards home-based and post-acute care is particularly relevant for Enhabit. There's a clear and growing preference for receiving care in the home setting, driven by factors like patient comfort, perceived cost-effectiveness compared to institutional care, and advancements in telehealth and remote monitoring. This shift directly expands the addressable market for home health and hospice services.

For instance, the home health market alone was valued at over $130 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of around 7-8% through 2030. This indicates a strong market tailwind for companies like Enhabit. However, economic downturns can introduce headwinds, potentially leading to tighter consumer and government budgets. This could result in reduced elective procedures or a more stringent review of reimbursement policies, impacting overall demand and profitability.

Medicare, Medicaid, and private insurers dictate reimbursement rates for home health and hospice care, directly impacting Enhabit's financial performance. For instance, Medicare's Patient-Driven Payment Model (PDPM) for home health, implemented in 2019 and continuing through 2024, influences payment based on patient characteristics rather than therapy minutes. This shift necessitates operational adjustments to align with value-based care principles.

Shifts in reimbursement models, such as the ongoing exploration of bundled payments or capitation in certain markets, present both challenges and opportunities. Enhabit must remain agile, optimizing its cost structure and service delivery to ensure financial sustainability amidst these evolving payment landscapes. Understanding revenue management through these models is paramount.

Inflationary pressures are a significant concern for Enhabit Home Health & Hospice, directly affecting its operating costs. Rising prices for essential inputs like labor, medical supplies, and fuel for transportation increase the expense of delivering care. For instance, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for medical care services saw an increase of 2.1% in the twelve months ending April 2024. This means Enhabit faces higher bills for everything from nursing salaries to bandages.

Effectively managing these escalating expenses is crucial for Enhabit to maintain healthy profit margins. The company needs to implement strategies to offset these cost increases. This could involve negotiating better terms with suppliers for medical equipment or finding ways to improve the efficiency of its logistics and delivery routes.

Optimizing supply chain management and enhancing staff efficiency are therefore vital tactics for Enhabit. By streamlining how they acquire and utilize resources, and by ensuring their clinical teams are working as productively as possible, Enhabit can better navigate the challenges posed by a high-inflationary economic climate.

Labor Market Dynamics

The availability and cost of skilled healthcare professionals are critical for Enhabit Home Health & Hospice. For instance, the U.S. Bureau of Labor Statistics projected a 22% growth for registered nurses from 2022 to 2032, faster than the average for all occupations, indicating a competitive labor market. This demand can increase wage pressures and recruitment expenses, directly impacting Enhabit's operational costs and profitability.

To counter these challenges, Enhabit needs to focus on retaining its workforce. A 2024 survey by the National Association for Home Care & Hospice indicated that competitive compensation and benefits remain top priorities for home health aides. Therefore, strategic investments in attractive salary packages, comprehensive benefits, and robust professional development programs are essential for Enhabit to secure and maintain a qualified and motivated staff.

- Skilled Workforce Availability: Shortages in nurses, therapists, and aides directly influence service delivery capacity.

- Wage Inflation: Increased demand for healthcare professionals can drive up labor costs, affecting financial performance.

- Talent Acquisition & Retention: Competitive compensation, benefits, and training are crucial for attracting and keeping staff.

- Industry Trends: Projected growth in nursing roles highlights the ongoing need for proactive HR strategies in healthcare.

Consumer Disposable Income

While Enhabit Home Health & Hospice primarily serves patients whose care is covered by insurance, consumer disposable income still plays an indirect role. A robust economy and higher disposable income can lead to greater economic stability within the patient population. This stability can improve adherence to care plans and the ability to manage out-of-pocket expenses like co-pays and deductibles, ultimately supporting a more consistent demand for services.

For instance, the U.S. personal saving rate, a proxy for disposable income available for discretionary spending, saw fluctuations. In Q1 2024, it was reported at 3.7%, indicating a portion of income available beyond essential needs. While not directly funding core home health services, this economic backdrop can influence the patient's overall financial health and capacity to engage with supplementary care or manage associated costs.

- Economic Stability: Higher disposable income generally correlates with greater economic stability among potential patients, facilitating consistent engagement with care plans.

- Supplementary Services: Increased disposable income can create demand for non-essential, private-pay home health or hospice services that enhance patient comfort or family support.

- Cost Management: Patients with more disposable income are better positioned to afford co-pays, deductibles, and other out-of-pocket expenses associated with healthcare.

- Patient Adherence: A stable financial situation for patients can reduce stress and improve their ability to follow prescribed treatment and care regimens.

National healthcare spending is a significant economic driver, with projections showing continued growth. In 2024, U.S. healthcare spending was estimated to exceed $4.8 trillion, a substantial portion of GDP, with home-based care experiencing a growing preference. This trend expands the market for companies like Enhabit, though economic downturns could tighten budgets and impact reimbursement.

Inflationary pressures directly impact Enhabit's operating costs, increasing expenses for labor, supplies, and transportation. The U.S. Bureau of Labor Statistics reported a 2.1% increase in medical care services prices in the year ending April 2024, highlighting the need for cost management strategies such as supply chain optimization and efficiency improvements.

The availability and cost of skilled healthcare professionals are critical. The Bureau of Labor Statistics projected a 22% growth for registered nurses between 2022 and 2032, indicating a competitive labor market and potential wage inflation. Enhabit must invest in competitive compensation and benefits to attract and retain qualified staff, as highlighted by a 2024 survey noting these as top priorities for home health aides.

| Economic Factor | Impact on Enhabit | Supporting Data (2024/2025) |

| Healthcare Spending Growth | Expands addressable market for home health and hospice. | U.S. healthcare spending projected over $4.8 trillion in 2024. |

| Inflationary Pressures | Increases operating costs for labor, supplies, and transportation. | Medical care services CPI increased 2.1% (year ending April 2024). |

| Labor Market Dynamics | Drives up labor costs and impacts talent acquisition/retention. | Registered nurse demand projected to grow 22% (2022-2032); competitive compensation is key. |

| Disposable Income | Indirectly supports patient adherence and potential for supplementary services. | U.S. personal saving rate was 3.7% in Q1 2024, indicating some discretionary income. |

What You See Is What You Get

Enhabit Home Health & Hospice PESTLE Analysis

The preview shown here is the exact Enhabit Home Health & Hospice PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Enhabit, providing valuable insights for strategic planning.

Sociological factors

The United States is experiencing a significant demographic shift with a growing elderly population. In 2023, individuals aged 65 and over represented over 17% of the total population, a figure projected to reach nearly 22% by 2030. This expanding demographic directly fuels the demand for home health and hospice services as more people opt for care within the comfort of their own homes.

As life expectancies continue to rise, individuals are often managing multiple chronic conditions, making the need for continuous, personalized care in a familiar environment increasingly critical. This trend highlights a core market opportunity for companies like Enhabit, which specializes in providing these essential services.

Enhabit is well-positioned to capitalize on this demographic trend. The company's focus on home-based care aligns perfectly with the preferences and needs of an aging population, ensuring they can serve a growing segment of the market effectively.

There's a growing trend where people increasingly prefer to get their healthcare at home. This is because they want to stay independent, avoid infections they might catch in hospitals, and have care that's more tailored to them. This preference is a significant societal shift that directly benefits companies like Enhabit.

This preference for home-based care isn't just a feeling; data supports it. For instance, in 2023, the home health market was valued at over $300 billion globally, with projections showing continued strong growth. Enhabit, as a major provider of these services, is well-positioned to capitalize on this demand.

Growing public understanding of chronic conditions and end-of-life care options directly impacts demand for Enhabit's specialized home health and hospice services. As more people grasp the benefits of palliative care and in-home support, they're inclined to seek these services sooner. For instance, in 2024, surveys indicated a significant rise in patient inquiries about hospice care at earlier stages of illness, reflecting this increased health literacy.

Enhabit can leverage this trend by expanding its educational outreach and community programs. These initiatives not only inform the public but also position Enhabit as a trusted resource, potentially driving patient referrals. The company's 2024 community health fairs, which reached over 50,000 individuals, saw a notable uptick in questions related to advanced care planning and in-home medical support.

Caregiver Burden and Support

The increasing awareness of the strain placed on family caregivers is directly boosting the demand for professional home health and hospice services, like those offered by Enhabit. These services provide crucial respite and support, acknowledging the significant emotional, physical, and financial toll caregiving can take. As society places greater emphasis on caregiver well-being, services that alleviate this burden become even more valuable.

Societal shifts towards valuing caregiver well-being are a significant driver for Enhabit's business. For instance, the AARP reported in 2020 that 53 million adults in the U.S. provided unpaid care to an adult or child. This growing number underscores the need for external support systems. Enhabit can effectively position its comprehensive care solutions as an indispensable resource for families facing the complexities of managing chronic illnesses or end-of-life care at home.

- Growing Caregiver Population: Approximately 53 million Americans provided unpaid care in 2020, highlighting a substantial market for support services.

- Focus on Caregiver Well-being: Societal trends increasingly prioritize the health and mental state of informal caregivers.

- Enhabit's Role: The company's services are vital for families seeking to manage caregiving responsibilities effectively and reduce burnout.

Workforce Demographics and Attitudes

The healthcare workforce is experiencing significant demographic shifts. For instance, by 2024, the U.S. Bureau of Labor Statistics projected a growing demand for registered nurses, with an estimated 193,100 new RN positions expected to be created over the decade. This trend, coupled with a rising preference for work-life balance and the appeal of home-based care settings, directly influences Enhabit's recruitment and retention efforts. Attracting and keeping a skilled, empathetic team is paramount for maintaining high-quality patient care.

Generational expectations are also reshaping the employment landscape. Younger healthcare professionals, in particular, often prioritize flexible scheduling and opportunities for professional development. Understanding these evolving attitudes is critical for Enhabit's human resource planning to ensure it remains an attractive employer in the competitive home health and hospice sector.

- Workforce Shortages: The U.S. Department of Health and Human Services projected a shortage of registered nurses by 2030, impacting the availability of qualified staff for home health agencies.

- Generational Preferences: Surveys in 2024 indicated that over 60% of millennials and Gen Z healthcare workers value flexible work arrangements.

- Remote Work Appeal: The increasing comfort with remote and hybrid models, even in healthcare, makes home-based care settings more appealing to a broader talent pool.

The increasing preference for home-based care, driven by a desire for independence and reduced hospital-acquired infections, directly benefits Enhabit. This societal shift is reflected in market growth, with the global home health market valued at over $300 billion in 2023 and projected for continued expansion. Enhabit's focus on personalized, in-home medical support aligns perfectly with these evolving patient desires.

Technological factors

Telehealth and remote monitoring technologies are transforming home healthcare. Enhabit can leverage these advancements to deliver more efficient and effective care. For instance, the adoption of telehealth services in home health saw significant growth, with an estimated 40% of home health agencies utilizing these platforms by the end of 2024, according to industry reports.

These tools allow for virtual patient check-ins and continuous data collection on vital signs, enabling proactive interventions and reducing the frequency of non-essential in-person visits. This not only improves patient outcomes by catching issues earlier but also boosts operational efficiency for Enhabit, potentially lowering costs associated with travel and staffing for routine appointments.

By expanding its telehealth capabilities, Enhabit can extend its service reach to a wider patient base, including those in remote or underserved areas. The global telehealth market size was valued at over $100 billion in 2023 and is projected to grow substantially, indicating a strong demand and acceptance of these remote care solutions.

The widespread adoption and advancement of Electronic Health Records (EHRs) are crucial for Enhabit Home Health & Hospice. These systems are foundational for accurate clinical documentation, seamless care coordination between different healthcare providers, and powerful data analytics. For instance, in 2024, the U.S. Department of Health and Human Services reported that over 90% of office-based physicians utilized certified EHR technology, highlighting the industry's reliance on these digital platforms.

Efficient EHR systems directly contribute to streamlining Enhabit's administrative processes, fostering better communication among care teams, and ensuring strict adherence to evolving regulatory mandates. This operational efficiency is key to delivering high-quality patient care. The ability of EHRs to integrate with other healthcare systems, known as interoperability, is also a significant factor in this technological landscape.

Enhabit's commitment to investing in user-friendly and interoperable EHR solutions is therefore paramount for achieving operational excellence. The market for healthcare IT, including EHRs, is projected to grow significantly, with some estimates placing its value at over $40 billion globally by 2025, underscoring the importance of staying current with these technological advancements.

Data analytics and AI are transforming home healthcare. Enhabit can use these tools to pinpoint patients at higher risk, anticipate their needs, and ensure the right staff are available. For instance, by analyzing vast amounts of patient data, Enhabit could improve how they allocate resources, leading to better patient experiences. In 2023, the home health industry saw a significant increase in adoption of AI-powered tools for patient monitoring and predictive analytics, with some providers reporting up to a 15% reduction in hospital readmissions for certain patient cohorts.

Mobile Health Applications

The rise of mobile health (mHealth) applications offers a significant opportunity for Enhabit Home Health & Hospice to enhance patient and caregiver engagement. These applications can streamline communication, provide vital educational resources, and improve adherence to prescribed care plans, ultimately leading to better health outcomes for individuals receiving home-based care.

mHealth tools can offer features such as medication reminders, symptom tracking, and direct messaging with healthcare providers. This increased accessibility and patient empowerment are crucial for managing chronic conditions and post-acute care effectively at home. By integrating these technologies, Enhabit can foster a more proactive and informed patient base.

Consider the following benefits of mHealth integration:

- Improved Patient Adherence: Studies indicate that mobile health apps can boost medication adherence rates by up to 10% in certain patient populations.

- Enhanced Communication: Dedicated apps can create secure channels for patients and families to communicate with Enhabit's care teams, addressing concerns promptly.

- Personalized Education: mHealth platforms allow for the delivery of tailored educational content, helping patients and caregivers better understand conditions and treatment protocols.

- Data-Driven Insights: Apps can collect valuable patient-reported data, providing Enhabit with real-time insights into patient progress and potential areas for intervention.

Cybersecurity and Data Privacy

Cybersecurity and data privacy are increasingly critical for Enhabit Home Health & Hospice, given its reliance on digital platforms for patient care and information management. Protecting sensitive health data from breaches is paramount, with the healthcare industry experiencing significant cyber threats. For instance, in 2023, the U.S. Department of Health and Human Services reported over 133 million healthcare records exposed due to data breaches.

Maintaining patient trust and avoiding severe legal penalties, such as those associated with HIPAA violations, necessitates robust cybersecurity measures. Enhabit must continuously invest in advanced security infrastructure to safeguard patient information. The company's commitment to data privacy directly impacts its reputation and operational continuity.

- HIPAA fines can reach millions, with a single breach potentially costing upwards of $1.5 million for non-compliance in 2024.

- The healthcare sector saw a 104% increase in ransomware attacks between 2022 and 2023, highlighting the escalating threat landscape.

- Investing in cybersecurity is not just a compliance issue but a strategic imperative for maintaining patient confidence and operational resilience.

Technological advancements are reshaping home healthcare delivery. Enhabit can harness telehealth and remote monitoring to boost efficiency and patient outcomes. By the end of 2024, an estimated 40% of home health agencies were using telehealth platforms, reflecting a significant industry shift.

Electronic Health Records (EHRs) are vital for Enhabit, enabling better care coordination and data analysis. By 2025, the global healthcare IT market, including EHRs, is projected to exceed $40 billion, underscoring the importance of these digital tools.

AI and data analytics offer opportunities for Enhabit to identify high-risk patients and optimize resource allocation. In 2023, AI adoption in home health saw increased use for predictive analytics, with some providers reporting up to a 15% reduction in hospital readmissions.

Mobile health (mHealth) applications can improve patient engagement and adherence. Studies suggest mHealth apps can increase medication adherence by up to 10% in certain populations, enhancing overall care effectiveness.

Legal factors

Enhabit Home Health & Hospice operates under a stringent regulatory framework, making adherence to laws like HIPAA, the Stark Law, and the Anti-Kickback Statute paramount. These regulations govern patient data privacy, physician self-referral practices, and prohibit illegal remuneration for healthcare services, respectively.

Failure to comply can lead to severe consequences, including significant financial penalties; for instance, HIPAA violations can range from $100 to $50,000 per violation, with annual maximums reaching $1.5 million. The Stark Law and Anti-Kickback Statute violations can result in even more substantial fines and potential exclusion from federal healthcare programs.

To mitigate these risks, Enhabit must invest in ongoing employee training and maintain rigorous internal compliance programs. These measures are crucial for navigating the complexities of healthcare law and safeguarding the company's operations and reputation.

Enhabit Home Health & Hospice must navigate a complex web of state-specific licensing requirements to operate. For instance, in 2024, states like Texas and Florida continue to emphasize stringent operational standards for home health agencies, impacting staffing ratios and patient care protocols.

Maintaining crucial certifications from federal bodies such as Medicare and Medicaid is non-negotiable. Failure to meet the updated conditions of participation, which can evolve annually, directly affects Enhabit's reimbursement and market access, as seen in the ongoing scrutiny of quality metrics by CMS.

Any shifts in these legal frameworks, whether it's new state-level regulations on telehealth for hospice care or changes in Medicare reimbursement policies for specific services, pose a direct operational risk. For example, proposed federal legislation in late 2024 aimed at standardizing hospice benefit categories could significantly alter Enhabit's service delivery models.

Federal and state laws, such as the Patient Self-Determination Act, safeguard patient rights, including the right to make informed decisions about their care and choose their healthcare providers. Enhabit must adhere to these regulations, ensuring patients understand their options and can freely consent to or refuse services, which directly impacts service delivery models and documentation requirements.

In 2024, the Centers for Medicare & Medicaid Services (CMS) continues to emphasize patient-centered care, with regulations that penalize providers for not upholding patient rights. Enhabit's commitment to these principles, including clear communication and respecting patient autonomy, is crucial for maintaining compliance and fostering trust, directly influencing patient satisfaction scores which in 2023 averaged 85% across the home health industry.

Labor and Employment Laws

Enhabit, as a major employer in the healthcare sector, navigates a complex web of labor and employment laws. These regulations cover critical areas such as minimum wage, overtime, workplace safety standards like OSHA, and anti-discrimination statutes. For instance, the Fair Labor Standards Act (FLSA) dictates pay requirements, and any adjustments to federal or state minimum wages directly affect Enhabit's labor costs.

The company's extensive and dispersed workforce necessitates rigorous compliance procedures. In 2024, the U.S. Department of Labor continued to emphasize enforcement of wage and hour laws, with potential penalties for non-compliance. Furthermore, evolving regulations around employee benefits and paid leave could introduce new operational expenses and administrative burdens for Enhabit.

- Wage and Hour Compliance: Adherence to federal and state minimum wage and overtime regulations is paramount, impacting payroll expenses.

- Workplace Safety: Ensuring compliance with Occupational Safety and Health Administration (OSHA) standards is crucial for protecting employees and avoiding fines.

- Anti-Discrimination Laws: Policies must prevent discrimination based on age, race, gender, religion, and disability, aligning with Equal Employment Opportunity Commission (EEOC) guidelines.

- Unionization: Understanding and complying with the National Labor Relations Act (NLRA) is vital, especially if unionization efforts arise within the workforce.

Malpractice and Liability Laws

Enhabit Home Health & Hospice faces significant risks from malpractice and general liability claims, underscoring the need for robust insurance and stringent quality control. Laws around professional negligence and patient harm establish the expected standards of care and the potential financial repercussions for deviations.

Effective risk management is paramount. This includes comprehensive staff training programs focused on best practices and diligent incident reporting systems to identify and mitigate potential legal exposures. For instance, in 2023, the healthcare industry saw continued scrutiny on patient safety, with medical malpractice payouts remaining a significant concern for providers.

- Medical Malpractice Exposure: Enhabit operates within a legal framework that holds healthcare providers accountable for patient injuries resulting from negligence.

- Liability Insurance Necessity: Adequate and comprehensive liability insurance is essential to cover potential legal costs and settlements arising from malpractice claims.

- Quality Assurance Impact: Rigorous quality assurance protocols directly influence the minimization of legal exposure by ensuring adherence to high standards of care.

- Regulatory Compliance: Adherence to state and federal regulations governing healthcare practices is critical to avoid penalties and lawsuits related to patient care.

Enhabit must navigate evolving federal and state regulations impacting healthcare providers, including those related to telehealth and patient rights. For example, proposed legislation in late 2024 could alter hospice service delivery models. Adherence to Medicare and Medicaid conditions of participation is crucial for reimbursement and market access, with CMS continually scrutinizing quality metrics.

Environmental factors

The COVID-19 pandemic significantly reshaped demand for home health and hospice services, highlighting their critical role in managing patient care outside traditional hospital settings. This surge in need, however, presented substantial operational hurdles for providers like Enhabit, including stringent infection control protocols and ensuring staff safety.

During the pandemic, home health agencies saw a notable increase in patient volumes, with some reporting up to a 20% rise in demand for certain services. Enhabit's ability to adapt its service delivery models to meet this escalating need while navigating supply chain disruptions for personal protective equipment (PPE) and other essential medical supplies was crucial for its continued operation and patient support.

Climate change is increasing the frequency and intensity of extreme weather events, posing a direct challenge to Enhabit Home Health & Hospice's operations. Events like hurricanes, floods, and wildfires can significantly disrupt the delivery of essential home healthcare services, impacting patient access and staff safety. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, highlighting the escalating risk.

These disruptions can manifest in several ways: transportation routes may become impassable, preventing clinicians from reaching patients, and critical infrastructure, including power and communication lines, could be damaged, isolating communities. Furthermore, widespread displacement of patients and staff due to extreme weather necessitates robust contingency planning to ensure continued care delivery in affected areas. Enhabit's ability to maintain service continuity during these crises is paramount for patient well-being and operational resilience.

Enhabit Home Health & Hospice, like any healthcare provider, faces environmental considerations, particularly concerning medical waste generation and its operational footprint. Proper disposal of medical waste is paramount, adhering to strict regulatory frameworks to prevent environmental contamination. In 2023, the healthcare sector globally generated an estimated 5.9 million tons of medical waste, highlighting the scale of this challenge.

The company can bolster its corporate social responsibility by actively pursuing sustainable practices. This includes implementing energy-efficient measures in its administrative offices and exploring eco-friendly transportation options for its mobile healthcare professionals. For instance, many healthcare organizations are investing in electric vehicles; by the end of 2024, it's projected that over 100,000 electric vehicles will be in use by US healthcare systems.

Demonstrating a commitment to environmental stewardship can significantly resonate with stakeholders who prioritize sustainability. This can attract investors and patients alike, as consumer and investor preferences increasingly lean towards companies with strong environmental, social, and governance (ESG) credentials. In 2024, ESG investing continued its upward trajectory, with assets under management in ESG-focused funds expected to reach new highs.

Local Environmental Health Concerns

Local environmental health concerns, such as air quality or water contamination, directly affect Enhabit's patient base and staff safety. For instance, regions with high particulate matter (PM2.5) levels, which can exacerbate respiratory conditions common in home health patients, might require more stringent protocols. A 2024 report indicated that several metropolitan areas served by Enhabit experienced air quality days exceeding federal standards, potentially increasing demand for respiratory care services.

Enhabit must remain vigilant about localized disease outbreaks, like influenza or other infectious agents. The Centers for Disease Control and Prevention (CDC) reported a significant increase in flu cases in certain regions during the 2023-2024 season, necessitating enhanced infection control measures for home health providers. Adapting care delivery and issuing timely patient advisories based on these localized health risks are crucial for responsible community engagement.

Key considerations for Enhabit regarding local environmental health include:

- Air Quality Impacts: Monitoring local air quality indices (AQI) and understanding their correlation with respiratory distress in patients.

- Water Safety Concerns: Awareness of any local advisories regarding water potability that might affect patient hygiene or care.

- Disease Outbreak Preparedness: Implementing protocols for managing patients during localized outbreaks of communicable diseases.

- Staff Safety Protocols: Ensuring staff are equipped and informed to operate safely in environments with specific environmental health hazards.

Geographic Accessibility and Infrastructure

The physical environment significantly impacts Enhabit's operational efficiency. In 2024, the company's ability to reach patients across its service areas hinges on the quality of road infrastructure and the availability of reliable public transportation, especially in more rural or geographically dispersed regions.

Challenging terrain or underdeveloped road networks can lead to increased travel times for Enhabit's mobile care teams, directly affecting the number of patient visits possible per day and escalating fuel and maintenance costs. For instance, in areas with limited highway access, the time spent on local roads can add considerable overhead to daily operations.

Strategic planning for Enhabit's service area expansion and resource allocation must therefore meticulously consider these geographic and environmental factors. Optimizing logistics involves mapping out efficient routes that account for potential infrastructure limitations to ensure timely and cost-effective patient care delivery.

- Infrastructure Impact: Poor road conditions can increase travel time for home health visits by an estimated 15-20% in affected areas.

- Geographic Dispersion: Enhabit operates in diverse geographic settings, from densely populated urban centers to spread-out rural communities, each presenting unique logistical challenges.

- Operational Costs: Inefficient travel due to infrastructure or geographic dispersion can raise per-visit operational costs by up to 10%.

Enhabit Home Health & Hospice must navigate the increasing frequency of extreme weather events, which disrupt service delivery and staff safety, as evidenced by the 28 billion-dollar weather disasters in the U.S. in 2023. The company also faces environmental considerations related to medical waste, with the healthcare sector generating millions of tons annually, necessitating sustainable disposal practices.

Furthermore, local environmental health concerns like poor air quality can exacerbate patient conditions, while the company's operational efficiency is directly tied to physical infrastructure, with poor roads potentially increasing travel times by 15-20% in certain areas.

| Environmental Factor | Impact on Enhabit | Supporting Data (2023-2024) |

|---|---|---|

| Extreme Weather Events | Disruption of services, staff safety risks | 28 U.S. billion-dollar weather/climate disasters in 2023 (NOAA) |

| Medical Waste Generation | Need for compliant disposal, operational footprint | Healthcare sector generated ~5.9 million tons of medical waste globally in 2023 |

| Air Quality | Exacerbation of patient respiratory conditions, increased demand for care | Several metropolitan areas exceeded federal air quality standards in 2024 |

| Infrastructure Quality | Increased travel time, operational costs for mobile teams | Poor roads can increase travel time by 15-20% in affected areas |

PESTLE Analysis Data Sources

Our Enhabit Home Health & Hospice PESTLE Analysis is built on a robust foundation of data from government health agencies, industry-specific market research reports, and reputable economic and demographic databases. Each factor, from regulatory changes to technological advancements, is informed by credible, current information.