Enhabit Home Health & Hospice Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Enhabit Home Health & Hospice Bundle

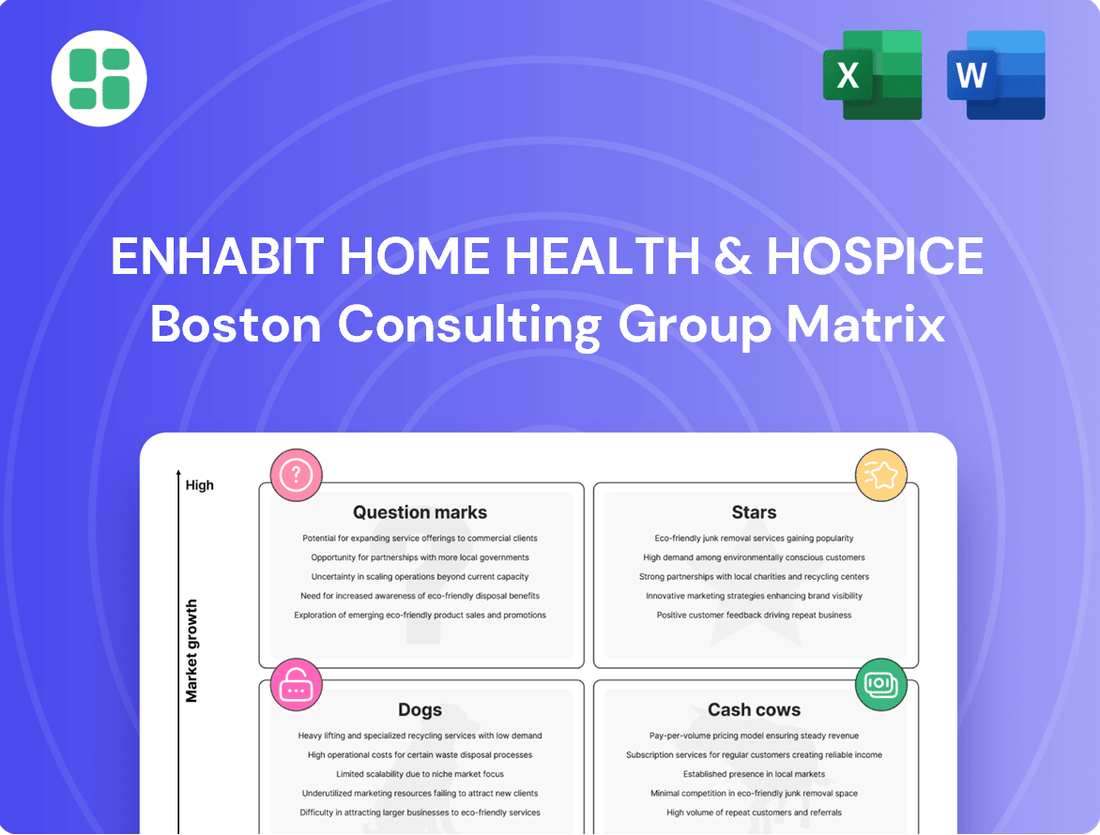

Curious about Enhabit Home Health & Hospice's strategic positioning? Our BCG Matrix preview offers a glimpse into how their services might be categorized as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive understanding of each service line's market share and growth potential, enabling you to make informed decisions about resource allocation and future investments.

Don't miss out on the actionable insights that will empower your strategic planning. Invest in the full BCG Matrix report today and equip yourself with the knowledge to navigate Enhabit's market landscape with confidence.

Stars

Enhabit's hospice segment is a clear star in its BCG matrix, demonstrating robust growth. In the first quarter of 2025, the average daily census for hospice services climbed by an impressive 12.3%, alongside an 8.0% increase in admissions. This momentum is further underscored by a substantial 20.5% surge in hospice revenue, signaling a dynamic market where Enhabit is effectively capturing share.

The company's strategic focus on expanding its hospice presence, through both new de novo locations and potential acquisitions, solidifies this star status. Enhabit is prioritizing hospice in its growth strategy, aiming for a 60/40 split favoring hospice in de novo development and an 80/20 split for mergers and acquisitions. This aggressive expansion plan reinforces their leadership in a high-growth sector.

Enhabit is actively pursuing innovative payer contracts, focusing on arrangements that offer better reimbursement rates and episodic payment models. This strategic push is designed to capture growth in a shifting healthcare payment environment.

A significant portion of Enhabit's business is now aligned with these forward-thinking agreements. Specifically, 48% of their home health non-Medicare visits are under payer innovation contracts that provide improved rates. This demonstrates a clear commitment to adapting to value-based care models.

The company has also successfully negotiated several rate increases directly linked to achieving quality performance metrics. This approach not only rewards quality care but also strengthens Enhabit's position as a comprehensive provider capable of navigating complex payer relationships and expanding market share.

Enhabit's de novo location expansion strategy for its hospice services clearly positions these new branches as Stars within the BCG Matrix. This indicates a high-growth, high-market-share segment for the company.

The company's commitment to growth is evident in its recent expansion efforts. Enhabit opened five new hospice operations in 2024. Furthermore, they opened one new hospice location in Q1 2025 and have 13 more planned, demonstrating a robust pipeline for future growth.

This aggressive expansion into new geographic areas reflects a strategy to quickly establish market presence and capture market share in regions with high growth potential or those that are currently underserved.

Technology-Enhanced Care Delivery

Enhabit Home Health & Hospice is actively investing in technology to transform care delivery. Their focus on predictive analytics and proprietary applications aims to boost efficiency and patient results. This strategic push into technology-enhanced care positions them strongly in a growing market.

The company's commitment to innovation is evident in its investments. For instance, in 2023, Enhabit reported a 9.9% increase in revenue, reaching $1.2 billion, partly driven by operational improvements and expanded service offerings, which technology plays a key role in. These advancements are designed to not only elevate the quality of care but also to manage costs effectively and increase patient throughput.

- Predictive Analytics: Enhabit utilizes predictive analytics to anticipate patient needs and potential complications, allowing for proactive interventions.

- Internally Developed Applications: The company leverages custom-built software to streamline clinician workflows and improve inter-team communication, enhancing operational efficiency.

- AI for Back-Office and Clinician Tools: Investments in artificial intelligence are targeted at optimizing administrative tasks and providing clinicians with advanced support tools, aiming for market leadership through superior patient experience and operational excellence.

Integrated Post-Acute Care Partnerships

Enhabit's strategic focus on integrated post-acute care partnerships aligns with a significant market trend toward seamless patient transitions. Their efforts to connect hospital care with home-based services reflect a growing demand for coordinated care models.

By leveraging predictive analytics to identify high-risk patients, Enhabit actively works to bridge the gap between inpatient and home care settings. This proactive approach aims to enhance patient outcomes and capture a larger share of the post-acute care market.

These integrated partnerships are vital for improving patient well-being and driving referral growth, positioning Enhabit to capitalize on the expanding post-acute care continuum.

- Market Trend: Growing emphasis on coordinated care across the patient journey.

- Enhabit's Strategy: Seamless transitions from hospital to home, supported by strategic inpatient facility partnerships.

- Key Technology: Predictive analytics for identifying and managing high-risk patients.

- Objective: Improve health outcomes, expand market reach, and increase referrals in post-acute care.

Enhabit's hospice operations are undeniably Stars in the BCG matrix, exhibiting strong growth and market leadership. The company's strategic expansion, evidenced by opening five new hospice locations in 2024 and one in Q1 2025 with 13 more planned, highlights this segment's star status.

This aggressive build-out is designed to capture significant market share in high-growth areas. The hospice segment's performance is further bolstered by a 12.3% increase in average daily census and an 8.0% rise in admissions in Q1 2025, alongside a 20.5% revenue surge.

The company's investment in technology, particularly predictive analytics and proprietary applications, enhances operational efficiency and patient outcomes, reinforcing its competitive edge in the burgeoning hospice market.

| Metric | 2024 | Q1 2025 | Growth/Change |

| New Hospice Locations Opened | 5 | 1 | 13 Planned |

| Hospice Avg. Daily Census | N/A | +12.3% | Strong Growth |

| Hospice Admissions | N/A | +8.0% | Positive Momentum |

| Hospice Revenue | N/A | +20.5% | Significant Increase |

What is included in the product

This BCG Matrix analysis details Enhabit's home health and hospice services, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It offers strategic recommendations for investing in Stars, maintaining Cash Cows, developing Question Marks, and divesting Dogs.

The Enhabit Home Health & Hospice BCG Matrix offers a clear, actionable overview of business unit performance, simplifying strategic decision-making.

This tool acts as a pain point reliever by providing a visualized roadmap to optimize resource allocation and identify growth opportunities.

Cash Cows

Enhabit's established home health services, primarily operating under the Medicare Fee-for-Service model, are a cornerstone of their business, acting as a classic Cash Cow. These services, despite operating in a mature market, continue to generate substantial and stable revenue, contributing significantly to the company's overall financial health. For instance, in 2023, Enhabit reported that its home health segment accounted for a significant portion of its net service revenue, demonstrating its consistent performance.

Skilled nursing and core therapies, including physical, occupational, and speech therapy, represent Enhabit's established cash cows within its home health segment. These services are offered across its 255 home health locations, demonstrating a mature market position with significant market share.

The consistent demand for these foundational healthcare services, coupled with Enhabit's broad national presence and proven operational efficiency, generates a steady and predictable stream of revenue. This reliability is a hallmark of a cash cow, providing a stable financial base for the company.

Furthermore, these mature service lines typically require minimal promotional investment, contributing to strong profit margins. For instance, in 2023, Enhabit reported net service revenue of $1,099.5 million, with home health services forming a substantial part of this, underscoring the financial strength of these core offerings.

Enhabit's focus on reducing home health cost per patient day, exemplified by their shift to outsourced coding and optimization of administrative expenses, highlights an exceptionally efficient operational infrastructure. This streamlined approach across their extensive network of facilities allows them to maintain strong profit margins on their core services.

These operational efficiencies position Enhabit's established home health and hospice services as cash cows. For instance, in the first quarter of 2024, Enhabit reported a net service revenue of $277.9 million, with their home health segment contributing significantly to their overall financial performance, underscoring their ability to generate consistent and substantial cash flow.

Existing Hospice Operations in Mature Markets

Enhabit's 115 existing hospice operations in mature markets represent their Cash Cows. These locations benefit from stable average daily census figures and well-established referral networks, ensuring a consistent and predictable stream of revenue. The successful implementation of a case management model has further solidified their clinical capacity, leading to improved retention and steady census growth, reinforcing their status as reliable cash generators.

- Stable Revenue Generation: The established nature of these hospice locations provides a dependable source of cash flow.

- Established Referral Networks: Strong relationships with referring physicians and institutions contribute to consistent patient volume.

- Case Management Efficiency: The case management model enhances clinical capacity, supporting retention and census growth.

- Mature Market Dominance: Operating in mature markets allows Enhabit to leverage existing infrastructure and brand recognition for consistent performance.

Long-Standing Referral Relationships

Enhabit's long-standing referral relationships with hospitals and physicians are a cornerstone of its business, acting as a consistent patient pipeline. These established connections across their national network ensure a steady volume of admissions for home health and hospice services.

This stability translates into predictable revenue streams and reduces the need for extensive new business development. For instance, in 2023, Enhabit reported a significant portion of its patient referrals originating from these trusted partnerships, underscoring their value.

- Consistent Patient Flow: These relationships provide a reliable source of admissions.

- Reduced Acquisition Costs: Less investment is needed for new patient acquisition.

- Revenue Stability: Predictable patient volumes support consistent revenue generation.

- Market Trust: Established partnerships reflect trust and quality in Enhabit's services.

Enhabit's established home health and hospice services are its primary cash cows, generating consistent revenue with minimal investment. These mature business lines benefit from strong referral networks and operational efficiencies, ensuring steady cash flow for the company.

In Q1 2024, Enhabit's home health segment continued to be a significant revenue driver. The company's hospice operations also demonstrated stability, benefiting from established referral patterns and efficient case management.

These segments, characterized by high market share in mature areas and predictable patient volumes, provide a stable financial foundation. For example, Enhabit's focus on operational improvements in 2023 aimed to further enhance the profitability of these core services.

The reliance on established physician and hospital partnerships ensures a consistent influx of patients, reducing the need for aggressive marketing spend. This allows Enhabit to maintain healthy profit margins on its core offerings.

| Segment | Q1 2024 Net Service Revenue (Millions USD) | Key Cash Cow Characteristics |

|---|---|---|

| Home Health | $277.9 (Total Company Q1 2024) | Mature market, strong referral base, operational efficiencies |

| Hospice | (Included in Total Company Q1 2024) | Stable census, established referral networks, case management model |

What You’re Viewing Is Included

Enhabit Home Health & Hospice BCG Matrix

The Enhabit Home Health & Hospice BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report is fully formatted and ready for immediate strategic application, providing a clear analysis of Enhabit's service portfolio without any demo content or alterations.

Dogs

Enhabit Home Health & Hospice has been actively addressing underperforming branches, with initiatives like closures and consolidations underway. This strategic move suggests that certain locations are situated in markets with limited growth potential or possess a low market share within their respective areas.

These underperforming branches represent a drain on resources, consuming capital and operational capacity without yielding commensurate returns. Consequently, they are prime candidates for divestiture or consolidation, aiming to bolster the company's overall profitability and efficiency. For instance, in Q1 2024, Enhabit reported a net loss of $6.4 million, underscoring the need to optimize its operational footprint.

Legacy Non-Medicare, Non-Payer Innovation Contracts within Enhabit's home health segment likely represent the 'dogs' in a BCG matrix analysis. These agreements are characterized by older terms and potentially lower reimbursement rates, which naturally limit their profitability and growth potential.

The focus on transitioning to newer, payer innovation contracts highlights the diminished strategic value of these legacy arrangements. As of the first quarter of 2024, Enhabit reported that its home health segment revenue was $256.5 million, and while specific breakdowns of legacy versus innovation contracts aren't detailed, the strategic shift implies these older contracts contribute less to overall margin expansion.

Before implementing recent cost-saving measures and new technologies, Enhabit Home Health & Hospice likely experienced inefficiencies in its administrative operations. These bottlenecks, often stemming from manual tasks and older systems, could have meant higher operational expenses without a corresponding increase in revenue. For instance, a reliance on paper-based record-keeping or manual billing could have significantly slowed down processes and increased the risk of errors.

These less efficient administrative functions, characterized by their reliance on manual input and potentially outdated software, would have been areas of concern. Such processes often consume more time and resources than necessary, directly impacting profitability. Enhabit's strategic push towards technology to streamline documentation and back-office functions clearly indicates a recognition of these past operational drains.

Geographic Regions with Declining Patient Populations or High Competition

Geographic regions with declining patient populations or intense competition can be considered Enhabit's 'Dog' segments within the BCG Matrix framework. These areas typically exhibit sluggish growth and a small market share for the company, hindering profitability.

While specific regions aren't publicly detailed as 'Dogs,' markets with aging demographics that are shrinking, or those saturated with numerous home health and hospice providers, would fit this profile. For instance, a state with a declining percentage of individuals over 65, coupled with a high number of licensed agencies, would present significant challenges.

- Low Growth Markets: Regions experiencing a contraction in their elderly population, a key demographic for home health and hospice services.

- High Competition: Areas where Enhabit faces numerous established competitors, potentially leading to price wars and reduced market share.

- Profitability Challenges: These segments likely struggle with low patient census growth and difficulty achieving economies of scale, impacting overall financial performance.

- Strategic Divestment/Focus: Companies often consider divesting or minimizing operations in such 'Dog' segments to reallocate resources to more promising 'Star' or 'Question Mark' markets.

Outdated or Niche Specialty Services with Low Demand

Outdated or niche specialty services with low demand represent Enhabit's Dogs in the BCG Matrix. These are services that, while perhaps once valuable, now struggle to attract significant patient volume or are not well-supported by current healthcare reimbursement structures. For example, highly specialized therapy modalities that have been superseded by newer, more effective treatments, or services catering to very specific, rare conditions with limited patient populations, would fall into this category.

These offerings typically exhibit low market share due to their limited appeal and low growth prospects because the demand is not expanding. This can lead to inefficient resource allocation, as capital and personnel might be tied up in segments that are not contributing meaningfully to the company's overall growth or profitability. Enhabit's strategic focus on delivering comprehensive and personalized patient care naturally steers the company away from such low-volume, highly niche services.

- Low Market Share: These services capture a minimal portion of the overall home health and hospice market.

- Low Growth Prospects: Demand for these specialized offerings is stagnant or declining.

- Resource Drain: Continued investment in these areas diverts resources from more promising segments.

- Strategic Misalignment: They do not align with Enhabit's broader strategy of providing comprehensive, personalized care.

Enhabit Home Health & Hospice's "Dogs" in the BCG Matrix likely encompass underperforming branches in low-growth or highly competitive geographic markets. These segments, characterized by limited patient population growth and a small market share, strain company resources without delivering commensurate returns. For instance, regions with shrinking elderly populations or an overabundance of competing agencies would fit this profile, impacting overall financial performance.

Legacy contracts, particularly non-Medicare and non-Payer Innovation agreements within the home health segment, also represent "Dogs." These older contracts often come with less favorable reimbursement rates, hindering profitability and growth potential. Enhabit's strategic shift towards newer, innovative contracts underscores the diminishing value of these legacy arrangements, as seen in the company's Q1 2024 net loss of $6.4 million, highlighting the need to shed less profitable ventures.

Outdated or niche specialty services with low patient demand also fall into the "Dog" category. These offerings, which may have once been valuable, now struggle to attract significant patient volume or are not well-supported by current reimbursement structures. This leads to inefficient resource allocation, as capital and personnel might be tied up in segments that are not contributing meaningfully to the company's overall growth or profitability.

| BCG Category | Characteristics | Enhabit Examples | Financial Impact | Strategic Action |

| Dogs | Low market share, low growth prospects | Underperforming branches in shrinking markets, legacy contracts, niche services with low demand | Resource drain, profitability challenges, inefficient operations | Divestment, consolidation, discontinuation of services |

Question Marks

New de novo home health locations for Enhabit are positioned as Question Marks in the BCG Matrix. These new sites represent significant upfront investment in staffing and infrastructure, aiming to capture market share in potentially growing areas.

While hospice de novos often start as Stars, these emerging home health locations face the challenge of quickly establishing referral relationships and achieving profitability. Their future success, and therefore their classification, hinges on rapid market penetration and operational efficiency.

Developing and scaling advanced chronic disease management programs in home health, beyond typical services, positions Enhabit Home Health & Hospice as a potential Question Mark. While the market for integrated home-based chronic care is expanding, Enhabit's current penetration in these specialized areas might be limited.

These advanced programs necessitate substantial investment in specialized clinician training, remote patient monitoring technology, and robust care coordination infrastructure. For example, the home health market, valued at approximately $130 billion in 2023, is projected to grow, with chronic disease management being a key driver.

Expanding into new payer models, such as value-based care pilots, positions Enhabit Home Health & Hospice in the Question Mark quadrant of the BCG Matrix. These innovative arrangements, which reward providers for quality outcomes rather than volume of services, represent a significant future growth avenue for the home health and hospice industry.

While these models offer promising long-term potential, Enhabit's current market penetration within these nascent programs is likely minimal. Successfully navigating these evolving payer landscapes demands considerable investment in advanced data analytics for outcome tracking, robust care coordination infrastructure, and sophisticated measurement tools to demonstrate efficacy and achieve scalability.

Remote Patient Monitoring (RPM) and Telehealth Expansion

While Enhabit Home Health & Hospice leverages technology, a substantial expansion of Remote Patient Monitoring (RPM) and telehealth into their core offerings could position these as Question Marks. The market for these services is booming, with projections indicating significant growth, but Enhabit's current penetration in scaled RPM programs may necessitate considerable investment to achieve market leadership.

The broader telehealth market saw substantial growth, with patient adoption accelerating. For instance, by the end of 2024, it's estimated that over 80% of patients will have used some form of telehealth. This rapid adoption presents both an opportunity and a challenge for Enhabit to deepen its integration.

- Market Growth: The global RPM market is projected to reach $175.1 billion by 2030, growing at a CAGR of 18.1% from 2023 to 2030.

- Patient Demand: A 2024 survey indicated that 76% of patients prefer telehealth options for routine check-ups and follow-ups.

- Investment Needs: Developing robust, scalable RPM programs requires significant upfront investment in technology infrastructure, data analytics, and staff training.

- Competitive Landscape: As more providers enter the telehealth space, capturing a dominant market share in advanced RPM solutions will require strategic differentiation and aggressive expansion.

Targeted Acquisitions in New Geographies or Service Lines

Enhabit's expressed strategy of pursuing small to medium-sized tuck-in acquisitions, with a particular emphasis on hospice, positions these ventures as Question Marks within the BCG framework. This approach aims to rapidly expand market share, but success hinges on seamless integration, understanding diverse local market dynamics, and effectively utilizing current operational capabilities.

These strategic moves carry significant upfront investment and inherent risks, yet they offer a compelling pathway to substantial growth if managed adeptly. For instance, the home health and hospice industry saw continued consolidation in 2024, with smaller players often being prime acquisition targets to gain immediate geographic or service line footholds.

- Strategic Focus: Enhabit's stated preference for tuck-in acquisitions, especially in hospice, highlights a targeted growth strategy.

- Integration Challenges: Success depends on the ability to effectively integrate acquired entities and navigate varying local market conditions.

- Risk vs. Reward: These acquisitions demand significant capital and carry strategic risk, but promise high growth potential upon successful execution.

- Industry Trend: The 2024 market showed a trend of consolidation, with smaller home health and hospice providers being attractive acquisition targets.

Enhabit's new de novo home health locations and expansion into advanced chronic disease management programs are positioned as Question Marks. These initiatives require substantial investment to build market share and operational efficiency, with their ultimate success dependent on rapid penetration and adoption in growing, yet competitive, markets.

The company's exploration of new payer models like value-based care and the scaled integration of Remote Patient Monitoring (RPM) and telehealth also fall into the Question Mark category. While these represent significant future growth avenues, Enhabit's current market penetration and the investment needed to lead in these evolving areas place them in this quadrant.

Strategic tuck-in acquisitions, particularly in the hospice sector, are also considered Question Marks. These moves aim to expand market share quickly but involve considerable upfront investment and integration risks, with success contingent on adept management and understanding diverse local market dynamics.

| Initiative | BCG Quadrant | Key Considerations | Market Data/Projections (2024-2025) |

|---|---|---|---|

| New De Novo Home Health Locations | Question Mark | High upfront investment, need for rapid market penetration and referral building. | Home health market expected to grow, but new entrants face established competition. |

| Advanced Chronic Disease Management Programs | Question Mark | Requires specialized training, technology investment, and robust care coordination. | Growing demand for integrated home-based chronic care; market valued at $130B in 2023. |

| Value-Based Care Pilots / New Payer Models | Question Mark | Investment in data analytics, outcome tracking, and demonstrating efficacy. | Evolving payer landscape, potential for long-term growth if successful. |

| Scaled RPM & Telehealth Integration | Question Mark | Significant investment in technology, data analytics, and staff training. | Telehealth adoption high (over 80% patient usage by end of 2024); RPM market projected to reach $175.1B by 2030. |

| Tuck-in Acquisitions (Hospice Focus) | Question Mark | Integration challenges, capital investment, understanding local markets. | Industry consolidation trend in 2024, smaller providers attractive targets. |

BCG Matrix Data Sources

Our BCG Matrix is informed by Enhabit's financial disclosures, industry growth trends, and competitive market analysis to provide a strategic overview.