Chugoku Electric Power Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chugoku Electric Power Bundle

Chugoku Electric Power operates within a landscape shaped by significant buyer power and the looming threat of substitutes, particularly from renewable energy sources. Understanding the intensity of these forces is crucial for navigating the evolving energy market. The complete report reveals the real forces shaping Chugoku Electric Power’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Chugoku Electric Power's reliance on imported fossil fuels, primarily liquefied natural gas (LNG), coal, and oil, exposes it to the bargaining power of suppliers. In 2023, thermal power generation accounted for a significant portion of its energy mix, making it susceptible to global commodity price volatility and potential supply chain disruptions.

The limited number of major global suppliers for these essential fuels grants them considerable leverage. This concentration means that utility companies like Chugoku Electric have fewer alternatives, potentially leading to increased input costs as suppliers can dictate terms more effectively.

Chugoku Electric Power faces significant bargaining power from uranium and nuclear technology suppliers. The company relies on a select group of global entities for essential uranium fuel and advanced reactor technology, including critical maintenance. This reliance is amplified by the exceptionally high barriers to entry and rigorous safety standards inherent in the nuclear industry, solidifying the suppliers' strong market position.

These specialized suppliers, often holding patents or unique expertise, have considerable leverage, making it challenging for Chugoku Electric to negotiate favorable terms or easily switch providers. For instance, the global uranium market, while expanding, remains concentrated, with a few major producing countries and companies dominating supply. In 2024, the spot price for uranium oxide (U3O8) has seen an upward trend, reflecting this supply concentration and increased demand from new reactor builds and existing plant life extensions.

Chugoku Electric Power relies on a limited number of global manufacturers for highly specialized equipment like turbines and advanced smart grid technologies. These suppliers often possess proprietary technology, making it difficult and costly for Chugoku Electric to switch. For instance, the average cost of a new large-scale power turbine can range from tens to hundreds of millions of dollars, and the integration of new smart grid components can involve significant retooling and training expenses, thus significantly amplifying supplier leverage.

Labor and Specialized Skills

The availability of skilled labor, especially engineers and technicians with expertise in power generation, transmission, and nuclear operations, plays a crucial role. A scarcity of this specialized talent, or the presence of strong labor unions, can drive up labor costs and affect operational efficiency, thereby enhancing the bargaining power of employees. This directly influences Chugoku Electric's operational expenditures.

In 2023, Japan faced a notable shortage of skilled engineers, with reports indicating a significant gap in specialized fields like nuclear engineering. This trend is expected to continue, potentially increasing labor costs for companies like Chugoku Electric as they compete for a limited pool of qualified professionals. Unions within the energy sector often negotiate for favorable wages and working conditions, which can directly impact the company's cost structure.

- Skilled Labor Shortage: Japan's ongoing deficit in specialized engineers, particularly in nuclear power, is a key factor.

- Union Influence: Labor unions can negotiate higher wages and benefits, increasing operational costs for Chugoku Electric.

- Operational Efficiency: A lack of specialized staff can hinder maintenance and operational efficiency, impacting overall performance.

Regulatory and Environmental Compliance Services

The bargaining power of suppliers for regulatory and environmental compliance services is significant for Chugoku Electric Power. Given the highly regulated nature of the power industry, specialized firms offering environmental compliance, safety audits, and regulatory consulting hold considerable sway. These specialized providers possess unique expertise and necessary certifications, making it difficult for Chugoku Electric to switch suppliers easily.

The critical need for these services, coupled with the severe financial penalties and operational disruptions associated with non-compliance, further strengthens the suppliers' leverage. For instance, in 2024, environmental regulations continue to tighten globally, increasing the demand for these specialized services and the associated costs for utility companies.

- Specialized Expertise: Suppliers offer niche knowledge in environmental, safety, and regulatory domains essential for utility operations.

- High Switching Costs: The complexity and certification requirements for compliance services make changing providers challenging and costly.

- Regulatory Dependence: Chugoku Electric's reliance on these services to meet legal obligations grants suppliers substantial bargaining power.

- Risk of Non-Compliance: The potential for significant fines and operational shutdowns for regulatory breaches empowers suppliers to dictate terms.

Chugoku Electric Power's bargaining power of suppliers is influenced by its reliance on imported fuels like LNG, coal, and oil, with thermal power forming a significant part of its energy mix in 2023. The limited number of global suppliers for these fuels means they have considerable leverage, potentially driving up input costs for the company.

The company also faces strong supplier power in the nuclear sector for uranium and specialized technology, due to high entry barriers and safety standards. This concentration in the uranium market, with a few dominant producers, has contributed to an upward trend in uranium oxide (U3O8) spot prices in 2024.

Suppliers of specialized equipment, such as turbines and smart grid technology, also wield significant power due to proprietary technology and high switching costs, which can run into millions for new turbines. Furthermore, a scarcity of skilled labor in Japan, particularly in nuclear engineering, is expected to increase labor costs for Chugoku Electric as competition for qualified professionals intensifies.

| Supplier Category | Key Dependence | Supplier Leverage Factors | 2023/2024 Impact |

|---|---|---|---|

| Fossil Fuels (LNG, Coal, Oil) | Thermal power generation | Limited global suppliers, commodity price volatility | Significant input cost exposure |

| Nuclear Fuel & Technology | Uranium, reactor technology, maintenance | High entry barriers, stringent safety standards, market concentration | Upward pressure on uranium prices (2024) |

| Specialized Equipment | Turbines, smart grid technology | Proprietary technology, high switching costs | Significant capital expenditure for upgrades |

| Skilled Labor | Engineers, technicians (nuclear, power operations) | Labor shortages, union influence | Increased operational expenditure, potential efficiency impacts |

What is included in the product

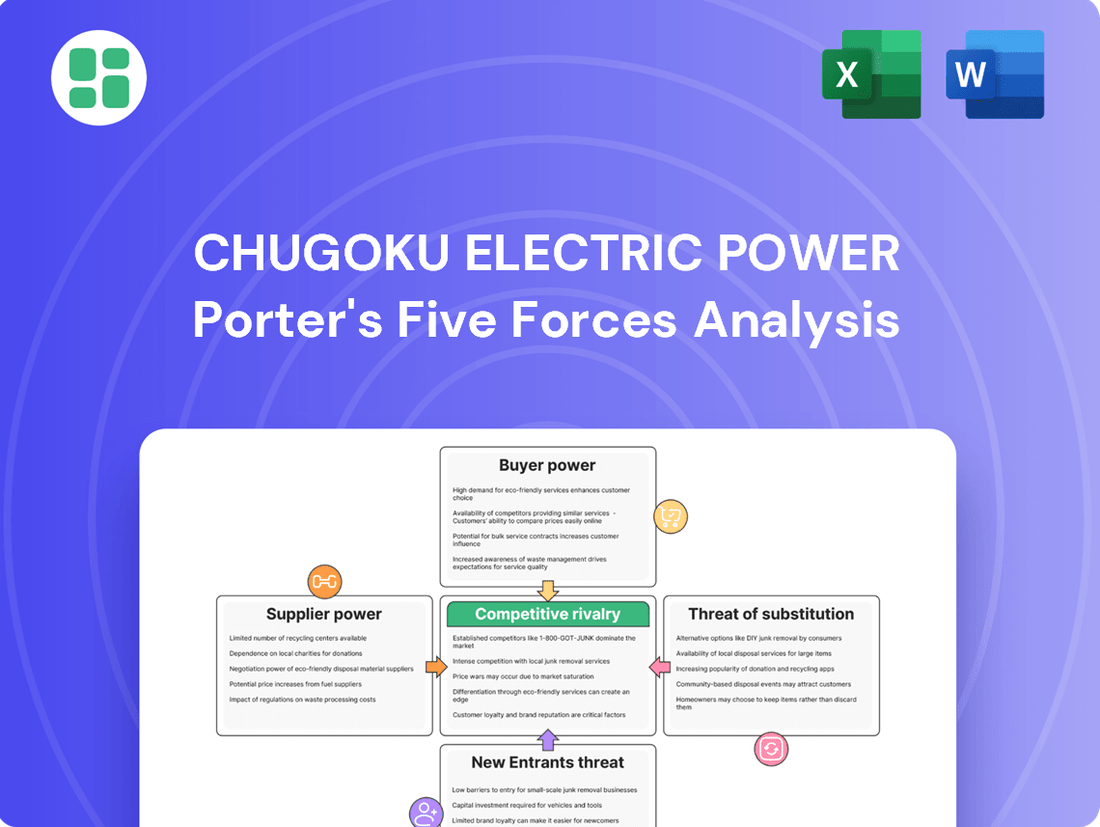

This analysis details the competitive forces impacting Chugoku Electric Power, examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the Japanese electricity market.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Chugoku Electric Power.

Customers Bargaining Power

Chugoku Electric Power serves a highly fragmented residential customer base, primarily individual households. This fragmentation significantly limits the bargaining power of any single customer. In 2023, residential customers accounted for a substantial portion of Chugoku Electric's sales, but their individual consumption levels are too low to exert meaningful pressure on pricing.

Large industrial and commercial consumers are a substantial part of Chugoku Electric's revenue, with significant consumption volumes. These entities, like major factories and shopping centers, often have the leverage to negotiate tailored contracts and specific service agreements. Their considerable demand gives them considerable influence in pricing discussions.

Japan's electricity market deregulation, particularly since its full liberalization in 2016, has significantly amplified customer bargaining power. Large industrial and commercial users can now negotiate directly with a wider range of retail electricity providers, seeking competitive pricing and customized service packages. This shift from a monopolistic system to a more competitive landscape means these customers can exert considerable pressure on suppliers like Chugoku Electric Power.

While the legal framework permits greater choice for all consumers, the practical impact on residential customers is more nuanced. Although around 80% of Japanese households are technically free to switch providers as of 2024, actual switching rates remain relatively low. This is often attributed to consumer inertia, a lack of perceived benefit, or the complexity involved in comparing different plans, which can somewhat temper their immediate bargaining power compared to larger, more sophisticated energy buyers.

Price Sensitivity and Economic Conditions

Customer price sensitivity for Chugoku Electric Power is a key factor. Residential customers tend to notice increases in their monthly bills, while industrial clients are much more attuned to energy costs as a significant portion of their operational expenses. For instance, in 2024, many households experienced increased utility costs due to fluctuating fuel prices, leading to greater attention on energy consumption patterns.

Economic conditions significantly amplify this sensitivity. During periods of economic slowdown or rising inflation, customers become more inclined to seek ways to reduce their energy spending. This could involve adopting energy-saving measures or actively looking for more competitive electricity providers, putting pressure on Chugoku Electric to maintain attractive pricing.

- Residential customers often react to monthly bill changes, impacting Chugoku Electric's revenue stability.

- Industrial customers are highly sensitive to energy costs, directly affecting their production expenses and competitiveness.

- Economic downturns in 2024 heightened customer price sensitivity, leading to increased demand for cost-saving solutions and potentially lower prices.

Availability of Self-Generation and Energy Efficiency

Customers, particularly large industrial and commercial entities, possess growing leverage due to the increasing viability of self-generation and energy efficiency. The ability for these customers to invest in distributed energy resources, such as solar photovoltaic (PV) systems or combined heat and power (CHP) units, directly reduces their dependence on Chugoku Electric's grid supply. For instance, in 2023, Japan saw a significant increase in distributed solar installations, with new capacity additions continuing to grow, meaning more large consumers can offset their grid purchases.

Furthermore, advancements in energy efficiency technologies allow businesses to consume less electricity overall, further diminishing their reliance on traditional utility providers. This dual capability—generating their own power and using less of it—grants these customers substantial bargaining power. Chugoku Electric, therefore, faces pressure to maintain competitive electricity pricing and ensure a high level of service reliability to retain these key customer segments.

- Increased Customer Options: Industrial and commercial clients can invest in on-site power generation like solar PV or CHP.

- Energy Efficiency Impact: Implementing energy-saving measures reduces overall demand from the grid.

- Growing Trend: Japan's distributed solar capacity continued its upward trajectory in 2023, offering more alternatives to grid power.

- Competitive Pressure: Chugoku Electric must offer attractive pricing and dependable service to counter this customer leverage.

The bargaining power of customers for Chugoku Electric Power is notably shaped by the distinction between residential and industrial/commercial segments. While residential customers are numerous, their individual consumption is too low to exert significant pressure, despite around 80% being eligible to switch providers as of 2024. Conversely, large industrial and commercial clients wield considerable influence due to their substantial energy needs and increasing options for self-generation and efficiency improvements.

The deregulation of Japan's electricity market since 2016 has been a game-changer, allowing large consumers to negotiate directly with multiple suppliers, thereby increasing their leverage. This competitive environment means Chugoku Electric must remain competitive on pricing and service to retain these vital customers. Economic factors, such as inflation experienced by households in 2024, also heighten price sensitivity across the board, pushing customers to seek cost-saving measures.

| Customer Segment | Bargaining Power Factors | Impact on Chugoku Electric |

|---|---|---|

| Residential | High fragmentation, low individual consumption, price sensitivity to monthly bills. | Limited direct negotiation power, but collective price sensitivity influences overall demand. |

| Industrial/Commercial | Large consumption volumes, direct negotiation capabilities, ability to invest in self-generation (e.g., solar PV), energy efficiency. | Significant leverage on pricing and service agreements, potential for customer churn. |

Preview the Actual Deliverable

Chugoku Electric Power Porter's Five Forces Analysis

This preview showcases the comprehensive Chugoku Electric Power Porter's Five Forces Analysis, detailing the competitive landscape of Japan's electricity sector. You're viewing the exact document you'll receive immediately after purchase, offering a complete breakdown of industry rivalry, buyer and supplier power, threat of new entrants, and substitute products. This professionally formatted analysis is ready for your immediate use, providing actionable insights without any surprises.

Rivalry Among Competitors

Chugoku Electric Power historically enjoyed a regional monopoly, but Japan's full retail liberalization in 2016 has significantly altered the competitive landscape. While the company still controls the essential transmission and distribution infrastructure, new players can now directly compete for end-users within its service territory.

This deregulation means rivalry has shifted from a traditional utility-to-utility model to a direct competition for customer acquisition in the retail electricity market. For instance, in 2023, the number of new electricity retailers entering the market continued to grow, putting pressure on established players like Chugoku Electric to retain their customer base through competitive pricing and service offerings.

The Japanese electricity market has welcomed a significant influx of new retail power companies. These new players, often originating from sectors like gas, telecommunications, and trading, are actively vying for customers. For instance, by early 2024, the number of electricity retailers in Japan had surpassed 700, a stark contrast to the pre-liberalization era.

These challengers frequently differentiate themselves through aggressive pricing strategies, bundled service offerings that combine electricity with other utilities, or by emphasizing a commitment to renewable energy sources. This dynamic forces established utilities like Chugoku Electric to constantly adapt its marketing efforts and pricing structures to retain its traditional customer base.

While direct competition for power distribution within Chugoku Electric Power's service area is limited due to established infrastructure, rivalry emerges in other forms. Major regional utilities across Japan, such as Kansai Electric Power or Kyushu Electric Power, may vie for large industrial customers or engage in power exchange agreements, particularly during peak demand periods. This competition, though less direct, influences pricing and service offerings.

A degree of rivalry also exists in the strategic acquisition of fuel supplies, such as liquefied natural gas (LNG) and coal, and in the development of new generation projects. However, these areas often involve more collaborative efforts or are heavily influenced by regulatory frameworks. For instance, the overall Japanese energy market trends, including government policies on renewable energy integration, shape the competitive landscape for all utilities.

Market Growth and Saturation

The Japanese electricity market is quite mature, meaning there isn't a lot of room for demand to grow significantly. This is largely due to Japan's demographics, with an aging and shrinking population, and a strong focus on energy efficiency which reduces overall consumption.

In such a mature market, the rivalry among existing players, like Chugoku Electric Power, becomes much more intense. Instead of competing for new customers from market expansion, companies are primarily focused on taking market share from each other. This competitive pressure means Chugoku Electric must work hard to keep its existing customers and attract new ones to maintain or grow its position.

For instance, in fiscal year 2023, the total electricity sales for Chugoku Electric Power were approximately 60.3 billion kilowatt-hours. This figure highlights the scale of operations within a market where growth is minimal, underscoring the importance of customer retention and competitive strategies.

- Mature Market Dynamics: Japan's electricity sector faces limited demand growth due to demographic trends and energy efficiency initiatives.

- Intensified Rivalry: Competition focuses on market share battles rather than overall market expansion, increasing pressure on Chugoku Electric.

- Customer Retention Focus: Chugoku Electric must prioritize retaining its existing customer base and acquiring new customers to sustain its market position.

- Sales Volume: Chugoku Electric Power's total electricity sales in FY2023 reached around 60.3 billion kWh, indicating the competitive landscape within which it operates.

Product Differentiation and Service Innovation

Chugoku Electric Power faces intense rivalry, especially as electricity itself is often seen as a commodity. Differentiation, therefore, hinges on superior service quality, attractive bundled packages that might include gas or internet services, and the provision of renewable energy options. By July 2025, the company will need to demonstrate a clear edge in these areas to stand out.

To remain competitive against emerging players, Chugoku Electric must actively innovate beyond its core function of power supply. New entrants are increasingly offering highly tailored solutions and prioritizing greener energy choices, putting pressure on established utilities. This necessitates substantial investment in developing and marketing these advanced services.

- Service Innovation Focus: Chugoku Electric's strategy must emphasize service innovation, moving beyond basic electricity provision.

- Bundled Offerings: Developing attractive bundles of electricity with other essential services like gas and internet can enhance customer loyalty.

- Renewable Energy Push: Expanding and promoting renewable energy options is crucial to attract environmentally conscious customers and new market segments.

- Smart Home Integration: Investing in smart home technologies and solutions offers a pathway to differentiate and create added value for consumers.

The competitive rivalry for Chugoku Electric Power has intensified significantly due to Japan's full retail electricity market liberalization in 2016. With over 700 electricity retailers operating by early 2024, competition is fierce, focusing on customer acquisition and retention in a mature market with limited growth potential. This necessitates differentiation through competitive pricing, bundled services, and renewable energy options, as the company's FY2023 sales of approximately 60.3 billion kWh operate within this challenging environment.

| Metric | Value (as of early 2024 or FY2023) | Implication for Rivalry |

| Number of Electricity Retailers in Japan | Over 700 | High competition for customer share |

| Chugoku Electric Power Sales (FY2023) | Approx. 60.3 billion kWh | Scale of operations in a competitive, low-growth market |

| Market Growth Potential | Limited (due to demographics & efficiency) | Focus shifts from market expansion to market share battles |

SSubstitutes Threaten

The growing affordability and efficiency of distributed renewable energy systems, particularly solar photovoltaic (PV) installations coupled with battery storage, present a significant threat of substitution for Chugoku Electric Power. These systems empower residential and commercial customers to become energy self-sufficient, directly reducing their demand for grid-supplied electricity.

In 2023, the global average cost of solar PV electricity generation fell by approximately 6% compared to 2022, making it an increasingly viable alternative. Furthermore, government incentives and declining battery storage costs, which saw a further 10-15% reduction in the same period, enhance the attractiveness of self-generation, especially in regions like Chugoku with ample sunlight, directly impacting Chugoku Electric's baseload demand.

Advancements in energy efficiency, such as better building insulation and LED lighting, directly reduce the need for purchased electricity. These improvements function as substitutes for Chugoku Electric's core product by lowering overall demand, thereby impacting sales volumes. Even though utilities may encourage these measures, they ultimately diminish revenue per customer.

Large industrial and commercial customers, and even some residential users, have the option to install fuel cells or combined heat and power (CHP) systems. These systems produce electricity and heat right where they are used, often powered by natural gas. This on-site generation provides a degree of energy independence and can lead to cost savings, directly replacing the need for electricity from the grid for certain uses.

This trend poses a significant threat, particularly for Chugoku Electric Power's high-consumption customers. For instance, in 2024, the Japanese government continued to promote distributed energy systems, including fuel cells, through various subsidies and policy support, aiming to enhance energy resilience and reduce carbon emissions. This makes the adoption of these substitute technologies more attractive and economically viable for businesses and households.

Alternative Energy Sources for Heating/Cooling

The threat of substitutes for Chugoku Electric Power's core electricity business in heating and cooling is significant. Beyond traditional electricity, consumers have viable alternatives like natural gas, increasingly efficient heat pumps, and geothermal systems. These options directly compete with electric heating and cooling solutions.

While Chugoku Electric does have a gas division, a widespread adoption of non-electric heating and cooling methods would still diminish its primary electricity revenue streams. This means the substitution threat extends beyond just other electricity providers to entirely different energy infrastructures.

For instance, in 2023, Japan saw continued growth in the adoption of heat pump technology for residential and commercial buildings, driven by efficiency and government incentives. This trend directly eats into the demand for electric resistance heating, a key load for power companies.

- Natural Gas: Offers a direct alternative for heating, with infrastructure already in place in many areas.

- Heat Pumps: Increasingly popular due to their high energy efficiency, utilizing ambient air or ground heat.

- Geothermal Systems: Provide stable and efficient heating and cooling by leveraging underground temperatures.

- Impact on Chugoku Electric: A shift to these alternatives reduces demand for electricity, impacting sales volumes and potentially requiring strategic adjustments in their energy mix and service offerings.

Technological Advancements in Energy Storage

Technological advancements in energy storage present a significant threat of substitutes for traditional utility models. Improvements in battery technology are making distributed solar power more practical, allowing customers to generate and store their own electricity, thereby reducing reliance on Chugoku Electric Power. For instance, by mid-2024, the cost of lithium-ion battery packs for utility-scale storage had fallen significantly, making these solutions increasingly competitive.

Furthermore, large-scale battery storage systems are enabling the development of microgrids for communities and industrial zones. These microgrids can operate independently of the main grid, offering enhanced reliability and energy independence. This trend is expected to accelerate as storage costs continue to decline, potentially impacting Chugoku Electric Power's customer base and revenue streams.

- Falling Battery Costs: Global average costs for lithium-ion battery packs for utility-scale storage saw a notable decrease in the years leading up to 2024, making grid-scale storage more economically feasible.

- Microgrid Growth: The number of operational microgrids, often incorporating battery storage, has been steadily increasing globally, demonstrating a shift towards localized energy solutions.

- Energy Independence: As storage solutions become more affordable and efficient, individual consumers and businesses are gaining the ability to achieve greater energy independence, reducing their dependence on traditional power providers like Chugoku Electric Power.

The increasing viability of distributed generation, especially rooftop solar coupled with battery storage, directly substitutes Chugoku Electric's core offering. By mid-2024, the cost of solar PV systems for residential use in Japan had become increasingly competitive due to falling component prices and government incentives, allowing more consumers to generate and store their own power.

This self-sufficiency reduces the volume of electricity purchased from the grid. For example, by the end of 2023, the number of households with solar power generation and storage systems in Japan had surpassed 2 million, a significant increase from previous years, directly impacting utilities like Chugoku Electric.

Furthermore, advancements in energy efficiency technologies, such as smart thermostats and high-efficiency appliances, further decrease overall electricity consumption. These improvements act as substitutes by lowering the demand for grid-supplied power, thereby eroding Chugoku Electric's customer base and revenue potential.

| Substitute Technology | Key Driver | Impact on Chugoku Electric | 2023/2024 Data Point |

|---|---|---|---|

| Rooftop Solar PV + Battery Storage | Decreasing costs, government incentives | Reduced grid electricity demand, potential for energy independence | Over 2 million households in Japan had solar + storage by end of 2023. |

| Energy Efficiency Improvements | Technological advancements, consumer awareness | Lower overall electricity consumption, reduced sales volume | Continued growth in adoption of high-efficiency appliances. |

| On-site Generation (Fuel Cells, CHP) | Energy resilience, cost savings | Direct replacement of grid electricity for specific loads | Japanese government continued promoting fuel cells via subsidies in 2024. |

Entrants Threaten

The electricity sector, particularly for a company like Chugoku Electric Power, presents a formidable barrier to new entrants due to exceptionally high capital costs. Building new power generation facilities, whether fossil fuel, nuclear, or renewable, along with the necessary transmission and distribution networks, demands billions of dollars in upfront investment. For instance, the construction of a new large-scale power plant can easily run into the billions, a sum that most aspiring competitors simply cannot raise.

These substantial infrastructure requirements create a significant deterrent. New companies would need to invest not only in generation but also in the complex and regulated grid systems to deliver power to consumers. This massive scale of investment effectively limits the pool of potential new entrants to only those with immense financial backing, such as large multinational corporations or state-backed entities.

The electricity sector in Japan, including for companies like Chugoku Electric Power, is characterized by significant regulatory hurdles. New entrants must navigate a complex web of licensing requirements, stringent safety approvals, and environmental permits. These processes are not only time-consuming but also incur substantial costs, effectively creating a high barrier to entry.

Chugoku Electric Power benefits significantly from deep-rooted brand loyalty and customer inertia. As a utility provider with a long history, it has cultivated strong brand recognition and trust, particularly among its residential customer base. This established relationship makes it challenging for new entrants to sway consumers.

New competitors must invest heavily in marketing and offer compelling incentives to overcome customer reluctance to switch from a familiar and trusted provider. This high barrier to switching directly impacts a new entrant's ability to quickly gain meaningful market share, thereby mitigating the threat of new entrants.

Access to Transmission and Distribution Networks

While deregulation in Japan, including the Chugoku Electric Power service area, mandates open access to transmission and distribution networks, new entrants face significant hurdles in connecting to and utilizing existing infrastructure. Navigating these complexities, which include intricate technical specifications for grid connection and the negotiation of long-term contractual agreements with the incumbent utility, presents a substantial barrier to entry. The incumbent's inherent control over the physical network, including its operational standards and maintenance schedules, provides a distinct advantage that can slow or complicate new participant integration.

These challenges can manifest as significant capital outlays for necessary upgrades or interface equipment, and the time required to secure approvals and establish operational links can extend for months, if not years. For instance, in 2024, the average lead time for new generation interconnections in similar regulated markets often exceeded 18 months, underscoring the practical difficulties.

- Technical Integration: New entrants must adhere to strict technical standards set by Chugoku Electric Power for grid connection, potentially requiring costly equipment upgrades.

- Contractual Hurdles: Negotiating access agreements with the incumbent utility involves complex terms regarding usage, pricing, and operational coordination.

- Infrastructure Bottlenecks: Existing transmission capacity and grid congestion can limit the ability of new, potentially intermittent, energy sources to deliver power reliably.

- Regulatory Compliance: Meeting evolving regulatory requirements for grid participation adds another layer of complexity and cost for potential new market players.

Economies of Scale and Experience Curve

Existing utilities like Chugoku Electric Power leverage massive economies of scale. Their extensive infrastructure for generation, transmission, and distribution, developed over decades, allows for significant cost efficiencies per unit of electricity delivered. For instance, in 2024, Chugoku Electric's operational expenditures were spread across a vast customer base, making their per-customer cost lower than any new entrant could realistically achieve without massive upfront investment.

New entrants face a formidable barrier in matching these established economies of scale. Building a comparable network would require billions in capital, making it difficult to compete on price against incumbents who have already amortized much of their infrastructure cost. This cost disadvantage inherently limits the threat of new, smaller players entering the market.

Furthermore, the experience curve plays a crucial role. Chugoku Electric has spent decades optimizing its operations, from fuel procurement to plant maintenance and grid management. This accumulated knowledge translates into smoother operations, fewer inefficiencies, and a deeper understanding of market dynamics that new entrants would struggle to replicate quickly.

- Economies of Scale: Chugoku Electric's vast operational footprint in 2024 allows for lower per-unit costs in generation and distribution compared to potential new entrants.

- Capital Intensity: The immense capital required to build a parallel infrastructure presents a significant barrier, making it economically challenging for new companies to enter.

- Operational Efficiency: Decades of experience have honed Chugoku Electric's processes, leading to greater operational efficiency and cost savings that new entrants cannot immediately match.

The threat of new entrants for Chugoku Electric Power is significantly mitigated by the immense capital requirements and established infrastructure. Building a new power generation facility and associated grid connections in Japan, as of 2024, necessitates investments often in the billions of dollars, a prohibitive cost for most potential competitors.

Regulatory hurdles, including stringent licensing and environmental approvals, further deter new players. These processes are time-consuming and costly, adding layers of complexity to market entry. Moreover, customer loyalty and the high cost of switching providers mean new entrants must invest heavily in marketing to gain traction.

Chugoku Electric benefits from existing economies of scale and operational expertise developed over decades, making it difficult for new entrants to compete on cost. While deregulation has opened up access to transmission networks, the practicalities of technical integration and contractual negotiations remain substantial barriers.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Billions of dollars for generation and grid infrastructure. | Prohibitive cost for most potential competitors. |

| Regulatory Hurdles | Licensing, safety, and environmental approvals. | Time-consuming and expensive to navigate. |

| Economies of Scale | Lower per-unit costs due to existing infrastructure. | New entrants face significant cost disadvantages. |

| Customer Inertia | Brand loyalty and reluctance to switch. | Requires substantial marketing investment for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Chugoku Electric Power leverages data from their annual reports, official investor relations disclosures, and relevant industry publications. We also incorporate information from Japanese energy market research reports and government energy policy documents.