Chugoku Electric Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Chugoku Electric Power Bundle

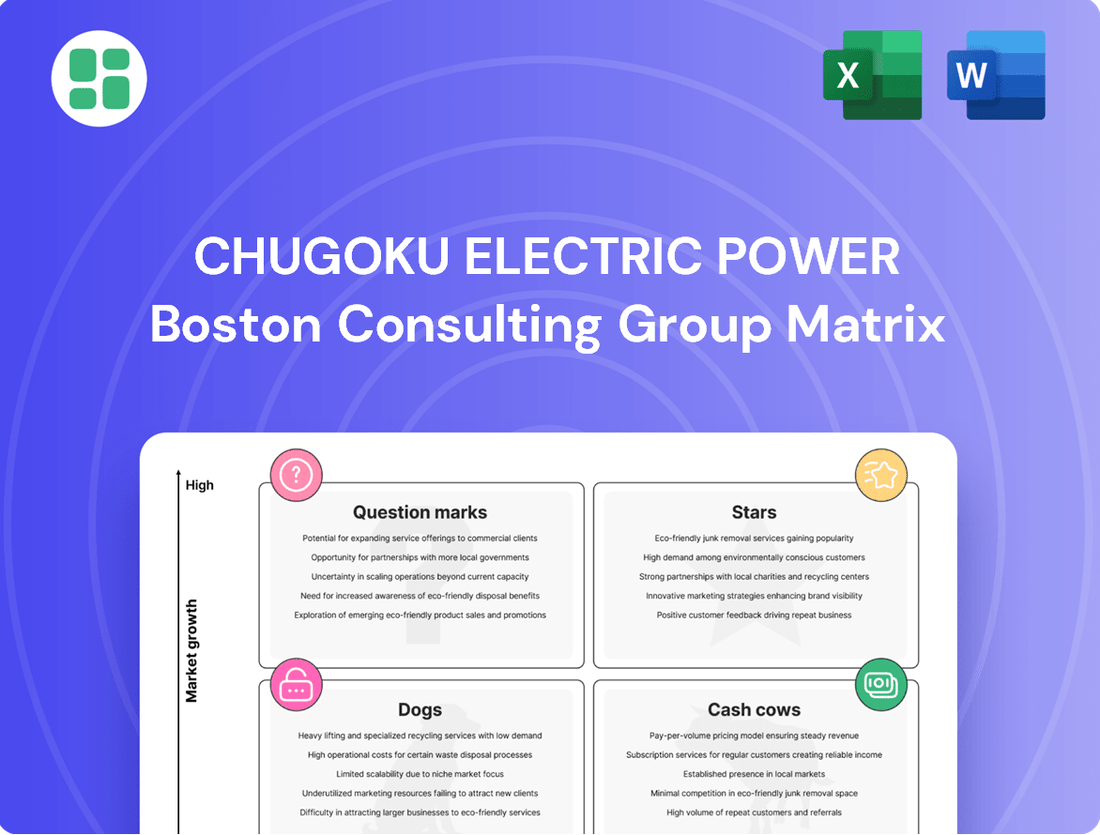

Curious about Chugoku Electric Power's strategic positioning? This glimpse into their BCG Matrix reveals how their energy sources and services are performing in the market. Understand which segments are driving growth and which might need a closer look.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Chugoku Electric Power's nuclear segment, anchored by the Shimane Nuclear Power Station, is a significant player. The successful restart of Shimane Unit 2 in December 2024, with commercial operations commencing in early January 2025, underscores its importance. This restart is crucial for Japan's energy security and decarbonization goals, offering a reliable, low-emission baseload power source.

The company's strategic focus on nuclear power is further evidenced by plans for the restart of Shimane Unit 3. This indicates a strong commitment to maintaining and expanding its presence in a segment characterized by high growth potential and substantial market share within Japan's energy landscape.

Chugoku Electric Power is making significant strides in overseas renewable energy, a key component of its growth strategy. In November 2024, the company secured a 35% stake in a Vietnamese hydroelectric power independent power producer (IPP), signaling a commitment to diversifying its renewable portfolio internationally. This move is supported by the inherent stability of long-term power purchase agreements, which are common in these projects and ensure a consistent revenue flow from expanding global markets.

Further demonstrating this global push, Chugoku Electric holds a substantial 44% ownership in Energy Fiji Limited. This investment in Fiji highlights the company's focus on accelerating renewable energy development in regions with high growth potential for green energy solutions. These overseas ventures are crucial for Chugoku Electric's objective of expanding its renewable energy capacity and solidifying its presence in the international green energy sector.

Chugoku Electric Power's advanced energy efficiency and smart grid solutions are positioned as a strong growth area, aligning with Japan's Green Transformation (GX) Plan. The company's focus on demand management, smart meters, and promoting high-efficiency equipment for customers directly addresses the national drive for reduced energy consumption and renewable integration. This strategic push into smart grid technologies, including grid-scale storage to manage renewable intermittency, signifies a significant opportunity for new value creation within the company.

Solar Panel Reuse and Recycling Initiatives

Chugoku Electric Power is actively engaging in the circular economy for solar energy. In July 2024, the company partnered with other entities to advance the reuse and recycling of used solar panels. This collaboration includes plans to develop solar power plants that utilize these repurposed panels, positioning Chugoku Electric Power uniquely in a developing market.

This forward-thinking initiative is further validated by its selection as a demonstration project under Hiroshima Prefecture's FY2024 subsidy program. This recognition highlights the significant growth potential within this emerging and crucial sector of the renewable energy industry.

- Circular Economy Focus: Chugoku Electric Power's partnership aims to create a closed-loop system for solar panel lifecycle management.

- Market Positioning: The initiative targets a growing demand for sustainable renewable energy solutions.

- Government Support: Selection for Hiroshima Prefecture's FY2024 subsidy program underscores the project's innovation and potential.

- Growth Potential: The reuse and recycling of solar panels represent a nascent but critical industry segment with high future growth prospects.

Wholesale Electricity Trading and Market Optimization

Chugoku Electric Power is actively boosting its financial performance by upgrading its electricity and fuel trading technologies and strategically engaging in the wholesale electricity market. This approach allows them to leverage price volatility for increased profitability, a crucial advantage in today's evolving energy sector.

The company's dedication to optimizing its trading portfolios and managing associated risks highlights its focus on this promising, high-return segment of the energy market.

- Enhanced Trading Technology: Investments in advanced systems enable more sophisticated electricity and fuel trading.

- Wholesale Market Participation: Active engagement in the wholesale market allows Chugoku Electric to capitalize on price fluctuations.

- Portfolio Optimization: Dedicated teams work to maximize returns and manage risk within their trading portfolios.

- Risk Management: Robust risk management frameworks are in place to safeguard against market volatility.

Chugoku Electric Power's nuclear segment, particularly the Shimane Nuclear Power Station, is a pivotal asset. The successful restart of Shimane Unit 2 in December 2024, with commercial operations beginning in early 2025, highlights its critical role in providing stable, low-emission baseload power. This strategic emphasis on nuclear power, including plans for Shimane Unit 3, positions it as a strong contender in a segment with high growth potential and significant market share within Japan.

The company's commitment to overseas renewables is demonstrated by its 35% stake in a Vietnamese hydroelectric IPP secured in November 2024, and its 44% ownership in Energy Fiji Limited. These investments underscore a strategy to expand renewable capacity globally, capitalizing on stable revenue streams from long-term power purchase agreements and high-growth regions for green energy.

Chugoku Electric Power's smart grid and energy efficiency solutions are aligned with Japan's Green Transformation Plan, focusing on demand management and high-efficiency equipment. The company's initiative in the circular economy for solar energy, including partnerships for reusing used solar panels and its selection for a Hiroshima Prefecture subsidy in July 2024, points to significant growth potential in this emerging sector.

The company's financial performance is being bolstered by upgrades to electricity and fuel trading technologies, enabling strategic engagement in the wholesale electricity market to capitalize on price volatility. This focus on portfolio optimization and risk management in trading represents a high-return segment for Chugoku Electric Power.

| Segment | Key Initiatives/Developments | Growth Potential | 2024/2025 Data Points |

|---|---|---|---|

| Nuclear Power | Shimane Nuclear Power Station (Unit 2 restart Dec 2024, Unit 3 plans) | High (Baseload power, energy security) | Unit 2 restart: Dec 2024; Commercial operations: Early 2025 |

| Overseas Renewables | Vietnamese Hydroelectric IPP (35% stake), Energy Fiji Limited (44% stake) | High (Global diversification, stable revenue) | Vietnam IPP stake: Nov 2024 |

| Smart Grid & Efficiency | Demand management, smart meters, high-efficiency equipment | High (Alignment with GX Plan, value creation) | Hiroshima Prefecture Subsidy: FY2024 |

| Circular Economy (Solar) | Reuse/recycling of solar panels, solar plant development | High (Emerging market, sustainability focus) | Partnership for reuse/recycling: July 2024 |

| Energy Trading | Upgraded trading tech, wholesale market engagement | High (Profitability from price volatility, risk management) | Focus on portfolio optimization and risk management |

What is included in the product

This overview analyzes Chugoku Electric Power's portfolio, categorizing business units as Stars, Cash Cows, Question Marks, or Dogs.

A clear BCG Matrix visualizes Chugoku Electric Power's portfolio, easing strategic decisions.

This matrix clarifies business unit performance, alleviating uncertainty in resource allocation.

Cash Cows

The electricity transmission and distribution network operated by Chugoku Electric Power is a quintessential cash cow. This vital infrastructure serves a captive market within its designated region, ensuring a stable and predictable revenue stream due to its monopolistic status. In 2023, Chugoku Electric Power reported approximately ¥1.8 trillion in total revenue, with transmission and distribution forming the bedrock of this financial stability.

Chugoku Electric Power boasts a substantial hydroelectric power generation capacity, serving as a mature and dependable source of renewable energy. These well-established plants, including upgraded facilities, deliver consistent, cost-effective electricity with significantly lower operating expenses than thermal power stations.

This segment is a reliable generator of cash flow, as it demands minimal additional capital for expansion. For instance, in fiscal year 2023, Chugoku Electric Power's hydroelectric power generation accounted for approximately 17% of its total electricity supply, highlighting its consistent contribution.

Chugoku Electric's modern, highly efficient thermal power plants, particularly those utilizing coal and LNG for baseload power, are significant contributors to its stable electricity supply and overall profitability. These facilities currently represent a substantial portion of the company's generation capacity, ensuring consistent revenue streams.

Despite the global trend towards decarbonization, these baseload plants maintain a strong market position by providing reliable and essential power. In 2024, Chugoku Electric reported that its thermal power segment continued to be a primary driver of operating income, showcasing its ongoing cash-generating capabilities due to operational stability and scale.

The company's commitment to enhancing the efficiency of these existing assets, coupled with its strategic application of operational expertise to international Independent Power Producer (IPP) projects, reinforces the status of these thermal power operations as key cash cows. This dual approach ensures continued financial strength while navigating the energy transition.

Industrial and Commercial Electricity Sales

Industrial and Commercial Electricity Sales represent a significant Cash Cow for Chugoku Electric Power. Long-term contracts and stable demand from businesses in the Chugoku region create a reliable revenue stream, solidifying the company's high market share in this segment. This strength is further bolstered by catering to evolving customer needs through innovative rate plans and services.

Chugoku Electric Power's Industrial and Commercial Electricity Sales are characterized by their stability and market dominance. The company benefits from established, high-volume relationships with industrial and commercial clients, ensuring consistent sales. For instance, in fiscal year 2023, sales to the industrial sector remained a cornerstone of their revenue, reflecting the enduring demand for reliable power in manufacturing and commercial operations.

- Stable Revenue: Long-term contracts with industrial and commercial entities provide predictable income.

- High Market Share: Established relationships and high consumption patterns lead to a dominant position.

- Customer Focus: Adapting to customer needs with new rate plans and services maintains market strength.

- Fiscal Year 2023 Performance: Sales to the industrial sector contributed significantly to overall revenue, underscoring its Cash Cow status.

Information and Telecommunications Business

Chugoku Electric Power's information and telecommunications segment functions as a Cash Cow within its BCG matrix. This business offers telecommunications and information processing services, likely utilizing the company's extensive fiber optic network established along its power transmission infrastructure.

This segment is characterized by its stability and consistent cash generation in a mature market. While not a high-growth area, it provides a reliable revenue stream that supports the core electricity business and contributes to overall diversification. For instance, in fiscal year 2023, Chugoku Electric Power reported total revenue of approximately ¥1,249.9 billion, with the information and telecommunications segment contributing a portion to this overall financial picture.

- Stable Revenue: Generates consistent income through established telecommunications and information processing services.

- Infrastructure Leverage: Utilizes existing fiber optic networks along power lines, minimizing new capital expenditure.

- Mature Market: Operates in a stable, albeit low-growth, market environment.

- Diversification Benefit: Provides an additional revenue stream, reducing reliance solely on the core energy business.

Chugoku Electric Power's transmission and distribution network is a prime example of a cash cow. This essential service operates within a defined geographic area, benefiting from a stable customer base and a monopolistic position that ensures predictable earnings. In fiscal year 2023, this segment was a cornerstone of Chugoku Electric Power's ¥1.8 trillion in total revenue, highlighting its consistent financial contribution.

The company's well-established hydroelectric power generation facilities represent another significant cash cow. These mature assets require minimal new investment for expansion and generate electricity at a lower operational cost compared to other generation methods. Hydroelectric power accounted for roughly 17% of Chugoku Electric's total electricity supply in fiscal year 2023, demonstrating its reliable output.

Chugoku Electric's modern thermal power plants, crucial for providing baseload electricity, also function as cash cows. Despite the energy transition, these plants maintain a strong market presence by ensuring a consistent and reliable power supply. In 2024, these thermal operations were reported as a primary driver of operating income, underscoring their ongoing revenue-generating capacity.

| Segment | BCG Classification | Key Characteristics | FY2023 Relevance |

|---|---|---|---|

| Transmission & Distribution | Cash Cow | Monopolistic, captive market, stable revenue | Bedrock of ¥1.8 trillion total revenue |

| Hydroelectric Power Generation | Cash Cow | Mature, low operating cost, minimal capex | ~17% of total electricity supply |

| Thermal Power Generation | Cash Cow | Baseload reliability, operational efficiency | Primary driver of operating income in 2024 |

Preview = Final Product

Chugoku Electric Power BCG Matrix

The BCG Matrix analysis of Chugoku Electric Power you are currently viewing is the complete, unwatermarked document you will receive immediately after purchase. This preview accurately represents the final, professionally formatted report, ready for your strategic planning and decision-making. You can confidently expect the same in-depth analysis and clear presentation in the version you download, enabling you to leverage its insights without delay.

Dogs

Older, less efficient coal-fired power plants not slated for significant upgrades or carbon capture, especially those being retired by 2030, are likely 'Dogs' in Chugoku Electric Power's portfolio. These assets are under growing environmental pressure and face rising operational costs as the company prioritizes decarbonization. For instance, Japan's overall coal power generation capacity, while still significant, is facing a long-term decline as the country aims for carbon neutrality by 2050, impacting the viability of older units.

Chugoku Electric Power's legacy non-core businesses, those not aligning with its primary energy focus, are likely positioned as Dogs in the BCG Matrix. These ventures typically exhibit low market share and minimal growth, demanding significant resources without commensurate returns. For instance, if the company had a historical investment in a small, unrelated manufacturing unit that consistently reported losses, it would fit this classification.

Older power generation facilities, particularly those nearing the end of their operational life and requiring substantial future decommissioning costs, could be considered Dogs. While they might still generate some revenue, the impending high costs of dismantling and environmental remediation reduce their net profitability and long-term value. This includes facilities like the scrapped Shimane No. 1 reactor, which, as of its decommissioning announcement, represented a significant future liability for Chugoku Electric Power.

Subsidized or Unprofitable Renewable Projects with Low Scale

Chugoku Electric Power's portfolio may include small-scale renewable energy projects that were initiated under older subsidy programs or haven't reached a size where they can compete effectively without ongoing support. These projects often have a limited market presence within the expanding renewable energy landscape and face challenges in generating significant profits.

Such ventures, if they exhibit low market share and profitability struggles within the growing renewable sector, could be categorized as Dogs in the BCG Matrix. While Chugoku Electric Power is committed to increasing its renewable energy capacity, some of these legacy projects might not align with the company's future strategic growth objectives.

- Low Profitability: These projects may not cover their operational costs without subsidies, indicating a weak financial performance.

- Limited Scale: Their small size prevents them from achieving economies of scale, making them less competitive.

- Aging Subsidies: Reliance on older, less favorable subsidy schemes can hinder their economic viability in the current market.

- Strategic Re-evaluation: Chugoku Electric Power might consider divesting or restructuring these projects to focus resources on more promising renewable initiatives.

Inefficient Internal Support Functions Not Digitalized

Inefficient internal support functions, such as legacy administrative systems or manual data processing, represent a significant drag on Chugoku Electric Power's overall operational efficiency. These areas, often not prioritized for digital transformation, consume substantial resources, including personnel and time, without directly contributing to revenue generation or market share expansion. For instance, if a significant portion of customer service inquiries are still handled manually, it increases labor costs and slows down response times, impacting customer satisfaction and potentially leading to lost business opportunities.

The company's stated commitment to improving management efficiency in 2024, as part of its broader strategic initiatives, likely includes a critical assessment of these traditional operational areas. The high operational costs associated with these non-digitalized functions directly detract from profitability and hinder the company's ability to invest in growth-oriented segments. For example, a report from the Japan Productivity Center in 2023 highlighted that Japanese companies, on average, are still lagging in digital transformation for back-office operations, which could translate to similar challenges for Chugoku Electric Power.

- High Operational Costs: Manual processes in areas like payroll, procurement, or record-keeping can lead to increased labor expenses and error rates compared to automated solutions.

- Low Productivity: Without digital tools, employees spend more time on repetitive tasks, reducing their capacity for value-added activities and strategic thinking.

- Resource Drain: These functions consume capital and human resources that could otherwise be allocated to innovation, customer acquisition, or improving core service delivery.

- Impact on Competitiveness: In an increasingly digitalized energy sector, companies with inefficient support functions may struggle to adapt quickly to market changes or offer competitive pricing.

Older, less efficient coal-fired power plants not slated for significant upgrades or carbon capture, especially those being retired by 2030, are likely 'Dogs' in Chugoku Electric Power's portfolio. These assets are under growing environmental pressure and face rising operational costs as the company prioritizes decarbonization. Japan's overall coal power generation capacity, while still significant, is facing a long-term decline as the country aims for carbon neutrality by 2050, impacting the viability of older units.

Chugoku Electric Power's legacy non-core businesses, those not aligning with its primary energy focus, are likely positioned as Dogs in the BCG Matrix. These ventures typically exhibit low market share and minimal growth, demanding significant resources without commensurate returns. For instance, if the company had a historical investment in a small, unrelated manufacturing unit that consistently reported losses, it would fit this classification.

Older power generation facilities, particularly those nearing the end of their operational life and requiring substantial future decommissioning costs, could be considered Dogs. While they might still generate some revenue, the impending high costs of dismantling and environmental remediation reduce their net profitability and long-term value. This includes facilities like the scrapped Shimane No. 1 reactor, which, as of its decommissioning announcement, represented a significant future liability for Chugoku Electric Power.

Inefficient internal support functions, such as legacy administrative systems or manual data processing, represent a significant drag on Chugoku Electric Power's overall operational efficiency. These areas, often not prioritized for digital transformation, consume substantial resources without directly contributing to revenue generation or market share expansion. The company's stated commitment to improving management efficiency in 2024 likely includes a critical assessment of these traditional operational areas.

Question Marks

Shimane Nuclear Power Station Unit 3, with planned commercial operations by fiscal 2030, embodies a significant question mark within Chugoku Electric Power's portfolio. This ambitious project aims to contribute to Japan's decarbonization goals, a sector with high growth potential.

However, the development is fraught with challenges, demanding substantial capital expenditure. For instance, the restart of existing Shimane reactors required approximately $6 billion, highlighting the immense investment needed for new units. Regulatory approvals and public acceptance remain critical hurdles.

The success of Shimane Unit 3 hinges on its ability to achieve stable operations and ensure a predictable return on its substantial investment. This makes its future contribution to Chugoku Electric Power's market position uncertain, placing it firmly in the question mark category of the BCG matrix.

Chugoku Electric Power is actively pursuing Carbon Capture, Utilization, and Storage (CCUS) projects, such as the Osaki CoolGen initiative, which targets an impressive 90% CO2 capture rate. This demonstrates a significant commitment to developing technologies vital for decarbonizing thermal power generation.

While these CCUS technologies are essential for environmental goals, they remain largely in experimental and demonstration stages, necessitating substantial upfront capital investment. The market for CCUS is expanding, but its commercial viability and broad market penetration are still uncertain, positioning it as a high-growth, low-market-share segment.

Chugoku Electric Power's investigation into hydrogen and ammonia power generation aligns with a strategy targeting high-growth, emerging energy sectors. These technologies are pivotal for decarbonization efforts, though still in their nascent stages of development and market adoption.

While the global hydrogen market is projected for significant expansion, with estimates suggesting it could reach over $2.5 trillion by 2030, Chugoku Electric's current market share in this specific generation technology is minimal. This positions the company within a category that demands substantial R&D investment for future market penetration and competitive advantage.

Offshore Wind Power Generation (Floating)

Floating offshore wind power generation holds immense promise for Chugoku Electric Power, particularly in the Sea of Japan off the San-in coast. This region boasts an estimated potential of around 108 GW, positioning it as a key growth frontier.

While the potential is substantial, the reality for Chugoku Electric Power is that large-scale commercial floating offshore wind projects in Japan are still in their nascent stages of planning and development. This means the company currently has a low market share in this burgeoning sector.

- High Growth Potential: The 108 GW estimated capacity off the San-in coast signifies a significant market opportunity.

- Early Stage Development: Commercial projects are in planning or early development, indicating a long-term growth trajectory.

- Low Current Market Share: Chugoku Electric Power's current involvement is minimal, characteristic of a question mark in the BCG matrix.

- Strategic Importance: Investing in this area aligns with future energy demands and technological advancements in renewable energy.

New Customer-Centric Energy Services

Chugoku Electric Power is actively developing new customer-centric energy services designed to cater to evolving consumer demands beyond basic electricity provision. These initiatives aim to capture a growing market segment, though current penetration remains low, necessitating substantial investment in marketing and customer acquisition.

These new offerings might encompass bundled energy solutions, advanced distributed energy management systems, or innovative services integrated with smart home technologies. For instance, in 2024, many utilities are exploring demand response programs and virtual power plants, areas where Chugoku Electric could innovate.

- Bundled Energy Solutions: Offering packages that combine electricity with other services like gas or broadband, appealing to customers seeking convenience.

- Distributed Energy Management: Services that help customers manage their own solar panels or battery storage, optimizing energy use and potentially earning revenue.

- Smart Home Integration: Leveraging smart meters and home devices to provide personalized energy insights and control, enhancing customer engagement.

- New Rate Plans: Exploring time-of-use pricing or other flexible plans that better align with individual consumption patterns and reduce costs.

Chugoku Electric Power's ventures into emerging technologies like hydrogen and ammonia power generation, alongside floating offshore wind, represent significant question marks. These areas offer high growth potential, driven by Japan's decarbonization goals, but currently have low market share for the company. Substantial R&D and capital investment are required to establish a competitive position, making their future contribution to profitability uncertain.

The development of Shimane Nuclear Power Station Unit 3 also falls into this category. While it promises to bolster decarbonization efforts, the project faces considerable financial and regulatory hurdles. The significant upfront investment, estimated to be in the billions of dollars, coupled with the need for regulatory approvals and public acceptance, positions it as a high-risk, high-reward initiative.

Similarly, the company's expansion into new customer-centric energy services, such as bundled solutions and distributed energy management, are question marks. These services tap into growing market segments, but Chugoku Electric's current penetration is low. Success hinges on effective marketing and customer acquisition strategies to convert potential into market share.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Risk Level |

| Shimane Unit 3 | High (Decarbonization) | Low (New Project) | Very High ($ Billions) | High |

| Hydrogen/Ammonia Power | Very High (Global Trend) | Negligible | High ($ Millions/Billions) | High |

| Floating Offshore Wind | High (Regional Potential) | Low | High ($ Billions) | High |

| New Energy Services | Moderate to High (Evolving Demand) | Low | Moderate ($ Millions) | Moderate |

BCG Matrix Data Sources

Our Chugoku Electric Power BCG Matrix draws from official company filings, industry growth forecasts, and market share data to provide a comprehensive view of their business units.