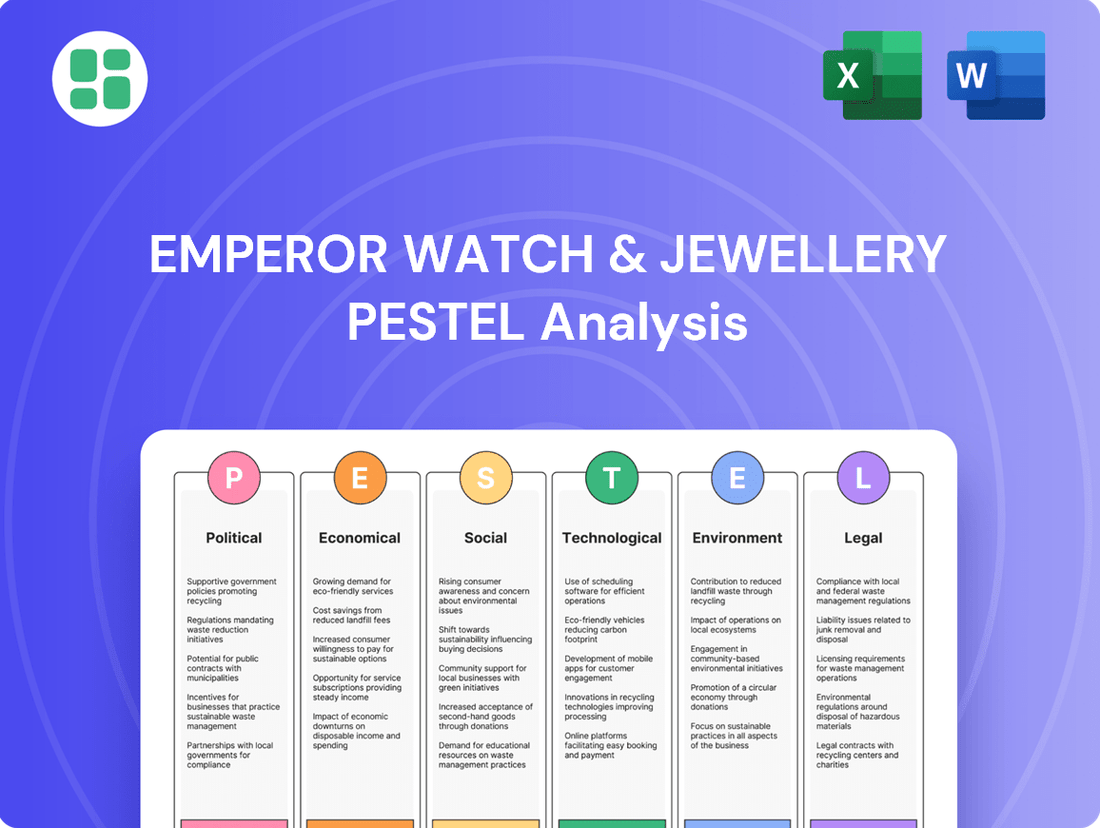

Emperor Watch & Jewellery PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Emperor Watch & Jewellery Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Emperor Watch & Jewellery's future. Our meticulously researched PESTLE analysis offers a strategic roadmap to navigate these external forces, providing you with the foresight needed to capitalize on opportunities and mitigate risks. Download the full version now and gain a decisive competitive advantage.

Political factors

Political stability in Greater China and Southeast Asia is crucial for Emperor Watch & Jewellery, as it directly influences consumer confidence and luxury spending. For instance, the Hong Kong Special Administrative Region (SAR) experienced a significant drop in retail sales in 2019 due to social unrest, impacting luxury goods. While sales have shown recovery, ongoing political developments remain a key consideration.

Trade agreements and tariffs, especially those affecting imported European watches and fine jewellery, can alter Emperor Watch & Jewellery's cost structure and final retail prices. In 2024, global trade dynamics continue to evolve, with potential implications for import duties on high-value goods, directly affecting margins and consumer affordability.

Geopolitical tensions and international monetary policies also shape the economic outlook and consumer spending in Emperor Watch & Jewellery's primary markets, Hong Kong and Mainland China. Fluctuations in currency exchange rates and broader economic sentiment driven by global events can significantly sway discretionary spending on luxury items.

The regulatory landscape for luxury goods in Greater China and Southeast Asia presents a complex web of import/export duties, luxury taxes, and customs procedures that directly affect Emperor Watch & Jewellery's operational costs and profit margins. For instance, in 2024, China's average import duty on watches remained a significant factor, impacting landed costs for high-value timepieces.

Government interventions aimed at managing luxury demand, such as duty-free initiatives, can significantly alter consumer behavior. The continued success of duty-free zones, like those in Hainan, demonstrates how policy can redirect luxury spending, potentially benefiting retailers with a strong presence in such areas.

Cross-border travel policies, especially between Mainland China and Hong Kong, significantly influence tourist spending, a vital revenue stream for luxury retailers like Emperor Watch & Jewellery. For instance, in 2023, Hong Kong saw a notable increase in visitor arrivals, with over 28.1 million visitors, a substantial portion of whom are from Mainland China, indicating a positive impact on luxury sales.

Changes in these policies, whether tightening or loosening, directly affect where luxury purchases occur, altering Emperor Watch & Jewellery's revenue distribution. The trend of Hong Kong residents traveling more frequently to Mainland China for shopping, particularly to Shenzhen, has also been observed, potentially diverting some spending away from Hong Kong's luxury market.

Anti-Corruption and Anti-Extravagance Campaigns

Government campaigns against corruption and extravagance, especially prominent in Mainland China, have a direct impact on the luxury goods market. These initiatives can lead to a noticeable cooling of demand for ostentatious luxury items, pushing consumers towards more understated or 'quiet luxury' preferences. Emperor Watch & Jewellery must therefore consider adapting its product lines and marketing approaches to align with these evolving consumer tastes.

The ongoing emphasis on anti-corruption measures, exemplified by crackdowns that have seen significant enforcement actions in recent years, directly affects discretionary spending on high-value items. For instance, reports from 2023 indicated a continued focus on financial probity, which indirectly influences consumer confidence in making conspicuous luxury purchases. This trend necessitates a strategic pivot for brands like Emperor Watch & Jewellery to cater to a more discerning clientele.

- Shifting Consumer Preferences: The anti-extravagance drive encourages a move from conspicuous consumption to more subtle displays of wealth, impacting demand for overtly branded luxury watches and jewelry.

- Market Adaptation: Emperor Watch & Jewellery may need to focus on craftsmanship, heritage, and unique designs rather than overt branding to appeal to consumers seeking discreet luxury.

- Impact on Sales: While specific figures for Emperor Watch & Jewellery's direct response are proprietary, the broader luxury sector in China experienced shifts in sales patterns in late 2023 and early 2024, with some categories seeing slower growth due to these political undertones.

Intellectual Property Protection

The robustness of intellectual property (IP) protection laws and their enforcement across Greater China is a critical consideration for luxury brands like those distributed by Emperor Watch & Jewellery. The prevalence of counterfeit watches and jewelry poses a significant threat, capable of eroding brand equity and impacting sales volumes. A strong governmental stance against IP infringement directly safeguards the authenticity and inherent exclusivity of European-made timepieces and fine jewelry.

Recent efforts highlight the ongoing battle against counterfeiting. For instance, in 2023, Chinese authorities seized millions of counterfeit goods, including luxury accessories, demonstrating a continued, albeit challenging, commitment to IP enforcement. Emperor Watch & Jewellery's reliance on the integrity of the supply chain means that effective IP protection directly translates to maintaining the premium perception and market value of its offerings.

- Brand Value Preservation: Strong IP laws prevent dilution of brand image caused by unauthorized replicas.

- Sales Integrity: Combating counterfeits ensures that genuine sales are not lost to illicit markets.

- Government Enforcement: The effectiveness of customs and market surveillance in seizing fake goods is paramount.

- Consumer Trust: Assured authenticity builds and maintains consumer confidence in luxury purchases.

Political stability and government policies significantly influence consumer confidence and spending on luxury goods in Emperor Watch & Jewellery's key markets. For instance, Hong Kong's retail sector, a vital component of the luxury market, saw a recovery in 2023 with over 28.1 million visitors, many from Mainland China, boosting sales. However, evolving trade agreements and potential tariffs in 2024 continue to impact import costs for high-value items, directly affecting pricing and consumer affordability.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Emperor Watch & Jewellery, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's operating landscape, identify potential threats and opportunities, and support strategic decision-making.

The Emperor Watch & Jewellery PESTLE Analysis offers a clear, summarized version of external factors, acting as a pain point reliever by providing easy referencing during meetings and presentations.

Economic factors

The rising affluence in Greater China and Southeast Asia is a significant tailwind for Emperor Watch & Jewellery. As disposable incomes climb, particularly for the burgeoning middle and high-net-worth segments, demand for luxury goods like watches and jewelry naturally increases. This trend is evident as China's per capita disposable income saw a notable increase, reaching an estimated RMB 40,300 in 2024, up from RMB 39,200 in 2023, fueling consumer appetite.

However, economic headwinds can create volatility. For instance, economic uncertainties and a more cautious consumer sentiment observed in markets like Hong Kong can dampen luxury spending. This was reflected in retail sales figures for Hong Kong, which experienced fluctuations, underscoring the sensitivity of the luxury sector to broader economic confidence.

Economic growth in Emperor Watch & Jewellery's primary markets, particularly Hong Kong and Mainland China, remains a critical determinant of luxury goods demand. While global economic headwinds have tempered luxury sales, emerging markets in Southeast Asia and India are anticipated to be key growth drivers in the coming years. Emperor Watch & Jewellery demonstrated notable revenue growth in 2024, even amidst prevailing market volatility, suggesting a degree of resilience within its operational segments.

Fluctuations in exchange rates significantly influence Emperor Watch & Jewellery's profitability. As the Hong Kong Dollar (HKD) is pegged to the US Dollar, its strength against other regional currencies directly affects the cost of imported luxury watches, often sourced from Europe. For instance, if the HKD strengthens considerably against currencies like the Euro, the cost of acquiring these high-end timepieces for Emperor Watch & Jewellery would increase.

Conversely, a robust HKD can diminish the purchasing power of international tourists, a crucial customer segment for luxury retailers in Hong Kong. A stronger HKD makes luxury goods, including the watches Emperor Watch & Jewellery sells, more expensive for visitors from countries with weaker currencies. This can lead to a slowdown in sales as tourists may opt for destinations with more favorable exchange rates.

For example, during periods of significant HKD appreciation, a tourist from mainland China might find that their Renminbi (RMB) buys fewer Hong Kong dollars, making a HK$100,000 watch effectively cost more in RMB terms. This price sensitivity can deter purchases, impacting Emperor Watch & Jewellery's revenue streams.

Inflation and Interest Rates

Rising inflation and interest rates are significant headwinds for luxury goods like those offered by Emperor Watch & Jewellery. As the cost of living increases, consumers tend to cut back on non-essential purchases, shifting their spending towards necessities. This trend was evident in 2024, with many economies experiencing persistent inflation, forcing central banks to maintain higher interest rates. For instance, the US Federal Reserve kept its benchmark interest rate in the 5.25%-5.50% range for much of 2024, impacting borrowing costs and consumer confidence.

While the ultra-luxury segment might show resilience, broader economic pressures can lead to a more cautious approach from a wider base of luxury consumers. This means even established brands need to be mindful of value and perceived worth. The impact is felt globally; high interest rates in major Western economies, which are significant markets for luxury goods, can dampen overall demand. For example, the European Central Bank continued its tightening cycle in early 2024, contributing to a slowdown in consumer spending across the Eurozone.

- Inflationary Pressures: Persistent inflation in 2024 eroded purchasing power, making luxury items less accessible for many consumers.

- Interest Rate Hikes: Central banks' efforts to combat inflation through higher interest rates increased the cost of credit and discouraged discretionary spending.

- Consumer Sentiment: Economic uncertainty fueled by inflation and interest rates led to a more cautious consumer mindset regarding luxury purchases.

- Global Market Impact: Higher interest rates in key markets like the US and Europe contributed to a slower global luxury market environment throughout 2024.

Tourism and Cross-Border Shopping

The rebound in tourism, particularly from Mainland China to Hong Kong, is a significant driver for luxury goods sales, directly benefiting retailers like Emperor Watch & Jewellery. In 2023, Hong Kong saw a notable increase in visitor arrivals, with Mainland Chinese visitors forming a substantial portion, signaling a positive trend for the luxury sector.

Shifts in travel habits also play a crucial role. For instance, an uptick in outbound travel by Hong Kong residents or a growing preference for domestic luxury shopping within Mainland China can alter where luxury spending occurs, impacting Emperor Watch & Jewellery's market focus.

- Visitor Arrivals: Hong Kong's visitor arrivals reached approximately 34 million in 2023, a substantial increase from previous years, with Mainland Chinese tourists representing a significant segment.

- Luxury Spending Trends: Mainland Chinese consumers continue to be a dominant force in global luxury spending, with a growing portion of this expenditure potentially returning to key Asian hubs as travel normalizes.

- Cross-Border Shopping Dynamics: Changes in currency exchange rates and local pricing strategies in destinations like Hong Kong can influence the attractiveness of cross-border shopping for luxury items.

Economic growth in Greater China and Southeast Asia remains a primary driver for Emperor Watch & Jewellery, with rising disposable incomes fueling demand for luxury goods. For example, China's per capita disposable income was projected to reach approximately RMB 40,300 in 2024, supporting consumer spending. Conversely, economic uncertainties and a more cautious consumer sentiment, as seen in Hong Kong's retail sales fluctuations, can temper luxury purchases, highlighting the sector's sensitivity to economic confidence.

Inflationary pressures and higher interest rates in 2024 acted as significant headwinds, reducing purchasing power for non-essential items and increasing borrowing costs. For instance, the US Federal Reserve maintained its benchmark interest rate between 5.25%-5.50% for much of the year, impacting consumer confidence globally. This environment encourages a more cautious approach to luxury spending, even for established brands, with global markets like the Eurozone also experiencing slower consumer spending due to central bank tightening cycles.

Exchange rate fluctuations, particularly the Hong Kong Dollar's peg to the US Dollar, directly impact Emperor Watch & Jewellery's cost of imported goods and the purchasing power of international tourists. A stronger HKD can increase the cost of sourcing watches from Europe and make luxury items more expensive for visitors, potentially deterring sales. For instance, a significant HKD appreciation would mean a Chinese tourist's RMB buys fewer Hong Kong dollars, increasing the effective cost of a luxury watch.

| Economic Factor | Impact on Emperor Watch & Jewellery | Supporting Data (2023-2024 Estimates) |

|---|---|---|

| Economic Growth in Greater China | Positive driver for luxury demand due to rising disposable incomes. | China Per Capita Disposable Income: ~RMB 40,300 (2024 est.) |

| Economic Uncertainty in Hong Kong | Can dampen luxury spending and create volatility. | Hong Kong retail sales experienced fluctuations. |

| Inflation and Interest Rates | Reduces purchasing power and discourages discretionary spending. | US Federal Reserve Rate: 5.25%-5.50% (maintained through much of 2024) |

| Exchange Rate Fluctuations (HKD) | Affects cost of imported goods and tourist spending. | HKD pegged to USD; strength impacts Euro-sourced goods and Chinese tourist purchasing power. |

Full Version Awaits

Emperor Watch & Jewellery PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis for Emperor Watch & Jewellery provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. It's designed to offer actionable insights for strategic planning and market understanding.

Sociological factors

Younger consumers, particularly Millennials and Gen Z, are reshaping the luxury landscape. These demographics, representing a significant portion of the global luxury market, increasingly value personalized experiences and digital interaction over ostentatious displays of wealth. For instance, a 2024 report indicated that over 60% of Gen Z luxury consumers prefer brands that offer unique customization options.

There's a noticeable shift towards bespoke creations and a growing appreciation for understated elegance, often termed 'quiet luxury.' This trend is driven by a desire for authenticity and individuality. Emperor Watch & Jewellery needs to strategically adjust its product development and marketing to resonate with these evolving tastes, ensuring its collections align with this demand for exclusivity and subtle sophistication.

In many Asian societies, watches and jewelry are more than just accessories; they are deeply embedded in cultural traditions. These items are frequently exchanged during significant life events like weddings and are integral to celebrations such as festivals. Their presence often signifies social standing and a connection to family history, which fuels a steady desire for these luxury goods.

This cultural weight means that demand for high-end timepieces and adornments remains robust, as purchasing decisions are often influenced by these traditions rather than fleeting fashion. For instance, the global luxury jewelry market was valued at approximately $250 billion in 2023 and is projected to grow, with Asia-Pacific being a key contributor to this expansion, underscoring the enduring cultural value placed on these items.

Consumer perception of luxury brands, particularly regarding heritage, craftsmanship, and exclusivity, heavily influences purchasing behavior. For Emperor Watch & Jewellery, their emphasis on European-made timepieces and the narrative around their own brand's history are central to attracting and retaining discerning clientele.

Maintaining strong brand loyalty among affluent customers is paramount. This is often achieved through well-structured loyalty programs and highly personalized customer service, ensuring repeat business and fostering a sense of value.

Influence of Social Media and Key Opinion Leaders (KOLs)

Social media platforms, particularly in Southeast Asia, are powerful engines for luxury trend diffusion and aspiration building, especially for younger demographics. Brands like Emperor Watch & Jewellery are recognizing this, leveraging social media to connect with digitally native consumers.

Key Opinion Leaders (KOLs) and celebrities are instrumental in this strategy. Their endorsements can significantly sway purchasing decisions, tapping into the desire for status and exclusivity that luxury goods represent. For instance, in 2024, influencer marketing spend in the luxury sector saw a notable increase, with many brands allocating substantial budgets to collaborations that resonate with a younger, aspirational audience.

- Digital Reach: Platforms like Instagram and TikTok are primary channels for showcasing luxury products and lifestyle imagery, reaching millions of potential customers.

- Influence on Trends: KOLs often dictate emerging fashion and accessory trends, impacting what consumers perceive as desirable in the luxury market.

- Consumer Engagement: Social media facilitates direct interaction between brands and consumers, fostering loyalty and providing valuable market insights.

- Southeast Asian Market: The region's rapidly growing middle class and high smartphone penetration make it a prime market for social media-driven luxury marketing efforts.

Ethical Consumerism and Social Responsibility

Consumers, particularly millennials and Gen Z, are increasingly prioritizing ethical considerations in their purchasing decisions. This shift is evident in the luxury market, where demand for transparency in sourcing and sustainability is growing. For instance, a 2024 report indicated that over 60% of luxury consumers consider a brand's ethical practices when making a purchase.

This growing awareness directly impacts luxury jewelers like Emperor Watch & Jewellery, pushing them to adopt more responsible business models. Brands are responding by focusing on:

- Ethical Sourcing: Ensuring gemstones and precious metals are sourced responsibly, avoiding conflict zones and adhering to fair labor practices.

- Sustainability: Incorporating recycled materials and reducing environmental impact throughout the production process.

- Transparency: Providing clear information about the origin of materials and manufacturing processes.

- Social Impact: Engaging in initiatives that benefit communities and promote social well-being.

The market for certified recycled gold, for example, saw a significant increase in demand in 2024, with many leading brands committing to using a higher percentage of such materials in their collections.

Younger generations, particularly Millennials and Gen Z, are a driving force in the luxury market, valuing personalization and digital engagement. A 2024 study highlighted that over 60% of Gen Z luxury shoppers prefer brands offering customization, signaling a need for Emperor Watch & Jewellery to adapt its offerings to this preference for unique experiences.

Cultural traditions in many Asian societies imbue watches and jewelry with significant meaning, often tied to life events and social status. This deep-rooted cultural appreciation ensures sustained demand for luxury timepieces and adornments, as seen in the global luxury jewelry market’s projected growth, with Asia-Pacific being a key region.

Ethical considerations are increasingly influencing consumer choices, with a growing demand for transparency in sourcing and sustainability within the luxury sector. By 2024, over 60% of luxury consumers reported factoring a brand's ethical practices into their purchasing decisions, prompting brands like Emperor Watch & Jewellery to focus on responsible sourcing and transparent operations.

Technological factors

The luxury retail landscape is being reshaped by a significant digital transformation. Consumers, accustomed to convenience, now expect seamless integration between online and physical stores, a trend particularly pronounced in the high-value watch and jewelry sector. Emperor Watch & Jewellery's investment in its online shopping platform directly addresses this by offering a digital touchpoint for its discerning clientele.

This shift is underscored by growing e-commerce penetration. For instance, global luxury e-commerce sales were projected to reach over $75 billion in 2024, highlighting the critical need for brands to master digital channels. Emperor Watch & Jewellery's online presence is therefore not just an addition but a necessity to capture market share and meet evolving customer expectations for a connected shopping experience.

Emperor Watch & Jewellery must embrace advanced digital marketing, using AI for predictive analytics and personalized recommendations to connect with today's luxury buyers. This technology allows for highly targeted advertising campaigns, ensuring messages reach the right audience. For instance, in 2024, the global luxury goods market saw a significant shift towards digital channels, with online sales projected to grow substantially, indicating the critical need for sophisticated digital engagement.

AI-powered tools are instrumental in refining customer interactions and optimizing product suggestions. By analyzing browsing behavior and purchase history, these systems can offer tailored recommendations, boosting conversion rates. This personalization is key in the competitive luxury sector, where consumers expect bespoke experiences. In 2025, it's estimated that over 70% of luxury brands will be investing heavily in AI for customer relationship management and marketing personalization.

Luxury retailers are increasingly integrating advanced in-store technologies to create more engaging customer experiences. For instance, augmented reality (AR) fitting rooms are becoming more common, allowing shoppers to virtually try on items without physically changing. This trend is driven by a desire to blend the convenience of digital with the tangible appeal of physical retail.

Physical stores are transforming into dynamic, multi-sensory environments. Emperor Watch & Jewellery, for example, can enhance its appeal by offering personalized services, such as private viewings or bespoke customization workshops, alongside curated events like exclusive product launches or watchmaking demonstrations. These initiatives aim to foster deeper customer connections and provide memorable experiences that go beyond simple transactions.

The luxury sector is seeing significant investment in experiential retail. By 2024, reports indicated that luxury brands were allocating substantial budgets towards in-store technology and experiential initiatives, recognizing their importance in differentiating themselves in a competitive market. This focus on creating unique, immersive environments is crucial for attracting and retaining high-net-worth individuals.

Supply Chain Digitization and Data Analytics

Emperor Watch & Jewellery is leveraging technological advancements to streamline its supply chain. By implementing digital solutions for inventory management and logistics, the company aims to boost efficiency and cut down on waste, a critical factor in the luxury goods sector where precision is paramount.

The integration of data analytics is proving invaluable for Emperor Watch & Jewellery. These insights into consumer preferences, emerging market trends, and internal operational metrics allow for more strategic and data-driven decision-making across the business. For instance, in 2024, the global luxury goods market saw a significant uptick in demand for personalized experiences, a trend that data analytics can help identify and capitalize on.

- Supply Chain Optimization: Digital tools are enhancing real-time tracking of goods, reducing lead times and improving inventory accuracy.

- Consumer Insights: Advanced analytics are uncovering purchasing patterns and preferences, enabling targeted marketing campaigns.

- Operational Efficiency: Data-driven insights are being used to identify bottlenecks and improve overall operational performance.

- Market Trend Analysis: Predictive analytics help Emperor Watch & Jewellery anticipate shifts in consumer demand and market dynamics.

Blockchain for Authenticity and Traceability

Blockchain technology is increasingly being adopted to verify the authenticity and track the journey of luxury timepieces and jewelry. This innovation is a powerful tool against the pervasive issue of counterfeiting, aiming to bolster consumer confidence in their high-value purchases. By offering a transparent ledger, blockchain can detail the origin of materials, a crucial factor for the growing segment of consumers prioritizing ethical sourcing and sustainability.

The luxury goods market, particularly for watches and jewelry, is actively exploring blockchain solutions. For instance, as of early 2024, several major luxury groups have been piloting or implementing blockchain-based platforms. These platforms provide immutable records of a product's lifecycle, from raw material sourcing to final sale. This transparency directly addresses consumer demand for verifiable provenance, a trend that has seen significant growth in the past few years.

- Combating Counterfeits: Blockchain offers a tamper-proof digital certificate of authenticity for luxury items, making it significantly harder for counterfeit products to enter the market.

- Enhanced Traceability: Consumers can access detailed information about the origin of materials, manufacturing processes, and ownership history, fostering trust and brand loyalty.

- Ethical Sourcing Verification: The technology allows for transparent tracking of precious metals and gemstones, confirming compliance with ethical and environmental standards, which is a key purchasing driver for a growing consumer base.

- Market Growth Impact: The global luxury goods market is projected for continued expansion, with technological advancements like blockchain playing a vital role in maintaining brand integrity and consumer trust in this high-value sector.

Technological advancements are fundamentally altering how luxury consumers interact with brands like Emperor Watch & Jewellery. The increasing demand for seamless online-to-offline experiences, driven by a global luxury e-commerce market projected to exceed $75 billion in 2024, necessitates robust digital platforms. Emperor Watch & Jewellery's investment in its online presence directly addresses this evolving consumer expectation for convenience and integrated shopping journeys.

The strategic adoption of AI for personalized marketing and customer relationship management is becoming paramount. By 2025, over 70% of luxury brands are expected to heavily invest in AI to enhance customer engagement and tailor product recommendations, a trend that Emperor Watch & Jewellery can leverage to deepen client relationships and boost conversion rates.

Furthermore, technologies like blockchain are crucial for verifying authenticity and tracing the provenance of high-value items, a critical factor in combating counterfeits and building consumer trust. As of early 2024, major luxury groups are actively exploring blockchain, recognizing its role in providing immutable records of a product's lifecycle and assuring ethical sourcing, a growing concern for discerning buyers.

Legal factors

Empower Watch & Jewellery operates under a framework of robust consumer protection laws across its markets. These regulations mandate transparency in advertising, fair warranty terms, and guarantees regarding product quality and authenticity. For instance, in 2024, regulatory bodies in key markets like Singapore and Hong Kong continued to emphasize stringent enforcement of misleading advertising practices, with potential fines for non-compliance impacting brand reputation.

Compliance with these consumer protection statutes is not merely a legal obligation but a cornerstone of customer trust and brand loyalty for Emperor Watch & Jewellery. Failure to adhere to these standards, such as misrepresenting the provenance or material of a luxury timepiece, can lead to significant penalties and damage to the company's established reputation, potentially affecting sales figures in the highly competitive luxury goods sector.

Robust legal frameworks are paramount for Emperor Watch & Jewellery to safeguard its proprietary designs, brand identity, and the trademarks of the European luxury watch brands it represents. These protections are vital for maintaining market exclusivity and brand value, especially in a competitive luxury segment.

Effective anti-counterfeiting legislation is a critical bulwark against revenue erosion and brand dilution. For instance, in 2023, the European Union reported seizures of counterfeit goods valued at over €670 million, highlighting the pervasive threat that Emperor Watch & Jewellery must actively combat through strict adherence to and advocacy for strong legal enforcement.

Emperor Watch & Jewellery must navigate a complex web of import/export regulations and tariffs across Greater China and Southeast Asia. For instance, China's average tariff rate on imported luxury goods, while subject to change, can significantly influence the landed cost of watches and jewelry. Keeping abreast of these duties, along with specific customs clearance procedures and potential import quotas in markets like Vietnam or Thailand, is crucial for maintaining competitive pricing and ensuring smooth supply chain operations.

Labor Laws and Employment Regulations

Emperor Watch & Jewellery must navigate a complex web of labor laws across its operating regions, covering everything from minimum wage requirements and working hour limits to employee benefits and anti-discrimination statutes. For instance, in 2024, many European countries are seeing continued adjustments to minimum wage laws, with some nations like Germany planning phased increases to reach €15 per hour by the end of 2025, impacting labor costs. Adherence to these regulations is crucial not only for ethical business conduct but also to avoid costly penalties and reputational damage stemming from non-compliance.

Failure to comply with employment regulations can lead to significant legal repercussions. These can include substantial fines, back-pay claims, and even legal challenges to employment contracts. For example, in 2024, the UK's Employment Tribunals reported an increase in unfair dismissal claims, highlighting the importance of robust HR practices and adherence to statutory dismissal procedures.

Key labor law considerations for Emperor Watch & Jewellery include:

- Minimum Wage Compliance: Ensuring all employees receive at least the legally mandated minimum wage in each jurisdiction.

- Working Conditions: Maintaining safe and healthy work environments as stipulated by labor laws.

- Employment Contracts: Utilizing legally sound contracts that clearly define terms of employment and employee rights.

- Discrimination and Equal Opportunity: Implementing policies that prevent discrimination based on age, gender, race, or other protected characteristics, a focus area for regulators in 2024.

Advertising and Marketing Regulations

Advertising and marketing regulations for luxury goods are particularly stringent, aiming to prevent deceptive practices and ensure fair competition. Emperor Watch & Jewellery must navigate these rules carefully to maintain brand integrity. For instance, in 2024, the Advertising Standards Authority (ASA) in the UK continued to scrutinize luxury advertising, with a notable focus on sustainability claims and the ethical sourcing of materials, impacting how brands like Emperor can communicate their value propositions.

Compliance with local laws is paramount for Emperor Watch & Jewellery's promotional efforts. This includes adhering to regulations on:

- Truthful representation of product quality and origin.

- Prohibitions against misleading pricing or discount claims.

- Restrictions on celebrity endorsements and influencer marketing.

- Data privacy laws affecting targeted advertising campaigns.

Navigating intellectual property laws is critical for Emperor Watch & Jewellery to protect its brand and the luxury watch manufacturers it represents. This includes robust trademark registration and enforcement against infringement. In 2024, global efforts to combat online counterfeiting intensified, with significant legal actions taken against platforms facilitating the sale of fake luxury goods, underscoring the need for vigilance.

The company must also adhere to stringent regulations concerning the sale of precious metals and gemstones, ensuring compliance with hallmarking laws and ethical sourcing standards. For instance, in 2023, the Responsible Jewellery Council reported increased scrutiny on supply chain transparency, influencing how businesses like Emperor must verify the origin and ethical production of their materials.

Furthermore, Emperor Watch & Jewellery is subject to various financial regulations, including those related to anti-money laundering (AML) and know your customer (KYC) procedures, particularly for high-value transactions. Compliance with these measures, which saw updated guidance from financial intelligence units in several Asian countries in 2024, is essential to prevent illicit financial activities and maintain regulatory standing.

The company's operations are also shaped by data privacy laws, such as the EU's GDPR and similar regulations emerging globally. In 2024, enforcement of these laws continued to strengthen, with significant fines levied for data breaches or misuse, impacting how Emperor handles customer information for marketing and loyalty programs.

Environmental factors

Growing consumer demand for ethically sourced luxury goods is a significant environmental driver. In 2024, reports indicate that over 60% of luxury consumers consider sustainability when making purchasing decisions, pushing companies like Emperor Watch & Jewellery to scrutinize their supply chains for precious metals and gemstones.

Regulatory bodies are also tightening environmental standards. For instance, upcoming EU regulations in 2025 are expected to mandate stricter due diligence for conflict minerals, requiring Emperor Watch & Jewellery to demonstrate responsible sourcing practices for gold and diamonds to maintain market access.

Emperor Watch & Jewellery must actively integrate recycled precious metals and explore the growing market for lab-grown diamonds. The global lab-grown diamond market alone is projected to reach $15.7 billion by 2030, presenting an opportunity to reduce environmental impact and appeal to a wider consumer base.

The luxury sector, including high-end watch and jewelry brands like Emperor Watch & Jewellery, is under increasing pressure to address its environmental impact. This scrutiny extends to energy used in production, the logistics of moving goods globally, and the energy demands of retail spaces.

Consumers and investors alike are pushing for greater transparency and action on carbon emissions. For instance, a 2024 report indicated that 70% of luxury consumers consider sustainability a key factor in their purchasing decisions, a significant jump from previous years.

Emperor Watch & Jewellery, like its peers, is expected to actively measure and work towards reducing its carbon footprint across its entire supply chain. This includes everything from sourcing raw materials to the final sale and even product end-of-life management.

Growing environmental awareness is compelling luxury retailers like Emperor Watch & Jewellery to re-evaluate their waste management. Concerns over packaging waste and the disposal of end-of-life luxury goods are driving a shift towards circular economy principles. For instance, the global luxury packaging market, a significant contributor to waste, was valued at approximately $12.2 billion in 2023 and is projected to grow, highlighting the scale of the challenge and the opportunity for sustainable practices.

Brands are increasingly adopting strategies focused on product longevity, repair services, and the repurposing of materials. This not only reduces environmental impact but also aligns with consumer demand for ethical and sustainable luxury. Initiatives such as take-back programs for old timepieces or jewelry, coupled with the use of recycled precious metals, are becoming more prevalent as companies seek to minimize their ecological footprint and enhance brand reputation in the face of tightening regulations and consumer scrutiny.

Consumer Demand for Eco-Friendly Products

Consumer demand for eco-friendly luxury goods is a significant environmental factor influencing Emperor Watch & Jewellery. A growing segment of affluent consumers actively seeks products that align with their environmental values, pushing brands to emphasize sustainability in their sourcing and production. This trend is not just a niche interest; it's becoming a mainstream consideration for luxury purchases.

This shift in consumer preference directly impacts purchasing decisions. For instance, a 2024 report indicated that over 60% of luxury consumers consider a brand's sustainability practices when making a purchase. Emperor Watch & Jewellery must therefore highlight its commitment to ethical sourcing, responsible manufacturing, and reduced environmental impact to resonate with this increasingly important customer base.

The incentive for brands to showcase their green credentials is substantial. Emperor Watch & Jewellery can leverage this by:

- Highlighting sustainable materials: Emphasizing the use of recycled precious metals or ethically sourced gemstones in their timepieces and jewelry.

- Communicating transparent supply chains: Providing clear information about where and how their products are made, ensuring minimal environmental harm.

- Investing in eco-friendly packaging: Adopting biodegradable or recyclable materials for their product presentation.

- Supporting environmental initiatives: Partnering with or contributing to organizations focused on conservation or climate action.

Environmental Regulations and Compliance

Emperor Watch & Jewellery navigates a landscape of evolving environmental regulations impacting its manufacturing and supply chain. These rules cover everything from responsible sourcing of precious metals to the management of hazardous materials used in polishing and finishing processes. For instance, regulations concerning the use of cyanide in gold plating, a common practice in jewellery making, require strict handling and disposal protocols.

Compliance is not merely a legal obligation but a strategic imperative for maintaining brand reputation and avoiding significant financial penalties. Failure to adhere to environmental standards could result in fines, operational disruptions, and damage to Emperor Watch & Jewellery's image among environmentally conscious consumers. The company must invest in sustainable practices and transparent reporting to meet these expectations.

Key areas of environmental compliance for Emperor Watch & Jewellery include:

- Waste Management: Proper disposal of chemical waste, packaging materials, and electronic waste from manufacturing facilities.

- Chemical Usage: Adherence to regulations on the use and handling of chemicals like plating solutions, solvents, and cleaning agents, ensuring minimal environmental impact.

- Resource Efficiency: Implementing measures to reduce water and energy consumption in production processes.

- Supply Chain Transparency: Ensuring that suppliers also comply with environmental standards, particularly concerning the extraction and processing of raw materials like diamonds and precious metals.

The luxury market's environmental footprint is under increasing scrutiny, with consumers and regulators demanding greater accountability. Emperor Watch & Jewellery faces pressure to reduce carbon emissions, manage waste effectively, and adopt circular economy principles, particularly concerning packaging. By 2024, over 60% of luxury consumers consider sustainability in their purchasing decisions, making eco-friendly practices a critical business imperative.

Regulatory bodies are also tightening environmental standards, with upcoming EU regulations in 2025 set to mandate stricter due diligence for conflict minerals, impacting sourcing practices for gold and diamonds. Emperor Watch & Jewellery must demonstrate responsible sourcing to maintain market access and avoid penalties.

The company should actively integrate recycled precious metals and explore the growing market for lab-grown diamonds, a sector projected to reach $15.7 billion by 2030. This strategic shift not only reduces environmental impact but also appeals to a broader, eco-conscious consumer base.

Emperor Watch & Jewellery must also address its energy consumption across production, logistics, and retail operations. Transparency regarding carbon footprints and a commitment to reduction are now expected by 70% of luxury consumers, as indicated by a 2024 report.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Emperor Watch & Jewellery is built on a foundation of credible data from official government publications, reputable market research firms, and leading financial institutions. We incorporate insights from industry-specific reports and economic trend analyses to ensure a comprehensive understanding of the macro-environmental factors impacting the luxury retail sector.