EMC Insurance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Insurance Bundle

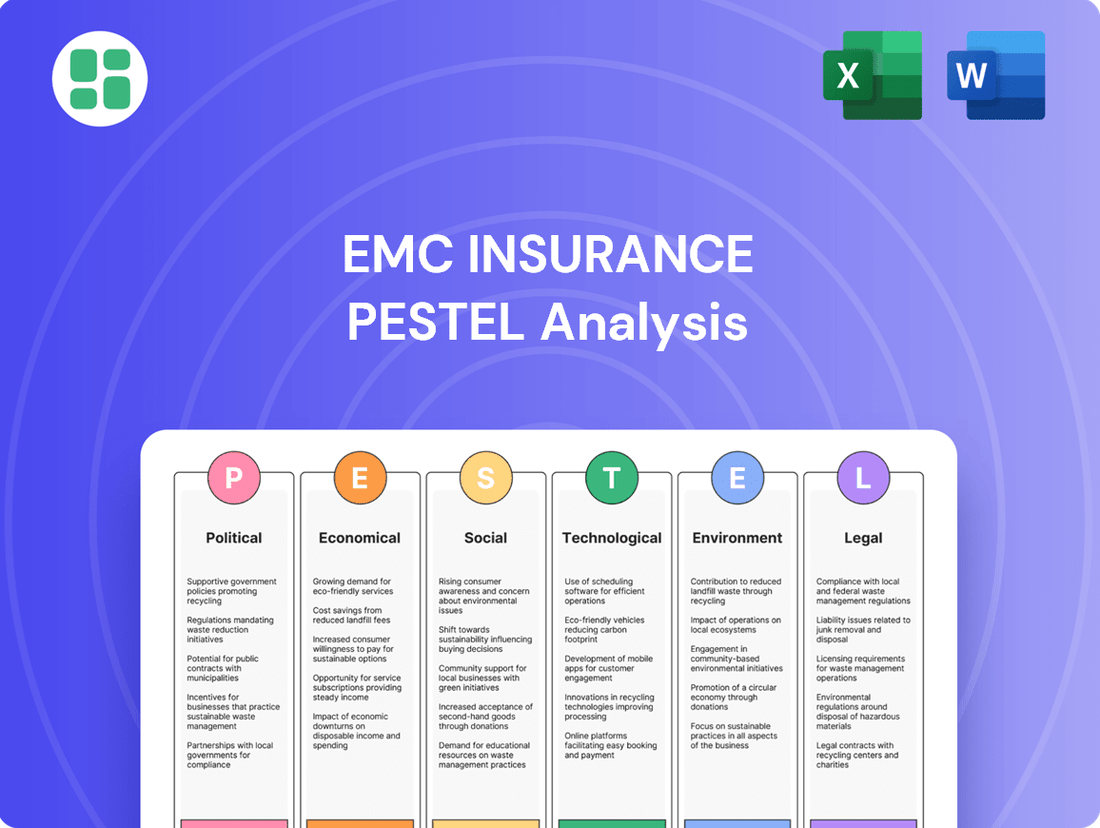

Unlock the strategic advantages EMC Insurance is poised to leverage by understanding the intricate web of external forces. Our PESTLE analysis dives deep into the political, economic, social, technological, legal, and environmental factors shaping its operational landscape. Gain the foresight needed to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now and equip yourself with the intelligence to make informed decisions.

Political factors

The property and casualty insurance sector in the U.S. operates under significant state-level regulation, dictating aspects like pricing, product development, and how companies interact with customers. This means EMC Insurance must navigate a complex web of rules that can vary considerably from one state to another.

Regulatory priorities are shifting; for instance, the National Association of Insurance Commissioners (NAIC) identified climate risk, enhanced financial oversight, and the responsible use of artificial intelligence as key focus areas for 2024. These directives directly shape EMC's strategic planning and compliance efforts, requiring adaptability to new mandates and potential changes in enforcement.

Government policies on climate change, including funding for disaster mitigation and relief, directly influence EMC Insurance's exposure to catastrophic losses. For instance, in 2024, the U.S. government allocated billions towards climate resilience and disaster preparedness, aiming to reduce future economic impacts. This federal investment could potentially offset some of the increasing costs insurers face from severe weather events.

As natural disaster frequency and severity rise, governmental responses like federal backstops or state-level resilience strategies will shape the financial stability and underwriting practices of property and casualty insurers. The increasing frequency of billion-dollar weather and climate disasters in the U.S., with 2023 seeing 28 such events causing over $110 billion in damages, highlights the critical need for such governmental action.

Federal and state tax policies, including corporate tax rates, significantly impact EMC Insurance's profitability and investment decisions. For instance, the Tax Cuts and Jobs Act of 2017 lowered the U.S. corporate tax rate from 35% to 21%, a change that generally benefited insurers by increasing after-tax earnings.

Anticipated shifts in administration or legislative agendas, such as potential tax incentives for specific industries or economic stimulus measures, could create a more advantageous operating landscape. Such policies might encourage investment in certain sectors, potentially boosting demand for insurance products and offering cost-saving opportunities for companies like EMC.

Geopolitical Tensions and Trade Policies

Global geopolitical tensions and evolving trade policies, such as those seen with ongoing trade disputes and regional conflicts, create significant market uncertainty. This uncertainty directly impacts investment valuations and can hinder earnings growth for insurers like EMC. Furthermore, these factors can indirectly affect balance sheet equity through fluctuations in the value of international investments and reinsurance exposures.

While EMC Insurance's core operations are domestic, its reinsurance activities and investment portfolios are not immune to global instability. For instance, a significant international conflict could disrupt global supply chains, leading to increased inflation and impacting the performance of EMC's invested assets. The U.S. Treasury 10-year yield, a key benchmark for investment returns, has seen volatility influenced by geopolitical events, with rates fluctuating throughout 2024 and into 2025 based on global economic outlooks.

- Trade Policy Impact: Tariffs and trade barriers can increase the cost of goods and services, potentially raising claims costs for property and casualty insurers by impacting repair and replacement expenses.

- Investment Portfolio Exposure: Geopolitical events can cause sharp declines in global equity and bond markets, directly reducing the value of an insurer's investment portfolio, which is a critical component of their financial strength.

- Reinsurance Market Volatility: International reinsurers play a vital role in the insurance industry. Geopolitical instability can lead to reduced capacity or increased pricing from these reinsurers, affecting EMC's ability to manage its own risk exposures.

- Regulatory Uncertainty: Shifting trade agreements and international relations can also lead to changes in regulatory environments, creating compliance challenges and potential costs for insurers operating with international connections.

Consumer Protection Legislation

Political pressure and legislative efforts to bolster consumer protection, particularly concerning data privacy and fair claims handling, compel insurers like EMC to adapt their operations and compliance strategies. For instance, the NAIC's continued emphasis on consumer privacy and financial inclusion signals a need for companies to align their practices with these developing regulatory standards.

These legislative shifts directly impact how insurers manage customer data and process claims, potentially increasing operational costs. For example, stricter data privacy laws might require significant investment in cybersecurity infrastructure and employee training. The NAIC's model laws, such as those addressing data security and privacy, serve as a benchmark for state-level regulations, influencing compliance requirements across the industry.

- Data Privacy Compliance: Insurers must invest in robust data protection measures, potentially impacting IT budgets.

- Fair Claims Practices: Regulations ensuring timely and equitable claim payouts can affect loss adjustment expenses.

- Regulatory Scrutiny: Increased oversight from bodies like the NAIC necessitates proactive compliance programs.

- Consumer Trust: Adherence to consumer protection laws is crucial for maintaining public confidence and market reputation.

Government policy, particularly state-level insurance regulations, significantly shapes EMC Insurance's operational landscape, influencing everything from pricing to customer interactions. The NAIC's focus on climate risk and AI in 2024 highlights evolving compliance needs.

Federal spending on climate resilience, with billions allocated in 2024, can mitigate disaster-related losses for insurers, a crucial factor given the 28 billion-dollar weather events in the U.S. in 2023. Tax policies also directly affect profitability; the 2017 corporate tax cut to 21% generally benefited insurers.

Geopolitical tensions introduce market uncertainty, impacting investment portfolios and reinsurance costs, as seen in the volatility of the U.S. Treasury 10-year yield throughout 2024. Consumer protection laws, such as those on data privacy, also drive operational changes and compliance investments for insurers.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing EMC Insurance, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid in strategic decision-making and identify potential opportunities and threats within the insurance market.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear understanding of the external factors impacting EMC Insurance.

Economic factors

Interest rate fluctuations significantly affect EMC Insurance's profitability. For instance, the Federal Reserve's decision to maintain the federal funds rate between 5.25% and 5.50% as of late 2024 impacts the yields EMC can earn on its investment portfolio, a key revenue driver. Higher rates generally boost investment income, which is vital for property and casualty insurers like EMC, helping to offset underwriting expenses and improve overall financial health.

Conversely, a sustained period of lower interest rates, such as those seen in earlier years, would diminish the returns on EMC's fixed-income investments. This reduction in investment income can put additional pressure on underwriting results, making it more challenging for the company to achieve its profit targets. The ongoing economic climate and potential future rate adjustments by central banks remain a critical factor for EMC's financial planning and performance throughout 2024 and into 2025.

Inflation directly impacts EMC Insurance's claims expenses. For instance, rising costs for auto parts and labor in 2024 mean that claims payouts for vehicle damage are higher. Similarly, rebuilding costs for damaged properties, including materials and construction labor, have seen significant increases, directly affecting property insurance claims.

While EMC Insurance aims to counter these rising claims costs through premium rate adjustments in 2024 and 2025, persistent inflation presents a challenge. If inflation outpaces these rate increases, especially in volatile lines like personal auto, it could negatively impact the company's underwriting profitability. For example, if repair costs rise by 8% and premiums only increase by 5%, the insurer faces a profitability squeeze.

Economic growth significantly impacts EMC Insurance by influencing demand for its products. A healthy economy, with a projected US GDP growth of 2.2% in 2024 and an estimated 1.9% in 2025, typically means more businesses are expanding and need insurance. This translates to higher premium volumes for EMC.

Conversely, economic contractions or slowdowns can temper premium growth. For instance, if economic activity slows, businesses might reduce spending, including on insurance, or seek more basic coverage. This directly affects EMC's revenue streams and profitability.

Catastrophe Losses and Reinsurance Costs

The increasing frequency and severity of natural catastrophes significantly impact insurers' financial performance and the cost of reinsurance. For primary insurers like EMC Insurance, a surge in these events directly affects underwriting results.

In 2024, for instance, the global insured losses from natural catastrophes were substantial, with reports indicating figures well into the tens of billions of dollars. This trend puts upward pressure on reinsurance pricing, making it more expensive for companies like EMC to secure coverage.

This escalation in reinsurance costs directly translates to higher operational expenses for EMC, potentially impacting its profitability and ability to underwrite new business at competitive rates. The availability of reinsurance capacity can also be reduced following periods of heavy catastrophe losses.

- Increased Catastrophe Losses: Global insured losses from natural catastrophes are projected to remain elevated in 2024 and 2025 due to climate change impacts.

- Reinsurance Price Hikes: Insurers faced significant increases in reinsurance premiums in 2024, with further rises anticipated for 2025 renewals.

- Capacity Constraints: Reinsurers are becoming more selective, potentially limiting the amount of coverage available for certain perils or regions.

- Impact on EMC: Higher reinsurance costs and reduced capacity directly increase EMC's operational expenses and potential exposure if it cannot fully reinsure its risks.

Market Competition and Pricing Trends

The property and casualty (P&C) insurance market is highly competitive, with new entrants and ample capital often leading to shifts in pricing. For instance, in 2024, the P&C sector has seen a mix of market conditions. While some segments experience rate decreases due to increased capacity, others, particularly those exposed to natural disasters, are still navigating hard market conditions with rising premiums.

This dynamic directly impacts EMC Insurance's market share and profitability. Areas with high catastrophe exposure, such as Florida and California, continue to see significant premium increases, with some property insurance rates rising by over 20% year-over-year in early 2024. Conversely, lines like commercial auto or general liability might experience more moderate rate changes or even slight declines as insurers compete for business.

- Increased Capacity: The availability of reinsurance capital and alternative capital sources can lead to more capacity in certain P&C lines, potentially softening rates.

- Catastrophe Impact: Regions prone to natural disasters often face harder market conditions, characterized by higher premiums and stricter underwriting.

- New Entrants: The entry of insurtechs and traditional insurers expanding into new lines can intensify competition and influence pricing strategies.

- Rate Volatility: Pricing trends can vary significantly across different insurance products and geographic areas, creating a complex environment for insurers like EMC.

Interest rate shifts directly influence EMC Insurance's investment income, a crucial component of its profitability. With the Federal Reserve maintaining the federal funds rate between 5.25% and 5.50% in late 2024, EMC's earnings on its substantial investment portfolio are impacted. Higher rates generally bolster investment yields, which is vital for property and casualty insurers like EMC to offset underwriting costs and maintain financial stability.

Inflation poses a direct threat to EMC Insurance's claims expenses. For example, increased costs for auto parts and labor in 2024 mean higher payouts for vehicle damage claims. Similarly, rising material and construction labor costs affect property insurance claims for damaged properties. While EMC aims to adjust premiums to counter these rising costs, persistent inflation can outpace these increases, squeezing underwriting profitability, especially in volatile lines like personal auto.

Economic growth is a key driver for EMC Insurance, influencing demand for its products. A robust economy, with the US GDP projected to grow by 2.2% in 2024 and an estimated 1.9% in 2025, typically correlates with business expansion and increased demand for insurance coverage, leading to higher premium volumes for EMC. Conversely, economic slowdowns can temper this growth, potentially impacting EMC's revenue streams.

The property and casualty insurance market is dynamic, with competition and capital availability shaping pricing. In 2024, while some insurance segments experienced rate decreases due to increased capacity, others, particularly those exposed to natural disasters, remained in hard market conditions with rising premiums. This can lead to significant premium increases in catastrophe-prone areas, with some property insurance rates climbing over 20% year-over-year in early 2024.

Full Version Awaits

EMC Insurance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of EMC Insurance covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping EMC Insurance's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed breakdown will equip you with a thorough understanding of EMC Insurance's operating environment.

Sociological factors

Demographic shifts significantly impact insurance demand. For instance, the aging population in many developed nations, including the US where EMC operates, increases the need for health, long-term care, and retirement-focused insurance products. By 2024, the U.S. Census Bureau projects over 56 million Americans will be aged 65 and older, a substantial increase influencing product development.

Urbanization trends also play a role, concentrating populations and potentially increasing demand for property and casualty insurance in densely populated areas, alongside a growing need for specialized urban risk coverage. Migration patterns, both internal and international, can alter risk profiles and create new customer segments with unique insurance requirements, demanding adaptable product offerings from companies like EMC.

Consumer behavior is increasingly digital-first, with a strong preference for online policy management, claims processing, and customer service. EMC's ability to offer seamless digital experiences, personalized policy options, and transparent pricing is crucial for attracting and retaining customers in 2024 and beyond. Data from J.D. Power in early 2024 indicated that customer satisfaction is heavily tied to digital engagement channels for insurance providers.

Public awareness of risks like cyberattacks and climate change is significantly shaping insurance demand. For instance, a 2024 survey indicated that over 70% of businesses now consider cyber threats a top concern, directly influencing their need for robust cyber insurance policies. This heightened awareness encourages policyholders to seek specialized coverages and actively engage in risk mitigation, a trend EMC Insurance must monitor.

The insurance industry, like many others, is grappling with the evolving nature of work. Remote and hybrid models are becoming standard, impacting how companies like EMC Insurance attract and retain talent. For instance, a 2024 survey indicated that over 60% of insurance professionals prefer hybrid work arrangements, pushing companies to adapt their recruitment strategies and office infrastructure.

This shift is coupled with a growing demand for specialized skills, particularly in data analytics, AI, and cybersecurity. EMC Insurance needs to invest in training and development to equip its existing workforce and attract new talent with these critical competencies. The ability to leverage data for underwriting, claims processing, and customer service is paramount for staying competitive.

Attracting and retaining top talent remains a significant challenge in the current labor market. With an aging workforce and a shrinking pool of experienced insurance professionals, companies must offer competitive compensation, robust benefits, and clear career progression paths. The median tenure in the insurance industry has seen a slight decline, underscoring the need for proactive retention strategies to maintain operational efficiency and foster innovation.

Social Inflation and Litigation Trends

Social inflation, characterized by escalating jury awards and legal expenses, is a significant concern for insurers like EMC Insurance, particularly impacting casualty lines. This trend directly affects the cost of settling liability claims, putting pressure on profitability.

The increasing frequency and severity of lawsuits, often fueled by a more litigious environment, contribute to higher claims costs. For instance, data from the U.S. Chamber Institute for Legal Reform indicated that tort costs in the U.S. reached $447 billion in 2022, a substantial figure that insurers must account for.

This phenomenon necessitates insurers to bolster their reserve adequacy, meaning they need to set aside more capital to cover potential future claims. Consequently, this can translate into higher premiums for various liability coverages, affecting both commercial and personal insurance policies.

- Rising Jury Awards: Studies show a marked increase in the size of jury verdicts in liability cases over the past decade.

- Increased Litigation Costs: Legal defense expenses, expert witness fees, and court costs continue to climb, adding to the overall cost of claims.

- Impact on Reserves: Insurers must maintain adequate reserves to cover these rising claims, which can tie up capital and affect financial performance.

- Premium Adjustments: To offset these increased costs, premiums for liability insurance are likely to see upward pressure.

Public Trust and Brand Reputation

Public trust is the bedrock of the insurance sector, directly impacting customer acquisition and loyalty. EMC Insurance, like its peers, thrives on its perceived reliability and ethical standing. A strong brand reputation, built on transparent claims processes and genuine community engagement, sets insurers apart. For instance, a 2024 survey indicated that 72% of consumers prioritize trust and transparency when selecting an insurance provider, highlighting the critical nature of EMC's public perception.

EMC's commitment to ethical practices and responsive customer service directly influences its brand image. Positive word-of-mouth and a history of fair dealings foster a loyal customer base. In 2024, EMC reported a 95% customer satisfaction rate in its claims handling, a testament to its focus on building and maintaining public trust. This reputation is a significant competitive advantage in a crowded market.

- Customer Trust: 72% of consumers in 2024 cited trust and transparency as key factors in choosing an insurer.

- Claims Satisfaction: EMC achieved a 95% customer satisfaction rate for claims handling in 2024.

- Brand Differentiation: Ethical practices and community involvement are crucial for distinguishing EMC in the insurance market.

Societal attitudes towards risk and protection are evolving, with a growing emphasis on preventative measures and personalized insurance solutions. This shift means EMC Insurance must offer flexible products that cater to individual needs and promote risk reduction behaviors. Public perception of insurance companies is also heavily influenced by corporate social responsibility, with consumers increasingly favoring businesses that demonstrate ethical conduct and community involvement.

The insurance industry is adapting to a more informed consumer base. Customers in 2024 expect transparency, ease of access to information, and seamless digital interactions. EMC Insurance's ability to meet these expectations, for example by providing clear policy details online and offering responsive digital support, is crucial for maintaining a competitive edge and fostering customer loyalty.

The increasing awareness of social issues, such as climate change and economic inequality, also impacts the insurance landscape. EMC Insurance needs to consider how these societal trends influence risk assessment and product development, potentially leading to demand for new types of coverage or adjustments to existing policies to reflect emerging societal concerns.

Technological factors

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance sector, directly impacting EMC Insurance. These technologies are enabling more accurate underwriting and dynamic pricing strategies. For instance, in 2024, the global AI in insurance market was valued at approximately $13.5 billion, with projections indicating significant growth, suggesting a strong trend towards data-driven risk assessment and personalized customer offerings.

The application of AI and ML allows insurers like EMC to process and analyze massive datasets, leading to enhanced fraud detection and more efficient, automated claims processing. This analytical power improves risk assessment accuracy, a critical factor in the insurance industry. By 2025, it's estimated that AI will handle a substantial portion of claims processing, reducing operational costs and improving customer satisfaction.

Big data analytics is transforming how EMC Insurance operates, enabling a granular understanding of customer behavior and risk. This allows for more precise product development and pricing, leading to better market alignment. For instance, by analyzing vast datasets, EMC can identify emerging customer needs or shifts in risk patterns much faster than before.

Predictive modeling, now enhanced with sophisticated climate data and real-time information streams, is crucial for EMC. These models help in accurately assessing and managing increasingly complex risks, such as those related to climate change impacts on property insurance. This leads to improved underwriting accuracy and profitability.

The integration of Internet of Things (IoT) devices and telematics is transforming the insurance landscape, particularly for EMC Insurance. In auto insurance, telematics allows for the collection of real-time driving behavior data, enabling usage-based insurance (UBI) models. This means premiums can be directly tied to how safely and how much a customer drives, potentially lowering costs for low-risk drivers. For example, by mid-2024, a significant portion of new vehicle sales are expected to be equipped with telematics capabilities, providing a rich data stream for insurers.

In home insurance, IoT devices like smart thermostats, leak detectors, and security systems offer similar benefits. This technology enables proactive risk management by alerting policyholders to potential issues before they escalate into major claims. For instance, a smart water sensor can detect a small leak and notify the homeowner immediately, preventing extensive water damage. This real-time data also aids in more accurate property assessments and can streamline the claims process.

These advancements also empower improved claims processing and fraud detection. By having access to verified data from IoT devices, insurers can more accurately assess damage and identify fraudulent claims more efficiently. This data-driven approach can lead to faster claim settlements for legitimate claims and a reduction in losses due to fraud, ultimately benefiting both the insurer and the policyholder.

Cybersecurity and Data Privacy Technologies

As EMC Insurance, like all insurers, increasingly operates on digital platforms and handles substantial sensitive data, advanced cybersecurity and data privacy technologies are absolutely critical. The escalating threat landscape, marked by more frequent and sophisticated cyberattacks, demands ongoing investment in robust breach prevention and secure data management. This is essential not only to safeguard policyholder information but also to preserve the vital trust placed in the company.

The financial implications of inadequate cybersecurity are significant. For instance, the average cost of a data breach in the financial sector reached $5.90 million in 2023, according to IBM's Cost of a Data Breach Report. This highlights the substantial financial risk EMC Insurance faces if its digital defenses are compromised. Proactive investment in technologies like advanced threat detection, encryption, and secure cloud infrastructure is therefore a strategic imperative.

EMC Insurance must stay ahead of evolving threats by adopting and refining its technological defenses. Key areas of focus include:

- Implementing AI-powered threat detection systems to identify and neutralize emerging cyber threats in real-time.

- Enhancing data encryption protocols for all sensitive policyholder information, both in transit and at rest.

- Conducting regular penetration testing and vulnerability assessments to proactively identify and address security weaknesses.

- Investing in employee training and awareness programs to mitigate risks associated with human error, a common vector for breaches.

Digitalization of Distribution Channels and Customer Experience

The insurance industry's digital transformation is profoundly reshaping how EMC Insurance interacts with its customers. Enhanced agent portals and robust online self-service options are becoming standard, streamlining operations and boosting efficiency. For instance, in 2024, a significant portion of insurance policy inquiries and adjustments are being handled digitally, reflecting a growing customer preference for convenience.

EMC Insurance is navigating this shift by adopting omnichannel strategies. This approach aims to blend the seamlessness of digital platforms with the essential human element, particularly for more intricate policy needs or claims. This balance is key to maintaining strong customer relationships in a rapidly evolving digital landscape.

- Digital Adoption: By late 2024, it's estimated that over 60% of insurance customers prefer digital channels for routine transactions.

- Efficiency Gains: Insurers investing in digital agent tools reported an average of 15% reduction in processing times for policy renewals in early 2025.

- Customer Experience Focus: Mobile applications are increasingly central, with insurers seeing a 20% rise in app usage for policy management and claims submission throughout 2024.

Technological advancements, particularly in AI and data analytics, are fundamentally reshaping the insurance sector, directly impacting EMC Insurance's operational efficiency and risk assessment capabilities. By 2025, AI is projected to handle a significant portion of claims processing, driving down costs and improving customer service.

The integration of IoT devices and telematics is enabling new models like usage-based insurance (UBI), where premiums are tied to actual behavior, such as driving habits. By mid-2024, a substantial percentage of new vehicles are expected to feature telematics, providing insurers with rich data streams for more accurate pricing and risk management.

Cybersecurity is paramount, with the financial sector experiencing average data breach costs of $5.90 million in 2023. EMC Insurance must invest in robust defenses, including AI-powered threat detection and advanced encryption, to protect sensitive data and maintain customer trust.

Digital transformation is leading to increased adoption of online self-service options and mobile applications for policy management, with over 60% of insurance customers preferring digital channels for routine transactions by late 2024.

Legal factors

EMC Insurance, like all insurers, faces a complex web of state-specific regulations. These rules dictate everything from licensing and capital reserves to how policies are sold and claims are handled. For instance, in 2024, states continue to refine solvency requirements, with many aligning with NAIC guidelines that emphasize robust risk management frameworks.

Navigating this regulatory landscape is a significant undertaking. Each state has unique requirements for product filings and consumer protection, demanding tailored compliance strategies. Failure to adhere to these diverse mandates can result in fines, license suspension, or even market exclusion, impacting EMC Insurance's ability to operate and serve customers nationwide.

The expanding landscape of U.S. state data privacy laws, with significant new regulations set to take effect in 2025, presents a critical legal challenge for EMC Insurance. These laws, such as the California Privacy Rights Act (CPRA) and similar statutes in states like Virginia and Colorado, dictate stringent requirements for how EMC must handle customer data, from collection and storage to usage and consent management.

Compliance with these evolving regulations, which often include detailed provisions on consumer rights, data minimization, and prompt data breach notifications, is paramount. Failure to adhere could result in substantial fines; for instance, violations of the CPRA can lead to penalties of up to $7,500 per intentional violation, as reported by the California Attorney General's office.

Insurance policies are fundamentally legal contracts, and how their terms are interpreted falls under the umbrella of contract law. This legal framework isn't static; it can differ significantly depending on the specific jurisdiction, impacting everything from policy wording to claim settlements. For EMC Insurance, understanding these nuances is critical for managing risk and ensuring compliance.

Legal precedents and past court rulings play a substantial role in shaping an insurer's operations. Decisions concerning ambiguous policy language, disputes over coverage, and the proper handling of claims can set important benchmarks. These legal interpretations directly influence EMC Insurance's liabilities and can necessitate adjustments to their underwriting strategies and product offerings to align with evolving legal standards.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for EMC Insurance, ensuring a level playing field in the insurance sector. These regulations prevent any single insurer from dominating the market or engaging in practices that stifle competition, such as price-fixing or predatory pricing. EMC must navigate these laws carefully, especially when considering mergers, acquisitions, or strategic partnerships to avoid antitrust violations.

For instance, the U.S. Department of Justice and the Federal Trade Commission actively monitor the insurance industry for anti-competitive behavior. In 2024, antitrust enforcement remained a priority across various sectors, and the insurance industry is no exception. EMC's market share in its operating regions is a key factor; exceeding certain thresholds could trigger closer regulatory scrutiny.

EMC’s compliance with these laws is vital to prevent significant penalties and reputational damage. Failure to adhere to antitrust regulations can result in substantial fines, divestitures, and limitations on future business activities. Staying informed about evolving competition law interpretations and proactively ensuring compliance is essential for EMC's sustained growth and stability.

Key considerations for EMC regarding antitrust laws include:

- Market Share Monitoring: Regularly assessing EMC's market share in various insurance lines and geographic areas to ensure compliance with concentration limits.

- Merger and Acquisition Scrutiny: Understanding the antitrust review process for any proposed M&A activities, including potential challenges from regulators based on market concentration.

- Collaboration Agreements: Ensuring that any joint ventures or strategic alliances with other insurance entities do not violate anti-collusion or market manipulation rules.

- Pricing Practices: Maintaining transparent and non-discriminatory pricing strategies to avoid allegations of unfair competition or predatory pricing.

Tort Reform and Liability Laws

Tort reform efforts continue across various U.S. states, aiming to cap punitive damages and limit non-economic damages in civil litigation. For property and casualty insurers like EMC Insurance, these reforms can directly influence the potential severity of liability claims. For instance, states that have successfully implemented caps on damages might see a reduction in the average cost of liability payouts.

Conversely, shifts in liability laws or evolving judicial interpretations can significantly alter an insurer's risk profile. An increase in plaintiff-friendly rulings or the expansion of liability for certain business practices could lead to higher claim payouts. This dynamic directly impacts an insurer's need for adequate reserves and influences pricing strategies to account for increased exposure. For example, in 2023, the U.S. saw continued debate on medical malpractice reform, a sector that often influences broader liability insurance trends.

- Impact of Caps: State-level tort reforms, such as damage caps, can reduce the upper limit of liability payouts for insurers, potentially lowering claim severity.

- Plaintiff-Favoring Trends: Changes in laws or court decisions that benefit plaintiffs can increase an insurer's exposure, leading to larger claim costs.

- Reserving and Pricing: These legal shifts necessitate careful adjustments to insurance reserves and premiums to reflect the changing liability landscape.

- Economic Damages: Reforms often target non-economic damages (like pain and suffering), which can be a significant component of liability claims.

EMC Insurance must navigate a complex and evolving legal framework, primarily dictated by state-specific regulations governing insurance operations. These rules cover everything from solvency requirements, which saw continued refinement in 2024 aligning with NAIC guidelines, to consumer protection mandates and claims handling procedures.

The increasing number of state-level data privacy laws, with significant new regulations taking effect in 2025, presents a critical compliance challenge, impacting how EMC handles sensitive customer information and potentially leading to substantial fines for violations, such as the up to $7,500 per intentional violation penalty under California's CPRA.

Furthermore, tort reform efforts across U.S. states, aimed at capping damages, can directly influence EMC's liability exposure and claim costs, while shifts in liability laws or plaintiff-favoring court decisions necessitate careful adjustments to reserving and pricing strategies to manage increased risk.

Environmental factors

The increasing frequency and severity of natural disasters like hurricanes, wildfires, and floods present a significant financial challenge for EMC Insurance, a property and casualty insurer. These events directly impact the company through higher claims payouts, which in turn can strain underwriting results and increase loss ratios.

For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023, a record number, resulting in substantial insured losses. This trend suggests a heightened risk environment for insurers like EMC, potentially leading to increased reinsurance costs and a greater need for robust risk management strategies to maintain profitability.

Insurers like EMC Insurance are increasingly exposed to litigation stemming from climate change. This includes lawsuits challenging the underwriting of fossil fuel projects and claims for damages caused by extreme weather events, a trend that saw a significant uptick in 2023 and is projected to continue its rise through 2025.

Such legal challenges can result in substantial financial penalties and significant reputational damage, forcing companies to re-evaluate their investment portfolios and underwriting practices to minimize climate-related liabilities.

EMC Insurance, like many in the financial sector, faces increasing scrutiny regarding its Environmental, Social, and Governance (ESG) performance. Investors, regulators, and the public are demanding greater transparency and action on sustainability. For instance, the global sustainable investment market reached an estimated $35.3 trillion in 2024, according to the Global Sustainable Investment Alliance, highlighting a significant shift in capital allocation towards ESG-conscious companies.

This pressure directly impacts how EMC Insurance approaches its investment portfolios and operational strategies. Insurers are expected to not only manage risks but also to contribute positively to environmental sustainability. This includes integrating climate risk assessment into underwriting processes and exploring investments in green technologies or sustainable infrastructure. EMC's commitment to community involvement and its operational footprint are also under the ESG lens, pushing for more responsible business practices.

Regulatory Pressure for Climate Risk Disclosure

Insurance regulators, including the National Association of Insurance Commissioners (NAIC), are significantly increasing their scrutiny of climate-related risks and the insurance industry's resilience. This heightened focus is likely to translate into new mandates for climate risk disclosure and the implementation of scenario analysis for insurers like EMC. For instance, the NAIC adopted its Climate Risk Disclosure Survey in 2021, with participation becoming increasingly expected, and many states are now considering or have implemented their own climate-related reporting requirements.

To navigate these evolving regulatory landscapes, EMC will need to invest in and enhance its data collection, management, and reporting infrastructure. This includes developing more robust capabilities for assessing climate-related financial impacts and communicating these effectively to regulators. Failure to adapt could lead to compliance issues and potential penalties.

- NAIC's growing emphasis on climate risk

- Potential for new mandatory climate risk disclosure requirements

- Need for enhanced data collection and reporting for insurers

- Importance of scenario analysis in assessing climate resilience

Impact of Environmental Pollution on Claims

Environmental pollution, encompassing contamination and resulting health crises, can trigger intricate and expensive liability claims for commercial insurers like EMC. These incidents can stem from anything from a leaky storage tank to a widespread industrial accident.

EMC, providing a range of business coverages, needs to diligently evaluate and manage its potential financial risks associated with environmental liabilities. This includes understanding the evolving regulatory landscape and the increasing frequency of pollution-related events.

The financial impact of environmental claims is significant. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to address legacy pollution sites, with remediation costs often running into millions of dollars per site, directly impacting the insurance sector.

- Increased Claims Frequency: More frequent extreme weather events, like floods and wildfires, exacerbate pollution incidents, leading to higher claim volumes for insurers.

- Rising Remediation Costs: The cost of cleaning up contaminated sites is escalating due to stricter regulations and more advanced, albeit expensive, remediation technologies.

- Litigation and Legal Expenses: Environmental pollution often results in protracted legal battles, significantly increasing the overall cost of claims for insurers.

The escalating frequency and intensity of natural disasters like hurricanes and wildfires directly impact EMC Insurance through increased claims payouts, affecting underwriting results and loss ratios. The U.S. saw a record 28 billion-dollar weather and climate disasters in 2023, underscoring a heightened risk environment and potentially higher reinsurance costs for EMC.

EMC Insurance faces growing litigation risk tied to climate change, including lawsuits over underwriting fossil fuel projects and claims for extreme weather damages, a trend expected to continue its rise through 2025.

Environmental pollution incidents, from minor leaks to major industrial accidents, can lead to complex and costly liability claims for EMC, with remediation costs for contaminated sites often running into millions of dollars, impacting the insurance sector significantly.

PESTLE Analysis Data Sources

Our EMC Insurance PESTLE analysis is meticulously constructed using data from reputable sources such as government economic reports, industry-specific insurance journals, and market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the insurance sector.