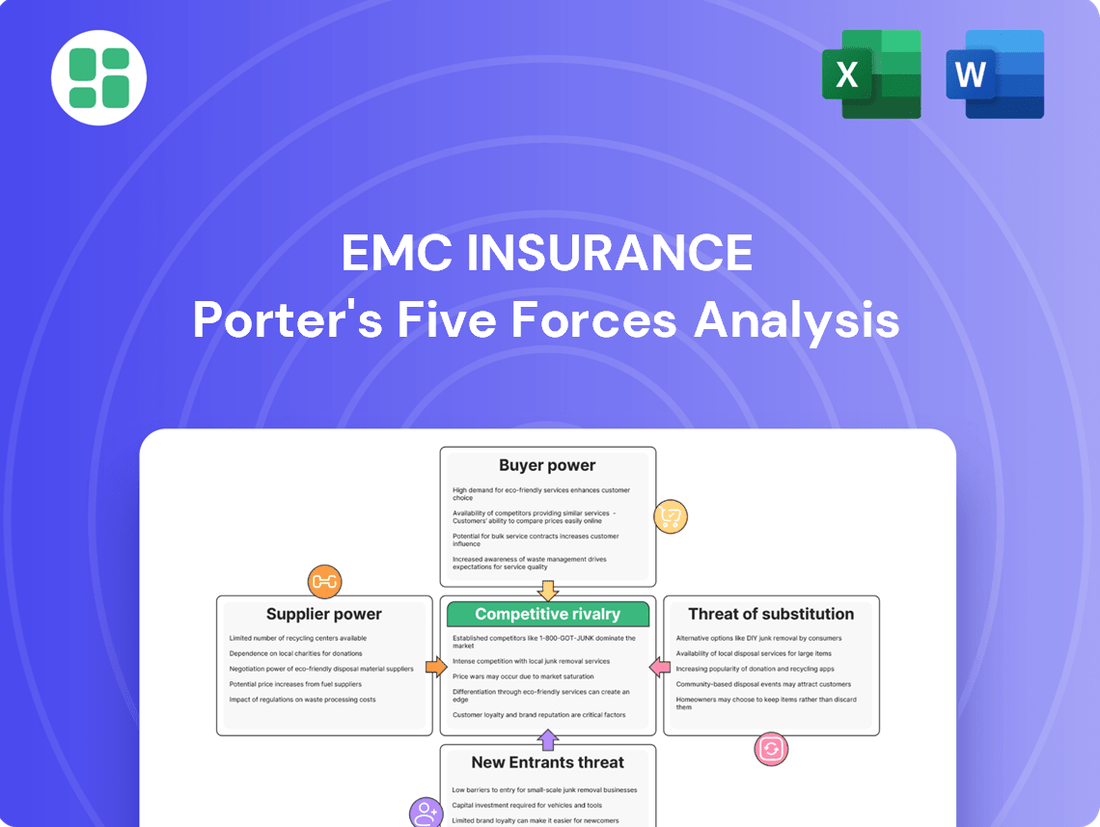

EMC Insurance Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

EMC Insurance Bundle

EMC Insurance operates within a dynamic insurance landscape, facing pressures from rivals, the bargaining power of customers, and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder looking to navigate this competitive sector.

The complete report reveals the real forces shaping EMC Insurance’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of reinsurers, crucial suppliers for primary insurers like EMC Insurance, is substantial. The global reinsurance market reported strong performance in 2024, with expectations of continued stability through 2025, underpinned by robust capitalization and enhanced underwriting profitability. This financial strength and the indispensable nature of their risk-transfer services grant reinsurers considerable leverage.

Further amplifying this supplier power is the ongoing upward trend in reinsurance pricing, especially within casualty lines. This escalation is primarily fueled by factors such as social inflation and increasing litigation expenses, which directly impact the cost and availability of risk capacity that EMC Insurance relies upon.

Independent insurance agents hold substantial bargaining power over EMC Insurance because EMC exclusively utilizes this distribution channel. This 100% reliance means agents are critical gatekeepers to EMC's customer base. In 2024, independent agencies were responsible for a significant 61.5% of all property and casualty premiums written in the United States, underscoring their market dominance and leverage.

The insurance sector's digital push, heavily leaning on AI and data analytics, significantly boosts the bargaining power of technology and data providers. Companies like EMC Insurance are increasingly dependent on specialized insurtech solutions for underwriting, claims processing, and customer engagement. This reliance is amplified by the demand for advanced data sets that enable personalized pricing and real-time risk assessment.

Providers offering proprietary or cutting-edge AI and machine learning tools are particularly influential. For instance, the global insurtech market was valued at approximately $2.6 billion in 2023 and is projected to grow substantially, indicating a strong demand for these specialized services. Their capacity to deliver enhanced customer experiences and more accurate risk evaluations makes them critical partners, granting them considerable leverage in negotiations.

Claims Adjusters and Legal Services

Claims adjusters and legal service providers wield significant bargaining power, especially as social inflation and litigation expenses escalate, impacting casualty insurance lines. These specialized services are indispensable for EMC Insurance in effectively managing losses and navigating intricate legal landscapes.

The demand for experienced claims adjusters and legal counsel intensifies during periods of elevated catastrophe losses or complex liability cases, granting these suppliers leverage. For instance, in 2023, the U.S. saw insured catastrophe losses reach $96 billion, a substantial figure that would increase the reliance on and thus the bargaining power of claims adjusters.

- Specialized Expertise: Claims adjusters and legal professionals possess unique skills vital for loss assessment and litigation management.

- Market Conditions: Rising social inflation and increased litigation costs enhance the negotiating position of these service providers.

- Demand Fluctuations: Periods of high catastrophe losses or complex claims amplify the demand for these professionals, strengthening their leverage.

- Impact on Profitability: EMC's ability to efficiently manage claims directly influences its profitability and customer retention.

Investment Managers

Investment managers hold considerable sway over EMC Insurance. In 2024, EMC reported record-high investment income from its substantial reserves, highlighting the critical role these managers play in optimizing returns. Their specialized knowledge in financial markets directly influences EMC's profitability, particularly when investment yields serve as a crucial cushion against underwriting fluctuations.

- Expertise in Market Navigation: External managers possess deep insights into optimizing investment portfolios.

- Direct Impact on Profitability: Their performance significantly affects EMC's overall financial health.

- Mitigation of Underwriting Volatility: Strong investment returns provide a vital buffer against insurance risk.

The bargaining power of EMC Insurance's suppliers, particularly reinsurers and independent agents, is significant. Reinsurers, essential for risk management, benefit from a robust global market in 2024, with strong capitalization and profitability bolstering their leverage. Similarly, EMC's exclusive reliance on independent agents, who wrote 61.5% of U.S. property and casualty premiums in 2024, grants these agents substantial influence.

Technology and data providers also exert considerable power due to EMC's increasing dependence on insurtech for operations like underwriting and claims processing. The global insurtech market, valued around $2.6 billion in 2023, demonstrates the growing demand for these specialized, data-driven solutions.

Claims adjusters and legal service providers hold strong bargaining power, especially given rising social inflation and litigation costs impacting casualty lines. High catastrophe losses, such as the $96 billion in U.S. insured losses in 2023, further amplify the need for and thus the leverage of these essential service providers.

| Supplier Type | Key Factors Influencing Bargaining Power | 2024/2023 Data Points |

|---|---|---|

| Reinsurers | Financial strength, indispensable risk-transfer services, market stability | Strong global market performance, robust capitalization |

| Independent Agents | Exclusive distribution channel, market dominance | Responsible for 61.5% of U.S. P&C premiums |

| Tech/Data Providers | Dependence on specialized insurtech, demand for advanced data | Global insurtech market valued at ~$2.6 billion (2023) |

| Claims Adjusters/Legal Services | Specialized expertise, rising social inflation/litigation costs | U.S. insured catastrophe losses reached $96 billion (2023) |

What is included in the product

This analysis dissects the competitive forces impacting EMC Insurance, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes.

Quickly assess competitive intensity and identify strategic vulnerabilities with a visually intuitive Porter's Five Forces analysis for EMC Insurance.

Customers Bargaining Power

Customers in the property and casualty insurance market, particularly for personal lines, are showing a growing sensitivity to price. This means they are actively comparing options and are more likely to switch providers to secure better rates. In 2024, research indicated that less than half of insurance customers believed their policies offered good value for the cost, highlighting a significant portion of the market seeking more competitive pricing.

This trend is further amplified by the expectation of a 'Shop-a-Palooza' in 2025, a term used by J.D. Power to describe a period of intense comparison shopping and switching among consumers. Such a dynamic environment grants customers substantial leverage, enabling them to push for more favorable premiums and contract terms from insurers like EMC Insurance.

Customers find it quite simple to switch insurance providers, especially with online comparison sites and independent agents making the process smoother. This ease of switching, coupled with numerous available carriers, significantly boosts customer bargaining power.

Modern consumers, particularly younger generations, expect digital-first interactions and readily available information. They leverage online portals, mobile apps, and comparison sites to research policies, pricing, and even claims, giving them significant power.

This digital access dramatically lowers information asymmetry. For instance, in 2024, a significant percentage of insurance shoppers used online comparison tools, with some studies indicating over 70% of consumers researching policies online before purchasing.

Influence of Independent Agents

Independent agents act as a crucial conduit, amplifying customer bargaining power for EMC Insurance. These agents, while suppliers to EMC, are primarily advocates for their policyholders. They can easily present a range of options from different insurance carriers, enabling customers to compare and select the most advantageous coverage and pricing. This forces EMC to actively compete for both direct business and the loyalty of these influential agents.

The influence of independent agents is significant, as they often guide policyholder decisions. In 2024, the independent agent channel remained a dominant force in the insurance industry, with many consumers preferring the personalized advice and choice offered by these professionals. For example, studies in late 2023 and early 2024 indicated that a substantial majority of small businesses still rely on independent agents for their commercial insurance needs. This reliance translates directly into increased leverage for policyholders, as agents can readily shift business to competitors offering better terms or service, thereby putting pressure on EMC to remain competitive.

EMC's strategy must therefore consider the dual role of these agents. To mitigate the increased customer bargaining power stemming from agent influence, EMC needs to foster strong relationships with its independent agent network. This includes offering competitive commission structures, providing excellent product support, and ensuring efficient claims processing, all of which make EMC a more attractive partner for agents and, by extension, for their clients.

- Independent agents enhance customer bargaining power by offering choices from multiple insurers.

- In 2024, independent agents continued to be a primary channel for many insurance purchases, particularly for small businesses.

- EMC must compete for the favor of independent agents who influence policyholder decisions.

Demand for Personalized and Value-Added Services

Customers are increasingly demanding insurance policies that are precisely tailored to their individual needs, moving beyond one-size-fits-all coverage. This includes a growing interest in usage-based insurance (UBI) models, where premiums reflect actual behavior, and a desire for a superior overall customer experience that encompasses more than just policy fulfillment.

This shift means insurers must focus on delivering customized policies, streamlining claims processes, and offering proactive advice on risk management to truly stand out. For instance, in 2024, many leading insurers are investing heavily in AI-powered platforms to analyze customer data and offer personalized recommendations, a trend expected to accelerate.

- Demand for Hyper-Personalization: Customers expect insurance products and services designed around their unique circumstances and preferences.

- Growth of Usage-Based Models: Telematics and data analytics are enabling insurers to offer premiums based on actual usage and risk behavior.

- Focus on Enhanced Customer Experience: Beyond coverage, customers value efficient digital interactions, responsive service, and proactive risk mitigation support.

- Impact on Insurer Innovation: Failure to meet these evolving expectations, particularly in digital engagement, can lead to customer attrition and reduced loyalty.

Customers in the property and casualty insurance market possess significant bargaining power due to increasing price sensitivity and the ease of switching providers. This leverage is amplified by digital tools and the crucial role of independent agents, forcing insurers like EMC to compete actively on price and service.

The trend towards hyper-personalization and enhanced customer experience further empowers consumers, as they seek tailored policies and seamless digital interactions. Insurers must innovate to meet these evolving demands, as a failure to do so can result in customer attrition.

In 2024, a notable portion of insurance customers expressed dissatisfaction with policy value, indicating a strong inclination to seek better pricing. This sentiment, combined with the anticipated 'Shop-a-Palooza' in 2025, underscores the substantial bargaining power held by policyholders.

| Factor | Description | Impact on EMC |

|---|---|---|

| Price Sensitivity | Customers actively compare rates and switch for better pricing. | Pressure on premiums, need for competitive offerings. |

| Ease of Switching | Online tools and agents simplify the process of changing providers. | Increased customer mobility, higher churn risk. |

| Independent Agents | Agents offer multiple insurer options, influencing customer choice. | EMC must compete for agent loyalty and their clients' business. |

| Digital Access | Consumers use online platforms for research and policy comparison. | Reduced information asymmetry, empowered consumers. |

Preview Before You Purchase

EMC Insurance Porter's Five Forces Analysis

This preview shows the exact EMC Insurance Porter's Five Forces Analysis you'll receive immediately after purchase, providing a comprehensive evaluation of competitive forces within the insurance industry. This detailed report, covering threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and intensity of rivalry among existing competitors, is fully formatted and ready for your strategic planning needs.

Rivalry Among Competitors

The U.S. property and casualty insurance market is a bustling arena, featuring a wide array of competitors from established national giants to nimble regional players and the increasingly influential insurtech startups. This fragmentation means EMC Insurance is constantly navigating a diverse competitive set.

Despite a general trend of improved underwriting results observed across the industry in 2024, competitive pressures are intensifying, especially within the personal auto insurance segment. This renewed competition directly impacts EMC Insurance's market position.

EMC Insurance contends with this broad spectrum of rivals, each bringing its own strengths and strategies to the table. The sheer number of participants underscores the dynamic and challenging nature of the P&C insurance landscape.

For many standard property and casualty insurance products, such as auto and homeowners insurance, it's tough to stand out from the competition. This often leads to fierce price wars. In 2024, many insurers were pushing for rate increases to offset rising claims costs, but customers are still very focused on price. This means they're actively comparing quotes from different companies.

This commoditization puts companies like EMC in a tricky spot. They need to make sure they're still profitable, but they also have to offer competitive prices to keep their current customers and bring in new ones. For example, the National Association of Insurance Commissioners reported that the average auto insurance premium in the US increased by approximately 10% in 2023, reflecting these pressures.

The insurance landscape is being reshaped by digital transformation and insurtechs, leading to heightened competitive rivalry. These agile players, often leveraging AI and machine learning, offer more personalized products and efficient processes, challenging established players like EMC. For instance, in 2023, global insurtech funding reached $6.2 billion, indicating significant investment in this disruptive sector.

Traditional insurers, including EMC, face pressure to adopt similar technologies to remain competitive. This involves investing in data analytics for better risk assessment and pricing, as well as improving digital customer interfaces. Failure to adapt risks losing market share to more technologically adept competitors who can offer superior customer experiences and potentially lower costs.

Slow Industry Growth in Mature Segments

The property and casualty (P&C) insurance industry is anticipating premium growth for 2024 and 2025, but this expansion is not uniform across all segments. Specifically, commercial lines are experiencing a slowdown, and the overall industry growth rate is expected to decelerate.

In these more mature markets, the primary avenue for growth is often by taking market share from rivals. This dynamic fuels aggressive tactics aimed at attracting and retaining policyholders, intensifying the competitive rivalry.

EMC Insurance's strategic emphasis on cultivating profitable business and concentrating on niche markets directly addresses these competitive pressures. This approach allows them to navigate the challenging landscape where growth is hard-won.

- Projected Industry Growth: The P&C insurance sector anticipates premium growth in 2024 and 2025.

- Commercial Lines Slowdown: Growth in commercial insurance segments is notably decelerating.

- Mature Market Dynamics: In mature markets, growth is often achieved by capturing market share from competitors.

- EMC's Strategy: EMC focuses on profitable business and niche markets to counter competitive intensity.

High Exit Barriers

The property and casualty (P&C) insurance sector, including companies like EMC Insurance, faces substantial exit barriers. These are primarily driven by the immense capital needed to operate, stringent regulatory compliance, and the nature of long-tail liabilities which can extend for years. For instance, as of the end of 2023, the U.S. P&C insurance industry maintained a robust surplus of over $900 billion, reflecting the significant capital base required for solvency and operational capacity.

These high barriers mean that even financially struggling insurers may persist in the market rather than cease operations. This can perpetuate intense competition, as the number of players doesn't readily shrink. Consequently, this environment often leads to sustained, elevated rivalry among insurers, impacting pricing and market share dynamics.

- Significant Capital Requirements: Insurers must maintain substantial capital reserves to cover potential claims and meet solvency regulations.

- Regulatory Obligations: Extensive state and federal regulations govern insurer operations, making withdrawal complex and costly.

- Long-Tail Liabilities: The nature of certain insurance policies means claims can emerge and be settled over many years, creating ongoing financial commitments.

The competitive rivalry within the U.S. property and casualty insurance market remains a defining characteristic for EMC Insurance. With a crowded field of national, regional, and insurtech competitors, differentiation is challenging, often leading to price-sensitive customer behavior. This dynamic is particularly acute in personal auto insurance, where insurers are actively seeking rate increases amidst rising claims costs, yet consumers remain highly focused on securing the most affordable coverage.

The rise of insurtechs, leveraging advanced technologies like AI and machine learning, further intensifies this rivalry by enabling more personalized products and efficient operations. In 2023 alone, global insurtech funding reached $6.2 billion, highlighting the significant investment flowing into disruptive innovation within the sector. This forces traditional players like EMC to invest in digital transformation and data analytics to maintain relevance and avoid losing market share to more agile, tech-savvy rivals.

Moreover, high exit barriers, such as substantial capital requirements and complex regulatory landscapes, mean that even struggling insurers tend to persist, perpetuating intense competition. The U.S. P&C insurance industry's surplus exceeded $900 billion by the end of 2023, underscoring the significant financial commitment required to operate. This sustained presence of numerous players often translates into aggressive tactics aimed at capturing market share, particularly in mature segments where organic growth is limited.

| Metric | Value (as of late 2023/early 2024) | Implication for EMC Insurance |

| Insurtech Funding (Global 2023) | $6.2 billion | Highlights significant investment in disruptive technologies, increasing competitive pressure. |

| U.S. P&C Industry Surplus | Over $900 billion | Indicates high capital requirements and a persistent presence of competitors, even weaker ones. |

| Personal Auto Insurance Pricing | Up approx. 10% (2023 average premium) | Shows increased cost pressures and heightened consumer price sensitivity, intensifying rivalry. |

SSubstitutes Threaten

Large corporations, especially those with predictable, substantial risks, are increasingly turning to self-insurance or establishing captive insurance companies as a substitute for traditional insurance policies. This strategy allows them to retain more risk and potentially stabilize costs.

Captives offer a unique advantage by enabling companies to fund risks that might not be insurable through conventional markets, providing a more customized approach to risk management and financing. For instance, the global captive insurance market was valued at approximately $70 billion in 2023, highlighting its growing significance.

Beyond traditional captives, alternative risk transfer (ART) mechanisms like structured programs, parametric insurance, and catastrophe bonds are increasingly prevalent. These innovative solutions, which saw significant growth in the 2023-2024 period, directly address gaps in conventional insurance coverage and can disintermediate traditional placements by offering more tailored risk management. For example, the catastrophe bond market reached an estimated $15 billion in new issuance in 2023, demonstrating a clear demand for these efficient, specialized risk transfer tools.

Companies are channeling more resources into proactive risk management, potentially dampening the demand for comprehensive insurance. For instance, in 2024, cybersecurity spending globally is projected to reach over $200 billion, a significant increase that could reduce the perceived need for extensive cyber insurance for many businesses.

Advanced safety protocols and technology investments also play a role. By minimizing workplace accidents, companies can lower their workers' compensation claims, making traditional insurance less critical for certain risks. This focus on prevention over pure indemnification is a key trend.

Government-Backed Programs and Social Safety Nets

Government-backed programs can act as a substitute threat to private insurers, particularly for certain high-risk or essential coverages. For instance, in areas prone to flooding, government flood insurance programs can diminish the demand for private flood insurance. Similarly, specific workers' compensation programs managed by states reduce the market share available to private workers' comp insurers.

These government initiatives, while not always a direct replacement for all property and casualty (P&C) lines, can significantly impact the market for private insurers. This is especially true in situations where private coverage is either unavailable or prohibitively expensive, pushing individuals and businesses towards state-sponsored alternatives. For example, the National Flood Insurance Program (NFIP) in the United States provides coverage in many flood-prone areas where private insurers might otherwise withdraw due to high risk, thus limiting the private market's reach.

- Government Flood Insurance: Programs like the NFIP offer coverage in high-risk flood zones, reducing reliance on private flood insurance.

- State-Managed Workers' Compensation: Several states operate their own workers' compensation systems, acting as a direct substitute for private insurers in those jurisdictions.

- Limited Private Market Penetration: When private insurance is scarce or costly, government programs become more attractive substitutes, impacting insurer revenue.

Non-Traditional Risk Pooling and Mutuals

The emergence of non-traditional risk pooling, like peer-to-peer (P2P) insurance and mutuals, poses a threat of substitution, especially in specialized market segments. These models, built on collaborative risk-sharing, offer an alternative to the established insurer-policyholder dynamic. While still developing for widespread adoption, they cater to communities and niche needs by promoting shared responsibility and potentially more competitive pricing.

For instance, platforms like Lemonade, which operates on a P2P model, reported significant growth, paying out claims in minutes and attracting a younger demographic. In 2023, Lemonade's gross written premiums continued to climb, indicating market acceptance of these alternative structures. This trend challenges traditional insurers by providing a more agile and community-focused approach to risk management.

- Peer-to-peer insurance models offer direct community-based risk sharing.

- Mutual insurance companies, owned by policyholders, can provide alternative structures.

- These models can be particularly attractive for niche markets or specific demographic groups.

- The potential for lower administrative costs and shared responsibility can drive adoption.

The threat of substitutes for EMC Insurance is significant as corporations increasingly explore self-insurance and captive insurance companies to manage risks. These alternatives allow for greater control over risk financing and potentially lower costs, especially for predictable, large-scale risks. The global captive insurance market's valuation of around $70 billion in 2023 underscores this shift.

Alternative risk transfer (ART) mechanisms, including parametric insurance and catastrophe bonds, are also gaining traction. The catastrophe bond market's estimated $15 billion in new issuance in 2023 highlights the demand for these specialized risk management tools, which can bypass traditional insurance structures.

Furthermore, proactive risk management, exemplified by the projected over $200 billion global cybersecurity spending in 2024, can reduce the perceived need for comprehensive insurance. Enhanced safety protocols and technology investments also diminish reliance on traditional coverage for certain risks.

Government programs, such as state-managed workers' compensation and national flood insurance, directly substitute for private insurance in specific sectors. These initiatives become particularly attractive when private coverage is scarce or prohibitively expensive, limiting the market for private insurers.

Emerging peer-to-peer (P2P) insurance models and mutuals offer collaborative risk-sharing alternatives, challenging the traditional insurer-policyholder relationship. Lemonade's continued growth in gross written premiums in 2023 demonstrates market acceptance of these agile, community-focused approaches.

| Substitute Type | Key Characteristics | Market Trend/Data Point |

|---|---|---|

| Self-Insurance/Captives | Risk retention, customized coverage, cost control | Global captive market valued at ~$70 billion (2023) |

| Alternative Risk Transfer (ART) | Parametric insurance, catastrophe bonds, structured programs | Catastrophe bond market issuance ~$15 billion (2023) |

| Proactive Risk Management | Investment in prevention, technology, safety protocols | Global cybersecurity spending projected >$200 billion (2024) |

| Government Programs | State-managed workers' comp, national flood insurance | NFIP provides coverage where private market may withdraw |

| P2P/Mutual Insurance | Collaborative risk sharing, community-focused, agile | Lemonade's growing gross written premiums (2023) |

Entrants Threaten

The property and casualty (P&C) insurance sector, including companies like EMC Insurance, necessitates significant capital investment. This is primarily due to stringent regulatory demands for maintaining adequate reserves to cover potential claims and ensure solvency. For instance, as of the first quarter of 2024, the P&C insurance industry in the U.S. maintained substantial policyholder surplus, a key indicator of financial strength, which new entrants would need to match to operate credibly and competitively.

These high capital requirements act as a formidable barrier to entry, making it exceedingly challenging for new firms to establish themselves at a scale that allows for meaningful market penetration. Existing, well-capitalized insurers, such as EMC, possess a distinct advantage due to their established financial infrastructure and strong balance sheets, which are crucial for weathering market volatility and offering competitive pricing.

Operating across multiple states in the U.S. means navigating a complex web of state-specific licensing, compliance, and reporting rules for insurers. This intricate regulatory landscape acts as a substantial barrier, requiring significant investment in legal and administrative expertise for any new player looking to enter the market.

Established insurers like EMC Insurance have cultivated significant brand recognition and policyholder trust over many years, acting as a substantial barrier for newcomers. In 2024, for instance, a customer's decision to switch insurance providers is often influenced by perceived reliability, with established brands frequently seen as more secure. New entrants must invest heavily in marketing and customer service to even begin building the credibility that EMC already possesses, a process that takes considerable time and resources.

Difficulty in Establishing Distribution Channels

EMC Insurance's exclusive reliance on independent agents, a distribution strategy they maintain at 100%, creates a formidable hurdle for newcomers. Establishing and cultivating these deep agent relationships demands considerable time and significant financial outlay. New entrants must also contend with the challenge of securing carrier commitment to their specific market segments, a crucial factor for agent loyalty.

This entrenched distribution model means new insurers must either replicate EMC's extensive agent network, a costly and time-consuming endeavor, or invest heavily in developing a direct-to-consumer digital platform. For context, in 2023, the independent agency channel continued to be a dominant force in property and casualty insurance distribution, with many agents expressing a preference for established, reliable carrier partners.

- Barrier to Entry: EMC's 100% commitment to independent agents presents a significant barrier for new entrants seeking to establish a market presence.

- Distribution Network Costs: Building a comparable network of independent agents requires substantial investment in time, resources, and relationship management.

- Digital Alternative Challenges: Developing a robust direct-to-consumer digital infrastructure also demands considerable capital and strategic planning to compete effectively.

- Agent Loyalty Factors: New entrants face the challenge of gaining the trust and commitment of independent agents who often prioritize established carrier relationships.

Access to Data, Analytics, and Technology

The threat of new entrants in the insurance sector, particularly concerning access to data, analytics, and technology, is significantly shaped by the incumbents' established advantages. EMC Insurance, like many established players, benefits from decades of deep historical claims data. This data is the bedrock for accurate underwriting and pricing, a critical component for profitability.

Newcomers often struggle to replicate this historical depth. For instance, while InsurTech startups are rapidly innovating, they typically begin with smaller data pools. This disparity means they may not possess the same level of predictive accuracy for risk assessment as firms like EMC, which have refined their advanced actuarial models over many years. By 2024, the reliance on AI-driven analytics is only intensifying, further widening the gap for those without robust technological infrastructure.

Consider the investment required: building a comprehensive data lake and implementing sophisticated AI tools demands substantial capital. A report from McKinsey in early 2024 highlighted that insurers investing heavily in advanced analytics saw a 3-5% improvement in underwriting profitability. New entrants face a steep climb to match this operational efficiency and risk management capability.

- Data Advantage: Incumbents like EMC possess vast historical claims data, crucial for accurate risk assessment and pricing.

- Model Sophistication: Years of development have led to advanced actuarial and AI-driven models that new entrants struggle to match.

- Technology Investment: The high cost of building and maintaining cutting-edge analytical infrastructure creates a barrier for new companies.

- Operational Efficiency: Established technological capabilities translate into greater operational efficiency, giving incumbents a competitive edge.

The threat of new entrants for EMC Insurance is considerably low due to the substantial capital requirements and complex regulatory environment in the P&C insurance sector. New companies need to match the significant policyholder surplus, akin to the levels seen in early 2024, to operate credibly. Navigating state-specific licensing and compliance also demands considerable investment, making market entry challenging.

EMC's established brand recognition and trust, built over many years, present another hurdle. In 2024, customers often favor established brands for perceived reliability. Furthermore, EMC's exclusive reliance on independent agents, a distribution channel that showed continued dominance in 2023, requires new entrants to invest heavily in building similar relationships or developing costly direct-to-consumer platforms.

The advantage of deep historical claims data and sophisticated actuarial models also deters new entrants. By 2024, advanced analytics are critical, and while InsurTechs innovate, they often lack the extensive data pools of incumbents like EMC. The substantial investment in data infrastructure and AI tools, which can improve underwriting profitability by 3-5% according to early 2024 reports, creates a significant barrier to entry.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | High solvency and reserve needs, matching Q1 2024 industry surplus levels. | Significant financial hurdle. |

| Regulatory Complexity | State-specific licensing, compliance, and reporting. | Requires substantial legal and administrative investment. |

| Brand Reputation | Established trust and recognition, a key factor in 2024 customer decisions. | Demands extensive marketing and time to build credibility. |

| Distribution Network | 100% reliance on independent agents, a dominant 2023 channel. | Costly to replicate agent relationships or build digital alternatives. |

| Data & Technology | Vast historical data and advanced AI models, critical for 2024 analytics. | High investment cost for new entrants to match predictive accuracy. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for EMC Insurance is built upon a foundation of verified data, including EMC's annual reports, industry-specific publications from insurance associations, and regulatory filings with state insurance departments. This comprehensive approach ensures a robust understanding of the competitive landscape.