Eiffage Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eiffage Bundle

Eiffage, a major player in construction and concessions, navigates a landscape shaped by intense competition and evolving client demands. Understanding the power of buyers, the threat of new entrants, and the influence of suppliers is crucial for their strategic positioning.

The complete report reveals the real forces shaping Eiffage’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Eiffage, a significant force in construction, depends on a wide array of suppliers, including those providing raw materials, specialized equipment, and subcontracting services. The leverage these suppliers hold can be substantial, particularly when there's a strong demand for skilled labor or unique materials.

The European construction sector has faced ongoing shortages of skilled workers, a trend that continued into 2024. This scarcity directly elevates the bargaining power of the available workforce and specialized trades, potentially driving up labor costs for companies like Eiffage.

For instance, in 2023, certain specialized construction trades in Germany experienced wage increases of up to 5% due to these labor deficits. This situation highlights how a tight labor market empowers suppliers of skilled labor to negotiate more favorable terms, impacting Eiffage's project costs and timelines.

Consolidation within certain construction supply sectors means a few dominant suppliers could dictate terms to Eiffage. For instance, if specialized concrete or advanced structural steel suppliers become highly concentrated, their pricing power increases. Eiffage's substantial procurement volume, however, typically mitigates this, as demonstrated by its €23.1 billion in revenue for 2023, allowing for negotiation leverage.

For Eiffage, the switching costs associated with finding alternative suppliers for specialized components or services can be substantial. These costs often include the expense of re-qualifying new vendors, establishing new logistical chains, and potentially retraining staff on new materials or processes. This creates a situation where established suppliers, especially those providing unique technologies or fulfilling long-term contracts, can wield considerable bargaining power.

Impact of sustainability requirements on supply chain

Increasing regulatory emphasis on sustainability, such as the EU's Green Deal Industrial Plan, can shift bargaining power towards suppliers offering eco-friendly materials. For instance, the EU aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, creating demand for sustainable construction inputs.

Eiffage's own ambitious targets, including a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030 and net-zero by 2050, directly influence its supplier relationships. This commitment means suppliers providing certified sustainable products or low-carbon alternatives gain leverage, as Eiffage actively seeks partners aligned with its environmental goals.

- Evolving Supplier Landscape: Suppliers with certified sustainable materials, like recycled concrete aggregates or low-carbon cement, are better positioned to negotiate terms.

- Increased Costs for Non-Compliance: Companies failing to meet sustainability criteria may face higher material costs or limited supplier options.

- Strategic Partnerships: Eiffage's focus on sustainability encourages long-term partnerships with suppliers committed to environmental performance, potentially leading to more favorable terms for those suppliers.

Eiffage's integrated network and purchasing policy

Eiffage's integrated network and purchasing policy significantly dampen supplier bargaining power. By consolidating purchasing through its network, Eiffage can leverage economies of scale. In 2023, Eiffage reported a revenue of €21.1 billion, indicating substantial purchasing volume that enhances its negotiation position with suppliers.

The company's responsible purchasing policy, which prioritizes low-carbon materials and committed suppliers, further strengthens its hand. This focus fosters long-term relationships and encourages suppliers to align with Eiffage's strategic goals, reducing their ability to dictate terms. Eiffage's substantial order book, exceeding €26 billion at the end of 2023, provides considerable leverage in procurement negotiations.

- Economies of Scale: Eiffage's centralized purchasing benefits from its large scale, as evidenced by its €21.1 billion in 2023 revenue.

- Supplier Collaboration: A focus on responsible and low-carbon purchasing encourages partnerships, reducing supplier opportunism.

- Negotiation Leverage: A robust order book, over €26 billion in 2023, empowers Eiffage to secure favorable terms.

The bargaining power of suppliers for Eiffage is influenced by several factors, including the availability of skilled labor and specialized materials. In 2024, shortages in skilled construction trades continue to empower these suppliers, potentially increasing labor costs for Eiffage, as seen with up to 5% wage increases in certain German trades in 2023.

While consolidation among some suppliers can enhance their leverage, Eiffage's substantial revenue, reaching €23.1 billion in 2023, provides significant purchasing power to counter this. Furthermore, the increasing demand for sustainable materials, driven by initiatives like the EU's Green Deal, gives suppliers offering eco-friendly options greater negotiating strength.

Eiffage's own commitment to sustainability, aiming for a 30% reduction in emissions by 2030, strategically positions suppliers aligned with these goals, potentially leading to more favorable terms for them. However, Eiffage's integrated network and responsible purchasing policies, supported by a robust order book exceeding €26 billion at the end of 2023, generally mitigate supplier leverage by fostering long-term partnerships and economies of scale.

| Factor | Impact on Supplier Bargaining Power | Eiffage's Mitigation Strategy |

|---|---|---|

| Skilled Labor Shortages | Increases power, driving up costs | Long-term contracts, training initiatives |

| Supplier Concentration | Enhances pricing power | Leveraging large purchasing volume |

| Demand for Sustainable Materials | Empowers eco-friendly suppliers | Strategic partnerships with aligned suppliers |

| Eiffage's Purchasing Scale (€23.1B revenue 2023) | Reduces supplier leverage | Economies of scale, consolidated purchasing |

| Eiffage's Order Book (€26B+ end 2023) | Provides negotiation strength | Securing favorable terms through volume commitment |

What is included in the product

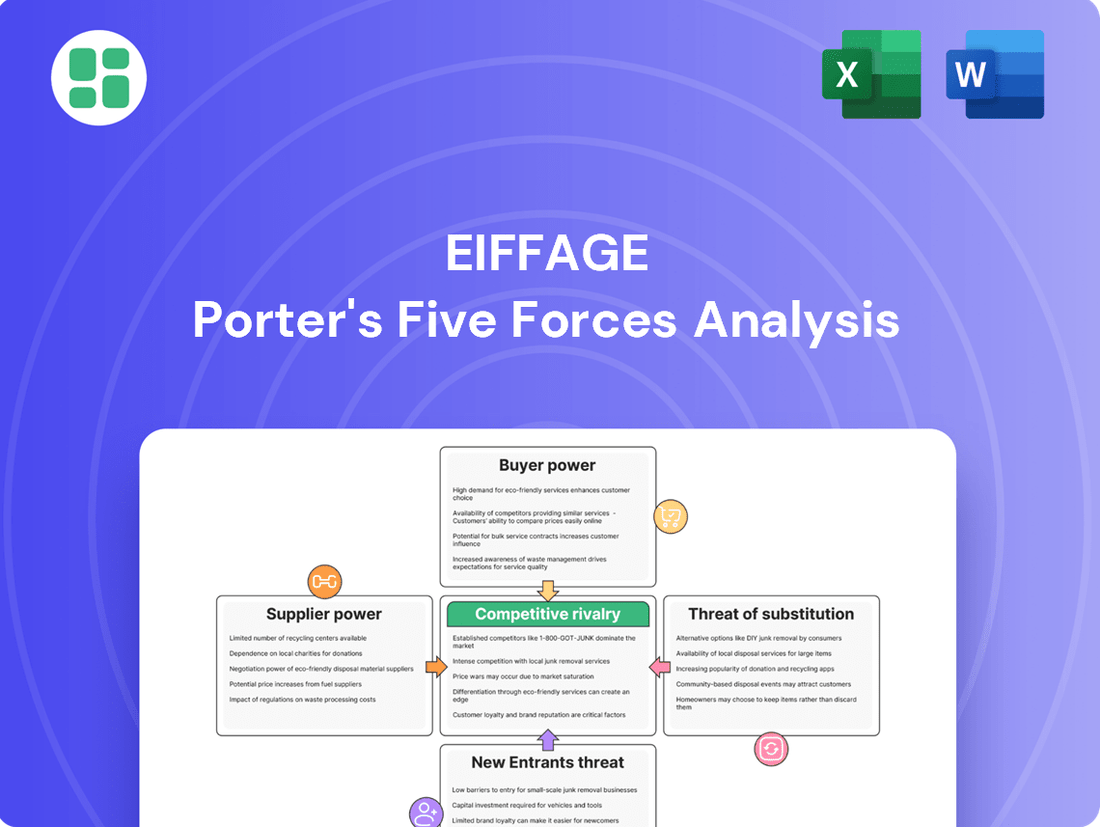

This analysis evaluates the five competitive forces impacting Eiffage, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the availability of substitutes within the construction and concessions sector.

Effortlessly identify and quantify competitive threats with a visual, interactive dashboard that highlights key industry pressures.

Customers Bargaining Power

Eiffage's customer base is diverse, featuring large public sector entities like national governments and local authorities, particularly for significant infrastructure undertakings and concessions. This public sector segment wields considerable bargaining power, often stemming from the sheer volume of their projects and the structured, competitive tendering processes they employ, which allow them to set stringent terms.

In addition to public clients, Eiffage also serves private sector developers in building construction. The scale of these infrastructure and construction projects means that clients, especially public ones, can exert substantial influence. For instance, in 2023, Eiffage's revenue from concessions and construction activities reached €21.1 billion, highlighting the significant commercial relationships involved.

In the fiercely competitive European construction arena, customers, particularly for standardized services, exhibit significant price sensitivity. This dynamic fuels intense bidding wars, forcing Eiffage to carefully calibrate pricing to remain competitive while safeguarding its profit margins. For example, new residential construction, a segment experiencing reduced demand, exemplifies this pressure, where clients often prioritize the lowest bid.

Eiffage's concessions business, which includes vital infrastructure like motorways and airports, is characterized by long-term contracts. Once these agreements are in place, the immediate bargaining power of the customers diminishes considerably for the duration of the contract. This structure secures predictable revenue streams for Eiffage.

However, even with long-term contracts, customers can exert influence through potential future renegotiations or by advocating for regulatory changes. For instance, the introduction of new taxes or shifts in government policy can impact Eiffage's profitability. A notable example is the new highway tax that affected Eiffage's concessions revenue in 2024, demonstrating how external factors can alter the customer's leverage.

Customer demand for integrated solutions and sustainability

Customers are increasingly demanding integrated solutions that manage projects from inception through to operation. This trend, coupled with a strong push for sustainability and energy efficiency in construction, significantly shapes their bargaining power. For instance, by 2024, the global green building market was projected to reach substantial figures, indicating a clear client preference for eco-conscious projects. Eiffage's ability to offer end-to-end services and low-carbon solutions can mitigate this power by providing unique value beyond mere cost, thus fostering loyalty.

The growing client expectation for sustainable construction is a powerful lever. Regulations and heightened environmental awareness are driving this demand, compelling companies like Eiffage to adapt. In 2024, many European countries strengthened their building energy performance directives, directly influencing client requirements. Eiffage's commitment to low-carbon strategies, as demonstrated in its numerous sustainable infrastructure projects, positions it to meet these evolving needs, thereby reducing the customers' ability to solely negotiate on price.

- Integrated Solutions: Clients seek a single point of responsibility for project lifecycle management, reducing complexity and risk.

- Sustainability Demand: Growing emphasis on eco-friendly construction, driven by regulations and corporate responsibility goals.

- Eiffage's Differentiation: Comprehensive service offerings and a focus on low-carbon solutions can lessen price-based bargaining.

- Market Trends: The green building sector continues to expand, underscoring client prioritization of sustainable attributes.

Diversified customer portfolio across sectors and geographies

Eiffage's extensive operational reach across various sectors, including building, civil engineering, energy systems, and roadworks, along with its presence in multiple European countries and beyond, significantly dilutes the bargaining power of individual customers. This diversification means that no single client or sector holds a disproportionate sway over Eiffage's overall business. For instance, even if certain segments like property development experienced headwinds in 2024, robust performance in infrastructure and energy systems provided a crucial counterbalance, demonstrating the resilience afforded by a broad customer base.

The company's strategy of maintaining a diversified customer portfolio across different industries and geographical regions is a key factor in managing customer bargaining power. This approach ensures that Eiffage is not overly reliant on any one customer or market segment.

- Sectoral Diversity: Eiffage operates in building, civil engineering, energy systems, and roadworks, spreading risk and reducing dependence on any single industry.

- Geographical Reach: Operations span multiple European countries and international markets, further diffusing customer concentration.

- Resilience in 2024: While some areas like property development saw challenges, growth in infrastructure and energy systems helped stabilize overall revenue, showcasing the benefit of diversification.

- Mitigating Customer Leverage: A broad customer base limits the ability of any single client to exert significant pricing or contractual pressure on Eiffage.

Eiffage's diverse customer base, ranging from large public entities to private developers, grants significant bargaining power, particularly through competitive tendering processes and price sensitivity in standardized services. While long-term concessions initially reduce customer leverage, evolving demands for integrated, sustainable solutions and potential regulatory shifts in 2024, such as new highway taxes, can reintroduce client influence. Eiffage's broad geographical and sectoral diversification, however, acts as a crucial buffer, limiting the impact of any single customer's power.

| Customer Segment | Basis of Bargaining Power | Eiffage's Mitigation Strategy |

|---|---|---|

| Public Sector (Governments, Local Authorities) | Volume of projects, competitive tendering, stringent terms | Diversification across sectors, long-term concessions |

| Private Sector Developers | Price sensitivity, focus on lowest bid for standardized services | Integrated solutions, sustainability focus, value-added services |

| Concessions Clients (Post-Contract) | Potential future renegotiations, advocacy for regulatory changes | Secured revenue streams, differentiation through service quality |

What You See Is What You Get

Eiffage Porter's Five Forces Analysis

This preview showcases the comprehensive Eiffage Porter's Five Forces Analysis, detailing the competitive landscape of the construction and concessions sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing insights into industry rivalry, buyer and supplier power, threat of new entrants, and the bargaining power of substitutes.

Rivalry Among Competitors

Eiffage operates in a highly competitive European and global construction landscape, facing strong rivalry from established giants like Vinci, Bouygues, and Balfour Beatty. These diversified groups often possess similar capabilities and market reach, leading to direct competition across Eiffage's core business areas, including building construction, major civil engineering projects, and energy infrastructure development.

In 2023, Vinci, a key competitor, reported revenues of €69.9 billion, highlighting the scale of operations Eiffage contends with. Similarly, Bouygues, another major player, generated €56.0 billion in revenue during the same period. This intense rivalry means Eiffage must constantly innovate and maintain operational efficiency to secure contracts and market share.

The European construction market is quite mature, meaning it's not experiencing rapid expansion. For 2025, a modest recovery is anticipated after a bit of a dip in 2024. This maturity often leads to tougher competition as companies vie for projects.

Within this mature landscape, growth rates vary significantly. Civil engineering and projects tied to energy infrastructure are showing positive momentum. However, the residential construction segment is struggling. High interest rates and increased building costs are making it harder for developers, which in turn intensifies the fight for fewer available home-building projects.

Competition is particularly fierce for large-scale public and private contracts, where companies like Eiffage must submit highly competitive bids to secure work. This intense bidding environment means margins can be squeezed as companies vie for significant projects.

The substantial order book Eiffage secured in 2024, which grew by 11% year-on-year, demonstrates its ability to win these competitive tenders. However, this impressive growth also highlights the aggressive nature of contract acquisition and the constant pressure to offer compelling proposals.

Differentiation through expertise, innovation, and sustainability

Competitive rivalry in the construction and infrastructure sectors is intense, with companies like Eiffage differentiating themselves beyond mere price competition. This differentiation is increasingly driven by specialized expertise, cutting-edge technological innovation, and a strong commitment to sustainability.

Eiffage actively pursues differentiation through its focus on low-carbon construction methods and the development of renewable energy projects. Their strategic investments in digital transformation, including a significant partnership with Google Cloud for artificial intelligence development, position them to offer advanced solutions and gain a competitive edge.

- Technological Innovation: Eiffage leverages Building Information Modeling (BIM) and other digital tools to enhance project efficiency and design.

- Sustainability Focus: The company is committed to reducing its carbon footprint, evident in its renewable energy ventures and eco-friendly construction practices.

- AI Integration: Partnerships, such as the one with Google Cloud, aim to integrate AI into operations for smarter decision-making and innovation.

- Expertise: Specialized knowledge in complex engineering and construction projects allows Eiffage to command premium value.

High fixed costs and exit barriers

The construction and concessions sector is characterized by significant upfront investments in heavy machinery, specialized equipment, and a substantial workforce. These considerable capital outlays act as formidable exit barriers. For instance, Eiffage's significant investment in infrastructure projects, such as the Grand Paris Express, demonstrates the scale of these fixed costs.

These high fixed costs and specialized assets mean that companies find it difficult and costly to exit the industry. Consequently, even during economic slowdowns, firms are compelled to remain active and compete aggressively. This persistence fuels intense rivalry as companies strive to maintain market share and recover their substantial investments, contributing to a highly competitive landscape.

- High Capital Intensity: Construction and concessions demand massive investments in plant, property, and equipment.

- Specialized Assets: Many assets, like tunneling machines or specialized bridge-building equipment, have limited alternative uses, increasing exit costs.

- Workforce Commitment: Maintaining a skilled and often unionized workforce represents a significant ongoing fixed cost.

- Industry Persistence: The inability to easily divest these assets forces companies to continue operating, intensifying competition.

The competitive rivalry within Eiffage's operating sectors is exceptionally high, driven by the presence of large, diversified global players like Vinci and Bouygues. These competitors often possess comparable capabilities and extensive market reach, leading to direct competition across all of Eiffage's business segments.

In 2023, Vinci reported revenues of €69.9 billion and Bouygues €56.0 billion, illustrating the scale of Eiffage's rivals. The European construction market's maturity means growth is often incremental, intensifying the battle for market share, particularly in booming areas like civil engineering and energy infrastructure.

| Competitor | 2023 Revenue (EUR billions) | Key Business Areas |

| Vinci | 69.9 | Concessions, Construction, Energy Services |

| Bouygues | 56.0 | Construction, Telecoms, Media |

| Balfour Beatty | 17.4 (approx. £14.9bn) | Infrastructure, Construction, Support Services |

SSubstitutes Threaten

Modular and prefabricated construction presents a growing threat of substitutes for traditional building methods. These solutions offer advantages like quicker project timelines and less on-site waste, appealing to clients seeking efficiency. For instance, the modular construction market in Europe saw significant growth, with projections indicating continued expansion in the coming years, driven by demand for faster and more sustainable building practices.

Advanced manufacturing techniques, particularly 3D printing, represent a growing threat of substitutes for traditional construction methods. These technologies offer the potential to create complex building components off-site, reducing labor needs and waste. For instance, by 2024, the global construction 3D printing market is projected to reach billions, indicating a significant shift in how structures can be assembled.

The ability of 3D printing to customize designs and accelerate project timelines directly challenges conventional building processes. This could lead to reduced demand for certain traditional materials and labor-intensive assembly methods that Eiffage currently relies on. Companies adopting these innovations may offer more cost-effective and faster solutions, thereby diverting projects from established players.

For Eiffage's concessions business, a significant threat comes from alternative infrastructure development and financing models. This could involve public entities opting for direct state funding or entirely different public-private partnership (PPP) structures that don't involve traditional concession agreements. For instance, a country might decide to finance a new high-speed rail line entirely through government bonds rather than a concession awarded to a private operator like Eiffage.

Another substitute could be the development of alternative public transport solutions that reduce the need for new road infrastructure. An example of this is the significant investment in expanding existing rail networks across Europe. In 2024, for example, the European Union allocated substantial funds towards rail infrastructure upgrades, aiming to shift freight and passenger transport away from roads, thereby potentially reducing demand for new toll roads that Eiffage might develop.

Despite these potential substitutes, the sheer scale of infrastructure needs across Europe remains a powerful counter-argument. Many European countries face a substantial infrastructure deficit, with estimates suggesting trillions of euros are needed for upgrades and new developments. This ongoing demand continues to support the viability of traditional concession models and PPPs, as governments often lack the immediate capital and expertise to undertake these projects alone.

Renovation and refurbishment over new builds

A growing preference for renovating and refurbishing existing buildings instead of new construction presents a significant substitute threat. This trend, fueled by environmental concerns and cost savings, can divert demand away from Eiffage's new build projects. For instance, in 2023, the UK government announced plans to invest significantly in retrofitting existing buildings to improve energy efficiency, highlighting a policy shift that favors refurbishment.

This shift impacts Eiffage's core business by potentially reducing the pipeline of new construction opportunities. While Eiffage does have renovation capabilities, a substantial market tilt towards refurbishment could disproportionately affect its revenue streams from large-scale new developments. The European Union's Green Deal, aiming for climate neutrality by 2050, further incentivizes the renovation of the existing building stock.

- Growing emphasis on sustainability: Client and governmental pressure to reduce carbon footprints favors renovation over new builds.

- Economic incentives: Refurbishment can often be more cost-effective than new construction, especially in mature markets.

- Policy support: Government initiatives and funding for energy efficiency upgrades in existing buildings bolster the refurbishment sector.

Digitalization and new project delivery methods

Digitalization, particularly through Building Information Modeling (BIM) and advanced project management software, is a significant threat of substitution for traditional construction practices. These tools streamline workflows and enhance collaboration, potentially reducing the reliance on certain manual or less integrated services. For instance, by 2024, the global construction software market was projected to reach over $10 billion, indicating a substantial shift towards digital solutions.

These technological advancements can enable entirely new project delivery methods, bypassing some of the established roles and services within the industry. Optimized processes through digital platforms can diminish the need for certain intermediary functions or specialized manual skills that were once essential. The adoption of BIM, for example, allows for better clash detection and prefabrication, which can alter the scope of on-site work and the services required.

The increasing efficiency and accuracy offered by digital tools present a compelling alternative to conventional approaches. This can lead to cost savings and faster project completion times, making them attractive substitutes for clients and developers. In 2023, companies leveraging BIM reported an average reduction in project costs by up to 10% and a decrease in rework by as much as 50%.

- Digitalization: BIM and advanced construction management software are key drivers.

- Process Optimization: These technologies reduce the need for traditional, less integrated services.

- New Delivery Methods: Digitalization enables alternative ways to execute construction projects.

- Market Growth: The global construction software market exceeded $10 billion in 2024, highlighting strong adoption trends.

The threat of substitutes for Eiffage's core construction and infrastructure businesses is multifaceted. Innovations in modular construction and 3D printing offer faster, more sustainable alternatives to traditional building methods, potentially diverting projects. For example, the global construction 3D printing market was projected to reach billions by 2024. Furthermore, alternative infrastructure financing and public transport solutions can reduce the need for new road concessions. A growing preference for renovating existing buildings over new construction, supported by initiatives like the EU's Green Deal, also presents a significant substitute. In 2023, the UK government's investment in building retrofitting exemplified this trend.

Entrants Threaten

The construction and concessions sector, particularly for major infrastructure and intricate building ventures, necessitates considerable capital outlay. This includes significant investment in specialized machinery, advanced technologies, and robust financial reserves. For instance, in 2024, major infrastructure projects often require billions of Euros in upfront funding, a figure that deters many aspiring companies.

This substantial capital intensity serves as a formidable barrier to entry for prospective new players. The sheer scale of financial resources and assets required means that only a limited number of established firms possess the capacity to compete. Eiffage itself, as a major player, demonstrates this with its extensive portfolio of equipment and its strong credit rating, enabling it to undertake vast projects.

Eiffage operates within a highly regulated sector, particularly concerning construction and infrastructure projects across Europe. The intricate and often varying national and EU-level regulations, including licensing and stringent environmental standards, present a significant barrier to entry. For instance, the implementation of the EU Construction Products Regulation in 2024 mandates rigorous compliance for materials, adding complexity and cost for newcomers.

Clients, especially governments and large corporations, often demand a proven history and significant experience for major infrastructure and concession projects. This is because these undertakings are inherently complex, carry substantial risks, and span many years. Newcomers struggle to meet these stringent requirements.

Established companies like Eiffage have built their reputations over decades by successfully delivering numerous projects. This extensive experience and solid track record create a significant barrier, making it challenging for new entrants to gain the trust and secure the contracts necessary to compete effectively.

Established relationships with clients and supply chains

Eiffage benefits from deeply entrenched relationships with its clients and supply chain partners. These long-standing connections translate into preferred access to lucrative projects and more favorable terms, creating a substantial barrier for newcomers. For instance, in 2023, Eiffage secured major contracts across various sectors, demonstrating the strength of these established relationships.

These robust networks offer new entrants significant challenges. Replicating the trust and reliability Eiffage has built over years with its subcontractors and suppliers is a time-consuming and capital-intensive endeavor. This makes it difficult for new players to secure the necessary resources and partnerships to compete effectively.

- Client Loyalty: Eiffage's history of successful project delivery fosters strong client loyalty, making it harder for new entrants to poach existing customers.

- Supplier Agreements: Long-term contracts and preferred supplier status provide Eiffage with cost advantages and supply chain stability.

- Subcontractor Networks: Established relationships with specialized subcontractors ensure quality and timely execution, a difficult advantage for new firms to match.

- Market Access: These deep ties grant Eiffage preferential access to tender processes and project pipelines, limiting opportunities for new competitors.

Economies of scale and scope enjoyed by incumbents

Eiffage benefits significantly from economies of scale and scope, a major deterrent to new entrants. Its vast operational footprint across diverse segments like construction, energy, and concessions allows for significant cost efficiencies. For instance, in 2023, Eiffage reported revenues of €21.2 billion, demonstrating the sheer size of its operations which new competitors would find difficult to replicate.

These economies of scale translate into a substantial cost advantage. Eiffage can negotiate better terms with suppliers due to its purchasing volume and spread its overhead costs across a larger revenue base. This makes it challenging for smaller, less established companies to compete on price, a critical factor in many of Eiffage's core markets.

Furthermore, Eiffage leverages economies of scope by cross-selling services and sharing expertise across its various business units. This integrated approach enhances operational efficiency and allows for bundled offerings that are more attractive and cost-effective for clients. New entrants typically lack this breadth of capability, limiting their ability to offer comprehensive solutions and achieve similar cost synergies.

- Economies of Scale: Eiffage's large-scale operations, evidenced by its €21.2 billion revenue in 2023, allow for lower per-unit costs in procurement and production.

- Economies of Scope: The company's presence in multiple, often complementary, sectors enables it to share resources and expertise, reducing overall operational expenses.

- Cost Advantage: Incumbent advantages in purchasing power and overhead absorption create a significant price barrier for potential new entrants.

- Operational Efficiency: Eiffage's ability to manage large, complex projects efficiently, leveraging its integrated business model, is a capability difficult for new firms to match.

The threat of new entrants for Eiffage is generally low due to high capital requirements, stringent regulations, and established client relationships. Significant upfront investment in specialized equipment and technology, often running into billions for major infrastructure projects as seen in 2024, acts as a substantial deterrent.

Furthermore, the complex web of national and EU-level regulations, including licensing and environmental compliance, as exemplified by the 2024 EU Construction Products Regulation, adds considerable complexity and cost for any newcomer. This regulatory environment, coupled with the need for proven track records and extensive experience, makes it difficult for new players to gain traction.

Eiffage's deep-rooted client loyalty and supplier agreements, demonstrated by its €21.2 billion revenue in 2023, create further barriers. Replicating these established networks and the trust they represent is a long and resource-intensive process, effectively limiting the competitive pressure from new market entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Eiffage is built upon a robust foundation of data, including Eiffage's annual reports, investor presentations, and financial statements. We also integrate industry-specific market research reports and data from reputable financial databases to provide a comprehensive view of the competitive landscape.