Eiffage Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Eiffage Bundle

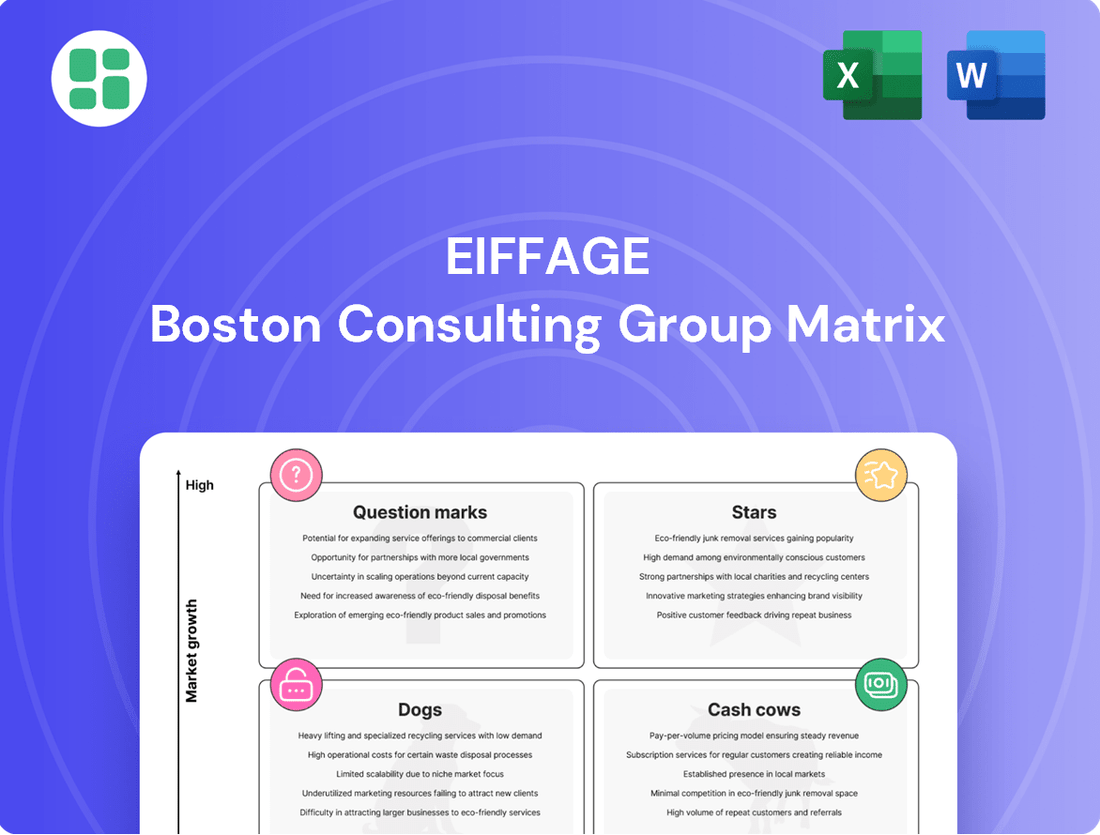

Curious about Eiffage's strategic product portfolio? This glimpse into their BCG Matrix highlights their current market positions, but the full report unlocks the complete picture. Understand which Eiffage offerings are Stars, Cash Cows, Dogs, or Question Marks, and gain the actionable insights needed to optimize your investment and resource allocation.

Ready to move beyond the basics? Purchase the full Eiffage BCG Matrix to receive a comprehensive breakdown of each product's quadrant placement, backed by data and expert analysis. This detailed report is your essential guide to making informed decisions and steering Eiffage's strategic direction with confidence.

Stars

Eiffage's Energy Systems division is a clear Star in the BCG matrix, exhibiting robust growth. In the first quarter of 2025, its revenue surged by 13.9%, and it's projected to hit nearly €8 billion for the full year 2025. This impressive performance stems from both internal expansion and smart acquisitions.

The division's leadership in the thriving European offshore wind market, a sector characterized by high growth potential, underscores its strong market position. This strategic advantage, combined with increasing profitability, confirms its Star status. While it requires investment for continued expansion, the division is poised to deliver substantial future returns.

Eiffage’s European offshore wind power segment is a clear Star in its BCG Matrix. This is driven by substantial growth prospects fueled by the accelerating global energy transition. The company's strategic acquisitions, such as HSM Offshore Energy in March 2025, significantly bolster its capabilities and market position in this high-growth sector.

Eiffage's involvement in major European infrastructure projects like the UK's HS2 high-speed rail and the Grand Paris Express firmly places its infrastructure segment in the Star category of the BCG matrix. These undertakings are in a high-growth sector fueled by substantial public and private investment, where Eiffage commands a significant market share for these complex, long-term endeavors.

The Infrastructure division demonstrated this strength with a robust 12.0% revenue increase in Q1 2025, underscoring its position in a thriving market. This growth is directly attributable to Eiffage's successful execution of these large-scale, high-profile ventures.

Sustainable Construction and Low-Carbon Solutions

Eiffage's commitment to sustainable construction, exemplified by projects like the Frontex Headquarters in Warsaw, positions this segment as a Star in the BCG Matrix. This project prominently features low-emission concrete and advanced geothermal systems, showcasing Eiffage's dedication to environmentally conscious building practices.

The market for green and low-carbon construction is experiencing robust growth, fueled by ambitious climate targets and increasing regulatory mandates. Eiffage is actively solidifying its leadership in this domain through continuous innovation and the successful acquisition of substantial green building contracts.

- Market Growth: The global green building market is projected to reach $375.4 billion by 2027, growing at a CAGR of 9.4%.

- Eiffage's Projects: The Frontex HQ in Warsaw, awarded in July 2025, is a prime example of Eiffage's success in securing high-profile sustainable projects.

- Key Technologies: Utilization of low-emission concrete and geothermal energy systems are core to Eiffage's low-carbon solutions.

- Strategic Positioning: Eiffage is recognized for its innovative approach and ability to secure significant green contracts, reinforcing its Star status.

International Expansion in Germany's Energy Services

Eiffage's strategic acquisitions of Eqos and Salvia underscore a robust push into Germany's energy services sector, aiming to capture significant market share in a key European growth area. This expansion is a testament to Eiffage's capability in identifying and integrating promising businesses to solidify its position as a leader in new territories.

The company's international footprint is clearly expanding, with activities outside France growing from 32% to 40% of total revenue over the last four years. This upward trend is further evidenced by a notable 19.1% increase in revenue from Europe, excluding France, during the first quarter of 2025.

- Strategic Acquisitions: Eqos and Salvia acquisitions in Germany's energy services market.

- Market Share Growth: Aiming to increase market share in high-growth European regions.

- International Revenue Increase: Activities outside France grew from 32% to 40% in four years.

- European Performance: Europe excluding France revenue saw a 19.1% rise in Q1 2025.

Eiffage's Energy Systems and Infrastructure divisions are strong Stars. Energy Systems saw a 13.9% revenue increase in Q1 2025, projecting nearly €8 billion for the full year, driven by offshore wind. The Infrastructure segment, boosted by major projects like HS2 and Grand Paris Express, grew revenue by 12.0% in Q1 2025, reflecting high demand in a growing sector.

The company's commitment to sustainable construction, highlighted by projects using low-emission concrete and geothermal systems, also positions it as a Star. This segment benefits from the expanding green building market, projected to reach $375.4 billion by 2027.

Eiffage's strategic expansion into Germany's energy services sector through acquisitions like Eqos and Salvia is also a key Star initiative. This aligns with a broader trend of international growth, with revenue outside France increasing from 32% to 40% of total revenue over four years, and a 19.1% rise in European revenue (excluding France) in Q1 2025.

| Division | BCG Status | Key Growth Drivers | Q1 2025 Revenue Growth | Full Year 2025 Revenue Projection |

| Energy Systems | Star | Offshore wind, energy transition | 13.9% | ~€8 billion |

| Infrastructure | Star | Major rail projects, public investment | 12.0% | N/A |

| Sustainable Construction | Star | Green building market, climate targets | N/A | N/A |

| International Expansion (Germany) | Star | Energy services, strategic acquisitions | 19.1% (Europe ex-France) | N/A |

What is included in the product

The Eiffage BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

This analysis guides investment decisions, highlighting units for growth, maintenance, or divestment.

Eiffage BCG Matrix provides a clear, one-page overview of business unit performance, simplifying strategic decision-making.

Its export-ready design allows for seamless integration into presentations, relieving the pain of manual data transfer.

Cash Cows

Eiffage's motorway concessions, APRR and AREA, are prime examples of Cash Cows within the BCG Matrix. Their established presence in a mature, stable market ensures consistent and significant cash generation with minimal need for further investment.

These long-term contracts are a bedrock of Eiffage's financial stability, providing predictable revenue streams. In fact, revenue from these networks saw a healthy 4.0% increase in the first quarter of 2025, demonstrating their continued strong performance and reliable contribution to the Group's overall financial health.

Eiffage's established civil engineering and roadworks, particularly its maintenance and upgrade services, are firmly positioned as Cash Cows in the BCG Matrix. This mature market segment benefits from Eiffage's dominant standing, generating reliable, high-margin income with minimal need for further investment to maintain its market share.

These operations serve as a consistent cash generator for the group. For instance, Eiffage Route in France demonstrated robust growth, with revenue climbing 7.5% in the first quarter of 2025, underscoring the ongoing strength and stability of these core infrastructure activities.

Eiffage's traditional building construction for public and commercial projects, distinct from property development, is a clear Cash Cow. This segment benefits from the company's deep-rooted expertise and substantial market share within a mature but stable sector.

In 2024, Eiffage's order book for building construction remained robust, underscoring the consistent demand for its services in public and commercial infrastructure. This segment generates reliable cash flow, allowing Eiffage to fund investments in other business areas.

Long-term Public-Private Partnerships (PPP) Operation

The operation and maintenance phase of long-term Public-Private Partnership (PPP) contracts, like Eiffage's Nové contract for state-owned housing stock, represents a significant cash cow. These agreements are designed to generate stable, recurring revenue streams over many years, especially after the initial construction investment is made. This means Eiffage benefits from consistent cash flow with limited need for further capital expenditure, solidifying its position as a reliable income generator.

- Stable Revenue: PPP contracts, such as those for managing public infrastructure or housing, provide predictable income over decades.

- Low Capital Intensity: Once the initial construction is complete, the ongoing operation and maintenance phases typically require less new investment.

- Lifecycle Management: Eiffage's engagement across the entire lifecycle of these projects ensures continuous cash generation from the operational phase.

- Example: The Nové contract for state-owned housing stock exemplifies this, offering long-term operational revenue.

Aggregate and Construction Materials Production

Eiffage's production of aggregates and construction materials acts as a robust cash cow within its operations. This segment benefits from a mature market characterized by substantial internal demand from Eiffage's own extensive construction projects. In 2023, Eiffage's Construction segment generated €10.0 billion in revenue, highlighting the significant internal consumption of these materials.

This integrated supply chain provides a consistent and reliable source of essential materials, thereby securing stable profit margins and cost efficiencies across the Group. The predictable cash flow generated by this segment is crucial for funding other, more growth-oriented ventures within Eiffage's diversified portfolio.

- Stable Revenue: The materials production segment consistently contributes to Eiffage's financial stability.

- Internal Demand: High utilization driven by Eiffage's construction activities ensures consistent sales.

- Cost Efficiency: Vertical integration leads to better cost control and improved margins on projects.

- Cash Generation: This segment reliably generates cash, supporting broader group investments.

Eiffage's motorway concessions, APRR and AREA, are prime examples of Cash Cows. These established assets operate in mature markets, generating consistent cash with minimal need for further investment. Their stable revenue streams are a cornerstone of Eiffage's financial health.

Eiffage's traditional building construction for public and commercial projects, separate from property development, also acts as a cash cow. This segment leverages Eiffage's deep expertise and significant market share in a stable sector, providing reliable cash flow to fund other group initiatives.

The operation and maintenance of long-term PPP contracts, such as the Nové contract for state housing, are significant cash cows. These agreements provide stable, recurring revenue after initial construction, requiring limited further capital expenditure and thus ensuring consistent income generation for Eiffage.

Eiffage's production of aggregates and construction materials is another strong cash cow. This segment benefits from mature markets and substantial internal demand from Eiffage's own construction projects, ensuring stable profit margins and cost efficiencies.

| Business Segment | BCG Matrix Category | Key Characteristics | 2025 Q1 Performance Highlight |

|---|---|---|---|

| Motorway Concessions (APRR, AREA) | Cash Cow | Mature market, stable revenue, low investment needs | 4.0% revenue increase |

| Civil Engineering & Roadworks (Maintenance) | Cash Cow | Dominant market position, reliable high margins, low investment | Eiffage Route revenue up 7.5% |

| Traditional Building Construction | Cash Cow | Deep expertise, substantial market share, stable sector | Robust order book in 2024 |

| PPP Contract Operations & Maintenance | Cash Cow | Long-term recurring revenue, low capital intensity | Nové contract exemplifies stable income |

| Aggregates & Construction Materials Production | Cash Cow | Mature market, high internal demand, cost efficiencies | Supports Eiffage's Construction segment revenue of €10.0 billion in 2023 |

What You’re Viewing Is Included

Eiffage BCG Matrix

The Eiffage BCG Matrix you're previewing is the complete, unwatermarked document you'll receive immediately after purchase. This strategic analysis tool is meticulously crafted to offer clear insights into Eiffage's business portfolio, enabling informed decision-making without any additional editing or formatting required.

Dogs

Eiffage's property development in France is currently positioned as a Dog in the BCG matrix. This segment saw a substantial revenue decline of 34.2% in the first quarter of 2025, indicating a struggling business unit with low growth potential and likely declining market share.

The challenges faced by this sector, particularly the new-housing crisis gripping Europe, contribute to its Dog status. This means the property development business may be tying up valuable capital and resources without generating commensurate returns, potentially hindering overall company performance.

Underperforming niche construction activities within Eiffage's portfolio, particularly those in highly competitive or stagnant local markets, can be categorized as Dogs. These segments typically exhibit low market share and contribute little to the group's overall growth or profitability, often operating at a break-even point.

An example illustrating this can be seen in Eiffage Métal's performance in France, where revenue declined by 33.3% in the first quarter of 2025. This downturn suggests that certain specialized or less strategic areas within even robust divisions may be facing significant headwinds, aligning with the characteristics of a Dog in the BCG matrix.

Legacy infrastructure maintenance contracts with low margins are typically considered Dogs in the BCG Matrix. These contracts, often in commoditized areas, generate minimal profit and demand significant operational resources, offering little room for expansion. For instance, a company might find itself locked into long-term, low-margin road maintenance agreements where competitive bidding has driven down profitability, a common scenario in many infrastructure sectors.

Non-Core, Stagnant Subsidiaries

Non-core, stagnant subsidiaries within Eiffage's portfolio might include smaller business units operating in mature or low-growth sectors without a clear competitive edge. These entities may not align with the company's broader strategic objectives, such as expansion into high-growth markets. For instance, a minor construction materials supplier in a region with declining infrastructure investment could fit this description.

Eiffage's strategic emphasis on acquiring businesses in dynamic sectors suggests a proactive approach to managing its asset base. This often involves a review of underperforming or non-strategic units. In 2024, such subsidiaries would likely represent a small fraction of Eiffage's overall revenue, perhaps less than 5%, and show minimal year-over-year growth.

- Low Market Growth: Subsidiaries operating in sectors experiencing minimal expansion, such as traditional building materials in saturated markets.

- Limited Competitive Advantage: Units lacking unique selling propositions or facing intense competition with little differentiation.

- Strategic Misalignment: Businesses that do not contribute to Eiffage's core competencies or future growth ambitions.

- Underperformance: Subsidiaries with consistently low profitability or negative returns on investment.

Outdated Construction Technologies or Practices

Investing in or relying on construction technologies or practices that are no longer efficient can place a company in the Dog quadrant of the BCG matrix. These outdated methods often result in higher operational costs and diminished competitiveness in the market. For instance, if Eiffage were to continue extensive use of older, less automated formwork systems instead of modern modular systems, it could lead to slower project completion times and increased labor expenses compared to competitors. Such areas typically hold a low market share in contemporary construction projects and offer very limited growth potential, acting as a drain on resources that could be better allocated to more promising ventures.

Eiffage’s commitment to innovation, however, suggests a strategic effort to identify and phase out these less productive areas. By embracing advancements like Building Information Modeling (BIM) and prefabrication, the company aims to boost efficiency and reduce reliance on older techniques. In 2023, Eiffage reported significant investments in digital transformation and sustainable construction methods, signaling a proactive approach to avoiding the pitfalls of outdated practices. For example, their use of digital twins in project management helps optimize resource allocation and identify inefficiencies early on.

The potential downsides of maintaining outdated construction technologies are substantial:

- Increased operational costs: Older machinery and methods often consume more energy and require more manual labor, driving up expenses.

- Reduced project timelines: Inefficient processes lead to delays, impacting profitability and client satisfaction.

- Lower quality output: Outdated techniques may not meet current industry standards for durability and performance.

- Environmental impact: Older technologies are frequently less energy-efficient and generate more waste, conflicting with sustainability goals.

Eiffage's property development in France, facing a 34.2% revenue drop in Q1 2025, exemplifies a Dog in the BCG matrix. This segment struggles with low growth and declining market share, exacerbated by Europe's new-housing crisis. Similarly, Eiffage Métal's 33.3% revenue decline in Q1 2025 highlights niche construction activities with low market share and profitability, characteristic of Dogs.

Legacy infrastructure maintenance contracts with low margins, often in commoditized areas, also fall into the Dog category. These require significant resources without offering expansion opportunities, similar to non-core, stagnant subsidiaries in mature sectors lacking a competitive edge.

Outdated construction technologies, leading to higher costs and reduced competitiveness, can also position business units as Dogs. Eiffage's investment in digital transformation and BIM aims to mitigate these risks.

| Eiffage Segment | BCG Category | Key Indicators (Q1 2025 unless specified) | Contributing Factors |

| Property Development (France) | Dog | -34.2% Revenue Decline | New-housing crisis, low growth potential |

| Eiffage Métal (France) | Dog | -33.3% Revenue Decline | Niche markets, high competition |

| Legacy Maintenance Contracts | Dog | Low margins, high resource demand | Commoditization, lack of differentiation |

| Non-core Subsidiaries | Dog | Minimal growth (<5% in 2024), low profitability | Mature sectors, strategic misalignment |

Question Marks

Eiffage's commitment to advanced digital solutions, particularly in areas like safety and project management through internal apps for incident reporting and safety inspections, positions these initiatives in a high-growth technological market. While adoption is increasing, their market share within the broader construction and infrastructure sector may still be developing, necessitating continued investment to achieve widespread impact and demonstrate full value.

Eiffage's investment in emerging bio-based materials and green chemistry for roadworks, exemplified by innovations like Recytal-ARM® and Biophalt®, positions it in a high-growth sector driven by increasing environmental regulations and consumer demand for sustainable infrastructure. The company's early-stage commitment suggests a strategic move into a potentially lucrative market, though current market share in these specific niche products remains limited.

Eiffage is actively exploring the high-potential smart city infrastructure and urban development sector, evidenced by pilot projects and R&D in innovative concepts like ecodistricts. For instance, their LaVallée ecodistrict project showcases a commitment to sustainable urban living, a key driver in future urban planning.

While this market presents significant growth opportunities, Eiffage's definitive leadership and widespread implementation of these smart city solutions are still in their formative stages. This necessitates ongoing investment and a focus on successful scaling to solidify their position in this emerging field.

Expansion into Untapped International Markets (Beyond Core Europe)

Expanding Eiffage's reach into untapped international markets beyond its core European and existing African operations presents a classic 'Question Mark' scenario in the BCG matrix. These new territories, potentially in rapidly developing regions like Southeast Asia or Latin America, offer substantial long-term growth prospects but currently represent a minimal market share for Eiffage. Significant upfront investment in infrastructure, talent, and market understanding is necessary, mirroring the high investment risk associated with Question Marks.

For instance, consider the infrastructure development needs in countries like Vietnam or Colombia, which are projected to see substantial GDP growth in the coming years. Eiffage could leverage its expertise in construction and concessions, but establishing a foothold would require substantial capital expenditure and a long-term vision. The success of such an expansion hinges on Eiffae's ability to adapt its business models to local conditions and manage the inherent risks.

- Untapped Markets: Regions like Southeast Asia and Latin America offer high growth potential but low current market penetration for Eiffage.

- Investment Risk: Entering these markets demands significant capital outlay for establishing operations, market entry, and talent acquisition.

- Strategic Nurturing: Success requires a patient, long-term strategy to build market share and brand recognition.

- Potential Returns: While risky, these markets could offer substantial future revenue streams and diversification benefits if Eiffage can successfully navigate the challenges.

Specialized Energy Transition Technologies (Beyond Core Renewables)

Investing in specialized energy transition technologies, such as advanced battery storage or cutting-edge grid management software, presents a unique opportunity for Eiffage. These areas, while not as established as offshore wind, hold significant promise for future growth.

The global market for advanced energy storage systems, for instance, was projected to reach over $100 billion by 2025, indicating substantial upward potential. Eiffage’s current market share in these niche segments may be modest, requiring a concentrated investment strategy to build a stronger competitive position.

Consideration of these specialized technologies within Eiffage's strategic framework is crucial:

- High Growth Potential: Emerging technologies like green hydrogen production or carbon capture utilization and storage (CCUS) are expected to see rapid adoption as decarbonization efforts intensify.

- Strategic Investment Needed: To capture market share in these nascent fields, Eiffage would need to allocate targeted capital for research, development, and pilot projects.

- Risk and Reward: While the initial investment may be higher and the market less defined, successful early entry into these specialized areas can yield significant long-term returns and establish Eiffage as an innovator.

- Market Diversification: Expanding into these beyond-core renewables offers Eiffage a pathway to diversify its energy transition portfolio and mitigate risks associated with reliance on a few dominant technologies.

Eiffage's exploration into new geographical markets, such as Southeast Asia or Latin America, represents a classic Question Mark. These regions offer substantial long-term growth potential due to developing economies and infrastructure needs, yet Eiffage currently holds a minimal market share. Significant investment is required to establish operations and gain traction, akin to the high investment characteristic of Question Marks.

For instance, infrastructure spending in Latin America was projected to reach over $1.5 trillion by 2030, highlighting the growth opportunity. However, navigating diverse regulatory environments and building local partnerships are critical challenges Eiffage must address to convert this potential into market share.

Eiffage's strategic focus on emerging technologies within the energy sector, like advanced battery storage solutions or grid modernization software, also falls into the Question Mark category. While the global energy transition is a high-growth trend, Eiffage's current penetration in these specific niche technology markets is likely modest.

The market for energy storage systems alone was estimated to grow significantly, with projections suggesting a market size exceeding $200 billion by 2030. Eiffage's success here depends on targeted R&D and strategic partnerships to build a competitive edge in these rapidly evolving fields.

BCG Matrix Data Sources

Our Eiffage BCG Matrix leverages comprehensive data from internal financial reports, industry growth statistics, and competitor market share analysis to accurately position business units.