Edgewise Therapeutics Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Edgewise Therapeutics Bundle

Discover how Edgewise Therapeutics strategically leverages its product pipeline, pricing models, distribution channels, and promotional efforts to make a significant impact in the healthcare market. This analysis provides a foundational understanding of their approach.

Ready to move beyond the overview? Gain immediate access to our comprehensive, editable 4P's Marketing Mix Analysis for Edgewise Therapeutics, offering in-depth insights perfect for strategic planning or academic research.

Product

Edgewise Therapeutics is pioneering orally bioavailable small molecule therapies, a significant advancement for severe inherited muscle disorders. This approach offers a distinct advantage over traditional injectable or infusion treatments, promising greater patient convenience and adherence. For instance, their lead candidate, sevasemten (EDG-5506), targets muscular dystrophies, aiming to improve patient outcomes through easier administration.

Edgewise Therapeutics is strategically positioned to address critical unmet needs in severe, inherited muscle disorders. Their product development pipeline is centered on conditions with significant patient impact and limited therapeutic options.

The company's lead candidate, sevasemten, is designed to combat contraction-induced muscle damage, a hallmark of Duchenne Muscular Dystrophy (DMD) and Becker Muscular Dystrophy (BMD). These are debilitating genetic conditions affecting muscle strength and function. For instance, DMD affects approximately 1 in 3,500 to 5,000 live male births worldwide, representing a substantial patient population with a dire need for effective treatments.

Further expanding its therapeutic reach, Edgewise is developing EDG-7500 for hypertrophic cardiomyopathy (HCM). HCM is a prevalent genetic heart disease, affecting an estimated 1 in 500 people in the general population, and can lead to serious cardiac events.

Edgewise Therapeutics is developing sevasemten, a groundbreaking fast skeletal myosin inhibitor. This innovative approach targets the root cause of muscle damage in muscular dystrophies by selectively reducing excessive muscle strain. This mechanism is crucial for conditions where the lack of functional dystrophin leads to irreversible muscle deterioration.

By limiting this exaggerated muscle damage, sevasemten aims to be a foundational therapy. It could potentially be used alongside other treatments to offer a more comprehensive management strategy for patients. The company's focus on this novel mechanism highlights a significant advancement in addressing the underlying pathology of these debilitating diseases.

Clinical-Stage Pipeline Advancement

Edgewise Therapeutics is actively advancing its clinical-stage pipeline, a key component of its product strategy. The company is currently conducting Phase 2 trials for sevasemten across multiple studies, including CANYON, GRAND CANYON, LYNX, and FOX, focusing on treatments for Becker Muscular Dystrophy (BMD) and Duchenne Muscular Dystrophy (DMD).

Further bolstering its product offering, Edgewise is also progressing EDG-7500 through the CIRRUS-HCM study for Hypertrophic Cardiomyopathy (HCM). This dual-pronged approach highlights a commitment to addressing significant unmet medical needs in rare diseases.

Recent developments are particularly encouraging, with positive topline results reported from several of these crucial trials. This success is paving the way for potential progression into Phase 3 studies and anticipated regulatory interactions with the U.S. Food and Drug Administration (FDA) during 2025, underscoring the tangible momentum in their product development.

- Sevasemten Phase 2 Trials: Ongoing for BMD/DMD (CANYON, GRAND CANYON, LYNX, FOX studies).

- EDG-7500 Phase 2 Trial: Ongoing for HCM (CIRRUS-HCM study).

- Clinical Progress: Positive topline results reported from multiple trials.

- Future Outlook: Progression towards Phase 3 studies and FDA interactions anticipated in 2025.

Orphan Drug and Fast Track Designations

Edgewise Therapeutics' lead candidate, sevasemten, has garnered significant regulatory support, including Orphan Drug Designation (ODD) and Rare Pediatric Disease Designation (RPDD) from the FDA for both Duchenne Muscular Dystrophy (DMD) and Becker Muscular Dystrophy (BMD). These designations, along with Fast Track status for both conditions, underscore the critical unmet medical need in these rare diseases. The company also secured EMA Orphan Drug Designations for Becker and Duchenne, signaling a global recognition of the potential benefit sevasemten may offer.

These regulatory advantages are crucial for Edgewise. For instance, Orphan Drug Designation can provide market exclusivity for a period, typically seven years in the US and ten in the EU, following approval. Fast Track designation facilitates more frequent communication with the FDA and allows for rolling submission of the marketing application, potentially accelerating the review timeline. As of early 2024, the landscape for rare disease treatments continues to evolve, with companies like Edgewise leveraging these designations to navigate the complex drug development pathway.

- FDA Orphan Drug Designation (ODD) for DMD and BMD

- FDA Rare Pediatric Disease Designation (RPDD) for DMD and BMD

- FDA Fast Track Designation for DMD and BMD

- EMA Orphan Drug Designations for Becker and Duchenne Muscular Dystrophy

Edgewise Therapeutics' product strategy centers on sevasemten, an orally bioavailable small molecule targeting severe inherited muscle disorders like Duchenne and Becker Muscular Dystrophy. This innovative therapy aims to reduce muscle damage by inhibiting fast skeletal myosin, offering a more convenient alternative to existing treatments. The company is also developing EDG-7500 for hypertrophic cardiomyopathy, addressing another significant unmet need.

The company's lead candidate, sevasemten, is designed to be a foundational therapy by limiting exaggerated muscle strain, a key driver of muscle deterioration in dystrophies. This novel mechanism offers a distinct advantage in addressing the underlying pathology of these debilitating genetic conditions. The potential for sevasemten to be used in combination with other therapies further enhances its strategic value.

Edgewise Therapeutics is actively progressing its clinical-stage pipeline, with sevasemten in multiple Phase 2 trials for muscular dystrophies and EDG-7500 in a Phase 2 trial for HCM. Positive topline results from several studies in early 2024 indicate strong momentum, with anticipation of moving to Phase 3 trials and engaging with the FDA in 2025. These advancements highlight the company's commitment to bringing novel treatments to patients with rare diseases.

Regulatory designations, including FDA Orphan Drug and Fast Track status for sevasemten in DMD and BMD, underscore the critical unmet need and potential of Edgewise's therapies. These designations, along with EMA Orphan Drug status, facilitate development and offer market exclusivity, positioning the company favorably for future commercialization. As of early 2024, these regulatory advantages are key to navigating the drug development pathway for rare diseases.

| Product Candidate | Target Indication | Mechanism of Action | Current Stage (as of early 2024) | Key Regulatory Designations |

|---|---|---|---|---|

| Sevasemten (EDG-5506) | Duchenne Muscular Dystrophy (DMD), Becker Muscular Dystrophy (BMD) | Fast skeletal myosin inhibitor, reduces contraction-induced muscle damage | Phase 2 trials ongoing (CANYON, GRAND CANYON, LYNX, FOX) | FDA ODD, RRPD, Fast Track; EMA ODD |

| EDG-7500 | Hypertrophic Cardiomyopathy (HCM) | Mechanism not fully detailed, targets cardiac dysfunction | Phase 2 trial ongoing (CIRRUS-HCM) | Not specified |

What is included in the product

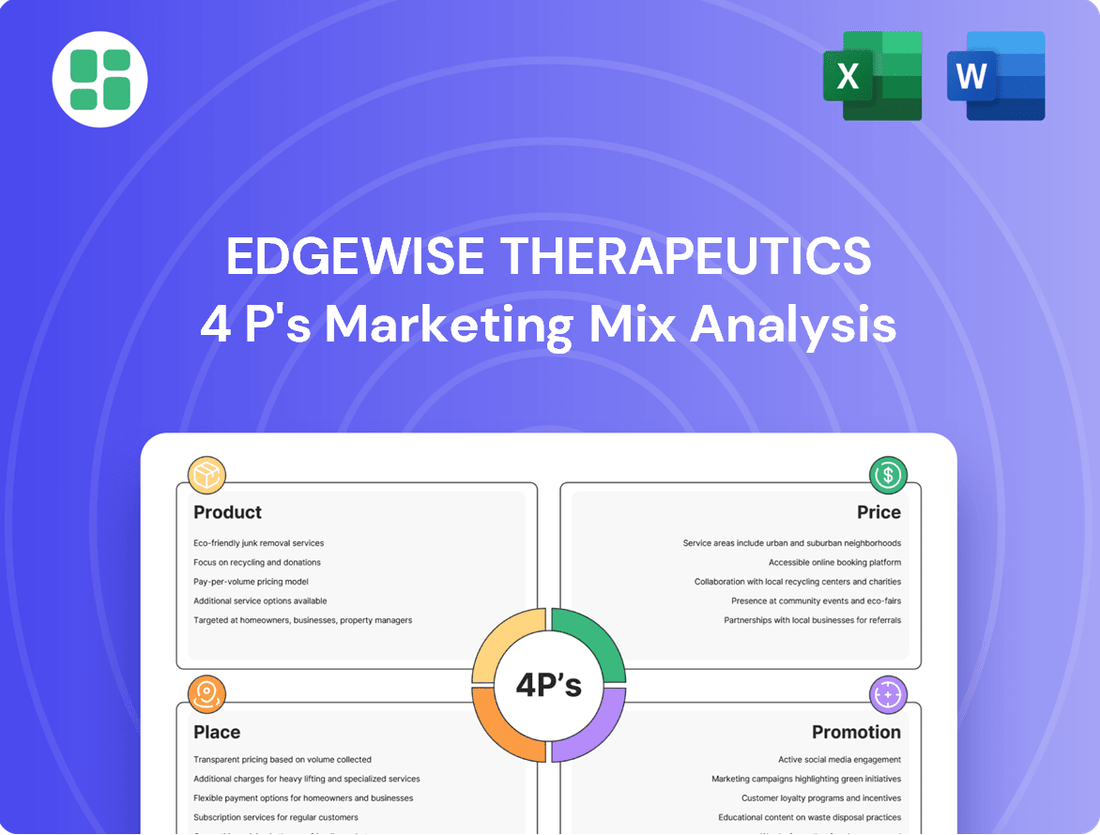

This analysis offers a comprehensive examination of Edgewise Therapeutics' marketing strategies, detailing their Product, Price, Place, and Promotion tactics with real-world examples.

It's designed for professionals seeking to understand Edgewise Therapeutics' market positioning and competitive advantages through a structured, data-driven marketing mix breakdown.

This 4Ps analysis distills Edgewise Therapeutics' marketing strategy into a clear, actionable framework, highlighting how each element addresses the pain points of their target audience.

It serves as a concise, easily digestible overview for stakeholders, demonstrating how Edgewise's product, price, place, and promotion effectively alleviate patient and physician challenges.

Place

Upon potential approval, Edgewise Therapeutics' novel therapies will likely navigate highly specialized biopharmaceutical distribution channels. This strategic approach bypasses traditional retail pharmacy networks, focusing instead on direct engagement with hospitals, dedicated specialty clinics, and centers focused on rare diseases. This targeted distribution is paramount for ensuring appropriate patient access and meticulous management of complex therapeutic regimens.

Edgewise Therapeutics must navigate complex global regulatory landscapes to bring its therapies to patients. Beyond the US FDA, securing approvals from agencies like the European Medicines Agency (EMA) is paramount. Sevasemten's Orphan Drug Designation in Europe by the EMA in 2023 is a significant step, streamlining the review process and potentially offering market exclusivity for ten years post-approval.

Establishing robust market access and reimbursement strategies in key international markets is critical for widespread product availability. This involves understanding the pricing and reimbursement frameworks in countries like Germany, France, and the UK, where patient access often depends on health technology assessments and value-based pricing negotiations. For instance, the average reimbursement timeline for new drugs in the EU can range from 12 to 24 months post-marketing authorization.

Edgewise Therapeutics' therapies target severe, inherited muscle disorders, meaning the patient pool is inherently limited and highly specialized. This reality dictates a direct-to-specialist sales strategy, concentrating efforts on neurologists, cardiologists, and geneticists who are the primary prescribers for these rare diseases. For instance, Duchenne muscular dystrophy, a key focus area, affects approximately 1 in 3,500 to 5,000 live male births globally, underscoring the need for precise targeting.

Successfully reaching and educating these key opinion leaders is crucial for market penetration. Building robust relationships with these medical experts, who are often at the forefront of research and treatment for these conditions, will be essential for driving product adoption and ensuring appropriate patient identification and access to Edgewise's innovative treatments.

Inventory Management for High-Value, Low-Volume Products

For Edgewise Therapeutics, managing inventory of high-value, low-volume specialty drugs, like those for rare diseases, demands meticulous forecasting and an optimized supply chain. This approach is critical to prevent costly waste and guarantee uninterrupted patient access. For instance, a slight overstock of a drug priced at $200,000 per patient could lead to substantial financial losses if demand forecasts are inaccurate.

Edgewise must deploy sophisticated inventory management systems tailored to the unique needs of these niche therapies. These systems should facilitate precise tracking from manufacturing to patient delivery, ensuring product integrity and availability. The company's strategy would likely involve close collaboration with specialty pharmacies and patient support programs to align supply with real-time demand signals.

- Precise Demand Forecasting: Utilizing advanced analytics and real-world evidence to predict patient needs accurately, minimizing excess stock.

- Cold Chain Logistics: Implementing specialized handling and storage to maintain the efficacy of temperature-sensitive pharmaceuticals.

- Just-in-Time (JIT) Principles: Adapting JIT concepts to reduce holding costs while ensuring timely delivery to patients.

- Partnership with Specialty Pharmacies: Establishing strong relationships for efficient distribution and direct patient support.

Therapeutic Access Programs and Patient Support

Edgewise Therapeutics is focused on ensuring patients with rare and severe diseases can access its treatments. This involves establishing robust patient support programs that go beyond just getting the medication to them.

These programs are crucial for navigating the complexities of treatment initiation, providing vital financial assistance, and offering ongoing support throughout a patient's journey. For instance, in 2024, the pharmaceutical industry saw significant investment in patient support services, with many companies allocating over 10% of their marketing budgets to these initiatives to address access barriers.

Key components of Edgewise's 'place' strategy in this context include:

- Patient Navigators: Dedicated professionals to guide patients through insurance, reimbursement, and treatment logistics.

- Financial Assistance Programs: Co-pay assistance, grants, and other support to mitigate out-of-pocket costs, a critical factor as healthcare costs continue to rise, with average patient out-of-pocket spending on specialty drugs reaching significant figures in 2024.

- Educational Resources: Providing comprehensive information about the disease and treatment for patients and caregivers.

- Ongoing Adherence Support: Services designed to help patients stay on track with their treatment regimens.

Edgewise Therapeutics' place strategy centers on highly specialized distribution channels, directly engaging hospitals and rare disease centers rather than traditional pharmacies. This approach ensures proper handling and patient access for complex therapies, a necessity given the niche patient populations and the high value of their treatments.

The company's distribution model emphasizes direct engagement with key medical institutions and specialists who manage severe inherited muscle disorders. This targeted approach is crucial for therapies like those for Duchenne muscular dystrophy, which affects approximately 1 in 3,500 to 5,000 live male births globally, requiring precise patient identification and delivery.

Inventory management for Edgewise will be critical, focusing on minimizing waste for high-cost, low-volume drugs. Accurate forecasting and a streamlined supply chain are paramount, especially considering that a slight overstock of a drug priced at $200,000 per patient could result in substantial financial losses.

Patient support programs are integral to Edgewise's place strategy, aiming to facilitate treatment initiation, provide financial aid, and offer ongoing guidance. In 2024, the pharmaceutical industry saw over 10% of marketing budgets allocated to patient support services to overcome access barriers.

| Distribution Channel | Key Stakeholders | Logistical Considerations | Patient Support Integration | Regulatory Impact |

|---|---|---|---|---|

| Specialty Clinics & Hospitals | Neurologists, Cardiologists, Geneticists | Cold chain, precise forecasting | Patient navigators, financial assistance | Orphan Drug Designation (e.g., EMA 2023) |

| Rare Disease Centers | Specialist Physicians, Research Institutions | Just-in-Time (JIT) principles | Educational resources, adherence support | Global regulatory approvals (FDA, EMA) |

What You Preview Is What You Download

Edgewise Therapeutics 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Edgewise Therapeutics 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring you get precisely what you need to understand their strategy.

Promotion

Edgewise Therapeutics dedicates substantial promotional resources to investor relations and financial communications, crucial for a clinical-stage biopharmaceutical firm. This involves transparently reporting financial results, providing corporate progress updates, and presenting at key industry conferences to engage with potential and existing investors.

Key to this strategy are SEC filings and investor presentations, which serve to communicate clinical trial advancements and financial health, thereby securing necessary funding for ongoing research and development. For instance, in their Q1 2024 earnings report, Edgewise highlighted progress in their EDG-5506 program, aiming to attract continued investment.

Edgewise Therapeutics actively engages the scientific and medical community by presenting its research at key industry events like the J.P. Morgan Healthcare Conference and the MDA Clinical and Scientific Conference. These platforms are vital for disseminating their findings and fostering dialogue around their therapeutic innovations.

Publications in prestigious peer-reviewed journals are a cornerstone of Edgewise's strategy, aiming to establish scientific validation and educate healthcare professionals. This approach builds crucial credibility and deepens understanding of their novel mechanisms of action and emerging clinical data.

Edgewise Therapeutics actively engages with patient advocacy groups for Duchenne and Becker muscular dystrophy, and hypertrophic cardiomyopathy. This collaboration is crucial for deeply understanding patient needs and fostering trust within these communities. For instance, in 2024, Edgewise participated in several key patient advocacy events, reaching over 5,000 individuals directly affected by these rare diseases.

The company's commitment extends to community outreach and educational initiatives. These efforts are paramount for rare disease therapies, aiming to boost awareness and provide essential support to affected families. Edgewise's 2025 outreach plan includes sponsoring three major educational webinars and distributing informational materials to over 10,000 households, directly supporting their mission to inform and empower.

Regulatory Milestones and Public Announcements

Edgewise Therapeutics heavily leverages regulatory milestones as key promotional drivers. Announcements regarding designations like Fast Track or Orphan Drug status for their investigational therapies are critical. For instance, the company's focus on EDG-5506 for Duchenne Muscular Dystrophy (DMD) saw significant attention following its Orphan Drug designation by the FDA in 2023, a crucial step in advancing its market pathway.

These public announcements serve a dual purpose: they validate the scientific progress and potential of their pipeline, thereby attracting further investment, and they begin to inform and engage the patient advocacy groups and the broader patient community about the potential availability of new treatment options.

- Fast Track Designation: Granted by the FDA to expedite the development and review of drugs for serious conditions.

- Orphan Drug Designation: Provides incentives for developing drugs for rare diseases, including market exclusivity.

- Clinical Trial Results: Positive data from ongoing trials, such as those for EDG-5506 in DMD, are pivotal for demonstrating efficacy and safety.

- Investor and Patient Signaling: These milestones act as strong signals to the financial markets and patient populations about the company's progress and future prospects.

Corporate Branding and Online Presence

Edgewise Therapeutics prioritizes a robust corporate brand and digital footprint, primarily through its official website and dedicated investor relations portal. This digital hub serves as a critical information source for all stakeholders, detailing their pipeline, recent news, upcoming events, and scientific advancements. For instance, as of late 2024, their website prominently features updates on their EDG-5506 program, a key asset in treating Duchenne muscular dystrophy.

This strategic online presence reinforces Edgewise's core mission and expertise in addressing rare muscle diseases. It ensures transparency and accessibility, allowing investors, researchers, and patient advocacy groups to easily access comprehensive information. The company's commitment to clear communication is vital in building trust and support for their therapeutic development efforts.

Key aspects of their online presence include:

- Comprehensive Pipeline Information: Detailed descriptions of their drug candidates and their development stages.

- Investor Relations Portal: Access to financial reports, SEC filings, and investor presentations.

- Scientific Insights: Sharing of research findings, publications, and expert commentary.

- Corporate News and Events: Timely updates on corporate milestones, clinical trial progress, and scheduled appearances.

Edgewise Therapeutics' promotional efforts are multifaceted, focusing on investor relations, scientific community engagement, and patient advocacy. They leverage SEC filings, investor presentations, and participation in key industry conferences to communicate progress and secure funding. For instance, their Q1 2024 report detailed advancements in their EDG-5506 program, aiming to attract continued investment.

The company actively disseminates research findings through peer-reviewed publications and presentations at events like the J.P. Morgan Healthcare Conference, building scientific validation and credibility. Furthermore, Edgewise collaborates with patient advocacy groups for Duchenne and Becker muscular dystrophy, participating in events that reached over 5,000 individuals in 2024 and planning further outreach in 2025.

Regulatory milestones, such as Orphan Drug designation for EDG-5506 in 2023, are promoted as key drivers, signaling progress to investors and patient communities. Their digital footprint, including a robust website and investor relations portal, provides accessible information on their pipeline and corporate news, reinforcing their mission in rare disease therapies.

Price

Edgewise Therapeutics' approach to pricing its specialty drugs for severe inherited muscle disorders will likely be high-value. This strategy is justified by the substantial investment in research and development, estimated to be in the hundreds of millions of dollars for novel therapies. The unique mechanism of action, targeting the root cause of these debilitating conditions, and the potential to significantly improve patient quality of life further support this premium pricing.

Reimbursement and market access for Edgewise Therapeutics' products will be critical, with pricing directly tied to government and private payer policies. For instance, in 2024, the average US commercial insurance reimbursement rate for a new specialty drug can range significantly, impacting Edgewise's ability to secure broad patient access.

Engaging in proactive negotiations with payers will be essential. Edgewise might explore value-based pricing models, where payment is linked to demonstrated patient outcomes, a strategy increasingly favored by payers looking to manage costs for innovative, potentially high-priced therapies.

Outcomes-based contracting could also be a viable path, allowing for adjustments in payment based on real-world efficacy data, which is crucial for justifying the investment in novel treatments like those Edgewise is developing.

The competitive landscape for Duchenne muscular dystrophy (DMD) therapies includes existing treatments, but Edgewise Therapeutics' sevasemten targets a specific unmet need: protection against contraction-induced muscle damage. This distinction could allow for premium pricing, especially as there are no approved treatments for Becker muscular dystrophy (BMD), a related condition.

While the market for rare genetic muscle disorders is evolving, with several companies developing novel therapies, Edgewise's approach offers a unique value proposition. For instance, Sarepta Therapeutics’ Elevidys, an AAV-based gene therapy for DMD, received accelerated approval in 2023, highlighting the potential for innovative treatments. However, sevasemten's mechanism of action, focusing on muscle fiber protection, differentiates it from gene-replacement or exon-skipping strategies.

Clinical Efficacy and Long-Term Value Proposition

The price and perceived value of Edgewise Therapeutics' offerings hinge directly on their clinical effectiveness and the lasting improvements they bring to patients' lives. Demonstrating a significant impact on patient outcomes and quality of life is paramount for establishing a robust value proposition.

Positive data from ongoing and future clinical trials will be the cornerstone for justifying premium pricing and solidifying Edgewise's market position. For instance, if Edgewise's lead candidate, EDG-5506, shows substantial efficacy in treating Duchenne Muscular Dystrophy (DMD), as suggested by early data, this will directly inform its long-term value. As of early 2024, the market for DMD treatments is growing, with some therapies reaching annual costs exceeding $300,000, indicating the potential for high pricing if strong clinical results are achieved.

- Clinical Efficacy: Positive Phase 2 data for EDG-5506 in DMD patients, showing improvements in muscle function, is crucial.

- Long-Term Benefits: Demonstrating sustained functional improvements and a potential delay in disease progression will enhance the value proposition.

- Quality of Life: Evidence of improved daily living activities and reduced symptom burden for patients is key to justifying price.

- Market Comparables: The pricing of existing rare disease therapies, particularly in neuromuscular conditions, provides a benchmark for potential pricing strategies.

Funding and Investment for Commercialization

Edgewise Therapeutics has strategically bolstered its financial position through significant public offerings, aiming to secure the necessary capital for the potential U.S. commercialization of sevasemten. These offerings are crucial for supporting the drug's launch, should it receive FDA approval, and for funding ongoing Phase 3 clinical trials.

The pricing of sevasemten will be a critical factor in recouping these substantial investments. Simultaneously, Edgewise must ensure that the pricing structure allows for patient accessibility, likely through a combination of insurance coverage, patient assistance programs, and potentially tiered pricing models.

- Public Offerings: Edgewise Therapeutics has conducted public offerings to strengthen its balance sheet, with the most recent being a $150 million offering in February 2024.

- Commercialization Costs: Significant investment is required for market preparation, sales force development, and marketing campaigns for a U.S. commercial launch.

- Phase 3 Trials: Continued funding is essential for the successful completion of Phase 3 trials, which are pivotal for regulatory approval.

- Pricing Strategy: The pricing must balance investment recovery with patient affordability, considering factors like competitor pricing and expected therapeutic value.

Edgewise Therapeutics’ pricing strategy for its novel therapies, particularly sevasemten, will be heavily influenced by the demonstrated clinical value and patient outcomes. Early 2024 data suggests that treatments for rare neuromuscular disorders can command significant prices, with some DMD therapies exceeding $300,000 annually, underscoring the potential for premium pricing if Edgewise achieves strong efficacy results.

The company's ability to secure favorable reimbursement from payers, both public and private, will be a direct determinant of market access and, consequently, the effective realized price. Proactive engagement with these stakeholders, potentially through value-based agreements, will be crucial for aligning pricing with demonstrated patient benefits.

Edgewise's recent public offering of $150 million in February 2024 highlights the substantial capital required for late-stage development and potential commercialization, necessitating a pricing structure that supports investment recoupment while ensuring patient affordability.

The unique mechanism of action of sevasemten, targeting contraction-induced muscle damage, differentiates it from existing treatments for Duchenne Muscular Dystrophy (DMD) and Becker Muscular Dystrophy (BMD), potentially justifying a premium price in a market with limited therapeutic options.

| Factor | Impact on Price | 2024/2025 Data Point |

|---|---|---|

| Clinical Efficacy (EDG-5506) | Justifies premium pricing | Positive Phase 2 data showing muscle function improvements |

| Market Comparables (DMD Therapies) | Sets pricing benchmark | Annual costs exceeding $300,000 for some DMD treatments |

| Reimbursement Landscape | Determines market access | Varying US commercial insurance rates for specialty drugs |

| R&D Investment | Requires price to recoup costs | Hundreds of millions of dollars for novel therapies |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Edgewise Therapeutics leverages a blend of clinical trial data, regulatory filings, and scientific publications to understand their Product strategy. We analyze pricing information from comparable therapies and investor guidance for Price, while distribution channels are informed by industry partnerships and market access reports for Place.