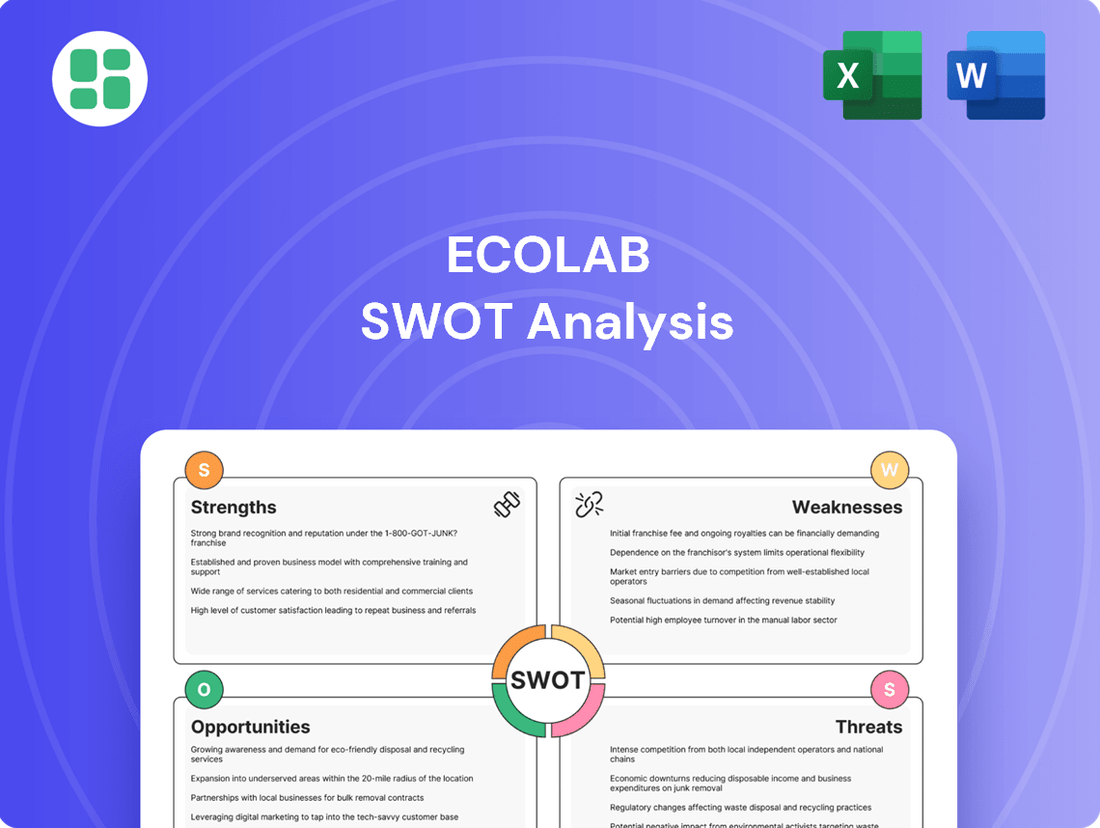

Ecolab SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecolab Bundle

Ecolab’s strengths lie in its dominant market position and innovative solutions for hygiene and water management, while its opportunities include expanding into emerging markets and leveraging digital technologies. However, potential threats like intense competition and regulatory changes require careful navigation.

Want the full story behind Ecolab’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ecolab's strength lies in its undisputed global market leadership in water, hygiene, and infection prevention. Serving over 3 million customer locations in 170 countries, the company boasts an impressive market penetration. This vast network, coupled with a diverse portfolio spanning food service, healthcare, and industrial sectors, significantly de-risks its operations against sector-specific downturns.

Ecolab showcased exceptional financial strength in 2024, achieving record sales, adjusted earnings per share, operating income margins, and free cash flow. This performance highlights the company's ability to navigate market dynamics effectively and deliver consistent shareholder value.

The company's commitment to growth is evident in its consistent double-digit earnings expansion. Ecolab is strategically targeting a 20% operating income margin by 2027, a testament to its focus on long-term profitability and operational excellence.

This impressive financial trajectory is fueled by a combination of factors, including successful value-based pricing strategies, continuous productivity enhancements across its operations, and significant growth within its higher-margin business segments.

Ecolab's commitment to innovation is a significant strength, demonstrated by substantial investments in research and development. The company is actively integrating advanced digital capabilities and artificial intelligence (AI) across its operations to refine its product and service portfolio.

Digital sales are showing robust growth, fueled by the introduction of cutting-edge solutions. For instance, their connected pest management systems and AI-powered water treatment technologies are delivering novel insights and enhanced value to clients.

This strategic emphasis on technological advancement allows Ecolab to maintain a competitive edge and significantly boost its operational efficiency, ensuring it remains a leader in its industry.

Sustainability Focus and Impact

Ecolab's deep commitment to sustainability is a significant strength, positioning it as a leader in crucial environmental areas like water conservation and greenhouse gas emission reduction. This focus resonates strongly with the growing global demand for eco-friendly solutions. In 2024 alone, Ecolab's innovative technologies helped its customers achieve remarkable environmental benefits.

- Water Savings: Customers saved billions of gallons of water through Ecolab's solutions.

- Emissions Reduction: Millions of metric tons of greenhouse gas emissions were avoided.

- Circular Economy: The company actively develops and promotes circular water solutions.

- Brand Enhancement: This dedication significantly bolsters Ecolab's brand reputation and customer loyalty.

Robust Service Model and Customer Relationships

Ecolab's strength lies in its robust service model, boasting the industry's largest and most skilled sales and service force. This global team delivers customized solutions, fostering deep customer understanding and building enduring relationships. This direct engagement allows Ecolab to consistently provide on-site expertise, a key differentiator.

This hands-on approach translates into tangible benefits for clients, ensuring optimal performance and reliability. For instance, in 2023, Ecolab reported that its service team directly supported over 3 million customer locations worldwide, reinforcing the scale and impact of its customer-centric strategy.

- Global Reach: Operates the industry's largest sales and service team across the globe.

- Customer Intimacy: Direct service model cultivates deep insights and strong, lasting client relationships.

- On-Site Expertise: Provides consistent, expert support directly at customer facilities.

- Competitive Edge: Differentiates through reliable performance and tailored solutions.

Ecolab's market leadership in water, hygiene, and infection prevention is a cornerstone strength, evidenced by its presence in 170 countries and over 3 million customer locations. This extensive reach, combined with a diversified business across food service, healthcare, and industrial sectors, provides significant operational resilience.

Financially, 2024 was a landmark year for Ecolab, marked by record sales, earnings per share, and operating income margins. The company's consistent double-digit earnings growth, targeting a 20% operating income margin by 2027, underscores its focus on profitability driven by value-based pricing and operational efficiencies.

Innovation is a key differentiator, with substantial R&D investments fueling the integration of digital capabilities and AI. This technological advancement, seen in AI-powered water treatment and connected pest management, enhances product offerings and operational efficiency.

Ecolab's commitment to sustainability is a significant advantage, aligning with global demand for eco-friendly solutions. In 2024, their technologies enabled customers to save billions of gallons of water and avoid millions of metric tons of greenhouse gas emissions.

What is included in the product

Delivers a strategic overview of Ecolab’s internal and external business factors, highlighting its market strengths, operational gaps, and potential threats.

Offers a clear, actionable framework to identify and leverage Ecolab's competitive advantages, mitigating risks and capitalizing on opportunities.

Weaknesses

Ecolab's significant reliance on industries like hospitality and food service, which are highly sensitive to economic cycles, presents a notable weakness. During economic downturns, these sectors often face reduced consumer spending, directly impacting Ecolab's sales volumes. For instance, in 2023, while Ecolab saw overall growth, the hospitality sector's recovery, though robust, still carries inherent cyclical risks that could be exacerbated by a recession.

Ecolab is susceptible to fluctuations in the cost of its raw materials, a vulnerability that can be exacerbated by global trade dynamics. For instance, tariffs on imported components can directly inflate production expenses.

These rising costs often translate into price adjustments for consumers. Ecolab implemented a 5% surcharge in the U.S. in early 2025 to offset these increased expenses, a move that could strain customer relationships and potentially affect sales volume.

The company's profit margins are directly impacted by its ability to manage these raw material cost escalations and the strategic implementation of price surcharges. Navigating these challenges is crucial for maintaining financial health.

Ecolab's extensive global footprint, spanning over 170 countries, exposes it to substantial foreign currency translation risks. Fluctuations in exchange rates directly affect the value of international sales and profits when converted into U.S. dollars, potentially distorting financial performance.

For instance, the company reported an unfavorable impact on its earnings growth in the first quarter of 2025 due to these currency movements. This highlights how currency volatility can directly hinder the company's ability to achieve its financial targets.

Integration Complexities of Acquisitions

While strategic, large-scale acquisitions like Ecolab's recent purchase of Ovivo Electronics for approximately $1.5 billion, present significant growth opportunities, they also introduce considerable integration complexities. These processes can encounter regulatory hurdles, potentially delaying or altering the acquisition's scope. Furthermore, substantial short-term costs are often incurred for restructuring, systems alignment, and workforce integration to ensure operational synergy.

Successfully merging acquired entities is paramount to realizing the strategic intent and avoiding operational disruptions that could impact financial performance. Ecolab's integration of Ovivo, for instance, will require careful management of distinct operational models and corporate cultures to unlock the projected synergies. Failure to manage these complexities effectively could lead to cost overruns and a delay in achieving the expected return on investment.

- Regulatory Hurdles: Acquisitions often face scrutiny from antitrust and industry-specific regulators, potentially leading to delays or divestitures.

- Short-Term Costs: Significant expenses are typically associated with integrating IT systems, consolidating operations, and potential workforce restructuring following an acquisition.

- Operational Alignment: Merging different business processes, supply chains, and cultures is a complex undertaking that requires meticulous planning and execution to avoid disruption.

- Synergy Realization: The ultimate success of an acquisition hinges on effectively integrating the acquired business to achieve anticipated cost savings and revenue enhancements.

Intense Competitive Market Pressures

Ecolab navigates an intensely competitive market, contending with global giants and focused niche players alike. This rivalry frequently translates into significant pricing pressures, demanding constant innovation and unique value propositions to preserve market standing. The imperative to consistently offer superior solutions can strain financial and operational resources, potentially impacting profit margins.

For instance, in the water treatment sector, Ecolab faces competition from companies like Veolia and Suez, which also offer comprehensive solutions. In 2024, the global industrial water treatment market was valued at approximately $70 billion, a figure expected to grow, indicating the scale of competition.

- Intense Rivalry: Competitors range from large, diversified corporations to specialized regional firms.

- Pricing Pressure: The need to remain competitive can force price adjustments, affecting profitability.

- Innovation Demands: Continuous investment in R&D is crucial to differentiate offerings and maintain market share.

- Resource Strain: Meeting competitive demands can stretch operational and financial resources.

Ecolab's reliance on cyclical industries like hospitality and food service makes it vulnerable to economic slowdowns. For example, while the hospitality sector showed a strong recovery in 2023, any future recession could significantly dampen demand for Ecolab's services.

The company is also exposed to raw material cost volatility, which can squeeze profit margins. Ecolab's decision to implement a 5% surcharge in the U.S. in early 2025, while necessary to offset these costs, risks alienating customers and impacting sales volume.

Furthermore, Ecolab's extensive global operations expose it to foreign currency risks, as seen in Q1 2025 when currency fluctuations negatively impacted earnings growth.

The company's significant acquisitions, such as the $1.5 billion Ovivo Electronics deal, bring integration challenges, including potential regulatory hurdles and substantial short-term costs for restructuring and system alignment, which could delay the realization of expected returns.

Preview Before You Purchase

Ecolab SWOT Analysis

This is the same Ecolab SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive view of their strategic positioning.

Opportunities

Ecolab is well-positioned to grow by entering and expanding within high-demand industries such as data centers, microelectronics, and life sciences, especially biopharmaceuticals. These sectors are experiencing significant expansion, driving a need for specialized water and hygiene solutions.

A prime example of this strategy is Ecolab's $1.8 billion acquisition of Ovivo Electronics, a move directly aimed at capturing the burgeoning demand for ultra-pure water essential for semiconductor fabrication. This acquisition signals a strong commitment to leveraging growth opportunities in technologically advanced markets.

These specialized verticals are not only characterized by rapid growth but also by their potential to deliver higher profit margins. By focusing on these areas, Ecolab can enhance its overall revenue streams and improve its profitability, solidifying its market leadership.

Ecolab's commitment to digital transformation is a significant opportunity, with AI poised to revolutionize its service offerings. For instance, in 2024, the company continued to invest in digital platforms that optimize water usage and sanitation processes for its clients. This focus allows for more predictive maintenance and proactive problem-solving, directly impacting customer efficiency and cost savings.

The integration of AI, particularly in areas like intelligent water management and pest intelligence, offers a pathway to more precise and predictive service delivery. By leveraging data analytics and machine learning, Ecolab can anticipate needs and offer solutions before issues arise. This not only enhances customer satisfaction but also opens doors for innovative, subscription-based revenue models, reflecting a growing trend in B2B service delivery.

The global push for environmental responsibility, particularly in water conservation, energy use, and waste management, is fueling a significant market expansion for Ecolab's sustainable offerings. This translates into substantial opportunities for Ecolab to collaborate with businesses aiming to meet their environmental, social, and governance (ESG) targets.

Ecolab's expertise in reducing resource consumption positions it to capitalize on this trend, driving both its own revenue growth and assisting clients in achieving their sustainability mandates. For instance, by 2025, the global ESG investing market is projected to exceed $50 trillion, highlighting the immense financial incentive for companies like Ecolab to provide solutions that align with these growing investor priorities.

Strategic Partnerships and Acquisitions

Ecolab can strategically acquire companies or form partnerships to bolster its technology portfolio and expand its global presence. This approach allows for quicker market penetration and the integration of innovative solutions, particularly in areas like water management and sustainability. For instance, in 2024, Ecolab continued to invest in ventures focused on water resilience, demonstrating a commitment to addressing critical environmental needs through collaborative efforts.

These strategic moves are designed to enhance Ecolab's competitive edge and unlock new revenue streams. By partnering with or acquiring businesses that possess specialized expertise or access to new markets, Ecolab can accelerate its growth trajectory. Such actions are crucial for staying ahead in a rapidly evolving industry that increasingly demands integrated solutions for complex global challenges.

- Broaden Technological Capabilities: Acquisitions can bring in new technologies, such as advanced water treatment or digital monitoring systems, enhancing Ecolab's service offerings.

- Expand Market Reach: Partnerships can open doors to new geographic regions or customer segments that might be difficult to penetrate independently.

- Address Global Challenges: Collaborations focused on water resilience and sustainability align with growing market demand for environmentally responsible solutions.

- Enhance Competitive Position: By integrating new capabilities and markets, Ecolab strengthens its overall market standing and differentiation.

Emerging Market Penetration and Growth

Ecolab has a strong global presence, but significant opportunities remain for expanding its reach and driving growth in emerging markets. These regions are experiencing rapid industrialization and urbanization, which directly increases the need for Ecolab's specialized hygiene, water management, and infection prevention solutions. For instance, by 2025, emerging markets are projected to account for a substantial portion of global GDP growth, creating a fertile ground for Ecolab's services.

The increasing awareness of water scarcity and the importance of public health in these developing economies further fuels demand for Ecolab's expertise. By adapting its offerings to meet the specific needs and regulatory environments of these markets, Ecolab can unlock considerable new revenue streams and solidify its position as a global leader.

- Untapped Market Potential: Emerging economies represent a vast, under-penetrated customer base for Ecolab's essential services.

- Demand Drivers: Industrial growth, urbanization, and heightened awareness of hygiene and water conservation are key catalysts for demand.

- Tailored Solutions: Customizing product and service portfolios for local market conditions is crucial for success.

- Growth Projections: Emerging markets are expected to be a primary engine for global economic expansion through 2025.

Ecolab is poised to capitalize on the growing demand for specialized water and hygiene solutions in high-growth sectors like data centers, microelectronics, and life sciences, particularly biopharmaceuticals. The company's strategic acquisition of Ovivo Electronics for $1.8 billion in 2024 underscores its commitment to securing a strong position in these technologically advanced markets, which promise higher profit margins and enhanced revenue streams.

The integration of AI and digital transformation presents a significant opportunity for Ecolab to revolutionize its service delivery, offering predictive maintenance and proactive problem-solving. By leveraging data analytics and machine learning, Ecolab anticipates client needs, driving customer efficiency and creating new subscription-based revenue models.

The global emphasis on environmental responsibility and ESG targets creates a substantial market for Ecolab's sustainable offerings, particularly in water conservation and waste management. With the ESG investing market projected to exceed $50 trillion by 2025, Ecolab is well-positioned to assist businesses in meeting their sustainability mandates and achieving significant financial incentives.

Strategic acquisitions and partnerships offer Ecolab avenues to broaden its technological capabilities, expand market reach, and address global challenges like water resilience. These collaborations are crucial for enhancing its competitive edge and unlocking new revenue streams in a dynamic industry.

Emerging markets represent a vast, under-penetrated customer base for Ecolab's essential services, driven by rapid industrialization, urbanization, and increasing awareness of public health and water conservation. By 2025, these markets are expected to contribute significantly to global GDP growth, providing fertile ground for Ecolab's tailored solutions.

Threats

Broader economic uncertainties, such as potential recessions and persistent inflationary pressures, present a significant threat to Ecolab's performance. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.6% in 2024, down from 3.0% in 2023, signaling a challenging environment.

These conditions can translate into reduced capital expenditures and operational budget cuts across key industries Ecolab serves, directly impacting demand for its water, hygiene, and infection prevention solutions. A slowdown in industrial production, particularly in manufacturing sectors, could further dampen sales opportunities.

The ongoing volatility necessitates that Ecolab maintain strategic agility and be prepared to adapt its offerings and operational focus to navigate these macroeconomic headwinds effectively.

Ecolab navigates a fiercely competitive arena, contending with global giants like Diversey and Henkel, alongside a multitude of agile, specialized firms. This crowded market often leads to price wars, which can squeeze Ecolab's profitability and make it harder to grow its market share.

For instance, in the industrial cleaning sector, where Ecolab is a major player, price sensitivity is high among customers. Competitors frequently introduce new products or offer aggressive pricing to gain an edge, forcing Ecolab to constantly adapt its strategies. In 2023, the global industrial cleaning market was valued at approximately $80 billion, with intense competition contributing to a compound annual growth rate (CAGR) projected to be around 5-6% through 2028, underscoring the pressure to innovate and maintain market presence.

Ecolab faces ongoing threats from evolving environmental, health, and safety (EHS) regulations across its global operations. For instance, stricter wastewater discharge limits in key markets could necessitate costly upgrades to treatment facilities. Adapting to these shifting compliance landscapes in 2024 and 2025 may demand significant capital expenditure for product reformulation and process modifications.

These compliance burdens translate directly into increased operational costs. For example, the need for new chemical registrations or updated safety protocols can add millions to annual expenses. Such escalating compliance costs, potentially impacting profitability by a few percentage points in affected segments, could also constrain Ecolab's ability to invest in new growth initiatives or adjust pricing strategies swiftly.

Supply Chain Disruptions

Global supply chain vulnerabilities, amplified by geopolitical instability and climate-related events, present a significant threat to Ecolab's ability to operate smoothly. These disruptions can directly impact the availability of essential raw materials, driving up logistics expenses and causing delays in getting products to customers. For instance, the ongoing geopolitical tensions in Eastern Europe and the lingering effects of the COVID-19 pandemic have continued to strain global shipping networks throughout 2024, impacting delivery times for various industrial components.

Such interruptions can create a ripple effect, leading to missed production schedules and potentially diminishing customer satisfaction. Ecolab's reliance on a complex network of suppliers means that even localized disruptions can have broader consequences on its manufacturing output and ability to meet demand. The company's Q1 2024 earnings report noted that while they managed these challenges, increased freight costs and component lead times did affect certain product lines.

- Increased Logistics Costs: Global shipping rates, while moderating from 2023 peaks, remained elevated in early 2024, with average container spot rates from Asia to Europe still approximately 15% higher than pre-pandemic levels.

- Raw Material Shortages: Specific chemical precursors and specialized packaging materials have experienced intermittent availability issues, forcing some production adjustments.

- Delivery Delays: Lead times for certain key components extended by an average of 10-15% in the first half of 2024 compared to 2023 averages.

Reputational Risks

Ecolab faces reputational risks if incidents occur concerning product effectiveness, environmental impact, or operational safety. For instance, any perceived failure in hygiene solutions or water management could severely damage its brand. Negative press, like reports of accidents within its pest elimination division, directly impacts customer confidence and the established value of its brand.

Maintaining rigorous quality control and safety protocols is therefore paramount for Ecolab to safeguard its reputation. For example, by ensuring compliance with global safety standards and proactively addressing any customer complaints, Ecolab can mitigate the potential for widespread negative publicity. In 2024, the company continued to emphasize its commitment to sustainability and safety in its annual reports, highlighting ongoing investments in training and technology to prevent operational mishaps.

- Product Efficacy Failures: Incidents where cleaning or sanitizing products do not perform as expected can lead to immediate customer dissatisfaction and potential health concerns.

- Environmental Incidents: Spills or improper disposal of chemicals used in Ecolab's operations could result in significant environmental damage and public backlash.

- Operational Safety Lapses: Accidents involving Ecolab employees or customers during service calls, particularly in segments like pest control, can attract negative media attention and erode trust.

Intensified competition from established players and specialized entrants poses a continuous threat, potentially leading to price erosion and reduced market share. For example, the global industrial cleaning market, valued at approximately $80 billion in 2023, is projected to grow at a CAGR of 5-6% through 2028, indicating a dynamic landscape where aggressive pricing is common.

Evolving environmental, health, and safety regulations across its global operations necessitate significant capital expenditure for compliance, potentially impacting profitability. Stricter wastewater discharge limits, for instance, could require costly facility upgrades, while new chemical registrations add to operational expenses.

Global supply chain vulnerabilities, exacerbated by geopolitical instability and climate events, can disrupt raw material availability and increase logistics costs. Elevated shipping rates and intermittent shortages of key components, observed through early 2024, directly impact manufacturing output and delivery timelines.

Reputational risks stemming from product efficacy failures, environmental incidents, or operational safety lapses can severely damage customer confidence and brand value. Proactive measures in quality control and safety protocols are crucial to mitigate potential negative publicity.

SWOT Analysis Data Sources

This Ecolab SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a well-rounded perspective on the company's internal capabilities and external market dynamics.