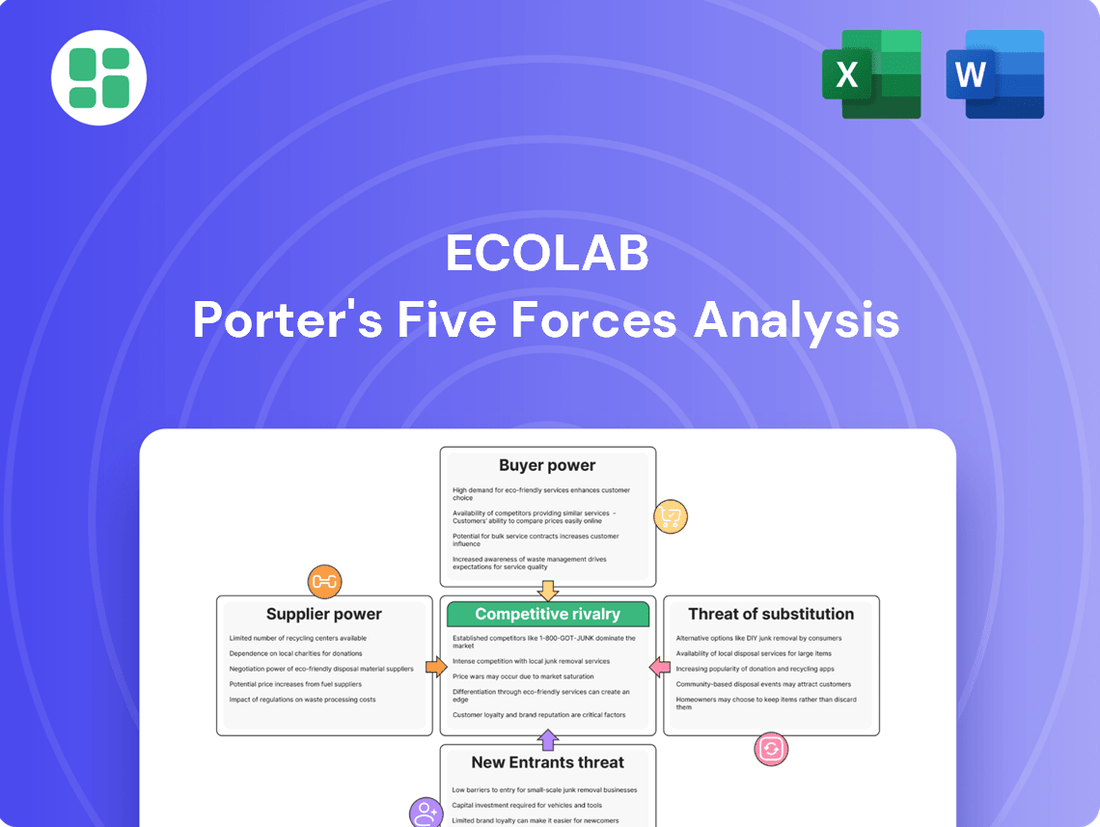

Ecolab Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ecolab Bundle

Ecolab operates in a dynamic market shaped by intense competition and evolving customer needs. Understanding the interplay of buyer power, supplier leverage, and the threat of substitutes is crucial for strategic success in this sector.

The complete report reveals the real forces shaping Ecolab’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ecolab's reliance on essential raw materials means that if a small number of suppliers control the market for these inputs, they gain considerable leverage. This concentration can translate directly into higher costs for Ecolab, potentially squeezing its profit margins.

For instance, in 2024, the global chemical distribution market, a key area for raw material sourcing, is characterized by significant consolidation. Major players in this sector have substantial influence over pricing, which directly impacts companies like Ecolab that depend on consistent and cost-effective supply chains for their extensive product lines.

The availability of substitute inputs significantly curtails supplier bargaining power. For Ecolab, if readily available alternative chemical compounds or raw materials exist, suppliers face less leverage. For instance, in 2024, the global specialty chemicals market, a key area for Ecolab, saw numerous innovations in bio-based and recycled feedstocks, offering potential alternatives to traditional petrochemical inputs.

Supplier switching costs significantly influence Ecolab's bargaining power with its suppliers. If Ecolab faces high costs to change its suppliers, this inherently strengthens the suppliers' position. These costs can be substantial, encompassing the expense of retooling manufacturing lines to accommodate new materials or components, the rigorous process of requalifying alternative materials to meet Ecolab's stringent quality standards, and the administrative and legal complexities of renegotiating intricate supply agreements.

These switching barriers can effectively lock Ecolab into relationships with its current suppliers, even when faced with price increases. For instance, a supplier providing a highly specialized chemical formulation might require extensive testing and validation before Ecolab can safely integrate it into its product lines, a process that can take months and incur significant R&D expenditure. In 2023, for example, the chemical industry saw average lead times for new material qualification extend by up to 15%, a trend that would amplify switching costs for companies like Ecolab.

Forward Integration Threat by Suppliers

Suppliers who can integrate forward into Ecolab's business, meaning they could start offering cleaning and sanitizing solutions themselves, gain significant bargaining power. This potential shift could directly impact Ecolab's market position by turning suppliers into competitors. For example, if a major chemical manufacturer, which supplies Ecolab with essential ingredients, decided to launch its own line of cleaning products, it would reduce the need for Ecolab's specialized formulations.

However, the threat of forward integration for many of Ecolab's suppliers is somewhat mitigated by the specialized nature of Ecolab's offerings. Ecolab's success often stems from its integrated approach, combining chemical products with service, equipment, and data analytics. This complexity makes it challenging for a raw material supplier, even a large one, to replicate Ecolab's comprehensive value proposition without substantial investment in R&D, distribution, and customer service infrastructure.

Consider the chemical industry's landscape. While some large chemical producers have diversified into downstream products, many focus on bulk or specialty chemical manufacturing. For instance, a supplier of surfactants or disinfectants might find it difficult to match Ecolab's expertise in application technology and on-site customer support, which is crucial for industries like food service and healthcare. Ecolab's reported revenue for 2023 was approximately $14.5 billion, highlighting the scale and sophistication of its operations that a typical chemical supplier would need to contend with if pursuing forward integration.

- Forward Integration Threat: Suppliers may enter Ecolab's market, increasing their bargaining power.

- Competitive Landscape: Ecolab's specialized solutions and integrated services present a barrier to entry for many suppliers.

- Supplier Capabilities: The ability of suppliers to replicate Ecolab's comprehensive offerings, including service and data analytics, is key to assessing this threat.

- Market Realities: Many chemical suppliers focus on raw material production, lacking the infrastructure for direct competition in Ecolab's service-oriented segments.

Uniqueness of Supplier Offerings

Suppliers providing highly specialized or proprietary ingredients, especially for Ecolab's advanced water treatment and infection prevention solutions, hold significant bargaining power. Ecolab's commitment to science-based innovations often relies on unique formulations or patented components, granting these suppliers considerable leverage. This dependency underscores the importance of cultivating robust supplier relationships and securing long-term agreements.

For instance, in the specialty chemicals sector, which is crucial for Ecolab's operations, supplier concentration can be a key factor. In 2024, the global water treatment chemicals market was valued at approximately $35 billion, with a notable portion driven by specialized, high-performance additives. Companies that develop and control unique chemical compounds for water purification or antimicrobial efficacy are well-positioned to command premium pricing and favorable terms.

- Proprietary Formulations: Suppliers with exclusive rights to key ingredients for Ecolab's advanced solutions have increased leverage.

- Innovation Dependence: Ecolab's reliance on cutting-edge, science-backed products means dependence on suppliers offering unique, potentially patented, components.

- Supplier Relationship Management: The need to secure these specialized inputs necessitates strong, often long-term, partnerships with key suppliers.

When suppliers control essential raw materials for Ecolab, their market dominance allows them to dictate terms and prices, potentially impacting Ecolab's profitability. This is particularly true in 2024 for specialized chemical inputs, where market consolidation among a few key players grants them significant leverage over pricing and supply availability.

The bargaining power of suppliers is also influenced by the costs Ecolab incurs to switch to alternative sources. If changing suppliers involves substantial expenses for retooling, requalification, or renegotiating contracts, suppliers gain an advantage. For example, the extended lead times for new material qualification observed in the chemical industry, up to 15% longer in 2023, amplify these switching costs for companies like Ecolab.

Suppliers who can potentially integrate forward into Ecolab's business, offering similar solutions, also wield considerable bargaining power. While Ecolab's integrated service and data analytics model presents a barrier to replication for many, a supplier with substantial resources could pose a competitive threat, especially in less specialized segments of the market. Ecolab's 2023 revenue of $14.5 billion underscores the scale of operations that would need to be matched.

| Factor | Impact on Ecolab | 2024/2023 Data/Trend |

|---|---|---|

| Supplier Concentration | Increased leverage, potential price hikes | Consolidation in global chemical distribution market |

| Switching Costs | Supplier lock-in, reduced negotiation flexibility | Up to 15% longer material qualification lead times (2023) |

| Forward Integration Threat | Potential competition, reduced market share | Challenging due to Ecolab's integrated model; $14.5B revenue (2023) |

| Proprietary Inputs | High supplier leverage for specialized chemicals | Specialty chemicals market driven by unique formulations |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Ecolab's position in the cleaning, hygiene, and water management sectors.

Easily identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for targeted strategic adjustments.

Customers Bargaining Power

Ecolab's customer base is incredibly diverse, spanning sectors like hospitality, healthcare, and food service. This breadth generally dilutes individual customer power. However, within specific industries, consolidation does occur. For instance, large hotel chains or major hospital networks represent significant buyers.

These consolidated customers, due to their sheer volume, can wield considerable bargaining power. They are in a position to negotiate for more favorable pricing, enhanced service agreements, and customized solutions. In 2023, Ecolab reported that its largest customers, while representing a smaller percentage of the total, contributed significantly to revenue, highlighting the impact of these key accounts.

Ecolab enjoys a significant advantage due to high customer switching costs, largely stemming from its unique 'razor-and-blade' approach. This model involves providing essential equipment, like water treatment systems or cleaning machinery, which then necessitates the use of Ecolab's proprietary consumables, such as specialized chemicals or cleaning agents. This integration makes it difficult and expensive for customers to simply switch to a competitor.

The reluctance to change is amplified by the substantial investments customers have already made. Replacing installed equipment represents a major capital expenditure. Furthermore, retraining staff to operate new systems and the inherent risk of disrupting critical operations, particularly in hygiene-sensitive environments like hospitals or food processing plants, create a strong disincentive to switch. For instance, a hospital switching its water treatment supplier would face not only equipment costs but also the complex process of revalidating water safety protocols, a process that can take months and incur significant operational costs.

These high switching costs effectively lock in customers, fostering strong loyalty and diminishing their bargaining power. Ecolab's 2023 annual report highlights its recurring revenue model, with a substantial portion coming from consumables, underscoring the sticky nature of its customer relationships. This creates a stable revenue stream and allows Ecolab to maintain its pricing power, as customers weigh the cost of switching against the ongoing benefits of their established relationship and integrated solutions.

Customers' price sensitivity is a significant factor influencing Ecolab's bargaining power of customers. This sensitivity isn't static; it shifts based on the industry and prevailing economic climates. For instance, in sectors where cost is a primary driver or during periods of economic contraction, customers are more inclined to seek out lower prices, thereby amplifying their leverage.

Ecolab actively manages this by focusing on the tangible value its solutions provide. By showcasing how its products and services lead to operational efficiencies and contribute to sustainability goals, Ecolab can justify its pricing. For example, in 2023, Ecolab reported that its sustainability initiatives helped customers save an estimated $1.2 billion in water, energy, and waste costs, directly demonstrating the value proposition beyond just the product price.

Availability of Alternative Solutions for Customers

Customers possess the ability to choose from a spectrum of alternatives, including managing processes internally or opting for competitors' offerings. While Ecolab provides sophisticated, science-backed solutions, clients might consider less complex, more economical options or undertake certain hygiene and water treatment tasks independently. The perceived value and intricacy of Ecolab's solutions diminish the appeal of these alternative paths.

The availability of substitutes directly impacts Ecolab's pricing power. For instance, in the industrial cleaning sector, while Ecolab offers specialized chemical formulations and service packages, a large manufacturing plant might evaluate the cost-benefit of developing its own cleaning protocols or using commodity chemicals, especially if capital expenditure for advanced systems is a constraint. In 2023, the global industrial cleaning market was valued at approximately $75 billion, with a significant portion representing less specialized solutions that customers could potentially adopt.

- Customer Choice: Clients can select between Ecolab's integrated solutions, competitor products, or in-house management of hygiene and water treatment.

- Cost-Benefit Analysis: The decision to switch often hinges on whether simpler, lower-cost alternatives or self-management offer comparable value to Ecolab's advanced offerings.

- Ecolab's Value Proposition: The perceived complexity and comprehensive nature of Ecolab's science-based solutions act as a deterrent to customers readily switching to less sophisticated alternatives.

- Market Dynamics: The presence of numerous suppliers and the potential for in-house capabilities increase customer bargaining power, particularly for less critical or commoditized aspects of service.

Customer Information and Transparency

Customers today have unprecedented access to information, significantly boosting their bargaining power. Data on competitor pricing, product performance, and service quality is readily available, allowing buyers to make more informed comparisons. For instance, in 2024, a significant percentage of B2B buyers reported using online research to evaluate suppliers before making a purchase decision, a trend that continues to grow.

This transparency, fueled by online reviews, industry benchmarks, and readily accessible data, enables customers to more effectively negotiate terms and pricing. They can easily identify alternatives and understand market value, putting pressure on suppliers to offer competitive solutions. This heightened awareness means customers are less likely to accept standard offerings without seeking better deals.

- Increased Information Access: Over 80% of B2B buyers in 2024 utilized digital channels for research, comparing product features and pricing across multiple vendors.

- Empowered Negotiation: Customers can leverage data from platforms like G2 or Capterra to benchmark Ecolab's offerings against competitors, seeking better value.

- Ecolab's Counter: Ecolab leverages its proprietary data analytics and deep technical expertise, often gained through extensive on-site service, to demonstrate unique value that transcends simple price comparisons.

- Focus on Total Cost of Ownership: By highlighting long-term savings through efficiency and reduced risk, Ecolab aims to shift the negotiation focus from initial price to overall value proposition.

Ecolab's diverse customer base generally limits individual customer power, but large, consolidated clients like major hotel chains can negotiate favorable terms due to their significant purchasing volume. In 2023, while representing a smaller portion of the total customer count, these key accounts contributed substantially to Ecolab's revenue, underscoring their influence.

High switching costs, driven by Ecolab's integrated equipment and consumable model, significantly reduce customer bargaining power. The substantial investment in existing systems and the operational risks associated with retraining staff and revalidating protocols further deter customers from switching. Ecolab's 2023 report noted the stickiness of its recurring revenue from consumables, reflecting these entrenched customer relationships.

Customers' price sensitivity varies by industry and economic conditions, increasing their leverage during downturns. Ecolab counters this by emphasizing the tangible value of its solutions, citing that in 2023, its sustainability initiatives helped customers save an estimated $1.2 billion in operational costs, demonstrating a value proposition beyond mere price.

While substitute solutions exist, including in-house management or less sophisticated alternatives, the perceived complexity and comprehensive nature of Ecolab's science-based offerings often diminish their appeal. The global industrial cleaning market, valued around $75 billion in 2023, includes many less specialized options that customers might consider, though Ecolab aims to differentiate through its total value proposition.

What You See Is What You Get

Ecolab Porter's Five Forces Analysis

This preview showcases the comprehensive Ecolab Porter's Five Forces Analysis that you will receive immediately after purchase. You're looking at the actual, professionally written document, ensuring no surprises or placeholders. Once your transaction is complete, you'll gain instant access to this exact, ready-to-use file, providing valuable strategic insights into Ecolab's competitive landscape.

Rivalry Among Competitors

The water, hygiene, and infection prevention sector is quite fragmented. This means there are many companies, both large global ones and smaller regional or local businesses, all competing. Ecolab is a major player, but it still faces intense competition from these numerous rivals across its various product and service areas.

This widespread presence of competitors directly contributes to a high level of rivalry within the industry. For instance, in the industrial water treatment segment, companies like Veolia and Suez are significant competitors, alongside many specialized regional providers. This competitive landscape means companies must constantly innovate and offer competitive pricing to maintain their market position.

The global market for water, hygiene, and infection prevention solutions, which Ecolab operates within, is experiencing robust growth. For instance, the global industrial water treatment market was projected to reach approximately $73.2 billion in 2024. However, growth rates can differ significantly across various segments and geographic regions. Mature markets, while stable, often see slower expansion, leading to intensified competition among established players vying for market share.

This dynamic places pressure on companies to innovate and differentiate. Ecolab is strategically addressing this by prioritizing investment in and expansion into high-growth sectors. Key areas of focus include the burgeoning data center industry, which requires specialized water management and cleaning solutions, and the life sciences sector, demanding stringent hygiene and infection control protocols. These segments offer greater potential for organic growth and market penetration.

Ecolab carves out its competitive edge through a strategic blend of science-backed solutions, actionable data insights, and exceptional customer service. This focus on delivering value beyond the product itself makes it harder for rivals to directly compete on price alone.

The company consistently channels resources into innovation, exemplified by its development of AI-driven tools and a growing portfolio of environmentally friendly products. For instance, Ecolab's investments in R&D are substantial, contributing to its ability to offer unique, high-value solutions that set it apart in the market.

Switching Costs for Customers

Ecolab benefits from substantial customer switching costs, particularly for its installed base of equipment and proprietary consumables. This integration makes it challenging and expensive for customers to transition to a competitor's offerings, fostering customer loyalty.

These high switching costs act as a significant barrier to entry and reduce the direct competitive pressure Ecolab faces. For instance, a hospitality client deeply embedded with Ecolab's dishwashing and sanitation systems, including specialized detergents and dispensing equipment, would face considerable disruption and investment to retool and retrain staff for a different vendor.

- High Integration: Ecolab's solutions often involve specialized equipment that is calibrated for their proprietary chemical formulations.

- Operational Disruption: Switching requires new equipment installation, staff retraining, and potential adjustments to operational workflows.

- Cost of Change: The combined expense of new capital equipment, product trials, and potential downtime can be prohibitive for many businesses.

Competitor Diversity and Strategies

Ecolab operates in a highly competitive landscape, facing rivals ranging from giant, diversified chemical manufacturers like Dow Inc. and PPG Industries, which leverage broad portfolios and economies of scale, to specialized water treatment and hygiene companies such as Xylem Inc. and Veolia Environnement. These competitors often pursue distinct strategies; some focus on price leadership, others on technological innovation, and many on building strong customer relationships within specific niches. For instance, in 2024, Dow continued to emphasize its materials science expertise, while Xylem focused on digital water solutions and operational efficiency.

The strategic diversity among competitors means that competitive pressures can vary significantly depending on the specific market segment Ecolab is targeting. A large chemical company might compete on broad product offerings and supply chain integration, whereas a specialized water treatment firm might win business through advanced technology and tailored service agreements. This multifaceted competitive environment necessitates that Ecolab constantly adapts its strategies to address the unique strengths and approaches of each rival.

- Dow Inc.: Broad chemical portfolio, strong R&D.

- PPG Industries: Focus on coatings and specialty materials.

- Xylem Inc.: Specialization in water technology and digital solutions.

- Veolia Environnement: Integrated water, waste, and energy management services.

Competitive rivalry within Ecolab's operating sectors is intense due to a fragmented market with numerous global and regional players. This dynamic forces companies to continuously innovate and offer competitive pricing to secure market share, especially in mature segments where growth is slower. For example, the industrial water treatment market, a key area for Ecolab, was projected to reach $73.2 billion in 2024, highlighting the significant revenue at stake and the fierce competition for it.

Ecolab differentiates itself through science-backed solutions, data insights, and superior customer service, making direct price competition more challenging for rivals. Significant investment in R&D, including AI-driven tools and eco-friendly products, further solidifies its competitive edge. High customer switching costs, stemming from integrated equipment and proprietary consumables, also act as a considerable barrier, fostering customer loyalty and reducing direct competitive pressure.

Major competitors like Dow Inc., PPG Industries, Xylem Inc., and Veolia Environnement employ diverse strategies, from broad portfolios and economies of scale to specialized technological solutions and integrated service offerings. This varied competitive landscape necessitates constant strategic adaptation by Ecolab to counter the unique strengths of each rival. For instance, in 2024, Dow emphasized materials science, while Xylem pushed digital water solutions.

| Competitor | Key Focus Areas | 2024 Market Emphasis Example |

| Dow Inc. | Broad chemical portfolio, strong R&D | Materials science expertise |

| PPG Industries | Coatings and specialty materials | Innovation in protective coatings |

| Xylem Inc. | Water technology, digital solutions | Operational efficiency through digital water |

| Veolia Environnement | Integrated water, waste, energy management | Sustainable resource management |

SSubstitutes Threaten

For some customers, especially smaller businesses or individual consumers, readily available DIY solutions and basic cleaning products can act as substitutes for Ecolab's more specialized offerings. These alternatives might include common household cleaners or simple in-house sanitation procedures.

However, these substitutes generally fall short in terms of performance and reliability compared to Ecolab's scientifically formulated products. For instance, while a restaurant might use off-the-shelf sanitizers, Ecolab's systems offer validated efficacy and traceability crucial for regulatory compliance, a benefit often absent in basic alternatives.

In 2024, the market for basic cleaning supplies remained robust, with many small businesses prioritizing cost savings. Yet, Ecolab's focus on integrated solutions, including training and advanced dispensing systems, continues to differentiate them, particularly for clients where hygiene standards and operational efficiency are paramount.

The threat of substitutes for general purpose chemical suppliers looms for Ecolab, particularly for clients with simpler cleaning and sanitizing requirements. These alternatives, often generic or less specialized, can present a lower initial cost. For instance, many smaller regional distributors offer basic cleaning agents that might appeal to businesses prioritizing immediate budget savings over specialized performance or integrated service packages.

The threat of substitutes in Ecolab's water treatment segment is moderate. Alternative technologies like advanced filtration, UV disinfection, and even water conservation strategies can reduce reliance on traditional chemical treatments. For instance, the global advanced water treatment market was valued at approximately $25 billion in 2023 and is projected to grow, indicating a growing availability of these substitutes.

Behavioral Changes and Manual Processes

While behavioral changes like increased handwashing might seem like a substitute for advanced cleaning chemicals, their effectiveness in commercial and industrial settings is limited. For instance, the Centers for Disease Control and Prevention (CDC) emphasizes that while handwashing is crucial, it's not always sufficient for eliminating all pathogens in environments with high contamination risks.

The scale and consistency demanded by industries, from food processing to healthcare, render manual processes largely inefficient compared to Ecolab's specialized solutions. In 2024, the global industrial cleaning market was valued at approximately $55 billion, with a significant portion driven by the need for efficacy and speed that manual methods cannot match.

- Limited Efficacy: Manual cleaning and basic hygiene practices often lack the germicidal potency of specialized chemical formulations.

- Scalability Issues: Industrial and commercial operations require consistent, widespread sanitation that manual efforts struggle to achieve.

- Cost Inefficiency: While seemingly cheaper upfront, the labor intensity and lower effectiveness of manual methods increase overall operational costs.

- Regulatory Compliance: Many sectors have stringent regulations requiring validated cleaning and sanitization processes, which manual methods may not satisfy.

Emerging Technologies and Sustainable Alternatives

The threat of substitutes for Ecolab's offerings is amplified by rapid technological advancements. Innovations in areas like advanced biological treatments or entirely chemical-free cleaning processes could offer compelling alternatives to traditional chemical-based solutions. For instance, by 2024, the global market for green cleaning products, a direct substitute category, was projected to reach significant growth, indicating a rising consumer and business preference for eco-friendly options.

Ecolab is proactively addressing this by heavily investing in research and development. A key focus is the creation of sustainable and innovative solutions that preemptively counter disruptive substitutes. This includes the development of products like PFAS-free repellents, a direct response to growing concerns and regulations surrounding certain chemical compounds, ensuring they remain competitive in an evolving market landscape.

Key areas where substitutes pose a threat include:

- Biological Cleaning Agents: These can offer effective cleaning without harsh chemicals, potentially reducing reliance on Ecolab's traditional product lines.

- Water-Based Cleaning Technologies: Advancements in high-pressure water or steam cleaning could displace chemical-dependent methods in certain industrial applications.

- UV-C and Ozone Sterilization: These technologies offer non-chemical disinfection methods that could substitute for chemical sanitizers in various settings.

- DIY and Natural Cleaning Solutions: While often less potent for industrial use, a growing trend towards natural alternatives in smaller-scale applications presents a low-end substitute threat.

While basic cleaning supplies and DIY solutions offer a low-cost alternative for some, they often lack the efficacy, reliability, and regulatory compliance of Ecolab's specialized products, especially in demanding commercial and industrial settings. The global industrial cleaning market, valued at approximately $55 billion in 2024, highlights the need for solutions that surpass manual methods in speed and effectiveness.

The threat of substitutes is moderate in water treatment, with technologies like advanced filtration and UV disinfection gaining traction, as evidenced by the global advanced water treatment market's projected growth from its 2023 valuation of around $25 billion. Furthermore, advancements in biological cleaning agents and chemical-free sterilization methods like UV-C and ozone are emerging as viable alternatives across various sectors.

Ecolab counters these threats by investing in R&D for sustainable solutions, such as PFAS-free repellents, to meet evolving market demands and regulatory pressures, ensuring continued relevance against disruptive innovations.

Entrants Threaten

Entering the water, hygiene, and infection prevention solutions market, particularly on a global scale similar to Ecolab's operations, demands significant capital. This investment is crucial for research and development, establishing state-of-the-art manufacturing facilities, building extensive distribution networks, and creating a robust service infrastructure. These high upfront costs act as a considerable deterrent for new companies looking to enter the industry.

Ecolab's deeply ingrained brand reputation, cultivated over a century of consistent, high-quality service and innovation, acts as a formidable barrier. This established trust makes potential customers hesitant to switch to unproven alternatives.

The company's success in forging enduring customer relationships, often cemented by multi-year contracts and a strategic 'razor-and-blade' business model, fosters significant customer loyalty. This entrenched loyalty makes it exceptionally challenging for new entrants to penetrate Ecolab's market share, as demonstrated by their consistent revenue growth, which reached $14.6 billion in 2023.

Ecolab's robust portfolio of science-based solutions, backed by numerous patents and proprietary formulations, presents a significant hurdle for potential new entrants. Developing comparable technologies requires substantial R&D investment, making it a costly and lengthy process for newcomers to match Ecolab's efficacy.

Regulatory Hurdles and Compliance Expertise

The highly regulated nature of Ecolab's core markets, including healthcare, food service, and industrial sectors, presents a substantial barrier to new entrants. These industries demand rigorous adherence to safety, health, and environmental standards, often varying by region and application.

New companies must invest heavily in understanding and complying with these complex regulatory frameworks, a process that requires specialized knowledge and significant resources. For instance, in the food safety sector, compliance with Food and Drug Administration (FDA) regulations in the US or equivalent bodies globally is non-negotiable.

- Significant Capital Investment: New entrants need substantial capital to establish operations that meet stringent regulatory requirements, including product testing, validation, and quality control systems.

- Expertise in Compliance: Navigating diverse and evolving regulations requires dedicated compliance teams and ongoing training, a cost that can be prohibitive for startups.

- Industry-Specific Certifications: Obtaining necessary certifications, such as NSF International or EPA registrations, can be a lengthy and costly process, delaying market entry.

- Reputational Risk: Non-compliance can lead to severe penalties, product recalls, and irreparable damage to a new company's reputation, making a cautious and expert-driven approach essential.

Extensive Distribution and Service Network

Ecolab's formidable global sales and service infrastructure, spanning over 170 countries, acts as a significant barrier to new entrants. This vast network, comprising thousands of trained professionals, ensures efficient product deployment and critical ongoing technical support. In 2023, Ecolab's extensive reach allowed it to serve over three million customer locations worldwide, underscoring the difficulty for newcomers to match this level of operational depth and customer intimacy.

The ability to provide seamless product delivery, expert installation, and responsive technical assistance is paramount in Ecolab's sector. New competitors would face immense capital expenditure and time investment to build a comparable service capability. For instance, Ecolab's investment in its field force and logistics in 2024 continues to solidify this advantage, making it challenging for nascent players to compete on service quality and reliability.

- Global Reach: Operates in over 170 countries.

- Service Network: Extensive sales and service team for installation and support.

- Customer Base: Serves over 3 million customer locations globally (as of 2023).

- Investment: Continued investment in field force and logistics in 2024.

The threat of new entrants in Ecolab's market is generally low due to substantial capital requirements for R&D, manufacturing, and distribution, along with significant regulatory hurdles. Ecolab's established brand loyalty, built over a century, and its extensive global service network further deter new players. For example, Ecolab's 2023 revenue of $14.6 billion and its service to over 3 million customer locations worldwide highlight the scale of investment and operational complexity required to compete effectively.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for R&D, manufacturing, and distribution networks. | Significant financial barrier, requiring substantial upfront funding. |

| Brand Reputation & Loyalty | Over 100 years of consistent service and innovation. | Customers are hesitant to switch to unproven alternatives. |

| Regulatory Compliance | Strict safety, health, and environmental standards across various industries. | Requires specialized knowledge, resources, and lengthy certification processes. |

| Global Service Infrastructure | Extensive sales and service network in over 170 countries. | Difficult and costly for newcomers to replicate the scale and responsiveness. |

Porter's Five Forces Analysis Data Sources

Our Ecolab Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry-specific market research from firms like IBISWorld, and publicly available financial filings.