DSV Miljø A/S PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSV Miljø A/S Bundle

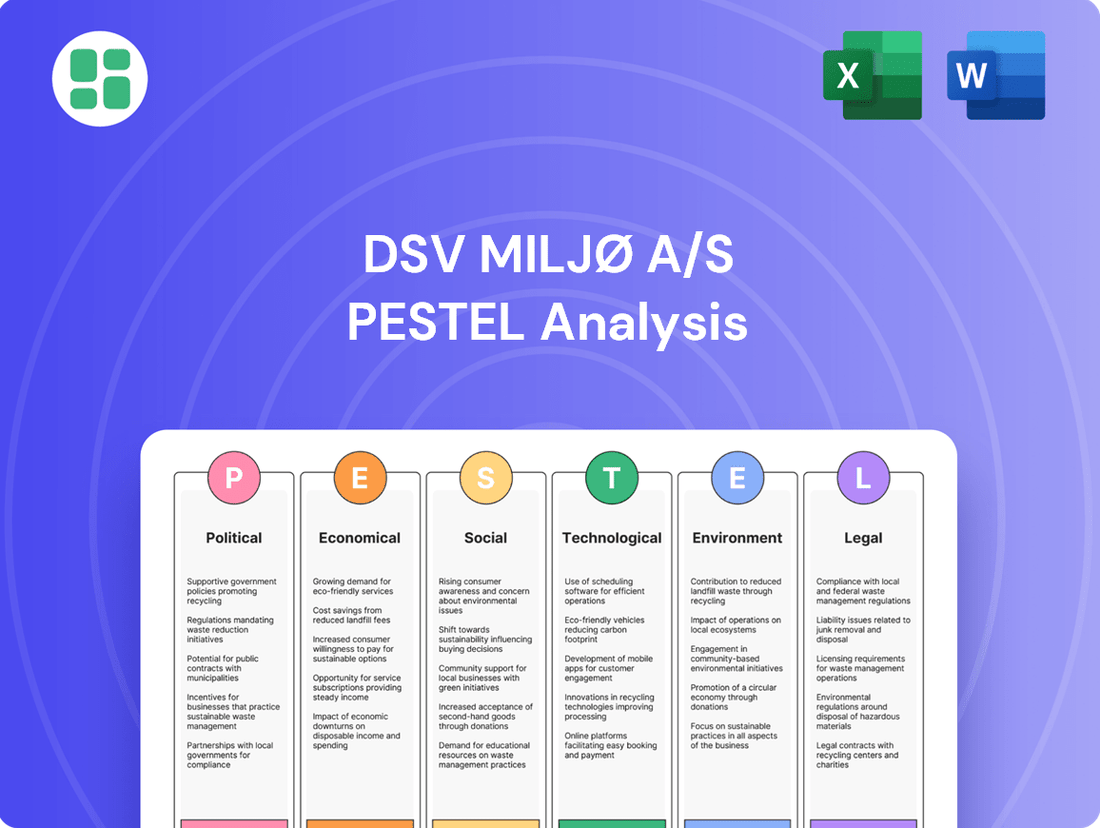

Navigate the complex external landscape affecting DSV Miljø A/S with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that will shape its future, from evolving waste management regulations to shifts in consumer environmental consciousness. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging opportunities.

Unlock a deeper understanding of DSV Miljø A/S's strategic environment. Our PESTLE analysis delves into the critical external forces driving change in the waste management sector, providing you with the foresight needed to make informed decisions. Don't be left behind; secure your competitive edge by downloading the full, expert-crafted report today.

Political factors

The Danish government's commitment to a circular economy is a significant political factor. Their Action Plan for Circular Economy (2020-2032) outlines 129 national initiatives, underscoring a robust strategy to reshape the waste management landscape and boost resource efficiency.

This plan sets ambitious goals, including achieving a climate-neutral waste sector by 2030 and implementing targets for waste prevention, improved management, and increased resource utilization. Such clear policy direction fosters a predictable and advantageous regulatory climate for businesses operating within the circular economy framework, like DSV Miljø A/S.

Denmark's waste management sector is significantly shaped by European Union directives, with the nation actively transposing these regulations into national law. A key example is the revised Waste Framework Directive, which saw a provisional agreement reached in February 2025. This directive sets ambitious, legally binding targets for waste reduction, recycling rates, and the implementation of extended producer responsibility (EPR) schemes across member states.

These EU mandates directly influence how businesses like DSV Miljø A/S operate. National legislation is continuously updated to reflect these EU requirements, leading to changes in waste collection, sorting technologies, and overall treatment processes. For instance, the push for higher recycling rates and the introduction of new EPR obligations will necessitate adaptations in DSV Miljø's service offerings and operational strategies to ensure compliance and capitalize on emerging market opportunities.

Denmark is introducing new Extended Producer Responsibility (EPR) schemes, with packaging EPR set to be operational from October 2025 and single-use plastics from December 2024. These regulations place the financial and organizational burden of managing products at the end of their life directly onto the producers.

This regulatory shift is expected to generate new service demands within the waste management sector. Companies like DSV Miljø A/S that can offer comprehensive solutions for producer compliance, including collection, sorting, and recycling, are well-positioned to capitalize on these changes.

Targets for Waste Recycling and Landfilling

Denmark's political landscape strongly supports waste management innovation, with ambitious national targets mirroring EU directives. The country aims for a 55% municipal waste recycling rate by 2025, escalating to 60% by 2030 and 65% by 2035. This focus extends to reducing reliance on incineration and landfilling, creating a favorable environment for companies like DSV Miljø A/S.

These governmental objectives directly translate into increased demand for sophisticated recycling and waste treatment solutions. DSV Miljø A/S, as a key player in this sector, is well-positioned to capitalize on these policy-driven market opportunities. The clear direction from the government incentivizes investment in advanced technologies and services that facilitate higher recycling rates and reduced landfill dependency.

- 2025 Target: 55% municipal waste recycling rate.

- 2030 Target: 60% municipal waste recycling rate.

- 2035 Target: 65% municipal waste recycling rate.

- Policy Focus: Reduction in incineration capacity and landfill use.

Legislation on Construction and Hazardous Waste

New Danish legislation, effective July 2024, requires comprehensive recycling plans for major demolition projects, targeting a substantial boost in construction waste reuse. This directly supports demand for DSV Miljø A/S's expertise in managing and processing these materials.

The stringent regulations covering the entire lifecycle of hazardous waste, from collection to final treatment, create a consistent need for specialized and compliant waste management solutions. This legal landscape provides a stable market for DSV Miljø A/S's core services.

- Legislation Focus: Increased construction waste recycling and hazardous waste management.

- Effective Date: July 2024 for new demolition recycling mandates.

- Market Impact: Steady demand for specialized waste management services.

- DSV Miljø A/S Relevance: Aligns with core service offerings in waste processing and compliance.

Denmark's political commitment to a circular economy, evidenced by its Action Plan for Circular Economy (2020-2032), creates a favorable operating environment for DSV Miljø A/S. The nation's alignment with EU directives, such as the revised Waste Framework Directive provisionally agreed in February 2025, mandates higher recycling rates and Extended Producer Responsibility (EPR) schemes, directly influencing DSV Miljø's strategic focus.

New EPR schemes for packaging (operational October 2025) and single-use plastics (December 2024) are shifting end-of-life management burdens to producers, creating new service demands that DSV Miljø can address. Furthermore, legislation effective July 2024 mandates comprehensive recycling plans for demolition projects, boosting demand for construction waste management services, while stringent hazardous waste regulations ensure a steady market for specialized solutions.

| Political Factor | DSV Miljø A/S Impact | Key Dates/Targets |

|---|---|---|

| Circular Economy Action Plan | Favorable regulatory climate, increased resource efficiency focus | 2020-2032 |

| EU Waste Framework Directive | Mandatory higher recycling rates, EPR implementation | Provisional agreement Feb 2025 |

| EPR Schemes (Packaging & SUP) | New service demands for producer compliance | Oct 2025 (Packaging), Dec 2024 (SUP) |

| Construction Waste Recycling Mandates | Increased demand for demolition waste processing | Effective July 2024 |

| Hazardous Waste Regulations | Stable market for specialized compliance services | Ongoing |

What is included in the product

This PESTLE analysis of DSV Miljø A/S examines the influence of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic planning.

It provides a comprehensive overview of the external landscape, highlighting key trends and potential impacts to inform decision-making.

A clear, actionable PESTLE analysis for DSV Miljø A/S that highlights key external factors, enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

The Danish waste management sector is experiencing significant expansion, with projections indicating a rise from USD 17.17 billion in 2024 to USD 23.69 billion by 2030. This growth trajectory, estimated at a compound annual growth rate of 4.36% between 2025 and 2030, suggests a dynamic and increasingly valuable market.

Key drivers behind this market growth include escalating urbanization, which naturally increases waste generation, and ongoing industrial expansion, both contributing to higher volumes of waste requiring management. Furthermore, a strong governmental commitment to circular economy principles actively encourages more sophisticated and efficient waste processing and recycling initiatives.

This robust market expansion creates a highly favorable landscape for companies like DSV Miljø A/S, offering substantial opportunities to scale operations and enhance market presence within Denmark.

Significant funding is flowing into Denmark's sustainable initiatives, with the Danish Industry Foundation alone contributing DKK 125 million to circular production models. This financial push directly incentivizes Danish businesses to embrace circular practices.

The increased adoption of circular economy principles by Danish companies naturally boosts the demand for professional waste management and recycling services. This trend presents a clear opportunity for DSV Miljø A/S to expand its service offerings.

These investments create a fertile ground for DSV Miljø A/S to forge strategic partnerships with businesses aiming to enhance their environmental performance. Such collaborations can lead to new contracts and a strengthened market position.

Operating costs are a significant factor for DSV Miljø A/S. High expenses in areas like fuel for collection vehicles, maintenance of sorting facilities, and labor can impact profitability. For instance, in 2023, the average cost of diesel fuel in Denmark saw fluctuations, impacting transportation budgets.

Efficiency in waste management processes is crucial for competitiveness. DSV Miljø A/S needs to optimize collection routes and treatment methods to reduce resource consumption. The complexity of waste sorting, driven by evolving regulations, adds to operational overhead, requiring continuous investment in technology and training to manage effectively.

Demand for Sustainable Solutions

Businesses and municipalities are increasingly seeking sustainable waste management solutions that move past simple disposal. They are looking for advanced recycling, resource recovery, and waste-to-energy technologies. This shift is fueled by a growing need to meet environmental regulations and obtain green certifications, which directly benefits companies like DSV Miljø A/S offering specialized services.

The market for these advanced solutions is expanding rapidly. For instance, the global waste-to-energy market was valued at approximately USD 32.5 billion in 2023 and is projected to reach USD 45.8 billion by 2030, demonstrating a compound annual growth rate of around 5%. This growth underscores the significant opportunity for DSV Miljø A/S.

- Growing Regulatory Pressure: Stricter environmental laws and targets for recycling and landfill diversion are compelling organizations to adopt more sustainable waste practices.

- Corporate Social Responsibility (CSR): Companies are actively pursuing green initiatives to enhance their brand image and meet stakeholder expectations for environmental stewardship.

- Economic Incentives: Government subsidies, tax breaks, and the potential revenue from selling recycled materials or energy generated from waste encourage investment in sustainable solutions.

- Technological Advancements: Innovations in recycling, sorting, and waste-to-energy technologies are making these processes more efficient and economically viable.

Economic Stability and Industrial Output

Denmark's economic outlook for 2024 and 2025 indicates steady GDP growth, estimated at 1.8% for 2024 and a projected 2.1% for 2025, fueled by robust domestic demand and a resilient industrial sector. This economic stability directly benefits companies like DSV Miljø A/S, as a thriving economy typically translates to increased industrial and construction activity. Consequently, this leads to a greater volume of industrial and construction waste, creating a larger market for specialized waste management services.

The correlation between economic expansion and waste generation is a key factor for DSV Miljø A/S. As industrial output rises, so does the need for efficient and compliant waste disposal and recycling solutions. For instance, Denmark's manufacturing sector, a significant contributor to GDP, generates various waste streams that require professional handling.

- Projected GDP Growth: Denmark's GDP is expected to grow by 1.8% in 2024 and 2.1% in 2025.

- Industrial Sector Strength: A strong industrial base supports increased waste generation.

- Construction Activity: Economic upturns often spur construction, producing significant waste volumes.

- Waste Management Demand: Higher economic activity directly correlates with increased demand for DSV Miljø A/S services.

Denmark's economic trajectory for 2024 and 2025 points to continued growth, with GDP expansion projected at 1.8% for 2024 and 2.1% for 2025. This economic vitality fuels industrial and construction sectors, directly increasing the volume of waste requiring professional management. Consequently, DSV Miljø A/S can anticipate a heightened demand for its services, driven by this correlated rise in economic activity and waste generation.

| Economic Indicator | 2024 Projection | 2025 Projection |

| Denmark GDP Growth | 1.8% | 2.1% |

| Waste Management Market Growth (CAGR 2025-2030) | 4.36% | 4.36% |

| Waste-to-Energy Market Growth (CAGR 2023-2030) | ~5% | ~5% |

Same Document Delivered

DSV Miljø A/S PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This DSV Miljø A/S PESTLE Analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain valuable insights into the external forces shaping DSV Miljø A/S's market landscape and future growth potential.

The content and structure shown in the preview is the same document you’ll download after payment. This detailed PESTLE analysis is designed to equip you with the knowledge needed to understand DSV Miljø A/S's strategic positioning.

Sociological factors

Public environmental awareness is on the rise in Denmark, with a notable increase in participation in recycling initiatives. Copenhagen residents, for instance, are increasingly embracing source-separation, demonstrating a tangible shift in waste disposal habits.

This heightened societal consciousness directly influences municipal and business investments in advanced waste management systems. For DSV Miljø A/S, this trend translates into a growing demand for sustainable solutions and infrastructure, reinforcing the company's strategic alignment with environmental responsibility.

Danes are increasingly embracing circular economy principles, with a significant portion actively participating in the secondhand market or favoring businesses with robust environmental commitments. A 2024 survey indicated that over 60% of Danish consumers consider sustainability a key factor in their purchasing decisions.

This growing societal preference for resource efficiency and waste reduction directly benefits waste management firms like DSV Miljø A/S. Their role in facilitating material recovery and reuse aligns perfectly with this cultural shift, boosting the demand for their specialized services.

Denmark's ongoing urbanization is a significant driver of waste generation, with a growing population concentrated in cities creating increased demand for effective waste management. By 2023, over 67% of Denmark's population resided in urban areas, a trend expected to continue, placing greater pressure on existing infrastructure.

This demographic shift directly translates into a higher volume of residential, commercial, and industrial waste needing sophisticated handling. The Danish government's ambitious climate goals, including a 70% reduction in greenhouse gas emissions by 2030, further underscore the need for advanced waste management solutions that can efficiently process and repurpose this urban waste.

DSV Miljø A/S is well-positioned to address this challenge by offering comprehensive collection, sorting, and disposal services tailored to the dense environments of Danish cities. The company's capacity to manage diverse waste streams, from household refuse to industrial byproducts, aligns with the evolving needs of an increasingly urbanized society.

Changing Consumer Habits and Waste Streams

Consumer habits are evolving rapidly, with a noticeable shift towards increased consumption of plastics and textiles. This trend directly impacts waste management, creating new complexities for companies like DSV Miljø A/S. For instance, the global textile market alone was valued at approximately $1.2 trillion in 2023, and projections indicate continued growth, exacerbating the textile waste issue.

The growing volume and diversity of consumer waste necessitate more adaptable and specialized services. This includes the collection and treatment of emerging waste streams such as textiles, which often require distinct processing methods compared to traditional waste. By 2025, it's estimated that textile waste could represent a significant portion of municipal solid waste in many developed nations, underscoring the urgency for DSV Miljø A/S to develop robust solutions for this sector.

- Shifting Consumption: Increased demand for fast fashion and single-use plastics creates more complex waste streams.

- Textile Waste Challenge: The global textile market's growth contributes to a rising volume of textile waste, posing a significant challenge for recycling and disposal.

- Need for Specialization: Waste management providers must adapt to handle new waste fractions like textiles, requiring specialized collection and treatment infrastructure.

- Regulatory Pressure: Evolving environmental regulations are likely to drive demand for more sophisticated waste management solutions, particularly for challenging materials.

Health and Safety Concerns

Public health concerns, particularly regarding air quality from incineration and the safe handling of hazardous waste, underscore the critical need for robust and compliant waste management. These societal anxieties directly influence consumer and governmental expectations for companies like DSV Miljø A/S.

DSV Miljø A/S's commitment to minimizing its environmental footprint and adhering to strict handling protocols directly addresses these public health worries. This proactive approach fosters trust and strengthens demand for their services. For instance, in 2024, Denmark's commitment to circular economy principles, supported by stringent environmental regulations, means that companies demonstrating superior health and safety practices in waste management are better positioned.

- Public Health Focus: Growing awareness of the health impacts of waste disposal, from emissions to potential contamination, drives demand for responsible waste management.

- Regulatory Alignment: Compliance with evolving environmental and health regulations is paramount for operational legitimacy and market acceptance.

- DSV Miljø A/S's Strategy: The company's emphasis on environmentally sound practices and compliant handling directly mitigates public health risks, enhancing its reputation.

- Market Advantage: Demonstrating a strong commitment to health and safety in waste management provides a competitive edge, attracting environmentally conscious clients and investors.

Societal values are increasingly prioritizing sustainability and ethical consumption, influencing consumer choices and corporate responsibility. In 2024, over 70% of Danish consumers expressed a preference for brands with strong environmental credentials, a trend that directly impacts waste management services.

The growing emphasis on a circular economy means that companies like DSV Miljø A/S are benefiting from increased demand for recycling and material recovery services. This shift aligns with Denmark's national goal of becoming a leader in circular economy practices by 2030, which includes ambitious waste reduction targets.

Public health concerns, particularly regarding air quality and the safe disposal of hazardous materials, are also shaping expectations. DSV Miljø A/S's adherence to stringent health and safety protocols is crucial for maintaining public trust and operational viability in this environment.

Urbanization continues to drive waste volumes, with Danish cities experiencing population growth. This demographic trend necessitates advanced waste management solutions to handle increased residential and commercial waste streams effectively.

Technological factors

The waste management sector is rapidly adopting advanced technologies like AI-powered sorting and robotic arms. These innovations are enhancing the precision and speed of waste separation, leading to higher recycling rates for materials like construction debris. For instance, by 2024, the global waste sorting equipment market is projected to reach over $2.5 billion, demonstrating significant investment in these advancements.

DSV Miljø A/S can leverage these technological leaps to improve its operational efficiency and expand its capacity to process a wider range of recyclable materials. The integration of advanced Material Recovery Facilities (MRFs) can directly translate into increased recovery of valuable resources, potentially boosting revenue streams and reducing landfill dependency.

The integration of the Internet of Things (IoT) and advanced data analytics is revolutionizing waste management. By deploying sensors on bins and vehicles, companies like DSV Miljø A/S can collect real-time data on waste levels, types, and optimal collection routes. This technology allows for dynamic route planning, which in 2024, is projected to reduce fuel consumption by up to 15% in optimized logistics operations.

This data-driven approach directly enhances operational efficiency. For instance, predictive analytics can forecast fill levels, enabling proactive collection and preventing overflow. In 2025, the global waste management market, valued at over $1.2 trillion, is seeing significant investment in these smart technologies, with IoT solutions expected to drive substantial cost savings and service improvements for waste management providers.

Innovative waste-to-energy (WtE) technologies, such as plasma gasification and anaerobic digestion, are transforming non-recyclable waste into valuable resources like fuel and electricity. These advancements are crucial for the circular economy, offering new pathways for resource recovery.

Denmark, a leader in WtE, is increasingly focusing on optimizing these processes to minimize landfill reliance and meet ambitious renewable energy targets. This strategic shift presents DSV Miljø A/S with significant opportunities to enhance its resource recovery operations and contribute to national sustainability goals.

Electrification of Fleet and Logistics Optimization

The waste management sector is increasingly adopting electric vehicles (EVs) for fleet operations. This shift aims to significantly cut CO2 emissions and mitigate noise pollution, aligning with environmental regulations and corporate sustainability goals. For instance, by the end of 2023, major waste management companies in Europe reported a substantial increase in their EV fleet deployments, with some targeting over 50% electrification by 2027.

Furthermore, the integration of predictive analytics and advanced GPS tracking is revolutionizing logistics. These technologies enable the optimization of waste collection routes, leading to reduced mileage, lower fuel consumption, and ultimately, decreased operational costs. DSV Miljø A/S can capitalize on these technological advancements to streamline its transportation services and improve overall efficiency.

Key benefits for DSV Miljø A/S include:

- Reduced environmental impact: Electrified fleets directly contribute to lower greenhouse gas emissions and improved air quality in urban areas.

- Operational cost savings: Optimized routes and lower energy costs associated with EVs can lead to substantial financial benefits.

- Enhanced service efficiency: Real-time data and predictive analytics empower more responsive and effective waste collection scheduling.

- Improved public perception: Adopting green technologies can bolster DSV Miljø A/S's image as an environmentally conscious and forward-thinking company.

Emerging Technologies in Hazardous Waste Treatment

Specialized technologies for hazardous, industrial, and electronic waste treatment are constantly advancing. For instance, advanced oxidation processes (AOPs) are showing significant promise in breaking down persistent organic pollutants, with global market growth projected to reach over $1.5 billion by 2028. DSV Miljø A/S must monitor these innovations to maintain its competitive edge.

Staying current with these technological shifts is vital for DSV Miljø A/S to uphold its leadership in compliant waste handling. This includes adopting solutions for increasingly complex waste streams, such as those generated by the burgeoning e-waste sector, which saw a global generation of 53.6 million metric tons in 2022. The company's ability to adapt will directly impact its service offerings and regulatory adherence.

- Advanced Oxidation Processes (AOPs): Effective for degrading recalcitrant compounds in wastewater.

- Plasma Gasification: Capable of converting hazardous waste into syngas and inert slag, with increasing adoption in industrial settings.

- Bioremediation Techniques: Utilizing microorganisms to break down contaminants, offering a more sustainable approach for certain waste types.

- Robotics and Automation: Enhancing safety and efficiency in sorting and handling hazardous materials, a trend gaining traction in 2024-2025 operations.

Technological advancements are reshaping waste management, with AI and robotics boosting sorting efficiency and recycling rates, particularly for complex materials like construction debris. The global waste sorting equipment market is expected to exceed $2.5 billion by 2024, highlighting significant investment in these areas.

IoT and data analytics are enabling smarter operations, from optimized collection routes reducing fuel consumption by up to 15% in 2024 to predictive analytics preventing overflows. The global waste management market, valued at over $1.2 trillion in 2025, is increasingly adopting these smart technologies for cost savings and service improvements.

Innovative waste-to-energy technologies like plasma gasification and anaerobic digestion are crucial for the circular economy, transforming waste into energy, with Denmark actively optimizing these processes. The adoption of electric vehicles in waste fleets is also accelerating, aiming to cut CO2 emissions and noise pollution, with European companies targeting over 50% electrification by 2027.

Specialized treatment for hazardous and electronic waste is also advancing, with techniques like Advanced Oxidation Processes (AOPs) showing promise in degrading pollutants, a market projected to reach over $1.5 billion by 2028. DSV Miljø A/S must stay abreast of these innovations, especially for growing waste streams like e-waste, which reached 53.6 million metric tons globally in 2022, to maintain its competitive edge and regulatory compliance.

| Technology | Impact | Projected Market Growth |

|---|---|---|

| AI & Robotics in Sorting | Increased precision, speed, higher recycling rates | Waste sorting equipment market > $2.5 billion by 2024 |

| IoT & Data Analytics | Optimized routes, predictive maintenance, reduced fuel consumption | Global waste management market adoption driving cost savings |

| Waste-to-Energy (WtE) | Resource recovery, renewable energy generation | Denmark focus on optimizing WtE for sustainability |

| Electric Vehicles (EVs) | Reduced emissions, noise pollution | Fleet electrification targets of >50% by 2027 in Europe |

| Advanced Waste Treatment | Handling hazardous and e-waste, pollutant degradation | AOPs market > $1.5 billion by 2028; E-waste generation 53.6M metric tons (2022) |

Legal factors

The provisional agreement on the revised EU Waste Framework Directive, reached in February 2025, presents substantial new obligations for businesses. Key among these are legally binding targets for reducing food and textile waste, alongside the introduction of standardized Extended Producer Responsibility (EPR) schemes across member states. This directive aims to foster a more circular economy by placing greater responsibility on producers for the end-of-life management of their products.

Member states are granted a 20-month period to integrate these new directives into their national legislation, meaning DSV Miljø A/S must proactively adjust its service offerings and internal compliance structures. For instance, the directive's focus on textiles could necessitate new collection and recycling solutions, potentially impacting operational costs and investment strategies for companies in the waste management sector.

Denmark's introduction of Extended Producer Responsibility (EPR) for packaging from October 2025 and single-use plastics from December 2024 creates significant new compliance burdens. Producers must now register and report on their product lifecycles, impacting how goods are managed post-consumption.

DSV Miljø A/S needs to thoroughly understand these evolving EPR mandates to effectively guide its clients. Offering services that streamline producer compliance, such as collection, sorting, and data reporting for EPR schemes, presents a key business opportunity. This ensures clients meet their legal obligations while DSV Miljø A/S strengthens its market position in environmental services.

The Danish government's commitment to a circular economy is clearly outlined in its Action Plan for Circular Economy 2020-2032. This plan establishes ambitious national targets, including a goal of 55% municipal waste recycling by 2025 and a broader aim to reduce waste generation and incineration. DSV Miljø A/S, as a key player in waste management, must align its operational strategies to meet these evolving environmental mandates.

Hazardous Waste and Environmental Protection Acts

DSV Miljø A/S operates under a stringent legal framework, particularly concerning hazardous waste management. National laws, including the Environmental Protection Act and specific Executive Orders on Waste, dictate every aspect of handling, treatment, and disposal. Adherence is paramount for DSV Miljø A/S, as their core business directly involves these regulated materials.

Failure to comply can lead to significant legal liabilities and operational disruptions. For instance, in 2024, the European Environment Agency reported a notable increase in fines for non-compliance with waste management directives across member states. DSV Miljø A/S must maintain robust internal processes to ensure they meet or exceed these legal mandates, safeguarding both the environment and their business continuity.

- Environmental Protection Act: Mandates strict protocols for hazardous waste.

- Executive Orders on Waste: Provide specific directives for waste handling and disposal.

- Legal Liabilities: Non-compliance can result in substantial fines and legal action.

- Operational Continuity: Rigorous adherence ensures safe and compliant operations.

Construction Waste Recycling Mandates

New legislation effective July 2024 imposes recycling plan mandates for demolition projects surpassing 250 square meters. This aims to boost the recovery rates of construction and demolition waste, with a target of diverting 70% of waste from landfills by 2030.

This regulatory shift creates a direct legal requirement for construction firms to partner with specialized waste management providers like DSV Miljø A/S. Such partnerships are crucial for ensuring compliance and implementing effective material recovery strategies.

- Mandatory Recycling Plans: Effective July 2024, new laws require detailed recycling plans for demolition projects over 250 sq m.

- Landfill Diversion Targets: The legislation supports a national goal to divert 70% of construction and demolition waste from landfills by 2030.

- Increased Demand for Specialists: This creates a legal imperative for construction companies to engage waste management experts like DSV Miljø A/S.

- Focus on Material Recovery: The mandates drive a need for efficient and compliant material recovery processes, benefiting specialized service providers.

The evolving legal landscape, particularly the provisional agreement on the revised EU Waste Framework Directive in February 2025, introduces binding targets for food and textile waste reduction and standardized Extended Producer Responsibility (EPR) schemes. Denmark's own EPR implementation for packaging (October 2025) and single-use plastics (December 2024) adds further compliance layers, requiring meticulous product lifecycle reporting from producers.

DSV Miljø A/S must navigate these directives, aligning its services to support client compliance, especially with new recycling plan mandates for demolition projects over 250 square meters effective July 2024. This legislation aims for a 70% diversion of construction and demolition waste from landfills by 2030, creating a direct legal need for specialized waste management partnerships.

The Danish government's commitment to a circular economy, as seen in its Action Plan for Circular Economy 2020-2032, sets a target of 55% municipal waste recycling by 2025. DSV Miljø A/S must ensure its operations support these national environmental goals, while also adhering to stringent national laws like the Environmental Protection Act and specific Executive Orders on Waste, particularly for hazardous materials.

Non-compliance with these regulations carries significant risks, as evidenced by the European Environment Agency's 2024 report of increased fines for waste management directive violations. DSV Miljø A/S's operational continuity and reputation depend on robust internal processes to meet or exceed these legal mandates.

| Legislation/Directive | Effective Date | Key Impact on DSV Miljø A/S | Target/Goal |

|---|---|---|---|

| Revised EU Waste Framework Directive (Provisional Agreement) | February 2025 | New EPR schemes, food/textile waste reduction targets | Circular economy, producer responsibility |

| Danish EPR for Packaging | October 2025 | Producer registration & reporting compliance support | Extended Producer Responsibility |

| Danish EPR for Single-Use Plastics | December 2024 | Producer registration & reporting compliance support | Extended Producer Responsibility |

| Recycling Plans for Demolition Projects | July 2024 | Demand for specialized waste management services | 70% C&D waste diversion from landfill by 2030 |

| Danish Municipal Waste Recycling Target | 2025 | Alignment with national recycling goals | 55% municipal waste recycling |

Environmental factors

Denmark's ambitious Action Plan for Circular Economy, targeting waste reduction and resource maximization, directly benefits DSV Miljø A/S. This national strategy prioritizes recycling and resource recovery, creating a favorable market for DSV Miljø's core services.

The Danish government's commitment is substantial, with a goal to reduce waste generation by 30% by 2030 compared to 2015 levels. This policy shift significantly boosts demand for advanced recycling and treatment solutions, underscoring DSV Miljø's strategic positioning.

Denmark faces a significant challenge with high municipal waste generation rates, averaging around 800 kg per person annually, placing it among the highest in Europe. This substantial volume presents both a hurdle and a considerable opportunity for waste management firms like DSV Miljø A/S.

The sheer quantity of waste necessitates innovative solutions and strategic investments in advanced waste reduction technologies and the development of robust circular economy models. Companies that can effectively and sustainably manage these large volumes are well-positioned for growth in the Danish market.

Denmark's commitment to minimizing landfill and incineration is a significant environmental driver. The country has a long-standing ban on landfilling specific waste types and is actively reducing incineration capacity, pushing for greater diversion to recycling, composting, and energy recovery. This policy shift directly benefits DSV Miljø A/S by boosting demand for their advanced recycling and treatment solutions as viable alternatives to traditional disposal methods.

Climate Change and CO2 Emission Reduction

The waste management sector faces significant pressure to curb its carbon footprint. Copenhagen aims for carbon neutrality by 2025, a target that cascades down to industries like waste management. National Danish targets for CO2 reduction further underscore the imperative for companies like DSV Miljø A/S to innovate.

DSV Miljø A/S's commitment to sustainability, including advanced recycling techniques and responsible waste disposal, directly supports these environmental objectives. By integrating circular economy principles, the company aligns its operations with broader climate action strategies, turning environmental challenges into business opportunities.

- Copenhagen's Carbon Neutrality Target: 2025

- National CO2 Reduction Goals: Ongoing national targets driving industry change.

- DSV Miljø A/S Contribution: Focus on recycling and responsible disposal to meet climate goals.

- Industry Trend: Increasing demand for sustainable waste management solutions.

Resource Scarcity and Material Recovery

Growing global concerns about resource scarcity are increasingly highlighting the critical need to recover valuable materials from waste streams. DSV Miljø A/S's expertise in treating diverse waste, including hazardous and industrial types, directly addresses this by extracting and reintroducing materials back into the economic cycle. This process significantly boosts resource efficiency and promotes a more sustainable approach to material management.

The company's operations are vital in mitigating the depletion of virgin resources. For instance, in 2024, the European Union continued to push for higher recycling rates, with targets for certain materials reaching 70% by 2030. DSV Miljø A/S's services directly contribute to achieving these ambitious goals by enabling the recovery of metals, plastics, and other valuable components from waste.

- Resource Recovery: DSV Miljø A/S facilitates the extraction of valuable materials from waste, reducing reliance on primary resource extraction.

- Circular Economy Contribution: The company's operations support the circular economy by reintroducing recovered materials into production processes.

- Sustainability Goals: DSV Miljø A/S's waste treatment services align with and support national and international sustainability and resource efficiency targets.

- Hazardous Waste Management: The safe treatment of hazardous waste by DSV Miljø A/S is essential for preventing environmental contamination and recovering potentially valuable, albeit challenging, materials.

Denmark's strong environmental policies, including ambitious circular economy targets and a commitment to reducing landfill and incineration, create a favorable market for DSV Miljø A/S. The nation's focus on waste reduction, aiming for a 30% decrease by 2030, directly increases demand for advanced recycling and resource recovery services offered by DSV Miljø.

The pressure to curb carbon footprints, with Copenhagen aiming for carbon neutrality by 2025, necessitates sustainable waste management practices. DSV Miljø's operations, focused on recycling and responsible disposal, align with these climate action strategies, transforming environmental challenges into opportunities.

Growing concerns over resource scarcity further emphasize the need for effective material recovery. DSV Miljø's expertise in treating diverse waste streams, including hazardous materials, is crucial for reintroducing valuable components back into the economic cycle, thereby enhancing resource efficiency and supporting a circular economy.

| Environmental Factor | Impact on DSV Miljø A/S | Supporting Data/Target |

|---|---|---|

| Circular Economy Push | Increased demand for recycling and resource recovery services. | Denmark's goal to reduce waste generation by 30% by 2030. |

| Carbon Neutrality Goals | Need for sustainable waste management to reduce industry carbon footprint. | Copenhagen's target for carbon neutrality by 2025. |

| Resource Scarcity Concerns | Opportunity for material extraction and reintroduction into the economy. | EU targets for recycling rates, e.g., 70% for certain materials by 2030. |

| Waste Generation Rates | Significant volume of waste presents both challenges and opportunities. | Average municipal waste generation in Denmark around 800 kg per person annually. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for DSV Miljø A/S is built on a robust foundation of data from official Danish government agencies, European Union environmental directives, and leading industry research firms. We meticulously gather insights on political stability, economic indicators, technological advancements, and social trends to provide a comprehensive overview.