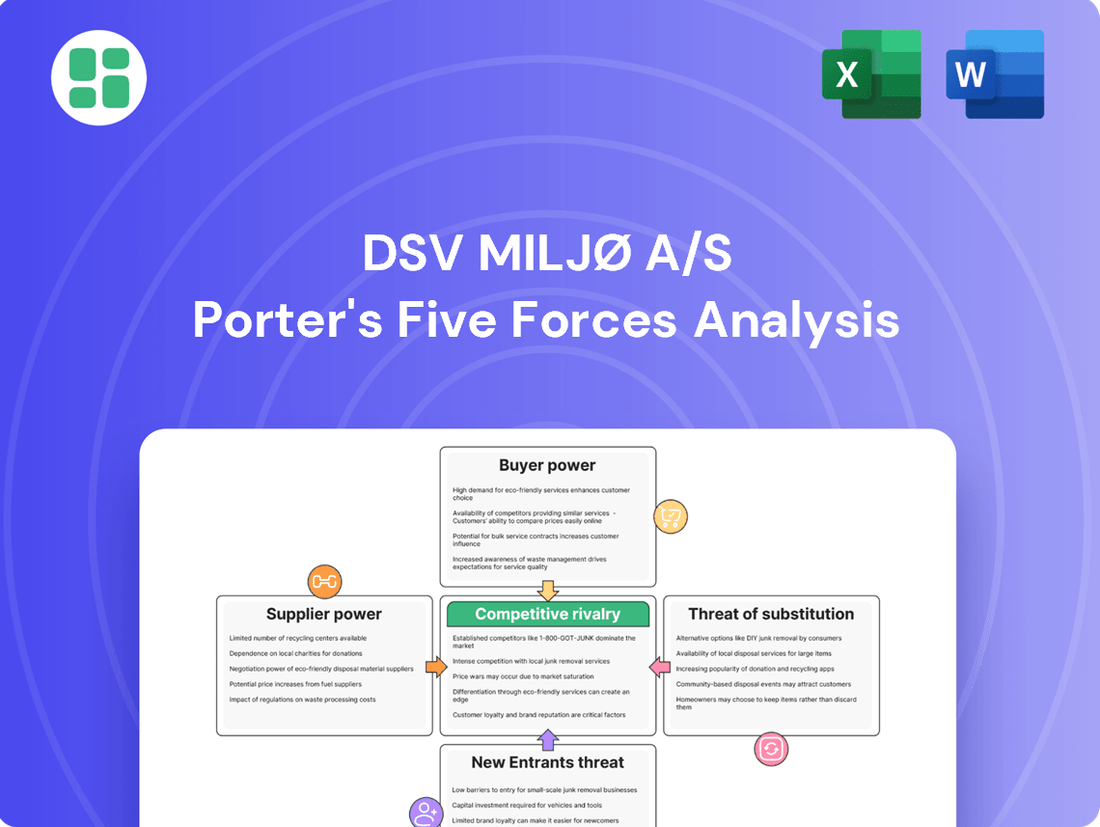

DSV Miljø A/S Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSV Miljø A/S Bundle

DSV Miljø A/S faces a dynamic competitive landscape shaped by moderate buyer power and significant threat from substitutes in the waste management sector. Understanding the intensity of these forces is crucial for strategic planning.

The complete report reveals the real forces shaping DSV Miljø A/S’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

DSV Miljø A/S depends on suppliers for specialized waste treatment equipment and advanced sorting technologies, giving these providers a moderate degree of bargaining power. The specialized nature and significant expense of this machinery, along with potentially high switching costs, limit DSV Miljø's options for certain essential parts.

For instance, in 2024, the global market for environmental technology and services reached an estimated $1.1 trillion, indicating a robust demand for innovative solutions. This growth, while potentially attracting more suppliers and easing some supplier pressure, also means that providers of cutting-edge technology can command premium pricing.

DSV Miljø A/S relies on landfill and incineration facility operators for waste streams that cannot be recycled or reused. The availability of these facilities is often constrained by strict environmental regulations and public sentiment, particularly concerning hazardous waste, which grants these operators considerable leverage.

The Danish government's directive for municipalities to tender waste incineration services starting in 2025 is expected to foster greater competition among these facilities. This increased competition could gradually diminish the individual bargaining power of each operator over time, potentially benefiting companies like DSV Miljø A/S.

DSV Miljø A/S, as a major player in waste collection and transport, relies heavily on fuel and vehicle maintenance. The bargaining power of fuel and vehicle maintenance providers can be significant, especially given the essential nature of these services for DSV Miljø's operations. Fluctuations in global oil prices, for instance, directly impact fuel costs, a key input for their extensive fleet. In 2024, global oil prices experienced notable volatility, impacting transportation and logistics companies like DSV Miljø.

The availability of specialized maintenance services for heavy-duty vehicles also plays a role. If there are only a few qualified providers capable of servicing DSV Miljø's fleet, their bargaining power increases. This is particularly true for complex repairs or specialized equipment. However, DSV Miljø's substantial fleet size and the potential for long-term contracts can offer some leverage, allowing them to negotiate more favorable terms and secure more stable pricing for these critical inputs.

Recycling Facilities and Material Buyers

DSV Miljø A/S's reliance on recycling facilities and material buyers significantly shapes its bargaining power. The company's circular economy model means these downstream partners are crucial. Their power hinges on the market demand for recycled materials and the availability of alternative processing sites.

A robust market for recycled commodities, such as plastics and metals, can diminish the bargaining power of buyers. For instance, the global recycled plastics market was valued at approximately USD 45.7 billion in 2023 and is projected to grow, indicating strong demand that could benefit DSV Miljø. Similarly, a competitive landscape among recycling facilities offers DSV Miljø more options, thereby reducing the leverage of any single facility.

- Demand for Recycled Materials: High demand for processed materials like recycled plastics and metals strengthens DSV Miljø's position. The global market for recycled plastics alone was estimated at USD 45.7 billion in 2023, showcasing significant buyer interest.

- Number of Processing Facilities: A larger number of available recycling facilities provides DSV Miljø with more choices, thereby reducing the bargaining power of any single partner.

- Material Quality and Specifications: The ability of DSV Miljø to consistently produce high-quality, specification-compliant recycled materials can enhance its negotiating power with buyers.

- Buyer Concentration: If there are few dominant buyers for specific recycled materials, their bargaining power increases. Conversely, a fragmented buyer market offers DSV Miljø greater flexibility.

Human Capital and Specialized Expertise

Suppliers of specialized labor, like environmental engineers and hazardous waste handlers, possess considerable bargaining power. This stems from the highly specific skills needed in waste management and regulatory compliance, creating a limited pool of qualified professionals.

The scarcity of such expertise directly impacts DSV Miljø A/S. It can drive up labor costs and complicate the recruitment process, potentially affecting operational efficiency and the company's overall cost structure. For instance, in 2024, the demand for skilled environmental engineers in Europe saw average salaries increase by 8-12% compared to the previous year, reflecting this tight labor market.

- Niche Skills: Environmental engineers, waste management specialists, hazardous waste handlers require unique technical knowledge.

- Scarcity of Talent: A limited supply of highly qualified personnel in complex waste treatment and regulatory compliance.

- Impact on DSV Miljø: Increased labor costs and recruitment challenges affecting operational efficiency and cost structure.

- 2024 Data: Average salaries for environmental engineers in Europe rose by 8-12% in 2024 due to high demand.

Suppliers of specialized waste treatment equipment and advanced sorting technologies hold moderate bargaining power due to the high cost and technical nature of their products. This can lead to significant switching costs for DSV Miljø A/S, limiting their options for essential machinery. The global environmental technology market, valued at approximately $1.1 trillion in 2024, highlights the demand for such innovations, allowing key suppliers to command premium pricing.

Landfill and incineration facility operators possess considerable leverage, particularly for hazardous waste, due to strict regulations and limited availability. However, upcoming tender processes for waste incineration services in Denmark from 2025 onwards are expected to increase competition among these operators, potentially reducing their individual bargaining power over time.

Providers of fuel and vehicle maintenance services exert significant influence on DSV Miljø A/S due to the critical nature of these inputs for its extensive fleet. Global oil price volatility in 2024 directly impacted fuel costs. Furthermore, a limited number of specialized maintenance providers for heavy-duty vehicles can increase their leverage, although DSV Miljø's fleet size may offer some negotiating advantage.

DSV Miljø A/S's bargaining power with recycling facilities and material buyers depends on market demand for recycled materials and the availability of alternative processing sites. Strong demand, as seen in the global recycled plastics market (valued at USD 45.7 billion in 2023), benefits DSV Miljø. A competitive landscape among processing facilities also enhances DSV Miljø's negotiating position.

| Supplier Type | Bargaining Power Factors | DSV Miljø A/S Impact | Relevant Data (2023-2024) |

|---|---|---|---|

| Specialized Equipment Providers | High cost, technical complexity, switching costs | Limited options, potential for premium pricing | Global environmental tech market: ~$1.1 trillion (2024) |

| Landfill/Incineration Facilities | Regulatory constraints, limited availability | Significant leverage, especially for hazardous waste | Danish municipal tender mandate from 2025 |

| Fuel & Vehicle Maintenance | Essential services, oil price volatility, specialized maintenance needs | Direct impact on operating costs, potential for higher service costs | Global oil price volatility (2024) |

| Recycling Facilities/Material Buyers | Market demand for recyclables, availability of alternatives | Negotiating power influenced by market conditions | Global recycled plastics market: USD 45.7 billion (2023) |

What is included in the product

This analysis dissects the competitive forces impacting DSV Miljø A/S, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the environmental services sector.

DSV Miljø A/S Porter's Five Forces Analysis provides a clear, one-sheet summary of all five forces, perfect for quick decision-making and identifying key competitive pressures.

Customers Bargaining Power

Municipalities and public sector entities are major clients for DSV Miljø A/S, often securing substantial, multi-year agreements via competitive bidding. These clients wield considerable influence, not only due to the sheer volume of waste they generate but also their capacity to shape the competitive landscape through their procurement decisions.

Their primary concerns revolve around achieving cost-effectiveness and meeting stringent public environmental mandates, which directly translates into their demands for services. For instance, in 2024, public sector contracts often include performance-based pricing and strict adherence to recycling and landfill diversion rates, giving them significant leverage in negotiations with waste management providers like DSV Miljø A/S.

Large industrial and commercial clients, especially those producing substantial quantities of specialized or hazardous waste, wield significant bargaining power. Their unique waste management requirements often lead them to seek integrated solutions, enabling them to negotiate more advantageous terms with waste management providers like DSV Miljø A/S. For instance, in 2024, major industrial clients in Denmark, responsible for over 60% of the country's industrial waste, often have the capacity to explore in-house waste management, even if it's capital-intensive, thereby strengthening their negotiating position.

Customers, particularly those generating substantial waste or operating under strict financial constraints, exhibit significant price sensitivity within the waste management sector. This means that pricing is a major factor in their decision-making process.

While DSV Miljø A/S provides crucial value through ensuring regulatory compliance and promoting sustainability, the fundamental nature of basic waste collection services often leads to a commoditized market. This commoditization naturally fuels competition based on price, putting pressure on service providers.

Consequently, DSV Miljø A/S faces a challenge in raising its service fees. A substantial increase in charges, even if justified by added value, could lead to a notable loss of customers who prioritize lower costs above all else.

Switching Costs for Customers

For businesses and municipalities, changing waste management providers often entails considerable administrative and logistical hurdles. These can include negotiating new contracts, integrating new systems, and making operational adjustments. For instance, a municipality might need to update its public service announcements and resident education materials, a process that can take months and incur printing and distribution costs.

These switching costs can effectively lower the bargaining power of customers. They create a degree of loyalty, or stickiness, for existing clients, particularly when DSV Miljø A/S provides complex, integrated waste management solutions. This is especially true for clients who have customized their waste streams and collection schedules, making a transition more disruptive.

- Administrative Burden: Switching providers can involve extensive paperwork, legal reviews, and internal re-training, estimated to cost some large organizations tens of thousands of dollars in staff time alone.

- Logistical Complexity: Reconfiguring collection routes, updating tracking systems, and ensuring compatibility with new equipment can be a significant undertaking.

- Contractual Lock-ins: Many long-term contracts include clauses that penalize early termination, further increasing the cost of switching.

Regulatory Compliance Demands

The increasing stringency of Danish and EU environmental regulations, such as those concerning hazardous waste disposal and circular economy initiatives, places significant demands on customers to ensure their waste handling practices are fully compliant. For instance, the EU's Waste Framework Directive sets ambitious recycling targets that businesses must meet. This complexity means customers often depend on specialized providers like DSV Miljø A/S to expertly navigate these evolving legal requirements.

Customers lacking in-house environmental expertise find themselves reliant on DSV Miljø A/S for guidance and assurance in meeting these regulatory obligations. This reliance can diminish a customer's bargaining power, as the ability to achieve and maintain compliance becomes a crucial factor in provider selection, often outweighing purely price-based considerations. In 2024, the focus on Extended Producer Responsibility (EPR) schemes across the EU further solidified the need for expert waste management partners.

- Regulatory Burden: Businesses face growing pressure to comply with stringent Danish and EU environmental laws, impacting waste management choices.

- Expertise Gap: Many customers lack the internal knowledge to manage complex waste regulations effectively.

- Provider Dependence: This expertise gap increases reliance on service providers like DSV Miljø A/S for compliant solutions.

- Reduced Customer Power: Compliance expertise becomes a key differentiator, lessening the impact of price as the sole bargaining factor for customers.

DSV Miljø A/S faces significant customer bargaining power, particularly from large public sector entities and industrial clients who represent substantial waste volumes. These clients, driven by cost-effectiveness and strict environmental mandates, often leverage competitive bidding processes and the threat of in-house management to negotiate favorable terms. For instance, in 2024, public sector contracts frequently incorporated performance-based pricing, directly empowering these clients.

While switching costs can mitigate some customer power, the commoditized nature of basic waste collection services means price sensitivity remains a key concern. Customers prioritizing cost over added value may readily switch providers if fees increase. This dynamic limits DSV Miljø A/S's ability to easily raise service charges, as even minor increases can lead to significant customer attrition.

| Customer Segment | Bargaining Power Factors | Impact on DSV Miljø A/S |

|---|---|---|

| Municipalities/Public Sector | High volume, competitive bidding, cost focus, regulatory mandates | Price pressure, contract negotiation leverage |

| Large Industrial/Commercial | Specialized waste needs, potential for in-house management, volume | Negotiation for integrated solutions, price sensitivity |

| Price-Sensitive Customers | Focus on cost-effectiveness, low switching loyalty | Limited ability to increase prices, risk of customer loss |

Preview the Actual Deliverable

DSV Miljø A/S Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details DSV Miljø A/S's Porter's Five Forces Analysis, thoroughly examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the environmental services sector. This comprehensive report is ready for your immediate use.

Rivalry Among Competitors

The Danish waste management sector is characterized by a fragmented market, featuring a mix of local, regional, national, and international competitors. This landscape, partly a legacy of diverse local collection systems, fuels robust competition based on both price and service quality.

DSV Miljø A/S contends with a broad spectrum of companies providing essential waste management services, including collection, transportation, and treatment. For instance, in 2023, the Danish waste management market saw significant activity, with companies like Marius Pedersen and Ragn-Sells also holding substantial market shares alongside DSV Miljø A/S, indicating a competitive environment where differentiation and efficiency are key.

The waste management sector, including companies like DSV Miljø A/S, faces intense competition driven by substantial fixed costs. These costs are tied to essential assets such as specialized collection vehicles, advanced treatment plants, and the complex infrastructure required for environmental and regulatory adherence. For instance, in 2024, the capital expenditure for a modern waste processing facility can easily run into tens of millions of euros.

This high fixed-cost structure creates a strong incentive for companies to operate at or near full capacity. When capacity is underutilized, firms may resort to aggressive price cuts to attract more business and cover their overheads, thereby intensifying the competitive rivalry. DSV Miljø A/S, like its peers, must therefore focus on maximizing its operational capacity utilization to ensure profitability and maintain a competitive edge in pricing.

Denmark's stringent environmental regulations, such as its ambitious 2030 recycling targets aiming for 65% of municipal waste to be recycled, create a competitive battleground. Companies that master compliance, like DSV Miljø A/S, gain an edge, but face constant pressure from rivals to match or surpass these evolving standards, particularly with the introduction of new producer responsibility schemes impacting sectors like electronics and packaging.

Focus on Sustainability and Circular Economy

The intensifying focus on sustainability and the circular economy significantly shapes competitive rivalry within the waste management sector. There's a pronounced national push for higher recycling rates and resource efficiency, compelling companies to innovate. For instance, in 2024, Denmark continued its commitment to ambitious climate goals, with the government setting targets to increase recycling by a further 10% by 2030, driving intense competition among waste management firms to offer superior circular solutions.

Companies are actively investing in cutting-edge technologies and eco-friendly services to capture market share among environmentally aware customers and to align with stringent regulatory requirements. This investment race means that firms demonstrating advanced sorting capabilities, waste-to-energy solutions, and robust material recovery processes are gaining a distinct advantage. DSV Miljø A/S's strategic positioning and commitment to sustainable waste management practices are therefore central to its competitive standing, as it navigates this evolving landscape.

- Circular Economy Drive: National policies and public demand are pushing for greater resource reuse and reduced landfill waste.

- Technological Investment: Companies are channeling funds into advanced sorting, recycling, and waste-to-energy technologies.

- Eco-Conscious Clientele: Attracting and retaining clients who prioritize sustainability is a key differentiator.

- Regulatory Alignment: Meeting and exceeding government targets for recycling and waste reduction is crucial for competitive parity.

Integration and Scope of Services

Competitive rivalry in the waste management sector is significantly fueled by the extent and integration of services. Businesses offering complete waste management solutions, encompassing collection, transport, and diverse treatment methods like recycling, energy recovery, and disposal, establish a stronger market position. DSV Miljø A/S's strategy focuses on delivering an integrated service model designed to simplify waste management for its clients.

This integration allows companies to capture more value across the waste lifecycle and offer a more convenient, one-stop solution. For instance, a company providing both hazardous waste disposal and specialized recycling for electronic components can attract clients seeking a holistic approach. In 2024, the demand for circular economy solutions, emphasizing resource recovery, further intensified this trend, pushing companies to broaden their service portfolios to include advanced sorting and material reprocessing.

DSV Miljø A/S's commitment to an integrated approach is evident in its efforts to streamline client waste processes, aiming for greater efficiency and cost-effectiveness. This means a client might engage DSV for everything from office paper recycling to the disposal of industrial byproducts, all managed under a single contract. This comprehensive offering directly combats the competitive pressure from specialized niche players by providing a more convenient and often more cost-effective alternative for businesses with varied waste streams.

- Service Breadth: Companies offering end-to-end waste management from collection to disposal and recycling gain a competitive advantage.

- Client Convenience: Integrated services simplify waste processes for clients, making them more attractive partners.

- Circular Economy Focus: The growing emphasis on recycling and resource recovery in 2024 encourages broader service offerings.

- Value Capture: Integrated providers can capture more value across the entire waste management lifecycle.

The competitive rivalry within Denmark's waste management sector is fierce, driven by a fragmented market with numerous players, including large national entities like Marius Pedersen and Ragn-Sells, alongside DSV Miljø A/S. This intense competition is further amplified by high fixed costs associated with specialized equipment and infrastructure, pushing firms to maximize capacity utilization and often leading to price competition.

Denmark's ambitious environmental targets, such as the 2030 goal of recycling 65% of municipal waste, create a dynamic landscape where companies must continuously innovate and invest in advanced technologies, like sophisticated sorting and waste-to-energy solutions. In 2024, the push for circular economy principles further intensified this rivalry, with companies like DSV Miljø A/S focusing on integrated service models to attract environmentally conscious clients and capture greater value across the waste lifecycle.

| Key Competitor | Market Presence | Service Offering |

| Marius Pedersen | National | Collection, treatment, recycling |

| Ragn-Sells | International, strong in Denmark | Waste management, recycling, resource recovery |

| DSV Miljø A/S | National | Integrated waste management, logistics |

SSubstitutes Threaten

Large industrial entities or municipalities may opt to build or enhance their internal waste management operations, particularly for specialized waste categories or to gain more direct oversight of their environmental impact. This strategy, though demanding substantial upfront capital and specialized knowledge, presents a viable alternative to relying on external waste management providers.

For instance, a large manufacturing firm might invest in on-site facilities to process specific industrial byproducts, thereby reducing reliance on third-party waste disposal services. Such in-house solutions can offer greater flexibility and potentially lower long-term operational costs, especially when dealing with high volumes or unique waste characteristics.

A significant substitute threat for DSV Miljø A/S arises from customers proactively minimizing their waste output. This trend is fueled by increasing environmental consciousness, a desire for cost reduction, and stricter regulations. For instance, in 2023, the European Union reported a 2.5% decrease in municipal waste generation per capita compared to 2021, highlighting this shift.

Innovations in product design and the adoption of circular economy principles directly counteract the need for traditional waste management services. Companies focusing on reusable packaging, extended product lifecycles, and efficient resource utilization are effectively reducing the volume of waste DSV Miljø would typically handle. This strategic shift by clients represents a potent substitute to conventional waste disposal and processing.

The threat of substitutes for DSV Miljø A/S's services is growing due to advancements in alternative waste treatment technologies. Innovations like chemical recycling, anaerobic digestion, and more efficient waste-to-energy plants offer new ways to handle waste, potentially diverting it from traditional collection and disposal methods. For instance, the European Union's push towards a circular economy, with targets to increase recycling rates, could accelerate the adoption of these substitute technologies. In 2023, the global waste-to-energy market was valued at approximately $38.5 billion and is projected to grow, indicating a significant shift in how waste is managed.

Shift to Different Material Inputs

Customer industries might pivot towards materials that produce less problematic waste, favoring easier recycling or biodegradable options. This shift in material sourcing directly impacts the demand for specialized waste treatment services, potentially diminishing the market for DSV Miljø A/S.

For instance, a significant portion of the construction sector, a key client base for waste management, is increasingly exploring sustainable building materials. In 2024, the global green building materials market was valued at over $290 billion, with projections indicating continued strong growth, suggesting a tangible trend away from traditional, potentially hazardous inputs.

This move towards eco-friendlier inputs by industries that previously relied on DSV Miljø A/S's services represents a substantial threat. Such a transition would naturally decrease the volume and complexity of waste requiring specialized treatment, thereby eroding the demand for DSV Miljø A/S's core offerings.

- Reduced Demand: Industries adopting easily recyclable or biodegradable materials will require fewer specialized waste treatment services.

- Market Erosion: A widespread shift away from complex waste streams directly shrinks the addressable market for DSV Miljø A/S.

- Competitive Pressure: Companies offering simpler, more cost-effective waste solutions for these new materials could emerge, increasing competitive pressure.

Direct Material Reuse and Exchange Platforms

The rise of direct material reuse and exchange platforms presents a significant threat. These platforms facilitate the direct reuse and exchange of materials, particularly in sectors like construction. For instance, initiatives promoting the circular economy are gaining traction, aiming to extend material lifecycles and decrease reliance on traditional waste management.

These platforms can bypass traditional waste management services by enabling direct reuse and repair. This shift towards a circular economy model, where materials are kept in use for extended periods, directly reduces the volume of waste requiring disposal or processing. In 2024, the global circular economy market was valued at approximately $2.3 trillion, indicating substantial growth and adoption of these principles.

- Growing Circular Economy: The circular economy market is expanding rapidly, with projections suggesting continued strong growth through 2025.

- Reduced Waste Volume: Direct reuse and exchange platforms directly divert materials from traditional waste streams.

- Bypassing Waste Management: These platforms offer an alternative to conventional waste management services, potentially impacting revenue for companies like DSV Miljø A/S.

- Material Longevity: The focus on keeping materials in use longer directly challenges the need for new material extraction and processing.

The threat of substitutes for DSV Miljø A/S is significant, driven by evolving customer behaviors and technological advancements. Customers are increasingly focused on waste reduction, adopting circular economy principles, and shifting to eco-friendlier materials. For example, the European Union saw a 2.5% decrease in municipal waste generation per capita between 2021 and 2023, indicating a clear trend towards less waste overall.

Alternative waste treatment technologies and direct material reuse platforms also pose a substantial threat. Innovations like chemical recycling and waste-to-energy plants offer new pathways for waste management, potentially diverting business from traditional services. The global waste-to-energy market reached approximately $38.5 billion in 2023, highlighting the growing adoption of these alternative methods.

Furthermore, industries are actively seeking materials that generate less problematic waste, favoring easily recyclable or biodegradable options. The global green building materials market, valued at over $290 billion in 2024, exemplifies this shift. This move towards sustainable inputs directly reduces the volume and complexity of waste requiring specialized treatment, impacting DSV Miljø A/S's core offerings.

| Substitute Strategy | Impact on DSV Miljø A/S | Supporting Data |

|---|---|---|

| Waste Minimization & Circular Economy | Reduced volume of waste handled | EU municipal waste per capita decreased by 2.5% (2021-2023) |

| Alternative Treatment Technologies | Diversion of waste from traditional streams | Waste-to-energy market valued at $38.5 billion (2023) |

| Shift to Eco-Friendlier Materials | Decreased demand for specialized treatment | Green building materials market exceeded $290 billion (2024) |

| Direct Material Reuse Platforms | Bypassing traditional waste management services | Global circular economy market valued at $2.3 trillion (2024) |

Entrants Threaten

Entering the comprehensive waste management sector, akin to DSV Miljø A/S's operations, demands significant financial outlay. This includes acquiring specialized fleets, establishing robust collection networks, and investing in advanced treatment and disposal facilities, often running into millions of euros. For instance, a new waste processing plant can cost upwards of €50 million to build and equip.

These substantial upfront capital needs create a formidable barrier for potential new competitors. The sheer scale of investment required to match existing infrastructure and operational capacity effectively deters many smaller or less capitalized entities from entering the market, thereby protecting established players like DSV Miljø A/S.

Stringent regulatory and licensing hurdles significantly deter new entrants in the Danish waste management sector. The industry is governed by a complex web of national and EU environmental laws, dictating everything from waste handling standards to intricate permitting processes. For instance, compliance with REACH regulations and specific waste treatment directives requires substantial investment and expertise, creating a high barrier to entry.

Established players like DSV Miljø A/S leverage significant economies of scale in waste collection, processing, and transportation, enabling them to spread fixed costs over larger volumes. This cost advantage is substantial; for instance, in 2024, the Danish waste management sector saw companies with larger operational footprints achieving up to 15% lower per-unit processing costs compared to smaller, regional operators.

Furthermore, network effects play a crucial role, as a more extensive collection and disposal network allows for greater route optimization and service availability, which is difficult for new entrants to replicate quickly. Building a comparable infrastructure and client base would require immense upfront capital investment, creating a formidable barrier for any new competitor aiming to challenge DSV Miljø A/S.

Access to Waste Streams and Established Relationships

Newcomers face significant hurdles in securing consistent and diverse waste streams. Established players like DSV Miljø A/S often hold long-term contracts with municipalities and large industrial clients, creating a barrier to entry. For instance, in 2024, municipal waste collection contracts often span 5-10 years, locking in supply for incumbent firms.

Incumbent companies benefit from deeply entrenched relationships and a demonstrated history of reliable service. This track record makes it considerably more difficult for new entrants to win over clients and secure the necessary feedstock for their operations. DSV's established partnerships, built over years, provide a predictable and stable supply chain that is hard to replicate.

- Established Contracts: Long-term agreements with municipalities and industrial clients limit access for new entrants.

- Relationship Capital: Proven track records and existing client trust are significant advantages for incumbents.

- Supply Chain Stability: Incumbents enjoy greater predictability in waste stream sourcing due to their established networks.

Brand Reputation and Expertise in Hazardous Waste

The threat of new entrants in the hazardous waste management sector, particularly for companies like DSV Miljø A/S, is significantly mitigated by the critical importance of brand reputation and specialized expertise. Successfully managing hazardous and complex waste streams demands not only deep technical knowledge but also stringent adherence to safety protocols and a proven track record of regulatory compliance. Building this level of trust and demonstrating the requisite capabilities presents a substantial hurdle for newcomers. For instance, in 2023, companies operating in the EU waste management sector faced an average of 15 significant regulatory audits, highlighting the rigorous compliance environment. Mistakes in this field carry severe environmental and legal repercussions, making established players with a strong reputation for reliability and safety a much safer bet for clients.

New entrants must overcome considerable barriers to entry, including the substantial investment required for specialized equipment, advanced training for personnel, and obtaining numerous permits and certifications. The hazardous waste industry is highly regulated, with varying national and international standards that new companies must navigate. DSV Miljø A/S, for example, likely holds certifications such as ISO 14001 for environmental management, which takes time and resources to achieve and maintain. The financial commitment to meet these standards and build a credible operational framework is a significant deterrent to potential competitors. The market often favors established firms that can demonstrate decades of experience and a history of successful, safe operations.

- Reputation as a Barrier: Newcomers must build a reputation for reliability and safety, which takes years and significant investment in demonstrable compliance.

- Expertise and Training: Specialized knowledge in handling diverse hazardous materials and strict safety protocols are essential, requiring costly and ongoing training programs.

- Regulatory Hurdles: Navigating complex and evolving environmental regulations, permits, and licensing processes creates a significant barrier for new entrants.

- Capital Investment: Acquiring specialized vehicles, treatment facilities, and safety equipment represents a substantial upfront financial commitment.

The threat of new entrants in the waste management sector, particularly for a company like DSV Miljø A/S, is generally low due to substantial barriers. These include high capital requirements for specialized equipment and facilities, stringent regulatory compliance, and the need for established operational networks. For instance, in 2024, the average cost to establish a new waste transfer station in Denmark was estimated to be between €5 million and €10 million, not including specialized processing technology.

Economies of scale enjoyed by incumbents like DSV Miljø A/S further deter new players. Companies with larger volumes can achieve lower per-unit operational costs. In 2024, Danish waste management firms with over 100,000 tonnes annual processing capacity reported operational cost savings of up to 12% compared to those handling less than 20,000 tonnes. This cost advantage makes it difficult for new, smaller entrants to compete effectively on price.

Securing long-term contracts with municipalities and large industrial clients is another significant barrier. These contracts, often lasting 5-10 years, provide stable revenue streams for established companies. In 2024, over 80% of municipal waste collection contracts in major Danish cities were held by companies with more than a decade of operational history, limiting opportunities for newcomers to secure essential feedstock.

| Barrier Type | Description | Example Data (2024) |

|---|---|---|

| Capital Requirements | High investment in fleets, facilities, and technology. | New waste processing plant: €50 million+ |

| Regulatory Compliance | Navigating complex environmental laws and permits. | Average of 15 significant regulatory audits for EU waste sector firms (2023). |

| Economies of Scale | Lower per-unit costs for larger operators. | 15% lower processing costs for large-scale Danish operators. |

| Contractual Lock-ins | Long-term agreements with clients. | 5-10 year municipal waste collection contracts. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for DSV Miljø A/S is built upon a foundation of industry-specific market research reports, company annual filings, and expert interviews within the environmental services sector.