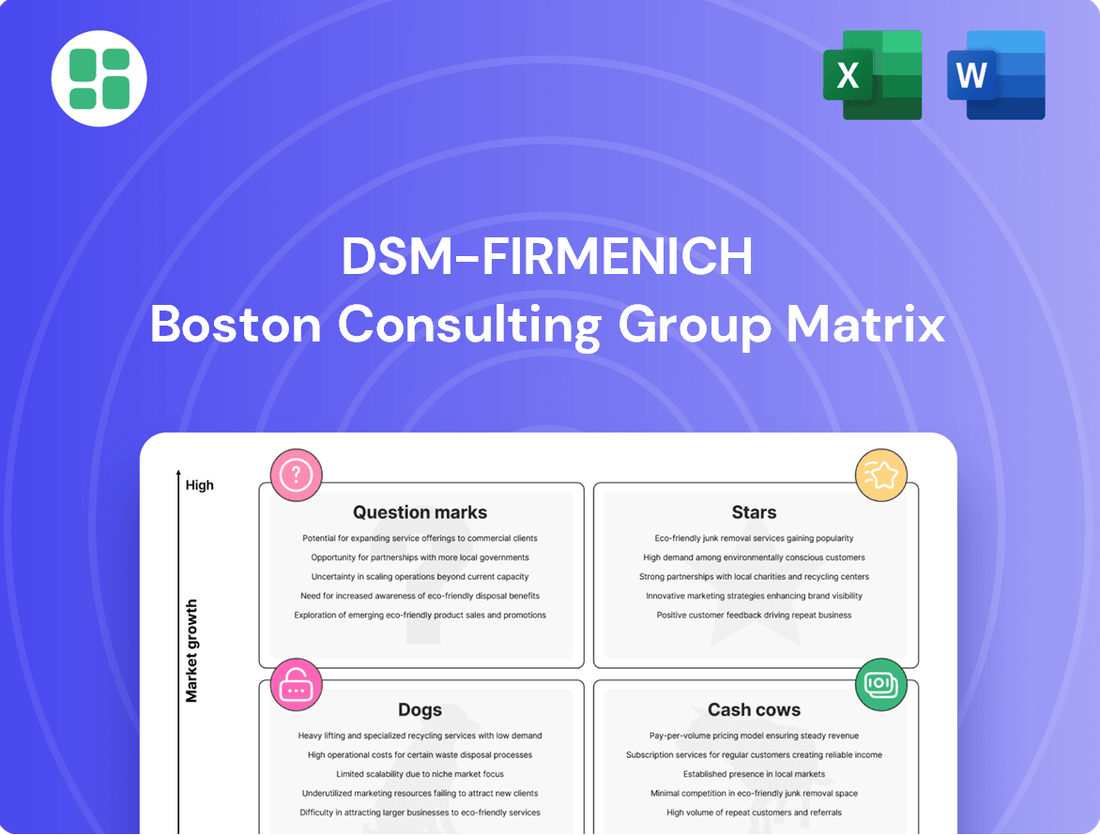

DSM-Firmenich Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DSM-Firmenich Bundle

DSM-Firmenich's BCG Matrix offers a powerful lens to understand their product portfolio's market share and growth potential. This glimpse into their strategic positioning highlights key areas of strength and potential challenges.

To truly harness this strategic intelligence, unlock the full DSM-Firmenich BCG Matrix report. Gain a comprehensive quadrant-by-quadrant analysis, revealing actionable insights to optimize resource allocation and drive future growth.

Stars

DSM-Firmenich is making significant strides in sustainable protein solutions, particularly with plant-based ingredients for meat and dairy alternatives. Their focus on enhancing taste and texture is crucial for meeting consumer demand for healthier, eco-friendly food choices.

The market for these alternatives is booming. For instance, the global plant-based meat market was valued at approximately $7.0 billion in 2023 and is projected to grow substantially, with some estimates suggesting it could reach over $30 billion by 2030, indicating a strong CAGR. DSM-Firmenich's investment in research and development, including the use of AI, positions them to capitalize on this expansion.

Personalized nutrition platforms are a burgeoning sector, driven by consumers actively seeking health solutions tailored to their unique genetic makeup, lifestyle, and specific health goals. DSM-Firmenich is well-positioned to capitalize on this trend by offering customized micro-nutrient blends and dietary supplements. This market is experiencing significant expansion, with projections indicating continued robust growth in the coming years as technology advances and consumer adoption accelerates.

High-performance fragrance technologies are a burgeoning segment, driven by consumer demand for scents that last longer and are more sustainable. DSM-Firmenich's innovations in this area, including novel fragrance molecules and advanced delivery systems, are key to capturing market share. These technologies are designed to create unique olfactive experiences, aligning with the growing preference for emotionally resonant and eco-conscious products in both fine fragrances and everyday consumer goods.

Biotechnology-Derived Ingredients

Biotechnology-derived ingredients, a cornerstone of DSM-Firmenich's innovation, are positioned as a strong contender within the BCG matrix, reflecting significant investment in advanced bio-fermentation technologies. These advanced processes yield novel ingredients like bio-fermented vitamins and enzymes, catering to a growing demand for sustainable and functional components across various industries.

This segment is characterized by high growth potential and a substantial market share, driven by consumer preference for clean label and natural product solutions. For instance, the global market for bio-based ingredients was projected to reach over $50 billion by 2024, with biotechnology playing a pivotal role in its expansion.

- High Growth Potential: Investments in advanced biotechnology enable the creation of novel ingredients, tapping into a rapidly expanding market.

- Market Share Dominance: DSM-Firmenich's focus on bio-fermented vitamins and enzymes positions them strongly in this high-demand sector.

- Sustainability Appeal: These ingredients offer superior sustainability profiles, aligning with industry trends toward eco-friendly solutions.

- Functional Advantages: Bio-actives derived from biotechnology provide enhanced functionality, meeting consumer and industry needs for performance.

Next-Generation Health & Wellness Solutions

Next-Generation Health & Wellness Solutions represent a significant growth area for DSM-Firmenich, driven by advancements in areas like microbiome modulation and early life nutrition. These cutting-edge offerings, including probiotics, prebiotics, and postbiotics for gut health, along with Human Milk Oligosaccharides (HMOs) for infant development, are positioned as stars due to their high growth potential and the company's leading market position.

The increasing scientific validation and robust consumer demand for solutions addressing fundamental health needs, such as improved digestion and enhanced immune function, fuel the star status of these segments. For instance, the global gut health market was valued at approximately $62.5 billion in 2023 and is projected to grow significantly, with prebiotics and probiotics being key drivers.

- Microbiome Modulation: Innovations in probiotics, prebiotics, and postbiotics addressing gut health.

- Early Life Nutrition: Focus on essential components like HMOs for infant development.

- Market Growth: Driven by scientific understanding and rising consumer awareness of health benefits.

- Leadership Position: DSM-Firmenich's established presence in these high-potential segments.

Next-Generation Health & Wellness Solutions, encompassing microbiome modulation and early life nutrition, are DSM-Firmenich's stars. These segments, including probiotics, prebiotics, and HMOs, benefit from strong scientific backing and growing consumer interest in preventative health and infant development. The company's leadership in these high-growth areas, projected to continue expanding, solidifies their star status within the BCG matrix.

| Segment | BCG Category | Key Drivers | Market Data (2023/2024 Estimates) | DSM-Firmenich Position |

|---|---|---|---|---|

| Microbiome Modulation & Early Life Nutrition | Stars | Scientific validation, consumer demand for gut health and infant development | Global gut health market: ~$62.5 billion (2023) | Leading |

What is included in the product

This BCG Matrix analysis highlights DSM-Firmenich's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

Simplifies complex portfolio analysis, allowing quick identification of high-potential Stars and cash-generating Cash Cows.

Cash Cows

Following their significant vitamin transformation, DSM-Firmenich's core vitamin portfolio, now excluding the divested Animal Nutrition & Health segment, is positioned as a reliable cash generator. This streamlined offering, despite operating in a mature market, benefits from consistent demand and enhanced profitability stemming from operational efficiencies.

Established Flavor & Taste Systems represent a significant Cash Cow for DSM-Firmenich. Their deep-rooted expertise in traditional flavors and taste systems for the food and beverage sector, operating within large, mature markets, generates consistent and strong cash flow.

These deeply integrated solutions boast high market penetration and necessitate comparatively lower ongoing investment for promotional activities, effectively leveraging established customer relationships. For instance, in 2024, the global flavor and fragrance market, a key segment for these systems, was projected to reach over $60 billion, with established players like DSM-Firmenich holding substantial market share in traditional taste profiles.

DSM-Firmenich's broad-spectrum personal care ingredients, including emollients, thickeners, and UV filters, are firmly established as cash cows. This mature segment boasts high market share, serving as foundational components for a vast range of consumer goods and consistently delivering robust revenue streams.

Food & Beverage Ingredient Solutions

The Food & Beverage Ingredient Solutions segment at DSM-Firmenich operates as a classic Cash Cow within the BCG framework. Its extensive portfolio, featuring texturants, stabilizers, and essential nutritional additives, caters to a vast and mature global food market. This deep integration into supply chains ensures a steady and predictable demand, translating into robust cash generation for the company.

In 2024, this segment continued to demonstrate its strength, benefiting from the ongoing consumer preference for processed and convenience foods, which rely heavily on these functional ingredients. For instance, the demand for texturants in dairy alternatives and plant-based meats remained a significant driver.

- Market Position: Dominant player in a mature, stable market.

- Revenue Contribution: Consistent, high revenue generation with low reinvestment needs.

- Profitability: Strong profit margins due to established scale and efficiency.

- Strategic Role: Funds growth initiatives in other business units.

Fragrance Ingredients for Mass Market

Fragrance ingredients for the mass market represent a significant Cash Cow for DSM-Firmenich. These are established, high-volume products used in everyday items like detergents and personal care products, ensuring stable demand.

The mature nature of these segments means high market share and consistent contribution to cash flow. For example, the global fragrance ingredients market is projected to reach approximately $25.5 billion by 2027, with a substantial portion attributed to mass-market applications.

- High Volume Production: Focus on efficient, large-scale manufacturing of well-known fragrance compounds.

- Established Market Share: Leverage long-standing relationships with major consumer goods companies.

- Stable Demand: Benefit from consistent consumer purchasing of essential hygiene and cleaning products.

- Significant Cash Flow Generation: These mature products provide a reliable revenue stream to fund other business areas.

DSM-Firmenich's established vitamin portfolio, post-divestiture, acts as a dependable Cash Cow. Operating in a mature market, it benefits from consistent demand and improved profitability through efficiency gains.

The company's foundational flavor and taste systems are also key Cash Cows. These mature offerings in the food and beverage sector generate strong, stable cash flow, supported by high market penetration and minimal reinvestment needs.

Broad-spectrum personal care ingredients, including emollients and UV filters, are firmly established Cash Cows for DSM-Firmenich. Their high market share in this mature segment ensures consistent revenue streams, forming the backbone of many consumer goods.

DSM-Firmenich's Food & Beverage Ingredient Solutions, featuring texturants and stabilizers, are classic Cash Cows. Catering to a vast, mature global market, these deeply integrated products ensure steady demand and robust cash generation.

| Business Unit | BCG Category | Key Characteristics | 2024 Market Insight |

| Vitamins (Core Portfolio) | Cash Cow | Mature market, consistent demand, operational efficiencies | Global vitamin market remains stable, driven by health and wellness trends. |

| Flavor & Taste Systems | Cash Cow | High market penetration, low reinvestment, established expertise | Flavor and fragrance market projected over $60 billion in 2024, with strong demand for traditional profiles. |

| Personal Care Ingredients | Cash Cow | High market share, foundational components, robust revenue | Continued growth in personal care sector, with stable demand for core ingredients. |

| Food & Beverage Ingredient Solutions | Cash Cow | Deep supply chain integration, mature market, steady demand | Demand for texturants and stabilizers remains strong, particularly in plant-based alternatives. |

| Fragrance Ingredients (Mass Market) | Cash Cow | High volume, established relationships, stable demand | Global fragrance ingredients market expected to reach ~$25.5 billion by 2027, with mass-market applications being a significant driver. |

Preview = Final Product

DSM-Firmenich BCG Matrix

The DSM-Firmenich BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive report, designed for strategic insight, contains no watermarks or demo content, ensuring you get an analysis-ready file for immediate application. You can confidently expect this precise BCG Matrix analysis to be delivered directly to you, ready for integration into your business planning and decision-making processes. This is the genuine, professionally crafted report that will empower your strategic initiatives.

Dogs

The Animal Nutrition & Health business, including its stake in the Feed Enzymes Alliance, represented a segment characterized by low growth and slim profit margins, coupled with significant capital investment needs. This made it a less attractive prospect for future development.

DSM-Firmenich's decision to divest this unit was a strategic move to eliminate a business that consumed considerable capital without generating substantial returns, often referred to as a cash trap. This divestiture allows for a more efficient allocation of financial resources.

By exiting this low-margin, high-capital intensity area, DSM-Firmenich can redirect its investments toward business units with greater growth potential and higher profitability, thereby enhancing overall portfolio performance and shareholder value.

Legacy Chemical Intermediates within DSM-Firmenich's portfolio are characterized by their mature, less differentiated nature. These products often struggle to keep pace with the company's strategic shift towards high-growth nutrition, health, and beauty segments. Their market share is typically modest, and they contribute little to the company's overall profitability, often facing strong competition.

DSM-Firmenich has identified certain activities and product lines, representing over €600 million in annual sales, as non-strategic. These segments, characterized by low growth and low market share, have been de-prioritized following a thorough strategic portfolio review. This move is aimed at streamlining the company's focus and resources.

The de-prioritization of these segments suggests they are candidates for further optimization or outright divestment. By shedding these lower-performing areas, DSM-Firmenich can concentrate its efforts on more promising and higher-growth opportunities within its portfolio. This strategic pruning is a common approach to enhance overall business performance and shareholder value.

Underperforming Niche Segments

Underperforming niche segments within DSM-Firmenich's portfolio would likely be categorized as Dogs in the BCG Matrix. These are areas where specific product lines, despite being in specialized markets, have failed to capture significant market share. They often face intense competition or a lack of compelling differentiation, leading to stagnant growth and minimal profitability.

These niche segments represent a drain on resources with a low probability of generating substantial returns. For instance, if a particular specialty ingredient for a niche food application has seen its market share decline to below 5% and its growth rate hover around 1-2% annually, it would fit the Dog profile. Such situations might necessitate a strategic decision to divest or significantly restructure operations.

Consider these characteristics for DSM-Firmenich's potential Dog segments:

- Low Market Share: Typically below 10% within their specific niche market.

- Low Market Growth: Annual growth rates often in the low single digits, or even declining.

- High Competitive Intensity: Facing strong pressure from established or emerging competitors.

- Limited Investment Potential: Requiring substantial turnaround investment with uncertain outcomes.

Commoditized Vitamin Products (Pre-Transformation)

Before its strategic transformation, DSM-Firmenich's vitamin division included several commoditized products. These faced intense price competition and fluctuating demand, leading to lower profit margins and making them less appealing from an investment standpoint.

For instance, in 2024, certain basic vitamins like Vitamin C saw global prices dip significantly due to oversupply from major Asian producers. This market dynamic directly impacted the profitability of these specific product lines within DSM-Firmenich's portfolio prior to their optimization efforts.

- Volatile Pricing: Commoditized vitamins often experience price swings influenced by raw material costs and global supply-demand imbalances.

- Low Profitability: Intense competition in these segments typically squeezes profit margins, making them less attractive.

- Strategic Challenge: Products unable to be differentiated or integrated into higher-value offerings could be classified as dogs in the BCG matrix.

- Market Dynamics: In 2024, the Vitamin C market exemplified this, with oversupply pressures leading to reduced profitability for basic grades.

Dogs in the BCG Matrix represent business units with low market share in low-growth industries. For DSM-Firmenich, these could be legacy chemical intermediates or certain commoditized vitamin lines that struggle to compete. These segments often require significant investment to maintain, with limited prospects for substantial returns.

The company's strategic review identified over €600 million in annual sales from non-strategic, low-growth, low-market share segments. These are prime candidates for being classified as Dogs, as they do not align with the company's focus on nutrition, health, and beauty. For example, a niche specialty ingredient with declining market share and minimal growth would fit this profile.

In 2024, the vitamin market, particularly for basic vitamins like Vitamin C, experienced price dips due to oversupply, impacting profitability. This scenario highlights how commoditized products with low differentiation and intense price competition can become Dogs. Such segments are often candidates for divestment or significant restructuring to improve overall portfolio performance.

Question Marks

DSM-Firmenich is exploring AI-driven ingredient discovery, a promising area for high-growth potential. These emerging initiatives, while in their nascent stages of commercialization, currently hold a low market share. Significant investment is being channeled to accelerate the translation of these AI-powered discoveries into market-leading products.

DSM-Firmenich's advanced sustainable packaging solutions represent a promising, high-growth area, fueled by increasing environmental regulations and consumer demand for eco-friendly products. This segment aligns with global sustainability goals, creating a significant market opportunity.

While the market for truly circular packaging is still developing, DSM-Firmenich's investment in this area positions them for future growth. The company's commitment to innovation in this space is crucial for capturing market share in this nascent but rapidly expanding sector.

DSM-Firmenich's novel biomaterials and bio-based chemicals represent a classic 'Question Mark' in the BCG matrix. These are exploratory ventures into new materials and specialized chemicals, pushing beyond their established ingredient offerings.

While these innovations hold the promise of significant future growth, they currently command a low market share. The company is investing heavily in research and development to prove their commercial viability, a characteristic of Question Mark products.

For instance, the burgeoning bio-based chemicals market is projected to grow substantially, with some segments expected to reach tens of billions of dollars globally by 2030. DSM-Firmenich's strategic investments in this area, though currently in early stages, position them to capitalize on this expansion.

Personalized Beauty Technologies

Personalized beauty technologies represent a significant area of investment for DSM-Firmenich, aligning with a high-growth, emerging market trend. The company's focus on custom skincare formulations and diagnostic tools for tailored beauty regimens positions it to capture this expanding consumer demand.

DSM-Firmenich's activities in personalized beauty are likely categorized as a Question Mark within the BCG Matrix. This implies that while the market potential is substantial, the company's current market share and traction may still be developing, necessitating strategic investment to foster growth and competitive positioning.

- Market Growth: The global personalized beauty market was valued at approximately $27.5 billion in 2023 and is projected to reach over $60 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 11.8%.

- DSM-Firmenich Investment: Increased R&D spending in 2024 is directed towards advanced diagnostic tools and AI-driven formulation platforms to enhance personalized beauty offerings.

- Strategic Focus: Expansion into direct-to-consumer channels for personalized beauty solutions is a key objective for 2024 to build brand loyalty and gather valuable customer data.

- Competitive Landscape: The sector sees growing competition from agile startups and established brands investing heavily in digital personalization capabilities.

New Geographic Market Entries for Specific Innovations

New geographic market entries for specific innovations within DSM-Firmenich's portfolio would likely be categorized as Stars or Question Marks, depending on their current market position and growth trajectory. For instance, introducing a novel bio-based ingredient in a rapidly expanding Southeast Asian market where DSM-Firmenich has minimal existing presence but sees significant potential for adoption would fit this description.

These ventures necessitate substantial upfront investment in marketing, sales force development, and local distribution networks to build brand awareness and secure market share. Consider the company's 2024 strategic focus on expanding its sustainable ingredient offerings into regions like India, where the demand for eco-friendly solutions is projected to grow by over 15% annually.

- Targeting High-Growth Emerging Markets: Focus on regions with strong economic expansion and increasing consumer demand for innovative solutions, such as specific biodegradable polymers in Latin America.

- Significant Investment Required: Allocate substantial resources for market penetration, including localized marketing campaigns and establishing robust distribution channels, mirroring the 2024 investment in building out sales infrastructure in sub-Saharan Africa.

- Low Initial Market Share, High Potential: Aim for markets where DSM-Firmenich currently holds a small percentage but where rapid growth is anticipated, driven by unmet needs for advanced nutritional supplements.

- Examples of Innovations: Introducing advanced enzyme technologies for the food industry in markets like Vietnam, where the sector is experiencing a CAGR of 10% plus.

DSM-Firmenich's novel biomaterials and bio-based chemicals are prime examples of Question Marks. These initiatives, while promising for future growth, currently hold a small market share. The company is making significant R&D investments to establish their commercial viability and capture future market expansion.

Personalized beauty technologies also fall into the Question Mark category, reflecting a high-growth market where DSM-Firmenich is still building its presence. The company's 2024 strategy includes increased R&D for diagnostic tools and AI platforms to strengthen its position in this sector.

Entering new geographic markets with specific innovations, like sustainable ingredients in India, also represents a Question Mark. These ventures require substantial investment in local infrastructure and marketing to build awareness and secure market share in these developing regions.

| Initiative Area | BCG Category | Market Growth Outlook | DSM-Firmenich Current Share | 2024 Focus |

| AI-Driven Ingredient Discovery | Question Mark | High | Low | Accelerate commercialization |

| Novel Biomaterials | Question Mark | High | Low | R&D for commercial viability |

| Personalized Beauty Technologies | Question Mark | High (approx. 11.8% CAGR to 2030) | Developing | Enhanced diagnostic tools, AI platforms |

| Sustainable Packaging (Circular) | Question Mark | Growing | Nascent | Innovation and market capture |

| New Geographic Market Entry (e.g., India) | Question Mark | High (e.g., >15% annual growth for eco-friendly solutions) | Minimal | Building sales infrastructure, localized marketing |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, and expert commentary to ensure reliable, high-impact insights.