Dr. Reddy's Laboratories PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Reddy's Laboratories Bundle

Navigate the dynamic pharmaceutical landscape with our comprehensive PESTLE analysis of Dr. Reddy's Laboratories. Understand how political stability, economic fluctuations, technological advancements, socio-cultural shifts, environmental regulations, and legal frameworks are collectively shaping the company's strategic direction and market opportunities. Gain a crucial competitive edge by leveraging these expert insights to inform your own business planning and investment decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

The Indian government's commitment to elevating drug safety and efficacy standards, with a keen eye on global market acceptance, directly shapes Dr. Reddy's operational framework and international market ambitions. This includes a significant emphasis on achieving certifications like EU-Good Manufacturing Practices (GMP), crucial for market access in developed economies.

While the National Health Policy (2017) targets increasing government health expenditure to 2.5% of GDP by 2025, actual public health spending has lagged, suggesting ongoing efforts to boost investment in this vital sector.

Recent amendments to India's Patent Rules in 2024 have introduced stricter timelines for filing 'Requests for Examination.' This change demands greater efficiency in patent application management for pharmaceutical giants like Dr. Reddy's Laboratories, impacting their intellectual property strategy and market entry timelines.

The Drugs and Cosmetics Rules 1945, specifically Schedule M, has seen revisions to its Good Manufacturing Practices (GMP) requirements. These updates include new stipulations for premises, plant, and equipment, compelling companies to invest in facility upgrades and bolster their quality control systems to meet these enhanced standards.

Adherence to these evolving regulatory landscapes is paramount for Dr. Reddy's to ensure consistent product quality and secure continued market access, particularly in international markets where compliance with diverse and stringent regulations is a prerequisite for export success.

Dr. Reddy's Laboratories, as a global pharmaceutical entity, is significantly shaped by international trade agreements and the geopolitical climate in its core markets like North America, Europe, and various emerging economies. Favorable trade policies streamline market entry and lower tariff burdens, whereas geopolitical instability or trade conflicts can impede supply chains and market access.

The company's robust performance in the United States, a key growth engine, underscores the critical importance of stable international relations for sustained success. For instance, in 2023, the US market contributed a substantial portion of Dr. Reddy's revenue, highlighting the direct impact of trade dynamics on its financial health.

Incentives for Research and Development

The Indian government is actively promoting pharmaceutical research and development (R&D) through various initiatives. This focus aims to foster domestic innovation and decrease dependence on foreign sources for crucial active pharmaceutical ingredients (APIs). For instance, the Production Linked Incentive (PLI) schemes and the Scheme for Promotion of Research and Innovation in Pharma MedTech Sector (PRIP) are designed to spur R&D activities within the country.

Dr. Reddy's Laboratories, with its strong commitment to R&D, is well-positioned to capitalize on these government incentives. The company's ongoing investment in developing new therapies and improving existing ones aligns directly with the government's strategic goals for the pharmaceutical industry.

- Government R&D Push: India's pharmaceutical sector is a key focus for government incentives to drive innovation.

- Key Schemes: Programs like PLI and PRIP are instrumental in encouraging domestic R&D and API production.

- Dr. Reddy's Advantage: The company's established R&D framework makes it a prime beneficiary of these supportive policies.

Pricing Controls and Reimbursement Policies

Government pricing controls and reimbursement policies in key markets like India, the US, and Europe directly influence Dr. Reddy's revenue from its generic and biosimilar portfolios. For instance, in 2023, the Indian government's National Pharmaceutical Pricing Authority (NPPA) continued to cap prices for essential medicines, impacting the profitability of certain products. Similarly, the US Medicare Part D prescription drug negotiation framework, initiated by the Inflation Reduction Act, could lead to price reductions for selected high-cost drugs in the coming years, affecting Dr. Reddy's US sales.

Navigating these diverse pricing environments is crucial for Dr. Reddy's to maintain sustainable revenue streams. The company's ability to adapt its market access strategies and product launch timing in response to evolving reimbursement landscapes, such as changes in formulary placements or co-payment structures, directly affects product uptake and financial performance. For example, securing favorable reimbursement for new biosimilar launches in Europe requires careful engagement with national health technology assessment bodies and payers.

- Price Controls Impact: Government-mandated price ceilings on pharmaceuticals in markets like India can limit revenue growth for Dr. Reddy's key products.

- Reimbursement Landscape: Changes in reimbursement policies in the US and Europe can affect market access and pricing power for generics and biosimilars.

- Affordability Initiatives: Policies aimed at increasing medicine affordability may lead to price erosion, requiring Dr. Reddy's to focus on volume and cost efficiencies.

- Market Access Strategy: Effective engagement with payers and health authorities is vital for securing favorable reimbursement and market access for Dr. Reddy's offerings.

Government initiatives like the Production Linked Incentive (PLI) scheme for pharmaceuticals aim to boost domestic manufacturing and R&D, providing a supportive ecosystem for companies like Dr. Reddy's. The Indian government's focus on enhancing drug safety and efficacy standards, aligning with international benchmarks, necessitates continuous investment in quality control and compliance for market access. Furthermore, evolving patent laws, such as the 2024 amendments to India's Patent Rules, demand agile intellectual property management strategies to navigate market entry timelines effectively.

| Policy/Initiative | Objective | Impact on Dr. Reddy's | 2023/2024 Data Point |

|---|---|---|---|

| PLI Scheme for Pharma | Boost domestic manufacturing & R&D | Enhanced competitiveness, potential cost savings | PLI scheme allocated ₹6,940 crore for the pharmaceutical sector. |

| Drug Safety & Efficacy Standards | Align with global benchmarks | Requires investment in quality systems, facilitates international market access | EU-GMP certification is critical for European market entry. |

| Patent Rules Amendments (2024) | Streamline patent examination | Requires efficient IP management, impacts launch timelines | Stricter timelines for 'Requests for Examination' introduced. |

What is included in the product

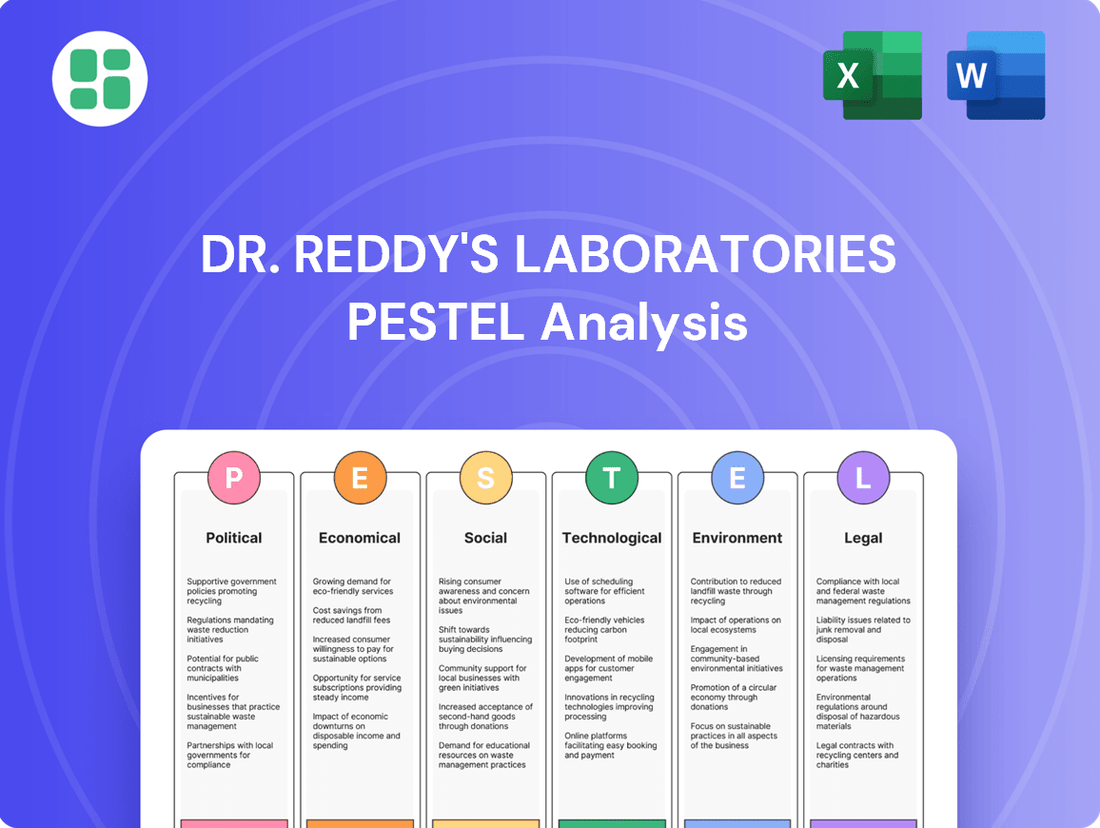

This PESTLE analysis of Dr. Reddy's Laboratories examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations, providing a comprehensive view of the external landscape.

It offers actionable insights to identify strategic opportunities and mitigate potential risks arising from these macro-environmental forces.

This PESTLE analysis for Dr. Reddy's Laboratories offers a concise, actionable overview of external factors, serving as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

It provides a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations to quickly understand the external landscape impacting Dr. Reddy's.

Economic factors

The global pharmaceutical market is experiencing robust expansion, anticipated to reach an estimated USD 1,645.75 billion in 2024. Projections indicate continued growth, with the market expected to hit USD 2,350.43 billion by 2030, demonstrating a compound annual growth rate (CAGR) of 6.1% between 2025 and 2030.

Dr. Reddy's Laboratories is capitalizing on this favorable market environment, showcasing impressive financial results. In Q4 FY24, the company reported a significant 36% increase in consolidated net profit and a 12% rise in revenue, bolstered by strong sales performance in key regions like North America, Europe, and emerging markets.

For the full fiscal year 2024, Dr. Reddy's Laboratories achieved total revenues of ₹27,920 crore, marking a substantial 14% increase. This growth underscores the company's ability to leverage domestic and global market opportunities across its diverse product offerings.

The pharmaceutical landscape is undergoing a major shift with many high-value drugs losing patent protection in 2025. This event, often called the 'patent cliff,' will intensify competition from generic and biosimilar alternatives, impacting companies like Dr. Reddy's Laboratories.

This patent expiration trend creates significant opportunities for companies specializing in generics and biosimilars. For Dr. Reddy's, this means a chance to expand its market share by offering more affordable versions of previously patented blockbuster drugs.

The global biosimilars market is a key growth area, valued at an estimated US$34.8 billion in 2024. Projections show this market expanding rapidly, expected to reach US$93.1 billion by 2030 with a compound annual growth rate of 17.8%, fueled by the increasing demand for cost-effective healthcare solutions.

Dr. Reddy's Laboratories demonstrates a significant commitment to innovation, with a notable R&D expenditure of ₹690 crore in the fourth quarter of fiscal year 2024. This investment is strategically directed towards advancing its biosimilar pipeline and developing novel oncology assets, alongside its established generics business.

Sustained investment in research and development is paramount for Dr. Reddy's to introduce new, affordable healthcare solutions and to establish future growth avenues via licensing and partnerships. This proactive approach is in step with the pharmaceutical industry's broader imperative to boost R&D efforts, thereby mitigating the impact of patent expirations and fostering continuous innovation.

Currency Fluctuations and Global Trade

Currency fluctuations significantly impact Dr. Reddy's Laboratories, a global pharmaceutical player with substantial operations in key markets like the US and Europe. Favorable foreign exchange movements provided a tailwind, contributing to revenue growth in fiscal year 2024. For instance, the company reported a strong performance in its North America segment, partly benefiting from currency tailwinds during this period.

These exchange rate shifts directly affect the cost of imported raw materials and the repatriation of profits from international sales. A stronger Indian Rupee against major currencies like the US Dollar or Euro could potentially dampen the reported value of overseas earnings. Conversely, a weaker Rupee can boost the Rupee-equivalent value of those earnings.

- Revenue Impact: Favorable currency movements boosted Dr. Reddy's reported revenues in FY24, particularly from its international markets.

- Cost Management: Fluctuations in exchange rates influence the cost of sourcing active pharmaceutical ingredients (APIs) and other critical raw materials, often imported.

- Profitability: The translation of foreign currency profits back into the company's reporting currency (INR) is directly affected by exchange rate volatility.

- Competitive Landscape: Managing currency risk is crucial for maintaining price competitiveness in global markets and ensuring stable financial performance.

Healthcare Spending and Affordability

Global healthcare spending continues its upward trajectory, directly impacting the demand for pharmaceuticals like those produced by Dr. Reddy's Laboratories, particularly its emphasis on accessible medications. This trend is amplified by rising healthcare budgets worldwide.

In India, the healthcare budget for 2024-25 reflects a commitment to strengthening the sector, with increased funding for infrastructure development and ongoing health programs. This could translate into broader access to healthcare services, benefiting companies like Dr. Reddy's.

The escalating cost of biologic drugs on a global scale is a significant driver for the biosimilars market. Dr. Reddy's, as a key player in this segment, is well-positioned to capitalize on the growing demand for more affordable alternatives to expensive biologics.

- Global healthcare spending projected to reach $11.6 trillion by 2025.

- India's Union Budget 2024-25 allocated ₹90,766 crore for the Ministry of Health and Family Welfare.

- The global biosimilars market is expected to grow significantly, driven by patent expiries of blockbuster biologics.

Economic factors present a dynamic landscape for Dr. Reddy's Laboratories. The expanding global pharmaceutical market, projected to reach $1,645.75 billion in 2024, offers substantial growth opportunities. However, currency fluctuations can impact international revenue and costs, as seen with favorable forex movements contributing to revenue growth in FY24. The increasing global healthcare spending, expected to hit $11.6 trillion by 2025, further fuels demand for pharmaceutical products, including Dr. Reddy's focus on accessible medications.

| Economic Factor | 2024 Projection/Data | Impact on Dr. Reddy's |

|---|---|---|

| Global Pharma Market Size | USD 1,645.75 billion | Significant growth opportunity |

| Global Healthcare Spending | USD 11.6 trillion by 2025 | Increased demand for pharmaceuticals |

| India Health Budget (2024-25) | ₹90,766 crore | Potential for broader healthcare access |

| FY24 Revenue Growth | 14% | Strong performance, partly due to forex |

Preview the Actual Deliverable

Dr. Reddy's Laboratories PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of Dr. Reddy's Laboratories. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. You'll gain valuable insights into market dynamics and potential challenges and opportunities.

Sociological factors

The global demographic shift towards an aging population, with projections indicating that individuals aged 65 and over will constitute nearly 16% of the world's population by 2050, fuels a sustained demand for pharmaceutical products. This aging trend is closely linked to a rising prevalence of chronic diseases. For instance, the World Health Organization reported in 2023 that cardiovascular diseases, cancer, and diabetes are leading causes of death and disability globally, necessitating continuous access to both innovative treatments and cost-effective generic medications.

This evolving health landscape directly benefits companies like Dr. Reddy's Laboratories, whose business model is built on supplying a wide range of pharmaceutical solutions. The increasing global cancer rates, estimated to affect over 19 million people annually according to the International Agency for Research on Cancer (IARC) in their 2022 report, are particularly significant. This surge is a key driver for the oncology biosimilars market, a strategic area where Dr. Reddy's has established a strong presence, aiming to provide more accessible treatment options.

Growing health awareness globally is a significant driver for Dr. Reddy's. This trend fuels demand for preventative measures, early detection, and effective treatments. For instance, the global preventive healthcare market was valued at approximately USD 30.5 billion in 2023 and is projected to grow substantially.

Patients are increasingly prioritizing accessible and affordable healthcare. This preference is shifting purchasing power towards generics and biosimilars, a segment where Dr. Reddy's has a strong presence. In 2024, the global generics market is expected to reach over USD 250 billion, highlighting the scale of this patient-driven demand.

Dr. Reddy's Laboratories actively aligns with these societal shifts by focusing on providing affordable and innovative medicines. Their strategy directly caters to the growing demand for cost-effective healthcare solutions, reinforcing their market position.

Dr. Reddy's Laboratories is committed to increasing access to affordable medicines worldwide, aiming to reach over 1.5 billion patients by 2030. This societal objective is particularly crucial for emerging markets and underserved populations who often face significant barriers to healthcare. The company's strategic focus directly addresses the growing global demand for equitable health solutions.

The company's efforts to reach a wider patient demographic are exemplified by collaborations like the one to market Vericiguat for heart failure in India's Tier-I and Tier-II cities. This initiative demonstrates a tangible commitment to bringing advanced treatments to more localized and potentially less-served communities, thereby enhancing healthcare accessibility.

Lifestyle Changes and Disease Patterns

Shifting lifestyle trends globally are fueling an increase in non-communicable diseases, presenting significant growth avenues for pharmaceutical players like Dr. Reddy's. For instance, the World Health Organization reported in 2023 that cardiovascular diseases, diabetes, and certain cancers, often linked to sedentary lifestyles and poor diets, remain leading causes of mortality worldwide.

Dr. Reddy's Laboratories, with its broad product base spanning active pharmaceutical ingredients (APIs), generic drugs, biosimilars, and specialized formulations, is well-positioned to address these evolving health challenges. The company's strategic investments in therapeutic segments such as cardiovascular health and oncology directly align with the rising prevalence of these lifestyle-driven conditions.

This adaptability is crucial as global healthcare spending on chronic disease management continues to rise. For example, the global market for cardiovascular drugs alone was valued at approximately $145 billion in 2023 and is projected to grow further. Dr. Reddy's commitment to innovation in these areas allows it to capitalize on these demographic and health shifts.

- Rising Chronic Diseases: Lifestyle changes are directly linked to increased incidences of conditions like diabetes, heart disease, and obesity, creating a growing demand for pharmaceutical interventions.

- Therapeutic Area Alignment: Dr. Reddy's focus on cardiovascular and oncology segments is strategically aligned with these prevalent lifestyle-related diseases, positioning the company for market growth.

- Market Opportunities: The expanding global market for chronic disease management, estimated to be in the hundreds of billions of dollars, offers substantial revenue potential for companies with relevant product portfolios.

- Diversified Portfolio Advantage: Dr. Reddy's ability to offer APIs, generics, biosimilars, and differentiated formulations allows it to serve a wide spectrum of patient needs arising from these changing disease patterns.

Ethical Considerations and Corporate Social Responsibility

Societal expectations for ethical business practices and corporate social responsibility (CSR) are increasingly crucial for pharmaceutical firms like Dr. Reddy's. In 2023, the company reinforced its commitment by publishing its annual Business Responsibility & Sustainability Report, detailing its progress on environmental, social, and governance (ESG) parameters. This demonstrates a proactive approach to responsible conduct, aligning with growing global demands for transparency and accountability in the sector.

Dr. Reddy's actively engages in CSR initiatives, focusing on areas like healthcare access and community development. For instance, their CSR spending in FY23 was reported at ₹125.7 crore, a significant investment in social impact. Adherence to ethical marketing practices and maintaining transparent operations are fundamental to building and sustaining trust with patients, healthcare providers, and the broader community, which is vital for long-term success in the pharmaceutical industry.

- Commitment to ESG: Dr. Reddy's annual Business Responsibility & Sustainability Report highlights its dedication to environmental, social, and governance standards.

- CSR Investment: The company invested ₹125.7 crore in CSR activities during FY23, underscoring its commitment to societal well-being.

- Trust Building: Ethical marketing and transparent operations are key to fostering trust with patients, healthcare professionals, and the public.

Societal shifts toward greater health awareness and a demand for accessible, affordable medicines significantly benefit Dr. Reddy's Laboratories. The company's strategic focus on generics and biosimilars, coupled with its commitment to CSR, aligns perfectly with these evolving patient expectations and global health priorities.

The increasing global emphasis on preventative healthcare and the rising prevalence of chronic diseases, driven by lifestyle changes, create substantial market opportunities. Dr. Reddy's diversified portfolio and investments in key therapeutic areas like oncology and cardiovascular health strategically position it to capitalize on these trends.

Dr. Reddy's actively addresses societal expectations for ethical conduct and corporate social responsibility, as evidenced by its annual sustainability reports and significant CSR investments. For example, the company invested ₹125.7 crore in CSR activities in FY23, demonstrating a commitment to societal well-being and building trust.

Technological factors

Technological advancements are dramatically reshaping pharmaceutical research and development, accelerating drug discovery and paving the way for more targeted therapies. Dr. Reddy's Laboratories actively invests in its R&D pipeline, seeking out licensing opportunities and focusing on key growth areas like biosimilars and innovative oncology treatments.

The creation of the R&D Indian Council ICPMRD is a significant development, designed to stimulate innovation and foster partnerships across the pharmaceutical and MedTech industries, offering Dr. Reddy's a valuable ecosystem to tap into.

The Indian pharmaceutical sector is rapidly embracing digital transformation, with projections indicating a robust compound annual growth rate of 19.2% for digitization efforts between 2024 and 2029. This shift is critical for enhancing efficiency and innovation across the industry.

Dr. Reddy's Laboratories is actively investing in digital health solutions, understanding the profound influence of Artificial Intelligence (AI). AI's capabilities are revolutionizing drug discovery, improving disease diagnosis accuracy, and streamlining patient care management, marking a significant technological advancement.

Already, AI algorithms demonstrate remarkable precision in diagnosing medical conditions and optimizing various operational processes throughout the pharmaceutical value chain. This technological integration is poised to drive substantial improvements in R&D and operational effectiveness for companies like Dr. Reddy's.

Advancements in biopharmaceutical manufacturing technologies are pivotal for Dr. Reddy's Laboratories' biosimilar segment. These technologies are essential for producing high-quality, cost-effective biosimilars, which represent a significant growth avenue for the company. For instance, continuous process improvements and automation in cell culture and purification are key to achieving competitive pricing and scale.

Dr. Reddy's commitment to leveraging advanced manufacturing is evident in its strategic acquisitions and collaborations in the biosimilar space. These moves allow the company to integrate cutting-edge technologies, enhancing its production capabilities and ensuring compliance with stringent global regulatory standards. The company's focus on optimizing upstream and downstream processes directly impacts its ability to bring complex biologics to market efficiently.

Telemedicine and Digital Health Solutions

Telemedicine and digital health solutions are transforming patient care, particularly in regions facing healthcare access challenges like India. Dr. Reddy's Laboratories is actively embracing this shift, exemplified by its launch of Nerivio®, a digital therapeutic for migraine management in India. This move highlights the company's strategy to leverage technology for improved patient outcomes and broader healthcare reach.

These advancements facilitate remote patient consultations, enabling continuous health monitoring through wearable devices and generating valuable data for personalized treatment plans. This digital integration is crucial for expanding healthcare accessibility and efficiency.

- Digital Therapeutics Adoption: Dr. Reddy's Nerivio® launch in India signifies a concrete step into digital therapeutics, addressing specific patient needs through technology.

- Remote Patient Engagement: Telemedicine platforms allow for virtual consultations, enhancing convenience and access for patients, especially in underserved areas.

- Data-Driven Personalization: Wearable devices and digital health platforms collect real-time data, empowering healthcare providers with insights for tailored patient care strategies.

- Market Growth Potential: The global digital health market is projected to reach significant valuations, with India expected to be a key growth driver, presenting substantial opportunities for companies like Dr. Reddy's. For instance, the Indian digital health market was estimated to be around $8.4 billion in 2022 and is anticipated to grow substantially in the coming years.

Data Analytics and Cybersecurity

The increasing volume of healthcare data, including patient records and clinical trial results, is driving a significant adoption of data analytics. For instance, by the end of 2024, the global big data and business analytics market in healthcare was projected to reach over $40 billion, highlighting its crucial role in uncovering insights into patient behaviors and market trends. This allows companies like Dr. Reddy's to refine their strategies and product development.

However, this data-centric approach introduces substantial cybersecurity risks. Protecting sensitive patient information is paramount, especially with the rise of digital health platforms and remote patient monitoring. A data breach could lead to severe financial penalties and reputational damage, underscoring the need for advanced security measures.

Dr. Reddy's Laboratories must therefore prioritize robust cybersecurity frameworks to ensure compliance with regulations like GDPR and HIPAA. Their investment in secure data handling practices is essential as they continue to integrate digital solutions, aiming to maintain trust and operational integrity in an increasingly data-driven healthcare landscape.

Key considerations for Dr. Reddy's include:

- Investing in advanced encryption and access control systems to safeguard patient data.

- Regularly updating cybersecurity protocols to counter evolving threats.

- Ensuring all digital health initiatives adhere to stringent data privacy regulations.

- Training staff on best practices for data security and handling.

Technological advancements are central to Dr. Reddy's Laboratories' strategy, particularly in R&D and digital health. The company is actively investing in AI for drug discovery and has launched digital therapeutics like Nerivio® in India, demonstrating a commitment to innovation. The Indian digital health market, projected for substantial growth, offers significant opportunities, with an estimated market size of $8.4 billion in 2022.

| Technology Area | Dr. Reddy's Focus/Investment | Market Data/Projection |

|---|---|---|

| Artificial Intelligence (AI) | Drug discovery, disease diagnosis, operational efficiency | AI in drug discovery market expected to grow significantly by 2025 |

| Digital Health Solutions | Nerivio® launch for migraine management | Indian digital health market: ~$8.4 billion (2022), strong CAGR expected |

| Biopharmaceutical Manufacturing | Advancements in biosimilar production (automation, process improvements) | Focus on cost-effectiveness and scale for biosimilar segment |

| Data Analytics | Leveraging healthcare data for insights | Global healthcare big data market projected >$40 billion by end of 2024 |

Legal factors

Dr. Reddy's Laboratories navigates a complex web of drug regulation and approval processes across its key markets, including the United States, Europe, and its home base in India. These regulations are fundamental to market access and product viability.

In 2024, India's Central Drugs Standard Control Organization (CDSCO) continued to implement enhanced guidelines aimed at improving drug safety and efficacy, impacting everything from clinical trial data requirements to post-market surveillance. For instance, new rules around pharmacovigilance reporting have become more rigorous.

Compliance with evolving standards, such as Good Manufacturing Practices (GMP) and increasingly stringent export protocols, is non-negotiable for Dr. Reddy's. Failure to adhere to these can lead to significant delays in product registration and can even bar market entry, directly affecting revenue streams and global reach.

Patent laws and intellectual property rights are critical for Dr. Reddy's, especially in the generics and biosimilars markets. The company's strategy involves extensive patent landscaping to identify opportunities and potential challenges. For instance, the upcoming patent expiries of several blockbuster drugs in 2024 and 2025 present significant opportunities for Dr. Reddy's to introduce cost-effective alternatives, potentially capturing a substantial share of the market.

Dr. Reddy's Laboratories, as a significant global pharmaceutical entity, must diligently comply with antitrust and competition regulations across its operating regions. These legal frameworks are designed to foster fair market practices and curb monopolistic tendencies, directly impacting how the company approaches market entry, sets pricing, and pursues strategic collaborations or acquisitions.

The evolving landscape of the biosimilar market, increasingly characterized by patent expirations, underscores the critical need for Dr. Reddy's to navigate these complex legal requirements with precision. For instance, in 2024, regulatory bodies worldwide continue to scrutinize market concentration, potentially affecting the launch and pricing of new generic and biosimilar products, which are key growth areas for Dr. Reddy's.

Product Liability and Consumer Protection Laws

Dr. Reddy's Laboratories operates under stringent product liability and consumer protection laws, making it accountable for the safety and effectiveness of its pharmaceutical products. Failure to meet these standards can result in significant penalties and reputational damage.

To manage these risks, the company must maintain rigorous quality control measures and thorough post-market surveillance to quickly identify and address any product defects or adverse events. This proactive approach is critical in the highly regulated pharmaceutical sector.

The global nature of Dr. Reddy's operations necessitates a sophisticated approach to compliance, as product liability and consumer protection laws differ significantly across various countries. For instance, in 2024, regulatory bodies like the FDA in the US and the EMA in Europe continued to emphasize stringent pharmacovigilance reporting, with companies facing increased scrutiny on adverse event data.

- Product Safety Mandates: Adherence to global Good Manufacturing Practices (GMP) is paramount to ensure product quality and prevent liability claims.

- Consumer Rights: Laws protect consumers from misleading advertising and ensure access to accurate product information, impacting marketing strategies.

- Adverse Event Reporting: Robust systems for tracking and reporting adverse drug reactions are legally required, with significant fines for non-compliance.

- Recall Procedures: Companies must have established protocols for product recalls, a critical component of consumer protection and liability mitigation.

Data Privacy and Digital Health Regulations

The growing use of digital health tools, including telemedicine and data analytics, brings fresh legal challenges concerning data privacy and safeguarding patient information. For instance, in 2024, the global digital health market was valued at over $350 billion, highlighting the scale of data involved.

Regulations such as the EU's General Data Protection Regulation (GDPR) and various national data protection laws demand strong cybersecurity and clear data handling policies. Non-compliance can lead to significant fines; for example, GDPR penalties can reach up to 4% of global annual turnover.

Dr. Reddy's Laboratories must navigate these evolving digital health legal frameworks to preserve patient confidence and steer clear of legal repercussions. This includes implementing stringent data protection protocols for all its digital health initiatives.

- Data Privacy Compliance: Adherence to GDPR and similar national laws is critical for handling patient data securely.

- Cybersecurity Investment: Robust cybersecurity measures are essential to protect sensitive health information from breaches.

- Transparency in Data Handling: Clear communication with patients about how their data is collected, used, and protected builds trust.

- Regulatory Monitoring: Staying updated on and complying with evolving digital health regulations is paramount to avoid legal penalties.

Dr. Reddy's Laboratories faces stringent regulatory oversight, impacting product approvals, manufacturing, and market access. Compliance with evolving standards like GMP remains critical, with significant penalties for non-adherence, as seen in India's CDSCO enhancing its safety guidelines in 2024.

Intellectual property laws are vital, especially with patent expiries of key drugs in 2024-2025 creating opportunities for generics and biosimilars, a core focus for Dr. Reddy's. Navigating antitrust regulations is also key to fair market practices and strategic growth.

Product liability and consumer protection laws hold Dr. Reddy's accountable for product safety, necessitating robust quality control and post-market surveillance, with global variations in regulations like pharmacovigilance reporting requiring diligent attention.

Digital health initiatives introduce data privacy challenges, with regulations like GDPR imposing strict data handling policies and significant financial penalties for breaches, underscoring the need for strong cybersecurity and transparency.

| Legal Factor | Impact on Dr. Reddy's | 2024/2025 Relevance |

| Drug Regulation & Approval | Market access, product viability | India's CDSCO enhanced safety guidelines; ongoing scrutiny of biosimilars |

| Intellectual Property Rights | Generics/biosimilars market share, R&D strategy | Patent expiries of blockbuster drugs in 2024-2025 |

| Product Liability & Consumer Protection | Reputational risk, operational costs | Increased focus on pharmacovigilance reporting by FDA/EMA |

| Data Privacy (Digital Health) | Cybersecurity investment, compliance costs | GDPR fines up to 4% of global annual turnover; digital health market exceeding $350 billion in 2024 |

Environmental factors

Dr. Reddy's Laboratories actively showcases its dedication to environmental, social, and governance (ESG) principles, notably in its Business Responsibility & Sustainability Report for FY2024. This report details the company's efforts in areas like reducing greenhouse gas emissions and managing water resources, aiming for more sustainable operations.

The company's integrated annual report for FY2024-25 further underscores its commitment by illustrating how ESG principles are woven into the core business strategy, emphasizing a comprehensive approach to creating long-term value. This includes investments in renewable energy sources and initiatives to minimize waste across its manufacturing facilities.

Dr. Reddy's Laboratories, like all pharmaceutical manufacturers, faces significant environmental responsibilities concerning waste management and pollution control. The complex processes involved in drug development and production inevitably generate diverse waste streams, including chemical byproducts and biological materials, necessitating stringent adherence to environmental regulations.

The company must meticulously manage the disposal of these hazardous wastes to mitigate any adverse effects on ecosystems. For instance, in 2023, the global pharmaceutical waste management market was valued at approximately $10.5 billion, highlighting the scale of this industry challenge and the critical need for robust systems.

Continuous investment in innovative waste reduction technologies and enhanced recycling programs is paramount for Dr. Reddy's to minimize its environmental footprint. Proactive measures in this area not only ensure regulatory compliance but also contribute to a more sustainable operational model.

Dr. Reddy's Laboratories, like many pharmaceutical firms, faces growing scrutiny regarding its environmental impact and carbon footprint. While specific, publicly disclosed carbon emission figures for Dr. Reddy's were not readily available in recent reports, the company's stated commitment to Environmental, Social, and Governance (ESG) principles indicates ongoing efforts to reduce its environmental impact.

The pharmaceutical sector is under increasing pressure to align with global climate change regulations and emissions targets. Compliance with these evolving standards across its diverse operating regions is crucial for Dr. Reddy's long-term business sustainability and reputation. For instance, the European Union's Green Deal aims for climate neutrality by 2050, a goal that will likely influence regulatory requirements for companies operating within or exporting to the EU.

Resource Scarcity and Sustainable Sourcing

The pharmaceutical sector, including Dr. Reddy's Laboratories, faces environmental challenges related to resource scarcity. Water and energy are critical inputs for manufacturing, and their availability can be impacted by climate change and increasing demand. For instance, the global water stress index highlights regions where water scarcity is already a significant issue, potentially affecting supply chains.

Dr. Reddy's must prioritize sustainable sourcing of raw materials and optimize resource usage. This involves a proactive approach to ensure long-term operational resilience. By focusing on efficient manufacturing processes, the company can mitigate risks associated with fluctuating resource availability and costs.

Exploring renewable energy sources and implementing robust water conservation measures are key strategies. For example, investments in solar power for manufacturing facilities can reduce reliance on fossil fuels. Similarly, advanced water recycling technologies can significantly lower overall water consumption, demonstrating a commitment to environmental stewardship and operational efficiency.

- Water Consumption: The pharmaceutical industry is a significant water user, with some facilities consuming millions of liters daily.

- Energy Intensity: Manufacturing active pharmaceutical ingredients (APIs) can be energy-intensive, requiring substantial electricity and thermal energy.

- Renewable Energy Adoption: Many leading pharmaceutical companies are setting targets to increase their use of renewable energy, aiming for 100% by specific future dates.

- Sustainable Sourcing: Initiatives focus on tracing raw material origins and ensuring suppliers adhere to environmental and ethical standards.

Supply Chain Environmental Impact

The environmental impact of Dr. Reddy's Laboratories' extensive supply chain, encompassing everything from sourcing raw materials to delivering finished pharmaceuticals, is a critical area of focus. This includes emissions from transportation, waste generation from packaging, and the environmental footprint of manufacturing processes used by partners.

Dr. Reddy's actively promotes sustainability throughout its supply chain, urging its partners to embrace and implement environmentally sound practices. This collaborative approach aims to minimize the collective ecological impact.

Effectively managing the environmental footprint across the entire value chain is paramount for Dr. Reddy's to demonstrate robust environmental stewardship and meet the growing expectations of investors, regulators, and consumers. For instance, in 2023, the company reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by 10% compared to its 2020 baseline, indicating progress in its operational sustainability efforts that extend to its supply chain partners.

- Greenhouse Gas Emissions: Dr. Reddy's aims to reduce emissions across its logistics and partner manufacturing sites.

- Waste Management: Initiatives focus on minimizing packaging waste and promoting recycling within the supply chain.

- Water Stewardship: Efforts are in place to ensure responsible water usage by suppliers, particularly in water-stressed regions where raw materials are sourced.

- Sustainable Sourcing: The company is increasingly evaluating suppliers based on their environmental performance and commitment to sustainable practices.

Dr. Reddy's Laboratories is addressing environmental factors by focusing on reducing greenhouse gas emissions and managing water resources, as detailed in its FY2024 Business Responsibility & Sustainability Report. The company's FY2024-25 integrated annual report highlights how ESG principles are integrated into its business strategy, including investments in renewable energy and waste minimization initiatives.

The pharmaceutical industry faces significant environmental responsibilities, particularly in waste management and pollution control, given the chemical and biological materials involved in drug production. The global pharmaceutical waste management market was valued at approximately $10.5 billion in 2023, underscoring the scale of this challenge and the need for robust systems.

Dr. Reddy's reported a 10% reduction in Scope 1 and Scope 2 greenhouse gas emissions by 2023 compared to its 2020 baseline, demonstrating progress in operational sustainability. This commitment extends to its supply chain, with initiatives targeting emissions, waste, water usage, and sustainable sourcing among its partners.

| Environmental Focus Area | Dr. Reddy's FY2023/2024 Data/Initiatives | Industry Context |

|---|---|---|

| Greenhouse Gas Emissions Reduction | 10% reduction in Scope 1 & 2 emissions (vs. 2020 baseline) by 2023. | Global pressure to align with climate regulations and emissions targets. |

| Waste Management | Minimizing packaging waste and promoting recycling across the supply chain. | Pharmaceutical waste management market valued at ~$10.5 billion in 2023. |

| Water Stewardship | Implementing robust water conservation measures and recycling technologies. | Pharmaceutical manufacturing is a significant water user; global water stress is a growing concern. |

| Renewable Energy Adoption | Investment in renewable energy sources for manufacturing facilities. | Many leading pharma companies setting targets for 100% renewable energy use. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Dr. Reddy's Laboratories is built on comprehensive data from reputable sources, including financial reports from international organizations like the World Health Organization, economic indicators from agencies such as the IMF and World Bank, and industry-specific publications.

We integrate insights from government regulatory bodies, environmental agencies, technological trend reports, and legal databases, alongside market research from leading firms and insights into socio-cultural shifts impacting the pharmaceutical sector.