Dr. Reddy's Laboratories Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dr. Reddy's Laboratories Bundle

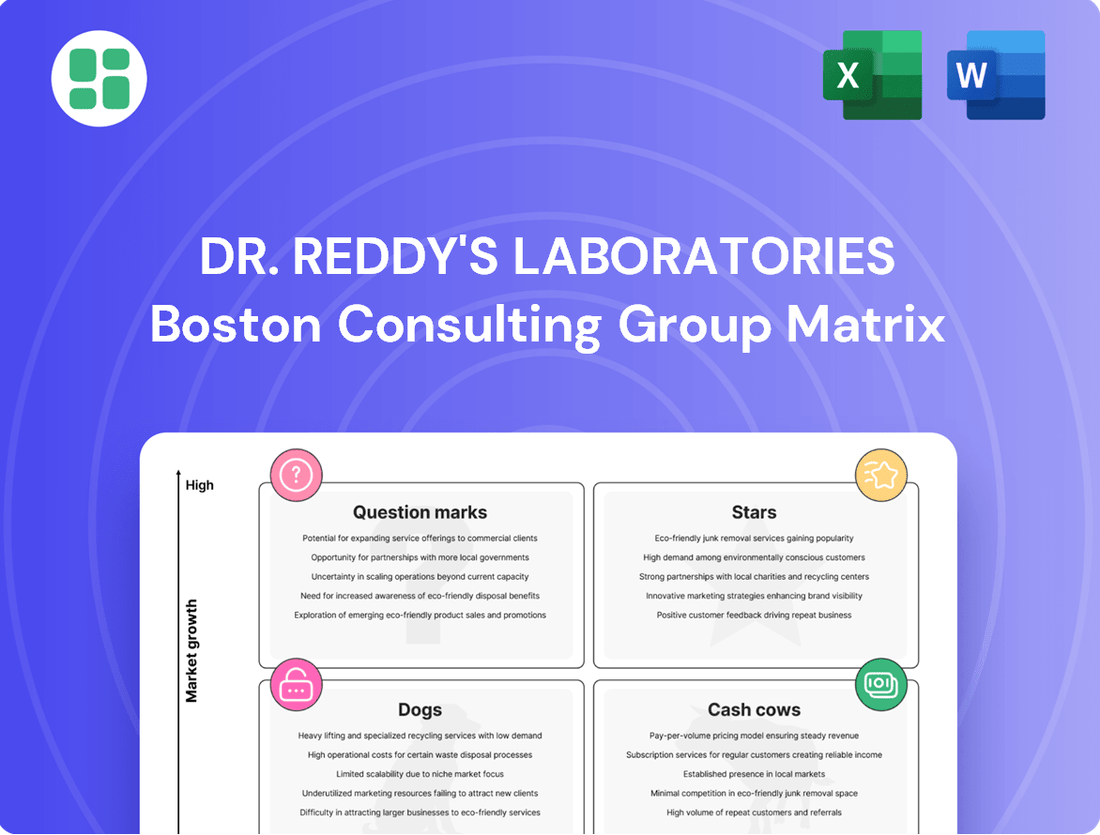

Curious about Dr. Reddy's Laboratories' strategic product portfolio? Our BCG Matrix analysis offers a glimpse into their market position, identifying potential Stars, Cash Cows, Dogs, and Question Marks. Don't miss out on the full picture.

Unlock the complete Dr. Reddy's Laboratories BCG Matrix to gain a comprehensive understanding of their product performance and market share. This detailed report provides actionable insights to guide your investment and strategic planning.

Ready to make informed decisions about Dr. Reddy's Laboratories? Purchase the full BCG Matrix for a clear, quadrant-by-quadrant breakdown, empowering you with the knowledge to capitalize on opportunities and mitigate risks.

Stars

Dr. Reddy's Nicotine Replacement Therapy (NRT) portfolio is a key growth area, significantly bolstered by the September 2024 acquisition of Haleon's Nicotinell and related NRT brands outside the US. This strategic move is already demonstrating impressive results, making these brands market leaders in a burgeoning segment.

The impact of this acquisition is clearly visible in the company's financial performance. Europe's revenue experienced a remarkable 75% growth in FY2025, largely driven by this NRT portfolio. Furthermore, the first quarter of FY2026 saw a substantial 12% quarter-over-quarter increase in contribution from these brands, underscoring their immediate and ongoing value.

Dr. Reddy's Laboratories is aggressively expanding its biosimilar portfolio, targeting high-growth segments. The launch of Versavo, a bevacizumab biosimilar, in key markets like the UK, US, and Europe demonstrates this commitment. This move positions them to capture significant market share in the increasingly competitive biosimilars arena.

The company's robust pipeline further underscores its strategic focus on biosimilars. With ongoing development of rituximab and denosumab, the latter already filed in the US and Europe, Dr. Reddy's is building a strong foundation. An anticipated Phase III readout for abatacept in November 2025, with a filing expected by year-end, highlights their forward-looking approach to innovation and market entry.

A pivotal partnership with Alvotech to co-develop a biosimilar to Keytruda (pembrolizumab) significantly bolsters Dr. Reddy's presence in the high-value oncology biosimilar space. This collaboration, expected to yield significant returns, reflects a strategic intent to leverage external expertise and resources for accelerated market penetration in critical therapeutic areas.

Dr. Reddy's Laboratories strategically targets complex generics and injectables, including first-to-file opportunities. These specialized products, such as their biosimilar injectables, often face limited competition and offer higher profit margins, driving revenue growth, especially in markets like North America.

Oncology Therapeutic Area

Dr. Reddy's Laboratories is significantly bolstering its oncology offerings. This includes pioneering novel small molecules targeting immuno-oncology, with several candidates progressing through preclinical and clinical trials. The company's strategic alliance with Alvotech for a biosimilar of Keytruda underscores its dedication to this high-growth sector.

This concentrated effort on cutting-edge and highly sought-after cancer therapies is designed to propel Dr. Reddy's oncology segment toward substantial future expansion and market dominance. For instance, in the fiscal year 2024, Dr. Reddy's reported a notable increase in its oncology revenue, driven by both its established products and the pipeline advancements.

- Portfolio Expansion: Development of novel small molecules in immuno-oncology with multiple assets in preclinical and clinical stages.

- Strategic Collaborations: Partnership with Alvotech for a Keytruda biosimilar, addressing a key market need.

- Growth Potential: Focus on innovative and high-demand cancer treatments positions the oncology segment for significant future growth.

- Market Position: Aiming for market leadership through a robust and forward-looking oncology strategy.

European Market Performance

The European market has been a significant growth engine for Dr. Reddy's Laboratories. Revenue in this region saw a remarkable surge of 75% in FY2025, followed by an even more impressive 142% increase in Q1FY26. This exceptional performance underscores the company's strategic focus and execution in Europe.

Key drivers behind this success include the strategic acquisition of the NRT portfolio, which has significantly bolstered the company's market presence. Furthermore, the successful introduction of new products across major European markets has resonated well with consumers and healthcare providers alike.

- Revenue Growth in Europe: 75% in FY2025 and 142% in Q1FY26.

- Key Growth Drivers: Acquired NRT portfolio and new product launches.

- Market Position: Strong momentum and solidifying market share.

- Strategic Approach: Continued focus on acquisitions and new product introductions.

Dr. Reddy's Laboratories' oncology segment, particularly its focus on immuno-oncology and biosimilars like the Keytruda biosimilar in partnership with Alvotech, positions it strongly within the BCG matrix as a potential Star. The company's investment in novel small molecules and a robust pipeline, including anticipated Phase III readouts and filings by late 2025, indicates a high growth potential in a rapidly expanding market. This strategic push aims to capture significant market share and drive future revenue, solidifying its standing as a key player in cancer therapies.

| Segment | Growth Rate | Market Share | Strategic Focus |

|---|---|---|---|

| Oncology (Immuno-oncology & Biosimilars) | High | Growing/Targeting Leadership | Novel small molecules, Keytruda biosimilar partnership, pipeline development |

| Nicotine Replacement Therapy (NRT) | High (driven by acquisition) | Market Leader (in specific segments) | Acquisition of Nicotinell, European market expansion |

| Biosimilars (General) | High | Expanding | Versavo launch, rituximab and denosumab development |

| Complex Generics & Injectables | Moderate to High | Established/Growing | First-to-file opportunities, North America focus |

What is included in the product

This BCG Matrix analysis of Dr. Reddy's Laboratories highlights which product units to invest in, hold, or divest based on market share and growth.

Dr. Reddy's Laboratories BCG Matrix provides a clear, visual roadmap for strategic resource allocation, alleviating the pain point of uncertain investment decisions.

Cash Cows

North America Generics, excluding Lenalidomide, stands as a significant cash cow for Dr. Reddy's Laboratories. This segment is projected to contribute roughly 50% of the company's global generics revenue in fiscal year 2025, underscoring its substantial market presence and consistent sales generation.

Despite general price pressures within the generics market, the sheer volume and established nature of Dr. Reddy's North American portfolio ensure robust cash flow. The company's broad range of stable generic medications in this region continues to be a reliable source of earnings.

Dr. Reddy's Active Pharmaceutical Ingredients (API) business is a cornerstone, acting as a cash cow that not only supports its own generic drug production through backward integration but also serves as a key supplier to other pharmaceutical companies. This segment is a significant contributor to the company's financial health, reflecting its maturity and stability in the market.

In fiscal year 2024, the API business accounted for a solid 11% of Dr. Reddy's overall revenue. This consistent performance underscores its role as a reliable revenue generator, bolstering the company's financial foundation and diminishing its dependence on outside API sources.

Established branded generics in India represent a significant Cash Cow for Dr. Reddy's Laboratories. This segment, contributing 17% to the company's overall sales in FY2025, demonstrates consistent growth fueled by both new product introductions and enhanced volumes of established offerings.

Dr. Reddy's strategically focuses on expanding its 'Mega Brands' within the prescription and over-the-counter (OTC) markets. These brands, characterized by their maturity, likely possess strong customer loyalty and a stable, dominant market share.

The robust performance of these branded generics in the key Indian domestic market ensures a reliable and substantial generation of cash flow, underscoring their Cash Cow status within the company's portfolio.

Key Therapeutic Areas: Cardiovascular and Gastrointestinal

Dr. Reddy's Laboratories has a significant and enduring commitment to its cardiovascular and gastrointestinal therapeutic areas. These segments, while operating in mature markets, are characterized by the company's strong market share and dependable customer demand.

The stability and robust profit margins generated by these foundational business areas are crucial for Dr. Reddy's overall cash flow. For instance, in fiscal year 2024, Dr. Reddy's reported strong performance in its established markets, contributing to its financial resilience.

- Cardiovascular and Gastrointestinal: Mature markets with high market share for Dr. Reddy's.

- Consistent demand and stability contribute to significant cash generation.

- These areas are key "cash cows" supporting other business segments.

- In FY24, Dr. Reddy's maintained a solid presence in these therapeutic categories, underpinning its financial strength.

In-licensed Sanofi Vaccine Portfolio in India

Dr. Reddy's Laboratories' in-licensed Sanofi vaccine portfolio in India is a prime example of a cash cow. This partnership, which positions Dr. Reddy's as the second-largest vaccine player in India, generated significant and stable revenue in FY2025, bolstering the company's domestic business. The consistent demand for these established vaccine brands provides a predictable income stream, reinforcing their cash cow status.

- Market Position: Dr. Reddy's holds the second position in the Indian vaccine market, largely due to the Sanofi partnership.

- Revenue Contribution: The in-licensed portfolio was a key driver of growth for Dr. Reddy's India business in FY2025.

- Predictable Income: The consistent demand for Sanofi's vaccine brands ensures a stable and reliable revenue stream.

The North America Generics segment, excluding Lenalidomide, is a significant cash cow for Dr. Reddy's, projected to contribute around 50% of global generics revenue in FY2025. Despite market price pressures, its large volume and established portfolio ensure robust cash flow. The company's Active Pharmaceutical Ingredients (API) business also acts as a cash cow, supporting internal production and serving external clients, contributing 11% to overall revenue in FY2024.

| Business Segment | Projected FY2025 Contribution | FY2024 Revenue Contribution | Key Characteristic |

|---|---|---|---|

| North America Generics (ex-Lenalidomide) | ~50% of Global Generics Revenue | N/A | High volume, established portfolio, stable cash generation |

| Active Pharmaceutical Ingredients (API) | N/A | 11% of Overall Revenue | Backward integration, external sales, mature and stable |

Preview = Final Product

Dr. Reddy's Laboratories BCG Matrix

The Dr. Reddy's Laboratories BCG Matrix you are previewing is the complete, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, offers a clear strategic overview of Dr. Reddy's product portfolio, ready for immediate integration into your business planning. You can confidently expect the exact same professionally formatted and data-rich report to be delivered to you, enabling informed decision-making and actionable insights.

Dogs

Dr. Reddy's Laboratories' older, undifferentiated US generics are in a challenging position. In the first quarter of fiscal year 2026, this segment experienced an 11% year-over-year decrease in revenue. This downturn is largely attributable to aggressive price reductions on several of their core generic medications.

These established, less specialized generic products are caught in a highly competitive market, which has severely squeezed their profit margins. The combination of declining profitability and limited potential for future growth means these products are classified as Dogs in the BCG matrix. Continued investment in this area is unlikely to generate substantial returns.

Within Dr. Reddy's Laboratories' API portfolio, some products fall into the category of commoditized offerings. These are APIs where differentiation is minimal, often due to a lack of proprietary manufacturing processes or unique intellectual property. For instance, in 2023, while the overall API segment showed resilience, certain basic APIs faced significant price pressures.

These commoditized APIs typically yield lower profit margins and are subject to intense global competition, making them less attractive from a strategic standpoint. Dr. Reddy's has been actively working to pivot its API business towards more complex, value-added, and differentiated products.

Dr. Reddy's Laboratories might have certain products in emerging markets where strong revenue growth is consistently eroded by unfavorable foreign exchange rate movements. This can lead to declining profitability when results are reported in a stronger currency, effectively trapping capital. For instance, if a product sees a 15% volume increase but the local currency depreciates by 10% against the reporting currency, the net reported growth could be significantly muted, hindering capital efficiency.

Specific Legacy Products with Declining Volumes

Within Dr. Reddy's Laboratories' extensive product range, certain established legacy medications are experiencing a steady decrease in sales volume. This decline is often a natural consequence of market saturation, evolving medical practices, or the introduction of more advanced therapeutic options. These products, if they lack substantial reinvestment in innovation or strategic market support, may operate at a breakeven point or even become cash drains, aligning them with the characteristics of a 'Dog' in a BCG matrix analysis.

For instance, considering the broader pharmaceutical landscape in 2024, many older antibiotics or cardiovascular drugs that were once blockbusters might now face significant competition from newer, more effective treatments. Dr. Reddy's, like its peers, must continually assess its portfolio to identify such products.

- Legacy Product Portfolio Assessment: Dr. Reddy's likely has several older drugs with declining sales, a common trend in the pharmaceutical industry as newer treatments emerge.

- Market Dynamics: Factors such as patent expirations, increased generic competition, and shifts in clinical guidelines contribute to the volume decline of legacy products.

- Financial Performance: These products may be nearing or at a breakeven point, potentially consuming resources without significant future growth potential, thus fitting the 'Dog' category.

Lenalidomide after Exclusivity Period

Lenalidomide, a cornerstone product for Dr. Reddy's Laboratories, is projected to shift into the 'Dog' quadrant of the BCG Matrix post-exclusivity. The US generics market is already experiencing pronounced pricing pressures, a trend expected to intensify for Lenalidomide.

Following the expiration of its exclusivity period after Q2 FY26, the product's revenue contribution is anticipated to diminish significantly. This transition marks Lenalidomide from a high-margin asset to a product facing substantial competitive headwinds and considerable price erosion.

- Product: Lenalidomide

- Market: US Generics

- Key Challenge: Intensifying pricing pressure

- Projected Transition: From Star/Cash Cow to Dog post-Q2 FY26 exclusivity

Dr. Reddy's Laboratories' legacy products, particularly in the US generics market, are increasingly being categorized as Dogs. These products face declining sales volumes and intense price competition, leading to reduced profitability and limited growth prospects. For instance, the company's older, undifferentiated US generics saw an 11% revenue decrease in Q1 FY26 due to aggressive price cuts.

Commoditized Active Pharmaceutical Ingredients (APIs) also represent a portion of Dr. Reddy's 'Dog' portfolio. These APIs lack significant differentiation and are subject to global price pressures, yielding lower margins. The company is actively working to shift its API focus towards more specialized and higher-value offerings.

Lenalidomide, a significant product for Dr. Reddy's, is projected to enter the 'Dog' quadrant following the expiration of its exclusivity after Q2 FY26. The US generics market's existing pricing pressures are expected to intensify for this drug, leading to a substantial decline in its revenue contribution and profitability.

| Product Category | Market Segment | Key Characteristics | Financial Trend (Illustrative) | BCG Classification |

|---|---|---|---|---|

| Legacy US Generics | United States | Declining sales volume, intense price competition | -11% YoY revenue decline (Q1 FY26) | Dog |

| Commoditized APIs | Global | Low differentiation, price sensitivity, lower margins | Stable but low growth, margin erosion | Dog |

| Lenalidomide (Post-Exclusivity) | United States | High competition, significant price erosion | Projected substantial revenue decline post-Q2 FY26 | Projected Dog |

Question Marks

Dr. Reddy's Laboratories' generic Semaglutide portfolio is positioned as a potential Star or Question Mark within its BCG Matrix. The company's ambitious plan to launch in 87 countries from 2026 highlights a high-growth market opportunity in the weight-loss drug sector.

However, the landscape is already competitive, with Canada seeing five generic Semaglutide manufacturers and Citi anticipating further market saturation. This intense competition introduces significant uncertainty regarding market share and future profitability, making it a high-risk, high-reward venture.

Dr. Reddy's Laboratories is heavily invested in novel chemical entities (NCEs) within the immuno-oncology space, a sector characterized by significant growth potential and inherent risks. Their pipeline includes promising assets such as CA170, currently in Phase III trials, and AUR103, progressing through Phase II development.

These immuno-oncology NCEs are quintessential examples of "Stars" in a BCG Matrix context. They operate in a high-growth market and require considerable R&D expenditure to reach commercialization. Successful clinical trials and regulatory approvals are critical for these ventures to realize their high-reward potential.

Dr. Reddy's Laboratories is strategically venturing into digital therapeutics and cell & gene therapies, signaling a commitment to high-growth, innovative healthcare. These represent emerging areas for the company, characterized by substantial initial investments and currently modest market penetration.

While these segments are nascent for Dr. Reddy's, holding low market share, their future potential is considerable. The success and eventual market positioning of these ventures remain subject to ongoing development and market acceptance, reflecting their status as question marks in the BCG matrix.

New Geographic and Niche Market Entries via Partnerships

Dr. Reddy's Laboratories strategically leverages partnerships to penetrate new geographic and niche markets, a classic "Question Mark" strategy in the BCG Matrix. For instance, their distribution agreement for Novartis' anti-diabetes brands, Galvus® and Galvus Met®, in Russia exemplifies this approach. This move targets a growing healthcare segment in a new territory.

Further expanding into niche medical devices, Dr. Reddy's launched the Nerivio® migraine device in Europe. This venture aims to capture a specific patient population with unmet needs. Similarly, the introduction of a new medical device for acute pancreatitis in Russia signifies an entry into another specialized medical field.

- New Geographic Entry: Distribution of Novartis' anti-diabetes brands in Russia.

- Niche Market Entry: Launch of Nerivio® migraine device in Europe.

- Niche Market Entry: Introduction of a medical device for acute pancreatitis in Russia.

These initiatives, while holding high growth potential, currently represent low market share. They necessitate substantial investment in marketing and driving adoption to achieve significant market penetration and transition into stronger positions within the BCG Matrix.

Biosimilar Abatacept Development

Biosimilar Abatacept represents a significant investment for Dr. Reddy's Laboratories, currently positioned as a question mark in their BCG matrix. The company anticipates a Phase III readout in November 2025 and plans to file for regulatory approval by the end of the same year. A potential launch for an intravenous version is slated for early 2027, indicating a substantial commitment to this high-value biologic.

While the biosimilar market offers considerable growth potential, Abatacept's development is ongoing, meaning its future market penetration and ultimate success remain uncertain. This necessitates continued substantial investment in research, clinical trials, and regulatory processes. The company's strategic focus is on navigating these development hurdles to unlock the product's full market potential.

- Biosimilar Abatacept Development Status: Phase III readout expected November 2025, filing planned by end of 2025.

- Potential Launch Timeline: Early 2027 for the intravenous version.

- Market Position: Considered a question mark in the BCG matrix due to ongoing development and regulatory stages.

- Investment Requirement: Continued heavy investment is necessary to overcome development and regulatory challenges and achieve market success.

Dr. Reddy's Laboratories' ventures into digital therapeutics, cell & gene therapies, and niche medical devices like Nerivio® are currently classified as Question Marks. These areas represent significant growth potential but require substantial upfront investment and have yet to establish a strong market share.

The company's strategic partnerships for distributing brands like Galvus® in Russia and its entry into the acute pancreatitis device market in the same region also fall into the Question Mark category. These moves aim to tap into growing healthcare segments in new territories, but their future success hinges on market adoption and penetration.

Biosimilar Abatacept, with its Phase III readout anticipated in late 2025 and a potential early 2027 launch, remains a Question Mark. Its future market share is uncertain, demanding continued investment to navigate development and regulatory pathways.

The generic Semaglutide portfolio, despite its high-growth market opportunity, is also a Question Mark due to intense competition and market saturation. Dr. Reddy's ambitious launch plans across 87 countries from 2026 face significant uncertainty regarding market share and profitability.

BCG Matrix Data Sources

Our BCG Matrix leverages Dr. Reddy's official financial disclosures, comprehensive market research reports, and industry growth forecasts to provide a robust strategic overview.