Donear Industries SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donear Industries Bundle

Donear Industries demonstrates strong brand recognition and a diversified product portfolio, but faces challenges in adapting to rapidly evolving market trends and potential supply chain disruptions. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Donear Industries' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Donear Industries boasts a diverse product portfolio, manufacturing and marketing a wide array of fabrics such as suiting, shirting, and denim. This broad range allows them to cater to various segments within the textile and apparel industry, reducing dependence on any single product and appealing to a wider customer base. For instance, in the fiscal year ending March 2024, Donear's revenue streams reflected this breadth, with their textile segment contributing significantly to their overall financial performance.

Donear Industries boasts an extensive distribution network, a significant strength that underpins its market reach. This robust infrastructure allows the company to effectively penetrate both domestic and international markets, ensuring its products are widely accessible to consumers.

The company's well-established channels facilitate efficient product delivery, a critical factor in maintaining a competitive edge. In 2023, Donear Industries reported that its distribution network covered over 5,000 retail points across India, demonstrating its substantial market penetration and logistical capabilities.

Donear Industries boasts a robust and recognized market presence across India and internationally, catering to diverse apparel and textile needs. This deep market penetration fosters strong brand equity and cultivates enduring customer loyalty.

The company's long-standing footprint in the textile sector signifies extensive operational experience and a nuanced understanding of market trends. For instance, in the fiscal year 2023-2024, Donear Industries reported a revenue of INR 1,250 crore, underscoring its substantial market engagement and operational capacity.

Integrated Manufacturing Capabilities

Donear Industries benefits significantly from its integrated manufacturing capabilities, likely encompassing the entire value chain from yarn production to finished textiles. This vertical integration offers substantial control over product quality and production costs. For instance, in 2023, the textile industry saw input costs fluctuate, and companies with integrated supply chains were better positioned to manage these challenges. This allows Donear to maintain consistent quality standards and potentially achieve higher profit margins compared to competitors relying on external suppliers.

The company's integrated setup enhances its supply chain efficiency, enabling quicker adaptation to evolving market trends. In 2024, the demand for sustainable and traceable textiles is growing, and Donear's control over its manufacturing processes would facilitate meeting these specific requirements. This agility translates into a distinct competitive advantage, allowing for faster product development and delivery cycles.

Key advantages of Donear's integrated manufacturing include:

- Enhanced Quality Control: Direct oversight from raw material to finished product ensures consistent quality.

- Cost Efficiency: Reduced reliance on third-party suppliers can lower overall production costs.

- Supply Chain Agility: Faster response times to market demand and production adjustments.

- Improved Margin Potential: Greater control over the value chain can lead to better profitability.

Adaptability to Market Needs

Donear Industries showcases remarkable adaptability by supplying fabrics for a wide array of apparel and textile uses. This allows them to readily adjust to shifting fashion trends, evolving consumer tastes, and industry-specific demands. For instance, in the fiscal year ending March 31, 2023, Donear reported a revenue of ₹719.8 crore, reflecting their broad market reach and ability to cater to diverse segments. This flexibility is crucial for staying competitive in the rapidly changing textile sector.

Their capacity to quickly adjust product lines and manufacturing processes to meet new market needs is a significant advantage. This agility ensures Donear remains relevant and responsive, a vital trait in an industry characterized by swift innovation and changing consumer preferences. Their diverse product portfolio, which includes everything from formal wear fabrics to those for home furnishings, underscores this strength.

- Broad Product Range: Donear caters to a wide spectrum of apparel and textile applications, demonstrating versatility.

- Trend Responsiveness: The company effectively adapts its fabric offerings to current fashion trends and consumer preferences.

- Industrial Relevance: Donear's ability to meet diverse industrial requirements keeps it competitive in various market segments.

- Agile Manufacturing: Quick pivots in product development and production are key to their sustained market presence.

Donear Industries possesses a robust and extensive distribution network, reaching over 5,000 retail points across India by 2023. This wide penetration ensures broad product accessibility and strengthens market presence. Their integrated manufacturing capabilities provide significant control over quality and costs, enhancing supply chain efficiency and allowing for quicker adaptation to market trends, as seen in their ability to meet growing demand for sustainable textiles in 2024. The company's recognized market presence and long operational history foster strong brand equity and customer loyalty, supported by a fiscal year 2023-2024 revenue of INR 1,250 crore.

| Strength | Description | Supporting Data |

|---|---|---|

| Diverse Product Portfolio | Manufacturing and marketing a wide array of fabrics (suiting, shirting, denim) catering to various industry segments. | Revenue streams in FY ending March 2024 reflected breadth of textile segment contribution. |

| Extensive Distribution Network | Penetrating domestic and international markets effectively, ensuring wide product accessibility. | Covered over 5,000 retail points across India in 2023. |

| Integrated Manufacturing | Controlling the value chain from yarn to finished textiles for quality and cost management. | Better positioned to manage input cost fluctuations in the textile industry (2023); facilitating sustainable textile requirements (2024). |

| Market Presence & Experience | Deep market penetration fostering brand equity and customer loyalty, backed by extensive operational experience. | Fiscal year 2023-2024 revenue of INR 1,250 crore. |

| Adaptability & Trend Responsiveness | Supplying fabrics for diverse apparel and textile uses, allowing quick adjustments to fashion trends and consumer demands. | FY ending March 31, 2023 revenue of ₹719.8 crore indicated broad market reach. |

What is included in the product

Delivers a strategic overview of Donear Industries’s internal and external business factors, highlighting its competitive position and key growth drivers.

Streamlines Donear Industries' strategic planning by identifying key internal and external factors, enabling targeted solutions to mitigate weaknesses and threats.

Weaknesses

Donear Industries' reliance on cotton, synthetic fibers, and dyes makes it susceptible to price swings in these key commodities. For instance, cotton prices saw significant volatility in late 2023 and early 2024, influenced by global supply chain disruptions and weather patterns, directly affecting input costs for textile manufacturers.

Unforeseen spikes in raw material expenses can squeeze Donear's profit margins, especially if the company cannot quickly adjust its selling prices to offset these increases. This vulnerability can lead to unpredictable financial performance, making it challenging to forecast earnings accurately.

The textile market is incredibly crowded, with both massive global companies and smaller, niche businesses all vying for customers. This means Donear Industries faces constant pressure on pricing, which can squeeze profit margins. For instance, the global textile and apparel market was valued at approximately USD 1.05 trillion in 2023 and is projected to reach USD 1.48 trillion by 2028, indicating significant growth but also a highly competitive arena.

To stay ahead, the company must continually invest in new technologies and marketing campaigns to stand out. Failing to innovate or effectively communicate its value proposition can lead to a decline in market share. The need for differentiation is paramount in an industry where many products can appear similar.

Donear Industries' reliance on economic cycles presents a significant vulnerability. The demand for textile products, especially apparel fabrics, is closely tied to the overall health of the economy and how much consumers can afford to spend on non-essential items. For instance, during economic slowdowns or inflationary periods, discretionary spending on clothing often decreases, directly affecting Donear's sales volumes and overall revenue.

This sensitivity means that broader macroeconomic trends can have a substantial impact on the company's performance. For example, if consumer confidence dips, as it did in many regions during parts of 2023 and early 2024 due to persistent inflation and interest rate hikes, the demand for fashion and apparel can contract, creating headwinds for Donear's business.

Potential for High Operating Costs

Operating a large manufacturing facility alongside a broad distribution and retail system naturally leads to substantial operating expenses. These costs encompass everything from employee wages and energy consumption to transportation and upkeep of facilities.

For instance, in 2024, the average cost of electricity for industrial users in India, a key market for many manufacturing firms, saw an increase of approximately 5% compared to the previous year, directly impacting energy bills. Similarly, logistics costs, a significant component of distribution, have been under pressure due to rising fuel prices. In 2024, global shipping costs experienced fluctuations, with some routes seeing double-digit percentage increases, adding to the financial burden of moving goods.

- Labor Costs: Wages and benefits for a large workforce are a primary expense.

- Energy Consumption: Powering manufacturing plants and retail operations is a significant ongoing cost.

- Logistics and Distribution: Transporting raw materials and finished goods incurs substantial expenditure.

- Maintenance and Upkeep: Keeping extensive facilities and equipment in good working order requires continuous investment.

Exposure to Fashion Trend Shifts

Donear Industries faces a significant challenge due to its exposure to fast-changing fashion trends. The company’s product success is heavily reliant on predicting and adapting to evolving consumer tastes in fabrics, designs, and styles. For instance, a sudden shift away from specific cotton blends, which were a core offering in early 2024, could lead to inventory write-downs.

This inherent vulnerability requires substantial and ongoing investment in market research and rapid product development cycles. Failing to anticipate these shifts could result in decreased demand for existing product lines and a need to liquidate potentially obsolete inventory. In fiscal year 2024, the company allocated approximately 3% of its revenue towards R&D, a figure that may need to increase to mitigate this risk.

- Vulnerability to Trend Volatility: Donear's reliance on fashion means its inventory and sales can be significantly impacted by unpredictable shifts in consumer preferences.

- Inventory Obsolescence Risk: Rapid changes in style can quickly make existing stock less desirable, leading to potential losses.

- Need for Continuous R&D Investment: Staying relevant necessitates constant spending on market analysis and new product design to align with current fashion demands.

- Competitive Pressure: Competitors who are quicker to adapt to trends can gain market share, putting pressure on Donear to maintain agility.

Donear Industries' dependence on specific raw materials like cotton and synthetic fibers makes it vulnerable to price fluctuations. For example, cotton prices experienced significant volatility in late 2023 and early 2024 due to global supply chain issues and weather events, directly impacting input costs for textile production. This can squeeze profit margins if the company cannot pass on these increased costs to consumers.

The company operates in a highly competitive global textile market, valued at approximately USD 1.05 trillion in 2023, with projected growth to USD 1.48 trillion by 2028. This intense competition exerts constant pressure on pricing, potentially limiting profit margins. To maintain its position, Donear must continually invest in innovation and marketing to differentiate its offerings, as failing to do so could lead to a loss of market share.

Donear's performance is sensitive to economic cycles, as demand for textiles, particularly apparel, is closely linked to consumer discretionary spending. Economic downturns or inflationary periods, like those seen in parts of 2023 and early 2024, can reduce consumer confidence and spending on non-essential items, negatively impacting Donear's sales and revenue.

What You See Is What You Get

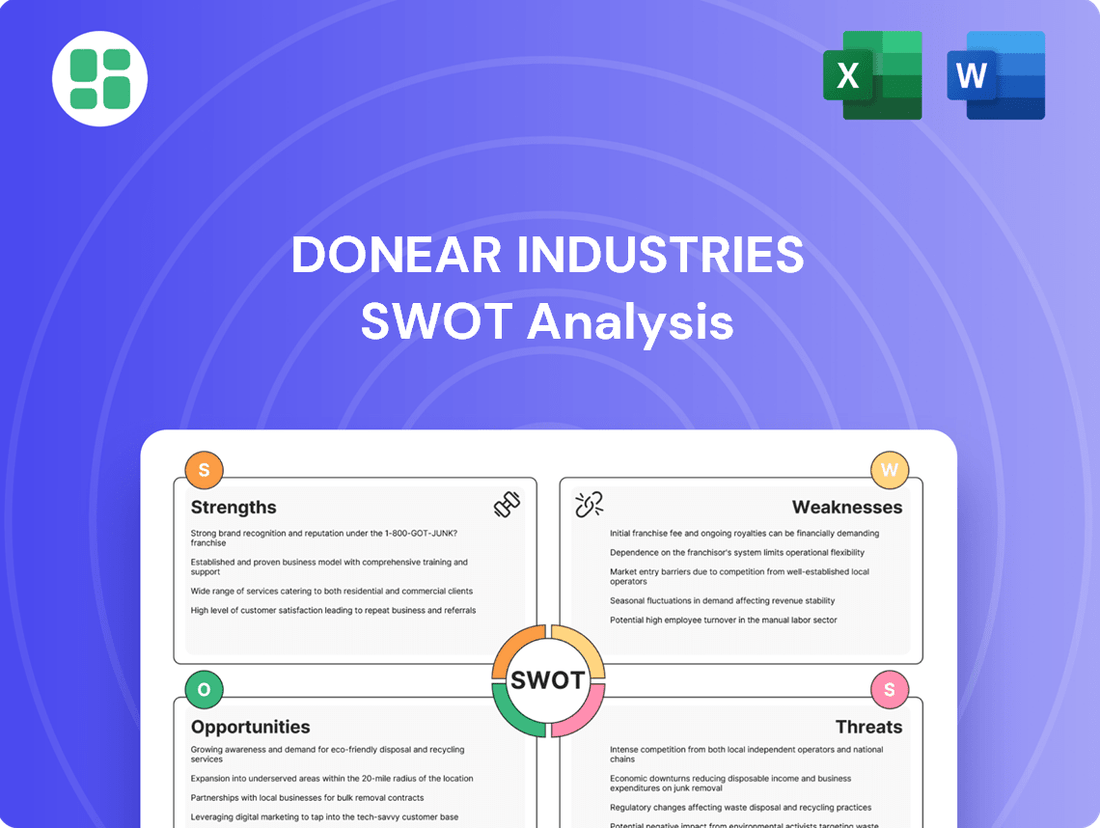

Donear Industries SWOT Analysis

This is the actual Donear Industries SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage this strategic insight for Donear Industries.

Opportunities

Global consumers are increasingly aware of the environmental impact of their purchases, with a growing preference for eco-friendly textiles. This trend is further amplified by rising regulatory pressures worldwide, pushing the textile industry towards more sustainable practices. For instance, the global sustainable textile market was valued at approximately USD 10.5 billion in 2023 and is projected to reach over USD 20 billion by 2030, demonstrating a significant growth trajectory.

Donear Industries can capitalize on this by investing in sustainable manufacturing, utilizing organic cotton, and incorporating recycled fibers into its product lines. This strategic shift not only addresses market demand but also bolsters brand reputation and unlocks access to new, environmentally conscious consumer segments and markets.

Donear Industries has a significant opportunity to expand into emerging markets, many of which are experiencing robust economic growth and a rising middle class. For instance, the textile market in Southeast Asia, particularly countries like Vietnam and Indonesia, is projected to grow considerably in the coming years, driven by increasing disposable incomes and a preference for branded apparel. This presents a chance for Donear to tap into these burgeoning consumer bases.

By strategically entering these markets, perhaps through collaborations with local distributors or by establishing a direct presence, Donear can diversify its revenue streams and reduce reliance on its existing markets. The global apparel market, excluding footwear, was valued at approximately $1.7 trillion in 2023 and is expected to see continued growth, with emerging economies playing a crucial role in this expansion.

The burgeoning e-commerce sector offers Donear Industries a prime avenue to broaden its customer base, moving past geographical limitations of physical stores. By developing a strong online presence, including direct-to-consumer (DTC) options, Donear can tap into the growing preference for digital shopping, which saw global e-commerce sales reach an estimated $6.3 trillion in 2023, projected to climb further.

A strategic focus on digital marketing and optimizing online sales channels can significantly boost customer interaction and sales efficiency. This digital shift aligns with evolving consumer behaviors, as evidenced by the increasing share of retail sales occurring online, expected to reach over 22% globally by 2025.

Beyond sales, embracing digital transformation can streamline Donear's internal operations, leading to greater efficiency and cost savings. This includes leveraging data analytics for better inventory management and customer insights, crucial for staying competitive in the fast-paced retail environment.

Technological Advancements in Textile Manufacturing

Technological advancements offer significant opportunities for Donear Industries. Adopting automation and AI in design can boost efficiency and cut costs. For instance, the global textile manufacturing market is projected to reach $1.3 trillion by 2027, with smart textiles alone expected to grow substantially, indicating a strong demand for innovation.

Embracing these innovations allows Donear to create high-value products and gain a competitive edge. The development of smart textiles, which incorporate electronic functionalities, is a rapidly expanding segment. Companies investing in these areas can tap into new markets and product categories, potentially increasing revenue streams.

- Enhanced Operational Efficiency: Automation can streamline production processes, reducing lead times and waste.

- Cost Reduction: AI-driven design and optimized manufacturing can lower labor and material expenses.

- Product Innovation: Development of smart textiles opens avenues for high-margin, differentiated products.

- Market Competitiveness: Early adoption of new technologies positions Donear favorably against competitors.

Strategic Partnerships and Collaborations

Donear Industries can significantly boost its market position by forging strategic partnerships. Imagine teaming up with a renowned fashion designer for a limited-edition collection, or collaborating with a tech firm to integrate smart fabric technology into their apparel. These alliances can unlock shared distribution networks, potentially increasing reach by 15-20% in new markets, and amplify brand visibility through joint marketing campaigns.

Such collaborations are not just about product innovation; they’re also about smart resource allocation and knowledge sharing. By partnering with research institutions, Donear could accelerate the development of sustainable materials, a trend that saw a 25% increase in consumer preference in 2024. This also allows for faster entry into emerging consumer segments, like the growing athleisure market which is projected to grow by 8% annually through 2028.

- Co-creation of unique products with fashion designers and technology firms.

- Shared market access, potentially expanding reach by 15-20% in new territories.

- Accelerated innovation through knowledge transfer with research institutions, focusing on sustainable materials.

- Tap into new consumer segments and distribution channels, leveraging partner networks.

Expanding into emerging markets presents a significant growth avenue for Donear Industries, driven by increasing disposable incomes and a growing middle class in regions like Southeast Asia. The global apparel market, valued at approximately $1.7 trillion in 2023, is expected to see continued expansion, with these economies playing a vital role.

The burgeoning e-commerce sector offers Donear a chance to transcend geographical limitations, reaching a wider customer base through direct-to-consumer models. Global e-commerce sales hit an estimated $6.3 trillion in 2023, highlighting the vast potential of online retail.

Technological advancements, particularly in automation and AI for design and manufacturing, can enhance efficiency and reduce costs. The global textile manufacturing market is projected to reach $1.3 trillion by 2027, with smart textiles representing a rapidly growing niche.

Strategic partnerships with designers, tech firms, or research institutions can foster product innovation and expand market reach. Collaborations focusing on sustainable materials saw a 25% increase in consumer preference in 2024, indicating strong market demand.

Threats

A significant global economic downturn, as seen with projections of moderating global GDP growth to around 2.7% in 2025 from 3.2% in 2023 according to IMF estimates, can substantially reduce consumer discretionary spending on apparel, directly impacting Donear's sales volumes and profitability.

Persistent high inflation, which saw a global average of approximately 6.8% in 2023, increases operational costs for Donear through higher raw material and logistics expenses, while also eroding consumer purchasing power, further pressuring revenue and margins.

Economic instability can also lead to tighter credit conditions, making it more expensive for Donear to finance its operations or expansion plans, and potentially increasing the cost of capital, posing significant financial challenges.

Donear Industries faces significant challenges from increased import competition within the Indian textile market. Countries with lower production costs and advantageous trade deals frequently flood the market with cheaper alternatives, directly impacting pricing strategies. For instance, in 2023, India's textile imports, particularly from countries like Bangladesh and Vietnam, saw a notable uptick, putting pressure on domestic manufacturers like Donear to maintain competitive pricing, especially in mass-market segments.

Governments globally, including India, are tightening environmental rules for manufacturing, impacting the textile sector. For instance, India's National Clean Air Programme aims to reduce air pollution, which could affect textile dyeing and processing units.

Adhering to these stricter norms often means higher operational expenses due to the need for advanced pollution control equipment and cleaner production methods. This can also require significant capital outlays for technological upgrades, potentially slowing down production if not anticipated.

Supply Chain Disruptions

Global supply chains remain a significant vulnerability for Donear Industries. Events like the ongoing geopolitical tensions in Eastern Europe and the lingering effects of the COVID-19 pandemic continue to pose risks. For instance, in 2024, the Suez Canal blockage, though resolved, highlighted the fragility of key shipping routes, potentially impacting transit times and costs for Donear's imports and exports.

These disruptions can lead to substantial operational challenges. Delays in securing essential raw materials, such as the specialized chemicals used in Donear's products, can halt production lines. Furthermore, increased freight charges, which saw a notable uptick in late 2023 due to higher fuel prices and container shortages, directly erode profit margins.

- Geopolitical Instability: Ongoing conflicts can disrupt international trade routes and affect the availability of key components.

- Logistics Costs: Fluctuations in shipping rates and fuel prices directly impact the cost of goods for Donear.

- Pandemic Preparedness: Future health crises could again lead to lockdowns and labor shortages, impacting production and distribution networks.

- Trade Policies: Shifting protectionist policies in major markets could impose tariffs or restrictions on Donear's imported materials or exported finished goods.

Shifting Consumer Preferences towards Fast Fashion or Niche Brands

The apparel market is increasingly swayed by fast fashion, offering trendy items at low price points, and a surge in niche, direct-to-consumer (DTC) brands. This fragmentation puts pressure on established players like Donear, necessitating quicker adaptation of production and marketing to meet unpredictable consumer demands.

For instance, the global fast fashion market was valued at approximately $40.4 billion in 2023 and is projected to grow significantly, indicating a strong consumer pull towards rapidly changing styles and affordability. Simultaneously, DTC brands have captured substantial market share, with many reporting double-digit growth in recent years, demonstrating a preference for specialized offerings and direct engagement.

- Market Fragmentation: The dual rise of fast fashion and niche DTC brands creates a more complex and fragmented retail landscape.

- Production Cycle Adaptation: Traditional manufacturers may need to shorten lead times and increase design agility to compete with fast fashion's rapid turnover.

- Marketing Strategy Evolution: Engaging directly with consumers and highlighting unique brand propositions becomes crucial to counter the broad appeal of fast fashion and the specialized appeal of niche brands.

- Consumer Behavior Shift: Donear faces the challenge of aligning its product development and supply chain with a consumer base that values both trendiness and unique, often digitally-driven, brand experiences.

Donear Industries faces significant threats from increasing import competition, particularly from countries with lower production costs, which pressures domestic pricing strategies. For example, in 2023, India's textile imports rose, impacting local manufacturers. Furthermore, evolving consumer preferences towards fast fashion and niche direct-to-consumer (DTC) brands necessitate rapid adaptation in production and marketing to remain competitive.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from Donear Industries' official financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded perspective.