Donear Industries Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Donear Industries Bundle

Donear Industries operates within a dynamic textile landscape, where buyer bargaining power significantly influences pricing and profitability. Understanding the intensity of this force is crucial for strategic planning.

The complete report reveals the real forces shaping Donear Industries’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Donear Industries is significantly influenced by supplier concentration. For Donear, a key textile manufacturer, the availability and cost of raw materials like cotton, synthetic fibers, and dyes are critical. If there are only a few major producers of these essential inputs, those suppliers gain considerable leverage.

For instance, in 2024, the global cotton market saw price fluctuations driven by weather patterns and demand from major textile hubs, highlighting how a concentrated supply base can impact costs. Should Donear rely on a limited number of dye manufacturers, for example, these suppliers could dictate terms, increasing input costs for Donear and potentially squeezing profit margins.

Conversely, if Donear has successfully diversified its supplier base, securing multiple sources for its primary raw materials, this reduces the dependence on any single supplier. This diversification would inherently lower the bargaining power of individual suppliers, allowing Donear to negotiate more favorable terms and ensuring a more stable supply chain.

The bargaining power of suppliers for Donear Industries is significantly influenced by the uniqueness of the inputs they require. If Donear relies on specialized or patented raw materials or components, suppliers of these unique inputs can exert considerable leverage. This is because finding alternative sources for such specialized items would be difficult and costly for Donear.

Conversely, if the inputs Donear needs are widely available and commoditized, like standard fabrics or basic manufacturing components, then Donear holds more power. In such cases, suppliers face greater competition from each other, limiting their ability to dictate terms or prices to Donear. For instance, in 2024, the textile industry saw fluctuations in raw cotton prices, but the availability of multiple global suppliers kept price increases manageable for many garment manufacturers.

Donear Industries faces significant switching costs if it were to change its suppliers. These costs can include the expense of retooling existing machinery to accommodate new materials or components, as well as the time and resources required to re-qualify any new suppliers and their products to ensure they meet Donear's stringent quality standards. For instance, if Donear relies on specialized alloys or custom-engineered parts, the investment in new molds or manufacturing processes could be substantial, potentially running into hundreds of thousands of dollars.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant consideration for Donear Industries. If suppliers, such as yarn manufacturers or fabric producers, possess the capabilities and resources, they could potentially enter the textile manufacturing and garment production sectors themselves. This would allow them to capture a larger portion of the value chain, directly competing with Donear.

Such a move would undoubtedly bolster their bargaining power. Suppliers would no longer be reliant on Donear as a customer; instead, they could become direct rivals. This potential competition would incentivize Donear to maintain favorable relationships and potentially accept less favorable terms to avoid losing its supply base to a more integrated competitor.

For instance, if a major cotton supplier to Donear were to invest in spinning and weaving facilities, it could then offer finished fabrics directly to garment retailers, bypassing Donear. This scenario is more plausible if suppliers have strong existing relationships with key customers in the retail segment and possess the necessary technical expertise and capital investment.

- Potential for Suppliers to Enter Textile Manufacturing: Suppliers of raw materials or intermediate goods could invest in machinery and expertise to produce finished textiles or even garments.

- Increased Bargaining Power: If suppliers can credibly threaten to move into Donear's market, they gain leverage in price negotiations and contract terms.

- Impact on Donear's Margins: Direct competition from suppliers could squeeze Donear's profit margins as they face increased pricing pressure.

- Strategic Implications: Donear may need to consider long-term supply agreements or even vertical integration to mitigate this threat.

Importance of Donear to Suppliers

The bargaining power of suppliers for Donear Industries is influenced by how crucial Donear is to their business. If Donear accounts for a significant percentage of a supplier's overall sales, that supplier may have less leverage. This is because the supplier would likely prioritize maintaining their relationship with Donear to secure their own revenue stream.

For instance, if a key raw material supplier derives over 20% of its annual revenue from Donear, that supplier's ability to dictate terms or raise prices might be limited. They would be incentivized to keep Donear satisfied. Conversely, if Donear represents a small fraction of a supplier's sales, the supplier has less dependence on Donear and can exert more power.

- Supplier Dependence: If Donear is a major client, suppliers are less likely to risk losing that business by demanding unfavorable terms.

- Switching Costs: High costs for Donear to switch suppliers for critical inputs would increase supplier power.

- Availability of Alternatives: If there are many alternative suppliers for essential materials, Donear's bargaining power increases, reducing supplier power.

The bargaining power of suppliers for Donear Industries is moderate, influenced by factors like supplier concentration and the uniqueness of inputs. For example, in 2024, the textile industry experienced some supply chain disruptions affecting raw material availability, but the presence of multiple global suppliers for common materials like cotton helped mitigate extreme price hikes for manufacturers like Donear. However, for highly specialized dyes or custom machinery parts, Donear might face stronger supplier leverage due to limited alternatives and higher switching costs, potentially involving significant retooling expenses.

| Factor | Impact on Donear | 2024 Context Example |

|---|---|---|

| Supplier Concentration (Commodity Inputs) | Moderate leverage for suppliers | Global cotton prices saw volatility, but multiple producers limited supplier power. |

| Uniqueness of Inputs | High leverage for specialized suppliers | Patented dyes or custom-engineered components could command premium pricing. |

| Switching Costs | Moderate to High | Retooling machinery for new materials can cost hundreds of thousands of dollars. |

| Threat of Forward Integration | Potential for increased supplier power | Raw material suppliers could enter garment production, becoming competitors. |

| Donear's Importance to Suppliers | Low to Moderate | If Donear is a small client, suppliers have more power; if large, less. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Donear Industries' position in the textile sector.

Instantly gauge competitive intensity across all five forces with a dynamic, interactive dashboard.

Effortlessly adapt to shifting market dynamics by easily updating threat levels and strategic responses.

Customers Bargaining Power

Donear Industries' customer concentration is a key factor in their bargaining power. If a few large distributors or retailers account for a significant portion of Donear's revenue, these major clients can demand more favorable pricing and payment terms, directly impacting Donear's profitability.

For instance, if Donear's top 10 customers represent over 60% of their sales, as can be seen in some segments of the textile industry, these customers gain substantial leverage. This concentration means Donear has less flexibility to push back on price reductions or extended credit terms, as losing even one major client could have a considerable financial impact.

Donear Industries' ability to differentiate its suiting, shirting, and denim fabrics plays a crucial role in mitigating customer bargaining power. When products are unique and offer distinct advantages, customers have fewer readily available substitutes, thereby weakening their leverage.

The success of Donear's 'neo-stretch' fabric exemplifies this. This innovative offering provides enhanced comfort and performance, setting it apart in a crowded market. In 2024, the textile industry saw a growing demand for performance-enhancing fabrics, with specialized materials like neo-stretch commanding premium pricing and fostering customer loyalty, thus limiting the power of buyers to negotiate lower prices.

The ease with which Donear Industries' customers can switch to alternative fabric manufacturers is a key factor in their bargaining power. If customers face minimal hurdles, such as readily available substitute suppliers and low costs associated with changing providers, their ability to negotiate favorable terms with Donear increases significantly.

For instance, in the broader textile industry, switching costs can be relatively low for many buyers, especially for standard fabric types where numerous manufacturers exist. This accessibility allows customers to easily compare prices and product offerings, putting pressure on Donear to remain competitive.

Threat of Backward Integration by Customers

The threat of backward integration by Donear's customers, such as major apparel brands, is a significant factor in their bargaining power. If these brands could realistically begin producing their own fabrics, it would dramatically increase their leverage over Donear. This is because Donear would be motivated to maintain favorable terms to prevent its clients from becoming direct competitors, potentially eroding Donear's market share.

Consider the scale of large apparel manufacturers. Many already have extensive supply chain operations and significant capital. For instance, a global apparel brand with billions in annual revenue could potentially allocate resources to establish in-house fabric manufacturing capabilities. While the technical expertise and initial investment are substantial, the strategic advantage of controlling a key input like fabric could outweigh these challenges for a sufficiently large and motivated customer.

- Customer Bargaining Power: Large apparel brands possess considerable bargaining power, amplified by the potential to integrate backward into fabric manufacturing.

- Industry Landscape: Major players in the apparel sector, like those sourcing from Donear, often have the financial clout and operational scale to consider in-house production.

- Strategic Implications: Donear must manage customer relationships carefully, as the threat of a customer becoming a competitor by producing its own fabrics can significantly weaken Donear's negotiating position.

Price Sensitivity of Customers

Donear Industries' customers exhibit varying degrees of price sensitivity. For bulk purchasers of standard fabric lines, particularly those operating with tight margins in the garment manufacturing sector, price is a critical factor. This means they have significant leverage to negotiate lower prices, directly impacting Donear's profitability.

The price sensitivity is amplified when customers can easily switch to alternative suppliers offering comparable quality fabrics at a lower cost. In 2024, the textile industry faced increased competition, with many smaller manufacturers in India and Bangladesh offering competitive pricing for basic fabrics. This environment forces Donear to be mindful of its pricing strategies to retain market share.

- High price sensitivity among bulk buyers of standard fabrics.

- Increased competition in 2024 pressured fabric prices.

- Customers can readily switch suppliers for comparable, lower-cost options.

- Price negotiations directly influence Donear's revenue and profit margins.

Donear Industries faces significant customer bargaining power, particularly from large apparel brands. These buyers can exert pressure through bulk purchasing, demanding lower prices, especially for standard fabric types. In 2024, the competitive landscape, with numerous suppliers in regions like Bangladesh offering cost-effective alternatives, intensified this pressure, forcing Donear to maintain competitive pricing to retain these crucial clients.

The potential for backward integration by major customers represents a substantial threat, increasing their leverage. If large apparel manufacturers were to establish their own fabric production, it would directly impact Donear's market share and pricing power. This strategic consideration means Donear must carefully manage relationships to mitigate the risk of losing key accounts to in-house manufacturing.

| Customer Factor | Impact on Donear | 2024 Context |

|---|---|---|

| Customer Concentration | High leverage for major clients | Top 10 customers can represent >60% of sales in some textile segments |

| Product Differentiation | Weakens buyer power | Innovative fabrics like 'neo-stretch' command premium pricing |

| Switching Costs | Low switching costs increase leverage | Easy access to numerous alternative suppliers for standard fabrics |

| Backward Integration Threat | Significant pressure on pricing | Large apparel brands have capital for in-house fabric production |

| Price Sensitivity | High for bulk, standard fabric buyers | Increased competition in 2024 from lower-cost Asian manufacturers |

Preview the Actual Deliverable

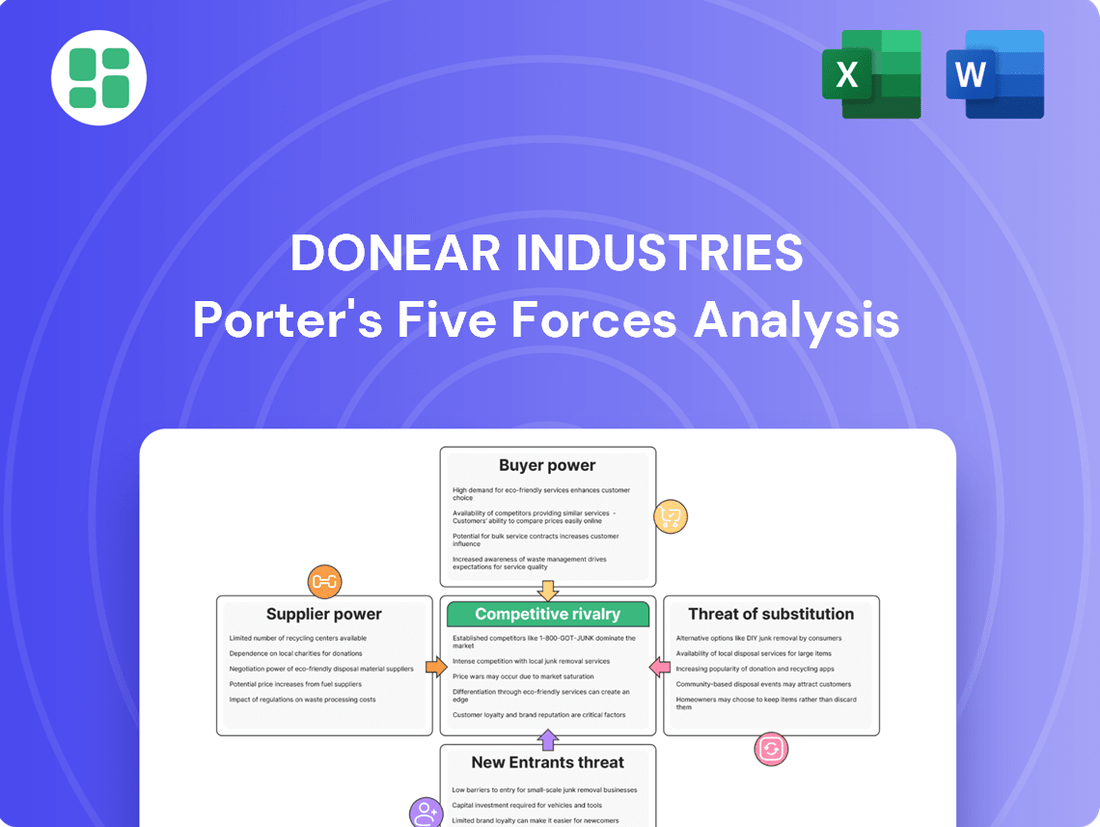

Donear Industries Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for Donear Industries, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products. The document you see here is exactly what you’ll be able to download after payment, offering a complete and ready-to-use strategic assessment.

Rivalry Among Competitors

The Indian textile industry, a significant global player, is characterized by a vast number of competitors across various segments like suiting, shirting, and denim. This sheer volume, coupled with the presence of both domestic powerhouses and international brands, fuels a highly competitive environment.

In 2023-24, India's textile and apparel exports reached an estimated USD 45 billion, highlighting the industry's scale and the intense competition to capture market share. This dynamic landscape means companies like Donear Industries must constantly innovate and differentiate to stand out.

The Indian textile industry, where Donear operates, is experiencing robust growth. Projections indicated exports reaching $45 billion by 2025, suggesting a healthy expansionary environment. This strong growth generally tempers intense rivalry, as companies can expand their sales by tapping into new demand rather than solely by capturing market share from competitors.

The fabric market sees varying degrees of product differentiation. Competitors often offer similar basic textiles, which can intensify price-based competition and elevate rivalry.

Donear Industries actively pursues product differentiation, notably with innovations like its 'neo-stretch' fabric. This focus on unique material properties aims to carve out a distinct market position and reduce direct price comparisons with competitors offering more standardized products.

Exit Barriers

Donear Industries, like many in the textile sector, faces significant hurdles when attempting to exit the market. These can include highly specialized machinery that has little resale value outside the industry and long-term labor contracts that are costly to break. Emotional attachments to a family business or brand legacy can also play a role, making divestment a difficult decision.

These high exit barriers can unfortunately lead to persistent overcapacity within the textile industry. When companies find it too expensive or difficult to leave, even those operating at a loss may continue to churn out products. This keeps supply high, often exceeding demand, which in turn intensifies competition as firms fight for market share, even if it means operating at lower profit margins or incurring losses.

The financial implications are stark. For instance, in 2024, many textile manufacturers reported struggling with inventory management due to these very issues. Companies that might otherwise have consolidated or ceased operations are instead continuing to compete, putting downward pressure on prices.

- Specialized Assets: Textile machinery, often custom-built, has limited alternative uses, making its resale value low.

- Labor Agreements: Severance packages and contractual obligations for a skilled workforce can be substantial exit costs.

- Brand and Reputation: The emotional and reputational capital invested in a textile brand can be a deterrent to a quick exit.

- Market Conditions: A lack of buyers for distressed textile assets further entrenches existing players, even those underperforming.

Fixed Costs and Capacity

The textile industry, including players like Donear Industries, often grapples with substantial fixed costs associated with machinery, plant infrastructure, and technology. For instance, setting up a modern spinning unit can involve significant capital expenditure, leading to high depreciation and maintenance expenses regardless of production levels. This inherent cost structure means that maintaining high capacity utilization is crucial for profitability.

When capacity utilization dips, companies face immense pressure to cover these fixed costs. This can trigger aggressive pricing strategies as firms attempt to secure sales volume, intensifying competitive rivalry. In 2024, reports indicated that certain segments of the textile market were operating below optimal capacity, a factor that likely contributed to price competition among manufacturers.

Donear Industries' strategic acquisitions of spinning units, which have notably increased its spindleage, directly impact its fixed cost base and capacity. While this expansion offers economies of scale, it also necessitates higher production volumes to achieve favorable cost per unit. The challenge then becomes managing this increased capacity effectively amidst fluctuating market demand and competitive pricing pressures.

- High fixed costs in textile manufacturing necessitate efficient capacity utilization to avoid losses.

- Excess capacity in the industry can lead to price wars as companies try to cover their overheads.

- Donear's expansion in spindleage increases its fixed cost burden but also its potential for scale economies.

- Managing increased capacity in a competitive market is key to Donear's profitability.

The Indian textile sector is highly competitive, with numerous players vying for market share in segments like suiting and shirting. This intense rivalry is exacerbated by the presence of both large domestic companies and international brands, creating a dynamic marketplace where innovation and differentiation are key.

Companies like Donear Industries face a challenging environment where product differentiation is often limited, leading to price-based competition. However, Donear's focus on unique offerings, such as its neo-stretch fabric, helps it carve out a distinct market position and mitigate direct price comparisons.

The industry also suffers from high exit barriers, including specialized machinery and labor contracts, which can lead to persistent overcapacity. This situation forces companies, even those operating at a loss, to continue production, thereby intensifying competition and putting downward pressure on prices, as seen in 2024 with many manufacturers struggling with inventory.

Furthermore, high fixed costs associated with textile machinery necessitate high capacity utilization for profitability. When capacity dips, as it did in certain market segments in 2024, companies resort to aggressive pricing to cover overheads, further intensifying competitive rivalry.

| Factor | Impact on Donear Industries | Industry Trend (2023-2025) |

|---|---|---|

| Number of Competitors | High, from domestic and international players | Consistently high, with new entrants and consolidation |

| Product Differentiation | Moderate; Donear focuses on unique fabrics like neo-stretch | Varies; basic fabrics have low differentiation, specialized ones higher |

| Price Competition | Present, especially for undifferentiated products | Elevated due to overcapacity and high fixed costs |

| Exit Barriers | Significant, leading to potential overcapacity | Persist, contributing to industry-wide capacity challenges |

SSubstitutes Threaten

The threat of substitutes for Donear Industries' fabrics is significant, particularly from ready-to-wear garments and alternative apparel materials. Customers can often find comparable quality and style in finished clothing, bypassing the need for Donear's core fabric offerings. This is especially true as Donear itself plans to expand into retail outlets for ready-to-wear, directly competing with its own fabric business.

The price-performance trade-off is a key consideration. While Donear's fabrics may offer specific performance attributes, consumers will weigh these against the convenience and often competitive pricing of readily available apparel. For instance, the global apparel market is projected to reach approximately USD 1.7 trillion by 2024, indicating a vast landscape of substitute products that consumers can easily access.

The threat of substitutes for Donear Industries' products, primarily fabrics and apparel, is moderate. Customers might consider switching to alternative materials or ready-made garments from competitors if price or perceived value shifts unfavorably. For instance, the rise of fast fashion brands offering lower-priced, trend-driven apparel can act as a substitute for Donear's more traditional fabric offerings.

Donear's strategy to mitigate this threat involves its broad product portfolio, catering to diverse tastes and needs, and its expansion into retail. By offering a wide range of fabrics and establishing its own retail presence, Donear aims to capture customer loyalty and reduce the propensity to switch by providing a complete solution, from raw material to finished product. In 2023, the Indian textile and apparel market was valued at approximately $145 billion, indicating significant competition and the presence of numerous substitutes.

Donear Industries faces a significant threat from substitutes, particularly in the broader textile and apparel market. Consumers can readily switch to alternative materials like synthetic fibers, recycled fabrics, or even non-textile solutions for certain applications, impacting demand for Donear's specific offerings. For instance, the global market for technical textiles, a segment Donear operates in, sees constant innovation in performance characteristics, with materials like advanced polymers often substituting traditional textiles in areas like automotive and construction.

Cost of Switching to Substitutes

The cost of switching from Donear's fabrics to substitutes is a critical factor influencing the threat of substitutes. Customers might face financial outlays such as the cost of new machinery, retooling, or even the expense of learning to use new materials. For instance, a textile manufacturer accustomed to Donear's specific weaving or dyeing processes might incur significant costs to adapt to a substitute fabric's requirements.

Beyond direct financial costs, non-financial switching costs can also be substantial. These include the time and effort required to research and test new suppliers, potential disruptions to production schedules, and the risk of lower quality or performance from an unfamiliar material. If these switching costs are low, customers are more likely to explore and adopt alternatives to Donear's offerings.

For example, if a competitor offers a synthetic fabric that requires minimal changes to existing manufacturing equipment and provides comparable performance at a lower price point, the threat of substitution increases significantly. In 2024, the global textile market saw increased innovation in sustainable and recycled materials, which could lower switching costs for manufacturers looking to adopt eco-friendly alternatives, potentially impacting Donear's market position if their current offerings are not competitive in this evolving landscape.

- Financial Switching Costs: Expenses related to new equipment, retooling, and material testing.

- Non-Financial Switching Costs: Time for research, production disruption, and quality assurance risks.

- Impact of Innovation: New materials with lower integration costs can heighten substitution threats.

- Market Trends: Growing demand for sustainable alternatives can reduce switching barriers for those materials.

Innovation in Substitute Industries

The threat of substitutes for Donear Industries is influenced by innovation in competing sectors. For example, advancements in smart textiles could offer alternatives to traditional fabrics, potentially impacting demand for Donear's core products.

Monitoring the pace of technological change in industries that produce substitute materials or products is crucial. Rapid developments in alternative technologies can swiftly elevate the threat of substitution.

- Innovation in Smart Textiles: Emerging smart textiles with enhanced functionalities could present a viable substitute for conventional fabrics used in various applications.

- Material Science Advancements: Breakthroughs in material science may yield new, cost-effective, or performance-superior alternatives to Donear's offerings.

- Technological Obsolescence: Donear must stay abreast of how new technologies might render its current product lines less competitive or entirely obsolete.

The threat of substitutes for Donear Industries is considerable, driven by readily available finished apparel and alternative materials. Consumers can easily opt for ready-to-wear garments, bypassing the need for Donear's fabrics, a trend amplified by Donear's own move into retail. The global apparel market, projected to reach approximately USD 1.7 trillion by 2024, underscores the vast array of substitute products available to consumers.

| Factor | Description | Impact on Donear | Example | 2024 Data/Trend |

| Availability of Ready-to-Wear | Finished garments offer convenience and immediate use. | Reduces demand for fabrics if consumers prefer direct apparel purchase. | Fast fashion brands offering low-cost, trendy clothing. | Global apparel market projected at USD 1.7 trillion. |

| Alternative Materials | New or improved materials can offer better performance or cost. | Can displace Donear's fabrics if substitutes offer superior value. | Advanced polymers in technical textiles. | Growth in sustainable and recycled materials. |

| Switching Costs | Financial and non-financial costs for customers to adopt substitutes. | Low switching costs increase the threat of substitution. | Minimal retooling needed for synthetic fabrics. | Innovation in sustainable materials can lower switching costs. |

Entrants Threaten

Entering the textile manufacturing sector, particularly for diverse product lines like suiting, shirting, and denim, demands substantial financial investment. These high capital requirements, covering machinery, raw materials, and skilled labor, form a significant barrier for potential new competitors seeking to challenge established players like Donear Industries.

Donear Industries itself demonstrates this by actively investing in expansion and new facilities, signaling the ongoing need for significant capital deployment within the industry to maintain competitiveness and scale of operations.

Donear Industries benefits significantly from economies of scale in its operations. With a substantial production capacity of 50 lakh meters per month, the company can achieve lower per-unit costs through bulk purchasing of raw materials and efficient, high-volume manufacturing processes. This scale advantage makes it challenging for new entrants to match Donear's cost structure and compete effectively on price.

For new companies looking to enter the market Donear operates in, securing access to established distribution channels presents a significant hurdle. Donear leverages an extensive network of agents, dealers, and retailers, built over years of operation, which new entrants would find difficult and costly to replicate.

In 2024, the retail sector, particularly for consumer goods where Donear is active, saw an increasing concentration of shelf space with major players. This makes it challenging for newcomers to get their products noticed and readily available to consumers, as shelf space is often a premium commodity, secured through strong relationships and volume commitments.

Brand Loyalty and Differentiation

Donear Industries benefits from significant brand loyalty across its diverse portfolio of recognized brands, making it challenging for new entrants to capture market share. The company’s commitment to product differentiation, focusing on quality and unique features, further solidifies its customer base.

The perceived value and distinctiveness of Donear's offerings create a substantial barrier to entry. Customers accustomed to the quality and specific attributes of Donear's products are less likely to switch to unproven alternatives, even if offered at a lower price point.

- Brand Recognition: Donear operates multiple well-established brands, fostering strong customer recognition and trust.

- Product Differentiation: The company emphasizes unique product features and quality, setting its offerings apart from potential competitors.

- Customer Loyalty: Existing customers demonstrate a high degree of loyalty, reducing the appeal of new entrants' products.

- Market Penetration: Donear's established presence across various market segments makes it difficult for newcomers to gain initial traction.

Government Policy and Regulations

Government policies and regulations can significantly influence the threat of new entrants in the textile industry. Stringent licensing requirements and compliance mandates can create substantial hurdles for newcomers. For instance, India's Production Linked Incentive (PLI) scheme, designed to boost domestic manufacturing and exports, primarily benefits established players by offering financial incentives, thereby increasing the cost and complexity for new companies to enter the market.

These policies can act as de facto barriers to entry by increasing operational costs and the time required to become compliant. For example, environmental regulations concerning water usage and effluent treatment in textile manufacturing necessitate significant capital investment in specialized equipment and processes, which can be prohibitive for startups.

In 2024, the global textile industry continues to navigate a landscape shaped by evolving trade agreements and domestic support policies. Countries are increasingly implementing measures to foster local production and reduce reliance on imports, which can deter new foreign entrants. The regulatory environment often favors companies that can demonstrate adherence to sustainability standards and labor laws, adding another layer of complexity for potential new market participants.

- Licensing and Permits: Obtaining necessary permits for manufacturing, chemical usage, and environmental compliance can be a lengthy and costly process.

- Production Linked Incentives (PLI): Schemes like India's PLI for textiles, which provided ₹10,683 crore (approximately $1.28 billion) over five years starting in 2021-22, are designed to encourage large-scale investment and expansion by existing entities.

- Environmental Regulations: Stricter norms on water discharge, chemical usage, and waste management require substantial upfront investment in pollution control technologies.

- Trade Policies: Tariffs, quotas, and preferential trade agreements can create an uneven playing field, favoring domestic or established international players.

The threat of new entrants for Donear Industries is relatively low due to several significant barriers. High capital requirements for machinery and operations, coupled with Donear's substantial economies of scale, make it difficult for newcomers to compete on cost. Furthermore, established distribution networks and strong brand loyalty, cultivated over years, present formidable challenges for any new player seeking to gain market traction.

| Barrier Type | Description | Impact on New Entrants | Donear's Advantage |

|---|---|---|---|

| Capital Requirements | Significant investment needed for machinery, raw materials, and skilled labor. | High barrier, requiring substantial funding. | Established financial capacity for expansion and upgrades. |

| Economies of Scale | Lower per-unit costs due to high-volume production. | Difficulty matching cost structure of established players. | Production capacity of 50 lakh meters/month allows for cost efficiencies. |

| Distribution Channels | Access to extensive networks of agents, dealers, and retailers. | Challenging and costly to replicate existing networks. | Years of building strong relationships and market presence. |

| Brand Loyalty & Differentiation | Strong customer trust and preference for unique product features. | Hard to attract customers away from established brands. | Portfolio of recognized brands with high customer retention. |

| Government Policies | Licensing, compliance, and incentives favoring existing entities. | Increased operational costs and complexity for new entrants. | Ability to leverage government schemes like PLI, which allocated ₹10,683 crore (approx. $1.28 billion) for textiles in India. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Donear Industries leverages data from financial statements, market research reports, and industry-specific trade publications to provide a comprehensive view of the competitive landscape.