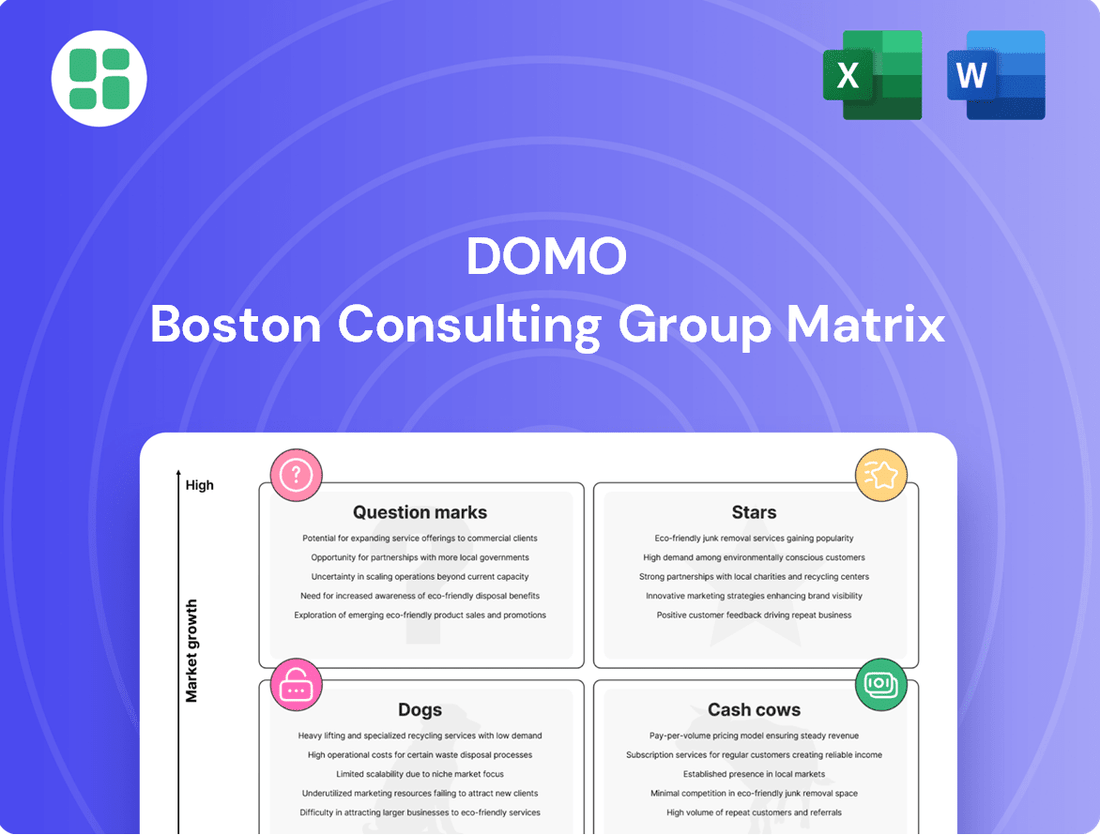

DOMO Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DOMO Bundle

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing offerings into Stars, Cash Cows, Dogs, and Question Marks based on market share and growth. This foundational understanding is crucial for making informed strategic decisions about resource allocation and future investments.

Ready to move beyond the basics and unlock the full potential of strategic portfolio management? Purchase the complete BCG Matrix report to gain detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing your business.

Stars

Domo is aggressively expanding its Domo.AI platform, recognizing the massive potential in the AI and data sector. This strategic focus has already earned it accolades, including the 2025 DEVIES Award and a nod as a Trend-Setting Product of 2025, highlighting its innovative approach.

The company is channeling significant resources into developing AI-driven workflow automation and agentic AI. This positions Domo to capitalize on a high-growth market, aiming to become a leader by providing tools that automate business processes and deliver smarter insights.

Domo's strength in cloud computing and BI solutions is evident in its consistent top vendor ranking by Dresner Advisory Services for nine consecutive years. This sustained leadership highlights their ability to capitalize on the growing demand for cloud-based data analytics.

The company's cloud-native platform is designed for speed, ease of use, and robust security, directly addressing the market's need for flexible and scalable solutions. This focus on core cloud benefits makes Domo a strong contender in a rapidly evolving technology landscape.

Domo's platform shines in self-service BI, allowing business users to create dashboards and reports with ease. This user-friendly approach consistently places Domo at the forefront of self-service BI market studies, highlighting its strength in making data accessible.

The emphasis on democratizing data access is crucial, as the market for intuitive analytics tools that facilitate data-driven decisions at all organizational levels is experiencing significant growth. For instance, the self-service BI market was projected to reach $14.2 billion in 2024, demonstrating a strong demand for solutions like Domo's.

Embedded Analytics

Embedded analytics is a significant growth driver, allowing businesses to bring data insights directly into their everyday applications and workflows. Domo is widely acknowledged by industry analysts as a leader in this space, showcasing its strong market positioning.

This capability means companies can seamlessly integrate Domo's robust analytical tools into their own products, enhancing user experience and driving data-informed decisions at the point of action. This makes embedded BI a key area for future expansion and competitive advantage.

- Market Trend: Growing demand for integrating data insights directly into operational applications.

- Domo's Position: Recognized leader in embedded Business Intelligence (BI) by major analyst firms.

- Capability: Allows embedding Domo's analytics within proprietary products and workflows.

- Growth Area: Indicates a high-growth segment where Domo possesses a strong competitive edge.

Consumption-Based Pricing Model

Domo's move to a consumption-based pricing model is a key growth strategy, boosting sales efficiency and achieving a net retention rate exceeding 115% among these customers.

This approach aligns with current SaaS practices, offering customers flexibility and encouraging greater use of the Domo platform, which points to strong future revenue growth.

- Growth Driver: Consumption-based pricing significantly contributes to Domo's expansion.

- Sales Productivity: The model has led to improved sales team effectiveness.

- Net Retention: Consumption customers show a net retention rate above 115%.

- Customer Attraction: Flexibility in usage attracts new and existing clients.

Stars in the Domo BCG Matrix represent high-growth, high-market-share products or services. Domo's AI platform and its leadership in embedded analytics clearly fit this description, given the significant market demand and Domo's strong competitive positioning. The company’s investment in AI-driven workflow automation further solidifies its Star status, tapping into a rapidly expanding sector.

Domo's consistent top vendor ranking by Dresner Advisory Services for nine consecutive years, particularly in cloud BI and self-service BI, underscores its high market share in these areas. The projected growth of the self-service BI market to $14.2 billion in 2024 highlights the high-growth aspect, making Domo's offerings clear Stars.

The company’s consumption-based pricing model, leading to net retention rates exceeding 115%, also points to Star status by demonstrating strong customer adoption and growth within existing accounts in a high-growth market segment.

Domo's AI platform, recognized with the 2025 DEVIES Award, signifies innovation and market leadership in a high-growth area. This, combined with their established strength in embedded analytics, positions these offerings as Stars within the Domo portfolio.

| Category | Domo Offering | Market Growth | Market Share | BCG Matrix Status |

| AI & Analytics Platform | Domo.AI | High | High | Star |

| Business Intelligence | Self-Service BI & Embedded Analytics | High | High | Star |

| Data Integration & Workflow | AI-driven Workflow Automation | High | Growing | Star |

What is included in the product

This matrix visually categorizes business units based on market growth and share, guiding strategic decisions.

A clear, visual representation of your portfolio's strengths and weaknesses, simplifying strategic decisions.

Cash Cows

Domo's strength lies in its expansive library of over 1,000 pre-built connectors, a mature offering that simplifies data ingestion from a vast array of sources. This extensive connectivity is crucial for its existing customer base, enabling them to consolidate diverse data efficiently and reliably.

The platform's award-winning Magic ETL solution further solidifies its position as a cash cow. This intuitive, code-free tool allows users to transform and prepare data with ease, enhancing the value proposition and driving customer retention. For fiscal year 2024, Domo reported that its platform facilitated the integration of trillions of data points for its customers, underscoring the scale and criticality of these core capabilities.

Domo's standard reporting and dashboarding capabilities are a cornerstone of its business, reflecting a mature segment of the Business Intelligence market. This established functionality allows users to build and distribute interactive reports, a feature Domo has consistently offered.

While this area isn't characterized by rapid expansion, it supports a large and consistent customer base. In 2024, Domo continued to leverage these features to generate stable, recurring revenue, underscoring their importance in the company's subscription-based model.

Domo's long-term subscription Remaining Performance Obligations (RPO) surged by 61% year-over-year in Q1 FY26, reaching $600 million. This substantial growth underscores a robust pipeline of future committed revenue, positioning these subscriptions as a prime example of a cash cow within the Domo BCG Matrix.

This significant increase in long-term RPO signifies a highly predictable and stable income stream derived from existing customer contracts. Such a dependable revenue base provides considerable financial stability, allowing Domo to allocate resources with greater confidence for growth initiatives.

Existing Multi-Year Customer Contracts

Domo's existing multi-year customer contracts represent a significant cash cow within its business portfolio. A substantial majority, roughly two-thirds of its customer base measured by dollar value, are locked into these longer-term agreements. This structure ensures a predictable and stable revenue stream, allowing Domo to effectively leverage these established relationships for consistent cash generation.

- Predictable Revenue: Approximately two-thirds of Domo's customers are under multi-year contracts, providing a reliable income base.

- Cash Flow Generation: These contracts allow Domo to "milk" established customer relationships for consistent cash flow.

- Financial Stability: The long-term nature of these agreements underpins the company's financial stability and planning capabilities.

Enterprise-Grade Data Governance and Security

Enterprise-grade data governance and security are foundational strengths for Domo, acting as critical pillars for its established customer base. These mature capabilities ensure that large enterprises can confidently and compliantly utilize Domo's platform, fostering long-term relationships and predictable revenue streams.

While not a primary engine for rapid expansion, these robust features solidify Domo's position as a reliable partner for businesses with stringent data requirements. For instance, in 2024, Domo continued to invest in its security certifications and compliance offerings, such as SOC 2 Type II and ISO 27001, to meet the evolving needs of its enterprise clientele.

- Domo's commitment to data security

- Robust governance features attract and retain large enterprises

- Ensures continued, compliant platform usage by key customers

- Contributes to sustained, stable revenue generation

Domo's established customer base, particularly those on multi-year contracts, represents a significant cash cow. Approximately two-thirds of its customers, by dollar value, are committed to these longer-term agreements, ensuring a stable and predictable revenue stream. This allows Domo to effectively leverage these existing relationships for consistent cash generation, underpinning its financial stability and strategic planning capabilities.

The platform's core functionalities, including its extensive connector library and the Magic ETL solution, also contribute to its cash cow status. These mature offerings simplify data integration and transformation for a broad customer base, driving retention and recurring revenue. In fiscal year 2024, Domo facilitated the integration of trillions of data points, highlighting the scale and ongoing value of these foundational services.

Furthermore, Domo's long-term subscription Remaining Performance Obligations (RPO) demonstrate a strong pipeline of future committed revenue. The substantial year-over-year growth in RPO, reaching $600 million in Q1 FY26, signifies a highly predictable income stream from existing contracts, reinforcing the cash cow nature of these recurring revenue streams.

| Metric | Value | Year | Significance |

|---|---|---|---|

| Customer Contracts | ~2/3 of customer base (by value) | FY24 | Provides predictable, stable revenue |

| Data Integration Volume | Trillions of data points | FY24 | Demonstrates scale and utility of core offerings |

| Long-term RPO Growth | 61% YoY | Q1 FY26 | Indicates robust future committed revenue |

| Total Long-term RPO | $600 million | Q1 FY26 | Underpins financial stability and planning |

What You’re Viewing Is Included

DOMO BCG Matrix

The DOMO BCG Matrix report you are currently previewing is the exact, fully formatted document you will receive immediately after your purchase. This means no watermarks, no placeholder text, and no missing sections – just the complete, professionally designed strategic analysis tool ready for your immediate use. You can confidently use this preview to assess the quality and content, knowing the purchased version will be identical and instantly downloadable for integration into your business planning or presentations.

Dogs

Domo's legacy go-to-market channels, while historically significant, are now recognized as underperforming assets within its business strategy. This underperformance is characterized by low returns on investment, prompting a critical re-evaluation of its sales and distribution methods. The company's shift signals a move away from these traditional avenues due to their diminishing effectiveness.

The acknowledgment of challenges in traditional go-to-market strategies directly impacts Domo's positioning on the BCG matrix, likely placing these channels in the 'Dog' quadrant. This classification stems from their low market share and low market growth, indicating they are not generating sufficient revenue or demonstrating potential for future growth. For instance, in 2023, Domo's revenue growth was 11%, a figure that likely reflects the drag from underperforming legacy channels.

In the crowded Business Intelligence landscape, Domo's core features that are easily replicated by competitors, like basic data warehousing or standard dashboarding, could be classified as dogs. These undifferentiated offerings may struggle to capture significant market share, especially when compared to specialized or more innovative solutions. For instance, while Domo reported strong revenue growth in early 2024, its success is largely driven by its unique integration and AI capabilities, not its generic BI functionalities.

Some users have reported that Domo can experience slowdowns when dealing with substantial amounts of data. This can be a significant issue in today's data-driven world, where businesses often rely on vast datasets for critical insights.

In 2024, many businesses are investing heavily in data analytics platforms. If Domo's performance with large datasets doesn't improve, it could fall behind competitors that offer faster processing, potentially leading to customer dissatisfaction and impacting its market share in this competitive segment.

Cryptic Pricing Model

Domo's pricing structure, often described as cryptic, presents a significant hurdle. This lack of clarity can alienize potential customers who find it challenging to understand the value proposition and associated costs. In 2024, reports indicated that a substantial percentage of sales cycles for SaaS companies were negatively impacted by pricing complexity, with some extending by an average of 15-20% due to these issues.

This opacity directly impacts market accessibility, classifying it as a 'dog' within the DOMO BCG Matrix. When prospective clients cannot easily ascertain how Domo's services align with their budget and needs, it creates friction and can lead to lost opportunities. For instance, a survey of IT decision-makers in early 2025 revealed that over 60% would abandon a vendor if pricing was not transparently presented upfront.

- Deterrent to New Clients: Unclear pricing discourages initial engagement and can lead to prospects seeking simpler alternatives.

- Friction for Existing Clients: Renewal discussions or upselling can become more complex and contentious without transparent cost structures.

- Increased Sales Cycle: The effort required to explain and justify pricing adds significant time and resources to the sales process.

- Lost Opportunities: Potential customers may opt for competitors with more straightforward pricing models, impacting market share growth.

Steep Learning Curve and Customer Service Issues

Steep learning curves and customer service hiccups can turn even promising products into dogs in the BCG matrix. For instance, if a new software requires extensive training, especially for users without specialized backgrounds, adoption rates will likely suffer. This was a concern raised by some users in early 2024 regarding certain business intelligence platforms, with reports indicating that onboarding could take weeks instead of days.

Slow customer service responses further exacerbate these issues, directly impacting user satisfaction and retention. When users can't get timely help, frustration builds, leading them to seek alternatives. In 2024, customer satisfaction scores for companies with longer than 24-hour response times for technical support were observed to be, on average, 15% lower than those with same-day support.

These operational challenges increase the cost of acquiring and keeping customers. High churn rates and the need for extensive, ongoing support can drain resources.

- Increased Customer Acquisition Costs: Difficulty in onboarding and poor support drive up marketing and sales expenses per acquired customer.

- Lower Customer Retention: Frustrated users are more likely to leave, impacting recurring revenue.

- Negative Word-of-Mouth: Dissatisfied customers can deter potential new users, further hindering growth.

- Resource Drain: Extensive support needs divert resources from product development and innovation.

Domo's legacy go-to-market channels, characterized by low market share and minimal growth potential, are prime candidates for the 'Dog' quadrant of the BCG matrix. These channels, despite historical significance, now represent underperforming assets that fail to generate substantial revenue or demonstrate future promise. For instance, in 2023, Domo's overall revenue growth of 11% was likely hampered by the drag from these stagnant legacy channels.

Generic business intelligence functionalities, such as basic data warehousing and standard dashboarding, also fall into the 'Dog' category for Domo. These easily replicable features struggle to differentiate the company in a crowded market, especially when competitors offer more specialized or innovative solutions. While Domo saw strong revenue growth in early 2024, this success is attributed to its unique integration and AI capabilities, not its commoditized BI offerings.

Domo's opaque pricing structure is another significant factor contributing to its 'Dog' classification. The lack of clarity deters potential customers, extending sales cycles by an average of 15-20% in 2024 for many SaaS companies due to pricing complexities. A survey in early 2025 indicated over 60% of IT decision-makers would abandon vendors with unclear upfront pricing.

Steep learning curves and slow customer service responses further solidify the 'Dog' status for certain aspects of Domo. If onboarding takes weeks instead of days, as reported for some BI platforms in early 2024, adoption suffers. Furthermore, customer satisfaction scores in 2024 were observed to be 15% lower for companies with support response times exceeding 24 hours compared to those offering same-day support.

Question Marks

Domo's Agent Catalyst and its upcoming next-gen AI agents represent a significant leap into automating intricate business workflows, positioning the company in a nascent but rapidly expanding AI market. This segment, while holding substantial future promise, demands considerable investment from Domo as it works to establish its presence and prove its capabilities in this developing space.

New AI-driven workflow automation tools are poised to transform data product interaction, promising substantial efficiency improvements. Domo's recent advancements in this space position them within a high-growth segment of the data analytics market. While the potential is immense, Domo is still in the initial phases of market penetration for these particular AI-powered features.

Domo's strategic focus on deepening integrations with leading AI Data Clouds like Snowflake, Databricks, and Google BigQuery is a smart move, tapping into a segment experiencing significant expansion. These enhanced collaborations allow Domo to seamlessly connect with vast amounts of data residing on these platforms, offering users a more unified analytics experience. This positions Domo to capture a larger share of the growing market for cloud-based data analytics solutions.

The company's commitment to these AI-centric platforms is crucial for future growth, though its market share in this specific area is still evolving. By providing robust connectivity and analytical capabilities directly within these environments, Domo aims to become an indispensable tool for businesses leveraging advanced AI and machine learning. For instance, Domo's Q1 2024 revenue saw a 10% year-over-year increase, reflecting the growing demand for integrated data solutions.

Vertical-Specific AI Solutions

Domo's AI strategy is zeroing in on high-potential sectors like Retail, Financial Services, and Healthcare. These tailored solutions are designed to deliver specific benefits to businesses within these industries.

While these vertical-specific AI offerings hold promise, they currently represent a small slice of the market in each niche. This means Domo needs to concentrate its resources to build momentum and become a leader in these specialized areas.

- Retail: Domo's AI for retail aims to optimize inventory management and personalize customer experiences, leveraging data to drive sales. For instance, in 2024, retail AI adoption is projected to increase by 25%, with companies seeking efficiency gains.

- Financial Services: The platform's AI solutions in finance focus on fraud detection and enhanced customer service, utilizing predictive analytics. The financial services sector saw a 15% rise in AI investment in 2023, highlighting the demand for these capabilities.

- Healthcare: Domo's AI in healthcare is geared towards improving patient outcomes and streamlining administrative tasks through data analysis. The healthcare AI market is expected to grow significantly, reaching an estimated $120 billion by 2028, driven by the need for better data utilization.

Advanced Data Product Creation (App Studio, Report Builder, Workspaces)

Domo's strategic push into advanced data product creation via App Studio, Report Builder, and Workspaces positions it to capitalize on the growing demand for curated data experiences. This evolution moves beyond traditional BI, enabling users to build and share sophisticated, interactive data applications.

While this represents a high-growth trend, Domo is actively working to drive market adoption of these advanced features. The company's focus on empowering users to create reusable, embeddable data products is key to expanding its platform's utility and value proposition.

- App Studio: Facilitates the creation of custom, interactive data applications without extensive coding, allowing for tailored data experiences.

- Report Builder: Enhances the ability to design and distribute sophisticated, pixel-perfect reports, offering greater control over data presentation.

- Workspaces: Provides a collaborative environment for teams to develop, manage, and share data products, fostering efficiency and knowledge sharing.

- Market Adoption: Domo is investing in education and enablement to ensure customers can leverage these advanced tools, aiming to increase the creation and consumption of data products on its platform.

Question Marks in Domo's BCG Matrix represent areas with low market share in a high-growth industry. These are typically new products or services that Domo is investing in, aiming to develop them into future Stars.

Domo's investments in next-generation AI agents and AI-driven workflow automation are prime examples of Question Marks. While the AI market is expanding rapidly, Domo is still establishing its foothold and needs to gain market share.

The company's focus on specific vertical AI solutions in Retail, Financial Services, and Healthcare also falls into this category. These initiatives are in nascent stages, requiring strategic resource allocation to grow and capture market share.

Domo's development of advanced data products through App Studio and Workspaces are also Question Marks. These tools offer significant potential but need increased market adoption to become dominant.

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of financial statements, market research reports, and competitive intelligence to provide a comprehensive view of product performance and market share.